Cloud Security Software Market Synopsis

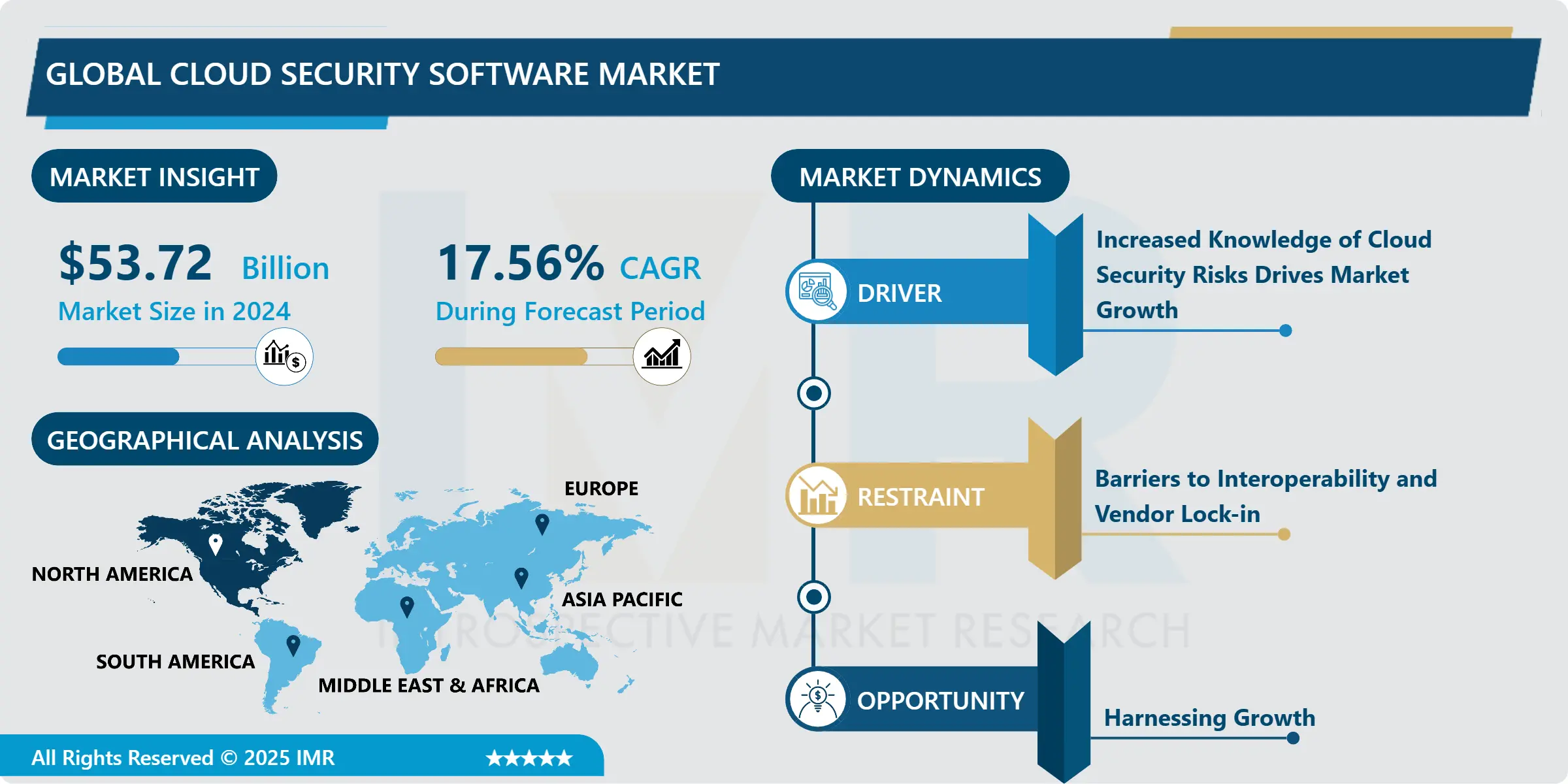

Cloud Security Software Market Size is Valued at USD 53.72 Billion in 2024 and is Projected to Reach USD 195.98 Billion by 2032, Growing at a CAGR of 17.56% From 2025-2032.

The Cloud Security Software Market is specifically a subsector of the cybersecurity market that aims to secure cloud-based applications, data, and facilities from threats and breaches. This market incorporates products that range from cloud access security brokers (CASBs), cloud workload protection platforms (CWPPs), and cloud security posture management (CSPM) tools. More and more businesses are moving to cloud computing services while the issue of security and compliance is quickly becoming vital and this is enforcing the need for cloud security software. But, factors like the increased threat of cybercrimes, enforcement of higher security standards for data and information, and the requirement of remote working platforms also contribute to this market. There are a number of drivers which are providing the thrust to the Cloud Security Software Market. This is the case mainly because more organizations are embracing cloud solutions for their operations, and as such, there is need for better security tools and measures to safeguard their valuable information and networks. Not only this, but data loss has also been a crucial concern and businesses wanted a secure way to store information; therefore, the growing threats and attacks in cyberspace have always kept the cloud security software market active.

Further, the ‘Work from Home’ culture and the usage of numerous portable devices have increased the risks stemming from security threats, necessitating the adoption of cloud security solutions that are capable of securing data and devices from any location. One more factor is continual and growing growth of industry-related legislation and compliance concerning data protection. To protect individual information that is being stored and processed on cloud service providers, governments, and regulatory authorities globally are putting in place measures that are even tighter in order to protect data and information in clouds. This has urged organization to invest into cloud security software that can assist them in adhering to these regulations in order to avert lawsuits and fines. In addition, the increasing understanding and concern of organizations in relation to cybersecurity, and the threat of getting attacks or data breaches also encouraged them to invest more in cloud security products, which will positively impact the market.

Cloud Security Software Market Trend Analysis

Rapid Growth Driven by Increasing Cloud Adoption and Advanced Cyber Threat

- The Cloud Security Software Market is growing rapidly at a worldwide level owing to the eagerness of Cloud-Based services. More and more organizations are extracting their data and applications to the cloud for greater efficiency and flexibility. This phenomenon has led to a high need of cloud security to shield the organizations from various cybercrimes.

- What’s more, the improved emergence of powerful cyber threats that compel organizations to invest solely in strong cloud security software accelerates market expansion. In addition, the market is experiencing new advancements in the improved cloud security to meet advanced cyber threats.

- Vendors are continuing to target developments like Articial intelligence and Machine intelligence to serve advanced threat detection and remediation. However, growth is being further fueled by the enhanced legal mandates that have been put in place with regard to data security, which has driven the necessity of acquiring effective cloud security solutions among various organizations.

Navigating Cyber Threats, The Role of Cloud Security Software

- The Cloud Security Software Market is growing rapidly at a worldwide level owing to the eagerness of Cloud-Based services. More and more organizations are extracting their data and applications to the cloud for greater efficiency and flexibility. This phenomenon has led to a high need of cloud security to shield the organizations from various cybercrimes.

- What’s more, the improved emergence of powerful cyber threats that compel organizations to invest solely in strong cloud security software accelerates market expansion. In addition, the market is experiencing new advancements in the improved cloud security to meet advanced cyber threats.

- Vendors are continuing to target developments like Articial intelligence and Machine intelligence to serve advanced threat detection and remediation. However, growth is being further fueled by the enhanced legal mandates that have been put in place with regard to data security, which has driven the necessity of acquiring effective cloud security solutions among various organizations.

Cloud Security Software Market Segment Analysis:

Cloud Security Software Market is segmented on the basis of Deployment Model, Security Type, and end-users.

By Deployment Type, Public segment is expected to dominate the market during the forecast period

- The market is classified according to the kind of cloud environment it serves, including public cloud, private cloud, hybrid cloud, and multi-cloud. There are solutions that are aiming at ensuring that data and applications that are hosted in public cloud platforms which are owned and operated by cloud service provider.

- Private Cloud Security targets the provision of security to those resources exclusively allocated for use within a specific organisation. cloud security solutions that focus on both public and private cloud infrastructure help the organization overcome the issues which arise when two environments are connected, thus providing advantages of both.

- Multi-cloud security solutions are usually provided to organizations that employ several cloud service providers; they can apply identical security policies and measures in all the clouds. They help enterprises in narrowing down on the kind of security solutions that will be best suited for the kind of cloud deployment model that is going to be supported by the business that is involved.

By End User, BFSI segment held the largest share in 2024

- The end-user industries that comprise the cloud security software market include banking, financial services, and insurance (BFSI), healthcare, government, IT & telecom, and others.

- Sturdy security solutions are necessary for BFSI firms to maintain regulatory compliance and safeguard confidential financial information. Healthcare organizations must follow healthcare laws like HIPAA and protect patient information. Because government data is sensitive and they must adhere to government rules and regulations, government agencies have special security demands.

- Cloud security solutions are necessary for IT and telecom businesses to safeguard their networks, data, and infrastructure against online attacks. Cloud security solutions are also necessary for other businesses, like manufacturing, retail, and education, to protect their digital assets and guarantee data security and privacy.

- Vendors may better understand the unique security requirements and constraints of various sectors by segmenting the market based on end-user industries. This enables them to create solutions that are specifically designed to satisfy these needs.

Cloud Security Software Market Regional Insights:

Cloud Security Software Market Surge in North America

- Because of its strong technological foundation and widespread use of cloud services across a wide range of industries, North America is a major region propelling growth in the cloud security software market. Due to the necessity of protecting sensitive data and adhering to strict data protection requirements, the region is experiencing significant investments in cloud security solutions.

- A significant portion of the North American market comes from the United States, where many businesses use cloud security software to protect their digital assets. With some of the top cloud security software providers having their headquarters in the United States, the nation's strong emphasis on cybersecurity and technical innovation is driving market growth.

- Due to rising cloud use and increased focus on data security and privacy, Canada is likewise turning into a sizable market for cloud security software. The demand for innovative cloud security solutions is being driven by the nation's proactive attitude to cybersecurity and strict data protection rules.

- The cloud security software market in North America is dynamic, with fierce rivalry and quickening technology breakthroughs. For cloud security software vendors aiming to grow their footprint and product offerings, the region is an attractive market due to its robust regulatory framework and emphasis on cybersecurity.

Active Key Players in the Cloud Security Software Market

- AccuKnox (US)

- Akamai Technologies (US)

- Ascend Technologies (US)

- AWS (US)

- Banyan cloud (US)

- Broadcom (US)

- Caveonix (US)

- Check Point (Israel and US)

- Cisco (US)

- DataTheorem (US)

- Ermetic (Israel)

- F5 (US)

- Fidelis Cybersecurity (US)

- FireMon (US)

- Forcepoint (US)

- Fortinet (US)

- Google (US)

- IBM (US)

- Imperva (US)

- LookOut (US)

- Menlo Security (US)

- Microsoft (US)

- Netskope (US)

- OpsCompass (US)

- Orca Security (US)

- Palo Alto Networks (US)

- Proofpoint (US)

- Qualys (US)

- Rapid7 (US)

- Secberus (US)

- Skyhigh Security (US)

- Sonrai Security (US)

- Sysdig (US)

- Tenable (US)

- Tigera (US)

- Trellix (US)

- TrendMicro (Japan)

- Other Active Players

|

Global Cloud Security Software Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 53.72 Bn. |

|

Forecast Period 2024-32 CAGR: |

17.56 % |

Market Size in 2032: |

USD 195.98 Bn. |

|

Segments Covered: |

By Deployment Model |

|

|

|

By Security Type |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cloud Security Software Market by Deployment Model (2018-2032)

4.1 Cloud Security Software Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Public Cloud

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Private Cloud

4.5 Hybrid Cloud

4.6 Multi-Cloud

Chapter 5: Cloud Security Software Market by Security Type (2018-2032)

5.1 Cloud Security Software Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Identity and Access Management

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Data Loss Prevention

5.5 Cloud Encryption

5.6 Network Security

5.7 Others

Chapter 6: Cloud Security Software Market by End-User (2018-2032)

6.1 Cloud Security Software Market Snapshot and Growth Engine

6.2 Market Overview

6.3 BFSI

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Healthcare

6.5 Government

6.6 IT & Telecom

6.7 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Cloud Security Software Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AWS (AMAZON WEB SERVICES) (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 GOOGLE (US)

7.4 IBM (US)

7.5 MICROSOFT (US)

7.6 DELL (US)

7.7 BAIDU (CHINA)

7.8 ALIBABA (CHINA)

7.9 TENCENT (CHINA)

7.10 AKAMAI TECHNOLOGIES (US)

7.11 CA TECHNOLOGIES (US)

7.12 CISCO SYSTEMS (US)

7.13 ENKI (US)

7.14 HUAWEI (CHINA)

7.15 ILAND (US)

7.16 JOYENT (US)

7.17 NETSUITE (US)

7.18 ORACLE (US)

7.19 SAP (GERMANY)

7.20 OTHER KEY PLAYERS

7.21

Chapter 8: Global Cloud Security Software Market By Region

8.1 Overview

8.2. North America Cloud Security Software Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Deployment Model

8.2.4.1 Public Cloud

8.2.4.2 Private Cloud

8.2.4.3 Hybrid Cloud

8.2.4.4 Multi-Cloud

8.2.5 Historic and Forecasted Market Size by Security Type

8.2.5.1 Identity and Access Management

8.2.5.2 Data Loss Prevention

8.2.5.3 Cloud Encryption

8.2.5.4 Network Security

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size by End-User

8.2.6.1 BFSI

8.2.6.2 Healthcare

8.2.6.3 Government

8.2.6.4 IT & Telecom

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Cloud Security Software Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Deployment Model

8.3.4.1 Public Cloud

8.3.4.2 Private Cloud

8.3.4.3 Hybrid Cloud

8.3.4.4 Multi-Cloud

8.3.5 Historic and Forecasted Market Size by Security Type

8.3.5.1 Identity and Access Management

8.3.5.2 Data Loss Prevention

8.3.5.3 Cloud Encryption

8.3.5.4 Network Security

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size by End-User

8.3.6.1 BFSI

8.3.6.2 Healthcare

8.3.6.3 Government

8.3.6.4 IT & Telecom

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Cloud Security Software Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Deployment Model

8.4.4.1 Public Cloud

8.4.4.2 Private Cloud

8.4.4.3 Hybrid Cloud

8.4.4.4 Multi-Cloud

8.4.5 Historic and Forecasted Market Size by Security Type

8.4.5.1 Identity and Access Management

8.4.5.2 Data Loss Prevention

8.4.5.3 Cloud Encryption

8.4.5.4 Network Security

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size by End-User

8.4.6.1 BFSI

8.4.6.2 Healthcare

8.4.6.3 Government

8.4.6.4 IT & Telecom

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Cloud Security Software Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Deployment Model

8.5.4.1 Public Cloud

8.5.4.2 Private Cloud

8.5.4.3 Hybrid Cloud

8.5.4.4 Multi-Cloud

8.5.5 Historic and Forecasted Market Size by Security Type

8.5.5.1 Identity and Access Management

8.5.5.2 Data Loss Prevention

8.5.5.3 Cloud Encryption

8.5.5.4 Network Security

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size by End-User

8.5.6.1 BFSI

8.5.6.2 Healthcare

8.5.6.3 Government

8.5.6.4 IT & Telecom

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Cloud Security Software Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Deployment Model

8.6.4.1 Public Cloud

8.6.4.2 Private Cloud

8.6.4.3 Hybrid Cloud

8.6.4.4 Multi-Cloud

8.6.5 Historic and Forecasted Market Size by Security Type

8.6.5.1 Identity and Access Management

8.6.5.2 Data Loss Prevention

8.6.5.3 Cloud Encryption

8.6.5.4 Network Security

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size by End-User

8.6.6.1 BFSI

8.6.6.2 Healthcare

8.6.6.3 Government

8.6.6.4 IT & Telecom

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Cloud Security Software Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Deployment Model

8.7.4.1 Public Cloud

8.7.4.2 Private Cloud

8.7.4.3 Hybrid Cloud

8.7.4.4 Multi-Cloud

8.7.5 Historic and Forecasted Market Size by Security Type

8.7.5.1 Identity and Access Management

8.7.5.2 Data Loss Prevention

8.7.5.3 Cloud Encryption

8.7.5.4 Network Security

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size by End-User

8.7.6.1 BFSI

8.7.6.2 Healthcare

8.7.6.3 Government

8.7.6.4 IT & Telecom

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Cloud Security Software Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 53.72 Bn. |

|

Forecast Period 2024-32 CAGR: |

17.56 % |

Market Size in 2032: |

USD 195.98 Bn. |

|

Segments Covered: |

By Deployment Model |

|

|

|

By Security Type |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||