Cold Heading Machine Market Synopsis

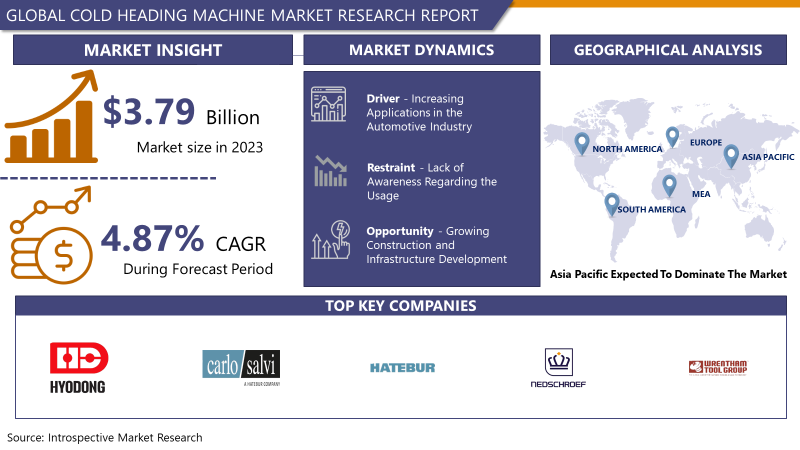

Cold Heading Machine Market Size Was Valued at USD 3.79 Billion in 2023, and is Projected to Reach USD 5.81 Billion by 2032, Growing at a CAGR of 4.87 % From 2024-2032.

A cold heading machine is mechanical equipment applied to form net-shaped or near-net-shaped parts of metal. This machine executes several steps to form a specific part from a metal wire or rod without adding heat. The process is conveyed using a replicated series of hammers, die, and punches at high speed. Cold heading machines are applied to produce headed parts, which are widely utilized to fabricate terminals of automobile control units, pressure sensors, engine control units, and other mechanical machinery.

- The cold heading machine is also utilized to manufacture bolts, screws, rivets, taper roller headings, and others. Furthermore, the expansion of the automotive and construction industries is estimated to fuel the cold-heading machine market. Surge for cold heading machines is anticipated to grow over the forecast period. The factors driving the growth of the market studied include increasing demand from the electrical industry and other factors, such as demand from the aerospace and defense sectors and the metalworking industries in China, India, and Thailand.

- Another factor contributing to the growth of the Cold Heading Machine market is the rising trend of customization in manufacturing. As consumer preferences become more diverse and industries seek to differentiate their products, the need for unique and specialized components has increased. Cold heading technology allows for the mass production of customized parts with consistent quality, providing manufacturers with the flexibility to meet specific requirements without sacrificing efficiency.

- The construction industry is also playing a significant role in driving the demand for Cold Heading Machines. The need for high-strength fasteners and components in construction projects has surged, and cold heading technology offers a cost-effective solution for producing these parts at scale. The versatility of Cold Heading Machines in processing various materials, including steel and aluminum, makes them a preferred choice for construction applications where robustness and durability are paramount.

Cold Heading Machine Market Trend Analysis

Increasing Applications in the Automotive Industry

- The increasing demand for cold heading machines in the automotive sector is the growing emphasis on lightweight materials. As automotive manufacturers strive to enhance fuel efficiency and reduce emissions, there is a widespread shift towards using lightweight materials such as aluminum and advanced high-strength steel in-vehicle components. Cold-heading machines play a pivotal role in shaping and forming these materials into intricate and precise parts, ensuring the structural integrity of the final products while maintaining the desired weight reduction.

- Additionally, the trend towards electric vehicles (EVs) has spurred demand for cold heading machines. The automotive industry is witnessing a rapid transition from traditional internal combustion engines to electric powertrains, necessitating a reconfiguration of various components within vehicles. Cold heading machines are instrumental in producing specialized fasteners and connectors required for electric vehicles, as these components must meet stringent standards for performance, safety, and durability.

- Moreover, the global push towards sustainable manufacturing practices has further fueled the demand for cold-heading machines. These machines are known for their efficiency in material utilization, minimizing waste, and optimizing production processes. As automotive manufacturers embrace sustainable practices to align with environmental regulations and consumer expectations, cold-heading machines become an essential asset in achieving eco-friendly and resource-efficient manufacturing.

- Another significant trend contributing to the increased adoption of cold-heading machines in the automotive sector is the rising complexity of vehicle designs. Modern automobiles incorporate a myriad of advanced features, from safety systems to connectivity solutions, leading to an intricate network of components.

Growing Construction and Infrastructure Development

- The construction industry is witnessing rapid expansion, driven by population growth, urbanization, and the need for modern infrastructure. Mega infrastructure projects, including highways, bridges, tunnels, and commercial buildings, require an extensive range of fasteners, and cold-heading machines provide a cost-effective and efficient means of producing them in large volumes.

- Moreover, the growing emphasis on sustainable and energy-efficient construction practices has further propelled the demand for cold-headed components. Cold heading technology enables the production of lightweight and high-strength fasteners, contributing to the overall efficiency and durability of structures. As sustainability becomes a critical factor in construction projects, the Cold Heading Machine market stands to benefit from the increased adoption of these advanced manufacturing processes.

- Infrastructure development, particularly in emerging economies, is another major catalyst for the Cold Heading Machine market's expansion. Governments worldwide are investing heavily in infrastructure projects to stimulate economic growth and enhance connectivity. This includes the development of transportation networks, energy grids, and telecommunications infrastructure. Cold heading machines are essential in the production of fasteners for these critical infrastructure projects, ensuring the structural integrity and reliability of the constructed facilities.

Cold Heading Machine Market Segment Analysis:

Cold Heading Machine Market Segmented on the basis of technique, tooling, and end-users.

By Technique, Upsetting segment is expected to dominate the market during the forecast period

- The demand for precision components in various industries such as automotive, aerospace, and electronics has surged. The Upsetting type cold heading machines excel in producing high-precision components with enhanced strength and durability, meeting the stringent requirements of modern applications. Moreover, advancements in technology have led to the development of more sophisticated Upsetting type cold-heading machines, incorporating features like automation, digital controls, and real-time monitoring.

By Tooling, Punches segment held the largest share of 62.4% in 2022

- The increasing demand for cold-formed components across various industries, including automotive, construction, and electronics. As these industries continue to expand, the need for efficient and high-quality cold heading processes rises, thereby boosting the demand for advanced Punches tooling. Furthermore, technological advancements in cold heading machines, including innovative designs and materials used in Punches tooling, contribute to improved performance, durability, and precision in the manufacturing process.

Cold Heading Machine Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The region has emerged as a major manufacturing hub, attracting investments from both domestic and international players. The robust industrial infrastructure and the availability of skilled labor in countries like China, India, Japan, and South Korea have created a conducive environment for the expansion of industries, including automotive and construction.

- The increasing demand for automobiles in the Asia Pacific region has played a pivotal role in driving the growth of the Cold Heading Machine Market. Cold-heading machines are extensively used in the automotive sector for the production of fasteners, bolts, and other components. As the automotive industry in Asia Pacific continues to grow, fueled by rising disposable incomes, urbanization, and a burgeoning middle class, the demand for cold-heading machines has witnessed a parallel surge.

Cold Heading Machine Market Top Key Players:

- Sacma Group (Italy)

- Hatebur Umformmaschinen AG (Switzerland)

- National Machinery LLC (United States)

- Chun Zu Machinery Industry Co., Ltd. (Taiwan)

- Sakamura Machine Co., Ltd. (Japan)

- Nedschroef Machinery (Netherlands)

- Wrentham Tool Group (United States)

- Tanisaka Iron Works Co., Ltd. (Japan)

- Carlo Salvi S.p.A. (Italy)

- Nakashimada Engineering Works, Ltd. (Japan)

- Hariton Machinery Co., Ltd. (Taiwan)

- Chun Yu Works & Co., Ltd. (Taiwan)

- Cold Heading Company (United States)

- Reed Machinery, Inc. (United States)

- Happe & Kranzler GmbH (Germany)

- National Machinery China (China)

- Hyodong Machine Co., Ltd. (South Korea)

- Wafios AG (Germany)

- Hei Yan Group (China)

- Chun Chan Tech Co., Ltd. (Taiwan)

- Henghui Precision Machinery Co., Ltd. (China)

- Nakashimada Engineering Works of America, Inc. (United States)

- Asahi Sunac Corporation (Japan)

- Hatebur BCK USA, Inc. (United States)

- Shandong Wantong Hydraulic Co., Ltd. (China)

Key Industry Developments in the Cold Heading Machine Market:

In April 2023, Eldon Machinery, a leading cold heading machine manufacturer, acquired BLF High Speed Forming, a specialist in high-speed cold headers. This strategic move strengthened Eldon's portfolio in the high-production segment and expanded its geographical reach.

In April 2023, German cold heading machine giant Kuhnke formed a strategic partnership with A&A Tooling Technologies, a renowned tooling manufacturer. This collaboration aimed to provide comprehensive, integrated cold heading solutions to customers by combining Kuhnke's machines with A&A's advanced tooling expertise.

|

Global Cold Heading Machine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.79 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.87% |

Market Size in 2032: |

USD 5.81 Bn. |

|

Segments Covered: |

By Technique |

|

|

|

By Tooling |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- COLD HEADING MACHINE MARKET BY TECHNIQUE (2017-2032)

- COLD HEADING MACHINE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- UPSETTING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- EXTRUSION

- COLD HEADING MACHINE MARKET BY TOOLING (2017-2032)

- COLD HEADING MACHINE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PUNCHES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DIES

- COLD HEADING MACHINE MARKET BY END-USER (2017-2032)

- COLD HEADING MACHINE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AUTOMOTIVE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ELECTRICAL

- INDUSTRIAL

- AEROSPACE & DEFENCE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- COLD HEADING MACHINE MARKET Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- SACMA GROUP (ITALY)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- HATEBUR UMFORMMASCHINEN AG (SWITZERLAND)

- NATIONAL MACHINERY LLC (UNITED STATES)

- CHUN ZU MACHINERY INDUSTRY CO., LTD. (TAIWAN)

- SAKAMURA MACHINE CO., LTD. (JAPAN)

- NEDSCHROEF MACHINERY (NETHERLANDS)

- WRENTHAM TOOL GROUP (UNITED STATES)

- TANISAKA IRON WORKS CO., LTD. (JAPAN)

- CARLO SALVI S.P.A. (ITALY)

- NAKASHIMADA ENGINEERING WORKS, LTD. (JAPAN)

- HARITON MACHINERY CO., LTD. (TAIWAN)

- CHUN YU WORKS & CO., LTD. (TAIWAN)

- COLD HEADING COMPANY (UNITED STATES)

- REED MACHINERY, INC. (UNITED STATES)

- HAPPE & KRANZLER GMBH (GERMANY)

- NATIONAL MACHINERY CHINA (CHINA)

- HYODONG MACHINE CO., LTD. (SOUTH KOREA)

- WAFIOS AG (GERMANY)

- HEI YAN GROUP (CHINA)

- CHUN CHAN TECH CO., LTD. (TAIWAN)

- HENGHUI PRECISION MACHINERY CO., LTD. (CHINA)

- NAKASHIMADA ENGINEERING WORKS OF AMERICA, INC. (UNITED STATES)

- ASAHI SUNAC CORPORATION (JAPAN)

- HATEBUR BCK USA, INC. (UNITED STATES)

- SHANDONG WANTONG HYDRAULIC CO., LTD. (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL COLD HEADING MACHINE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Technique

- Historic And Forecasted Market Size By Tooling

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Cold Heading Machine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.79 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.87% |

Market Size in 2032: |

USD 5.81 Bn. |

|

Segments Covered: |

By Technique |

|

|

|

By Tooling |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Cold Heading Machine Market research report is 2024-2032.

Sacma Group (Italy), Hatebur Umformmaschinen AG (Switzerland), National Machinery LLC (United States), Chun Zu Machinery Industry Co., Ltd. (Taiwan), Sakamura Machine Co., Ltd. (Japan), Nedschroef Machinery (Netherlands), Wrentham Tool Group (United States), Tanisaka Iron Works Co., Ltd. (Japan), Carlo Salvi S.p.A. (Italy), Nakashimada Engineering Works, Ltd. (Japan), Hariton Machinery Co., Ltd. (Taiwan), Chun Yu Works & Co., Ltd. (Taiwan), Cold Heading Company (United States), Reed Machinery, Inc. (United States), Happe & Kranzler GmbH (Germany), National Machinery China (China), Hyodong Machine Co., Ltd. (South Korea), Wafios AG (Germany), Hei Yan Group (China), Chun Chan Tech Co., Ltd. (Taiwan), Henghui Precision Machinery Co., Ltd. (China), Nakashimada Engineering Works of America, Inc. (United States), Asahi Sunac Corporation (Japan), Hatebur BCK USA, Inc. (United States), Shandong Wantong Hydraulic Co., Ltd. (China), and Other Major Players.

The Cold Heading Machine Market is segmented into Type, Tooling, End-User, and region. By Type, the market is categorized into Upsetting and Extrusion. By Tooling, the market is categorized into Punches and Dies. By End-User, the market is categorized into Automotive, Electrical, Industrial, Aerospace & Defence. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A cold heading machine is mechanical equipment applied to form net-shaped or near-net-shaped parts of metal. This machine executes several steps to form a specific part from a metal wire or rod without adding heat. The process is conveyed using a replicated series of hammers, die, and punches at high speed. Cold heading machines are applied to produce headed parts, which are widely utilized to fabricate terminals of automobile control units, pressure sensors, engine control units, and other mechanical machinery.

Cold Heading Machine Market Size Was Valued at USD 3.79 Billion in 2023, and is Projected to Reach USD 5.81 Billion by 2032, Growing at a CAGR of 4.87 % From 2024-2032.