Global Connected Truck Market Overview

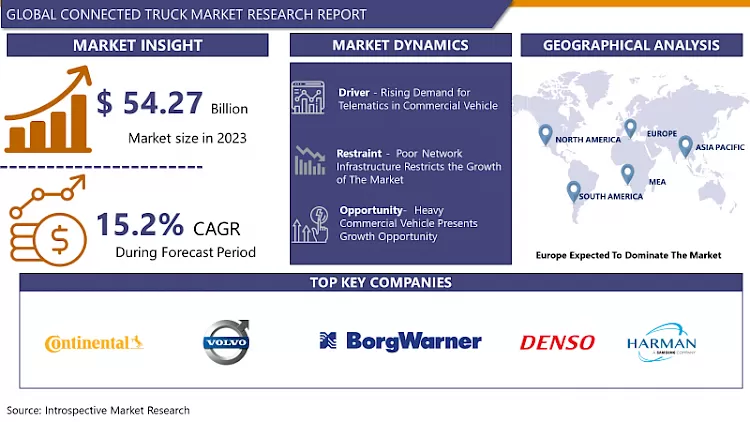

The Global Connected Truck Market Size Was Valued At USD 54.27 Billion In 2023 And Is Projected To Reach USD 193.92 Billion By 2032, Growing At A CAGR Of 15.2% From 2024 to 2032.

A "connected truck" refers to a commercial vehicle equipped with advanced technology that allows it to communicate with other vehicles, infrastructure, and a central system. This connectivity is typically achieved through telematics systems, which use sensors, GPS, and communication networks to gather and transmit data. This data can include information on vehicle performance, location, and driver behavior, all of which are sent to fleet managers or other stakeholders in real time.

- The primary benefit of connected trucks is improved operational efficiency. Fleet managers can monitor vehicle performance and driver behavior, optimizing routes, maintenance schedules, and fuel consumption. This real-time data helps reduce costs and increase productivity by allowing for proactive maintenance and better route planning.

- Safety is another significant advantage of connected trucks. The technology often includes features like collision avoidance systems, lane-keeping assistance, and emergency braking. These systems enhance road safety by providing drivers with alerts and support, and by enabling communication with other vehicles and infrastructure to prevent accidents.

- The connected trucks contribute to environmental sustainability. By optimizing routes and driving behavior, these vehicles can reduce fuel consumption and lower emissions. Additionally, the data collected can be used to implement more efficient driving practices and support the development of alternative energy solutions for the trucking industry.

Market Dynamics And Factors For Connected Truck Market

Drivers:

Rising Demand for Telematics in Commercial Vehicles

- Telematics plays a significant role in the development of new strategies for efficient fleet management and supply chain logistics. Telematics provides real-time data and insight into the supply chain to enhance workflows, maintain product integrity, increase shelf life, and reduce insurance risks. Telematics is becoming more significant in commercial logistics and supply chains because it addresses significant difficulties with safety and regulatory compliance, driver monitoring, insurance, and infrastructure.

- Telematics systems combine features like automatic toll transactions, live traffic updates, smart routing and tracking, quick roadside assistance in the event of accidents or breakdowns, and insurance telematics. They are therefore essential to improving fleet operating KPIs including real-time communication, resource optimization, and fuel cost reduction. Large sums of money are being spent by businesses to enhance telematics technology and incorporate telematics devices into commercial vehicles. For instance, starting in March 2022, Navistar made telematics devices a standard feature on all new International Truck and IC Bus vehicle models in Class 6-8 range, including electric versions.

Restraints:

Poor Network Infrastructure Restricts the Growth of The Market

- The lack of network infrastructure poses a serious obstacle to the market's growth. Although rising costs are this industry's biggest problem, they also prevent it from growing. The growth of the linked truck industry has also been hampered by other problems like expensive installation costs and difficult configuration. The market cannot expand as a result of these problems. The transport and logistics sector is currently and shortly dealing with several major difficulties. Both Amazon and the global epidemic have altered long-standing corporate paradigms. As a result, there is greater competition in the market due to rising customer expectations and complicated operational requirements such as one- and two-day shipping models, real-time product tracking, and environmental effect considerations. The elements are right for a perfect storm when you combine these factors with rising fuel prices, driver scarcity, and more governmental rules.

Opportunity:

Heavy Commercial Vehicle Presents Growth Opportunity

- Large commercial trucks used for lengthy freight transit are the focus of truck driver assistance, which uses cellular IoT to continuously monitor the vehicle. To ensure that drivers are following the rules, onboard digital recorders track their driving and resting times. Additionally, it enables driver coaching, which makes use of analytics to give both individual drivers real-time insights into their driving behavior and an aggregated view of driving behavior throughout the fleet. This feedback loop can significantly reduce carbon emissions while also improving driving habits and fuel efficiency. Fuel consumption rises as a result of inefficient truck driving practices such as abrupt braking or acceleration, which also raises costs and CO2 emissions. With the global transportation sector contributing more than one-fifth of all carbon emissions, trucks make up a disproportionately large part of those emissions. Trucks that haul freight account for 29% of all transportation-related emissions. Another issue is that many drivers work longer hours than required, which is problematic because fatigue is the primary factor in auto accidents. In reality, fatigue and excessive work hours are factors in 4 out of 10 truck accidents. Additionally, there is a severe global scarcity of truck drivers, pressuring shipping businesses to streamline their processes. There are 20% fewer heavy goods vehicle drivers than necessary in Australia and Central Asia. Companies must enhance working conditions to recruit and keep drivers.

Segmentation Analysis Of The Connected Truck Market

- By Communication Type, the V2V segment dominates the Connected Truck Market. This technique enables mobile ad HOC wireless networks and ad hoc mesh networks for data transfer in cars. Each vehicle reports traffic and road conditions, vehicle position and speed, route direction, loss of stability, and brake failure using V2V communication. Research and development into vehicle-to-vehicle contact have received considerable funding from several firms, including Tesla, Toyota, and others. Toyota research indicates that V2V technology can reduce accidents by 70% to 80%. Additionally, this technology has a considerable impact on carbon emissions and traffic congestion. The performance of vehicle safety systems can be improved via V2V communication technology, potentially saving lives. In 2019, there were reportedly 36,096 fatalities and 2.7 million estimated injuries in crashes that were reported to the police in an estimated 6.8 million cases. The number of fatalities each year will be significantly reduced thanks to connected car technologies, which will give drivers the resources they need to foresee future collisions.

- By Vehicle Type, Light commercial vehicles are likely to dominate the segment in the Connected Truck Market. Due to a rise in demand for these cars in developing markets, the category will rule the market Along with the increase in light commercial vehicle production, end-user demand for safety and comfort features has increased. The European Union Manufacturers Association reports an 8.2% increase in connected light commercial vehicle registrations in the area. The production of these vehicles is also growing across North America. Additionally, developing countries like China and India have experienced rapid economic development, which has raised the demand for commercial cars equipped with connected devices to enhance fleet safety and reduce operating expenses.

Regional Analysis Of The Connected Truck Market

- Europe region dominates the Connected Truck Market. Connected Trucks and autonomous trucks are evident in the automotive industry, which is transitioning from a hardware-focused to one that is more driven by software and (digital) services. About other services and technology, connectivity is specifically considered a catalyst for innovation in the sector106. An increase in innovation in the realms of digital and Information and Communications Technology (ICT) technologies serves as an example of this change. In 2010, connection, Advanced Driver Assistance Systems (ADAS), and interfaces accounted for around 26% of OEMs advancements. This percentage increased to 55% in 2020. In light of the growing significance of technologies like augmented reality, software services, voice control, and parking assistance, it is necessary to examine how prepared the EU car industry is to develop in these fields. On November 2021 in Frankfurt, the most significant order for large zero-emission trucks in Europe to date has been placed by DB Schenker, one of the top logistics service providers in the world and the leader in European land transport, and Volta Trucks, a leading and innovative full-electric commercial vehicle manufacturer and services provider, just days after the conclusion of the COP 26 conference in Glasgow. These trucks are equipped with connectivity which enhances performance as well as elevates the function of fleet management.

- North American region is growing at a significant rate in the Connected Truck Market. Technology businesses are the major inventors in autonomous driving. Other than General Motors in the USA, OEMs are now the only ones who are following this practice. Strategically, US businesses like Alphabet's subsidiary Waymo, Intel's Mobileye, and Amazon's Zoox are best positioned since they combine hardware and software expertise with data expertise and sizable testing fleets. However, OEMs like the VW Group, Tesla, and Hyundai have been investing in expanding their skills. For instance, the VW Group's partnership with Ford (ArgoAI). The area is primed to take the top spot in the market for smart trucks worldwide. This market is due to the greater adoption rate of smart trucks in North American developed nations like the U.S., Canada, and others, as well as the region's modern infrastructure, which is a key element in the industry's expansion. In addition, it is anticipated that over the forecasted timeframe, technical development and rising public concern over road safety would boost market expansion. Additionally, the developing business sector will generate profitable revenue development prospects due to the rising demand for effective logistics and transportation services.

Top Key Players Covered In The Connected Truck Market

- Continental AG

- AB Volvo

- BorgWarner Inc.

- Denso Corporation

- Harman International

- Magna International Inc.

- Mercedes-Benz Group AG

- Robert Bosch GmbH

- Verizon Communications Inc.

- ZF Friedrichshafen AG

- Sierra Wireless Inc.

- Geotab Inc.

- TomTom International BV

- Trimble Inc.

- Paccar Inc.

- Navistar International Corporation

- Teltonika Networks

- Wabco Holdings Inc.

- Fleetsmart Technologies

- MiX Telematics And Other Major Players.

Key Industry Development In The Connected Truck Market

- In March 2023, PACCAR revealed that it has made a minority equity investment in Platform Science, a key partner in its connected truck initiatives. This investment enhances the ongoing partnership between PACCAR and Platform Science, aimed at integrating Platform Science’s Virtual Vehicle technology with PACCAR Connect’s telematics system. This strategic move builds on their recent collaboration, which focuses on advancing connected truck technology by merging Platform Science’s innovative solutions with PACCAR’s established telematics framework.

- In February 2023, Volvo Trucks North America introduced a new connected technology tool designed to help fleet customers maximize fuel efficiency and vehicle productivity. The Connected Vehicle Analytics (CVA) tool collected real-world data from fleet operations, including truck configurations, daily routes, average speed, and fuel efficiency. This data enabled dealers to recommend optimal configurations for new Class 8 truck purchases tailored to each customer’s specific needs. The tool was unveiled at the ATA's Technology & Maintenance Council's (TMC) 2023 Annual Meeting & Transportation Technology Exhibition, held in Orlando, Florida.

|

Global Connected Truck Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 47.23 Bn. |

|

Forecast Period 2023-30 CAGR: |

14.7% |

Market Size in 2030: |

USD 141.49 Bn. |

|

Segments Covered: |

By Communication Type |

|

|

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Connected Truck Market by Communication Type (2018-2032)

4.1 Connected Truck Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Vehicle to Vehicle (V2V)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Vehicle to Cloud (V2C)

4.5 Vehicle to Infrastructure (V2I)

Chapter 5: Connected Truck Market by Vehicle Type (2018-2032)

5.1 Connected Truck Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Light Commercial Vehicle

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Heavy Commercial Vehicle

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Connected Truck Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 CERTARA(USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 DASSAULT SYSTEMES (FRANCE)

6.4 ADVANCED CHEMISTRY DEVELOPMENT (CANADA)

6.5 SIMULATION PLUS (CALIFORNIA)

6.6 SCHRODINGER INC. (US)

6.7 CHEMICAL COMPUTING GROUP ULC (CANADA)

6.8 PHYSIOMICS PLC (UK)

6.9 ROSA & CO. LLC (US)

6.10 BIOSIMULATION CONSULTING INCGENEDATA AG (SWITZERLAND)

6.11 INSTEM GROUP OF COMPANIES (USA)

6.12 PPD INC. (NORTH CAROLINA)

6.13 YOKOGAWA INSILICO BIOTECHNOLOGY GMBH (GERMANY)

6.14 INSILICO MEDICINE (HONG KONG)

6.15 GENEDATA (SWITZERLAND)

6.16 PHYSIOMICS PLC (UK)

6.17 BIOSIMULATION CONSULTING INC. (US)

6.18 YOKOGAWA INSILICO BIOTECHNOLOGY GMBH (GERMANY)

6.19 IMMUNETRICS (US)

6.20

Chapter 7: Global Connected Truck Market By Region

7.1 Overview

7.2. North America Connected Truck Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Communication Type

7.2.4.1 Vehicle to Vehicle (V2V)

7.2.4.2 Vehicle to Cloud (V2C)

7.2.4.3 Vehicle to Infrastructure (V2I)

7.2.5 Historic and Forecasted Market Size by Vehicle Type

7.2.5.1 Light Commercial Vehicle

7.2.5.2 Heavy Commercial Vehicle

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Connected Truck Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Communication Type

7.3.4.1 Vehicle to Vehicle (V2V)

7.3.4.2 Vehicle to Cloud (V2C)

7.3.4.3 Vehicle to Infrastructure (V2I)

7.3.5 Historic and Forecasted Market Size by Vehicle Type

7.3.5.1 Light Commercial Vehicle

7.3.5.2 Heavy Commercial Vehicle

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Connected Truck Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Communication Type

7.4.4.1 Vehicle to Vehicle (V2V)

7.4.4.2 Vehicle to Cloud (V2C)

7.4.4.3 Vehicle to Infrastructure (V2I)

7.4.5 Historic and Forecasted Market Size by Vehicle Type

7.4.5.1 Light Commercial Vehicle

7.4.5.2 Heavy Commercial Vehicle

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Connected Truck Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Communication Type

7.5.4.1 Vehicle to Vehicle (V2V)

7.5.4.2 Vehicle to Cloud (V2C)

7.5.4.3 Vehicle to Infrastructure (V2I)

7.5.5 Historic and Forecasted Market Size by Vehicle Type

7.5.5.1 Light Commercial Vehicle

7.5.5.2 Heavy Commercial Vehicle

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Connected Truck Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Communication Type

7.6.4.1 Vehicle to Vehicle (V2V)

7.6.4.2 Vehicle to Cloud (V2C)

7.6.4.3 Vehicle to Infrastructure (V2I)

7.6.5 Historic and Forecasted Market Size by Vehicle Type

7.6.5.1 Light Commercial Vehicle

7.6.5.2 Heavy Commercial Vehicle

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Connected Truck Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Communication Type

7.7.4.1 Vehicle to Vehicle (V2V)

7.7.4.2 Vehicle to Cloud (V2C)

7.7.4.3 Vehicle to Infrastructure (V2I)

7.7.5 Historic and Forecasted Market Size by Vehicle Type

7.7.5.1 Light Commercial Vehicle

7.7.5.2 Heavy Commercial Vehicle

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Connected Truck Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 47.23 Bn. |

|

Forecast Period 2023-30 CAGR: |

14.7% |

Market Size in 2030: |

USD 141.49 Bn. |

|

Segments Covered: |

By Communication Type |

|

|

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Connected Truck Market research report is 2024-2032.

Continental AG, AB Volvo, BorgWarner Inc., Denso Corporation, Harman International, Magna International Inc., Mercedes-Benz Group AG, Robert Bosch GmbH, Verizon Communications Inc., ZF Friedrichshafen AG, Sierra Wireless, Inc., Geotab Inc., TomTom International BV, Trimble Inc., MiX Telematicsand other major players.

The Connected Truck Market is segmented into Communication Type, Vehicle Type, and region. By Communication Type, the market is categorized into Vehicle to Vehicle (V2V), Vehicle to Cloud (V2C), Vehicle to Infrastructure (V2I). By Vehicle Type, the market is categorized into Light Commercial Vehicle, Heavy Commercial Vehicle. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

An advanced driver assistance system (ADAS) and a fleet management system (FMS), which display vehicle upgrades, driver-support systems, fuel management, and other information on the screen, are two examples of modern technologies that are included in a connected truck's equipment.

The Global Connected Truck Market Size Was Valued At USD 54.27 Billion In 2023 And Is Projected To Reach USD 193.92 Billion By 2032, Growing At A CAGR Of 15.2% From 2024 to 2032.