Cosmetic Serum Market Synopsis

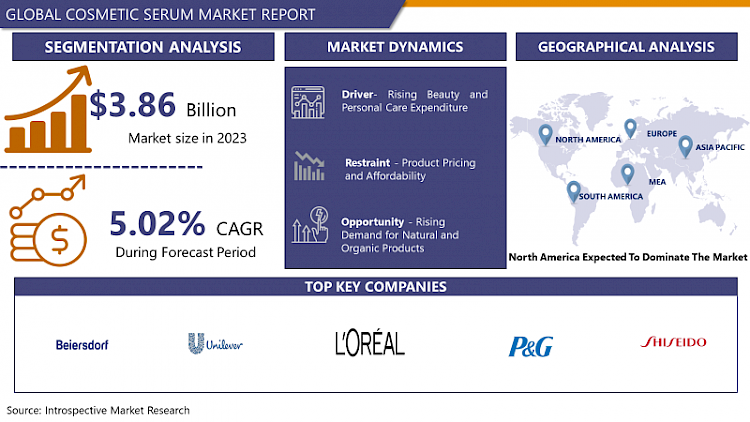

Cosmetic Serum Market Size Was Valued at USD 3.86 Billion in 2023, and is Projected to Reach USD 6.0 Billion by 2032, Growing at a CAGR of 5.02 % From 2024-2032.

Cosmetic serum is a concentrated product based on water or oil. Serums contain 10 times more biologically active ingredients than cream making it more effective and quicker in reaction time. Cosmetic serum is in high demand due to health & facial consciousness among people, unhealthy diet, and increased pollution.

In addition, cosmetic serums moisturize, rejuvenate, nourish, and soothe skin making them an essential cosmetic bag product. Innovation in skin serum segment has made age-defying products which target dark spots, wrinkles, and reduces pores. The global cosmetic serum market has experienced a significant growth and is expected to grow considerably in next few years.

Consumers are increasingly seeking cosmetic serums with clean and natural ingredients. Brands are responding by formulating serums free from harmful chemicals, parabens, and artificial fragrances, catering to the growing demand for clean beauty products. Personalized skincare has gained traction, with consumers seeking serums tailored to their unique skin concerns. Brands are offering customization options, allowing customers to choose ingredients and target specific issues.

Cosmetic Serum Market Trend Analysis

Rising Beauty and Personal Care Expenditure

- The beauty and personal care industry has witnessed substantial growth in recent years, with consumers allocating more of their disposable income towards skincare and cosmetic products. This increased spending on beauty and personal care products, including serums, is a key driver for the Cosmetic Serum market. As consumers prioritize skincare and invest in premium and specialized products, the demand for Cosmetic Serums continues to grow.

- As disposable incomes rise in many regions globally, consumers are allocating a larger portion of their budgets to beauty and personal care products. This includes skincare, where serums are a sought-after product due to their effectiveness.

- Consumers are willing to invest in premium and high-quality skincare products, including cosmetic serums. Premium serums often contain concentrated and advanced ingredients, making them more effective and appealing to those seeking visible results.

- With aging populations in many countries, there is a growing interest in anti-aging and preventive skincare. Cosmetic serums are well-positioned to address these concerns, offering formulations that target fine lines, wrinkles, and age-related skin issues.

- Beauty and wellness are global trends, transcending borders and cultures. The desire to look and feel good is driving the demand for skincare products, with consumers seeking serums that can enhance their skin's health and appearance.

Rising Demand for Natural and Organic Products

- Many consumers are becoming increasingly conscious of the ingredients in their skincare products. They are actively seeking clean and transparent beauty options, which include natural and organic cosmetic serums that are free from synthetic chemicals, parabens, and artificial fragrances.

- Natural and organic cosmetic serums are perceived as safer and less likely to cause skin irritations or allergic reactions. This safety aspect appeals to consumers with sensitive skin or those who prioritize gentle, non-toxic skincare.

- Eco-conscious consumers are concerned about the environmental impact of their beauty products. Natural and organic cosmetic serums often use sustainable sourcing practices, eco-friendly packaging, and biodegradable ingredients, aligning with consumers' desire for environmentally responsible choices.

- Brands that offer natural and organic serums typically emphasize ingredient transparency. They provide clear information about the origin and benefits of each ingredient, instilling trust and confidence in consumers.

- Natural and organic serums often feature nutrient-rich ingredients like plant extracts, botanical oils, vitamins, and antioxidants. These formulations can provide nourishment and skincare benefits derived from nature.

Cosmetic Serum Market Segment Analysis:

The Cosmetic Serum market segments covers by Type, Ingredient Type, Gender and Distribution Channel. By Ingredient Type, the Vitamin C Serums segment is Anticipated to Dominate the Market Over the Forecast period.

- Vitamin C, also known as ascorbic acid, is well-known for its skin-enhancing properties. It is a potent antioxidant that helps protect the skin from free radicals, promotes collagen production, and brightens the complexion. These benefits make Vitamin C serums highly sought after by consumers looking to address various skincare concerns.

- Vitamin C is effective in reducing the appearance of fine lines and wrinkles, making it a popular choice for anti-aging skincare routines. It helps improve skin elasticity and firmness, leading to a more youthful appearance.

- Vitamin C is known for its ability to fade hyperpigmentation, dark spots, and uneven skin tone. Consumers often turn to Vitamin C serums to achieve a more even and radiant complexion.

- Vitamin C provides a level of protection against UV damage and helps minimize the harmful effects of sun exposure on the skin. This makes Vitamin C serums a valuable addition to daily skincare routines, particularly for those concerned about sun damage.

- Vitamin C is essential for collagen synthesis, which is crucial for maintaining skin's elasticity and suppleness. Collagen is a structural protein that helps keep the skin looking youthful and firm.

Cosmetic Serum Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period.

- North American consumers are highly conscious of skincare and beauty products. There is a strong culture of skincare awareness and a willingness to invest in high-quality products to achieve and maintain healthy, youthful-looking skin.

- The region, particularly the United States, is home to numerous skincare companies, research institutions, and laboratories that continually innovate in the skincare field. This innovation leads to the development of cutting-edge serum formulations with advanced ingredients.

- North American consumers often prioritize anti-aging products, and cosmetic serums are a key component of anti-aging skincare routines. The desire to combat the signs of aging, such as fine lines and wrinkles, drives the demand for serums with proven efficacy.

- North America has a strong presence of premium and luxury skincare brands that offer high-end serums. These brands emphasize quality, efficacy, and often use unique and advanced ingredients in their formulations, attracting consumers willing to invest in premium products.

- Skincare education is prevalent in North America, with consumers actively seeking information about skincare ingredients and product benefits. The availability of information through blogs, beauty magazines, social media, and dermatologist recommendations contributes to informed consumer choices.

- North America has a diverse consumer base with varying skincare needs. Cosmetic serums are versatile products that can address a wide range of concerns, from anti-aging to hydration and brightening, making them appealing to a broad audience.

Cosmetic Serum Market Key Players

- L'Oréal (France)

- Estée Lauder Companies Inc. (United States)

- Shiseido Co., Ltd. (Japan)

- Johnson & Johnson (US)

- Procter & Gamble (US)

- Unilever (United Kingdom/Netherlands)

- Coty Inc. (US)

- Revlon, Inc. (US)

- Amorepacific Corporation (South Korea)

- Kao Corporation (Japan)

- Avon Products, Inc. (United Kingdom)

- Beiersdorf AG (Germany)

- Mary Kay Inc. (US)

- Colgate-Palmolive Company (US)

- Estée Lauder Companies (US)

- Nu Skin Enterprises, Inc. (US)

- Clarins Group (France)

- Elizabeth Arden, Inc. (US)

- Oriflame Cosmetics AG (Switzerland)

- Cosmax Inc. (South Korea), and Other Major Players.

Key Industry Developments in the Cosmetic Serum Market

- In February 2023, L'Oréal acquired Pattern Beauty, a Black-owned haircare brand. Pattern Beauty is known for its natural hair care products, including serums, conditioners, and shampoos. This acquisition is a strategic move for L'Oréal, as it allows the company to expand its reach into the Black hair care market.

- In February 2023, Estée Lauder launched its new Advanced Night Repair Synchronized Recovery Serum. This serum is said to help reduce the appearance of dark spots and uneven skin tone by up to 50% in just 4 weeks.

|

Cosmetic Serum Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.68 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.0% |

Market Size in 2032: |

USD 6.0 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Ingredient Type |

|

||

|

BY Gender |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- COSMETIC SERUM MARKET BY TYPE (2017-2032)

- COSMETIC SERUM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ANTI-AGING SERUM

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SKIN WHITENING SERUM

- ANTI-ACNE SERUM

- OTHERS

- COSMETIC SERUM MARKET BY LIQUEFACTION INGREDIENT TYPE (2017-2032)

- COSMETIC SERUM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- VITAMIN C SERUMS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HYALURONIC ACID SERUMS

- RETINOL SERUMS

- PEPTIDE SERUMS

- ANTIOXIDANT SERUMS

- OTHERS

- COSMETIC SERUM MARKET BY LIQUEFACTION GENDER (2017-2032)

- COSMETIC SERUM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MEN

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- WOMEN

- COSMETIC SERUM MARKET BY LIQUEFACTION DISTRIBUTION CHANNEL (2017-2032)

- COSMETIC SERUM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HOSPITALS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SUPERMARKET

- DERMATOLOGY CLINICS

- DRUG STORES

- RETAIL STORES

- ONLINE PHARMACIES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- COSMETIC SERUM Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- L'ORÉAL (FRANCE)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ESTÉE LAUDER COMPANIES INC. (UNITED STATES)

- SHISEIDO CO., LTD. (JAPAN)

- JOHNSON & JOHNSON (US)

- PROCTER & GAMBLE (US)

- UNILEVER (UNITED KINGDOM/NETHERLANDS)

- COTY INC. (US)

- REVLON, INC. (US)

- AMOREPACIFIC CORPORATION (SOUTH KOREA)

- KAO CORPORATION (JAPAN)

- AVON PRODUCTS, INC. (UNITED KINGDOM)

- BEIERSDORF AG (GERMANY)

- MARY KAY INC. (US)

- COLGATE-PALMOLIVE COMPANY (US)

- ESTÉE LAUDER COMPANIES (US)

- NU SKIN ENTERPRISES, INC. (US)

- CLARINS GROUP (FRANCE)

- ELIZABETH ARDEN, INC. (US)

- ORIFLAME COSMETICS AG (SWITZERLAND)

- COSMAX INC. (SOUTH KOREA)

- COMPETITIVE LANDSCAPE

- GLOBAL COSMETIC SERUM MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Ingredient Type

- Historic And Forecasted Market Size By Gender

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Cosmetic Serum Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.68 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.0% |

Market Size in 2032: |

USD 6.0 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Ingredient Type |

|

||

|

BY Gender |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. COSMETIC SERUM MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. COSMETIC SERUM MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. COSMETIC SERUM MARKET COMPETITIVE RIVALRY

TABLE 005. COSMETIC SERUM MARKET THREAT OF NEW ENTRANTS

TABLE 006. COSMETIC SERUM MARKET THREAT OF SUBSTITUTES

TABLE 007. COSMETIC SERUM MARKET BY TYPE

TABLE 008. ANTI-AGING SERUM MARKET OVERVIEW (2016-2030)

TABLE 009. SKIN WHITENING SERUM MARKET OVERVIEW (2016-2030)

TABLE 010. ANTI-ACNE SERUM MARKET OVERVIEW (2016-2030)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 012. COSMETIC SERUM MARKET BY INGREDIENT TYPE

TABLE 013. VITAMIN C SERUMS MARKET OVERVIEW (2016-2030)

TABLE 014. HYALURONIC ACID SERUMS MARKET OVERVIEW (2016-2030)

TABLE 015. RETINOL SERUMS MARKET OVERVIEW (2016-2030)

TABLE 016. PEPTIDE SERUMS MARKET OVERVIEW (2016-2030)

TABLE 017. ANTIOXIDANT SERUMS MARKET OVERVIEW (2016-2030)

TABLE 018. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 019. COSMETIC SERUM MARKET BY GENDER

TABLE 020. MEN MARKET OVERVIEW (2016-2030)

TABLE 021. WOMEN MARKET OVERVIEW (2016-2030)

TABLE 022. COSMETIC SERUM MARKET BY DISTRIBUTION CHANNEL

TABLE 023. HOSPITALS MARKET OVERVIEW (2016-2030)

TABLE 024. SUPERMARKET MARKET OVERVIEW (2016-2030)

TABLE 025. DERMATOLOGY CLINICS MARKET OVERVIEW (2016-2030)

TABLE 026. DRUG STORES MARKET OVERVIEW (2016-2030)

TABLE 027. RETAIL STORES MARKET OVERVIEW (2016-2030)

TABLE 028. ONLINE PHARMACIES MARKET OVERVIEW (2016-2030)

TABLE 029. NORTH AMERICA COSMETIC SERUM MARKET, BY TYPE (2016-2030)

TABLE 030. NORTH AMERICA COSMETIC SERUM MARKET, BY INGREDIENT TYPE (2016-2030)

TABLE 031. NORTH AMERICA COSMETIC SERUM MARKET, BY GENDER (2016-2030)

TABLE 032. NORTH AMERICA COSMETIC SERUM MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 033. N COSMETIC SERUM MARKET, BY COUNTRY (2016-2030)

TABLE 034. EASTERN EUROPE COSMETIC SERUM MARKET, BY TYPE (2016-2030)

TABLE 035. EASTERN EUROPE COSMETIC SERUM MARKET, BY INGREDIENT TYPE (2016-2030)

TABLE 036. EASTERN EUROPE COSMETIC SERUM MARKET, BY GENDER (2016-2030)

TABLE 037. EASTERN EUROPE COSMETIC SERUM MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 038. COSMETIC SERUM MARKET, BY COUNTRY (2016-2030)

TABLE 039. WESTERN EUROPE COSMETIC SERUM MARKET, BY TYPE (2016-2030)

TABLE 040. WESTERN EUROPE COSMETIC SERUM MARKET, BY INGREDIENT TYPE (2016-2030)

TABLE 041. WESTERN EUROPE COSMETIC SERUM MARKET, BY GENDER (2016-2030)

TABLE 042. WESTERN EUROPE COSMETIC SERUM MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 043. COSMETIC SERUM MARKET, BY COUNTRY (2016-2030)

TABLE 044. ASIA PACIFIC COSMETIC SERUM MARKET, BY TYPE (2016-2030)

TABLE 045. ASIA PACIFIC COSMETIC SERUM MARKET, BY INGREDIENT TYPE (2016-2030)

TABLE 046. ASIA PACIFIC COSMETIC SERUM MARKET, BY GENDER (2016-2030)

TABLE 047. ASIA PACIFIC COSMETIC SERUM MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 048. COSMETIC SERUM MARKET, BY COUNTRY (2016-2030)

TABLE 049. MIDDLE EAST & AFRICA COSMETIC SERUM MARKET, BY TYPE (2016-2030)

TABLE 050. MIDDLE EAST & AFRICA COSMETIC SERUM MARKET, BY INGREDIENT TYPE (2016-2030)

TABLE 051. MIDDLE EAST & AFRICA COSMETIC SERUM MARKET, BY GENDER (2016-2030)

TABLE 052. MIDDLE EAST & AFRICA COSMETIC SERUM MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 053. COSMETIC SERUM MARKET, BY COUNTRY (2016-2030)

TABLE 054. SOUTH AMERICA COSMETIC SERUM MARKET, BY TYPE (2016-2030)

TABLE 055. SOUTH AMERICA COSMETIC SERUM MARKET, BY INGREDIENT TYPE (2016-2030)

TABLE 056. SOUTH AMERICA COSMETIC SERUM MARKET, BY GENDER (2016-2030)

TABLE 057. SOUTH AMERICA COSMETIC SERUM MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 058. COSMETIC SERUM MARKET, BY COUNTRY (2016-2030)

TABLE 059. L'ORÉAL (FRANCE): SNAPSHOT

TABLE 060. L'ORÉAL (FRANCE): BUSINESS PERFORMANCE

TABLE 061. L'ORÉAL (FRANCE): PRODUCT PORTFOLIO

TABLE 062. L'ORÉAL (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. ESTÉE LAUDER COMPANIES INC. (UNITED STATES): SNAPSHOT

TABLE 063. ESTÉE LAUDER COMPANIES INC. (UNITED STATES): BUSINESS PERFORMANCE

TABLE 064. ESTÉE LAUDER COMPANIES INC. (UNITED STATES): PRODUCT PORTFOLIO

TABLE 065. ESTÉE LAUDER COMPANIES INC. (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. SHISEIDO CO.: SNAPSHOT

TABLE 066. SHISEIDO CO.: BUSINESS PERFORMANCE

TABLE 067. SHISEIDO CO.: PRODUCT PORTFOLIO

TABLE 068. SHISEIDO CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. LTD. (JAPAN): SNAPSHOT

TABLE 069. LTD. (JAPAN): BUSINESS PERFORMANCE

TABLE 070. LTD. (JAPAN): PRODUCT PORTFOLIO

TABLE 071. LTD. (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. JOHNSON & JOHNSON (US): SNAPSHOT

TABLE 072. JOHNSON & JOHNSON (US): BUSINESS PERFORMANCE

TABLE 073. JOHNSON & JOHNSON (US): PRODUCT PORTFOLIO

TABLE 074. JOHNSON & JOHNSON (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. PROCTER & GAMBLE (US): SNAPSHOT

TABLE 075. PROCTER & GAMBLE (US): BUSINESS PERFORMANCE

TABLE 076. PROCTER & GAMBLE (US): PRODUCT PORTFOLIO

TABLE 077. PROCTER & GAMBLE (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. UNILEVER (UNITED KINGDOM/NETHERLANDS): SNAPSHOT

TABLE 078. UNILEVER (UNITED KINGDOM/NETHERLANDS): BUSINESS PERFORMANCE

TABLE 079. UNILEVER (UNITED KINGDOM/NETHERLANDS): PRODUCT PORTFOLIO

TABLE 080. UNILEVER (UNITED KINGDOM/NETHERLANDS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. COTY INC. (US): SNAPSHOT

TABLE 081. COTY INC. (US): BUSINESS PERFORMANCE

TABLE 082. COTY INC. (US): PRODUCT PORTFOLIO

TABLE 083. COTY INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. REVLON: SNAPSHOT

TABLE 084. REVLON: BUSINESS PERFORMANCE

TABLE 085. REVLON: PRODUCT PORTFOLIO

TABLE 086. REVLON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. INC. (US): SNAPSHOT

TABLE 087. INC. (US): BUSINESS PERFORMANCE

TABLE 088. INC. (US): PRODUCT PORTFOLIO

TABLE 089. INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. AMOREPACIFIC CORPORATION (SOUTH KOREA): SNAPSHOT

TABLE 090. AMOREPACIFIC CORPORATION (SOUTH KOREA): BUSINESS PERFORMANCE

TABLE 091. AMOREPACIFIC CORPORATION (SOUTH KOREA): PRODUCT PORTFOLIO

TABLE 092. AMOREPACIFIC CORPORATION (SOUTH KOREA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. KAO CORPORATION (JAPAN): SNAPSHOT

TABLE 093. KAO CORPORATION (JAPAN): BUSINESS PERFORMANCE

TABLE 094. KAO CORPORATION (JAPAN): PRODUCT PORTFOLIO

TABLE 095. KAO CORPORATION (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. AVON PRODUCTS: SNAPSHOT

TABLE 096. AVON PRODUCTS: BUSINESS PERFORMANCE

TABLE 097. AVON PRODUCTS: PRODUCT PORTFOLIO

TABLE 098. AVON PRODUCTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. INC. (UNITED KINGDOM): SNAPSHOT

TABLE 099. INC. (UNITED KINGDOM): BUSINESS PERFORMANCE

TABLE 100. INC. (UNITED KINGDOM): PRODUCT PORTFOLIO

TABLE 101. INC. (UNITED KINGDOM): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 101. BEIERSDORF AG (GERMANY): SNAPSHOT

TABLE 102. BEIERSDORF AG (GERMANY): BUSINESS PERFORMANCE

TABLE 103. BEIERSDORF AG (GERMANY): PRODUCT PORTFOLIO

TABLE 104. BEIERSDORF AG (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 104. MARY KAY INC. (US): SNAPSHOT

TABLE 105. MARY KAY INC. (US): BUSINESS PERFORMANCE

TABLE 106. MARY KAY INC. (US): PRODUCT PORTFOLIO

TABLE 107. MARY KAY INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 107. COLGATE-PALMOLIVE COMPANY (US): SNAPSHOT

TABLE 108. COLGATE-PALMOLIVE COMPANY (US): BUSINESS PERFORMANCE

TABLE 109. COLGATE-PALMOLIVE COMPANY (US): PRODUCT PORTFOLIO

TABLE 110. COLGATE-PALMOLIVE COMPANY (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 110. ESTÉE LAUDER COMPANIES (US): SNAPSHOT

TABLE 111. ESTÉE LAUDER COMPANIES (US): BUSINESS PERFORMANCE

TABLE 112. ESTÉE LAUDER COMPANIES (US): PRODUCT PORTFOLIO

TABLE 113. ESTÉE LAUDER COMPANIES (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 113. NU SKIN ENTERPRISES: SNAPSHOT

TABLE 114. NU SKIN ENTERPRISES: BUSINESS PERFORMANCE

TABLE 115. NU SKIN ENTERPRISES: PRODUCT PORTFOLIO

TABLE 116. NU SKIN ENTERPRISES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 116. INC. (US): SNAPSHOT

TABLE 117. INC. (US): BUSINESS PERFORMANCE

TABLE 118. INC. (US): PRODUCT PORTFOLIO

TABLE 119. INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 119. CLARINS GROUP (FRANCE): SNAPSHOT

TABLE 120. CLARINS GROUP (FRANCE): BUSINESS PERFORMANCE

TABLE 121. CLARINS GROUP (FRANCE): PRODUCT PORTFOLIO

TABLE 122. CLARINS GROUP (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 122. ELIZABETH ARDEN: SNAPSHOT

TABLE 123. ELIZABETH ARDEN: BUSINESS PERFORMANCE

TABLE 124. ELIZABETH ARDEN: PRODUCT PORTFOLIO

TABLE 125. ELIZABETH ARDEN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 125. INC. (US): SNAPSHOT

TABLE 126. INC. (US): BUSINESS PERFORMANCE

TABLE 127. INC. (US): PRODUCT PORTFOLIO

TABLE 128. INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 128. ORIFLAME COSMETICS AG (SWITZERLAND): SNAPSHOT

TABLE 129. ORIFLAME COSMETICS AG (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 130. ORIFLAME COSMETICS AG (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 131. ORIFLAME COSMETICS AG (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 131. COSMAX INC. (SOUTH KOREA): SNAPSHOT

TABLE 132. COSMAX INC. (SOUTH KOREA): BUSINESS PERFORMANCE

TABLE 133. COSMAX INC. (SOUTH KOREA): PRODUCT PORTFOLIO

TABLE 134. COSMAX INC. (SOUTH KOREA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 134. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 135. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 136. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 137. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. COSMETIC SERUM MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. COSMETIC SERUM MARKET OVERVIEW BY TYPE

FIGURE 012. ANTI-AGING SERUM MARKET OVERVIEW (2016-2030)

FIGURE 013. SKIN WHITENING SERUM MARKET OVERVIEW (2016-2030)

FIGURE 014. ANTI-ACNE SERUM MARKET OVERVIEW (2016-2030)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 016. COSMETIC SERUM MARKET OVERVIEW BY INGREDIENT TYPE

FIGURE 017. VITAMIN C SERUMS MARKET OVERVIEW (2016-2030)

FIGURE 018. HYALURONIC ACID SERUMS MARKET OVERVIEW (2016-2030)

FIGURE 019. RETINOL SERUMS MARKET OVERVIEW (2016-2030)

FIGURE 020. PEPTIDE SERUMS MARKET OVERVIEW (2016-2030)

FIGURE 021. ANTIOXIDANT SERUMS MARKET OVERVIEW (2016-2030)

FIGURE 022. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 023. COSMETIC SERUM MARKET OVERVIEW BY GENDER

FIGURE 024. MEN MARKET OVERVIEW (2016-2030)

FIGURE 025. WOMEN MARKET OVERVIEW (2016-2030)

FIGURE 026. COSMETIC SERUM MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 027. HOSPITALS MARKET OVERVIEW (2016-2030)

FIGURE 028. SUPERMARKET MARKET OVERVIEW (2016-2030)

FIGURE 029. DERMATOLOGY CLINICS MARKET OVERVIEW (2016-2030)

FIGURE 030. DRUG STORES MARKET OVERVIEW (2016-2030)

FIGURE 031. RETAIL STORES MARKET OVERVIEW (2016-2030)

FIGURE 032. ONLINE PHARMACIES MARKET OVERVIEW (2016-2030)

FIGURE 033. NORTH AMERICA COSMETIC SERUM MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 034. EASTERN EUROPE COSMETIC SERUM MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 035. WESTERN EUROPE COSMETIC SERUM MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 036. ASIA PACIFIC COSMETIC SERUM MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 037. MIDDLE EAST & AFRICA COSMETIC SERUM MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 038. SOUTH AMERICA COSMETIC SERUM MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Cosmetic Serum Market research report is 2024-2032.

L'Oréal (France), Estée Lauder Companies Inc. (United States), Shiseido Co., Ltd. (Japan), Johnson & Johnson (US), Procter & Gamble (US), Unilever (United Kingdom/Netherlands), Coty Inc. (US), Revlon, Inc. (US), Amorepacific Corporation (South Korea), Kao Corporation (Japan), Avon Products, Inc. (United Kingdom), Beiersdorf AG (Germany), Mary Kay Inc. (US), Colgate-Palmolive Company (US), Estée Lauder Companies (US), Nu Skin Enterprises, Inc. (US), Clarins Group (France), Elizabeth Arden, Inc. (US), Oriflame Cosmetics AG (Switzerland), Cosmax Inc. (South Korea), and Other Major Players.

The Cosmetic Serum Market is segmented into Type, Ingredient Type, Gender, Distribution Channel, and region. By Type, the market is categorized into Anti-aging Serum, Skin Whitening Serum, Anti-acne Serum, Others. By Ingredient Type, the market is categorized into Vitamin C Serums, Hyaluronic Acid Serums, Retinol Serums, Peptide Serums, Antioxidant Serums, and Others. By Gender, the market is categorized into Men, Women. By Distribution Channel, the market is categorized into (Hospitals, Supermarket, Dermatology Clinics, Drug Stores, Retail Stores, Online Pharmacies. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Cosmetic serum is a concentrated product based on water or oil. Serums contain 10 times more biologically active ingredients than cream making it more effective and quicker in reaction time. Cosmetic serum is in high demand due to health & facial consciousness among people, unhealthy diet, and increased pollution.

Cosmetic Serum Market Size Was Valued at USD 3.86 Billion in 2023, and is Projected to Reach USD 6.0 Billion by 2032, Growing at a CAGR of 5.02 % From 2024-2032.