Cloud Data Security Market Synopsis

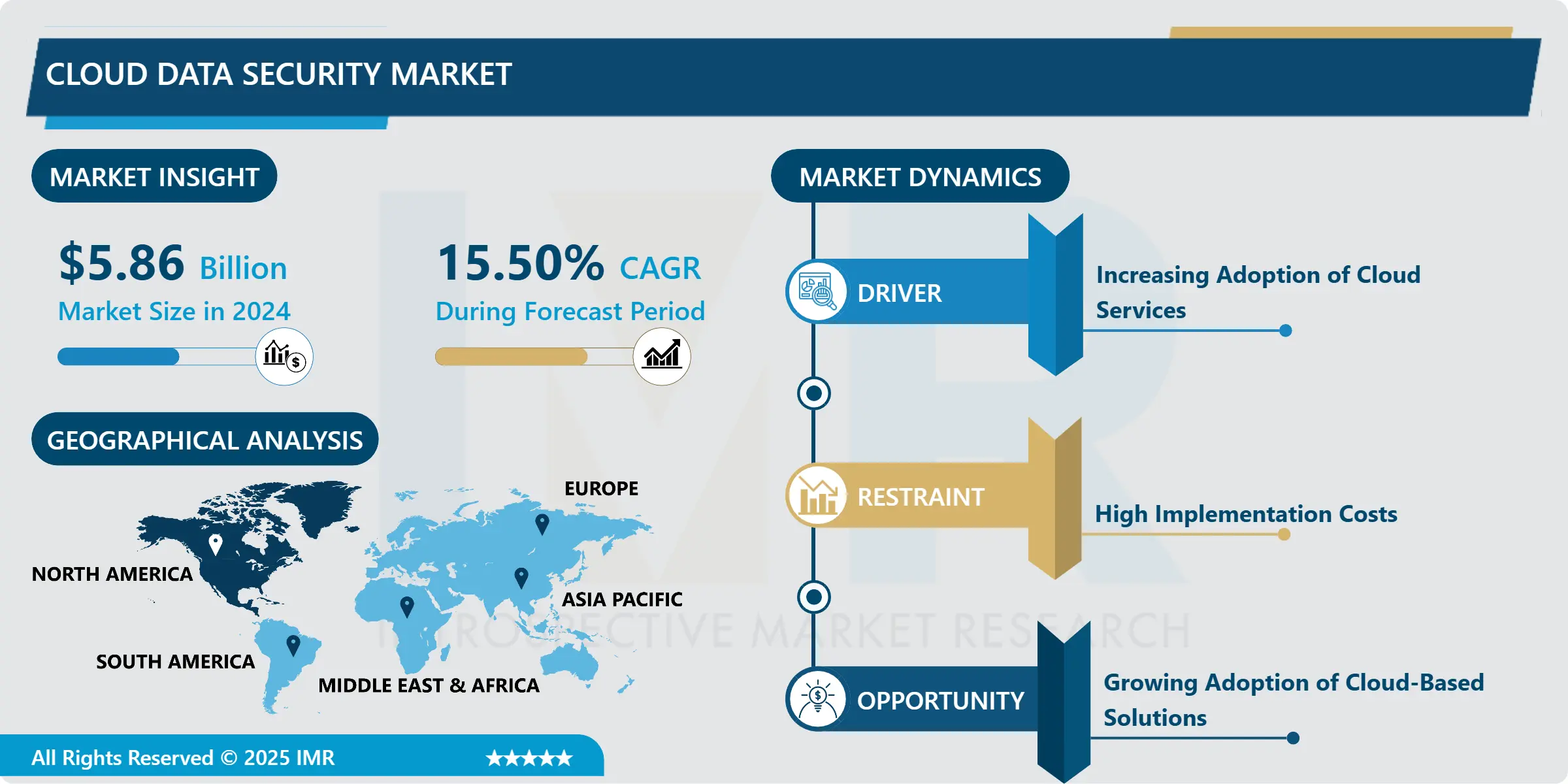

Cloud Data Security Market Size is Valued at USD 5.86 Billion in 2024 and is Projected to Reach USD 18.56 Billion by 2032, Growing at a CAGR of 15.50% From 2025-2032.

The Cloud Data Security Market involves products and services that are aimed at defending stored information in cloud systems from threatening and unauthorized access. This market comprises; data encryption, identity and access management, and security information and event management. It exists with operations across both domestic and international spaces, with solution provision for all organizations and sectors; public, private, and hybrid cloud. Increased use of clouds and call for strong data security due to risks increase cloud data security demand.

By use of cloud computing services across industries, the Global Cloud Data Security Market is regarded as growing. With the increasing adoption of solutions on the cloud since it has the characteristics of scalability, flexibility, and lower cost, there is a heightened need for better and more effective cloud data security solutions. It thus brings about the requirement for effective security measures that can guarantee the protection of the data from various cyber threats, violations, and accesses. Increased regulatory laws like the GDPR, HIPAA, CCPA, and others are supporting the market as these guidelines force organization to adopt capable security solutions.

Also, an increase in the level of complex threats and unauthorized access to information has contributed to concerns about protecting cloud solutions. Ransomware and other types of cyberattacks put pressure on organizations demanding the protection of business continuity and corporate image in clouds. Strengthening security in multi-clouds and hybrid setups is another drive toward centralized cloud data security solutions that provide real, current protection, response mechanisms, and proper visibility across the multiple cloud platforms.

Cloud Data Security Market Trend Analysis

Cloud Data Security Market Growth Drivers- The Rise of AI and Hybrid Cloud Solutions

- Cloud Data Security was found to be on the rise in the global market owing to the usage of cloud service in industries. With organizations moving to the cloud applications security has become a necessity and key driver for new form of encryption, identity and access management and Security Information and Event Management systems. It is driven by the desire to shield information from leakage and cyber-attacks, today’s organizations are procuring superior security products to meet the legal obligation and secure their electronics assets.

- One more trend that the authors distinguish is the growing interest in incorporating the AI and ML techniques into cloud-based data security. As for the developments in the field of technologies, AI and ML are being incorporated in an attempt to advance threat diagnosis and prevention by incorporating systems that are smarter and more effective. Furthermore, the increasing focus is being placed on the hybrid and multi-cloud strategies which, in turn defining the need for an integrated security system that can address the data protection in the different cloud models. These trends comprise a more general picture of emergence of more detailed and complex approaches to cloud data protection that responds to the changing structure of threats.

Cloud Data Security Market Opportunities- Navigating the Cloud, Key Opportunities in Cloud Data Security

- It can be clearly seen that there are large growth prospects in the Cloud Data Security market mainly due to the evolving interest in cloud computing services. With the increasing shift of data and applications to the cloud environment the importance of enhancing security to guard information cannot be overemphasized. The following are some of concepts that are closely related and helping in driving demand for cloud security solutions in the world. Private organizations are spending a lot of money in new security solutions like encryption, identity and access management, cloud security posture management, etc. to secure their cloud.

- Also, the increasing rate of working from home and the growth of digital organizational agendas accentuate the necessity of Cloud Data Security. Companies are now coming to term with the idea that there is no option to fully secure their cloud-based resources and operations which are critical to business continuity. This trend holds a potential to be highly beneficial for vendors bringing new security solutions suitable for the chosen deployment models and organizational requirements. Thus, the market for cloud data security is expected to expand as enterprises push forward with cloud technologies and the threats transform with their adoptions.

Cloud Data Security Market Segment Analysis:

Cloud Data Security Market Segmented on the basis of Solution, Deployment and End User.

By Solution, Data Encryption segment is expected to dominate the market during the forecast period

- Depending on the type of solution, Cloud Data Security has been subdivided into several important segments. Full form Data Encryption is a process of converting the data into a form that cannot be easily understood by any person, who does not have the decryption key. Identity and Access Management deals more with authorization and authentication of the users and overclocking the access to the cloud resources to only permitted individuals. Security Information and Event Management (SIEM) is a holistic approach to security events as well as alerts analyzing process in real-time to identify possible threats and respond to them effectively. Cloud Firewall guards the cloud infrastructure by blocking or permitting the traffic to/from cloud environments as per the cloud security policy. DLP is to ensure that no data leakage and breach occurs; hence, it is an effective tool that is meant to prevent data breaches. Cloud Security Posture Management (CSPM) deals with cloud security settings, its risks and compliance in order to enhance the security of organizational clouds. Finally, Cloud Access Security Broker (CASB) provides the organization oversight into the usage of cloud services and functions as a security enforcer for regulating cloud application usage. All of them have their specific importance in the protection of data in the cloud and meeting the need of today’s business organizations.

By Deployment, Public Cloud segment held the largest share in 2024

- Depending on the form of deployment, Cloud Data Security market is comprised of Public, Private & Hybrid Cloud. Public Cloud deployment entails the adoption of the Cloud services from third-party service providers where the resources and infrastructure of the Cloud for the multiplied organizations are pooled, hence the demand for vigorous security measures due to the broad network, a characteristic feature of the Public Cloud. It is firmly associated with single organization’s usage, thus guaranteeing better control over agreements and a high level of security adapted to certain needs and regulations. Hybrid Cloud is the integration of both public and private cloud structures; this implies that an organization can take advantage of the two, as well as regulating security in the two different kinds of clouds to make sure that sensitive data is protected irrespective of the cloud kind where it is retained or processed. Both the deployment modes have their own set of security threats and rewards that must be managed and seized in order to protect the assets stored in the cloud.

Cloud Data Security Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The Cloud Data Security Market in North America is rapidly growing due to the escalating incidences of data theft and organisations’ shifting towards cloud solutions in various sectors. Firms in this area are using the cloud data security to safeguard their information and to meet the compliance standards of the GDPR and CCPA. The availability of large technology players and developed infrastructures increases the requirement of prestigious security solutions, and thereby making North America the largest region for cloud data security.

- The market is fairly competitive and has high growth rates; significant market players regularly engage in the creation of complex innovations like artificial intelligence and machine learning to improve information security. However, one of the key verticals, the enterprise segment, is quickly adopting cloud security solutions because of the rapidly increasing digitalization trend. Currently, North American organizations recognize that protection of resources has to involve data encryption, identity, and threat Intelligence to secure their cloud systems for emerging threat problems.

Active Key Players in the Cloud Data Security Market

- IBM (United States)

- Microsoft (United States)

- Cisco Systems (United States)

- McAfee (United States)

- Symantec (United States)

- Trend Micro (Japan)

- Check Point Software Technologies (Israel)

- Palo Alto Networks (United States)

- Fortinet (United States)

- SailPoint Technologies (United States)

- Others Active Players

|

Global Cloud Data Security Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 5.86 Bn. |

|

Forecast Period 2024-32 CAGR: |

15.50 % |

Market Size in 2032: |

USD 18.58 Bn. |

|

Segments Covered: |

By Solution |

|

|

|

By Deployment Mode |

|

||

|

By end User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cloud Data Security Market by Solution (2018-2032)

4.1 Cloud Data Security Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Data Encryption

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Identity and Access Management

4.5 Security Information and Event Management (SIEM)

4.6 Cloud Firewall

4.7 Data Loss Prevention (DLP)

4.8 Cloud Security Posture Management (CSPM)

4.9 Cloud Access Security Broker (CASB)

Chapter 5: Cloud Data Security Market by Deployment Mode (2018-2032)

5.1 Cloud Data Security Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Public Cloud

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Private Cloud

5.5 Hybrid Cloud

Chapter 6: Cloud Data Security Market by end User (2018-2032)

6.1 Cloud Data Security Market Snapshot and Growth Engine

6.2 Market Overview

6.3 BFSI (Banking

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Financial Services

6.5 and Insurance)

6.6 Healthcare

6.7 Government

6.8 IT and Telecommunications

6.9 Retail

6.10 Manufacturing

6.11 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Cloud Data Security Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 IBM (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 MICROSOFT (UNITED STATES)

7.4 CISCO SYSTEMS (UNITED STATES)

7.5 MCAFEE (UNITED STATES)

7.6 SYMANTEC (UNITED STATES)

7.7 TREND MICRO (JAPAN)

7.8 CHECK POINT SOFTWARE TECHNOLOGIES (ISRAEL)

7.9 PALO ALTO NETWORKS (UNITED STATES)

7.10 FORTINET (UNITED STATES)

7.11 SAILPOINT TECHNOLOGIES (UNITED STATES)

7.12 OTHERS

7.13

Chapter 8: Global Cloud Data Security Market By Region

8.1 Overview

8.2. North America Cloud Data Security Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Solution

8.2.4.1 Data Encryption

8.2.4.2 Identity and Access Management

8.2.4.3 Security Information and Event Management (SIEM)

8.2.4.4 Cloud Firewall

8.2.4.5 Data Loss Prevention (DLP)

8.2.4.6 Cloud Security Posture Management (CSPM)

8.2.4.7 Cloud Access Security Broker (CASB)

8.2.5 Historic and Forecasted Market Size by Deployment Mode

8.2.5.1 Public Cloud

8.2.5.2 Private Cloud

8.2.5.3 Hybrid Cloud

8.2.6 Historic and Forecasted Market Size by end User

8.2.6.1 BFSI (Banking

8.2.6.2 Financial Services

8.2.6.3 and Insurance)

8.2.6.4 Healthcare

8.2.6.5 Government

8.2.6.6 IT and Telecommunications

8.2.6.7 Retail

8.2.6.8 Manufacturing

8.2.6.9 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Cloud Data Security Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Solution

8.3.4.1 Data Encryption

8.3.4.2 Identity and Access Management

8.3.4.3 Security Information and Event Management (SIEM)

8.3.4.4 Cloud Firewall

8.3.4.5 Data Loss Prevention (DLP)

8.3.4.6 Cloud Security Posture Management (CSPM)

8.3.4.7 Cloud Access Security Broker (CASB)

8.3.5 Historic and Forecasted Market Size by Deployment Mode

8.3.5.1 Public Cloud

8.3.5.2 Private Cloud

8.3.5.3 Hybrid Cloud

8.3.6 Historic and Forecasted Market Size by end User

8.3.6.1 BFSI (Banking

8.3.6.2 Financial Services

8.3.6.3 and Insurance)

8.3.6.4 Healthcare

8.3.6.5 Government

8.3.6.6 IT and Telecommunications

8.3.6.7 Retail

8.3.6.8 Manufacturing

8.3.6.9 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Cloud Data Security Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Solution

8.4.4.1 Data Encryption

8.4.4.2 Identity and Access Management

8.4.4.3 Security Information and Event Management (SIEM)

8.4.4.4 Cloud Firewall

8.4.4.5 Data Loss Prevention (DLP)

8.4.4.6 Cloud Security Posture Management (CSPM)

8.4.4.7 Cloud Access Security Broker (CASB)

8.4.5 Historic and Forecasted Market Size by Deployment Mode

8.4.5.1 Public Cloud

8.4.5.2 Private Cloud

8.4.5.3 Hybrid Cloud

8.4.6 Historic and Forecasted Market Size by end User

8.4.6.1 BFSI (Banking

8.4.6.2 Financial Services

8.4.6.3 and Insurance)

8.4.6.4 Healthcare

8.4.6.5 Government

8.4.6.6 IT and Telecommunications

8.4.6.7 Retail

8.4.6.8 Manufacturing

8.4.6.9 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Cloud Data Security Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Solution

8.5.4.1 Data Encryption

8.5.4.2 Identity and Access Management

8.5.4.3 Security Information and Event Management (SIEM)

8.5.4.4 Cloud Firewall

8.5.4.5 Data Loss Prevention (DLP)

8.5.4.6 Cloud Security Posture Management (CSPM)

8.5.4.7 Cloud Access Security Broker (CASB)

8.5.5 Historic and Forecasted Market Size by Deployment Mode

8.5.5.1 Public Cloud

8.5.5.2 Private Cloud

8.5.5.3 Hybrid Cloud

8.5.6 Historic and Forecasted Market Size by end User

8.5.6.1 BFSI (Banking

8.5.6.2 Financial Services

8.5.6.3 and Insurance)

8.5.6.4 Healthcare

8.5.6.5 Government

8.5.6.6 IT and Telecommunications

8.5.6.7 Retail

8.5.6.8 Manufacturing

8.5.6.9 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Cloud Data Security Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Solution

8.6.4.1 Data Encryption

8.6.4.2 Identity and Access Management

8.6.4.3 Security Information and Event Management (SIEM)

8.6.4.4 Cloud Firewall

8.6.4.5 Data Loss Prevention (DLP)

8.6.4.6 Cloud Security Posture Management (CSPM)

8.6.4.7 Cloud Access Security Broker (CASB)

8.6.5 Historic and Forecasted Market Size by Deployment Mode

8.6.5.1 Public Cloud

8.6.5.2 Private Cloud

8.6.5.3 Hybrid Cloud

8.6.6 Historic and Forecasted Market Size by end User

8.6.6.1 BFSI (Banking

8.6.6.2 Financial Services

8.6.6.3 and Insurance)

8.6.6.4 Healthcare

8.6.6.5 Government

8.6.6.6 IT and Telecommunications

8.6.6.7 Retail

8.6.6.8 Manufacturing

8.6.6.9 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Cloud Data Security Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Solution

8.7.4.1 Data Encryption

8.7.4.2 Identity and Access Management

8.7.4.3 Security Information and Event Management (SIEM)

8.7.4.4 Cloud Firewall

8.7.4.5 Data Loss Prevention (DLP)

8.7.4.6 Cloud Security Posture Management (CSPM)

8.7.4.7 Cloud Access Security Broker (CASB)

8.7.5 Historic and Forecasted Market Size by Deployment Mode

8.7.5.1 Public Cloud

8.7.5.2 Private Cloud

8.7.5.3 Hybrid Cloud

8.7.6 Historic and Forecasted Market Size by end User

8.7.6.1 BFSI (Banking

8.7.6.2 Financial Services

8.7.6.3 and Insurance)

8.7.6.4 Healthcare

8.7.6.5 Government

8.7.6.6 IT and Telecommunications

8.7.6.7 Retail

8.7.6.8 Manufacturing

8.7.6.9 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Cloud Data Security Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 5.86 Bn. |

|

Forecast Period 2024-32 CAGR: |

15.50 % |

Market Size in 2032: |

USD 18.58 Bn. |

|

Segments Covered: |

By Solution |

|

|

|

By Deployment Mode |

|

||

|

By end User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||