Business Parcel Delivery Service Market Synopsis

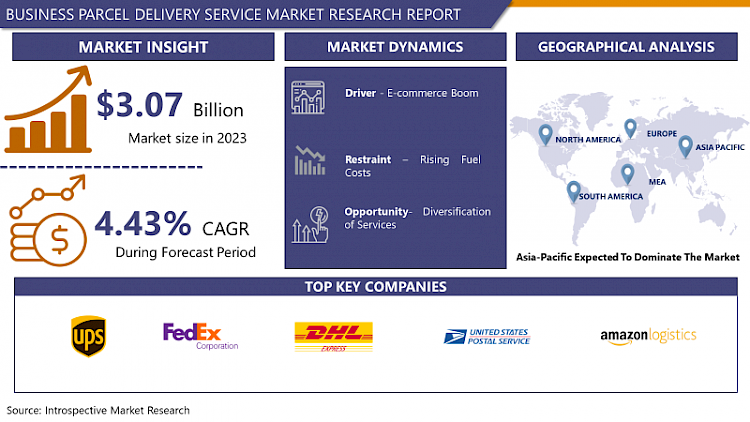

Assisted Living Software Market Size Was Valued at USD 3.07 Billion in 2023, and is Projected to Reach USD 4.53 Billion by 2032, Growing at a CAGR of 4.43% From 2024-2032.

The business parcel delivery service market encompasses the dynamic ecosystem of companies dedicated to transporting packages, documents, and goods between businesses, ranging from small enterprises to multinational corporations. This market caters to the growing demand for efficient and reliable transportation solutions in a globalized economy, where timely delivery of goods is crucial for maintaining supply chains and meeting customer expectations. With the advent of e-commerce and the increasing trend towards online shopping, the business parcel delivery service market has experienced significant expansion, prompting innovation in logistics technology and strategies to optimize delivery routes, minimize costs, and enhance customer satisfaction. Key players in this market include courier services, freight forwarders, logistics companies, and postal agencies, all competing to provide seamless and cost-effective delivery solutions tailored to the diverse needs of businesses across various industries.

- The business parcel delivery service market is witnessing significant growth, fueled by the global expansion of e-commerce and the increasing demand for efficient logistics solutions. With consumers relying more on online shopping, businesses are under pressure to streamline their delivery processes to meet rising expectations for fast and reliable service. This trend is driving companies in the parcel delivery sector to innovate and invest in advanced technologies to optimize their operations.

- One key driver of market growth is the rise of same-day and next-day delivery options, which are becoming standard offerings for many retailers. This shift is pushing parcel delivery providers to enhance their last-mile capabilities, including investments in delivery drones, autonomous vehicles, and smart routing algorithms. Moreover, the COVID-19 pandemic has accelerated the adoption of contactless delivery methods, further emphasizing the importance of efficient and flexible logistics solutions.

- Another significant trend in the business parcel delivery service market is the increasing focus on sustainability. Consumers are becoming more environmentally conscious, driving companies to adopt greener practices throughout their supply chains. Parcel delivery providers are responding by investing in electric and alternative fuel vehicles, optimizing delivery routes to minimize emissions, and implementing packaging solutions that reduce waste.

- Furthermore, the market is witnessing growing competition from both traditional players and new entrants, including tech giants and startups offering innovative delivery solutions. This competition is driving consolidation and partnerships within the industry as companies seek to expand their geographic reach, enhance their service offerings, and achieve economies of scale.

- In summary, the business parcel delivery service market is experiencing robust growth driven by the expansion of e-commerce, the demand for faster and more efficient delivery options, and increasing focus on sustainability. To succeed in this competitive landscape, parcel delivery providers must continue to innovate, invest in advanced technologies, and prioritize customer experience and environmental sustainability.

Business Parcel Delivery Service Market Trend Analysis

Evolving Landscape of E-commerce and Parcel Delivery Services

- The exponential growth of e-commerce in recent years has revolutionized the way businesses operate and how consumers shop. With the convenience of online shopping becoming increasingly irresistible, businesses have swiftly adapted to this digital landscape, setting up virtual storefronts to cater to the evolving needs of consumers. This surge in e-commerce activity has resulted in a corresponding spike in parcel deliveries, as goods purchased online need to be transported from sellers to buyers efficiently and reliably. Consequently, the demand for parcel delivery services has soared, creating a highly competitive market environment where companies vie for market share and customer loyalty.

- In response to this intensified competition, delivery companies have been compelled to innovate and enhance their services to stay ahead in the race. Recognizing that speed and convenience are paramount for today's consumers, these companies have invested heavily in technology and infrastructure to streamline their operations and expedite the delivery process. From implementing advanced tracking systems to optimizing delivery routes using data analytics, delivery providers are leaving no stone unturned in their quest to meet and exceed customer expectations. Additionally, there's a growing emphasis on last-mile delivery solutions, with companies exploring innovative methods such as drones and autonomous vehicles to expedite deliveries and reduce transit times. As the e-commerce boom shows no signs of slowing down, delivery companies must continue to innovate and adapt to meet the evolving demands of consumers in this digital age.

Sustainability Initiatives Transforming the Parcel Delivery Sector

- In response to mounting environmental concerns, sustainability has become a central pillar in the operations of parcel delivery companies worldwide. The transportation sector, including parcel delivery, has long been associated with carbon emissions and environmental degradation. However, recognizing their role in mitigating these impacts, delivery companies have embarked on a journey toward sustainability. One of the most prominent strategies is the adoption of eco-friendly vehicles, such as electric and hybrid delivery trucks. These vehicles produce significantly lower emissions compared to traditional diesel counterparts, thereby reducing the carbon footprint of parcel delivery operations. By investing in electric and hybrid fleets, delivery companies not only contribute to cleaner air and reduced greenhouse gas emissions but also position themselves as environmentally responsible entities in the eyes of consumers.

- Moreover, parcel delivery companies are implementing strategies to minimize packaging waste, another critical aspect of their sustainability initiatives. Excessive packaging not only contributes to environmental pollution but also adds to transportation costs and inefficiencies. To address this issue, delivery firms are exploring innovative packaging solutions that prioritize efficiency and sustainability. This includes using recycled materials, right-sizing packaging to minimize waste, and promoting reusable packaging options. By reducing packaging waste, delivery companies not only lower their environmental impact but also improve operational efficiency and cost-effectiveness. As consumers increasingly prioritize sustainability in their purchasing decisions, delivery companies that embrace eco-friendly practices stand to gain a competitive edge, enhancing their brand reputation and customer loyalty in the process.

Business Parcel Delivery Service Market Segment Analysis:

Business Parcel Delivery Service Market is Segmented based on Service Type, Technology and End User

By Service Type, Express delivery segment is expected to dominate the market during the forecast period

- Express delivery has firmly cemented its position as the cornerstone of the delivery service market, boasting the lion's share due to its unparalleled speed and efficiency. In an era where instant gratification is the norm, consumers and businesses alike increasingly rely on express delivery to meet their urgent needs. Particularly in sectors like e-commerce and healthcare, where time is of the essence, express delivery services have become indispensable. The ability to swiftly transport goods from point A to point B not only satisfies customers' expectations but also enhances their overall experience, fostering loyalty and trust in the brand. This dominance is further solidified by the seamless integration of express delivery into modern supply chain logistics, where every minute saved translates into a competitive advantage.

- Furthermore, the exponential growth of online shopping has fueled the demand for express delivery, propelling its dominance to new heights. With consumers accustomed to the convenience of ordering products with a click of a button, the pressure on delivery services to deliver swiftly and reliably has never been greater. Businesses recognize the pivotal role that express delivery plays in meeting these expectations and gaining a competitive edge in the market. From perishable goods to time-sensitive medical supplies, the immediacy offered by express delivery services addresses a myriad of needs across various industries, further solidifying its status as the dominant force in the delivery service landscape. As technology continues to advance and consumer demands evolve, express delivery remains at the forefront, shaping the future of logistics with its unwavering commitment to speed and efficiency.

By End User, E-commerce segment held the largest share in 2023

- E-commerce stands as the undisputed giant among end users, wielding immense influence and commanding the largest share in the delivery service market. Its dominance is underpinned by the seismic shift in consumer behavior towards online shopping, a trend that has only accelerated in the wake of global events precipitating a rapid digital transformation of retail. With the convenience of browsing and purchasing goods from the comfort of one's home, consumers have flocked to e-commerce platforms in unprecedented numbers, reshaping the retail landscape and driving exponential growth in online transactions. As a result, the demand for efficient delivery mechanisms has soared, as e-commerce companies race to meet and exceed customer expectations for prompt and reliable shipping

- This unprecedented surge in e-commerce activity has propelled the need for a diverse range of delivery services tailored to the specific requirements of online retailers. From express delivery for time-sensitive orders to specialized handling of delicate or perishable goods, the delivery ecosystem has evolved to cater to the multifaceted demands of e-commerce. Furthermore, the relentless pursuit of innovation and optimization within the logistics sector has enabled e-commerce companies to offer increasingly seamless and personalized delivery experiences, further solidifying their position as the primary driver of demand for delivery services. As e-commerce continues to reshape the retail landscape and redefine consumer expectations, its dominance in the delivery service market is set to endure, serving as a testament to the transformative power of digital commerce in the modern age.

Business Parcel Delivery Service Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- In the Asia-Pacific region, local players like Alibaba's Cainiao, JD Logistics, and SF Express have been able to secure dominant shares in the booming parcel delivery market by leveraging their deep understanding of local logistics challenges and consumer preferences. These companies have strategically invested in robust infrastructure and innovative technology to streamline their operations and enhance efficiency. For instance, Cainiao, Alibaba's logistics arm, has developed a vast network of warehouses, sorting centers, and delivery hubs across China and beyond, enabling it to offer fast and reliable delivery services to millions of consumers. JD Logistics, a subsidiary of e-commerce giant JD.com, has similarly invested heavily in automation and data analytics, allowing it to optimize delivery routes and minimize costs. By focusing on providing seamless end-to-end solutions tailored to the unique needs of the Asian market, these local players have successfully captured a significant portion of the parcel delivery market share.

- Moreover, the dominance of local players in the Asia-Pacific parcel delivery market is further bolstered by their strong brand recognition and customer loyalty. Companies like SF Express have built reputations for reliability and customer satisfaction through consistent service excellence and a customer-centric approach. By fostering trust and loyalty among consumers, these local players have established formidable barriers to entry for global competitors seeking to penetrate the Asian market. Through strategic partnerships and continuous innovation, Alibaba's Cainiao, JD Logistics, SF Express, and other local players are well-positioned to maintain their dominant shares in the rapidly expanding Asia-Pacific parcel delivery market for the foreseeable future.

Active Key Players in the Business Parcel Delivery Service Market

- UPS (United Parcel Service)

- FedEx Corporation

- DHL Express

- USPS (United States Postal Service)

- Amazon Logistics

- TNT Express

- DPD (Dynamic Parcel Distribution)

- Royal Mail Group

- YRC Worldwide Inc

- GLS (General Logistics Systems)

- Other Key Players

|

Global Business Parcel Delivery Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.07 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.43 % |

Market Size in 2032: |

USD 4.53 Bn. |

|

Segments Covered: |

By Service Type |

|

|

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- BUSINESS PARCEL DELIVERY SERVICE MARKET BY SERVICE TYPE (2017-2032)

- BUSINESS PARCEL DELIVERY SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- EXPRESS DELIVERY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SAME-DAY DELIVERY

- STANDARD DELIVERY,

- SPECIALIZED DELIVERY

- BUSINESS PARCEL DELIVERY SERVICE MARKET BY TECHNOLOGY (2017-2032)

- BUSINESS PARCEL DELIVERY SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MOBILE APPS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- TRACKING SYSTEMS

- AUTOMATED DELIVERY

- BUSINESS PARCEL DELIVERY SERVICE MARKET BY END USER (2017-2032)

- BUSINESS PARCEL DELIVERY SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- E-COMMERCE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HEALTHCARE

- RETAIL

- MANUFACTURING

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Business Parcel Delivery Service Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- UPS (UNITED PARCEL SERVICE)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- FEDEX CORPORATION

- DHL EXPRESS

- USPS (UNITED STATES POSTAL SERVICE)

- AMAZON LOGISTICS

- TNT EXPRESS

- DPD (DYNAMIC PARCEL DISTRIBUTION)

- ROYAL MAIL GROUP

- YRC WORLDWIDE INC

- GLS (GENERAL LOGISTICS SYSTEMS)

- COMPETITIVE LANDSCAPE

- GLOBAL BUSINESS PARCEL DELIVERY SERVICE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Service Type

- Historic And Forecasted Market Size By Technology

- Historic And Forecasted Market Size By End User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Business Parcel Delivery Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.07 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.43 % |

Market Size in 2032: |

USD 4.53 Bn. |

|

Segments Covered: |

By Service Type |

|

|

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BUSINESS PARCEL DELIVERY SERVICE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BUSINESS PARCEL DELIVERY SERVICE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BUSINESS PARCEL DELIVERY SERVICE MARKET COMPETITIVE RIVALRY

TABLE 005. BUSINESS PARCEL DELIVERY SERVICE MARKET THREAT OF NEW ENTRANTS

TABLE 006. BUSINESS PARCEL DELIVERY SERVICE MARKET THREAT OF SUBSTITUTES

TABLE 007. BUSINESS PARCEL DELIVERY SERVICE MARKET BY TYPE

TABLE 008. TYPE I MARKET OVERVIEW (2016-2028)

TABLE 009. TYPE II MARKET OVERVIEW (2016-2028)

TABLE 010. BUSINESS PARCEL DELIVERY SERVICE MARKET BY APPLICATION

TABLE 011. B2B MARKET OVERVIEW (2016-2028)

TABLE 012. B2C MARKET OVERVIEW (2016-2028)

TABLE 013. NORTH AMERICA BUSINESS PARCEL DELIVERY SERVICE MARKET, BY TYPE (2016-2028)

TABLE 014. NORTH AMERICA BUSINESS PARCEL DELIVERY SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 015. N BUSINESS PARCEL DELIVERY SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 016. EUROPE BUSINESS PARCEL DELIVERY SERVICE MARKET, BY TYPE (2016-2028)

TABLE 017. EUROPE BUSINESS PARCEL DELIVERY SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 018. BUSINESS PARCEL DELIVERY SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 019. ASIA PACIFIC BUSINESS PARCEL DELIVERY SERVICE MARKET, BY TYPE (2016-2028)

TABLE 020. ASIA PACIFIC BUSINESS PARCEL DELIVERY SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 021. BUSINESS PARCEL DELIVERY SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 022. MIDDLE EAST & AFRICA BUSINESS PARCEL DELIVERY SERVICE MARKET, BY TYPE (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA BUSINESS PARCEL DELIVERY SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 024. BUSINESS PARCEL DELIVERY SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 025. SOUTH AMERICA BUSINESS PARCEL DELIVERY SERVICE MARKET, BY TYPE (2016-2028)

TABLE 026. SOUTH AMERICA BUSINESS PARCEL DELIVERY SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 027. BUSINESS PARCEL DELIVERY SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 028. A-1 EXPRESS: SNAPSHOT

TABLE 029. A-1 EXPRESS: BUSINESS PERFORMANCE

TABLE 030. A-1 EXPRESS: PRODUCT PORTFOLIO

TABLE 031. A-1 EXPRESS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 031. DHL: SNAPSHOT

TABLE 032. DHL: BUSINESS PERFORMANCE

TABLE 033. DHL: PRODUCT PORTFOLIO

TABLE 034. DHL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. FEDEX: SNAPSHOT

TABLE 035. FEDEX: BUSINESS PERFORMANCE

TABLE 036. FEDEX: PRODUCT PORTFOLIO

TABLE 037. FEDEX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. TFORCE FINAL MILE: SNAPSHOT

TABLE 038. TFORCE FINAL MILE: BUSINESS PERFORMANCE

TABLE 039. TFORCE FINAL MILE: PRODUCT PORTFOLIO

TABLE 040. TFORCE FINAL MILE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. UPS: SNAPSHOT

TABLE 041. UPS: BUSINESS PERFORMANCE

TABLE 042. UPS: PRODUCT PORTFOLIO

TABLE 043. UPS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. USA COURIERS: SNAPSHOT

TABLE 044. USA COURIERS: BUSINESS PERFORMANCE

TABLE 045. USA COURIERS: PRODUCT PORTFOLIO

TABLE 046. USA COURIERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. AMERICAN EXPEDITING: SNAPSHOT

TABLE 047. AMERICAN EXPEDITING: BUSINESS PERFORMANCE

TABLE 048. AMERICAN EXPEDITING: PRODUCT PORTFOLIO

TABLE 049. AMERICAN EXPEDITING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. ARAMEX: SNAPSHOT

TABLE 050. ARAMEX: BUSINESS PERFORMANCE

TABLE 051. ARAMEX: PRODUCT PORTFOLIO

TABLE 052. ARAMEX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. DELIV: SNAPSHOT

TABLE 053. DELIV: BUSINESS PERFORMANCE

TABLE 054. DELIV: PRODUCT PORTFOLIO

TABLE 055. DELIV: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. EXPRESS COURIER: SNAPSHOT

TABLE 056. EXPRESS COURIER: BUSINESS PERFORMANCE

TABLE 057. EXPRESS COURIER: PRODUCT PORTFOLIO

TABLE 058. EXPRESS COURIER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. LASERSHIP: SNAPSHOT

TABLE 059. LASERSHIP: BUSINESS PERFORMANCE

TABLE 060. LASERSHIP: PRODUCT PORTFOLIO

TABLE 061. LASERSHIP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. PARCELFORCE WORLDWIDE: SNAPSHOT

TABLE 062. PARCELFORCE WORLDWIDE: BUSINESS PERFORMANCE

TABLE 063. PARCELFORCE WORLDWIDE: PRODUCT PORTFOLIO

TABLE 064. PARCELFORCE WORLDWIDE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. NAPAREX: SNAPSHOT

TABLE 065. NAPAREX: BUSINESS PERFORMANCE

TABLE 066. NAPAREX: PRODUCT PORTFOLIO

TABLE 067. NAPAREX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. POWER LINK DELIVERY: SNAPSHOT

TABLE 068. POWER LINK DELIVERY: BUSINESS PERFORMANCE

TABLE 069. POWER LINK DELIVERY: PRODUCT PORTFOLIO

TABLE 070. POWER LINK DELIVERY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. PRESTIGE DELIVERY: SNAPSHOT

TABLE 071. PRESTIGE DELIVERY: BUSINESS PERFORMANCE

TABLE 072. PRESTIGE DELIVERY: PRODUCT PORTFOLIO

TABLE 073. PRESTIGE DELIVERY: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BUSINESS PARCEL DELIVERY SERVICE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BUSINESS PARCEL DELIVERY SERVICE MARKET OVERVIEW BY TYPE

FIGURE 012. TYPE I MARKET OVERVIEW (2016-2028)

FIGURE 013. TYPE II MARKET OVERVIEW (2016-2028)

FIGURE 014. BUSINESS PARCEL DELIVERY SERVICE MARKET OVERVIEW BY APPLICATION

FIGURE 015. B2B MARKET OVERVIEW (2016-2028)

FIGURE 016. B2C MARKET OVERVIEW (2016-2028)

FIGURE 017. NORTH AMERICA BUSINESS PARCEL DELIVERY SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 018. EUROPE BUSINESS PARCEL DELIVERY SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. ASIA PACIFIC BUSINESS PARCEL DELIVERY SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. MIDDLE EAST & AFRICA BUSINESS PARCEL DELIVERY SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. SOUTH AMERICA BUSINESS PARCEL DELIVERY SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Business Parcel Delivery Service Market research report is 2024-2032.

UPS (United Parcel Service), FedEx Corporation, DHL Express, USPS (United States Postal Service), Amazon Logistics, TNT Express, DPD (Dynamic Parcel Distribution), Royal Mail Group,YRC Worldwide Inc, GLS (General Logistics Systems) and Other Key Players

The Business Parcel Delivery Service Market is segmented into By Service Type, By Technology, By End User and region.By Service Type, the market is categorized into Express delivery, Same-day delivery, Standard delivery, Specialized delivery (e.g., perishable goods). By Technology, the market is categorized into Mobile apps, Tracking systems, Automated delivery and Others. By End User, the market is categorized into E-commerce, Healthcare, Retail, Manufacturing, and others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The business parcel delivery service market encompasses the dynamic ecosystem of companies dedicated to transporting packages, documents, and goods between businesses, ranging from small enterprises to multinational corporations. This market caters to the growing demand for efficient and reliable transportation solutions in a globalized economy, where timely delivery of goods is crucial for maintaining supply chains and meeting customer expectations. With the advent of e-commerce and the increasing trend towards online shopping, the business parcel delivery service market has experienced significant expansion, prompting innovation in logistics technology and strategies to optimize delivery routes, minimize costs, and enhance customer satisfaction. Key players in this market include courier services, freight forwarders, logistics companies, and postal agencies, all competing to provide seamless and cost-effective delivery solutions tailored to the diverse needs of businesses across various industries.

Assisted Living Software Market Size Was Valued at USD 3.07 Billion in 2023, and is Projected to Reach USD 4.53 Billion by 2032, Growing at a CAGR of 4.43% From 2024-2032.