Cold-Brew Coffee Market Synopsis

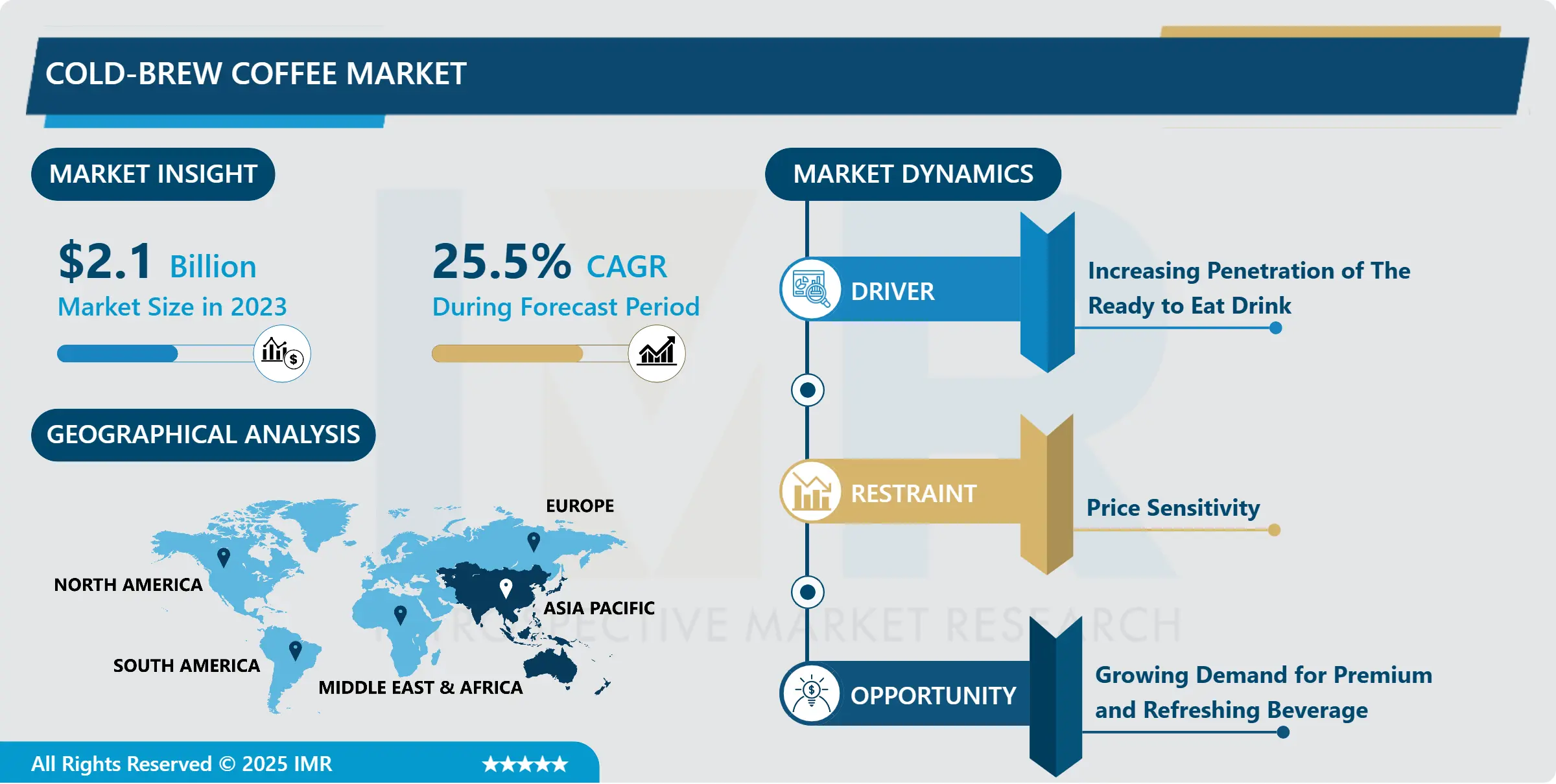

Cold-Brew Coffee Market Size Was Valued at USD 2.1 Billion in 2023 and is Projected to Reach USD 16.22 Billion by 2032, Growing at a CAGR of 25.5% From 2024-2032.

Cold-brew coffee is a method of brewing coffee by steeping coarsely ground coffee beans in cold water for an extended period, the slow steeping process extracts flavor compounds from the beans without heat, resulting in a smooth, less acidic brew. The concentrate is then diluted with water or milk and served over ice. Cold-brew coffee is known for its rich flavor and lower acidity than traditional hot-brewed coffee.

Cold brew, characterized by its smooth taste and lower acidity than traditional hot-brewed coffee, has gained popularity among coffee enthusiasts and casual drinkers. The market landscape is characterized by a diverse range of players, including established coffee chains, specialty coffee shops, and independent producers. Moreover, the emergence of ready-to-drink (RTD) cold-brew coffee products has additionally expanded the market reach, making cold brew more accessible to consumers on the go.

Innovations in packaging and distribution have also played a significant role in driving market growth, with manufacturers introducing new formats such as canned cold brew and concentrated cold-brew coffee kits for home brewing.

Geographically, the cold-brew coffee market is witnessing robust growth across regions, with North America and Europe leading the way. However, Asia-Pacific markets, particularly countries like Japan and South Korea, are also experiencing increasing demand for cold brew, driven by changing consumer preferences and the growing popularity of coffee culture.

The cold-brew coffee market is poised for continued expansion, powered by innovation, shifting consumer preferences, and the growing influence of coffee culture worldwide. As manufacturers continue to experiment with flavors, formats, and marketing strategies, the cold-brew coffee segment is expected to remain a vibrant and competitive space in the broader coffee industry.

Cold-Brew Coffee Market Trend Analysis

Increasing Penetration of The Ready to Eat Drink

- The increasing penetration of ready-to-drink (RTD) coffee, beverages offers convenience and portability, bringing into line with modern consumers' fast-paced lifestyles. Cold-brew coffee, known for its smoother and less acidic taste profile compared to traditionally brewed coffee, has garnered significant popularity among coffee enthusiasts seeking unique flavors and experiences.

- Furthermore, the rising demand for on-the-go refreshment options has propelled the consumption of cold-brew coffee, as it eliminates the need for brewing equipment and can be consumed straight from the bottle or can. The convenience factor appeals to busy professionals, students, and commuters who prioritize efficiency without compromising on quality.

- Moreover, the expanding distribution channels, including supermarkets, convenience stores, online platforms, and cafes, have widened the accessibility of cold-brew coffee to a broader consumer base. This accessibility, coupled with aggressive marketing strategies by manufacturers, has significantly contributed to the market's growth demand.

- Overall, the increasing penetration of ready-to-drink cold-brew coffee is reshaping consumer preferences and driving the expansion of the cold-brew coffee market, presenting lucrative opportunities for both established brands and new entrants.

Growing Demand for Premium and Refreshing Beverage

- The growing demand for premium and refreshing beverages has emerged as a major opportunity factor in the cold-brew coffee market due to shifting consumer preferences and lifestyle trends. Cold-brew coffee, with its smoother taste profile and lower acidity compared to traditional hot-brewed coffee, aligns well with the evolving tastes of consumers seeking unique and high-quality refreshments.

- Premiumization has become a key driver in the beverage industry, with consumers increasingly willing to pay a premium for products that offer superior quality, taste, and experience. Cold-brew coffee, often perceived as a more sophisticated and upscale alternative to regular coffee, caters to this demand for premium beverages.

- Moreover, the rise in health consciousness among consumers has fueled the popularity of cold-brew coffee, as it is perceived as a healthier option due to its lower acidity and smoother flavor profile. This health-conscious trend, coupled with the desire for indulgent yet guilt-free treats, further amplifies the appeal of cold-brew coffee among consumers.

- Additionally, the versatility of cold-brew coffee as a base for various innovative beverages, such as flavored cold brews, nitro cold brews, and coffee cocktails, opens up new avenues for product innovation and market expansion, driving further growth opportunities in the cold-brew coffee segment. Overall, the convergence of these factors underscores the significant opportunity presented by the growing demand for premium and refreshing beverages in the cold-brew coffee market.

Cold-Brew Coffee Market Segment Analysis:

Cold-Brew Coffee Market Segmented based on Product, Category, and Distribution Channel.

By Product, the Arabica-Based Cold Brew Coffee segment is expected to dominate the market during the forecast period

- Arabica beans are renowned for their smoothness, low acidity, and nuanced flavors, making them ideal for cold brewing. The process of cold brewing extracts the rich flavors of Arabica beans while minimizing bitterness, resulting in a refreshing and highly enjoyable beverage. Additionally, the rise of health-conscious consumers seeking lower acidity and smoother coffee options has fueled the popularity of Arabica-based cold brew. Its naturally sweeter taste and lower caffeine content also appeal to a wider audience, including those sensitive to caffeine. As demand for specialty coffee continues to surge, Arabica-based cold brew stands out as a premium offering, driving its dominance in the market and solidifying its position as the preferred choice for discerning coffee enthusiasts.

By Category, the Traditional segment held the largest share of xx% in 2023

- The Traditional segment stands poised to assert dominance. Renowned for its rich heritage and time-honoured brewing methods, the Traditional category embodies the essence of authentic coffee culture. With a focus on artisanal craftsmanship and quality ingredients, Traditional cold brews offer consumers a taste experience steeped in tradition and flavor. This segment appeals to purists and enthusiasts seeking the robust complexity and smooth finish characteristic of classic cold-brewed coffee. Furthermore, as consumers increasingly gravitate towards products with a sense of history and authenticity, the Traditional segment is well-positioned to capture a significant market share. Its ability to evoke nostalgia while satisfying modern tastes renders it a formidable force in the Cold-Brew Coffee Market landscape, promising continued growth and prominence in the years to come.

Cold-Brew Coffee Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region's burgeoning young population, coupled with changing lifestyles and a growing preference for convenience, has led to an increased demand for ready-to-drink beverages like cold-brew coffee. Moreover, the rising influence of Western coffee culture, particularly among urban millennials and Gen Z consumers, has further fueled the growth of the cold-brew segment in the region.

- Furthermore, the increasing penetration of coffee shop chains and cafes, along with the expansion of distribution channels in urban and semi-urban areas, has significantly contributed to the accessibility of cold-brew coffee products across Asia Pacific. Additionally, the region's diverse consumer preferences and the introduction of innovative flavors and variants catered to local tastes have propelled the market forward.

- The rapid urbanization, economic development, and disposable income growth in countries like China, India, Japan, and South Korea are creating a conducive environment for the expansion of the cold-brew coffee market. Additionally, the growing awareness of health and wellness among consumers, coupled with the perception of cold-brew coffee as a healthier alternative to traditional hot brewed coffee, is further driving its popularity in the region.

- Overall, with its vast consumer base, changing consumption patterns, and favorable market dynamics, Asia Pacific is expected to emerge as the dominant force in the global cold-brew coffee market over the forecast period. As companies continue to innovate and expand their product offerings to meet the evolving demands of consumers in the region, the cold-brew coffee market is poised for substantial growth and opportunities.

Active Key Players in the Cold-Brew Coffee Market

- Califia Farms (United States)

- Grady’s (United States)

- Seaworth Coffee Co (United States)

- Slingshot Coffee Co (United States)

- KonaRed (United States)

- Venice (United States)

- Groundwork (United States)

- Secret Squirrel (United States)

- 1degreeC (United States)

- Cove Coffee Co (United States)

- Schnobs (United States)

- STATION (United States)

- Sandows (United Kingdom)

- ZoZozial (Netherlands)

- Julius Meinl (Austria)

- Tata Coffee (India), and other major players.

Key Industry Delopments in the Cold-Brew Coffee Market:

- In June 2023, Tata Coffee unveiled its latest offering, Tata Coffee Gold, a brand-new cold brew product. Crafted to perfection, Tata Coffee Gold is meticulously brewed in cold water to preserve its smoothness and utilizes only the finest ingredients. Available in three distinct variants - classic, mocha, and hazelnut - this innovative product aims to revolutionize the coffee experience by presenting a well-balanced flavor profile devoid of any bitterness.

- In November 2022, Nestle SA, a Switzerland-based food and drink processing conglomerate corporation, acquired Starbucks Corp. for an undisclosed amount. This acquisition was expected to strengthen Nestle's position in the market by adding Seattle's Best Coffee to the global coffee alliance. Starbucks Corp., a US-based company that provided various coffee products, including cold-brew coffee, was involved in the deal.

|

Global Cold-Brew Coffee Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.1 Bn. |

|

Forecast Period 2024-32 CAGR: |

25.5 % |

Market Size in 2032: |

USD 16.22 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Category |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cold-Brew Coffee Market by Product (2018-2032)

4.1 Cold-Brew Coffee Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Arabica-Based Cold Brew Coffee

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Robusta-Based Cold Brew Coffee

4.5 Liberica-Based Cold Brew Coffee

Chapter 5: Cold-Brew Coffee Market by Category (2018-2032)

5.1 Cold-Brew Coffee Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Traditional

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Decaf

Chapter 6: Cold-Brew Coffee Market by Distribution Channel (2018-2032)

6.1 Cold-Brew Coffee Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Company-Owned Outlets

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Convenience Stores

6.5 Online

6.6 Supermarket And Hypermarket

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Cold-Brew Coffee Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 DOW CORNING CORPORATION (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 MOMENTIVE PERFORMANCE MATERIALS INC. (UNITED STATES)

7.4 NUSIL (UNITED STATES)

7.5 KBR (UNITED STATES)

7.6 HEXCEL (UNITED STATES)

7.7 APPLE RUBBER PRODUCTS (UNITED STATES)

7.8 NOVAGARD SOLUTIONS (UNITED STATES)

7.9 SHIN-ETSU CHEMICAL COLTD. (JAPAN)

7.10 SUMITOMO CHEMICAL COMPANY (JAPAN)

7.11 TOKUYAMA CORPORATION (JAPAN)

7.12 WACKER CHEMIE AG (GERMANY)

7.13 ELKEM SILICONES AS (NORWAY)

7.14 BLUESTAR SILICONES (FRANCE)

7.15 SAINT-GOBAIN (FRANCE)

7.16 KBR SILICONE (SOUTH KOREA)

7.17 ZHEJIANG CHENGUANG CHEMICAL COLTD. (CHINA)

7.18 JIANGSU ZHONGLU SILICONE COLTD. (CHINA)

7.19 ALADDIN COLTD. (CHINA)

7.20

Chapter 8: Global Cold-Brew Coffee Market By Region

8.1 Overview

8.2. North America Cold-Brew Coffee Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product

8.2.4.1 Arabica-Based Cold Brew Coffee

8.2.4.2 Robusta-Based Cold Brew Coffee

8.2.4.3 Liberica-Based Cold Brew Coffee

8.2.5 Historic and Forecasted Market Size by Category

8.2.5.1 Traditional

8.2.5.2 Decaf

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 Company-Owned Outlets

8.2.6.2 Convenience Stores

8.2.6.3 Online

8.2.6.4 Supermarket And Hypermarket

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Cold-Brew Coffee Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product

8.3.4.1 Arabica-Based Cold Brew Coffee

8.3.4.2 Robusta-Based Cold Brew Coffee

8.3.4.3 Liberica-Based Cold Brew Coffee

8.3.5 Historic and Forecasted Market Size by Category

8.3.5.1 Traditional

8.3.5.2 Decaf

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 Company-Owned Outlets

8.3.6.2 Convenience Stores

8.3.6.3 Online

8.3.6.4 Supermarket And Hypermarket

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Cold-Brew Coffee Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product

8.4.4.1 Arabica-Based Cold Brew Coffee

8.4.4.2 Robusta-Based Cold Brew Coffee

8.4.4.3 Liberica-Based Cold Brew Coffee

8.4.5 Historic and Forecasted Market Size by Category

8.4.5.1 Traditional

8.4.5.2 Decaf

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 Company-Owned Outlets

8.4.6.2 Convenience Stores

8.4.6.3 Online

8.4.6.4 Supermarket And Hypermarket

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Cold-Brew Coffee Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product

8.5.4.1 Arabica-Based Cold Brew Coffee

8.5.4.2 Robusta-Based Cold Brew Coffee

8.5.4.3 Liberica-Based Cold Brew Coffee

8.5.5 Historic and Forecasted Market Size by Category

8.5.5.1 Traditional

8.5.5.2 Decaf

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 Company-Owned Outlets

8.5.6.2 Convenience Stores

8.5.6.3 Online

8.5.6.4 Supermarket And Hypermarket

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Cold-Brew Coffee Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product

8.6.4.1 Arabica-Based Cold Brew Coffee

8.6.4.2 Robusta-Based Cold Brew Coffee

8.6.4.3 Liberica-Based Cold Brew Coffee

8.6.5 Historic and Forecasted Market Size by Category

8.6.5.1 Traditional

8.6.5.2 Decaf

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 Company-Owned Outlets

8.6.6.2 Convenience Stores

8.6.6.3 Online

8.6.6.4 Supermarket And Hypermarket

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Cold-Brew Coffee Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product

8.7.4.1 Arabica-Based Cold Brew Coffee

8.7.4.2 Robusta-Based Cold Brew Coffee

8.7.4.3 Liberica-Based Cold Brew Coffee

8.7.5 Historic and Forecasted Market Size by Category

8.7.5.1 Traditional

8.7.5.2 Decaf

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 Company-Owned Outlets

8.7.6.2 Convenience Stores

8.7.6.3 Online

8.7.6.4 Supermarket And Hypermarket

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Cold-Brew Coffee Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.1 Bn. |

|

Forecast Period 2024-32 CAGR: |

25.5 % |

Market Size in 2032: |

USD 16.22 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Category |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||