Canned Corn Market Synopsis

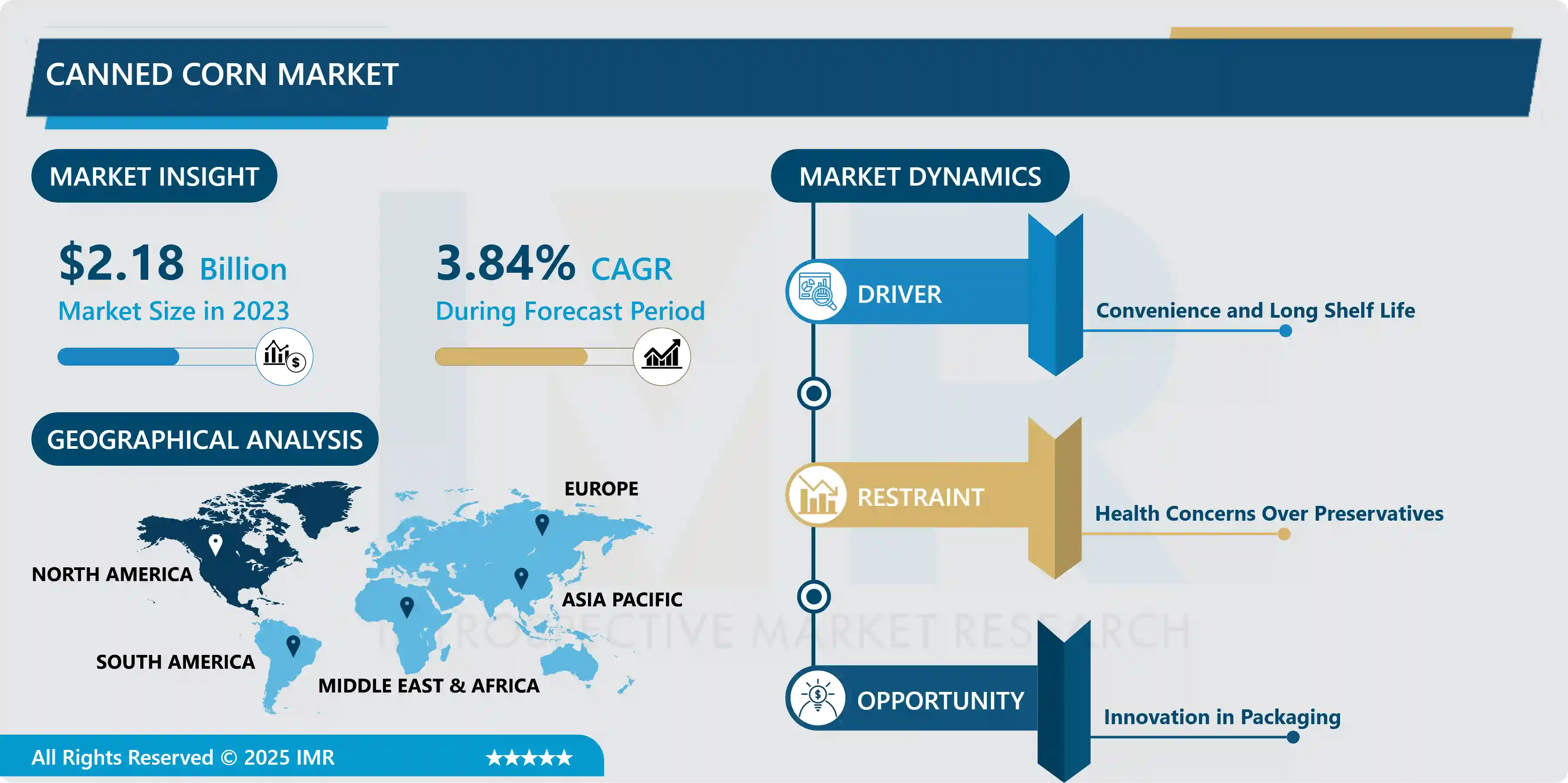

Canned Corn Market Size was valued at USD 2.18 Billion in 2023, and is projected to reach USD 3.06 Billion by 2032, growing at a CAGR of 3.84% from 2024 to 2032.

The canned corn showcase alludes to the commercial segment that includes the generation, dispersion, and deal of corn bits that have been gathered, prepared, and protected in fixed cans for amplified rack life.

This advertise envelops different item sorts, counting entirety part corn and corn mush, and serves different applications extending from family cooking to utilize in eateries and foodservice businesses. The advertise moreover incorporates different players such as producers, providers, and retailers who contribute to making canned corn broadly accessible to buyers all inclusive. The canned corn advertise could be a noteworthy portion inside the worldwide prepared nourishment industry, catering to the developing request for helpful and long-lasting nourishment items. Canned corn, made from gathered corn bits that are prepared and protected in cans, offers customers a flexible and promptly accessible fixing that can be utilized in an assortment of dishes. This showcase has been driven by variables such as expanding urbanization, changing ways of life, and the require for reasonable and open nourishment alternatives. As a staple in numerous families, canned corn gives a down to earth arrangement for those looking for a speedy and nutritious expansion to their dinners. The advertise has moreover seen development in regions such as bundling and item assortment, with an accentuation on maintainability and assembly the differing inclinations of health-conscious shoppers.

Canned Corn Market Trend Analysis

Convenience and Long Shelf Life

- Canned corn is profoundly esteemed by shoppers for its comfort and common sense, particularly in today’s fast-paced world. Its ready-to-eat nature disposes of the require for arrangement, cooking, or long handling, making it a perfect alternative for active families where time could be a premium. The long rack life of canned corn includes to its offer, permitting it to be put away for amplified periods without losing its wholesome esteem or taste.

- Usually especially advantageous for those living in zones with restricted get to newly create, where canned corn gets to be a solid source of fundamental supplements year-round. Its capacity to be put away without refrigeration and its accessibility in different retail groups encourage upgrade its notoriety, situating it as a staple in numerous kitchens around the world.

Opportunity

Innovation in Packaging

- Innovation in packaging, especially within the advancement of eco-friendly and feasible arrangements like biodegradable cans, is becoming progressively pivotal within the canned corn showcase. As customers develop more ecologically cognizant, they are looking for items that adjust with their values, counting diminishing plastic squander and minimizing natural affect.

- By contributing in economical bundling, companies cannot as it was separate their items but moreover tap into a developing portion of eco-conscious buyers. Biodegradable cans, for occurrence, offer the double benefits of protecting the item whereas too being naturally mindful, decreasing the carbon impression related with conventional bundling materials. This move towards supportability can open up unused advertise openings, improve brand notoriety, and possibly lead to organizations with retailers and merchants who prioritize green activities, eventually driving development and advancement within the industry.

Canned Corn Market Segment Analysis:

Canned Corn market is segmented on the basis of Type, Application.

By Type, Canned whole kernel Segment Is Expected to Dominate the Market During the Forecast Period

- Canned whole kernel corn tends to be the prevailing sort within the showcase compared to canned corn mush. This dominance is basically due to the flexibility and broader request of entirety bit corn. Customers regularly favor canned entirety bit corn since it closely takes after new corn in both taste and surface, making it appropriate for a wide extend of dishes, counting servings of mixed greens, soups, casseroles, and side dishes. The intaglio parts offer a fulfilling crunch and visual offer that upgrades supper introduction, which is particularly esteemed in domestic cooking and nourishment benefit settings.

- In differentiate, canned corn mush, which is ordinarily utilized as a base for particular formulas or as a thickener, encompasses a more constrained application and is less commonly utilized by buyers. Whereas it may be prevalent in certain territorial cuisines or specialized nourishment arrangements, its specialty utilization limits its showcase share. The broader convenience and recognition of entire bit corn donate it a critical advantage, making it the favored choice for both regular customers and the nourishment industry.

By Application, Home Segment Held the Largest Share In 2023

- The home segment is regularly the prevailing application for canned corn, outpacing utilization in eateries and other settings. This dominance is driven by a few components, counting the comfort and flexibility that canned corn offers to domestic cooks. In families, canned corn may be a wash room staple, esteemed for its long rack life, ease of arrangement, and capacity to be consolidated into a wide assortment of dishes, from speedy servings of mixed greens and soups to casseroles and side dishes. Its ready-to-eat nature appeals to active families and people seeking out for fast supper arrangements without compromising on taste or nourishment.

- Besides, the reasonableness and availability of canned corn make it a prevalent choice for domestic utilize, where customers are regularly more price-sensitive and look for out cost-effective nourishment choices. Whereas eateries and other foodservice foundations do utilize canned corn, especially in dishes where new corn may not be accessible year-round, their utilization is for the most part more specific and volume-based, frequently favouring new or solidified corn when conceivable for a fresher taste and surface. The broad use of canned corn in ordinary domestic cooking cements its position as the overwhelming application within the advertise.

Canned Corn Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America dominates the global canned corn market primarily due to its strong consumer demand, well-established food processing industry, and agricultural strengths. The United States, in particular, has a long-standing tradition of incorporating canned vegetables, including corn, into its diet, driven by the convenience and extended shelf life these products offer. This demand is supported by major food processing companies like Del Monte and Green Giant, which have a robust presence and extensive distribution networks across the region.

- North America's vast corn-growing areas, especially in the U.S., provide a reliable supply of raw materials, further fueling production. Additionally, the region's advanced food processing technologies ensure high-quality and cost-effective production, making canned corn both affordable and widely available. Consumer preferences for ready-to-eat, long-lasting foods also align perfectly with the offerings of the canned corn market, reinforcing North America's leading position in this industry.

Canned Corn Market Active Players

- Del Monte Foods, Inc. (USA)

- Bonduelle Group (France)

- Green Giant (B&G Foods, Inc.) (USA)

- General Mills, Inc. (USA)

- Kraft Heinz Company (USA)

- Dole Food Company (USA)

- Conagra Brands, Inc. (USA)

- Goya Foods, Inc. (USA)

- Seneca Foods Corporation (USA)

- La Doria S.p.A. (Italy)

- Baxters Food Group (UK)

- AYAM Brand (Malaysia)

- Podravka d.d. (Croatia)

- Ardo Group (Belgium)

- Sabarot Wassner (France)

- Danish Crown AmbA (Denmark)

- Heritage Foods Limited (India)

- H.J. Heinz Company Australia Ltd. (Australia)

- SunOpta, Inc. (Canada)

- Jotunheim Canning AS (Norway)

- McCall Farms, Inc. (USA)

- San Miguel Food and Beverage, Inc. (Philippines)

- Apetit Oyj (Finland)

- Simplot Australia Pty Ltd. (Australia)

- Princes Limited (UK) and other active players.

|

Canned Corn Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.18 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.84% |

Market Size in 2032: |

USD 3.06 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Canned Corn Market by Type (2018-2032)

4.1 Canned Corn Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Canned Whole Kernel Corn

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Canned Corn Mush

Chapter 5: Canned Corn Market by Application (2018-2032)

5.1 Canned Corn Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Home

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Restaurants

5.5 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Canned Corn Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 DEL MONTE FOODS INC. (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 BONDUELLE GROUP (FRANCE)

6.4 GREEN GIANT (B&G FOODS INC.) (USA)

6.5 GENERAL MILLS INC. (USA)

6.6 KRAFT HEINZ COMPANY (USA)

6.7 DOLE FOOD COMPANY (USA)

6.8 CONAGRA BRANDS INC. (USA)

6.9 GOYA FOODS INC. (USA)

6.10 SENECA FOODS CORPORATION (USA)

6.11 LA DORIA S.P.A. (ITALY)

6.12 BAXTERS FOOD GROUP (UK)

6.13 AYAM BRAND (MALAYSIA)

6.14 PODRAVKA D.D. (CROATIA)

6.15 ARDO GROUP (BELGIUM)

6.16 SABAROT WASSNER (FRANCE)

6.17 DANISH CROWN AMBA (DENMARK)

6.18 HERITAGE FOODS LIMITED (INDIA)

6.19 H.J. HEINZ COMPANY AUSTRALIA LTD. (AUSTRALIA)

6.20 SUNOPTA INC. (CANADA)

6.21 JOTUNHEIM CANNING AS (NORWAY)

6.22 MCCALL FARMS INC. (USA)

6.23 SAN MIGUEL FOOD AND BEVERAGE INC. (PHILIPPINES)

6.24 APETIT OYJ (FINLAND)

6.25 SIMPLOT AUSTRALIA PTY LTD. (AUSTRALIA)

6.26 PRINCES LIMITED (UK)

Chapter 7: Global Canned Corn Market By Region

7.1 Overview

7.2. North America Canned Corn Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Canned Whole Kernel Corn

7.2.4.2 Canned Corn Mush

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Home

7.2.5.2 Restaurants

7.2.5.3 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Canned Corn Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Canned Whole Kernel Corn

7.3.4.2 Canned Corn Mush

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Home

7.3.5.2 Restaurants

7.3.5.3 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Canned Corn Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Canned Whole Kernel Corn

7.4.4.2 Canned Corn Mush

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Home

7.4.5.2 Restaurants

7.4.5.3 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Canned Corn Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Canned Whole Kernel Corn

7.5.4.2 Canned Corn Mush

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Home

7.5.5.2 Restaurants

7.5.5.3 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Canned Corn Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Canned Whole Kernel Corn

7.6.4.2 Canned Corn Mush

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Home

7.6.5.2 Restaurants

7.6.5.3 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Canned Corn Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Canned Whole Kernel Corn

7.7.4.2 Canned Corn Mush

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Home

7.7.5.2 Restaurants

7.7.5.3 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Canned Corn Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.18 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.84% |

Market Size in 2032: |

USD 3.06 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||