Crowdfunding Market Synopsis

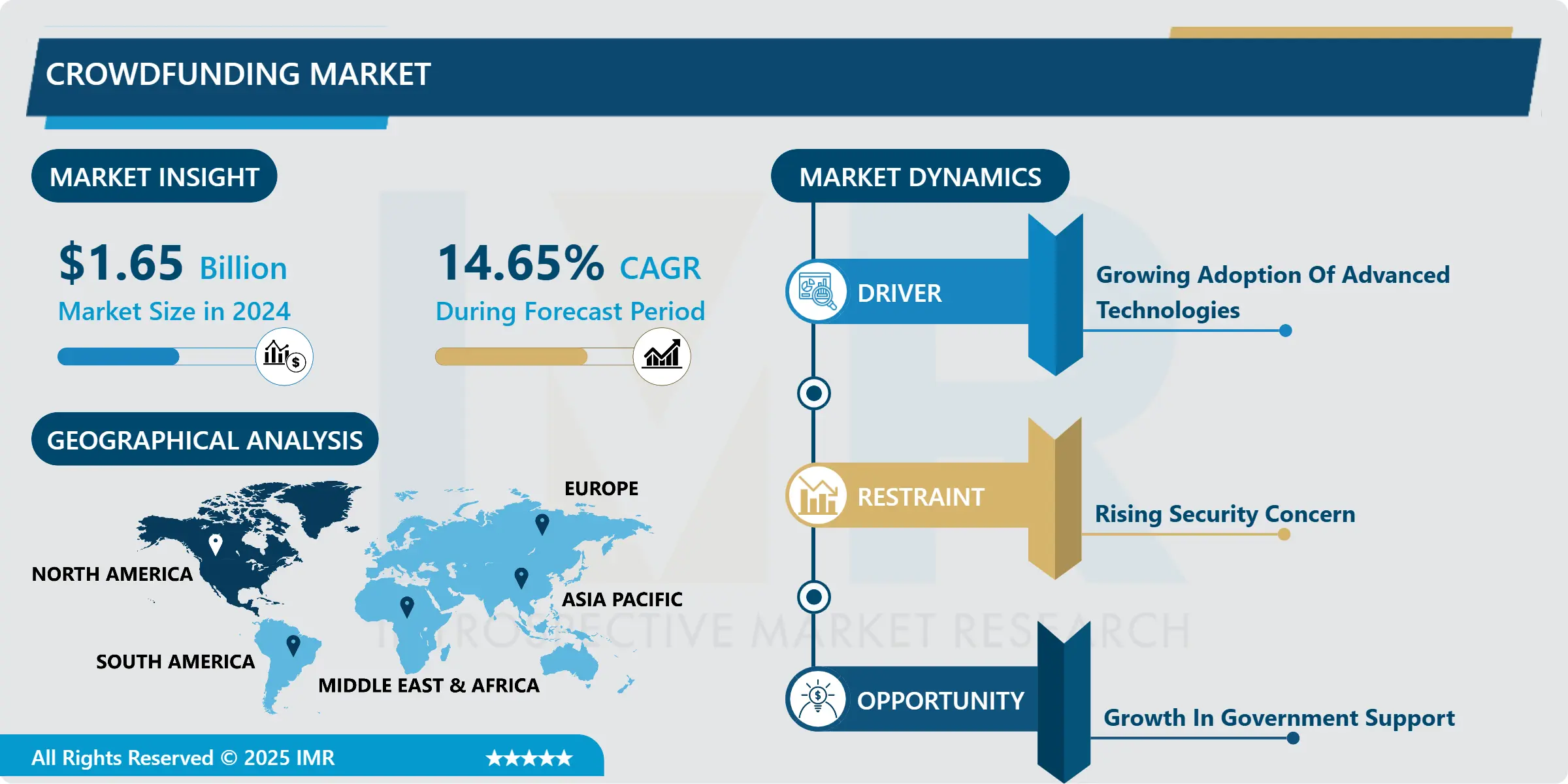

Global Crowdfunding Market size was valued at USD 1.65 Billion in 2024 and is projected to reach USD 4.93 Billion by 2032, growing at a CAGR of 14.65% from 2025 to 2032.

Crowdfunding is a financing model that leverages the collective contributions of a large number of individuals, typically through online platforms, to fund projects, ventures, or initiatives. This innovative approach to raising capital has gained significant popularity in recent years, enabling individuals, entrepreneurs, and organizations to access funding from a diverse group of backers, often referred to as "crowd" or "crowd investors." Crowdfunding has transformed traditional funding methods by democratizing access to capital and allowing virtually anyone with an internet connection to participate in supporting ideas, businesses, creative endeavors, and charitable causes.

One of the key features of crowdfunding is its versatility, accommodating a wide range of funding needs and purposes. These include equity crowdfunding, where backers receive shares or equity in the project or company in exchange for their investment; rewards-based crowdfunding, where backers receive tangible rewards or products related to the project they support; donation-based crowdfunding, primarily used for charitable or social causes where backers contribute without expecting financial returns; and debt-based crowdfunding, also known as peer-to-peer lending, where backers provide loans to individuals or businesses with the expectation of repayment with interest.

Crowdfunding platforms serve as intermediaries that connect project creators with potential backers. These platforms provide a space for creators to showcase their ideas, set funding goals, and present their vision to the public. Backers, in turn, can browse through various projects, contribute funds, and engage with creators through comments and updates. The success of a crowdfunding campaign often depends on the ability of project creators to effectively communicate their value proposition and mobilize their network, as well as their appeal to a broader online audience.

The Crowdfunding Market Trend Analysis

Growing Adoption Of Advanced Technologies

- The growing adoption of advanced technologies is a significant driver of the crowdfunding market. This trend is transforming the way crowdfunding platforms operate and expanding the opportunities for both project creators and backers.

- One of the key ways technology is driving crowdfunding is through the development of user-friendly, digital platforms. The rise of the internet and mobile apps has made it easier for project creators to showcase their ideas and connect with a global audience of potential backers. These platforms provide intuitive interfaces, multimedia capabilities, and secure payment processing, making it convenient for individuals to browse, support, and track crowdfunding campaigns from anywhere in the world.

- Additionally, advancements in data analytics and artificial intelligence have enabled crowdfunding platforms to enhance their matchmaking algorithms. These algorithms connect backers with projects that align with their interests, increasing the chances of campaign success. By leveraging data and predictive analytics, platforms can provide personalized recommendations to users, improving the overall crowdfunding experience.

- Blockchain technology is another notable driver of crowdfunding innovation. Blockchain introduces transparency and security to crowdfunding campaigns by recording transactions on a decentralized ledger. This not only reduces the risk of fraud but also enables the use of cryptocurrencies for crowdfunding, offering backers more options for contributing to campaigns.

- Furthermore, the growth of crowdfunding is closely tied to the rise of crowdfunding for specific sectors, such as fintech, real estate, and green technology. These industries leverage cutting-edge technologies to create innovative crowdfunding models. For example, real estate crowdfunding platforms use blockchain for property tokenization, allowing fractional ownership and investment in real estate assets.

Growth In Government Support

- The growth in government support represents a significant opportunity for the crowdfunding market. This support takes various forms, including regulatory initiatives, funding programs, and partnerships, all of which play a crucial role in fostering a favorable environment for crowdfunding to thrive.

- One of the most notable aspects of government support is the creation of regulatory frameworks that facilitate crowdfunding activities. Many governments around the world have recognized the potential of crowdfunding as a means to stimulate economic growth, entrepreneurship, and innovation. They have responded by enacting regulations that provide legal clarity and oversight for crowdfunding platforms and campaigns. These regulations often include crowdfunding-specific exemptions, such as raising crowdfunding caps or simplifying registration requirements, making it easier for both businesses and individuals to engage in crowdfunding activities.

- Government funding programs also represent a significant opportunity for the crowdfunding market. Many governments allocate resources to support startups, small businesses, and creative projects through crowdfunding. These programs often match crowdfunding contributions, effectively doubling the funding received by campaigns. By doing so, governments encourage private individuals and businesses to participate in crowdfunding while also providing a financial incentive for backers to support projects in their communities.

- Moreover, governments can partner with crowdfunding platforms to promote specific initiatives and projects. These partnerships can help raise awareness and drive funding for projects that align with public policy goals, such as those related to sustainability, education, or innovation. Crowdfunding platforms can serve as valuable tools for governments to engage with their constituents and involve them in decision-making processes.

Crowdfunding Market Segmentation Analysis

Crowdfunding Market segments cover the Type, End-User and Region.

By type, Debt-based segment is Anticipated to Dominate the Market Over the Forecast period.

- The debt-based crowdfunding segment was indeed a dominating and prominent segment in the crowdfunding market. This segment, often referred to as peer-to-peer (P2P) lending or debt crowdfunding, has garnered significant attention and popularity for several reasons.

- Debt-based crowdfunding offers a straightforward and well-understood investment model. In this segment, backers provide loans to individuals or businesses, and in return, they expect repayment with interest over a specified period. This familiarity and the potential for predictable returns make debt-based crowdfunding an attractive option for both individual and institutional investors looking to diversify their portfolios.

- Moreover, the growth of the debt-based crowdfunding segment has been fueled by advancements in technology and data analytics. Online platforms have made it easier for borrowers to access capital and for lenders to connect with creditworthy borrowers. The use of algorithms and credit scoring models has improved risk assessment and decision-making, enhancing the overall efficiency and security of debt crowdfunding transactions.

- Additionally, low-interest rate environments in some regions have driven investors to seek alternative investment opportunities, including debt-based crowdfunding, in pursuit of higher yields. This search for better returns has contributed to the growth of the segment.

- Government regulations and supportive frameworks have played a pivotal role in the dominance of debt-based crowdfunding. Regulators in various countries have recognized the importance of balancing investor protection with fostering access to capital. As a result, they have introduced regulations that provide oversight while allowing for innovation in debt crowdfunding.

Regional Analysis of The Crowdfunding Market

North America is dominating the Market Over the Forecast Period.

- North America was indeed a dominating segment in the crowdfunding market. The region, particularly the United States and Canada, had established itself as a global leader in the crowdfunding industry. Several factors contributed to North America's dominance in crowdfunding. Firstly, the United States, in particular, had a well-developed and mature crowdfunding ecosystem. It was home to a multitude of crowdfunding platforms, spanning various models such as rewards-based, equity-based, and debt-based crowdfunding. These platforms catered to a wide range of projects, startups, and initiatives, making it a highly diverse and active marketplace.

- The regulatory frameworks in North America, especially in the United States, were conducive to the growth of crowdfunding. The Jumpstart Our Business Startups (JOBS) Act, enacted in 2012, introduced regulations that paved the way for equity crowdfunding, allowing businesses to raise capital by offering securities to a broader pool of investors. These regulatory changes democratized access to investment opportunities and expanded the reach of crowdfunding.

- North America's entrepreneurial culture and a thriving community of early adopters played a significant role in the success of crowdfunding. The region had a strong culture of innovation, risk-taking, and support for startups, which aligned perfectly with the crowdfunding ethos of supporting new and innovative ideas.

- North America's substantial investor base, including accredited investors, provided a robust pool of potential backers for crowdfunding campaigns. The availability of discretionary income and a culture of angel investing made North America an attractive region for crowdfunding campaigns seeking financial support.

Crowdfunding Market Key Player

- Kickstarter

- PBC

- Indiegogo, Inc.

- Crowdcube Capital Ltd

- StartSomeGood

- GoFundMe

- Fundable

- ConnectionPoint Systems Inc. (CPSI)

- Wefunder Inc.

- Seedrs Limited

- Fundly

- Kickstarter (USA)

- PBC (Patreon) (USA)

- Indiegogo, Inc. (USA)

- Crowdcube Capital Ltd (UK)

- StartSomeGood (Australia)

- GoFundMe (USA)

- Fundable (USA)

- ConnectionPoint Systems Inc. (CPSI) (USA)

- Wefunder Inc. (USA)

- Seedrs Limited (UK)

- Fundly (USA)

- Gofundme (USA)

- Kickstarter (USA)

- Crowdcube Capital Ltd (UK)

- Wefunder Inc. (USA)

- Other Active Players

Key Industry Developments in the Crowdfunding Market

- In May 2024, Corpay, a corporate payments firm headquartered in Atlanta, California, announced the acquisition of Paymerang, a leading provider of accounts payable automation solutions situated in Richmond, Virginia. Financial specifics of the deal were not revealed, but the transaction successfully concluded in the second quarter of 2024, subject to regulatory clearance and standard closing prerequisites. This strategic move substantially bolstered Corpay's presence in crucial sectors like education, healthcare, hospitality, and manufacturing.

- In April 2024, Goparity, the sustainable finance platform, spearheaded a crowdfunding drive worth €600,000, with the potential to increase to €800,000, marking a significant step towards sustainable energy solutions. The campaign was aimed at supporting Comunidad Solar, a pioneering venture that facilitated remote self-consumption of renewable energy. This initiative sought to revolutionize the renewable energy landscape in Spain. Through the collective effort of backers, Goparity aimed to propel the adoption of renewable energy sources and contribute to environmental sustainability.

|

Crowdfunding Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.65 Bn. |

|

Forecast Period 2025-32 CAGR: |

14.65 % |

Market Size in 2032: |

USD 4.93 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Crowdfunding Market by Type (2018-2032)

4.1 Crowdfunding Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Reward-based Crowdfunding

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Equity-based Crowdfunding

4.5 Debt-based Crowdfunding

4.6 Donation-based Crowdfunding

4.7 Others

Chapter 5: Crowdfunding Market by End-User (2018-2032)

5.1 Crowdfunding Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Start-ups

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 NGO’s

5.5 Individual

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Crowdfunding Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ROCHE

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 GSK GROUP

6.4 TEVA

6.5 SANDOZ(NOVARTIS)

6.6 STADA-VN J.V.CO. LTD

6.7 HEXAL AG

6.8 NATIONAL COMPANY FOR PHARMACEUTICAL INDUSTRY

6.9 LUNAN PHARMACEUTICAL GROUP CORPORATION

6.10 ZEIN PHARMACEUTICAL

6.11 HISUN

6.12 TAJ PHARMACEUTICALS LTD

6.13 KABIR LIFE SCIENCES & RESEARCH

6.14 DM PHARMA

6.15 CHINA ZHONGSHAN PHARM

Chapter 7: Global Crowdfunding Market By Region

7.1 Overview

7.2. North America Crowdfunding Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Reward-based Crowdfunding

7.2.4.2 Equity-based Crowdfunding

7.2.4.3 Debt-based Crowdfunding

7.2.4.4 Donation-based Crowdfunding

7.2.4.5 Others

7.2.5 Historic and Forecasted Market Size by End-User

7.2.5.1 Start-ups

7.2.5.2 NGO’s

7.2.5.3 Individual

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Crowdfunding Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Reward-based Crowdfunding

7.3.4.2 Equity-based Crowdfunding

7.3.4.3 Debt-based Crowdfunding

7.3.4.4 Donation-based Crowdfunding

7.3.4.5 Others

7.3.5 Historic and Forecasted Market Size by End-User

7.3.5.1 Start-ups

7.3.5.2 NGO’s

7.3.5.3 Individual

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Crowdfunding Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Reward-based Crowdfunding

7.4.4.2 Equity-based Crowdfunding

7.4.4.3 Debt-based Crowdfunding

7.4.4.4 Donation-based Crowdfunding

7.4.4.5 Others

7.4.5 Historic and Forecasted Market Size by End-User

7.4.5.1 Start-ups

7.4.5.2 NGO’s

7.4.5.3 Individual

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Crowdfunding Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Reward-based Crowdfunding

7.5.4.2 Equity-based Crowdfunding

7.5.4.3 Debt-based Crowdfunding

7.5.4.4 Donation-based Crowdfunding

7.5.4.5 Others

7.5.5 Historic and Forecasted Market Size by End-User

7.5.5.1 Start-ups

7.5.5.2 NGO’s

7.5.5.3 Individual

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Crowdfunding Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Reward-based Crowdfunding

7.6.4.2 Equity-based Crowdfunding

7.6.4.3 Debt-based Crowdfunding

7.6.4.4 Donation-based Crowdfunding

7.6.4.5 Others

7.6.5 Historic and Forecasted Market Size by End-User

7.6.5.1 Start-ups

7.6.5.2 NGO’s

7.6.5.3 Individual

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Crowdfunding Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Reward-based Crowdfunding

7.7.4.2 Equity-based Crowdfunding

7.7.4.3 Debt-based Crowdfunding

7.7.4.4 Donation-based Crowdfunding

7.7.4.5 Others

7.7.5 Historic and Forecasted Market Size by End-User

7.7.5.1 Start-ups

7.7.5.2 NGO’s

7.7.5.3 Individual

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Crowdfunding Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.65 Bn. |

|

Forecast Period 2025-32 CAGR: |

14.65 % |

Market Size in 2032: |

USD 4.93 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||