Dental Equipment Market Synopsis

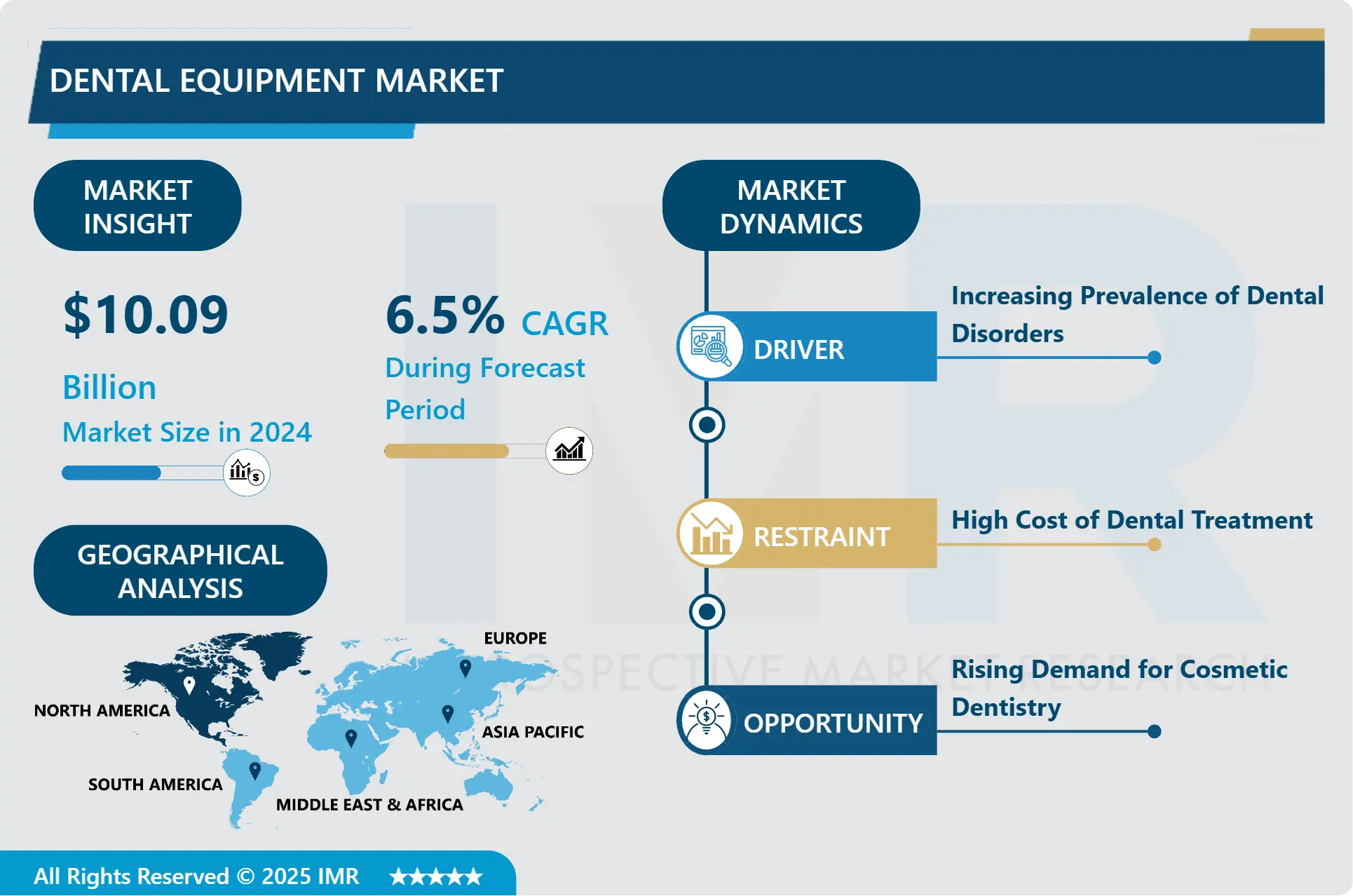

Dental Equipment Market Size Was Valued at USD 10.09 Billion in 2024, and is Projected to Reach USD 16.7 Billion by 2032, Growing at a CAGR of 6.5% From 2025-2032.

Dental equipment can therefore be described as a set of tools used in analysis, manipulation, treatment and management of any oral ailment. Some of the growth promoting factors that have been under discussion include: the growing world’s geriatric dentistry population that is suffering from oral diseases, a related and developing medical tourism regarding dental treatment and care, numerous government public oral health care plan and program launches. Further, the availability of various technologically enhanced and efficient dental products from the prominent companies is also affecting the market growth.

They all pointed out that the most frequent conditions affecting the majority of the population were dental caries and gingival inflammation. Fluctuations in the number of procedures performed in the dental field may also be related to projected changes in the usage of dental equipments. In addition, the dental equipment assist in the identification and management of caries, which is an infection by bacteria.

The common dental services performed in these visits comprise of fillings, bonding, root canal treatments, crowning, bridging, periodontal therapy, and oral/ maxillofacial surgery. These demonstrate the current possibilities of dental procedures internationally. The other prominent diseases which are likely to help the overall growth of the market are periodontal diseases, oral malignancies, and environmental injuries leading to oro-dental injuries.

The dental conditions like caries, periodontal diseases, and oral cancer are becoming common in people of all age groups which in turn, is creating a demand for dental equipment. Others may include malnutrition, lack of oral hygiene, and increase in the population of seniors all of which increase the prevalence of dental diseases. Subsequently, as individuals become more conscious of their oral health and progression to the preventive care measures, the number of patients seeking dental procedures is expected to rise. This increased dental traffic drives the need for all sorts of dental equipment including diagnostic mechanisms, treatment procedures, and surgical apparatus thus definitely driving more growth of the market in the next year.

However, laser dental treatment costs more than regular dental operational procedures by a large margin. It is between $6,700 and $78,000 for value, based on parameters of specifications, Wavelength, and Distribution networks hence challenging the growth of the dental equipment market size.

Dental Equipment Market Trend Analysis

Dental Equipment Market Growth Driver- Increasing awareness among consumers regarding oral hygiene

- Increasing awareness among consumers regarding oral hygiene propels the dental equipment market opportunity growth. People's increasing focus on beauty has compelled them to seek prostheses, and technological breakthroughs and product launches, which have also contributed to the market growth. The advancement in technology to improve surgical treatment is expected to offer lucrative opportunities to the dental equipment market. As a result, it helps in the more effective treatment and efficient way for the dental surgery.

Dental Equipment Market Opportunity- Technological Advancements in Dental Care

- The developments in technology like digital imaging, 3D printing and Computer generated design and manufacture (CAD/CAM) are changing the face of dentistry. These advancements can improve diagnosis, planning of treatment, and the construction of dental restorations. As an example, digital radiography allows obtaining high-quality images with less radiation, and 3D printing allows the fabrication of precise dental implants and crowns. Thus, the increasing adoption of these technologies in the dental practice will lead to the increased demand for modern dental equipment, fueling the market growth.

Dental Equipment Market Segment Analysis:

Dental Equipment Market Segmented based on Procedure Type, Product Type, and End User.

By product type, dental laser equipment segment is expected to dominate the market during the forecast period

- On the basis of product types, the dental laser equipment segment held the largest share of the global dental equipment market in 2023. Lasers in dentistry are defined as instruments creating a thin light beam and are used in dentistry to cut or ablate tissue. Dental lasers have made it easy to undertake procedures that are rapid and of no pain. It is quite useful to a certain extent, although the competence of the dentist to set the time the patient is exposed to the laser and output power of the laser plays a central role. The following are some of the advantages of dental lasers; there will be less post-operative discomfort, bleeding, and morbidity, less anesthetic is used, and the process takes less time. The use of dental equipment especially in the automotive industry will definitely ensure that segment of the market elaborates a certain potentiality for development in the course of the forecast period.

By end user, hospital's segment held the largest share in 2024

- In terms of the end user, the hospital segment indicated the highest demand in 2023 due to the constant usage of dental equipment as the access to the modern digitally upgraded technologies and the presence of more institutions with a dentistry section. Besides, the growth of segment can be boosted by the intensified incidence of the oral problems. Depending on the application, dental equipment in hospitals is expected to help drive growth for the segment within the next couple of years.

Dental Equipment Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In 2024, North America led the market and is expected to be the highest growing region over the course of the forecast period. The customers using dental equipments are gradually increasing in countries like the U. S. & Canada largely due to increased incidences of dental ailments and due to awareness.

- This is due to the increasing incidence of the geriatric population, robust healthcare systems, sound reimbursement policies, presence of market majors, and improvements in the preventive and reconstructive dental procedures. Also, 85% of people in the United States strongly agree with the notion that has been proposed by the American dental association regarding the significance of dental health hence the oral health as a crucial part of general wellbeing. All these factors will collectively lead to north America to emerge as the most promising regional market over the forecast period.

- For example, on July 15th, 2021, Lakewood Ranch Dental affiliated with North American Dental Group that is a huge dental support organization including more than 250 dental practices in 15 states. Lakewood Ranch is a dental clinic in Lakewood Ranch, Florida near Sarasota that offers general dentistry, children dentistry and cosmetic dentistry. These aspects are assumed to positively influence this market’s growth and stimulate the demand for dental equipment in North America within the forecast period.

Active Key Players in the Dental Equipment Market

- A-Dec Inc.

- Planmeca Oy

- Dentsply Sirona

- Patterson Companies Inc.

- Straumann

- GC Corp.

- Carestream Health Inc.

- Biolase Inc.

- Danaher Corp.

- 3M ESPE, Other Active Players

|

Global Dental Equipment Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 10.09 Bn. |

|

Forecast Period 2025-32 CAGR: |

6.5 % |

Market Size in 2032: |

USD 16.7 Bn. |

|

Segments Covered: |

By Procedure Type |

|

|

|

By Product Type |

|

||

|

By End user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Dental Equipment Market by Procedure Type (2018-2032)

4.1 Dental Equipment Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Restorative

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Peridontal

4.5 Endodontic

4.6 Orthodontic

4.7 Others

Chapter 5: Dental Equipment Market by Product Type (2018-2032)

5.1 Dental Equipment Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Dental Laser Equipment

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Dental Radiology Equipment

5.5 Dental Software and Imaging

5.6 Mechanical Systems

5.7 Others

Chapter 6: Dental Equipment Market by End user (2018-2032)

6.1 Dental Equipment Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Academic Institute and Research Centers

6.5 Dental Clinics

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Dental Equipment Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 A-DEC INCPLANMECA OY

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 DENTSPLY SIRONA

7.4 PATTERSON COMPANIES INCSTRAUMANN

7.5 GC CORPCARESTREAM HEALTH INCBIOLASE INCDANAHER CORP3M ESPE

7.6 OTHER KEY PLAYERS

7.7

Chapter 8: Global Dental Equipment Market By Region

8.1 Overview

8.2. North America Dental Equipment Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Procedure Type

8.2.4.1 Restorative

8.2.4.2 Peridontal

8.2.4.3 Endodontic

8.2.4.4 Orthodontic

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size by Product Type

8.2.5.1 Dental Laser Equipment

8.2.5.2 Dental Radiology Equipment

8.2.5.3 Dental Software and Imaging

8.2.5.4 Mechanical Systems

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size by End user

8.2.6.1 Hospitals

8.2.6.2 Academic Institute and Research Centers

8.2.6.3 Dental Clinics

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Dental Equipment Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Procedure Type

8.3.4.1 Restorative

8.3.4.2 Peridontal

8.3.4.3 Endodontic

8.3.4.4 Orthodontic

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size by Product Type

8.3.5.1 Dental Laser Equipment

8.3.5.2 Dental Radiology Equipment

8.3.5.3 Dental Software and Imaging

8.3.5.4 Mechanical Systems

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size by End user

8.3.6.1 Hospitals

8.3.6.2 Academic Institute and Research Centers

8.3.6.3 Dental Clinics

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Dental Equipment Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Procedure Type

8.4.4.1 Restorative

8.4.4.2 Peridontal

8.4.4.3 Endodontic

8.4.4.4 Orthodontic

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size by Product Type

8.4.5.1 Dental Laser Equipment

8.4.5.2 Dental Radiology Equipment

8.4.5.3 Dental Software and Imaging

8.4.5.4 Mechanical Systems

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size by End user

8.4.6.1 Hospitals

8.4.6.2 Academic Institute and Research Centers

8.4.6.3 Dental Clinics

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Dental Equipment Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Procedure Type

8.5.4.1 Restorative

8.5.4.2 Peridontal

8.5.4.3 Endodontic

8.5.4.4 Orthodontic

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size by Product Type

8.5.5.1 Dental Laser Equipment

8.5.5.2 Dental Radiology Equipment

8.5.5.3 Dental Software and Imaging

8.5.5.4 Mechanical Systems

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size by End user

8.5.6.1 Hospitals

8.5.6.2 Academic Institute and Research Centers

8.5.6.3 Dental Clinics

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Dental Equipment Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Procedure Type

8.6.4.1 Restorative

8.6.4.2 Peridontal

8.6.4.3 Endodontic

8.6.4.4 Orthodontic

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size by Product Type

8.6.5.1 Dental Laser Equipment

8.6.5.2 Dental Radiology Equipment

8.6.5.3 Dental Software and Imaging

8.6.5.4 Mechanical Systems

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size by End user

8.6.6.1 Hospitals

8.6.6.2 Academic Institute and Research Centers

8.6.6.3 Dental Clinics

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Dental Equipment Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Procedure Type

8.7.4.1 Restorative

8.7.4.2 Peridontal

8.7.4.3 Endodontic

8.7.4.4 Orthodontic

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size by Product Type

8.7.5.1 Dental Laser Equipment

8.7.5.2 Dental Radiology Equipment

8.7.5.3 Dental Software and Imaging

8.7.5.4 Mechanical Systems

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size by End user

8.7.6.1 Hospitals

8.7.6.2 Academic Institute and Research Centers

8.7.6.3 Dental Clinics

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Dental Equipment Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 10.09 Bn. |

|

Forecast Period 2025-32 CAGR: |

6.5 % |

Market Size in 2032: |

USD 16.7 Bn. |

|

Segments Covered: |

By Procedure Type |

|

|

|

By Product Type |

|

||

|

By End user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||