Micro Funding Market Synopsis

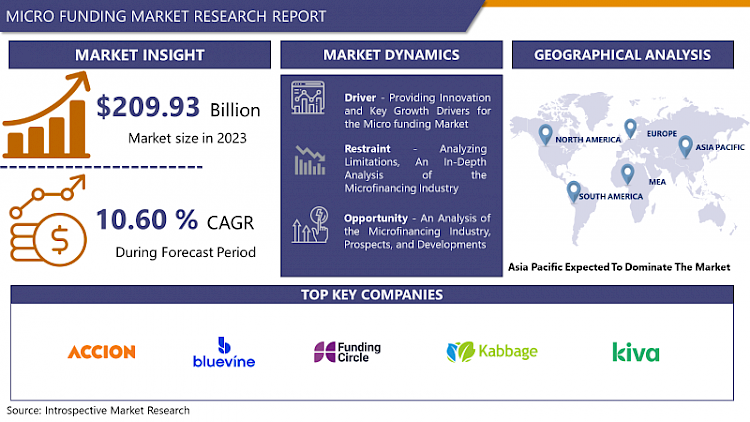

Micro Funding Market Size Was Valued at USD 209.93 Billion in 2023 and is Projected to Reach USD 519.84 Billion by 2032, Growing at a CAGR of 10.60 % From 2024-2032.

Microfunding pertains to the provision of modest financial assistance, commonly in the shape of loans or grants, to small enterprises or individuals who may lack access to conventional financial services. Typically, entrepreneurial endeavors, community initiatives, or individuals facing adversity receive this type of financial assistance, especially in developing nations or marginalized communities. Microfinance has the potential to foster economic expansion, empower citizens, and tackle regional challenges, frequently with an emphasis on social responsibility and sustainability.

- Micro-funding is also referred to as micro-credit, and it is relevant in supplying funding services to the undeserved market, which cannot be financed through the customary channels of conventional commerce. It is mainly triggered by the desire to reduce and eradicate poverty, support and enhance the communities’ capability, and meet the financial needs of the society. Micro-funding institutions usually provide small credit, savings and insurance services aimed at the objectives of the lower income earners and the business individuals.

- Factors that will help foster micro-funding market are, enhanced consciousness in micro financing as an economic solution to poverty, unremitting demand for credit services in unserved population, and the technology that can support extensive provision of credit services. Moreover, legally required consumer protection and continuing government policies in many countries promote the development of the micro-funding part, where investments are made also by public and private funds. With the evolution of the market in the country, new products like digital lending facilities and mobile banking will help to grow the market and make more impacts.

Micro Funding Market Trend Analysis

Increasing Applications in the Automotive Industry

- The global micro-funding market is undergoing substantial expansion, propelled by a number of pivotal trends. The increasing prevalence of microloans among small business owners and entrepreneurs who may not qualify for conventional bank loans is one of the most significant developments. The proliferation of micro-funding platforms and applications is facilitating these individuals' access to capital with reduced barriers to entry, thereby stimulating market expansion.

- An additional development that is influencing the micro-funding industry is the expansion of peer-to-peer (P2P) lending platforms. These platforms facilitate direct connections between borrowers and individual lenders, thereby circumventing the involvement of conventional financial institutions. In comparison to conventional savings or investment alternatives, P2P lending delivers greater returns to lenders and affords borrowers greater flexibility and frequently reduced interest rates. The micro-funding market is anticipated to experience further expansion due to the increasing number of individuals exploring alternative borrowing and investment methods.

Unlocking Potential, Opportunities in Micro Funding

- The microfinance market offers borrowers and investors equally a substantial opportunity. Microfunding, which operates as a subsidiary of the larger financial services sector, is dedicated to extending financial services and financing on a small scale to entrepreneurs, individuals, and small businesses that may lack access to conventional banking offerings. In recent years, there has been a surge in interest in this market owing to its capacity to tackle obstacles related to financial inclusion and bolster economic expansion, specifically in developing nations.

- Increasing digital technology adoption is one of the primary factors propelling the microfinance market forward. By utilizing technology, platforms that provide microfinance services are able to reduce expenses, expedite operations, and reach a larger audience. Regulatory initiatives and government assistance that are specifically designed to foster financial inclusion are contributing to the continued growth of this sector. In order to accommodate the varied requirements of borrowers and investors in the microfinance sector, innovative financial solutions and partnerships are becoming increasingly vital as the demand for microfunding continues to increase.

Micro Funding Market Segment Analysis:

Micro Funding Market Segmented on the basis of By Borrower Segment, Loan Size, Purpose of Loans.

By Loan Size, Small Loans segment is expected to dominate the market during the forecast period

- The microfinancing market provides a variety of loan sizes, including nano loans, micro loans, and small loans, to meet a variety of requirements. Nano loans, which typically range from a few dollars to approximately $100, are utilized to finance supplies or emergency expenses, among other extremely urgent matters. Microloans, which typically range between $100 and $1,000, are utilized frequently by small businesses and entrepreneurs to finance equipment purchases or small-scale initiatives. Small loans, which typically range in value from $1,000 to $10,000, are frequently applied to substantial business investments or individual expenditures. The provision of loans in diverse quantities accommodates an extensive array of financial requirements, thereby fostering financial inclusion and bolstering economic development in numerous communities.

By Purpose Of Loan, Business Expansion segment held the largest share in 2024

- The microfinance market offers loans for a multitude of objectives, such as working capital, business expansion, and emergency purposes. Entrepreneurs and small businesses utilize business expansion loans to finance the establishment of new locations or the purchase of additional products and services. Working capital loans assist organizations in financing routine expenditures such as inventory purchases and payroll. Loans for emergency requirements are utilized to pay for unforeseen costs, including home repairs or medical expenses. Microfunding is of paramount importance in assisting individuals and businesses to accomplish their financial objectives and navigate through financial obstacles by providing the necessary funds for these purposes.

Micro Funding Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific micro-funding market is undergoing substantial expansion, propelled by a number of pivotal factors. Micro-funding initiatives have been able to flourish in the region due to the increasing adoption of digital financial services and the region's dynamic and diverse economies. An important factor propelling the expansion of this sector is the emergence of financial technology (fintech) firms that provide inventive micro-funding alternatives. These organizations utilize technological advancements to offer expedient and convenient small loan accessibility, thereby serving underserved demographics such as small businesses and individuals lacking conventional banking services.

- Government initiatives supporting small and medium-sized businesses (SMEs) and promoting financial inclusion have also contributed to the expansion of the micro-funding market in the region. Frequently, these endeavors encompass regulatory adjustments, financial literacy initiatives, and financial assistance for fintech businesses; collectively, they foster an environment that is favorable for micro-funding endeavors. The proliferation of internet connectivity and smartphones has significantly contributed to the expansion of the micro-funding industry in the Asia-Pacific region. The prevalence of mobile-based lending platforms has grown substantially, providing consumers with the ability to conveniently apply for loans and oversee their financial affairs through their mobile devices.

- However, the Asia-Pacific microfinancing market is not devoid of obstacles. Regulatory ambiguity, concerns regarding data privacy, and the potential for debtors to incur excessive debt are among the most significant obstacles confronting the market. It will be imperative to confront these obstacles in order to maintain the expansion of the micro-funding industry in the area.

Active Key Players in the Micro Funding Market

- Accion International (United States)

- BlueVine (United States)

- Fundera (United States)

- Funding Circle (United Kingdom)

- Kabbage (United States)

- Kiva (United States)

- Lendio (United States)

- LENDR (United States)

- OnDeck (United States)

- StreetShares (United States)

- Others

Global Micro Funding Market Scope:

|

Global Micro Funding Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 209.93 Bn. |

|

Forecast Period 2023-30 CAGR: |

10.60 % |

Market Size in 2032: |

USD 519.84 Bn. |

|

Segments Covered: |

By Borrower Segment |

|

|

|

Loan Size |

|

||

|

Purpose of Loans |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- MICRO FUNDING MARKET BY BORROWER SEGMENT (2017-2032)

- MICRO FUNDING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- INDIVIDUALS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MICRO – ENTREPRENEURS

- SMALL AND MEDIUM SIZED ENTERPRISE

- MICRO FUNDING MARKET BY LOAN SIZE (2017-2032)

- MICRO FUNDING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- NANO LOANS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MICRO LOANS

- SMALL LOANS

- MICRO FUNDING MARKET BY PURPOSE OF LOANS (2017-2032)

- MICRO FUNDING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BUSINESS EXPANSION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- WORKING CAPITAL

- EMERGENCY NEEDS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Micro Funding Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ACCION INTERNATIONAL (UNITED STATES)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BLUEVINE (UNITED STATES)

- FUNDERA (UNITED STATES)

- FUNDING CIRCLE (UNITED KINGDOM)

- KABBAGE (UNITED STATES)

- KIVA (UNITED STATES)

- LENDIO (UNITED STATES)

- LENDR (UNITED STATES)

- ONDECK (UNITED STATES)

- STREETSHARES (UNITED STATES)

- COMPETITIVE LANDSCAPE

- GLOBAL MICRO FUNDING MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Borrower Segment

- Historic And Forecasted Market Size By Loan Size

- Historic And Forecasted Market Size By Purpose of Loans

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

Global Micro Funding Market Scope:

|

Global Micro Funding Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 209.93 Bn. |

|

Forecast Period 2023-30 CAGR: |

10.60 % |

Market Size in 2032: |

USD 519.84 Bn. |

|

Segments Covered: |

By Borrower Segment |

|

|

|

Loan Size |

|

||

|

Purpose of Loans |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. MICRO FUNDING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. MICRO FUNDING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. MICRO FUNDING MARKET COMPETITIVE RIVALRY

TABLE 005. MICRO FUNDING MARKET THREAT OF NEW ENTRANTS

TABLE 006. MICRO FUNDING MARKET THREAT OF SUBSTITUTES

TABLE 007. MICRO FUNDING MARKET BY TYPE

TABLE 008. BANKS MARKET OVERVIEW (2016-2028)

TABLE 009. MICRO FINANCE INSTITUTE MARKET OVERVIEW (2016-2028)

TABLE 010. NBFC MARKET OVERVIEW (2016-2028)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 012. MICRO FUNDING MARKET BY APPLICATION

TABLE 013. APPLICATION 1 MARKET OVERVIEW (2016-2028)

TABLE 014. APPLICATION 2 MARKET OVERVIEW (2016-2028)

TABLE 015. OTHER MARKET OVERVIEW (2016-2028)

TABLE 016. NORTH AMERICA MICRO FUNDING MARKET, BY TYPE (2016-2028)

TABLE 017. NORTH AMERICA MICRO FUNDING MARKET, BY APPLICATION (2016-2028)

TABLE 018. N MICRO FUNDING MARKET, BY COUNTRY (2016-2028)

TABLE 019. EUROPE MICRO FUNDING MARKET, BY TYPE (2016-2028)

TABLE 020. EUROPE MICRO FUNDING MARKET, BY APPLICATION (2016-2028)

TABLE 021. MICRO FUNDING MARKET, BY COUNTRY (2016-2028)

TABLE 022. ASIA PACIFIC MICRO FUNDING MARKET, BY TYPE (2016-2028)

TABLE 023. ASIA PACIFIC MICRO FUNDING MARKET, BY APPLICATION (2016-2028)

TABLE 024. MICRO FUNDING MARKET, BY COUNTRY (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA MICRO FUNDING MARKET, BY TYPE (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA MICRO FUNDING MARKET, BY APPLICATION (2016-2028)

TABLE 027. MICRO FUNDING MARKET, BY COUNTRY (2016-2028)

TABLE 028. SOUTH AMERICA MICRO FUNDING MARKET, BY TYPE (2016-2028)

TABLE 029. SOUTH AMERICA MICRO FUNDING MARKET, BY APPLICATION (2016-2028)

TABLE 030. MICRO FUNDING MARKET, BY COUNTRY (2016-2028)

TABLE 031. ACCION INTERNATIONAL: SNAPSHOT

TABLE 032. ACCION INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 033. ACCION INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 034. ACCION INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. BLUEVINE: SNAPSHOT

TABLE 035. BLUEVINE: BUSINESS PERFORMANCE

TABLE 036. BLUEVINE: PRODUCT PORTFOLIO

TABLE 037. BLUEVINE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. FUNDERA: SNAPSHOT

TABLE 038. FUNDERA: BUSINESS PERFORMANCE

TABLE 039. FUNDERA: PRODUCT PORTFOLIO

TABLE 040. FUNDERA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. FUNDING CIRCLE: SNAPSHOT

TABLE 041. FUNDING CIRCLE: BUSINESS PERFORMANCE

TABLE 042. FUNDING CIRCLE: PRODUCT PORTFOLIO

TABLE 043. FUNDING CIRCLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. KABBAGE: SNAPSHOT

TABLE 044. KABBAGE: BUSINESS PERFORMANCE

TABLE 045. KABBAGE: PRODUCT PORTFOLIO

TABLE 046. KABBAGE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. KIVA: SNAPSHOT

TABLE 047. KIVA: BUSINESS PERFORMANCE

TABLE 048. KIVA: PRODUCT PORTFOLIO

TABLE 049. KIVA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. LENDIO: SNAPSHOT

TABLE 050. LENDIO: BUSINESS PERFORMANCE

TABLE 051. LENDIO: PRODUCT PORTFOLIO

TABLE 052. LENDIO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. LENDR: SNAPSHOT

TABLE 053. LENDR: BUSINESS PERFORMANCE

TABLE 054. LENDR: PRODUCT PORTFOLIO

TABLE 055. LENDR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. ONDECK: SNAPSHOT

TABLE 056. ONDECK: BUSINESS PERFORMANCE

TABLE 057. ONDECK: PRODUCT PORTFOLIO

TABLE 058. ONDECK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. STREETSHARES: SNAPSHOT

TABLE 059. STREETSHARES: BUSINESS PERFORMANCE

TABLE 060. STREETSHARES: PRODUCT PORTFOLIO

TABLE 061. STREETSHARES: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. MICRO FUNDING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. MICRO FUNDING MARKET OVERVIEW BY TYPE

FIGURE 012. BANKS MARKET OVERVIEW (2016-2028)

FIGURE 013. MICRO FINANCE INSTITUTE MARKET OVERVIEW (2016-2028)

FIGURE 014. NBFC MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 016. MICRO FUNDING MARKET OVERVIEW BY APPLICATION

FIGURE 017. APPLICATION 1 MARKET OVERVIEW (2016-2028)

FIGURE 018. APPLICATION 2 MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 020. NORTH AMERICA MICRO FUNDING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. EUROPE MICRO FUNDING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. ASIA PACIFIC MICRO FUNDING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. MIDDLE EAST & AFRICA MICRO FUNDING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. SOUTH AMERICA MICRO FUNDING MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Micro Funding Market research report is 2024-2032.

Accion International (United States), BlueVine (United States), Fundera (United States), Funding Circle (United Kingdom), Kabbage (United States), Kiva (United States), Lendio (United States), LENDR (United States), OnDeck (United States), StreetShares (United States) and Other Major Players.

The Micro Funding Market is segmented into by Borrower Segment (Individuals, Microentrepreneur, Small and Medium Sized Enterprise), Loan Size (Nano Loans, Micro Loans, Small Loans) By Purpose of loans (Business Expansion, Working Capital, Emergency Needs). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Microfunding pertains to the provision of modest financial assistance, commonly in the shape of loans or grants, to small enterprises or individuals who may lack access to conventional financial services. Typically, entrepreneurial endeavors, community initiatives, or individuals facing adversity receive this type of financial assistance, especially in developing nations or marginalized communities. Microfinance has the potential to foster economic expansion, empower citizens, and tackle regional challenges, frequently with an emphasis on social responsibility and sustainability.

Micro Funding Market Size Was Valued at USD 209.93 Billion in 2023 and is Projected to Reach USD 519.84 Billion by 2032, Growing at a CAGR of 10.60 % From 2024-2032.