Electric Parking Brake Market Synopsis

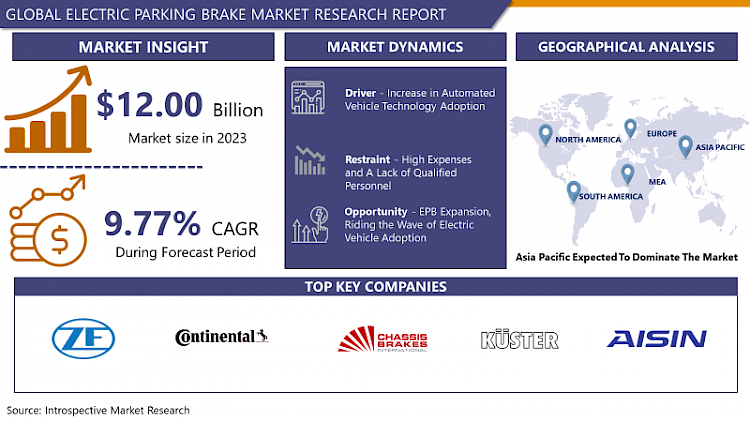

Electric Parking Brake Market Size is Valued at USD 12.00 Billion in 2023 and is Projected to Reach USD 25.31 Billion by 2032, Growing at a CAGR of 9.77% From 2024-2032.

- The Electronic Parking Brake (EPB), is a modern replacement of the conventional handbrake lever or foot pedal with an electronic switch. Once engaged, the EPB brings the brakes into electronic operation, thus enabling the vehicle to stay stationary when parked. It has many benefits over conventional system like auto engagement, extensive safety characteristics, and utilization of area. Cars with EPBs are growing more popular nowadays due to the comfort they offer together with their latest features.

- The EPB market, like some others, is being pushed by several critical elements. The pressing demand for innovative auto security and comfort systems is one of the primary factors. In contrast to the mechanical parking brakes used traditionally, EPBs have got a number of advantages among which are more compact design, higher safety, and a nicer appearance of the vehicle.

- The tendency of electrification of vehicles is another important factor to take into account. It is estimated that the demand for electrically activated braking systems, or EPBs, will increase while electric and hybrid vehicle technologies continue to be introduced on the road. In addition, the EPBs also make it possible for automotive manufacturers to include the feature of the autonomous driving mode in their vehicles together with the advanced driver assistance systems (ADAS).

- Increasing numbers of EPB vehicles are reported all over the world as the consequence of strict pollution and car safety laws. In order to achieve the purpose of improved road safety and decreased emissions, regulatory agencies everywhere are more and more demanding vehicle manufacturers to equip their cars with EPB systems.

- Also, the demand for EPBs is increasing as the market trend is moving towards weight reducing vehicles to improve fuel efficiencies. EPB’s are smaller and lighter than conventional parking brake systems, hence are economical for automakers when they want to improve the overall efficiency of their cars.

Electric Parking Brake Market Trend Analysis

Revolutionizing Safety The Impact of Trends on the EPB Market

- Many of the most important trends are shaping the Electric Parking Brake (EPB) market, and they are doing it in both ways. The considerate rise in the demand for hybrid cars or electric vehicles (EVs) is an outstanding characteristic which is dictating the future requirements for electric power boosters (EPBs) worldwide. Parking that requires 100% trust and safety, and EPBs will guarantee that.

- The second trends are merging modern technology into EPB for better functionality, security and ease of use features Sensors and electronic control units (ECU’s) are some of these technologies. Moreover, drivers are even supported in such actions as automatic braking engagement and release, hill hold, and integration of an anti-lock braking system (ABS) which are all enabled applying these technologies.

- Furthermore, car manufacturers are made to include advanced safety features such as EPB in new vehicles which are currently targeted in emissions and vehicle safety policies. When talking about the benefits of EPBs, they include lightweight, space savings and improve safety. Both consumers and regulatory agents are satisfied with this innovation.

- In addition, this development will also allow expansion of driverless vehicles and the emergence of a new dawn for the EPBs. The market is further expected to expand to cater for manufacturers that strive to improve the efficiency and safety of electric and autonomous vehicles, which will mark another boost in demand for the leading edge of EPB products.

EPB Expansion, Riding the Wave of Electric Vehicle Adoption

- Certainly, EPB sector has a lot of opportunities for development and progress. The growing use of EVs on a global scale is an important chance that should be tapped. It is expected that EPBs market will grow as the automotive sector begins to change to electric drive. Contrary to conventional mechanical parking brakes, EPBs (electropolishing brakes) have a list of benefits, including a smaller footprint, improved security, and automatic parking in vehicles interfaces with car electronics.

- Better safety measures as well as driver-assist systems might be another factor contributing to it. These systems using EPBs which are additionally equipped with features like automatic brake engagement in emergency and hill start assist. The situation is also improved for the EPBs as the integration ensures that it is coherent with the global trend of vehicle electrification and automation.

- Besides EPB manufacturers, the aftermarket sector provides another considerable opportunity for them as well. There will be a corresponding increase in the demand for part replacements and services as more cars which have the EPBs are on the road. Companies can draw benefits from the EPB activities having a steady income from this segment.

- The overall market for electronic parking brakes is expected to rise due to the increasing demand of electric cars, the inclusion of EPBs into hi-tech driver-assist systems, and the fast-developing aftermarket systems. The companies in this industry should make use of the opportunities that are available by creating advanced products, diversifying their product lines and strong positioning of their commodities in the right places.

Electric Parking Brake Market Segment Analysis:

Electric Parking Brake Market is segmented on the basis of type, application.

By Type, Caliper Integrated EPB segment is expected to dominate the market during the forecast period

- The EPB function of brake calipers is to apply the pressure of the brake pads onto the rotor, in order to slow down or stop the vehicle. These EPBs have smaller profiles and are most of the times seamlessly integrated into the car's total braking operation. They are usually found in modern cars, especially those with electronic braking systems.

- On the other hand, the cable puller EPBs apply the brakes by a network of cables. The cables pull on the brake mechanism that pressurize the brake pads when the EPB is engaged. This ESBP offers the benefit of electric control and it is more similar to conventional mechanical parking brakes. In automobiles where it's impractical or uneconomical to use a caliper integrated design, cable puller EPBs are more often used.

- The advantages of both types of EPBs are the space-saving design, improved safety features, and connection to car electronics. The comparison between the cable puller and the caliper integrated EPBs often comes down to the system integration level, economic issues, and the vehicle design.

According to this application, the sedan one had the biggest contribution in 2023.

- EPBs are very convenient to use in a variety of vehicles like sedans, SUVs, and other classes of cars.

- EPBs serve as a fashionable and modern alternative to traditional parking brakes among cars. The implementation of space-saving designs is a result of their electric power which is highly applicable to compact car models. To get the best driving experience, EPBs can also be linked with other systems found in sedans, including infotainment system and driver assistance features.

- Additionally, EPBs can be useful for SUVs because of the imperative space optimization, especially in large vehicles. For safety and stability purposes of SUV especially while parking on hills or hauling large objects, computer-controlled EPBs are essential to ensure the accurate and reliable braking performance.

- In addition, the same principle can be used for other vehicles such as some trucks, hatchbacks, cross over vehicles, etc. The general advantages of enclosed passenger boxes, like space-saving design and enhanced safety measures, are appropriate for any vehicle type, regardless of such vehicles having different design and performance specifications from sedans and SUVs.

- To illustrate, EPBs are found in various types of vehicles such as sedans, SUVs regardless of their designs and needs.

Electric Parking Brake Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The EPB market in North America, triggered by a number of reasons, is growing gradually. The region's dominant automotive industry, technical breakthroughs, and customers' demand for ease in cars and safety features are the main trends that may have an impact on the region. North America’s EPB market is a very competitive one, consisting of both established businesses as well as recent players who offer high quality products.

- The market development consists of the incessant growth of electric vehicles (EVs) as many of these EVs and hybrid cars now include EBPs as the standard equipment. On the one hand, the stringent governmental norms against pollution and vehicle safety are compelling the manufacturers to introduce advanced braking technology such as EPB.

- Developmental drivers for North American EPB market are being hindered by factors such as huge startup costs and specialized maintenance requirements rather than obstacles. New technology developments and growing consumer Awareness, however are the key drivers of the market’s growing trend.

Active Key Players in the Electric Parking Brake Market

- ZF (Germany)

- Continental (Germany)

- Chassis Brakes International (Belgium)

- Küster (Germany)

- Aisin (Japan)

- Mando (South Korea)

- Hyundai Mobis (South Korea)

- Zhejiang Libang Hexin (China)

- Wuhu Bethel Automotive (China)

- Others

|

Global Electric Parking Brake Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.00 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.77% |

Market Size in 2032: |

USD 25.31 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ELECTRIC PARKING BRAKE MARKET BY TYPE (2017-2032)

- ELECTRIC PARKING BRAKE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CALIPER INTEGRATED EPB

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CABLE PULLER EPB

- ELECTRIC PARKING BRAKE MARKET BY APPLICATION (2017-2032)

- ELECTRIC PARKING BRAKE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SEDANS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SUVS

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Electric Parking Brake Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ZF (GERMANY)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- CONTINENTAL (GERMANY)

- CHASSIS BRAKES INTERNATIONAL (BELGIUM)

- KÜSTER (GERMANY)

- AISIN (JAPAN)

- MANDO (SOUTH KOREA)

- HYUNDAI MOBIS (SOUTH KOREA)

- ZHEJIANG LIBANG HEXIN (CHINA)

- WUHU BETHEL AUTOMOTIVE (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL ELECTRIC PARKING BRAKE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Electric Parking Brake Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.00 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.77% |

Market Size in 2032: |

USD 25.31 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ELECTRIC PARKING BRAKE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ELECTRIC PARKING BRAKE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ELECTRIC PARKING BRAKE MARKET COMPETITIVE RIVALRY

TABLE 005. ELECTRIC PARKING BRAKE MARKET THREAT OF NEW ENTRANTS

TABLE 006. ELECTRIC PARKING BRAKE MARKET THREAT OF SUBSTITUTES

TABLE 007. ELECTRIC PARKING BRAKE MARKET BY TYPE

TABLE 008. CALLIPER INTEGRATED EPB MARKET OVERVIEW (2016-2028)

TABLE 009. CABLE PULLER EPB MARKET OVERVIEW (2016-2028)

TABLE 010. ELECTRIC PARKING BRAKE MARKET BY APPLICATION

TABLE 011. SEDANS MARKET OVERVIEW (2016-2028)

TABLE 012. SUVS MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA ELECTRIC PARKING BRAKE MARKET, BY TYPE (2016-2028)

TABLE 015. NORTH AMERICA ELECTRIC PARKING BRAKE MARKET, BY APPLICATION (2016-2028)

TABLE 016. N ELECTRIC PARKING BRAKE MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE ELECTRIC PARKING BRAKE MARKET, BY TYPE (2016-2028)

TABLE 018. EUROPE ELECTRIC PARKING BRAKE MARKET, BY APPLICATION (2016-2028)

TABLE 019. ELECTRIC PARKING BRAKE MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC ELECTRIC PARKING BRAKE MARKET, BY TYPE (2016-2028)

TABLE 021. ASIA PACIFIC ELECTRIC PARKING BRAKE MARKET, BY APPLICATION (2016-2028)

TABLE 022. ELECTRIC PARKING BRAKE MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA ELECTRIC PARKING BRAKE MARKET, BY TYPE (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA ELECTRIC PARKING BRAKE MARKET, BY APPLICATION (2016-2028)

TABLE 025. ELECTRIC PARKING BRAKE MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA ELECTRIC PARKING BRAKE MARKET, BY TYPE (2016-2028)

TABLE 027. SOUTH AMERICA ELECTRIC PARKING BRAKE MARKET, BY APPLICATION (2016-2028)

TABLE 028. ELECTRIC PARKING BRAKE MARKET, BY COUNTRY (2016-2028)

TABLE 029. ZF: SNAPSHOT

TABLE 030. ZF: BUSINESS PERFORMANCE

TABLE 031. ZF: PRODUCT PORTFOLIO

TABLE 032. ZF: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. CONTINENTAL: SNAPSHOT

TABLE 033. CONTINENTAL: BUSINESS PERFORMANCE

TABLE 034. CONTINENTAL: PRODUCT PORTFOLIO

TABLE 035. CONTINENTAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. CHASSIS BRAKES INTERNATIONAL: SNAPSHOT

TABLE 036. CHASSIS BRAKES INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 037. CHASSIS BRAKES INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 038. CHASSIS BRAKES INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. KÜSTER: SNAPSHOT

TABLE 039. KÜSTER: BUSINESS PERFORMANCE

TABLE 040. KÜSTER: PRODUCT PORTFOLIO

TABLE 041. KÜSTER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. AISIN: SNAPSHOT

TABLE 042. AISIN: BUSINESS PERFORMANCE

TABLE 043. AISIN: PRODUCT PORTFOLIO

TABLE 044. AISIN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. MANDO: SNAPSHOT

TABLE 045. MANDO: BUSINESS PERFORMANCE

TABLE 046. MANDO: PRODUCT PORTFOLIO

TABLE 047. MANDO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. HYUNDAI MOBIS: SNAPSHOT

TABLE 048. HYUNDAI MOBIS: BUSINESS PERFORMANCE

TABLE 049. HYUNDAI MOBIS: PRODUCT PORTFOLIO

TABLE 050. HYUNDAI MOBIS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. ZHEJIANG LIBANG HEXIN: SNAPSHOT

TABLE 051. ZHEJIANG LIBANG HEXIN: BUSINESS PERFORMANCE

TABLE 052. ZHEJIANG LIBANG HEXIN: PRODUCT PORTFOLIO

TABLE 053. ZHEJIANG LIBANG HEXIN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. WUHU BETHEL AUTOMOTIVE: SNAPSHOT

TABLE 054. WUHU BETHEL AUTOMOTIVE: BUSINESS PERFORMANCE

TABLE 055. WUHU BETHEL AUTOMOTIVE: PRODUCT PORTFOLIO

TABLE 056. WUHU BETHEL AUTOMOTIVE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 057. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 058. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 059. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ELECTRIC PARKING BRAKE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ELECTRIC PARKING BRAKE MARKET OVERVIEW BY TYPE

FIGURE 012. CALLIPER INTEGRATED EPB MARKET OVERVIEW (2016-2028)

FIGURE 013. CABLE PULLER EPB MARKET OVERVIEW (2016-2028)

FIGURE 014. ELECTRIC PARKING BRAKE MARKET OVERVIEW BY APPLICATION

FIGURE 015. SEDANS MARKET OVERVIEW (2016-2028)

FIGURE 016. SUVS MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA ELECTRIC PARKING BRAKE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE ELECTRIC PARKING BRAKE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC ELECTRIC PARKING BRAKE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA ELECTRIC PARKING BRAKE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA ELECTRIC PARKING BRAKE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Electric Parking Brake Market research report is 2024-2032.

ZF (Germany), Continental (Germany), Chassis Brakes International (Belgium), Küster (Germany), Aisin (Japan), Mando (South Korea), Hyundai Mobis (South Korea), Zhejiang Libang Hexin (China), Wuhu Bethel Automotive (China) and Other Major Players.

The Electric Parking Brake Market is segmented into by Type (Calliper Integrated EPB, Cable Puller EPB), Application (Sedans, SUVs, Others). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

An electric parking brake (EPB) is a modern braking system that replaces the traditional handbrake lever or foot pedal with an electronic switch. When activated, the EPB applies the brakes electronically, helping to hold the vehicle stationary when parked. It offers several advantages over traditional systems, such as automatic engagement, improved safety features, and space-saving design. EPBs are becoming increasingly common in modern vehicles due to their convenience and advanced functionalities.

Electric Parking Brake Market Size is Valued at USD 12.00 Billion in 2023 and is Projected to Reach USD 25.31 Billion by 2032, Growing at a CAGR of 9.77 % From 2024-2032.