Instant Beverage Premix Market Synopsis

Instant Beverage Premix Market Size Was Valued at USD 92.3 Billion in 2023, and is Projected to Reach USD 159.96 Billion by 2032, Growing at a CAGR of 6.3% From 2024-2032.

Instant Beverage Premix refers to a ready-to-use mixture of ingredients that can be quickly prepared into a beverage by simply adding water or milk. These premixes typically include various ingredients such as coffee, tea, chocolate, or other flavorings, along with sweeteners and milk solids. They offer convenience and ease of preparation, making them popular among consumers looking for quick and hassle-free beverage options.

- Instant Beverage Premixes are versatile beverages that cater to various consumer preferences and lifestyles. They are popular for home consumption, office and workplace use, the hospitality industry, travel, health and wellness, specialty and gourmet, and retail and e-commerce. Home-based premixes are convenient for busy individuals or families, while office and workplace premixes are used for quick refreshments during breaks or meetings.

- In the hospitality industry, they are often included in the beverage menus of hotels, restaurants, and cafes. Travel and on-the-go premixes are ideal for travelers who prefer quick beverages without bulky ingredients or brewing facilities. Health and wellness premixes are tailored to specific dietary preferences or wellness goals. Specialty and gourmet premixes feature unique flavors, premium ingredients, or artisanal blends. Retail and e-commerce platforms offer instant beverage premixes in single-serve sachets or multi-serving containers to suit different usage preferences.

- Instant Beverage Premixes are popular due to their convenience, time-saving benefits, consistency, variety, portability, cost-effectiveness, and health and wellness trends. These premixes offer a quick and hassle-free way to prepare beverages without brewing equipment or complicated recipes, making them ideal for busy lifestyles. They also provide consistency, ensuring a satisfying drinking experience each time. The wide range of flavors and beverage options available caters to diverse consumer preferences, allowing consumers to experiment with different flavors and discover new favorites.

- Portability is another key factor, as these premixes are often packaged in single-serve sachets or lightweight containers, making them suitable for consumption on the go. They also offer a more cost-effective alternative to cafe-bought beverages, making them budget-friendly options for daily consumption. Health and wellness trends are driving demand for Instant Beverage Premixes that cater to specific dietary preferences or functional needs. Manufacturers are offering options such as low-sugar, dairy-free, or protein-enriched premixes, as well as those containing functional ingredients like vitamins, minerals, or antioxidants.

Instant Beverage Premix Market Trend Analysis

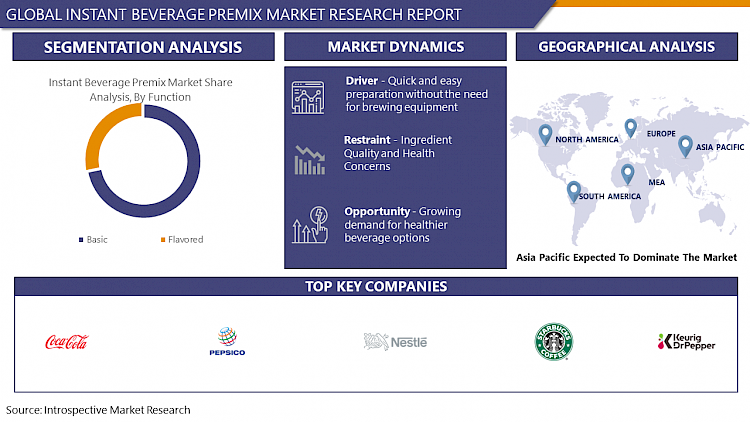

Quick and easy preparation without the need for brewing equipment

- Instant Beverage Premixes are designed to offer consumers a hassle-free way to enjoy their favorite beverages without the need for specialized brewing equipment or extensive preparation. Traditional methods of making coffee, tea, or other beverages often require equipment such as coffee makers, teapots, or milk frothers, along with the necessary ingredients and precise measurements. However, with Instant Beverage Premixes, all the essential ingredients are already blended and portioned in convenient packaging, typically in the form of single-serve sachets or pre-measured containers.

- To prepare a beverage using an Instant Beverage Premix, consumers simply need to tear open the sachet or measure out the specified amount of premix, add water or milk, and stir or shake to dissolve the mixture. The entire process takes only a few seconds or minutes, depending on the beverage type and individual preferences. There's no need for grinding coffee beans, steeping tea leaves, or frothing milk everything is conveniently pre-packaged and ready to use.

- This driver appeals to consumers who lead busy lifestyles and prioritize convenience, as well as those who may lack the time, equipment, or expertise to prepare beverages using traditional methods. Instant Beverage Premixes provides a quick solution for satisfying cravings for coffee, tea, hot chocolate, or other beverages, whether at home, in the office, while traveling, or on the go.

- Furthermore, the simplicity of preparation makes Instant Beverage Premixes accessible to a wide range of consumers, including those who may have limited culinary skills or physical abilities. The user-friendly nature of these products contributes to their widespread adoption and popularity in the market, as they offer a convenient and time-saving alternative to traditional beverage preparation methods.

Restraint

Ingredient Quality and Health Concerns

- Consumers are increasingly concerned about the quality of ingredients in Instant Beverage Premixes, which may raise concerns about the origin, freshness, and processing methods of ingredients. They may prefer beverages made with natural, organic, or ethically sourced ingredients. Many Instant Beverage Premixes contain additives, preservatives, artificial flavors, and sweeteners, which raise concerns about allergies, intolerances, and long-term health risks. There is a growing demand for premix products with cleaner ingredient lists and fewer artificial additives.

- Sugar content is a significant concern for health-conscious consumers, with some products containing high levels of added sugars. Artificial sweeteners and flavors are often used as alternatives to sugar, but there is ongoing debate about their safety and health implications. Consumers may also question the nutritional value of Instant Beverage Premixes, particularly in terms of vitamins, minerals, and other beneficial nutrients.

Growing demand for healthier beverage options

- The growing demand for healthier beverage options presents a significant opportunity for Instant Beverage Premixes to capitalize on these trends. Health and wellness trends are driving demand for beverages with nutritional benefits and aligning with dietary preferences. Instant Beverage Premixes can tap into this trend by offering formulations catering to specific needs, such as low-sugar, reduced-calorie, dairy-free, gluten-free, or organic options.

- Functional ingredients, such as vitamins, minerals, antioxidants, probiotics, or botanical extracts, can enhance their nutritional profile. Natural and clean-label products with transparent ingredient sourcing and minimal processing can differentiate Instant Beverage Premixes from competitors. Reduced sugar and low-calorie formulas can cater to concerns about health risks associated with excessive sugar consumption.

- Customization and personalization can be achieved by providing modular premix systems that allow consumers to adjust sweetness levels, choose milk alternatives, or add functional boosters. Effective marketing and branding can attract health-conscious consumers by highlighting nutritional value, functional ingredients, wellness claims, and certifications. Individual Beverage Premixes can also expand into niche markets within the health and wellness segment, such as sports nutrition, meal replacement, beauty drinks, or immunity-boosting beverages.

Challenge

Maintaining the stability and shelf life of ingredients in premix formulations

- Manufacturers of Instant Beverage Premixes face challenges in maintaining the stability and shelf life of ingredients in premix formulations. These include ingredient interactions, moisture sensitivity, oxidation, temperature sensitivity, light exposure, packaging integrity, and preservative systems. Premix ingredients can interact with each other, causing changes in flavor, texture, color, and overall product quality. Moisture sensitivity can lead to clumping, caking, or microbial growth, while oxidation can cause rancidity, off-flavors, and loss of nutritional value.

- Temperature sensitivity can accelerate degradation during storage and transportation, while light exposure can cause degradation and loss of vibrancy. Packaging integrity is crucial, as poorly sealed or inadequate barrier properties can allow moisture, oxygen, or light to permeate, leading to product degradation. Preservative systems can extend shelf life by inhibiting microbial growth and oxidation, but their use may be limited due to consumer preferences for clean-label products.

Instant Beverage Premix Market Segment Analysis:

Instant Beverage Premix Market is Segmented based on product type, function, form, and distribution channel.

By Product Type, Instant Coffee segment is expected to dominate the market during the forecast period

- Instant coffee is a popular and widely consumed beverage worldwide, offering convenience, variety, and long shelf life. It is available in various formats such as single-serve sachets, jars, sticks, and capsules, catering to different usage occasions and consumer preferences. Instant coffee's extended shelf life reduces waste and ensures product availability over time.

- Marketing and branding are crucial for the dominance of instant coffee. Major coffee brands invest heavily in marketing and branding initiatives to promote their products, reinforcing consumer loyalty. The instant coffee segment continues to innovate with new product offerings, including flavored variants, specialty blends, and premium formulations.

- It is generally more affordable than freshly brewed coffee from cafes or coffee shops, making it an attractive option for budget-conscious consumers. Globalization has further strengthened the dominance of instant coffee, as multinational coffee companies expand globally, making it readily available in markets worldwide. This global presence contributes to its dominance and market share across diverse geographic regions.

By Function, Basic segment held the largest share of 53% in 2023

- Basic instant beverage premixes, including coffee, tea, and milk-based beverages, have a high market share due to their widespread appeal across various age groups and demographics. These beverages are highly consumed globally, offering convenience and familiarity. They are quick and accessible, requiring only hot water or milk for preparation.

- The market for these products is relatively mature, with well-established brands and distribution networks. The basic segment offers a diverse range of products, catering to different preferences and tastes. They are often more affordable than specialized or premium options, making them accessible to a wide range of consumers. The global demand for coffee and tea is due to varying preferences and consumption patterns across different regions.

Instant Beverage Premix Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region, including densely populated countries like China and India, is experiencing a growing demand for convenient beverages like Instant Beverage Premixes due to changing lifestyles, coffee and tea cultures, and diverse flavor preferences. Rapid urbanization and modern retail channels have increased access to these products, particularly in urban areas with fast-paced lifestyles. As health consciousness rises, there is a growing demand for healthier beverage options, leading manufacturers to introduce functional ingredients, reduced sugar content, and health-focused formulations.

- Companies in the Asia Pacific market are investing in innovation and marketing strategies, including product diversification, packaging innovations, and targeted marketing campaigns tailored to local preferences and consumer segments. This has led to a wide variety of flavors and formulations that cater to the diverse tastes and preferences of consumers in the region.

Instant Beverage Premix Market Top Key Players:

- Nestlé (Switzerland)

- The Coca-Cola Company (USA)

- Starbucks Corporation (USA)

- PepsiCo, Inc. (USA)

- Keurig Dr Pepper Inc. (USA)

- Mondelez International (USA)

- Dunkin' Brands Group, Inc. (USA)

- Keurig Green Mountain, Inc. (USA)

- Dr. Pepper Snapple Group, Inc. (USA)

- Jacobs Kronung (Germany)

- Unilever (UK)

- Jacobs Douwe Egberts (Netherlands)

- FrieslandCampina (Netherlands)

- Lavazza Group (Italy)

- Barry Callebaut (Switzerland)

- JAB Holding Company (Luxembourg)

- Tingyi (Cayman Islands) Holding Corporation (China)

- Tata Consumer Products (India)

- Tata Global Beverages Limited (India)

- UCC Ueshima Coffee Co., Ltd. (Japan)

- Ajinomoto Co., Inc. (Japan)

- Asahi Group Holdings, Ltd. (Japan)

- Lotte Chilsung Beverage Co., Ltd. (South Korea)

- Strauss Group Ltd. (Israel), and other major players

Key Industry Developments in the Instant Beverage Premix Market:

- In October 2022, Keurig Dr Pepper Inc. and Grupo PiSA announced KDP will sell, distribute, and merchandise Electrolit®, a premium hydration beverage, across the United States as part of a long-term sales and distribution agreement. The partnership extends KDP's portfolio into sports hydration, a key white space category for the Company, and is designed to significantly expand Electrolit's distribution and continue the brand's accelerated growth.

- In May 2022, Nestle Health Science, a business unit of Nestle SA, agreed to acquire Puravida, a Brazilian nutrition and lifestyle brand that manufactures and markets such applications as drink mixes, protein powders, nutrition bars, and snacks that are based in São Paulo.

|

Global Instant Beverage Premix Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

92.3 Bn |

|

Forecast Period 2024-32 CAGR: |

6.3% |

Market Size in 2032: |

159.96 Bn |

|

Segments Covered: |

By Product Type |

|

|

|

By Function |

|

||

|

By Form |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- INSTANT BEVERAGE PREMIX MARKET BY PRODUCT TYPE (2017-2032)

- INSTANT BEVERAGE PREMIX MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- INSTANT COFFEE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INSTANT TEA

- INSTANT MILK

- INSTANT HEALTH DRINKS

- SOUPS

- INSTANT BEVERAGE PREMIX MARKET BY FUNCTION (2017-2032)

- INSTANT BEVERAGE PREMIX MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BASIC

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FLAVORED

- INSTANT BEVERAGE PREMIX MARKET BY FORM (2017-2032)

- INSTANT BEVERAGE PREMIX MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LIQUID

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- GRANULAR

- POWDER

- INSTANT BEVERAGE PREMIX MARKET BY DISTRIBUTION CHANNEL (2017-2032)

- INSTANT BEVERAGE PREMIX MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RETAIL STORES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ONLINE RETAILING

- SPECIALTY STORES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Instant Beverage Premix Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- NESTLÉ (SWITZERLAND)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- THE COCA-COLA COMPANY (USA)

- STARBUCKS CORPORATION (USA)

- PEPSICO, INC. (USA)

- KEURIG DR PEPPER INC. (USA)

- MONDELEZ INTERNATIONAL (USA)

- DUNKIN' BRANDS GROUP, INC. (USA)

- KEURIG GREEN MOUNTAIN, INC. (USA)

- DR. PEPPER SNAPPLE GROUP, INC. (USA)

- JACOBS KRONUNG (GERMANY)

- UNILEVER (UK)

- JACOBS DOUWE EGBERTS (NETHERLANDS)

- FRIESLANDCAMPINA (NETHERLANDS)

- LAVAZZA GROUP (ITALY)

- BARRY CALLEBAUT (SWITZERLAND)

- JAB HOLDING COMPANY (LUXEMBOURG)

- TINGYI (CAYMAN ISLANDS) HOLDING CORPORATION (CHINA)

- TATA CONSUMER PRODUCTS (INDIA)

- TATA GLOBAL BEVERAGES LIMITED (INDIA)

- UCC UESHIMA COFFEE CO., LTD. (JAPAN)

- AJINOMOTO CO., INC. (JAPAN)

- ASAHI GROUP HOLDINGS, LTD. (JAPAN)

- LOTTE CHILSUNG BEVERAGE CO., LTD. (SOUTH KOREA)

- STRAUSS GROUP LTD. (ISRAEL)

- COMPETITIVE LANDSCAPE

- GLOBAL INSTANT BEVERAGE PREMIX MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product Type

- Historic And Forecasted Market Size By Function

- Historic And Forecasted Market Size By Form

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Instant Beverage Premix Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

92.3 Bn |

|

Forecast Period 2024-32 CAGR: |

6.3% |

Market Size in 2032: |

159.96 Bn |

|

Segments Covered: |

By Product Type |

|

|

|

By Function |

|

||

|

By Form |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. INSTANT BEVERAGE PREMIX MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. INSTANT BEVERAGE PREMIX MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. INSTANT BEVERAGE PREMIX MARKET COMPETITIVE RIVALRY

TABLE 005. INSTANT BEVERAGE PREMIX MARKET THREAT OF NEW ENTRANTS

TABLE 006. INSTANT BEVERAGE PREMIX MARKET THREAT OF SUBSTITUTES

TABLE 007. INSTANT BEVERAGE PREMIX MARKET BY PRODUCT TYPE

TABLE 008. INSTANT COFFEE MIX MARKET OVERVIEW (2016-2028)

TABLE 009. INSTANT TEA MIX MARKET OVERVIEW (2016-2028)

TABLE 010. INSTANT HEALTH DRINKS MIX MARKET OVERVIEW (2016-2028)

TABLE 011. INSTANT MILK MIX MARKET OVERVIEW (2016-2028)

TABLE 012. INSTANT SOUP MIX MARKET OVERVIEW (2016-2028)

TABLE 013. INSTANT BEVERAGE PREMIX MARKET BY DISTRIBUTION CHANNEL

TABLE 014. STORE BASED MARKET OVERVIEW (2016-2028)

TABLE 015. ONLINE STORES MARKET OVERVIEW (2016-2028)

TABLE 016. NORTH AMERICA INSTANT BEVERAGE PREMIX MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 017. NORTH AMERICA INSTANT BEVERAGE PREMIX MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 018. N INSTANT BEVERAGE PREMIX MARKET, BY COUNTRY (2016-2028)

TABLE 019. EUROPE INSTANT BEVERAGE PREMIX MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 020. EUROPE INSTANT BEVERAGE PREMIX MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 021. INSTANT BEVERAGE PREMIX MARKET, BY COUNTRY (2016-2028)

TABLE 022. ASIA PACIFIC INSTANT BEVERAGE PREMIX MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 023. ASIA PACIFIC INSTANT BEVERAGE PREMIX MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 024. INSTANT BEVERAGE PREMIX MARKET, BY COUNTRY (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA INSTANT BEVERAGE PREMIX MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA INSTANT BEVERAGE PREMIX MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 027. INSTANT BEVERAGE PREMIX MARKET, BY COUNTRY (2016-2028)

TABLE 028. SOUTH AMERICA INSTANT BEVERAGE PREMIX MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 029. SOUTH AMERICA INSTANT BEVERAGE PREMIX MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 030. INSTANT BEVERAGE PREMIX MARKET, BY COUNTRY (2016-2028)

TABLE 031. AJINOMOTO GENERAL FOODS: SNAPSHOT

TABLE 032. AJINOMOTO GENERAL FOODS: BUSINESS PERFORMANCE

TABLE 033. AJINOMOTO GENERAL FOODS: PRODUCT PORTFOLIO

TABLE 034. AJINOMOTO GENERAL FOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. COCO-COLA COMPANY: SNAPSHOT

TABLE 035. COCO-COLA COMPANY: BUSINESS PERFORMANCE

TABLE 036. COCO-COLA COMPANY: PRODUCT PORTFOLIO

TABLE 037. COCO-COLA COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. DUNKIN BRANDS GROUP: SNAPSHOT

TABLE 038. DUNKIN BRANDS GROUP: BUSINESS PERFORMANCE

TABLE 039. DUNKIN BRANDS GROUP: PRODUCT PORTFOLIO

TABLE 040. DUNKIN BRANDS GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. KEURIG GREEN MOUNTAIN: SNAPSHOT

TABLE 041. KEURIG GREEN MOUNTAIN: BUSINESS PERFORMANCE

TABLE 042. KEURIG GREEN MOUNTAIN: PRODUCT PORTFOLIO

TABLE 043. KEURIG GREEN MOUNTAIN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. MONSTER BEVERAGE COMPANY: SNAPSHOT

TABLE 044. MONSTER BEVERAGE COMPANY: BUSINESS PERFORMANCE

TABLE 045. MONSTER BEVERAGE COMPANY: PRODUCT PORTFOLIO

TABLE 046. MONSTER BEVERAGE COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. PEPSICO: SNAPSHOT

TABLE 047. PEPSICO: BUSINESS PERFORMANCE

TABLE 048. PEPSICO: PRODUCT PORTFOLIO

TABLE 049. PEPSICO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. STARBUCKS CORPORATION: SNAPSHOT

TABLE 050. STARBUCKS CORPORATION: BUSINESS PERFORMANCE

TABLE 051. STARBUCKS CORPORATION: PRODUCT PORTFOLIO

TABLE 052. STARBUCKS CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. FOOD LIMITED: SNAPSHOT

TABLE 053. FOOD LIMITED: BUSINESS PERFORMANCE

TABLE 054. FOOD LIMITED: PRODUCT PORTFOLIO

TABLE 055. FOOD LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. THE REPUBLIC OF TEA: SNAPSHOT

TABLE 056. THE REPUBLIC OF TEA: BUSINESS PERFORMANCE

TABLE 057. THE REPUBLIC OF TEA: PRODUCT PORTFOLIO

TABLE 058. THE REPUBLIC OF TEA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. ITO EN. INC.: SNAPSHOT

TABLE 059. ITO EN. INC.: BUSINESS PERFORMANCE

TABLE 060. ITO EN. INC.: PRODUCT PORTFOLIO

TABLE 061. ITO EN. INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. SUNTORY BEVERAGE: SNAPSHOT

TABLE 062. SUNTORY BEVERAGE: BUSINESS PERFORMANCE

TABLE 063. SUNTORY BEVERAGE: PRODUCT PORTFOLIO

TABLE 064. SUNTORY BEVERAGE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 065. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 066. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 067. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. INSTANT BEVERAGE PREMIX MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. INSTANT BEVERAGE PREMIX MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 012. INSTANT COFFEE MIX MARKET OVERVIEW (2016-2028)

FIGURE 013. INSTANT TEA MIX MARKET OVERVIEW (2016-2028)

FIGURE 014. INSTANT HEALTH DRINKS MIX MARKET OVERVIEW (2016-2028)

FIGURE 015. INSTANT MILK MIX MARKET OVERVIEW (2016-2028)

FIGURE 016. INSTANT SOUP MIX MARKET OVERVIEW (2016-2028)

FIGURE 017. INSTANT BEVERAGE PREMIX MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 018. STORE BASED MARKET OVERVIEW (2016-2028)

FIGURE 019. ONLINE STORES MARKET OVERVIEW (2016-2028)

FIGURE 020. NORTH AMERICA INSTANT BEVERAGE PREMIX MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. EUROPE INSTANT BEVERAGE PREMIX MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. ASIA PACIFIC INSTANT BEVERAGE PREMIX MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. MIDDLE EAST & AFRICA INSTANT BEVERAGE PREMIX MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. SOUTH AMERICA INSTANT BEVERAGE PREMIX MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Instant Beverage Premix Market research report is 2024-2032.

Nestlé (Switzerland), The Coca-Cola Company (USA), Starbucks Corporation (USA), PepsiCo, Inc. (USA), Keurig Dr Pepper Inc. (USA), Mondelez International (USA), Dunkin' Brands Group, Inc. (USA), Keurig Green Mountain, Inc. (USA), Dr. Pepper Snapple Group, Inc. (USA), Jacobs Kronung (Germany), Unilever (UK), Jacobs Douwe Egberts (Netherlands), FrieslandCampina (Netherlands), Lavazza Group (Italy), Barry Callebaut (Switzerland), JAB Holding Company (Luxembourg), Tingyi (Cayman Islands) Holding Corporation (China), Tata Consumer Products (India), Tata Global Beverages Limited (India), UCC Ueshima Coffee Co., Ltd. (Japan), Ajinomoto Co., Inc. (Japan), Asahi Group Holdings, Ltd. (Japan), Lotte Chilsung Beverage Co., Ltd. (South Korea), Strauss Group Ltd. (Israel), and Other Major Players.

The Instant Beverage Premix Market is segmented into Product Type, Function, Form, Distribution Channel, and region. By Product Type, the market is categorized into Instant Coffee, Instant Tea, Instant Milk, Instant Health Drinks, Soups, and Others. By Function, the market is categorized into Basic, Flavored. By Form, the market is categorized into Liquid, Granular, and Powder. By Distribution Channel, the market is categorized into Retail Stores, Online Retailing, and Specialty Stores. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Instant Beverage Premix Market refers to the industry segment involved in the production, distribution, and sale of ready-to-use mixtures of ingredients that can be quickly prepared into beverages by adding water or milk. These premixes typically include coffee, tea, chocolate, or other flavorings, along with sweeteners and milk solids. The market caters to consumers seeking convenient and quick beverage solutions for home consumption, office use, hospitality, travel, and other occasions.

Instant Beverage Premix Market Size Was Valued at USD 92.3 Billion in 2023, and is Projected to Reach USD 159.96 Billion by 2032, Growing at a CAGR of 6.3% From 2024-2032.