Digital Adoption Platform Software Market Synopsis

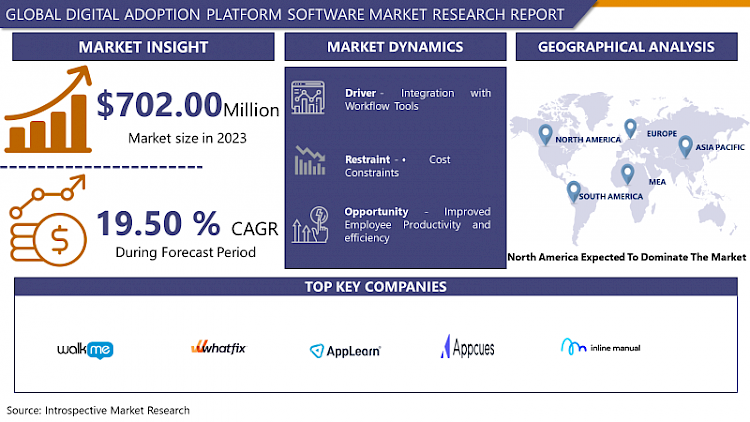

Digital Adoption Platform Software Market Size Was Valued at USD 702.00 Million in 2023 and is Projected to Reach USD 3,488.58 Million by 2032, Growing at a CAGR of 19.50 % From 2024-2032.

- A Digital Adoption Platform (DAP) is a software application created to simplify the adoption and application of digital tools within a single organization. It provides interactive guides, tutorials, and contextual support that empower users to easily navigate through software applications. Through support, analysis, and feedback tools, DAPs help companies get better users, decrease training costs, and use digital investments most efficiently.

- The digital adoption platform (DAP) software market has witnessed tremendous growth with the digitalization of business operations and industries at a higher rate. A digital adoption platform is a software product that helps people adopt and use digital tools more efficiently. It gives directions, training, and support to people thus they can use complicated digital environments without stress.

- The main driving force behind digital adoption platform software market expansion is the increasing speed of technological innovation. With the rise of digital tools and technologies to optimize and speed up operations, organizations frequently face the problems of user acceptance and skills enhancement. Digital adoption platforms tackle these challenges by offering users a user-friendly environment with step-by-step guidance and interactive tutorials that walk them through the use and benefits of the software.

- The following factor behind the growth of the DAP software market is the rising call for workforce digitalization. As remote work and distributed teams are on the rise, companies are focusing on finding tools that enable their staff to work effectively and smartly wherever they are. Digital adoption platforms are a vital element in this equation as they equip remote workers with the training and support they need to work with digital tools and collaborate well with their colleagues.

- The COVID-19 situation has sped up the implementation of digital technologies across different sectors as companies seek to be able to operate remotely and adopt digital-first business models. This has led to a huge chance for the Digital Adoption Platform providers to cash in on the increased need for tools that enable remote operations and digital transformation.

- It is also a fact that the digital adoption platform software market is profiting from the increasing importance of user experience and user satisfaction. Organizations have understood the necessity of giving both their employees and customers enjoyable, user-friendly digital experiences. Digital adoption platforms contribute to the goal of the new user onboarding process by training users, reducing training time, and improving overall user proficiency.

- Although there are promising growth prospects, the digital adoption platform software market faces several challenges. An instance of the DAP challenge is the technical complexity of combining DAP solutions with legacy IT infrastructures and software systems. Organizations may experience difficulties in incorporating digital adoption platforms into their toolset and workflow, thus limiting the adoption and realization of these tools.

- The market becomes more crowded with the market entry of a larger number of vendors offering digital adoption platform solutions which increases competition. Vendors are always innovating and changing their lines to get a bigger market share and differentiate themselves in the market. Thus, there is an avalanche of features and functionalities in digital adoption platforms so the job of the organization to assess and pick the right solution for them becomes complicated.

Digital Adoption Platform Software Market Trend Analysis

Integration with Workflow Tools

- Integration of workflow tools is becoming one of the vital factors in the digital adoption platform (DAP) software market. In the pursuit of effortless digital transformation, DAP services are becoming indispensable enablers. Through the integration of workflow tools like project management platforms, CRMs, and Q collaboration software, DAPs make it easier for individuals to carry out their activities as the guidance they provide is contextual. The combination of these applications allows users to gain access to relevant help and training resources from within the apps they use daily, thereby reducing disruptions and improving the rate of technology adoption.

- Apart from this, data-driven platforms are also able to generate personalized guidance and insights using data gathered from workflow tools as they help to increase efficiency and maximize digital initiative ROI. With the increasingly prevalent need for comprehensive digital adoption platforms, the ability to integrate with workflow software will continue to serve as a distinguishing factor among DAP vendors in the future, enabling companies to confidently and swiftly manage their digital ecosystems.

Improved Employee Productivity and efficiency

- The Enhanced Employee Productivity and Performance Digital Adoption Platform Software Market has enjoyed tremendous growth, fueled by the increasing desire for solutions that optimize the productivity and performance of the workforce. These platforms are equipped with features that include personalized teaching, real-time coaching, and performance analytics, with the intent of equipping employees to reach their highest productivity. With the spread of work from home and the digital transformation campaigns of many industries, organizations gradually invest more and more in these solutions so that they can successfully integrate all new technologies and processes. The key players in the market are consistently hiring the best experts to engineer more intelligent and personalized solutions to each business problem. With a continuous focus on employee cooperation and efficiency, the market for digital adoption platforms will likely continue to thrive.

- The Enhanced Employee Productivity and Performance Digital Adoption Platform Software Market features a wide variety of solutions, including those for healthcare, finance, manufacturing, and other verticals. In addition to streamlining onboarding procedures for new technologies, these platforms serve as an enduring support system, ensuring that employees remain skilled and informed about updated tools and processes. Integration with the existing software environment and user experience are the main concerns for market competition.

- Moreover, with artificial intelligence and machine learning technology, these platforms can deliver predictive insights and individualized recommendations to improve employee productivity. With companies understanding the necessity of employee productivity for business success, it is expected that the trend of the demand for digital adoption platforms is going to rise in the future and will also focus on innovation and scalability to match businesses' changing needs.

Digital Adoption Platform Software Market Segment Analysis:

Digital Adoption Platform Software Market is segmented based on Deployment Model, Enterprise Type, Application, and End Use.

By Deployment Model, Cloud segment is expected to dominate the market during the forecast period

- Cloud Deployment: Cloud deployment implies hosting of the DAP software on remote servers which are managed either by the vendor of DAP software or by a third-party cloud service provider. Users get DAP via the internet either through web browsers or dedicated applications. Scalability is one of the strengths of cloud-based DAP tools, which allows organizations to adapt resources whenever needed. The DAP platform is available on any device with an internet connection, thus it can be used by distributed groups of people or individuals working from home. Most cloud systems tend to have lower initial costs than on-premises solutions because companies do not have to bear the burden of investing in hardware infrastructure. Sample applications in this category are WalkMe, Pendo, and Whatfix.

- On-premises Deployment: On-premise implementation is accomplished by installing and executing the DAP software on the company's servers or infrastructure within their physical premises. Data control: With on-premises deployment, businesses have such control over their data as they store it locally on their servers. Some agencies, especially in industries with stringent rules and regulations, prefer on-premises deployments to ensure compliance with specific data security and privacy regulations. On-premises deployments may provide more opportunities for customization and integration with existing systems as they are usually installed within the internal IT environment of the organization. Examples of on-premises DAP software are Userlane and Apty.

By Application, Fruits & Vegetables segment held the largest share in 2023

- The digital adoption platform (DAP) software market involves all kinds of applications that are focused on optimizing and improving users' experience within the many domains. User onboarding serves as a marketplace catalyst that helps users familiarize themselves with software interfaces effortlessly. Apart from that, customer support solutions make use of DAP software to give users immediate help and solutions, thus resolving their issues promptly. Similarly, the employee onboarding tool leverages DAP capabilities to streamline the integration process of new employees making their transition into roles more seamless.

- The product training modules within the DAP software system allow the organizations to quickly educate the users on the feature and update so that you will have proficient and satisfied users. The arena of change management also proves to be an important area of application, using DAP solutions to handle changes within organizations or software systems smoothly and swiftly. Apart from these major cases, the versatility of DAP software makes it possible to be used in a wide number of other situations, serving different purposes and increasing the level of engagement among users within digital environments.

Digital Adoption Platform Software Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is at the top of the digital adoption platform software market owing to some of the factors. Primarily, the area offers robust technology infrastructure and digital maturity at a high level among businesses of all industries. This technological preparedness empowers organizations to embrace digital adoption platforms (DAPs) which are geared towards streamlining operations, improving user experience, and driving efficiency.

- North America is a leader in the tech field with a huge number of active tech companies and startups that are investing and developing DAP solutions contributing to the market growth. Furthermore, the region's area of expertise focuses on digital transformation initiatives, and the growing need for digital upskilling and onboarding services creates an environment where DAP software is more widely used. In addition, government policies in favor, supportive regulations, and a conducive business environment lead to innovation and businesses to invest in advanced digital tools.

Active Key Players in the Micro-perforated Food Packaging Market

- WalkMe Ltd. (Israel)

- WhatFix (U.S.)

- AppLearn Ltd. (U.K.)

- Appcues (U.S.)

- Inline Manual Ltd. (U.K.)

- Newired (Italy)

- Userlane (Germany)

- Toonimo (U.S.)

- UserGuiding (U.S.)

- Pendo.io, Inc. (U.S.)

- Sealed Air Corporation (U.S.)

- Sonoco Products Company (U.S.)

- Avery Dennison Corporation (U.S.)

- Bemis Company, Inc. (U.S.)

- Berry Global, Inc. (U.S.)

- Amcor Limited (Switzerland)

- Amcor Flexibles Transpac (Netherlands)

- Mondi Group (Austria)

- Coveris Holdings S.A. (Austria)

- LINPAC Packaging Limited (U.K.)

- Clondalkin Group Holdings B.V. (Netherlands)

- TCL Packaging (U.K.)

- Plastopil Hazorea Company Ltd. (Israel)

- Toppan Printing Co., Ltd. (Japan)

- Uflex Ltd. (India) Other Key Players

Key Industry Developments in the Digital Adoption Platform Software Market

- In December of 2023 - Generis and Userlane established a strategic partnership. The integration of their systems enables CARA platform customers to facilitate the onboarding of users and realize a quick ROI.

- In August 2023, Ciklum joined forces with WalkMe, a digital adoption platform solutions provider, to expedite the adoption of digital technologies in companies. WalkMe platform is leveraged by Ciklum to monitor and analyze the application and implementation of digital solutions as well as to contribute to improvement initiatives. Through this, customers from various sectors will be able to fully realize the success of their digital transformation initiatives.

- For instance, in March 2023, WalkMe and NTT Data unveiled a novel partnership designed to address digital adoption problems. With the advent of NTT Data – WalkMe DAP, the clients of NTT Data would get insights into issues related to digital adoption. Productivity, usability, and compliance are some of the challenges such as these.

- In May 2023 We unveiled our latest product, Enterprise Insights. Product WhatFix is still in its early stages of quick innovation, added to the Analytics offering business-oriented analytical capabilities and processes. Enterprise Insight gives organizations a bird’s eye view of the applications, processes across apps, and enterprise-level data on adoption and engagement.

- The new Product Analytics product line was launched by WhatFix in February 2023. The solutions allow businesses to do things like, analyze, visualize, and track user engagement and behavior data. In addition, the single instrumentation avoids hand-coding of event tracking and ensures data consistency.

|

Global Digital Adoption Platform Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 702.00 Mn. |

|

Forecast Period 2023-34 CAGR: |

19.50% |

Market Size in 2032: |

USD 3,488.58 Mn. |

|

Segments Covered: |

By Deployment Model |

|

|

|

By Enterprise Type |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- DIGITAL ADOPTION PLATFORM SOFTWARE MARKET BY DEPLOYMENT MODEL (2017-2032)

- DIGITAL ADOPTION PLATFORM SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CLOUD

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ON - PREMISES

- DIGITAL ADOPTION PLATFORM SOFTWARE MARKET BY ENTERPRISE TYPE (2017-2032)

- DIGITAL ADOPTION PLATFORM SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LARGE ENTERPRISES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SME

- DIGITAL ADOPTION PLATFORM SOFTWARE MARKET BY APPLICATION (2017-2032)

- DIGITAL ADOPTION PLATFORM SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- USER ONBOARDING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CUSTOMER SUPPORT

- EMPLOYEE ONBOARDING

- PRODUCT TRAINING

- CHANGE MANAGEMENT

- OTHERS

- DIGITAL ADOPTION PLATFORM SOFTWARE MARKET BY END-USER (2017-2032)

- DIGITAL ADOPTION PLATFORM SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BFSI

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- RETAIL & CONSUMER GOODS

- IT & TELECOMMUNICATIONS

- HEALTHCARE

- GOVERNMENT & PUBLIC SECTOR

- MANUFACTURING

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Luxury Goods Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- WALKME LTD. (ISRAEL)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- WhatFix (U.S.)

- AppLearn Ltd. (U.K.)

- Appcues (U.S.)

- Inline Manual Ltd. (U.K.)

- Newired (Italy)

- Userlane (Germany)

- Toonimo (U.S.)

- UserGuiding (U.S.)

- Pendo.io, Inc. (U.S.)

- Sealed Air Corporation (U.S.)

- Sonoco Products Company (U.S.)

- Avery Dennison Corporation (U.S.)

- Bemis Company, Inc. (U.S.)

- Berry Global, Inc. (U.S.)

- Amcor Limited (Switzerland)

- Amcor Flexibles Transpac (Netherlands)

- Mondi Group (Austria)

- Coveris Holdings S.A. (Austria)

- LINPAC Packaging Limited (U.K.)

- Clondalkin Group Holdings B.V. (Netherlands)

- TCL Packaging (U.K.)

- Plastopil Hazorea Company Ltd. (Israel)

- Toppan Printing Co., Ltd. (Japan)

- Uflex Ltd. (India)

- COMPETITIVE LANDSCAPE

- GLOBAL DIGITAL ADOPTION PLATFORM SOFTWARE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Deployment Model

- Historic And Forecasted Market Size By Enterprise Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Digital Adoption Platform Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 702.00 Mn. |

|

Forecast Period 2023-34 CAGR: |

19.50% |

Market Size in 2032: |

USD 3,488.58 Mn. |

|

Segments Covered: |

By Deployment Model |

|

|

|

By Enterprise Type |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET COMPETITIVE RIVALRY

TABLE 005. DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET THREAT OF NEW ENTRANTS

TABLE 006. DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET THREAT OF SUBSTITUTES

TABLE 007. DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET BY TYPE

TABLE 008. ON-PREMISES MARKET OVERVIEW (2016-2028)

TABLE 009. CLOUD BASED MARKET OVERVIEW (2016-2028)

TABLE 010. DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET BY APPLICATION

TABLE 011. LARGE ENTERPRISES MARKET OVERVIEW (2016-2028)

TABLE 012. MARKET OVERVIEW (2016-2028)

TABLE 013. SMES MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 015. NORTH AMERICA DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 016. N DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 018. EUROPE DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 019. DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 021. ASIA PACIFIC DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 022. DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 025. DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 027. SOUTH AMERICA DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 028. DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 029. WALKME: SNAPSHOT

TABLE 030. WALKME: BUSINESS PERFORMANCE

TABLE 031. WALKME: PRODUCT PORTFOLIO

TABLE 032. WALKME: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. APPLEARN: SNAPSHOT

TABLE 033. APPLEARN: BUSINESS PERFORMANCE

TABLE 034. APPLEARN: PRODUCT PORTFOLIO

TABLE 035. APPLEARN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. USERIQ: SNAPSHOT

TABLE 036. USERIQ: BUSINESS PERFORMANCE

TABLE 037. USERIQ: PRODUCT PORTFOLIO

TABLE 038. USERIQ: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. APPCUES: SNAPSHOT

TABLE 039. APPCUES: BUSINESS PERFORMANCE

TABLE 040. APPCUES: PRODUCT PORTFOLIO

TABLE 041. APPCUES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. WHATFIX: SNAPSHOT

TABLE 042. WHATFIX: BUSINESS PERFORMANCE

TABLE 043. WHATFIX: PRODUCT PORTFOLIO

TABLE 044. WHATFIX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. INLINE MANUAL: SNAPSHOT

TABLE 045. INLINE MANUAL: BUSINESS PERFORMANCE

TABLE 046. INLINE MANUAL: PRODUCT PORTFOLIO

TABLE 047. INLINE MANUAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. MYGUIDE: SNAPSHOT

TABLE 048. MYGUIDE: BUSINESS PERFORMANCE

TABLE 049. MYGUIDE: PRODUCT PORTFOLIO

TABLE 050. MYGUIDE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. USERLANE: SNAPSHOT

TABLE 051. USERLANE: BUSINESS PERFORMANCE

TABLE 052. USERLANE: PRODUCT PORTFOLIO

TABLE 053. USERLANE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. TOONIMO: SNAPSHOT

TABLE 054. TOONIMO: BUSINESS PERFORMANCE

TABLE 055. TOONIMO: PRODUCT PORTFOLIO

TABLE 056. TOONIMO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. 3DR: SNAPSHOT

TABLE 057. 3DR: BUSINESS PERFORMANCE

TABLE 058. 3DR: PRODUCT PORTFOLIO

TABLE 059. 3DR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. AETHERPAL: SNAPSHOT

TABLE 060. AETHERPAL: BUSINESS PERFORMANCE

TABLE 061. AETHERPAL: PRODUCT PORTFOLIO

TABLE 062. AETHERPAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. JUMPSEAT.IO: SNAPSHOT

TABLE 063. JUMPSEAT.IO: BUSINESS PERFORMANCE

TABLE 064. JUMPSEAT.IO: PRODUCT PORTFOLIO

TABLE 065. JUMPSEAT.IO: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET OVERVIEW BY TYPE

FIGURE 012. ON-PREMISES MARKET OVERVIEW (2016-2028)

FIGURE 013. CLOUD BASED MARKET OVERVIEW (2016-2028)

FIGURE 014. DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET OVERVIEW BY APPLICATION

FIGURE 015. LARGE ENTERPRISES MARKET OVERVIEW (2016-2028)

FIGURE 016. MARKET OVERVIEW (2016-2028)

FIGURE 017. SMES MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA DIGITAL ADOPTION PLATFORM (DAP) SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Digital Adoption Platform Software Market research report is 2024-2032.

WalkMe Ltd. (Israel), WhatFix (U.S.), AppLearn Ltd. (U.K.), Appcues (U.S.), Inline Manual Ltd. (U.K.), Newired (Italy), Userlane (Germany) and Other Major Players.

The Digital Adoption Platform Software Market is segmented into Deployment Model, Enterprise Type, Application, End Use, and Region. By Deployment Model, the market is categorized as Cloud or on-premises. By Enterprise Type, the market is categorized into Large Enterprises and SMEs. By Application, the market is categorized into User Onboarding, Customer Support, Employee Onboarding, Product Training, Change Management, and Others. By End Use, the market is categorized into BFSI, Retail & Consumer Goods, IT & Telecommunications, Healthcare, Government & Public Sector, Manufacturing, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A Digital Adoption Platform (DAP) is a software solution designed to streamline the adoption and usage of digital tools within an organization. It offers interactive guides, tutorials, and contextual support to help users navigate through software applications efficiently. By providing real-time assistance, analytics, and feedback mechanisms, DAPs enable businesses to enhance user proficiency, reduce training costs, and maximize the ROI of their digital investments.

Digital Adoption Platform Software Market Size Was Valued at USD 702.00 Million in 2023 and is Projected to Reach USD 3,488.58 Million by 2032, Growing at a CAGR of 19.50 % From 2024-2032.