Dietary Fibers Market Synopsis

Dietary Fibers Market Size Was Valued at USD 7.95 billion in 2023 and is Projected to Reach USD 18.14 Billion by 2032, Growing at a CAGR of 9.6% From 2024-2032.

Dietary fibers, found in plant-based foods, are essential for digestive health, regulating bowel movements, preventing constipation, and promoting gut health. They come in soluble and insoluble types, each offering unique health benefits. Soluble fibers lower cholesterol and stabilize blood sugar levels, while insoluble fibers aid digestion and prevent digestive disorders. A diet rich in dietary fibers promotes weight management and reduces chronic disease risk.

- The demand for dietary fibers is on the rise due to factors such as increasing health awareness, consumer preferences, and dietary habits. Fiber-rich foods are being incorporated into diets to support digestive health, weight management, and overall well-being. The rising incidence of lifestyle-related diseases like obesity, diabetes, and cardiovascular disorders has also fueled the demand for dietary fibers, known for their potential to lower cholesterol levels, regulate blood sugar levels, and promote satiety.

- Dietary fibers are indigestible plant-based compounds that pass through the digestive tract relatively intact, providing bulk to stool and facilitating regular bowel movements. Some types of fibers, such as soluble fibers, can ferment in the colon, producing short-chain fatty acids that nourish beneficial gut bacteria and support a healthy gut microbiome.

- Dietary fibers are utilized across various industries, including food and beverages, pharmaceuticals, dietary supplements, and animal feed. In the food and beverage sector, fibers are incorporated into various products to boost nutritional content, enhance texture, and provide functional benefits. In the pharmaceutical industry, dietary fiber supplements are formulated to manage gastrointestinal disorders and promote overall health.

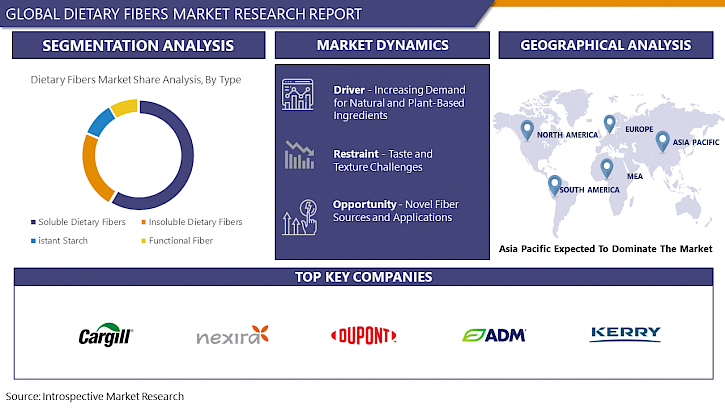

- Market trends shaping the dietary fibers industry include increased demand for natural and plant-based ingredients, growing interest in functional foods and beverages fortified with dietary fibers, rising awareness of the health benefits of dietary fibers, the expansion of the clean label movement, and adoption of sustainable sourcing and production practices.

Dietary Fibers Market Trend Analysis

Increasing Demand for Natural and Plant-Based Ingredients

- The rising desire for natural and plant-based ingredients stands as a pivotal driving factor propelling the growth of the dietary fibers market. With a heightened emphasis on health and wellness globally, consumers are increasingly drawn to products perceived as wholesome, unadulterated, and minimally processed. Natural and plant-based ingredients, encompassing fruits, vegetables, grains, legumes, nuts, and seeds, inherently boast rich stores of dietary fibers, offering an array of health advantages.

- Consumers are actively seeking out foods and beverages incorporating these natural fibers to bolster digestive health, manage weight, and enhance overall well-being. Furthermore, the surging popularity of plant-centric diets and vegetarian/vegan lifestyles further amplifies the demand for fiber-rich plant sources.

- The clean label movement, advocating for transparency and simplicity in food ingredients, prompts manufacturers to prioritize natural and plant-based fibers over synthetic or chemically derived alternatives. Consequently, the escalating quest for natural and plant-based ingredients continues to fuel the expansion of the dietary fibers market, with consumers gravitating towards products aligning with their health-conscious and ethical preferences.

Novel Fiber Sources and Applications

- The advent of innovative fiber sources and their versatile applications represents a significant opportunity within the dietary fibers market. Emerging sources such as seaweed, algae, fruit peels, and food processing by-products introduce novel possibilities for integrating dietary fibers into a wide array of products. These fresh sources not only diversify the range of available fibers but also offer distinctive nutritional profiles and functional attributes.

- The utilization of these novel fiber sources extends across various sectors, including the food and beverage industry, pharmaceuticals, and dietary supplements. In food and beverages, these fibers can fortify an assortment of products like baked goods, snacks, dairy alternatives, and functional beverages. In pharmaceuticals, they can be incorporated into dietary supplements or pharmaceutical formulations targeting specific health concerns. Moreover, leveraging novel fiber sources in dietary supplements presents opportunities for crafting innovative formulations tailored to cater to specific consumer demographics or health needs.

- Novel fiber sources are addressing sustainability concerns in the food industry by utilizing underutilized materials, reducing waste, and promoting circular economy principles. These sources offer health benefits beyond traditional fibers, such as antioxidant properties and immune-boosting effects. As consumer awareness of fiber-rich diets grows, manufacturers can differentiate their products and meet the demand for functional foods and beverages. By leveraging these innovative ingredients, the dietary fibers market can capitalize on growing consumer interest in health, sustainability, and novel food experiences.

Dietary Fibers Market Segment Analysis:

Dietary Fibers Market Segmented based on type, application, and end-users.

By Type, Soluble Dietary Fibers segment is expected to dominate the market during the forecast period

- The dominance of the Soluble Dietary Fibers segment in the dietary fibers market can be attributed to several factors. Firstly, these fibers possess distinctive functional characteristics, rendering them highly adaptable and sought after across various applications. Soluble fibers, including types like pectin, beta-glucan, and inulin, exhibit the ability to dissolve in water, forming viscous solutions that enhance the texture, mouthfeel, and stability of food and beverage products.

- Furthermore, soluble dietary fibers offer an array of health advantages, such as lowering cholesterol, regulating blood sugar levels, and promoting digestive health. With increasing consumer awareness regarding health consciousness and the desire for products supporting overall well-being, there's a growing demand for soluble fiber-enriched foods and supplements. Soluble fibers are typically sourced from natural origins like fruits, vegetables, and grains, aligning with consumer preferences for clean-label ingredients. This further drives the popularity of products containing soluble dietary fibers in the market.

- Soluble dietary fibers form gel-like substances in the digestive tract, slowing down nutrient absorption, and making them beneficial for managing blood sugar levels and reducing cardiovascular disease risk. They also support gut health by serving as a prebiotic substrate for beneficial bacteria in the colon, leading to the increased popularity of soluble fiber-rich foods and supplements.

By Raw Materials, the Cereals & Grains segment is expected to dominate the market during the forecast period

- The dominance of the Cereals & Grains segment in the dietary fibers market is anticipated for several compelling reasons. Firstly, cereals and grains stand as widely consumed and abundant sources of dietary fibers globally, offering vital nutrients and fiber-rich components like bran, husks, and germ. Their prevalence and accessibility make them favored choices for integrating dietary fibers into a diverse array of food and beverage products.

- Moreover, cereals and grains provide formulation versatility, enabling the creation of fiber-rich products with various textures, flavors, and applications. They can be easily processed into forms such as flours, bran, and flakes, suitable for incorporation into bakery items, breakfast cereals, snacks, and functional foods.

- Additionally, the increasing awareness among consumers regarding the health advantages associated with fiber-rich diets, including enhanced digestive health, weight management, and lowered risk of chronic diseases, drives demand for cereals and grains as sources of dietary fibers. As consumers increasingly seek healthier food alternatives, manufacturers are responding by enriching their products with fiber-rich ingredients, thereby reinforcing the dominance of the Cereals & Grains segment in the dietary fibers market.

Dietary Fibers Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific is poised to lead the dietary fibers market for several compelling reasons. Firstly, the region's substantial and swiftly expanding population, particularly in nations like China, India, and various Southeast Asian countries, propels considerable demand for functional foods and beverages, including those fortified with dietary fibers. As health awareness rises among consumers in Asia Pacific, there is a heightened interest in products that promote digestive health, weight management, and overall wellness, fueling the need for fiber-rich options.

- Rapid urbanization and evolving lifestyles within the region contribute to dietary changes, with a growing consumption of processed foods and sedentary behaviors. This shift increases the demand for fiber-enriched products to counteract adverse health effects associated with urban living, such as digestive ailments and obesity.

- Governmental efforts to encourage healthier eating habits and address diet-related health issues are further driving the adoption of fiber-rich diets across many Asia Pacific nations. These collective factors position Asia Pacific as a dominant player in the dietary fibers market, offering significant opportunities for market expansion and growth in the region.

Dietary Fibers Market Top Key Players:

- Cargill, Incorporated (US)

- DuPont de Nemours, Inc. (US)

- Archer Daniels Midland Company (ADM) (US)

- Ingredion Incorporated (US)

- Grain Processing Corporation (GPC) (US)

- Fiberstar, Inc. (US)

- Grain Millers, Inc. (US)

- NOW Health Group, Inc. (US)

- CP Kelco (US)

- Nutri-Pea Limited (Canada)

- SunOpta, Inc. (Canada)

- BENEO GmbH (Germany)

- J. Rettenmaier & Söhne GmbH (JRS) (Germany)

- KONINKLIJKE DSM N.V. (DSM) (Netherlands)

- Sensus BV (Netherlands)

- Roquette Frères (France)

- Nexira SAS (France)

- Tate & Lyle PLC (UK)

- Kerry Group plc (Ireland)

- Lonza Group Ltd. (Switzerland)

- Cosucra Groupe Warcoing SA (Belgium)

- Taiyo International, Inc. (Japan)

- Shandong Baolingbao Biology Co., Ltd. (China)

- GELYMAR S.A. (Chile), and Other Major Players.

Key Industry Developments in the Dietary Fibers Market:

- In April 2022, Ingredion Incorporated completed the acquisition of KaTech, a company based in Germany known for delivering advanced texture and stabilization solutions to the food and beverage sectors. This strategic move marks a significant expansion for Ingredion's Food Systems platform, as it now incorporates a wide array of innovative solutions. These offerings aim to support food and beverage manufacturers in enhancing product formulation, optimizing ingredient functionality, and providing technical support. With this acquisition, Ingredion strengthens its position in the market by providing comprehensive solutions to meet the evolving needs of its customers in the food and beverage industry.

|

Global Dietary Fibers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.95 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.6 % |

Market Size in 2032: |

USD 18.14 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Raw Material |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- DIETARY FIBERS MARKET BY TYPE (2017-2032)

- DIETARY FIBERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SOLUBLE DIETARY FIBERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INSOLUBLE DIETARY FIBERS

- RESISTANT STARCH

- FUNCTIONAL FIBER

- DIETARY FIBERS MARKET BY RAW MATERIAL (2017-2032)

- DIETARY FIBERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FRUITS & VEGETABLES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CEREALS & GRAINS

- LEGUMES & NUTS & SEEDS

- DIETARY FIBERS MARKET BY END-USER (2017-2032)

- DIETARY FIBERS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FOOD & BEVERAGE INDUSTRY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PHARMACEUTICAL INDUSTRY

- ANIMAL FEED INDUSTRY

- DIETARY SUPPLEMENT MANUFACTURERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Dietary Fibers Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- CARGILL, INCORPORATED (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- DUPONT DE NEMOURS, INC. (US)

- ARCHER DANIELS MIDLAND COMPANY (ADM) (US)

- INGREDION INCORPORATED (US)

- GRAIN PROCESSING CORPORATION (GPC) (US)

- FIBERSTAR, INC. (US)

- GRAIN MILLERS, INC. (US)

- NOW HEALTH GROUP, INC. (US)

- CP KELCO (US)

- NUTRI-PEA LIMITED (CANADA)

- SUNOPTA, INC. (CANADA)

- BENEO GMBH (GERMANY)

- J. RETTENMAIER & SÖHNE GMBH (JRS) (GERMANY)

- KONINKLIJKE DSM N.V. (DSM) (NETHERLANDS)

- SENSUS BV (NETHERLANDS)

- ROQUETTE FRÈRES (FRANCE)

- NEXIRA SAS (FRANCE)

- TATE & LYLE PLC (UK)

- KERRY GROUP PLC (IRELAND)

- LONZA GROUP LTD. (SWITZERLAND)

- COSUCRA GROUPE WARCOING SA (BELGIUM)

- TAIYO INTERNATIONAL, INC. (JAPAN)

- SHANDONG BAOLINGBAO BIOLOGY CO., LTD. (CHINA)

- GELYMAR S.A. (CHILE)

- COMPETITIVE LANDSCAPE

- GLOBAL DIETARY FIBERS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Raw Material

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Dietary Fibers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.95 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.6 % |

Market Size in 2032: |

USD 18.14 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Raw Material |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. DIETARY FIBERS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. DIETARY FIBERS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. DIETARY FIBERS MARKET COMPETITIVE RIVALRY

TABLE 005. DIETARY FIBERS MARKET THREAT OF NEW ENTRANTS

TABLE 006. DIETARY FIBERS MARKET THREAT OF SUBSTITUTES

TABLE 007. DIETARY FIBERS MARKET BY TYPE

TABLE 008. SOLUBLE MARKET OVERVIEW (2016-2028)

TABLE 009. INSOLUBLE MARKET OVERVIEW (2016-2028)

TABLE 010. DIETARY FIBERS MARKET BY SOURCE

TABLE 011. CEREALS & GRAINS MARKET OVERVIEW (2016-2028)

TABLE 012. FRUITS & VEGETABLES MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. DIETARY FIBERS MARKET BY APPLICATION

TABLE 015. FUNCTIONAL FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 016. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

TABLE 017. OTHER APPLICATIONS MARKET OVERVIEW (2016-2028)

TABLE 018. NORTH AMERICA DIETARY FIBERS MARKET, BY TYPE (2016-2028)

TABLE 019. NORTH AMERICA DIETARY FIBERS MARKET, BY SOURCE (2016-2028)

TABLE 020. NORTH AMERICA DIETARY FIBERS MARKET, BY APPLICATION (2016-2028)

TABLE 021. N DIETARY FIBERS MARKET, BY COUNTRY (2016-2028)

TABLE 022. EUROPE DIETARY FIBERS MARKET, BY TYPE (2016-2028)

TABLE 023. EUROPE DIETARY FIBERS MARKET, BY SOURCE (2016-2028)

TABLE 024. EUROPE DIETARY FIBERS MARKET, BY APPLICATION (2016-2028)

TABLE 025. DIETARY FIBERS MARKET, BY COUNTRY (2016-2028)

TABLE 026. ASIA PACIFIC DIETARY FIBERS MARKET, BY TYPE (2016-2028)

TABLE 027. ASIA PACIFIC DIETARY FIBERS MARKET, BY SOURCE (2016-2028)

TABLE 028. ASIA PACIFIC DIETARY FIBERS MARKET, BY APPLICATION (2016-2028)

TABLE 029. DIETARY FIBERS MARKET, BY COUNTRY (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA DIETARY FIBERS MARKET, BY TYPE (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA DIETARY FIBERS MARKET, BY SOURCE (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA DIETARY FIBERS MARKET, BY APPLICATION (2016-2028)

TABLE 033. DIETARY FIBERS MARKET, BY COUNTRY (2016-2028)

TABLE 034. SOUTH AMERICA DIETARY FIBERS MARKET, BY TYPE (2016-2028)

TABLE 035. SOUTH AMERICA DIETARY FIBERS MARKET, BY SOURCE (2016-2028)

TABLE 036. SOUTH AMERICA DIETARY FIBERS MARKET, BY APPLICATION (2016-2028)

TABLE 037. DIETARY FIBERS MARKET, BY COUNTRY (2016-2028)

TABLE 038. DUPONT: SNAPSHOT

TABLE 039. DUPONT: BUSINESS PERFORMANCE

TABLE 040. DUPONT: PRODUCT PORTFOLIO

TABLE 041. DUPONT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. GRAIN PROCESSING CORPORATION: SNAPSHOT

TABLE 042. GRAIN PROCESSING CORPORATION: BUSINESS PERFORMANCE

TABLE 043. GRAIN PROCESSING CORPORATION: PRODUCT PORTFOLIO

TABLE 044. GRAIN PROCESSING CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. GRAIN MILLERS INC.: SNAPSHOT

TABLE 045. GRAIN MILLERS INC.: BUSINESS PERFORMANCE

TABLE 046. GRAIN MILLERS INC.: PRODUCT PORTFOLIO

TABLE 047. GRAIN MILLERS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. FUJI NIHON SEITO CORPORATION: SNAPSHOT

TABLE 048. FUJI NIHON SEITO CORPORATION: BUSINESS PERFORMANCE

TABLE 049. FUJI NIHON SEITO CORPORATION: PRODUCT PORTFOLIO

TABLE 050. FUJI NIHON SEITO CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. ARCHER DANIEL MIDLAND (ADM): SNAPSHOT

TABLE 051. ARCHER DANIEL MIDLAND (ADM): BUSINESS PERFORMANCE

TABLE 052. ARCHER DANIEL MIDLAND (ADM): PRODUCT PORTFOLIO

TABLE 053. ARCHER DANIEL MIDLAND (ADM): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. TEREOS: SNAPSHOT

TABLE 054. TEREOS: BUSINESS PERFORMANCE

TABLE 055. TEREOS: PRODUCT PORTFOLIO

TABLE 056. TEREOS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. CJ CHEILJEDANG CORP.: SNAPSHOT

TABLE 057. CJ CHEILJEDANG CORP.: BUSINESS PERFORMANCE

TABLE 058. CJ CHEILJEDANG CORP.: PRODUCT PORTFOLIO

TABLE 059. CJ CHEILJEDANG CORP.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. NOVA GREEN INC.: SNAPSHOT

TABLE 060. NOVA GREEN INC.: BUSINESS PERFORMANCE

TABLE 061. NOVA GREEN INC.: PRODUCT PORTFOLIO

TABLE 062. NOVA GREEN INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. MENGZHOU TAILIJIE CO. LTD.: SNAPSHOT

TABLE 063. MENGZHOU TAILIJIE CO. LTD.: BUSINESS PERFORMANCE

TABLE 064. MENGZHOU TAILIJIE CO. LTD.: PRODUCT PORTFOLIO

TABLE 065. MENGZHOU TAILIJIE CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. BAOLINGGBAO BIOLOGY CO. LTD: SNAPSHOT

TABLE 066. BAOLINGGBAO BIOLOGY CO. LTD: BUSINESS PERFORMANCE

TABLE 067. BAOLINGGBAO BIOLOGY CO. LTD: PRODUCT PORTFOLIO

TABLE 068. BAOLINGGBAO BIOLOGY CO. LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. CARGILL INCORPORATED: SNAPSHOT

TABLE 069. CARGILL INCORPORATED: BUSINESS PERFORMANCE

TABLE 070. CARGILL INCORPORATED: PRODUCT PORTFOLIO

TABLE 071. CARGILL INCORPORATED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. B&D NUTRITIONAL INGREDIENTS INC.: SNAPSHOT

TABLE 072. B&D NUTRITIONAL INGREDIENTS INC.: BUSINESS PERFORMANCE

TABLE 073. B&D NUTRITIONAL INGREDIENTS INC.: PRODUCT PORTFOLIO

TABLE 074. B&D NUTRITIONAL INGREDIENTS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. NATUREX.: SNAPSHOT

TABLE 075. NATUREX.: BUSINESS PERFORMANCE

TABLE 076. NATUREX.: PRODUCT PORTFOLIO

TABLE 077. NATUREX.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. TATE & LYLE: SNAPSHOT

TABLE 078. TATE & LYLE: BUSINESS PERFORMANCE

TABLE 079. TATE & LYLE: PRODUCT PORTFOLIO

TABLE 080. TATE & LYLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. KFSU LTD. AUSTRALIA: SNAPSHOT

TABLE 081. KFSU LTD. AUSTRALIA: BUSINESS PERFORMANCE

TABLE 082. KFSU LTD. AUSTRALIA: PRODUCT PORTFOLIO

TABLE 083. KFSU LTD. AUSTRALIA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. INGREDIENTS CORPORATION: SNAPSHOT

TABLE 084. INGREDIENTS CORPORATION: BUSINESS PERFORMANCE

TABLE 085. INGREDIENTS CORPORATION: PRODUCT PORTFOLIO

TABLE 086. INGREDIENTS CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 087. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 088. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 089. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. DIETARY FIBERS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. DIETARY FIBERS MARKET OVERVIEW BY TYPE

FIGURE 012. SOLUBLE MARKET OVERVIEW (2016-2028)

FIGURE 013. INSOLUBLE MARKET OVERVIEW (2016-2028)

FIGURE 014. DIETARY FIBERS MARKET OVERVIEW BY SOURCE

FIGURE 015. CEREALS & GRAINS MARKET OVERVIEW (2016-2028)

FIGURE 016. FRUITS & VEGETABLES MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. DIETARY FIBERS MARKET OVERVIEW BY APPLICATION

FIGURE 019. FUNCTIONAL FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 020. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

FIGURE 021. OTHER APPLICATIONS MARKET OVERVIEW (2016-2028)

FIGURE 022. NORTH AMERICA DIETARY FIBERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. EUROPE DIETARY FIBERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. ASIA PACIFIC DIETARY FIBERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. MIDDLE EAST & AFRICA DIETARY FIBERS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. SOUTH AMERICA DIETARY FIBERS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Dietary Fibers Market research report is 2024-2032.

Cargill, Incorporated (US), DuPont de Nemours, Inc. (US), Archer Daniels Midland Company (ADM) (US), Ingredion Incorporated (US), Grain Processing Corporation (GPC) (US), Fiberstar, Inc. (US), Grain Millers, Inc. (US), NOW Health Group, Inc. (US), CP Kelco (US), Nutri-Pea Limited (Canada), SunOpta, Inc. (Canada), BENEO GmbH (Germany), J. Rettenmaier & Söhne GmbH (JRS) (Germany), KONINKLIJKE DSM N.V. (DSM) (Netherlands), Sensus BV (Netherlands), Roquette Frères (France), Nexira SAS (France), Tate & Lyle PLC (UK), Kerry Group plc (Ireland), Lonza Group Ltd. (Switzerland), Cosucra Groupe Warcoing SA (Belgium), Taiyo International, Inc. (Japan), Shandong Baolingbao Biology Co., Ltd. (China), GELYMAR S.A. (Chile) and Other Major Players.

The Dietary Fibers Market is segmented into Type, Raw Material, End-User, and region. By Type, the market is categorized into Soluble Dietary Fibers, Insoluble Dietary Fibers, Resistant Starch, and Functional Fiber. By Raw Material, the market is categorized into Fruits & Vegetables, Cereals & Grains, Legumes & Nuts & Seeds. By End-User, the market is categorized into the Food & Beverage Industry, Pharmaceutical Industry, Animal Feed Industry, and Dietary Supplement Manufacturers. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Dietary fibers, found in plant-based foods, are essential for digestive health, regulating bowel movements, preventing constipation, and promoting gut health. They come in soluble and insoluble types, each offering unique health benefits. Soluble fibers lower cholesterol and stabilize blood sugar levels, while insoluble fibers aid digestion and prevent digestive disorders. A diet rich in dietary fibers promotes weight management and reduces chronic disease risk.

Dietary Fibers Market Size Was Valued at USD 7.95 billion in 2023 and is Projected to Reach USD 18.14 Billion by 2032, Growing at a CAGR of 9.6% From 2024-2032.