Coffee Market Synopsis

Coffee Market Size Was Valued at USD 126.05 Billion in 2023, and is Projected to Reach USD 192.55 Billion by 2032, Growing at a CAGR of 4.82% From 2024-2032.

Coffee, originating from African roasted seeds, is a globally popular beverage with diverse brewing methods. Its caffeine-rich effects enhance alertness and focus. Coffee culture extends beyond consumption, fostering social connections and rituals. Its rich aroma and complex flavors offer a spectrum of experiences, from robust to smooth. Enjoyed alone or in cafes, coffee fuels mornings and fosters community.

- Coffee, renowned for its robust flavor and stimulating properties, boasts a multitude of advantages. Primarily, its caffeine content serves as a natural energizer, enhancing alertness, focus, and cognitive abilities, making it an ideal choice for kick-starting mornings or aiding in concentration during study sessions. Additionally, coffee is rich in antioxidants, including chlorogenic acid, which combat oxidative stress and inflammation, potentially reducing the risk of chronic ailments such as heart disease and certain cancers.

- The uses of coffee extend far beyond a mere beverage. It holds a prominent place in various cultures, often enjoyed socially in cafes or at home gatherings. Coffee serves as a versatile ingredient in culinary applications, adding depth and complexity to an array of recipes, ranging from desserts to savory dishes. the demand for coffee remains robust, fueled by its widespread consumption and cultural significance. The surge in popularity of specialty coffee and the proliferation of coffee establishments contribute to the escalating demand.

- As consumer preferences lean towards health-conscious choices, there's a growing demand for organic and sustainably sourced coffee, reflecting a preference for ethical and environmentally friendly products. In essence, coffee's myriad benefits and adaptable nature ensure its enduring appeal in the global market.

- Coffee is a valuable beverage with potential health benefits, including lowering the risk of certain diseases like type 2 diabetes and neurodegenerative conditions like Alzheimer's and Parkinson's. Coffee also plays a vital economic role, particularly in coffee-producing countries, providing income for millions of farmers and communities. The coffee industry, encompassing cultivation, harvesting, processing, roasting, and distribution, provides employment opportunities and drives economic growth.

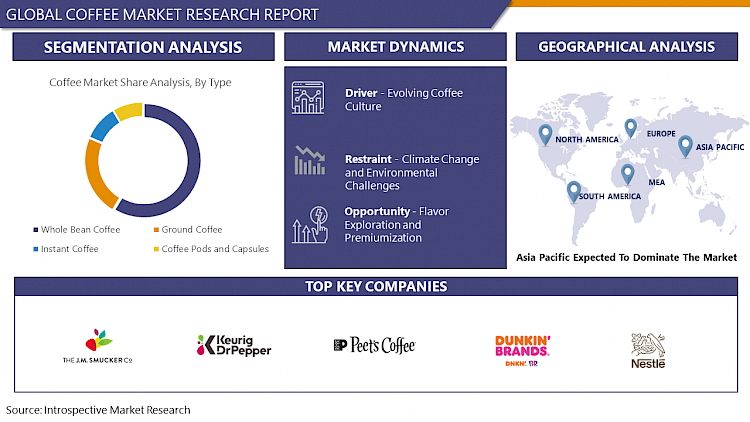

Coffee Market Trend Analysis

Evolving Coffee Culture

- The transformation of coffee culture emerges as a pivotal force propelling the expansion of the coffee market. Initially valued for its stimulating effects, coffee has evolved into a cultural phenomenon that molds social dynamics, consumer inclinations, and market trajectories. This evolution is epitomized by the ascendancy of specialty coffee, characterized by its focus on superior-grade beans, artisanal brewing techniques, and distinct flavor profiles. This premiumization trend has fostered the emergence of specialty coffee outlets, artisanal roasters, and coffee-centric gatherings worldwide, catering to discerning consumers seeking refined coffee experiences.

- Coffee culture has interwoven itself with broader lifestyle trends such as wellness, sustainability, and ethical consumption. Consumers increasingly gravitate towards coffee products that resonate with their values, including organically sourced, fair trade, and socially responsible options.

- The coffee culture fuels innovation across product development, packaging, and marketing domains, fueling market expansion and diversification. From groundbreaking brewing methodologies to inventive flavor blends, the evolving coffee culture continues to shape the coffee market landscape, presenting a spectrum of experiences and avenues for industry stakeholders to connect with consumers on a profound level.

Flavor Exploration and Premiumization

- Flavor exploration and premiumization stand as promising avenues for the coffee market's expansion. As consumers increasingly seek new and refined tastes, there emerges a heightened demand for diverse flavor profiles that elevate the coffee-drinking experience. This trend corresponds with the growing appeal of specialty and gourmet coffee, where individuals pursue superior-quality beans, unique blends, and artisanal brewing techniques.

- Coffee producers and retailers are seizing this opportunity by offering an extensive array of flavor options, encompassing single-origin beans, exotic blends, and flavored coffees enriched with ingredients like vanilla, caramel, and spices. Moreover, the proliferation of specialty coffee shops and boutique roasters provides platforms for enthusiasts to delve into and appreciate an array of flavor nuances through curated tasting events, coffee samplings, and educational initiatives.

- Premiumization within the coffee sector entails the introduction of upscale products and experiences that command higher price points, catering to consumers seeking superior quality, exclusivity, and craftsmanship. This includes offerings such as limited-edition roasts, luxurious packaging, and specialized brewing apparatuses, amplifying the perceived value and prestige associated with the coffee brand. Overall, flavor exploration and premiumization present lucrative opportunities for companies to distinguish themselves, captivate discerning audiences, and foster revenue growth amid the competitive coffee landscape.

Coffee Market Segment Analysis:

Coffee Market Segmented on the basis of Type, Nature, and Distribution Channel.

By Type, Ground Coffee segment is expected to dominate the market during the forecast period

- The ground coffee segment is poised to maintain its dominance in the coffee market due to several factors. Ground coffee offers convenience and adaptability, appealing to a broad spectrum of consumers seeking a straightforward brewing experience without the need for specialized equipment. Unlike whole-bean coffee, ground coffee eliminates the necessity for grinding, making it accessible to individuals without dedicated coffee-making tools.

- Ground coffee caters to diverse brewing preferences, including drip, French press, and espresso methods, accommodating a variety of tastes and requirements. This versatility enhances its attractiveness to consumers valuing ease of use while preserving flavor. Ground coffee is widely available across retail channels, including supermarkets, specialty stores, and online platforms, ensuring broad market penetration and accessibility for consumers globally.

- Additionally, ongoing product innovation within the ground coffee segment, characterized by the introduction of new flavors, blends, and packaging options, caters to evolving consumer demands and sustains interest and loyalty. These aspects collectively reinforce the segment's prominence in the competitive coffee market landscape.

By Nature, Conventional segment is expected to dominate the market during the forecast period

- The conventional segment of the coffee market is poised to maintain its dominance for several reasons. Conventional farming practices are currently the most prevalent and established methods in the industry. Many coffee growers worldwide rely on conventional techniques, employing synthetic fertilizers, pesticides, and herbicides to optimize yields and safeguard crops against pests and diseases. These approaches often result in increased productivity and reduced production costs, rendering conventional coffee more accessible and cost-effective for consumers.

- Conventional coffee production typically operates on a larger scale, enabling economies of scale and enhanced efficiency throughout the production, processing, and distribution processes. Consequently, conventional coffee products tend to hold a competitive edge in terms of pricing and availability compared to organic counterparts.

- Despite the growing interest in organic and sustainable offerings, conventional coffee remains the predominant choice in global production and consumption. As a result, the conventional segment is expected to retain its market dominance due to well-established supply chains, widespread availability, and competitive pricing relative to organic alternatives.

Coffee Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific is anticipated to emerge as a dominant force in the coffee market due to several compelling factors. The region is witnessing rapid urbanization and economic growth, resulting in a burgeoning middle class with greater disposable incomes. Consequently, a larger portion of consumers in Asia Pacific can afford coffee products, thereby boosting demand for both traditional and specialty coffee offerings.

- There is a noticeable proliferation of coffee culture across many countries in the Asia Pacific region, driven by increasing exposure to Western lifestyles and preferences. This cultural shift is evident in the rising number of coffee shops, cafes, and specialty roasters popping up in major urban centers, catering to the evolving tastes and desires of consumers.

- Asia Pacific boasts some of the world's largest coffee-producing nations, including Vietnam and Indonesia, which significantly contribute to global coffee output. The geographical proximity to these key coffee-growing regions facilitates easier access to fresh coffee beans, thereby supporting the development of local coffee industries and fostering a robust supply chain. the growing social appeal and status associated with coffee consumption further propel its popularity in Asia Pacific, solidifying the region's position as a dominant player in the global coffee market in the foreseeable future.

Coffee Market Top Key Players:

- The J.M. Smucker Company (US)

- Keurig Green Mountain (US)

- Peet's Coffee (US)

- Dunkin' Brands Group (US)

- Coffee Holding Co., Inc. (US)

- Kraft Heinz Company (US)

- Tootsie Roll Industries (US)

- Community Coffee Company (US)

- Trader Joe's (US)

- Mondelez International (US)

- McCafé (US)

- Tchibo (Germany)

- NKG (Neumann Kaffee Gruppe) (Germany)

- Melitta Group (Germany)

- D.E Master Blenders 1753 (Netherlands)

- Nestlé (Switzerland)

- JAB Holding Company (Luxembourg)

- Luigi Lavazza S.p.A. (Italy)

- Illycaffè S.p.A. (Italy)

- Massimo Zanetti Beverage Group (Italy)

- illy Group (Italy)

- Costa Coffee (UK)

- Tata Consumer Products (India)

- Strauss Group (Israel), and Other Major Players.

Key Industry Developments in the Coffee Market:

- In September 2022, saw the unveiling of a pioneering innovation by CoffeeB, a renowned Swiss coffee brand. They introduced revolutionary compressed coffee balls, touted as "the future of single-serve coffee." These balls are encased in an innovative seaweed-based material, a departure from conventional aluminum or plastic capsules. This sustainable packaging not only ensures the retention of the balls' shape but also underscores CoffeeB's commitment to environmental responsibility.

- In March 2022, Beat Coffee, a Melbourne-based coffee establishment, introduced a specialty instant coffee offering packaged in individual sachets. This innovative product captures the essence of quality, flavor, and convenience, allowing consumers to enjoy the vibrant taste of coffee on the go. Utilizing freeze-drying technology, Beat Coffee preserves the coffee's rich flavors, unveiling delightful caramel and honey notes in an instant format.

- In January 2022, marked a significant milestone for Starbucks as they inaugurated their first drive-thru location in Italy, situated in Erbusco, Lombardy. This strategic move reflects Starbucks' expansion efforts in the Italian market, facilitated by a partnership between Percassi, Starbucks' exclusive licensee partner in Italy, and the Q8 service station company. The collaboration underscores Starbucks' commitment to providing accessible and convenient coffee experiences to customers in Italy.

|

Global Coffee Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 126.05 Bn. |

|

Forecast Period 2023-30 CAGR: |

4.82 % |

Market Size in 2032: |

USD 192.55 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Nature, |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- COFFEE MARKET BY TYPE (2017-2032)

- COFFEE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- WHOLE BEAN COFFEE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- GROUND COFFEE

- INSTANT COFFEE

- COFFEE PODS AND CAPSULES

- COFFEE MARKET BY NATURE (2017-2032)

- COFFEE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CONVENTIONAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ORGANIC

- COFFEE MARKET BY DISTRIBUTION CHANNEL (2017-2032)

- COFFEE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ON-TRADE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- OFF-TRADE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Coffee Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- THE J.M. SMUCKER COMPANY (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- KEURIG GREEN MOUNTAIN (US)

- PEET'S COFFEE (US)

- DUNKIN' BRANDS GROUP (US)

- COFFEE HOLDING CO., INC. (US)

- KRAFT HEINZ COMPANY (US)

- TOOTSIE ROLL INDUSTRIES (US)

- COMMUNITY COFFEE COMPANY (US)

- TRADER JOE'S (US)

- MONDELEZ INTERNATIONAL (US)

- MCCAFÉ (US)

- TCHIBO (GERMANY)

- NKG (NEUMANN KAFFEE GRUPPE) (GERMANY)

- MELITTA GROUP (GERMANY)

- D.E MASTER BLENDERS 1753 (NETHERLANDS)

- NESTLÉ (SWITZERLAND)

- JAB HOLDING COMPANY (LUXEMBOURG)

- LUIGI LAVAZZA S.P.A. (ITALY)

- ILLYCAFFÈ S.P.A. (ITALY)

- MASSIMO ZANETTI BEVERAGE GROUP (ITALY)

- ILLY GROUP (ITALY)

- COSTA COFFEE (UK)

- TATA CONSUMER PRODUCTS (INDIA)

- STRAUSS GROUP (ISRAEL)

- COMPETITIVE LANDSCAPE

- GLOBAL COFFEE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Nature

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

Potential Market Strategies

|

Global Coffee Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 126.05 Bn. |

|

Forecast Period 2023-30 CAGR: |

4.82 % |

Market Size in 2032: |

USD 192.55 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Nature, |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. COFFEE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. COFFEE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. COFFEE MARKET COMPETITIVE RIVALRY

TABLE 005. COFFEE MARKET THREAT OF NEW ENTRANTS

TABLE 006. COFFEE MARKET THREAT OF SUBSTITUTES

TABLE 007. COFFEE MARKET BY TYPE

TABLE 008. WHOLE BEAN COFFEE MARKET OVERVIEW (2016-2028)

TABLE 009. GROUND COFFEE MARKET OVERVIEW (2016-2028)

TABLE 010. INSTANT COFFEE MARKET OVERVIEW (2016-2028)

TABLE 011. COFFEE PODS MARKET OVERVIEW (2016-2028)

TABLE 012. CAPSULES MARKET OVERVIEW (2016-2028)

TABLE 013. COFFEE MARKET BY VARIETY

TABLE 014. ARABICA MARKET OVERVIEW (2016-2028)

TABLE 015. ROBUSTA MARKET OVERVIEW (2016-2028)

TABLE 016. CANEPHORA MARKET OVERVIEW (2016-2028)

TABLE 017. COFFEE MARKET BY DISTRIBUTION CHANNELS

TABLE 018. ON TRADE MARKET OVERVIEW (2016-2028)

TABLE 019. OFF TRADE MARKET OVERVIEW (2016-2028)

TABLE 020. NORTH AMERICA COFFEE MARKET, BY TYPE (2016-2028)

TABLE 021. NORTH AMERICA COFFEE MARKET, BY VARIETY (2016-2028)

TABLE 022. NORTH AMERICA COFFEE MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 023. N COFFEE MARKET, BY COUNTRY (2016-2028)

TABLE 024. EUROPE COFFEE MARKET, BY TYPE (2016-2028)

TABLE 025. EUROPE COFFEE MARKET, BY VARIETY (2016-2028)

TABLE 026. EUROPE COFFEE MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 027. COFFEE MARKET, BY COUNTRY (2016-2028)

TABLE 028. ASIA PACIFIC COFFEE MARKET, BY TYPE (2016-2028)

TABLE 029. ASIA PACIFIC COFFEE MARKET, BY VARIETY (2016-2028)

TABLE 030. ASIA PACIFIC COFFEE MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 031. COFFEE MARKET, BY COUNTRY (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA COFFEE MARKET, BY TYPE (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA COFFEE MARKET, BY VARIETY (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA COFFEE MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 035. COFFEE MARKET, BY COUNTRY (2016-2028)

TABLE 036. SOUTH AMERICA COFFEE MARKET, BY TYPE (2016-2028)

TABLE 037. SOUTH AMERICA COFFEE MARKET, BY VARIETY (2016-2028)

TABLE 038. SOUTH AMERICA COFFEE MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 039. COFFEE MARKET, BY COUNTRY (2016-2028)

TABLE 040. NESTLE SA: SNAPSHOT

TABLE 041. NESTLE SA: BUSINESS PERFORMANCE

TABLE 042. NESTLE SA: PRODUCT PORTFOLIO

TABLE 043. NESTLE SA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. JAB HOLDING COMPANY: SNAPSHOT

TABLE 044. JAB HOLDING COMPANY: BUSINESS PERFORMANCE

TABLE 045. JAB HOLDING COMPANY: PRODUCT PORTFOLIO

TABLE 046. JAB HOLDING COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. THE KRAFT HEINZ COMPANY: SNAPSHOT

TABLE 047. THE KRAFT HEINZ COMPANY: BUSINESS PERFORMANCE

TABLE 048. THE KRAFT HEINZ COMPANY: PRODUCT PORTFOLIO

TABLE 049. THE KRAFT HEINZ COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. STRAUSS GROUP LTD: SNAPSHOT

TABLE 050. STRAUSS GROUP LTD: BUSINESS PERFORMANCE

TABLE 051. STRAUSS GROUP LTD: PRODUCT PORTFOLIO

TABLE 052. STRAUSS GROUP LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. STARBUCKS COFFEE COMPANY: SNAPSHOT

TABLE 053. STARBUCKS COFFEE COMPANY: BUSINESS PERFORMANCE

TABLE 054. STARBUCKS COFFEE COMPANY: PRODUCT PORTFOLIO

TABLE 055. STARBUCKS COFFEE COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. THE J.M. SMUCKER COMPANY: SNAPSHOT

TABLE 056. THE J.M. SMUCKER COMPANY: BUSINESS PERFORMANCE

TABLE 057. THE J.M. SMUCKER COMPANY: PRODUCT PORTFOLIO

TABLE 058. THE J.M. SMUCKER COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. LUIGI LAVAZZA SPA: SNAPSHOT

TABLE 059. LUIGI LAVAZZA SPA: BUSINESS PERFORMANCE

TABLE 060. LUIGI LAVAZZA SPA: PRODUCT PORTFOLIO

TABLE 061. LUIGI LAVAZZA SPA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. THE COCA-COLA COMPANY: SNAPSHOT

TABLE 062. THE COCA-COLA COMPANY: BUSINESS PERFORMANCE

TABLE 063. THE COCA-COLA COMPANY: PRODUCT PORTFOLIO

TABLE 064. THE COCA-COLA COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. TATA GLOBAL BEVERAGES: SNAPSHOT

TABLE 065. TATA GLOBAL BEVERAGES: BUSINESS PERFORMANCE

TABLE 066. TATA GLOBAL BEVERAGES: PRODUCT PORTFOLIO

TABLE 067. TATA GLOBAL BEVERAGES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. TCHIBO GMBH: SNAPSHOT

TABLE 068. TCHIBO GMBH: BUSINESS PERFORMANCE

TABLE 069. TCHIBO GMBH: PRODUCT PORTFOLIO

TABLE 070. TCHIBO GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 071. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 072. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 073. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. COFFEE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. COFFEE MARKET OVERVIEW BY TYPE

FIGURE 012. WHOLE BEAN COFFEE MARKET OVERVIEW (2016-2028)

FIGURE 013. GROUND COFFEE MARKET OVERVIEW (2016-2028)

FIGURE 014. INSTANT COFFEE MARKET OVERVIEW (2016-2028)

FIGURE 015. COFFEE PODS MARKET OVERVIEW (2016-2028)

FIGURE 016. CAPSULES MARKET OVERVIEW (2016-2028)

FIGURE 017. COFFEE MARKET OVERVIEW BY VARIETY

FIGURE 018. ARABICA MARKET OVERVIEW (2016-2028)

FIGURE 019. ROBUSTA MARKET OVERVIEW (2016-2028)

FIGURE 020. CANEPHORA MARKET OVERVIEW (2016-2028)

FIGURE 021. COFFEE MARKET OVERVIEW BY DISTRIBUTION CHANNELS

FIGURE 022. ON TRADE MARKET OVERVIEW (2016-2028)

FIGURE 023. OFF TRADE MARKET OVERVIEW (2016-2028)

FIGURE 024. NORTH AMERICA COFFEE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. EUROPE COFFEE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. ASIA PACIFIC COFFEE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. MIDDLE EAST & AFRICA COFFEE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. SOUTH AMERICA COFFEE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Coffee Market research report is 2022-2028.

Nestle SA, JAB Holding Company, The Kraft Heinz Company, Strauss Group Ltd, Starbucks Coffee Company, The J.M. Smucker Company, Luigi Lavazza SPA, The Coca-Cola Company, Tata Global Beverages, Tchibo GmbH, and other major players.

The Coffee Market is segmented into Product Type, Variety, Distribution Channels, and region. By Product Type, the market is categorized into Whole Bean Coffee, Ground Coffee, Instant Coffee, Coffee Pods, and Capsules. By Variety, the market is categorized into Arabica, Robusta, and Canephora. By Distribution Channels, the market is categorized into On Trade and Off Trade. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Coffee is one of the most popular beverages around the globe, due to which coffee bean is the second most highly traded commodity in the global market after petrochemical products.

The Coffee Market was valued at USD 120.48 Billion in 2021 and is projected to reach USD 166.39 Billion by 2028, growing at a CAGR of 4.72% from 2022 to 2028.