Global Datacenter Deployment Spending Market Overview

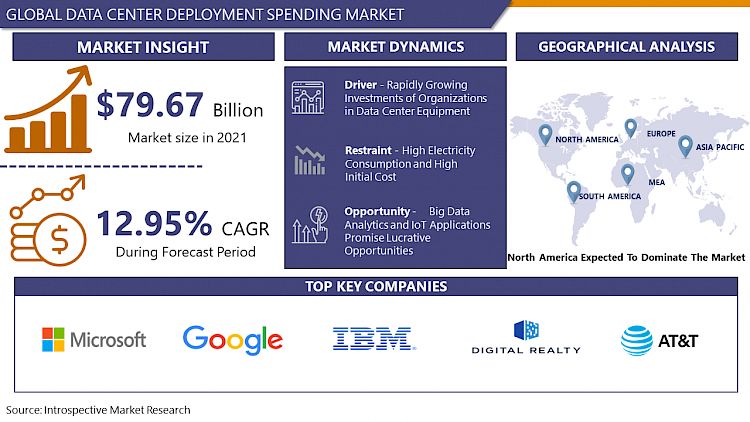

Global Data Center Deployment Spending Market was valued at USD 90.24 billion in 2021 and is expected to reach USD 244.53 billion by the year 2028, at a CAGR of 13.27%.

Data center deployment deploys and maintains the data center server and network infrastructure of the organizations. There is a need to be well-planned, flawlessly executed, and closely maintained in the data center deployment of the networking equipment, integration of the conventional servers, and storage resources. The data center deployment requires logically segmenting all Genesys web services (GWS) nodes into different groups that use the devoted service resource like T-Servers, StatServers, and others. The data center products provide sophisticated capabilities and services in different areas which contain infrastructure automation, security, and compliance, user management, reliability, and more that help to manage more effectively enterprise-grade deployments. Creating the standard and modular design of the data center, setting the timeline and goals of the data center, and communicating with stakeholders contained in the data center is the strategy for the deployment. SMEs develop the Internet of Things (IoT) and big data, expanding the need for servers and other hardware, and improvement in the number of interconnected smart devices, these factors are involved in the blooming data center deployment spending markets.

Market Dynamics And Factors For Datacenter Deployment Spending Market

Drivers:

Rapidly Growing Investments of Organizations in Data Center Equipment

The number of organizations increasing their investment in the equipment of the data center is the key factor that helps the growth of the market of the data center deployment spending during the forecast period. Data centers are designed the support business applications and activities which contain email and file sharing, productivity applications, customer relationship management (CRM), enterprise resource planning (ERP) and databases, big data, artificial intelligence, machine learning, virtual desktops, communications, and collaboration services. Owing to its beneficial factors several organizations in the IT and telecom sector, healthcare, BFSI, government, energy, and another sector are highly invested in data center equipment. The data center equipment includes routers, switches, firewalls, storage systems, servers, and application delivery controllers. This component provides together network infrastructure, storage infrastructure, and computing resources. Thus, increasing investment in data center equipment by various organizations that propels the growth of the data center deployment spending market.

Restraints:

High Electricity Consumption and High Initial Cost

Data centers require electricity to run their equipment. Organizations use a lot of electricity to keep data centers running continuously without any interruption. The high electricity requirement increases the cost of the data center. Making the data centers among the various organization are expensive due to the cost of the component of the data center like land and building shell, electrical systems HVAC cooling systems, and building fit-out is high. Thus, the high electricity consumption and maximum initial cost for the data center deployment spending are anticipated to hamper the growth of the market.

Opportunity:

Big Data Analytics and IoT Applications Promise Lucrative Opportunities

The growing application of IoT in data centers provides a lucrative opportunity for the data center deployment spending market. In the data centers, IoT devices have used the management the task automatically and to eliminate human errors. The number of the routine center task like monitoring infrastructure, updating software, releasing patches, scheduling jobs, configuring VMs, and automating reporting managed by IoT devices digitally. The IoT devices used as sensors can be used to measure energy consumption in the data center. This sensor tracks temperature set points, humidity, electricity levels, flow rates, and even equipment performance. It is easier to achieve an increase in storage capacity, availability of servers, computing capabilities, uptime, and network reliability due to the automating of data center tasks, processes, and operations, and is essential for the growth of the market. Moreover, the growing number of businesses that adopt the online platforms that generate big data also provides a remunerative opportunity for the data center deployment spending market during the forecast period.

Segmentation Analysis of Datacenter Deployment Spending Market

By Data Center Type, Colocation is anticipated to have maximum market share in the data center deployment market during the forecast period. The colocation data center is a physical facility to host businesses computing hardware and servers that provide space with cooling, proper power, and security. It provides better connectivity, developed network security, bursting capability, and supplies redundant power. There are two types of colocation facility such as retail and wholesale. The retail colocation facility provides the option to racks, rent space, and cages while wholesale colocation includes leasing entire rooms and facilities to place IT equipment. Data colocation requires for the IT industry, it provides better connectivity, developed network security, power redundancy through a combination of diesel power generators, double battery backup systems, multiple power grids, and excellent maintenance practices. The most organization does not have enough time for maintenance and IT team to handle IT issues, colocation data center facility provides those services. Apart from the IT sector data center colocation is contributing to the BFSI and other government sectors. The growing number of IT and telecom, BFSI, and other sectors across the globe boost the demand for the colocation data center.

By End-Users, the IT and telecom sectors have the highest market growth in data center deployment spending. This is owing to data centers being extensively used in the IT sectors. The number of IT sectors across the world is increasing due to the development of advanced technology. The IT sectors mostly used collocating to hyperscale data centers for the better management of the data. The government is majorly dependent on IT-intensive services to enhance its performance and has designed many Government-to-Citizen (G2C) delivery platforms like the National eGovernance Plan (NeGP), e-visa, and National CSR Data portal. The government of the various countries focused on the investment in the development of IT and telecom infrastructure. Thus, the growing number of IT company across the world is propelling the growth of the data center deployment market.

Regional Analysis Of Datacenter Deployment Spending Market

North America has dominated the region in the data center deployment spending market over the forecast period. This is owing to remarkable big data and IoT investment, the high presence of the number of data centers in the different sectors among the developed economies such as Canada and the United States. A number of organizations in this region adopted AI-designed processors to automate more tasks which leads to the development of the new data centers. For instance, according to Statista, in the United States as of January 2022, there are 2,751 data centers and in Canada, there are 324 data centers. The growing penetration of high-end cloud computing in enterprises in this region also rising the adoption of data centers in large organizations. The growing IT with BFSI sectors in this region supports to the increase in the demand for data centers. For instance, Statista stated that in the US the number of banks in 2021 is 4236 and according to the survey of the IT company Easyleadz, the IT sector in the US country is more than 4,50,00. These are the growth factors that can increase the market of data center deployment spending in the North American region.

Followed by North America, Asia Pacific is expected to capture the maximum market share for the data center deployment due to its growing population and with the rising number of businesses in this region. In the APAC region IT and telecom sectors rapidly growing. For instance, according to the survey of the IT and IT company Easyleadz, in India, the number of IT companies is more than 1,70,000. This growing no. of IT sectors that leads to an increase in the number of data centers. Statista stated that the number of data centers in 2022 is 447 in China, 272 in Australia, and 207 in Japan. These higher numbers of data centers support the growth of the data center deployment market in this region. Data centers are also highly used in BFSI sectors owing to the rising number of online payment applications and mobile wallets. In the APAC region a high number of BFSI sectors, so the demand for the data center is rising in this region which supports the growth of the data center deployment spending market in this region.

Europe has notable growth in the data center deployment market owing to the rapid adoption of advanced technology, and a growing number of businesses. The high IoT investment, and large presence of the number of data centers in the various sectors in this developed region. For instance, Statista stated the number of data centers present in 2022 in Germany is 484, in the United Kingdom is 458, and in France is 263. This high presence of the data centers results in the growth of the data center deployment spending market in the Europe region.

Covid-19 Impact Analysis On Datacenter Deployment Spending Market

COVID-19 began in Wuhan (China) in December 2019 and has since rapidly grown around the globe. In terms of confirmed cases and reported deaths, the US, India, Brazil, Russia, France, the UK, Turkey, Italy, and Spain are among the countries that have been most severely impacted. Because of the lockdowns, travel restrictions, and business closures, COVID-19 has had an impact on the businesses and industries of numerous nations. The Covid -19 has led to positive growth in data demand owing to remote work and shelter-in-place orders across the world. During this time the adoption of the data centers in the healthcare, BFSI, and government sectors. Growing work-from-home culture, and rising mobile streaming apps’ popularity during the pandemic, results in increasing the data centers which provided the growth for the data center deployment spending market.

Top Key Players Covered In Datacenter Deployment Spending Market

- Microsoft(US)

- IBM (US)

- Google Inc. (California)

- Digital Reality (UK)

- AT&T (Dallas)

- NTT Communication Corporation (Japan)

- HP Company (California)

- Cisco Systems (San Jose)

- Equinix (California)and other major players.

Key Industry Development In The Datacenter Deployment Spending Market

In March 2022, Microsoft announced the launch of a new data center in the India region. Indian organizations provide local data residency and faster access to the cloud, delivering advanced data security and cloud solutions. The new data center region consists of availability zones, providing high availability and additional tolerance to data center failures.

|

Global Data Center Deployment Spending Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 90.24 Bn. |

|

Forecast Period 2023-30 CAGR: |

13.27% |

Market Size in 2030: |

USD 244.53 Bn. |

|

|

By Data Center Type |

|

|

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Data Center Type

3.2 By End-Users

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Datacenter Deployment Spending Market by Data Center Type

5.1 Datacenter Deployment Spending Market Overview Snapshot and Growth Engine

5.2 Datacenter Deployment Spending Market Overview

5.3 Colocation

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Colocation: Geographic Segmentation

5.4 Hyperscale Data Centers

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Hyperscale Data Centers: Geographic Segmentation

5.5 Onsite Data Centers

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Onsite Data Centers: Geographic Segmentation

5.6 Edge Data Center

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Edge Data Center: Geographic Segmentation

Chapter 6: Datacenter Deployment Spending Market by End-Users

6.1 Datacenter Deployment Spending Market Overview Snapshot and Growth Engine

6.2 Datacenter Deployment Spending Market Overview

6.3 BFSI

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 BFSI: Geographic Segmentation

6.4 IT & Telecom

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 IT & Telecom: Geographic Segmentation

6.5 Healthcare

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Healthcare: Geographic Segmentation

6.6 Government

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Government: Geographic Segmentation

6.7 Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2016-2028F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Others: Geographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Datacenter Deployment Spending Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Datacenter Deployment Spending Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Datacenter Deployment Spending Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 MICROSOFT (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 IBM (US)

7.4 GOOGLE INC. (CALIFORNIA)

7.5 DIGITAL REALITY (UK)

7.6 AT&T (DALLAS)

7.7 NTT COMMUNICATION CORPORATION (JAPAN)

7.8 HP COMPANY (CALIFORNIA)

7.9 CISCO SYSTEMS (SAN JOSE)

7.10 EQUINIX (CALIFORNIA)

7.11 OTHER MAJOR PLAYERS

Chapter 8: Global Datacenter Deployment Spending Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Data Center Type

8.2.1 Colocation

8.2.2 Hyperscale Data Centers

8.2.3 Onsite Data Centers

8.2.4 Edge Data Center

8.3 Historic and Forecasted Market Size By End-Users

8.3.1 BFSI

8.3.2 IT & Telecom

8.3.3 Healthcare

8.3.4 Government

8.3.5 Others

Chapter 9: North America Datacenter Deployment Spending Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Data Center Type

9.4.1 Colocation

9.4.2 Hyperscale Data Centers

9.4.3 Onsite Data Centers

9.4.4 Edge Data Center

9.5 Historic and Forecasted Market Size By End-Users

9.5.1 BFSI

9.5.2 IT & Telecom

9.5.3 Healthcare

9.5.4 Government

9.5.5 Others

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Datacenter Deployment Spending Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Data Center Type

10.4.1 Colocation

10.4.2 Hyperscale Data Centers

10.4.3 Onsite Data Centers

10.4.4 Edge Data Center

10.5 Historic and Forecasted Market Size By End-Users

10.5.1 BFSI

10.5.2 IT & Telecom

10.5.3 Healthcare

10.5.4 Government

10.5.5 Others

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Datacenter Deployment Spending Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Data Center Type

11.4.1 Colocation

11.4.2 Hyperscale Data Centers

11.4.3 Onsite Data Centers

11.4.4 Edge Data Center

11.5 Historic and Forecasted Market Size By End-Users

11.5.1 BFSI

11.5.2 IT & Telecom

11.5.3 Healthcare

11.5.4 Government

11.5.5 Others

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Datacenter Deployment Spending Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Data Center Type

12.4.1 Colocation

12.4.2 Hyperscale Data Centers

12.4.3 Onsite Data Centers

12.4.4 Edge Data Center

12.5 Historic and Forecasted Market Size By End-Users

12.5.1 BFSI

12.5.2 IT & Telecom

12.5.3 Healthcare

12.5.4 Government

12.5.5 Others

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Datacenter Deployment Spending Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Data Center Type

13.4.1 Colocation

13.4.2 Hyperscale Data Centers

13.4.3 Onsite Data Centers

13.4.4 Edge Data Center

13.5 Historic and Forecasted Market Size By End-Users

13.5.1 BFSI

13.5.2 IT & Telecom

13.5.3 Healthcare

13.5.4 Government

13.5.5 Others

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Data Center Deployment Spending Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 90.24 Bn. |

|

Forecast Period 2023-30 CAGR: |

13.27% |

Market Size in 2030: |

USD 244.53 Bn. |

|

|

By Data Center Type |

|

|

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. DATACENTER DEPLOYMENT SPENDING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. DATACENTER DEPLOYMENT SPENDING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. DATACENTER DEPLOYMENT SPENDING MARKET COMPETITIVE RIVALRY

TABLE 005. DATACENTER DEPLOYMENT SPENDING MARKET THREAT OF NEW ENTRANTS

TABLE 006. DATACENTER DEPLOYMENT SPENDING MARKET THREAT OF SUBSTITUTES

TABLE 007. DATACENTER DEPLOYMENT SPENDING MARKET BY DATA CENTER TYPE

TABLE 008. COLOCATION MARKET OVERVIEW (2016-2028)

TABLE 009. HYPERSCALE DATA CENTERS MARKET OVERVIEW (2016-2028)

TABLE 010. ONSITE DATA CENTERS MARKET OVERVIEW (2016-2028)

TABLE 011. EDGE DATA CENTER MARKET OVERVIEW (2016-2028)

TABLE 012. DATACENTER DEPLOYMENT SPENDING MARKET BY END-USERS

TABLE 013. BFSI MARKET OVERVIEW (2016-2028)

TABLE 014. IT & TELECOM MARKET OVERVIEW (2016-2028)

TABLE 015. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 016. GOVERNMENT MARKET OVERVIEW (2016-2028)

TABLE 017. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 018. NORTH AMERICA DATACENTER DEPLOYMENT SPENDING MARKET, BY DATA CENTER TYPE (2016-2028)

TABLE 019. NORTH AMERICA DATACENTER DEPLOYMENT SPENDING MARKET, BY END-USERS (2016-2028)

TABLE 020. N DATACENTER DEPLOYMENT SPENDING MARKET, BY COUNTRY (2016-2028)

TABLE 021. EUROPE DATACENTER DEPLOYMENT SPENDING MARKET, BY DATA CENTER TYPE (2016-2028)

TABLE 022. EUROPE DATACENTER DEPLOYMENT SPENDING MARKET, BY END-USERS (2016-2028)

TABLE 023. DATACENTER DEPLOYMENT SPENDING MARKET, BY COUNTRY (2016-2028)

TABLE 024. ASIA PACIFIC DATACENTER DEPLOYMENT SPENDING MARKET, BY DATA CENTER TYPE (2016-2028)

TABLE 025. ASIA PACIFIC DATACENTER DEPLOYMENT SPENDING MARKET, BY END-USERS (2016-2028)

TABLE 026. DATACENTER DEPLOYMENT SPENDING MARKET, BY COUNTRY (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA DATACENTER DEPLOYMENT SPENDING MARKET, BY DATA CENTER TYPE (2016-2028)

TABLE 028. MIDDLE EAST & AFRICA DATACENTER DEPLOYMENT SPENDING MARKET, BY END-USERS (2016-2028)

TABLE 029. DATACENTER DEPLOYMENT SPENDING MARKET, BY COUNTRY (2016-2028)

TABLE 030. SOUTH AMERICA DATACENTER DEPLOYMENT SPENDING MARKET, BY DATA CENTER TYPE (2016-2028)

TABLE 031. SOUTH AMERICA DATACENTER DEPLOYMENT SPENDING MARKET, BY END-USERS (2016-2028)

TABLE 032. DATACENTER DEPLOYMENT SPENDING MARKET, BY COUNTRY (2016-2028)

TABLE 033. MICROSOFT (US): SNAPSHOT

TABLE 034. MICROSOFT (US): BUSINESS PERFORMANCE

TABLE 035. MICROSOFT (US): PRODUCT PORTFOLIO

TABLE 036. MICROSOFT (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. IBM (US): SNAPSHOT

TABLE 037. IBM (US): BUSINESS PERFORMANCE

TABLE 038. IBM (US): PRODUCT PORTFOLIO

TABLE 039. IBM (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. GOOGLE INC. (CALIFORNIA): SNAPSHOT

TABLE 040. GOOGLE INC. (CALIFORNIA): BUSINESS PERFORMANCE

TABLE 041. GOOGLE INC. (CALIFORNIA): PRODUCT PORTFOLIO

TABLE 042. GOOGLE INC. (CALIFORNIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. DIGITAL REALITY (UK): SNAPSHOT

TABLE 043. DIGITAL REALITY (UK): BUSINESS PERFORMANCE

TABLE 044. DIGITAL REALITY (UK): PRODUCT PORTFOLIO

TABLE 045. DIGITAL REALITY (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. AT&T (DALLAS): SNAPSHOT

TABLE 046. AT&T (DALLAS): BUSINESS PERFORMANCE

TABLE 047. AT&T (DALLAS): PRODUCT PORTFOLIO

TABLE 048. AT&T (DALLAS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. NTT COMMUNICATION CORPORATION (JAPAN): SNAPSHOT

TABLE 049. NTT COMMUNICATION CORPORATION (JAPAN): BUSINESS PERFORMANCE

TABLE 050. NTT COMMUNICATION CORPORATION (JAPAN): PRODUCT PORTFOLIO

TABLE 051. NTT COMMUNICATION CORPORATION (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. HP COMPANY (CALIFORNIA): SNAPSHOT

TABLE 052. HP COMPANY (CALIFORNIA): BUSINESS PERFORMANCE

TABLE 053. HP COMPANY (CALIFORNIA): PRODUCT PORTFOLIO

TABLE 054. HP COMPANY (CALIFORNIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. CISCO SYSTEMS (SAN JOSE): SNAPSHOT

TABLE 055. CISCO SYSTEMS (SAN JOSE): BUSINESS PERFORMANCE

TABLE 056. CISCO SYSTEMS (SAN JOSE): PRODUCT PORTFOLIO

TABLE 057. CISCO SYSTEMS (SAN JOSE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. EQUINIX (CALIFORNIA): SNAPSHOT

TABLE 058. EQUINIX (CALIFORNIA): BUSINESS PERFORMANCE

TABLE 059. EQUINIX (CALIFORNIA): PRODUCT PORTFOLIO

TABLE 060. EQUINIX (CALIFORNIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 061. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 062. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 063. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. DATACENTER DEPLOYMENT SPENDING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. DATACENTER DEPLOYMENT SPENDING MARKET OVERVIEW BY DATA CENTER TYPE

FIGURE 012. COLOCATION MARKET OVERVIEW (2016-2028)

FIGURE 013. HYPERSCALE DATA CENTERS MARKET OVERVIEW (2016-2028)

FIGURE 014. ONSITE DATA CENTERS MARKET OVERVIEW (2016-2028)

FIGURE 015. EDGE DATA CENTER MARKET OVERVIEW (2016-2028)

FIGURE 016. DATACENTER DEPLOYMENT SPENDING MARKET OVERVIEW BY END-USERS

FIGURE 017. BFSI MARKET OVERVIEW (2016-2028)

FIGURE 018. IT & TELECOM MARKET OVERVIEW (2016-2028)

FIGURE 019. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 020. GOVERNMENT MARKET OVERVIEW (2016-2028)

FIGURE 021. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 022. NORTH AMERICA DATACENTER DEPLOYMENT SPENDING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. EUROPE DATACENTER DEPLOYMENT SPENDING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. ASIA PACIFIC DATACENTER DEPLOYMENT SPENDING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. MIDDLE EAST & AFRICA DATACENTER DEPLOYMENT SPENDING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. SOUTH AMERICA DATACENTER DEPLOYMENT SPENDING MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Data Center Deployment Spending Market research report is 2023-2030.

Microsoft (US), IBM (US), Google Inc. (California), Digital Reality (UK), AT&T (Dallas), NTT Communication Corporation (Japan), HP Company (California), Cisco Systems (San Jose), Equinix (California), and other major players.

The Datacenter Deployment Spending Market is segmented into data Center Type, end-user, and region. By Data Center Type the market is categorized into Colocation, Hyperscale Data Centers, Onsite Data Centers, and Edge Data centers. By End-user, the market is categorized into BFSI, IT & Telecom, Healthcare, Government, and Others. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain etc.), Asia-Pacific (China; India; Japan; Southeast Asia etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa etc.).

Data center deployment deploys and maintains the data center server and network infrastructure of the organizations. There is a need to be well-planned, flawlessly executed, and closely maintained in the data center deployment of the networking equipment, integration of the conventional servers, and storage resources. The data center deployment requires logically segmenting all Genesys web services (GWS) nodes into different groups that use the devoted service resource like T-Servers, StatServers, and others.

Global Data Center Deployment Spending Market was valued at USD 90.24 billion in 2021 and is expected to reach USD 244.53 billion by the year 2028, at a CAGR of 13.27%.