Global Brake Pads Market Overview

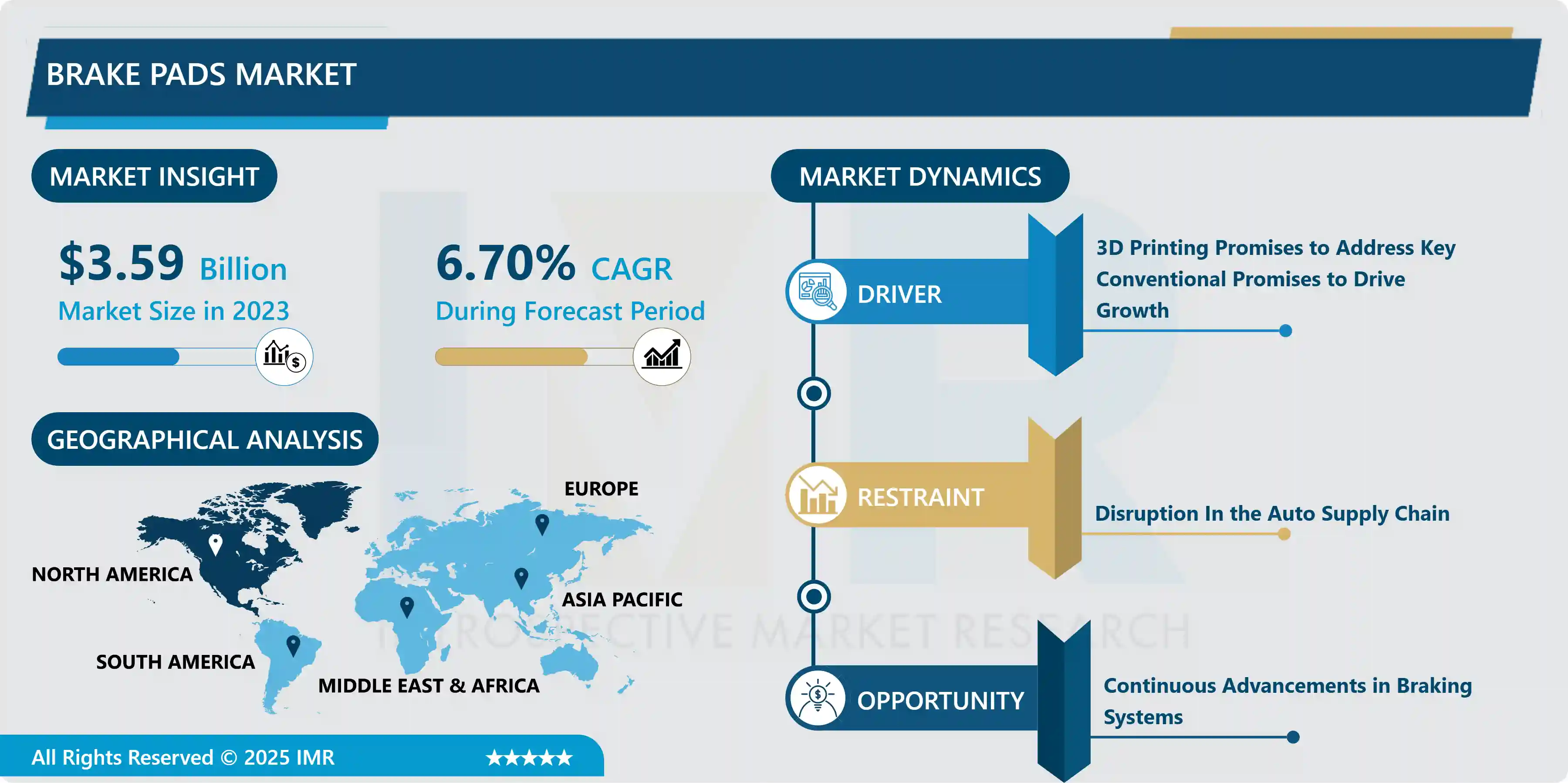

Global Brake Pads Market was valued at USD 3.59 Billion in 2023 and is expected to reach USD 6.44 Billion by the year 2032, at a CAGR of 6.7% (2024-2032)

Brake pads are a component of disc brakes used in automobiles and other applications. Brake pads are made up of steel pads with a friction material bonded to the contact surface of the rotors of the brake disc. Brake pads convert the vehicle's kinetic energy into heat through friction. The two brake pads are contained within the brake with their friction surface facing the rotor. When braking hydraulically, the caliper clamps or squeezes two spacers together on the rotating rotor to slow the vehicle down and come to a complete stop. As the brake pad heats up from contact with the rotor, it transfers a small amount of its friction material to the disc, leaving a matte gray coating on it. The brake disc and the disc (both now with friction material) then "stick" together, creating friction to bring the car to a stop. In disc brakes, there are usually two brake pads on each disc rotor. Brake pads, in general, need to be replaced regularly (depending on the pad material) to prevent the brake pads from fading. Most brake pads are equipped with a method to warn the driver when it is necessary to do so. A common technique is to make a small groove in the center whose eventual disappearance due to wear indicates the end of the gasket's life. Other methods involve placing a thin strip of soft metal in the groove so that when exposed (due to wear), the brake squeaks. A soft metal wear tab can also be implanted in the pad material that closes an electric circuit when the brake pad wears thin, lighting a dashboard warning light.

In addition, the system requires less effort to control the vehicle's speed, producing minimal noise and vibration. In addition, brake pads generate less heat than drum brakes. Low heat damages the disc-less, thus increasing its lifespan. The increase in demand for efficient braking at high speeds has led to the expansion of the brake pad market. As a result, the demand for brake pads is expected to soar and drive the automotive brake pads market in the future.

Market Dynamics And Factors For Brake Pads Market

Drivers:

3D Printing Promises to Address Key Conventional Promises to Drive Growth

- Automotive brake pads, given the small size of their parts, remain a complex task for traditional production that values ??mass production. However, new 3D printing or additive manufacturing technology holds the promise of delivering rapid prototypes with great cost reduction benefits. In addition to reducing costs, the technology also promises to reduce heat, which is often the cause of brake system failures. According to NHTSA, advances in technology have reduced vehicle downtime by about 30%. In addition, technologies such as 3D printing are also paving the way for better brake pads for racing cars and promising a niche market for electric car brands, the competition is likely to become fiercer as more and more car manufacturers grow. slightly hit the electric vehicle market. The 3D printed brake systems also promise to be more lightweight, making way for advanced braking systems to reduce weight, and subsequently, fuel usage.

- The rising GDP of the world's population has boosted their disposable income, which in turn has boosted car sales. This increase in global vehicle sales has boosted the brake pad market. Increasing safety awareness among vehicle consumers as well as government agencies has prompted the integration of various technologies, such as ABS and EBD, as a standard feature in most vehicles. new car. These technologies accelerate the wear of brake pads, thus driving the global brake pad market. The development of industrialization across the continents has promoted commercial activities, thereby increasing the number of kilometers traveled by commercial means of transport. The increase in the number of kilometers traveled by vehicles leads to high wear of brake pads and leads to an increase in the global brake pad market.

Restraints:

- The recent outbreak of the COVID-19 pandemic has hampered the majority of businesses worldwide, as manufacturing and manufacturing operations have been forced to shut down. This caused the global economy to shrink at its lowest growth rate. Disruptions to the auto supply chain have hampered vehicle production. In addition, the demand for new vehicles has decreased as people do not spend money on non-essential goods and services. The growing popularity of electric vehicles equipped with regenerative braking systems is reducing the use of friction brakes, thereby reducing brake pad wear and thus reducing aftermarket demand.

Opportunities:

- Continuous advancements in braking systems and the development of organic fibers such as palm kernel shells to meet emissions regulations are expected to bring investment opportunities to the market.

Market Segmentation

Segmentation Analysis of Brake Pads Market:

- Based on the material type, the non-asbestos organic segment is expected to dominate the brake pads market during the forecast period. Most new cars sold in the United States are equipped with the manufacturer's organic brake pads. These pads are also known as non-asbestos organic (or NAO) pads. They were developed to replace the asbestos sheets used many years ago. Although some vehicles come from the factory with other types of brake pads, when someone refers to OEM brake pads, they usually mean organic pads. Organic brake pads are made from materials like glass, fiber, rubber, carbon, and even Kevlar mixed with resin to hold them together. Organic brake pads are often the cheapest option when brake repair is needed. They're relatively "soft", smooth, and gentle on your brakes, and they're a good choice for everyday driving. However, asbestos has a good ingredient for manufacturing brake pads, but it is harmful to health. Risks when using asbestos brake pads, after pressing the brake pedal to stop the vehicle, soot from the brake pads will stick to the wheel, soil fibers can fly into the vehicle. Perhaps the most common brake pad, the semi-metallic style is composed of 30-65% metal. Additional materials may include steel wool, wire, and copper, among others.

- Based on the vehicle type, the commercial vehicle segment is anticipated to hold the maximum brake pads market share during the forecast period. Commercial cars have the largest market share of around 43% globally thanks to an increase in demand and concurrent production, as well as the effective adoption of vehicle brakes. According to OICA, automobiles in the brake pad market in 2020 account for about 3.8 billion USD due to the increasing demand for automobiles and the increasing supply of raw materials. Commercial vehicles represent a major market segment with a market share of approximately 29% due to the increase in research and development of heavy-duty brake pads and the rise of the transportation industry globally.

- Based on the distribution channel, the Aftermarket segment is expected to hold the maximum brake pads market during the forecast period. Aftermarket components include any options you may install that are not made by your vehicle's original manufacturer. Aftermarket parts are widely available and sold at many auto parts retailers, so they are more widely accessible than OEM parts.

Regional Analysis of Brake Pads Market:

- North America is expected to become dominant in terms of automotive brake pads market share. Strong sales and growing vehicle output are expected to drive growth. Furthermore, manufacturers invest heavily in research and development to produce advanced automotive brake pads. They focused on reducing brake pad size and improving heat dissipation. Hence, upcoming product developments and innovations are expected to drive the growth of the market.

- Europe is expected to rank second in the global market. Growing demand for passenger vehicles is expected to be the main driver of growth in the coming years. In addition, strict rules and regulations regarding vehicle safety are expected to increase the growth of the market.

- The Asia-Pacific region promises strong growth in automotive systems as features and luxury remain central to most consumers looking to improve their social status. in traditional societies. Growing demand for luxury goods in the Asia Pacific increased investment in automotive technology and widespread electrical infrastructure, and changing consumer demand will lead to significant growth. of the brake pad market shortly.

Players Covered in Brake Pads Market are:

- ASIMCO

- Brembo S.p.A.

- ACDelco

- Akebono Brake Industry Co. Ltd.

- Allied-Nippon Limited

- ATE. Bosch Auto Parts

- Brakes India Pvt. Ltd.

- Brakewel Automotive Components India Pvt. Ltd.

- Rane Brake Lining Limited

- G.U.D Holdings

- Sundaram Brake Linings

- Hindustan Composites Limited

- Makino Auto Industries Pvt. Ltd

- MAT Holdings

- AISIN SEIKI Co. Ltd.

- Nisshinbo Group Company

- Ranbro

- AVS BRAKE LININGS Private Limited

- Brakes India Limited

- Brake Parts Inc.

- STEINHOF

- ASK Automotive Pvt. Ltd.

- Tenneco Inc

- BSK Auto Industries

- TMD

- ZF Friedrichshafen and others major players.

Key Industry Developments In Brake Pads Market

- In February 2024, Webb unveiled its new Ultra Grip air disc brake pads, featuring three distinct levels. The Ultra Grip Plus is a high-quality pad designed for various on-highway truck and trailer applications. The Ultra Grip Premium offers premium performance for a wide range of on-highway truck and trailer uses. The Ultra Grip Severe-Duty is engineered for the most demanding applications, providing a robust design to handle extreme conditions.

- In September 2023, Brembo SpA announced a strategic plan to address the rising demand for carbon ceramic brake discs in both passenger and commercial vehicles. To support this initiative, Brembo SGL Carbon Ceramic Brakes (BSCCB) committed an investment of USD 169.5 million by 2027, aiming to boost production capacity by 70% at its facilities in Meitingen, Germany, and Stezzano, Italy.

- In May 2023, Robert Bosch GmbH introduced its innovative Elite brake pads, specifically designed for the TVS Apache motorcycle. These advanced pads feature a stripe coating integrated with the proprietary ABRACOAT technology.

- In March 2023, Brakes India launched ZAP brake pads, incorporating advanced friction technology tailored for electric vehicles. These pads provide enhanced corrosion resistance and ensure noiseless braking, meeting the unique requirements of battery-powered vehicles.

|

Global Brake Pads Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.59 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.7% |

Market Size in 2032: |

USD 6.44 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Vehicle |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Brake Pads Market by Type (2018-2032)

4.1 Brake Pads Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Semi-Metallic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Non-Asbestos Organic

4.5 Low-Metallic Nao

4.6 Ceramic

Chapter 5: Brake Pads Market by Vehicle (2018-2032)

5.1 Brake Pads Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Two-Wheeler Vehicle

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Passenger Vehicle

5.5 Commercial Vehicle

5.6 Off-Road Vehicle

Chapter 6: Brake Pads Market by Distribution Channel (2018-2032)

6.1 Brake Pads Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Original Equipment Manufacturer

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Aftermarket

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Brake Pads Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CHANGCHUN GAOXIANG SPECIAL PIPES CO. LTDDALIAN YINGYU CO. LIMITED

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 FLEXPIPE INCFLEXSTEEL PIPELINE TECHNOLOGIES INCH.A.T. FLEX

7.4 NATIONAL OILWELL VARCO

7.5 PIPELIFE INTERNATIONAL GMBH

7.6 POLYFLOW LLCSHANDONG JUYE JUGONG HOSE INDUSTRY CO. LTDVICTREX PLC

7.7 BAKER HUGHES

7.8 STROHM

7.9

Chapter 8: Global Brake Pads Market By Region

8.1 Overview

8.2. North America Brake Pads Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Semi-Metallic

8.2.4.2 Non-Asbestos Organic

8.2.4.3 Low-Metallic Nao

8.2.4.4 Ceramic

8.2.5 Historic and Forecasted Market Size by Vehicle

8.2.5.1 Two-Wheeler Vehicle

8.2.5.2 Passenger Vehicle

8.2.5.3 Commercial Vehicle

8.2.5.4 Off-Road Vehicle

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 Original Equipment Manufacturer

8.2.6.2 Aftermarket

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Brake Pads Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Semi-Metallic

8.3.4.2 Non-Asbestos Organic

8.3.4.3 Low-Metallic Nao

8.3.4.4 Ceramic

8.3.5 Historic and Forecasted Market Size by Vehicle

8.3.5.1 Two-Wheeler Vehicle

8.3.5.2 Passenger Vehicle

8.3.5.3 Commercial Vehicle

8.3.5.4 Off-Road Vehicle

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 Original Equipment Manufacturer

8.3.6.2 Aftermarket

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Brake Pads Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Semi-Metallic

8.4.4.2 Non-Asbestos Organic

8.4.4.3 Low-Metallic Nao

8.4.4.4 Ceramic

8.4.5 Historic and Forecasted Market Size by Vehicle

8.4.5.1 Two-Wheeler Vehicle

8.4.5.2 Passenger Vehicle

8.4.5.3 Commercial Vehicle

8.4.5.4 Off-Road Vehicle

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 Original Equipment Manufacturer

8.4.6.2 Aftermarket

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Brake Pads Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Semi-Metallic

8.5.4.2 Non-Asbestos Organic

8.5.4.3 Low-Metallic Nao

8.5.4.4 Ceramic

8.5.5 Historic and Forecasted Market Size by Vehicle

8.5.5.1 Two-Wheeler Vehicle

8.5.5.2 Passenger Vehicle

8.5.5.3 Commercial Vehicle

8.5.5.4 Off-Road Vehicle

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 Original Equipment Manufacturer

8.5.6.2 Aftermarket

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Brake Pads Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Semi-Metallic

8.6.4.2 Non-Asbestos Organic

8.6.4.3 Low-Metallic Nao

8.6.4.4 Ceramic

8.6.5 Historic and Forecasted Market Size by Vehicle

8.6.5.1 Two-Wheeler Vehicle

8.6.5.2 Passenger Vehicle

8.6.5.3 Commercial Vehicle

8.6.5.4 Off-Road Vehicle

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 Original Equipment Manufacturer

8.6.6.2 Aftermarket

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Brake Pads Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Semi-Metallic

8.7.4.2 Non-Asbestos Organic

8.7.4.3 Low-Metallic Nao

8.7.4.4 Ceramic

8.7.5 Historic and Forecasted Market Size by Vehicle

8.7.5.1 Two-Wheeler Vehicle

8.7.5.2 Passenger Vehicle

8.7.5.3 Commercial Vehicle

8.7.5.4 Off-Road Vehicle

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 Original Equipment Manufacturer

8.7.6.2 Aftermarket

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Brake Pads Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.59 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.7% |

Market Size in 2032: |

USD 6.44 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Vehicle |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||