Chatbot for Banking Market Synopsis

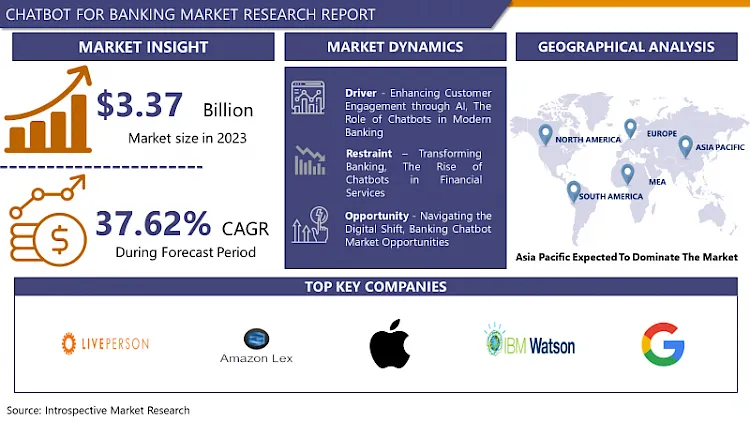

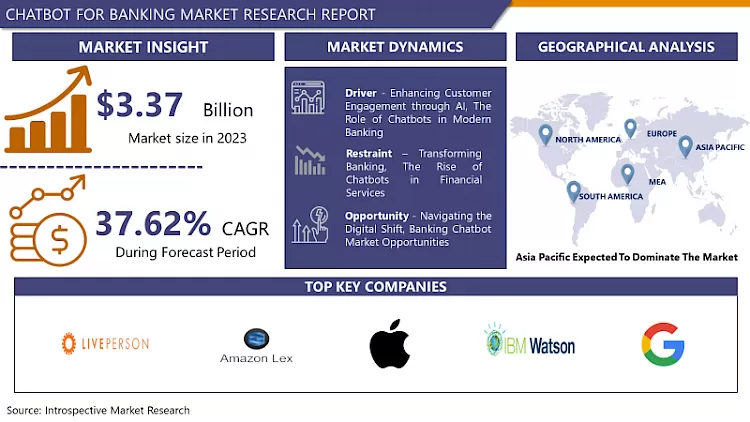

Chatbot for Banking Market Size is Valued at USD 3.37 Billion in 2024, and is Projected to Reach USD 83.38 Billion by 2032, Growing at a CAGR of 37.62% From 2024-2032.

The Chatbot for Banking Market pertains to the implementation and application of conversational artificial intelligence (AI) tools in the banking industry with the aim of augmenting customer service, optimizing processes, and enhancing overall productivity. Chatbots utilize advanced technologies such as machine learning (ML), artificial intelligence (AI), and natural language processing (NLP) to deliver round-the-clock support, address client queries, facilitate transactions, identify fraudulent activities, and provide tailored financial management guidance. The market for these solutions is anticipated to experience significant growth as banks progressively implement them to enhance customer engagement and decrease operational expenses. This expansion will be propelled by technological progress and the need for streamlined and effective banking experiences.

- The primary drivers for the chatbot for the banking market include the need to offer better and improved experience to consumers and to transform the working of the banking system to become operational efficient. In the current era where more and more banks operating in the digital space, customers are in search for instantons and correct information which is served by chatbots.

- Recent advancements of AI that have emerged in the financial industry are able to perform various activity levels, where it includes answering regular customer’s questions, helping in sales, providing an individual’s financial consultation. Compared to employing the help of customers and other workers, chatbots create incredible savings, thus enhancing production and customers’ experience for banks. Moreover, the accessibility and round-the-clock functionality are the factors, for which their use is rapidly growing because the clients can go for banking at any time and not only during the banking hours. Also, with AI and NLP, getting better and allowing the chatbots to comprehend the question and provide a suitable answer about the product and service.

- By connecting with core banking systems, chatbots are capable of offering accurate information and perform conventional processes like, balance check, transfer of funds and identification of frauds. It means that the customer services and relations provided by the aid of chatbots have been also improving through the means of personalization according to the customers’ activity and choices, contributing to the increase of the usage of this technology. Risk management is also an essential factor, contemporary chatbots are built to avoid violating the set regulations in the financial industry, protect customers’ data. Taken together, they contribute to the dynamic growth of the chatbot for banking market, which could be deemed a necessity for the further evolution of financial organizations’ digital initiatives.

Chatbot for Banking Market Trend Analysis

Transforming Financial Services, The Role of Chatbots in Modern Banking

- The market for banking chatbots is expanding rapidly due to the expanding implementation of artificial intelligence and machine learning technologies. Financial institutions are utilizing chatbots as a means to optimize customer service operations, diminish operational expenditures, and deliver round-the-clock assistance.

- These sophisticated algorithms provide prompt and precise replies to customer queries, thereby enhancing customer satisfaction on a broad scale. Additionally, the incorporation of chatbots into fundamental banking systems facilitates the provision of uninterrupted services, including inquiries regarding account balances, transaction records, and transfers of funds.

- The proliferation of personalized banking experiences, facilitated by artificial intelligence and machine learning, enables chatbots to comprehend customer preferences and behaviour, thereby augmenting customer engagement. The continuation of regulatory compliance and data security is of the utmost importance as chatbots progress, guaranteeing adherence to financial regulations and protecting consumer data.

The Future of Banking, Enhancing Efficiency and Security with Chatbots.

- The Chatbot for Banking Market is indeed full of great prospects due to the various changes happening due to advanced technology and changes in the expectations of the consumer. There are a number of prospects that can be derived from the introduction of the concept, with the first of them being the ability to increase the efficiency of customer service. AI/ NLP integrated chatbots can solve numerous customer queries at once, and the answers are consistent and prompt 24/7.

- This not only helps in optimizing the satisfaction level of customers but also comes up with the cut down of operations expenses for the banks by avoiding the intervention of humans in common queries. Moreover, the basic features such as balance checking, account history, and funds transfer can also be linked to core banking and this will help the users of the application to have an easy way or more personalized banking process.

- A related tenet brought about from the success of data mining is in the area of fraud detection and prevention. The machine learning equipped chatbots to track the transactions in live, identify the abusive any events, and notify the customer and banks executives also. Some of these strategies include the following, which prevent the looming threats against executing banking operations and create confidence with customers.

- Moreover, chatbots in sales and marketing can help in creating awareness of new products and services, creating market leads, and enhancing customers’ interactions through other personalized chat . There is an opportunity for multi-lingual chatbots as banks move forward in their digital transformation, and there is an appeal to address multitudes of people from different backgrounds and segments. Since it is predicted that the global market for chatbot for banking will experience a significant growth within the next few years, those that already incorporate these technologies are likely to be competitive players on the market.

Chatbot for Banking Market Segment Analysis:

Chatbot for Banking Market is segmented on the basis of Type, Technology, and End-users.

By Type, Test Based segment is expected to dominate the market during the forecast period

- By type, chatbots in the banking industry can be divided into three major categories: text-based, voice-based, and hybrid. Voice-activated chatbots employ sophisticated voice recognition and natural language processing technologies to engage in conversations with clients via spoken language, thereby delivering an experience that is both effortless and uncomplicated.

- Text-based chatbots, conversely, operate via written text, rendering them well-suited for concurrently managing a substantial influx of inquiries while delivering regular and timely replies. By integrating the functionalities of text-based and voice-based interactions, hybrid chatbots provide clients with the option to select their preferable mode of communication. The inherent adaptability of this system guarantees a smooth and individualized financial encounter, accommodating a wide range of client inclinations and augmenting overall user contentment.

By Technology, Artificial intelligence segment held the largest share in 2023

- Chatbots in the banking sector are driven by three core technologies: AI, NLP, and ML are some commonly used short forms that acronyms a number of techniques. AI is the foundation of the functioning, as well as problem-solving and contextual comprehension of the application and its development of learning capabilities. Through NLP, these chatbots are able to understand and process, customer messages appropriately for engage meaningful dialogue with customers.

- Machine learning also increases the effectiveness of a chatbot because it has the ability to learn and improve their responses from prior experiences as well as in conveying answers to new questions. Altogether these technologies generate advanced and effective chatbots which can compete with traditional customer service providing, rationalization of banking processes and offering unique customer experiences.

Chatbot for Banking Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Overall, the Asia Pacific region is rapidly adopting chatbots for banking with the market reaching its peak due to the implementation of innovations such as AI. In this context, Asian Pacific banking institutions are using chatbots, which are great tools to improve customer relations, optimize processes, and minimize overhead charges. The latest technology advancements are being spearheaded in regions such as Asia, with countries including China, India, Japan, and South Korea leading in the usage of mobile & internet connections, thereby promoting chatbot technologies.

- This is one of the major factors that would continue to spur the growth of the chatbot market in the specific region of interest – the need for round the clock customer support. Majority of banks are using chatbots to answer frequently asked questions, to offer financial advice, and also for handling the actual transactions, thus creating effective customer relations. In particular, the advancement of NLP and ML in the functionality of chatbots allows a bank to deliver accurate and detailed responses to a client inquiry, which is why chatbots have proven to be an indispensable tool in bank work.

- Further, recovery from the economic downturn and an increase in regulatory support and government encouragement of digital banking services are some of the factors responsible for the market’s growth. For instance, several central banks and financial authorities in the region, including central banks, are considering the adoption of AI and chatbots to enhance the objective of the financial sector and innovation of increased access to banking services, including in rural regions and others that are underserved.

- In addition, the competition in the Asia Pacific chatbot for banking market is high as is evident from the numerous players that are either global or regional players. Larger companies such as IBM, Microsoft and Google have been providing more sophisticated chatbot solutions on the market, while regionally established businesses are creating conversational applications that would address particular banking concerns. Bank partnerships with technology firms are widespread to implement a continuous stream of new services that can improve the overall banking experience.

Active Key Players in the Chatbot for Banking Market

- LivePerson (United States)

- Amazon Lex (United States)

- Apple (United States)

- IBM Watson (United States)

- Google (United States)

- PayPal (United States)

- LiveChat (Poland)

- Kasisto (United States)

- WeChat (China)

- Alipay (China)

- Others Active Players.

|

Global Chatbot for Banking Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.37 Bn. |

|

Forecast Period 2024-32 CAGR: |

37.62 % |

Market Size in 2032: |

USD 43.38 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Chatbot for Banking Market by Type (2018-2032)

4.1 Chatbot for Banking Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Voice Based

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Text Based

4.5 Hybrid

Chapter 5: Chatbot for Banking Market by Technology (2018-2032)

5.1 Chatbot for Banking Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Artificial Intelligence

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Natural Language Processing

5.5 Machine Learning

Chapter 6: Chatbot for Banking Market by End User (2018-2032)

6.1 Chatbot for Banking Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Retail Banking

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Corporate Banking

6.5 Investment Banking

6.6 Private Banking

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Chatbot for Banking Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ALLIANZ(GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AXA (FRANCE)

7.4 NIPPON LIFE INSURANCE (JAPAN)

7.5 AMERICAN INTL. GROUP (US)

7.6 AVIVA(UK)

7.7 ASSICURAZIONI GENERALI (ITALY)

7.8 CARDINAL HEALTH (US)

7.9 STATE FARM INSURANCE (US)

7.10 DAI-ICHI MUTUAL LIFE INSURANCE (JAPAN

7.11 MUNICH RE GROUP (GERMANY)

7.12 ZURICH FINANCIAL SERVICES (SWITZERLAND)

7.13 PRUDENTIAL (US)

7.14 ASAHI MUTUAL LIFE INSURANCE (JAPAN)

7.15 SUMITOMO LIFE INSURANCE (JAPAN)

7.16 METLIFE (US)

7.17 ALLSTATE (US)

7.18 AEGON (NETHERLANDS)

7.19 PRUDENTIAL FINANCIAL (US)

Chapter 8: Global Chatbot for Banking Market By Region

8.1 Overview

8.2. North America Chatbot for Banking Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Voice Based

8.2.4.2 Text Based

8.2.4.3 Hybrid

8.2.5 Historic and Forecasted Market Size by Technology

8.2.5.1 Artificial Intelligence

8.2.5.2 Natural Language Processing

8.2.5.3 Machine Learning

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Retail Banking

8.2.6.2 Corporate Banking

8.2.6.3 Investment Banking

8.2.6.4 Private Banking

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Chatbot for Banking Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Voice Based

8.3.4.2 Text Based

8.3.4.3 Hybrid

8.3.5 Historic and Forecasted Market Size by Technology

8.3.5.1 Artificial Intelligence

8.3.5.2 Natural Language Processing

8.3.5.3 Machine Learning

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Retail Banking

8.3.6.2 Corporate Banking

8.3.6.3 Investment Banking

8.3.6.4 Private Banking

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Chatbot for Banking Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Voice Based

8.4.4.2 Text Based

8.4.4.3 Hybrid

8.4.5 Historic and Forecasted Market Size by Technology

8.4.5.1 Artificial Intelligence

8.4.5.2 Natural Language Processing

8.4.5.3 Machine Learning

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Retail Banking

8.4.6.2 Corporate Banking

8.4.6.3 Investment Banking

8.4.6.4 Private Banking

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Chatbot for Banking Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Voice Based

8.5.4.2 Text Based

8.5.4.3 Hybrid

8.5.5 Historic and Forecasted Market Size by Technology

8.5.5.1 Artificial Intelligence

8.5.5.2 Natural Language Processing

8.5.5.3 Machine Learning

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Retail Banking

8.5.6.2 Corporate Banking

8.5.6.3 Investment Banking

8.5.6.4 Private Banking

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Chatbot for Banking Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Voice Based

8.6.4.2 Text Based

8.6.4.3 Hybrid

8.6.5 Historic and Forecasted Market Size by Technology

8.6.5.1 Artificial Intelligence

8.6.5.2 Natural Language Processing

8.6.5.3 Machine Learning

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Retail Banking

8.6.6.2 Corporate Banking

8.6.6.3 Investment Banking

8.6.6.4 Private Banking

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Chatbot for Banking Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Voice Based

8.7.4.2 Text Based

8.7.4.3 Hybrid

8.7.5 Historic and Forecasted Market Size by Technology

8.7.5.1 Artificial Intelligence

8.7.5.2 Natural Language Processing

8.7.5.3 Machine Learning

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Retail Banking

8.7.6.2 Corporate Banking

8.7.6.3 Investment Banking

8.7.6.4 Private Banking

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Chatbot for Banking Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.37 Bn. |

|

Forecast Period 2024-32 CAGR: |

37.62 % |

Market Size in 2032: |

USD 43.38 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Chatbot for Banking Market research report is 2024-2032.

LivePerson (United States), Amazon Lex (United States), Apple (United States), IBM Watson (United States), Google (United States), PayPal (United States), LiveChat (Poland), Kasisto (United States), WeChat (China), Alipay (China) and Other Major Players.

The Chatbot for Banking Market is segmented into by Type (Text Based, Voice Based, Hybrid), By Technology (Artificial Intelligence, Natural Language Processing, Machine Learning) End-User (Retail Banking, Corporate Banking, Investment Banking, Private Banking), and Region. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Chatbot for Banking Market pertains to the implementation and application of conversational artificial intelligence (AI) tools in the banking industry with the aim of augmenting customer service, optimizing processes, and enhancing overall productivity. Chatbots utilize advanced technologies such as machine learning (ML), artificial intelligence (AI), and natural language processing (NLP) to deliver round-the-clock support, address client queries, facilitate transactions, identify fraudulent activities, and provide tailored financial management guidance. The market for these solutions is anticipated to experience significant growth as banks progressively implement them to enhance customer engagement and decrease operational expenses. This expansion will be propelled by technological progress and the need for streamlined and effective banking experiences.

Chatbot for Banking Market Size is Valued at USD 3.37 Billion in 2024, and is Projected to Reach USD 83.38 Billion by 2032, Growing at a CAGR of 37.62% From 2024-2032.