Data Integration Tool Market Synopsis

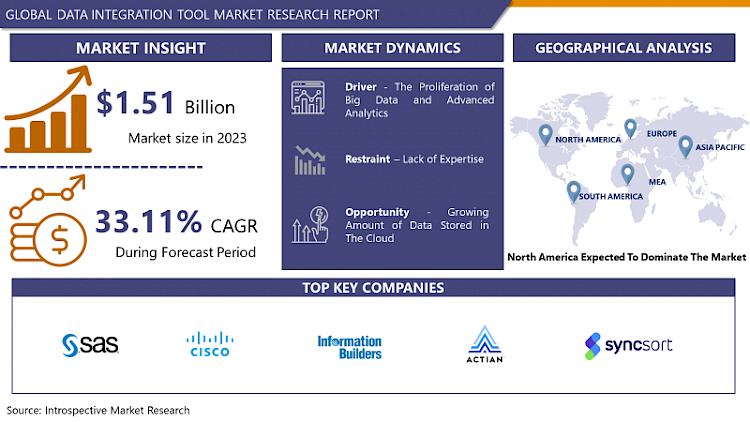

Global Data Integration Tool Market size is expected to grow from USD 1.51 Billion in 2023 to USD 19.81 Billion by 2032, at a CAGR of 33.11% during the forecast period (2024-2032).

A data integration tool is software that facilitates the consolidation of data from various sources into a unified view, enabling seamless access and analysis. These tools employ techniques like ETL (extract, transform, load) to harmonize disparate data formats and structures, ensuring compatibility and consistency for efficient decision-making and reporting processes.

- The practice of merging data from several unrelated sources to provide people with a single, cohesive picture is known as data integration. The process of combining smaller parts into a single system so that it can operate as a whole is known as integration. Additionally, in the context of IT, it refers to the process of combining various data subsystems to create a system that is more extensive, complete, and standardized across many teams, assisting in the development of unified insights for everyone.

- These solutions offer benefits including better decision-making processes, increased operational efficiency, and greater data accuracy. Data Integration Tools help companies break down data silos and promote a more thorough view of their information environment by enabling the seamless transmission of data between systems.

- Data integration tools are useful in many different areas, such as e-commerce, healthcare, and finance. They assist with data warehousing, real-time data integration, data migration, and ETL (Extract, Transform, Load) procedures. Due to the growing amounts of data that businesses are producing, data integration tools are currently seeing significant expansion in the market. Gaining meaningful insights requires the capacity to collect, process, and evaluate this data. Data Integration Tools are essential for optimizing this process. These tools continue to be important as more and more businesses realize the benefit of making decisions based on data. They enable organizations to extract the most value possible from their data assets, which keeps them competitive in today's data-driven market.

Data Integration Tool Market Trend Analysis:

The Proliferation of Big Data and Advanced Analytics

- The growth of the data integration tool market is primarily being driven by the proliferation of big data and advanced analytics data-driven world, organizations have to deal with large and diverse datasets that come from a multitude of platforms and apps. The volume, pace, and diversity of Big Data necessitate the use of advanced technologies for the smooth integration of data and the coherent extraction of insightful information. Data integration tools are essential for standardizing formats, bringing disparate sources of information together, and creating a single, cohesive view of the data. This becomes especially important in the field of Advanced Analytics, where the availability of well-integrated and organized data is vital to the ability to draw significant patterns and forecasts.

- Moreover, there has been an exponential increase in the need for reliable data integration tools as businesses recognize the strategic importance of making decisions based on data. With the use of these technologies, companies may break down organizational barriers, promote teamwork, and gain insights more quickly. Big Data, advanced analytics, and data integration tools are interrelated, and this has become a driving force for innovation and competitiveness in many sectors. Because of this synergy, the industry is thriving and solutions are always evolving to suit the ever-increasing demands of analytics and data management. Fundamentally, one of the main factors propelling the growth of the data integration tool market is the symbiotic link between the spread of big data and the powers of advanced analytics.

Growing Amount of Data Stored in The Cloud

- The industry is poised for significant growth due to the increasing amount of data being kept on the cloud. An abundance of data is being created and stored in cloud settings as organizations gradually move their computing and data storage activities to these platforms. The rise in cloud-based data storage may be attributed to several factors, including cloud solutions' scalability, affordability, and inherent flexibility. Businesses are becoming more and more aware of how they can use this growing pool of data that is kept in the cloud to gain a competitive edge, extract insightful information, and direct strategic decision-making.

- The ability of the cloud to handle large datasets and offer resources for on-demand access opens up new possibilities for applications related to data analytics, AI, and machine learning. Companies may use this expanding cloud-based data library to find correlations, patterns, and trends that spur innovation and increase productivity.

- Furthermore, cloud platforms' collaboration features and accessibility make it easier to share and integrate data, which promotes a more connected and flexible company environment. In summary, the increasing amount of data being kept in the cloud not only signals a fundamental change in data management techniques but also offers businesses a huge chance to realize the full value of their data assets and propel the market's expansion.

Data Integration Tool Market Segment Analysis:

Data Integration Tool Market is Segmented Based on By Component, Deployment, Organization Size, and Vertical.

By Deployment, On-Premise Segment Is Expected to Dominate the Market During the Forecast Period.

- The market for data integration tools is dominated by the on-premise sector due to the preferences of many businesses that prioritize having internal control over infrastructure and place a strong emphasis on security and compliance. The localized and flexible approach offered by on-premise solutions guarantees that sensitive data stays inside the physical walls of the company. This control gives companies confidence, especially those in heavily regulated sectors.

- Furthermore, on-premise solutions enable customizable setups because they are designed to meet the integration needs of particular businesses. The on-premise market is expected to maintain its leadership despite the increasing ubiquity of cloud-based alternatives. This is due to the persistent need for reliable and flexible data integration solutions across various industries.

By Organization Size, Large Enterprise Segment Held the Largest Share Of 67.10% In 2022

- The major enterprise category holds a significant market share in the Data Integration Tool market due to its unique requirements and extended activities. Large businesses require sophisticated integration solutions to improve decision-making and optimize operations due to their numerous data sources and large amounts of information.

- These organizations place a high priority on complete data integration solutions that can seamlessly unite dissimilar systems, assuring an efficient and seamless flow of information throughout the whole corporation. Large businesses need reliable solutions that offer scalability, flexibility, and cutting-edge functionality due to the scope of their operations. As a result, the market for data integration tools is significantly shaped by the big business segment, highlighting the necessity for powerful, scalable, and customizable integration solutions that are suited to the complex requirements of large corporate settings.

Data Integration Tool Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The market for data integration tools is dominated by North America, which has established its dominance through several causes. The region's prominence is largely due to its broad use of modern data integration techniques and technical know-how. To improve operational operations, businesses in North America's different industries place a high priority on efficient data management and seamless integration.

- The area is positioned as an important player in the industry because of its proactive approach to digital transformation and strong IT infrastructure. North America's supremacy is further bolstered by the existence of significant technological players and an early adopter culture. The continuous need for novel approaches and the adoption of state-of-the-art technology by businesses bolster North America's position as the dominant player in the ever-changing Data Integration Tool market.

Key Players Covered in Data Integration Tool Market:

- SAS Institute Inc. (US)

- Cisco System Inc. (US)

- Information Builders (US)

- Actian Corporation (US)

- Syncsort (US)

- Pitney Bowes Inc. (US)

- IBM (US)

- Informatica Corporation (US)

- Oracle Corporation (US)

- Talend (US)

- Microsoft Corporation (US)

- Denodo Technologies (US)

- HVR Software (US)

- Attunity Ltd. (US)

- Qlik (US)

- Salesforce (US)

- Tibco (US)

- Precisely (US)

- SAP SE (Germany)

- Software AG (Germany), and Other Major Players

Key Industry Development in The Data Integration Tool Market:

- In September 2023, Salesforce and Snowflake collaboratively introduced a data-sharing-based integration platform. This platform facilitates seamless data sharing between Salesforce's Customer Relationship Management (CRM) system and Snowflake's cloud data platform. It enables organizations to leverage data-driven insights more effectively, enhancing customer experiences and data analytics capabilities.

- In May 2023, SAP SE and Google Cloud announced an extensive expansion of their partnership, introducing a comprehensive open data offering designed to simplify data landscapes and unleash the power of business data.

|

Global Data Integration Tool Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2032 |

Market Size in 2023: |

USD 1.51 Bn. |

|

Forecast Period 2024-32 CAGR: |

33.11% |

Market Size in 2032: |

USD 19.81 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment |

|

||

|

By Organization Size |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- DATA INTEGRATION TOOL MARKET BY COMPONENT (2017-2032)

- DATA INTEGRATION TOOL MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SOLUTIONS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SERVICES

- DATA INTEGRATION TOOL MARKET BY DEPLOYMENT (2017-2032)

- DATA INTEGRATION TOOL MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CLOUD

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ON-PREMISE

- HYBRID

- DATA INTEGRATION TOOL MARKET BY ORGANIZATION SIZE (2017-2032)

- DATA INTEGRATION TOOL MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SMES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LARGE ENTERPRISE

- DATA INTEGRATION TOOL MARKET BY VERTICAL (2017-2032)

- DATA INTEGRATION TOOL MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BFSI

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- GOVERNMENT & PUBLIC SECTOR

- HEALTHCARE & LIFE SCIENCES

- IT & TELECOM

- MANUFACTURING

- MEDIA & ENTERTAINMENT

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Data Integration Tool Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- SAS INSTITUTE INC. (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- CISCO SYSTEM INC. (US)

- INFORMATION BUILDERS (US)

- ACTIAN CORPORATION (US)

- SYNCSORT (US)

- PITNEY BOWES INC. (US)

- IBM (US)

- INFORMATICA CORPORATION (US)

- ORACLE CORPORATION (US)

- TALEND (US)

- MICROSOFT CORPORATION (US)

- DENODO TECHNOLOGIES (US)

- HVR SOFTWARE (US)

- ATTUNITY LTD. (US)

- QLIK (US)

- SALESFORCE (US)

- TIBCO (US)

- PRECISELY (US)

- SAP SE (GERMANY)

- SOFTWARE AG (GERMANY)

- COMPETITIVE LANDSCAPE

- GLOBAL DATA INTEGRATION TOOL MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Deployment

- Historic And Forecasted Market Size By Organization Size

- Historic And Forecasted Market Size By Vertical

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Data Integration Tool Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2032 |

Market Size in 2023: |

USD 1.51 Bn. |

|

Forecast Period 2024-32 CAGR: |

33.11% |

Market Size in 2032: |

USD 19.81 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment |

|

||

|

By Organization Size |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. DATA INTEGRATION TOOL MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. DATA INTEGRATION TOOL MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. DATA INTEGRATION TOOL MARKET COMPETITIVE RIVALRY

TABLE 005. DATA INTEGRATION TOOL MARKET THREAT OF NEW ENTRANTS

TABLE 006. DATA INTEGRATION TOOL MARKET THREAT OF SUBSTITUTES

TABLE 007. DATA INTEGRATION TOOL MARKET BY TYPE

TABLE 008. ON-PREMISES MARKET OVERVIEW (2016-2028)

TABLE 009. ON-DEMAND MARKET OVERVIEW (2016-2028)

TABLE 010. DATA INTEGRATION TOOL MARKET BY APPLICATION

TABLE 011. APPLICATION A MARKET OVERVIEW (2016-2028)

TABLE 012. APPLICATION B MARKET OVERVIEW (2016-2028)

TABLE 013. APPLICATION C MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA DATA INTEGRATION TOOL MARKET, BY TYPE (2016-2028)

TABLE 015. NORTH AMERICA DATA INTEGRATION TOOL MARKET, BY APPLICATION (2016-2028)

TABLE 016. N DATA INTEGRATION TOOL MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE DATA INTEGRATION TOOL MARKET, BY TYPE (2016-2028)

TABLE 018. EUROPE DATA INTEGRATION TOOL MARKET, BY APPLICATION (2016-2028)

TABLE 019. DATA INTEGRATION TOOL MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC DATA INTEGRATION TOOL MARKET, BY TYPE (2016-2028)

TABLE 021. ASIA PACIFIC DATA INTEGRATION TOOL MARKET, BY APPLICATION (2016-2028)

TABLE 022. DATA INTEGRATION TOOL MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA DATA INTEGRATION TOOL MARKET, BY TYPE (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA DATA INTEGRATION TOOL MARKET, BY APPLICATION (2016-2028)

TABLE 025. DATA INTEGRATION TOOL MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA DATA INTEGRATION TOOL MARKET, BY TYPE (2016-2028)

TABLE 027. SOUTH AMERICA DATA INTEGRATION TOOL MARKET, BY APPLICATION (2016-2028)

TABLE 028. DATA INTEGRATION TOOL MARKET, BY COUNTRY (2016-2028)

TABLE 029. SAP SE (GERMANY): SNAPSHOT

TABLE 030. SAP SE (GERMANY): BUSINESS PERFORMANCE

TABLE 031. SAP SE (GERMANY): PRODUCT PORTFOLIO

TABLE 032. SAP SE (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. SAS INSTITUTE INC. (US): SNAPSHOT

TABLE 033. SAS INSTITUTE INC. (US): BUSINESS PERFORMANCE

TABLE 034. SAS INSTITUTE INC. (US): PRODUCT PORTFOLIO

TABLE 035. SAS INSTITUTE INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. CISCO SYSTEM INC. (US): SNAPSHOT

TABLE 036. CISCO SYSTEM INC. (US): BUSINESS PERFORMANCE

TABLE 037. CISCO SYSTEM INC. (US): PRODUCT PORTFOLIO

TABLE 038. CISCO SYSTEM INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. INFORMATION BUILDERS (US): SNAPSHOT

TABLE 039. INFORMATION BUILDERS (US): BUSINESS PERFORMANCE

TABLE 040. INFORMATION BUILDERS (US): PRODUCT PORTFOLIO

TABLE 041. INFORMATION BUILDERS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. ACTIAN CORPORATION (US): SNAPSHOT

TABLE 042. ACTIAN CORPORATION (US): BUSINESS PERFORMANCE

TABLE 043. ACTIAN CORPORATION (US): PRODUCT PORTFOLIO

TABLE 044. ACTIAN CORPORATION (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. SYNCSORT (US): SNAPSHOT

TABLE 045. SYNCSORT (US): BUSINESS PERFORMANCE

TABLE 046. SYNCSORT (US): PRODUCT PORTFOLIO

TABLE 047. SYNCSORT (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. PITNEY BOWES INC. (US): SNAPSHOT

TABLE 048. PITNEY BOWES INC. (US): BUSINESS PERFORMANCE

TABLE 049. PITNEY BOWES INC. (US): PRODUCT PORTFOLIO

TABLE 050. PITNEY BOWES INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. IBM (US): SNAPSHOT

TABLE 051. IBM (US): BUSINESS PERFORMANCE

TABLE 052. IBM (US): PRODUCT PORTFOLIO

TABLE 053. IBM (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. INFORMATICA CORPORATION (US): SNAPSHOT

TABLE 054. INFORMATICA CORPORATION (US): BUSINESS PERFORMANCE

TABLE 055. INFORMATICA CORPORATION (US): PRODUCT PORTFOLIO

TABLE 056. INFORMATICA CORPORATION (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. ORACLE CORPORATION (US): SNAPSHOT

TABLE 057. ORACLE CORPORATION (US): BUSINESS PERFORMANCE

TABLE 058. ORACLE CORPORATION (US): PRODUCT PORTFOLIO

TABLE 059. ORACLE CORPORATION (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. TALEND (US): SNAPSHOT

TABLE 060. TALEND (US): BUSINESS PERFORMANCE

TABLE 061. TALEND (US): PRODUCT PORTFOLIO

TABLE 062. TALEND (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. MICROSOFT CORPORATION (US): SNAPSHOT

TABLE 063. MICROSOFT CORPORATION (US): BUSINESS PERFORMANCE

TABLE 064. MICROSOFT CORPORATION (US): PRODUCT PORTFOLIO

TABLE 065. MICROSOFT CORPORATION (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. DENODO TECHNOLOGIES (US): SNAPSHOT

TABLE 066. DENODO TECHNOLOGIES (US): BUSINESS PERFORMANCE

TABLE 067. DENODO TECHNOLOGIES (US): PRODUCT PORTFOLIO

TABLE 068. DENODO TECHNOLOGIES (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. HVR SOFTWARE (US): SNAPSHOT

TABLE 069. HVR SOFTWARE (US): BUSINESS PERFORMANCE

TABLE 070. HVR SOFTWARE (US): PRODUCT PORTFOLIO

TABLE 071. HVR SOFTWARE (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. ATTUNITY LTD. (US): SNAPSHOT

TABLE 072. ATTUNITY LTD. (US): BUSINESS PERFORMANCE

TABLE 073. ATTUNITY LTD. (US): PRODUCT PORTFOLIO

TABLE 074. ATTUNITY LTD. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. DATA INTEGRATION TOOL MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. DATA INTEGRATION TOOL MARKET OVERVIEW BY TYPE

FIGURE 012. ON-PREMISES MARKET OVERVIEW (2016-2028)

FIGURE 013. ON-DEMAND MARKET OVERVIEW (2016-2028)

FIGURE 014. DATA INTEGRATION TOOL MARKET OVERVIEW BY APPLICATION

FIGURE 015. APPLICATION A MARKET OVERVIEW (2016-2028)

FIGURE 016. APPLICATION B MARKET OVERVIEW (2016-2028)

FIGURE 017. APPLICATION C MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA DATA INTEGRATION TOOL MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE DATA INTEGRATION TOOL MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC DATA INTEGRATION TOOL MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA DATA INTEGRATION TOOL MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA DATA INTEGRATION TOOL MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Data Integration Tool Market research report is 2024-2032.

SAS Institute Inc. (US), Cisco System Inc. (US), Information Builders (US), Actian Corporation (US),Syncsort (US), Pitney Bowes Inc. (US), IBM (US),Informatica Corporation (US), Oracle Corporation (US), Talend (US), Microsoft Corporation (US), Denodo Technologies (US),HVR Software (US), Attunity Ltd. (US),Qlik (US),Salesforce (US), Tibco (US), Precisely (US), SAP SE (Germany), Software AG (Germany), and Other Major Players.

The Configuration Auditing Tools Market is segmented into Component, Deployment, Organization Size, Vertical and region. By Component, the market is categorized into Solutions and Services. By Deployment, the market is categorized into Cloud-Based, On-Premise and Hybrid. By Organization Size, the market is categorized into SMEs and Large Enterprise. By Vertical, the market is categorized into BFSI, Government & Public Sector, Healthcare & Life Sciences, IT & Telecom, Manufacturing, Media & Entertainment, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A data integration tool is software that facilitates the consolidation of data from various sources into a unified view, enabling seamless access and analysis. These tools employ techniques like ETL (extract, transform, load) to harmonize disparate data formats and structures, ensuring compatibility and consistency for efficient decision-making and reporting processes.

Global Data Integration Tool Market size is expected to grow from USD 1.51 Billion in 2023 to USD 19.81 Billion by 2032, at a CAGR of 33.11% during the forecast period (2024-2032).