Botanical Extracts Market Synopsis

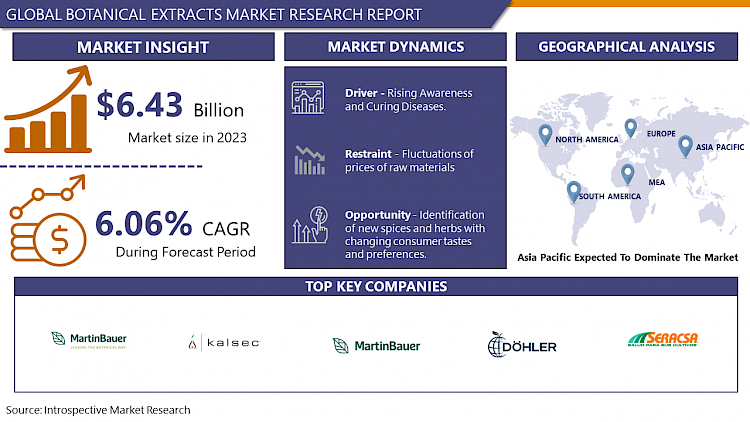

The Global Botanical Extracts Market size is expected to grow from USD 6.43 billion in 2023 to USD 10.91 billion by 2032, at a CAGR of 6.06% during the forecast period (2024-2032)

Botanical extracts are used as an ingredient in the food & beverages industry to amend flavor, aroma, or nutritive quality. This market is greatly altered by the changes in preferences and consumption patterns of consumers who are looking for natural flavors in their food.

- The botanical extracts market has witnessed significant growth in recent years, driven by increasing consumer demand for natural and plant-based products in various industries. These extracts are derived from plants, herbs, and flowers, and are valued for their diverse applications in food and beverages, pharmaceuticals, cosmetics, and nutraceuticals.

- Consumers are increasingly seeking healthier and sustainable alternatives, leading to a surge in the popularity of botanical extracts. The food and beverage industry utilizes these extracts for flavoring, coloring, and functional benefits. In the pharmaceutical sector, botanical extracts are valued for their medicinal properties and potential health benefits.

- The global market is characterized by a wide range of botanical extracts, including those from herbs like ginseng, echinacea, and turmeric, as well as fruits such as berries and citrus. The rising awareness of the health benefits associated with these extracts, coupled with growing research and development activities, is expected to further propel market growth.

Botanical Extracts Market Trend Analysis

Rising Awareness Among Individuals About the Benefits of Botanical Extracts

- In recent years, there has been a notable surge in awareness among individuals regarding the manifold benefits of botanical extracts, propelling the botanical extracts market to new heights. As people become increasingly health-conscious and seek natural alternatives, the demand for botanical extracts has witnessed a significant upswing. These extracts, derived from various plants and herbs, are gaining recognition for their therapeutic properties and potential contributions to overall well-being.

- Consumers are embracing botanical extracts for their diverse applications, including skincare, dietary supplements, and medicinal purposes. The growing awareness of the potential health benefits, such as anti-inflammatory, antioxidant, and immune-boosting properties, has fueled a positive perception of botanical extracts. Additionally, the trend towards sustainable and eco-friendly products has further amplified the appeal of these natural extracts.

- The information age has played a pivotal role in disseminating knowledge about botanical extracts, with individuals seeking information through online platforms and social media. As a result, there is a burgeoning market for botanical extracts, driven by a well-informed and health-conscious consumer base keen on integrating these natural solutions into their lifestyles. This rising awareness is not only shaping consumer choices but also influencing product innovation and market dynamics within the botanical extracts industry.

Identification of new spices and herbs with changing consumer tastes and preferences Creates an Opportunity

- The evolving landscape of consumer tastes and preferences presents a lucrative opportunity for the Botanical Extracts Market. As culinary trends shift and consumers seek novel flavor profiles, there is an increased demand for new spices and herbs to enhance the sensory experience of food and beverages. This dynamic market scenario prompts the exploration and identification of unique botanical extracts that can cater to changing preferences.

- Consumers are increasingly drawn to exotic and diverse flavors, driven by a growing interest in global cuisines and a desire for unique culinary experiences. As a result, the Botanical Extracts Market can capitalize on this trend by introducing innovative and lesser-known spices and herbs. The discovery and incorporation of these new botanical extracts not only align with consumer preferences but also contribute to the development of distinctive and marketable products.

- Manufacturers in the botanical extracts industry have the opportunity to collaborate with food innovators and chefs to create cutting-edge flavor combinations. This proactive approach to identifying and incorporating new spices and herbs ensures that the Botanical Extracts Market remains dynamic and responsive to the ever-changing landscape of consumer tastes, ultimately fostering growth and success in the industry.

Botanical Extracts Market Segment Analysis:

Botanical Extracts Market Segmented based on form, source, application.

By Source, Spices segment is expected to dominate the market during the forecast period

- The Spices segment is anticipated to emerge as the dominant force in the Botanical Extracts Market, fueled by several key factors that underscore its prominence. First and foremost, the increasing consumer demand for natural and organic products has significantly bolstered the appeal of botanical extracts derived from spices. Consumers are increasingly seeking healthier alternatives, and spices not only add flavor but also come with various health benefits.

- Moreover, the rich cultural and culinary heritage associated with spices has contributed to their widespread acceptance and utilization in various cuisines globally. As people become more adventurous in their culinary pursuits, the demand for exotic and diverse flavors, often derived from botanical extracts, is on the rise. This trend has particularly propelled the growth of the Spices segment, positioning it at the forefront of the Botanical Extracts Market.

By Form, powdered form segment held the largest share of 52.8% in 2022

- Powdered botanical extracts are known for their ease of handling, storage, and incorporation into different products, making them a preferred choice for manufacturers across diverse industries such as food and beverages, pharmaceuticals, and cosmetics. The powdered form allows for precise dosing and ensures consistent quality in the final products. Additionally, it offers a longer shelf life compared to liquid or other forms, enhancing the product's stability and usability.

- Furthermore, powdered botanical extracts are often more cost-effective in terms of transportation and storage, making them economically attractive for both producers and consumers. This segment's dominance is also driven by the increasing consumer preference for natural and plant-based ingredients, as powdered botanical extracts retain the essential bioactive compounds of plants in a concentrated form. As the demand for natural and functional ingredients continues to grow, the powdered form segment is expected to maintain its stronghold in the Botanical Extracts Market.

Botanical Extracts Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is poised to emerge as the dominant force in the global botanical extracts market, showcasing robust growth and market leadership. This projection is underpinned by several key factors contributing to the region's ascendancy in this industry.

- The Asia Pacific region boasts an abundant and diverse range of botanical resources, providing a rich repository for the extraction of various plant-based compounds. This abundance not only facilitates cost-effective production but also allows for a wide array of botanical extracts catering to diverse consumer demands.

- The increasing awareness and preference for natural and plant-based products among consumers in the Asia Pacific region drive the demand for botanical extracts. The cultural affinity towards traditional herbal remedies and holistic wellness practices further propels the adoption of botanical extracts in various applications.

- Moreover, the expanding pharmaceutical, food, and cosmetic industries in the Asia Pacific region contribute significantly to the market's growth. These industries increasingly recognize and integrate botanical extracts for their therapeutic, flavoring, and cosmetic properties, further amplifying the demand.

Botanical Extracts Market Top Key Players:

- BI Nutraceuticals (U.S.)

- Synergy Flavors (U.S.)

- Bell Flavors & Fragrances (U.S.)

- International Flavors and Fragrances Inc (US)

- Kalsec Inc (U.S.)

- Martin Bauer Group (Germany)

- Döhler GmbH (Germany)

- Fytosan (France)

- Nexira (France)

- Blue Sky Botanics (U.K.)

- Ransom Naturals Limited (UK)

- Frutarom Ltd. (Israel)

- Haldin Natural (Indonesia)

- Nutra Green Biotechnology Co.Ltd. (China)

- Synthite Industries Limited (India)

Key Industry Developments in the Botanical Extracts Market:

- In March 2023, US-basedIngredion, a leading ingredient solutions provider, completed the acquisition of Ingredi SA, a French botanical extracts manufacturer. This move strengthens Ingredion's foothold in the European market and expands its botanical extracts portfolio.

- In August 2023, French botanical extracts specialist Naturex joined forces with Danish flavor and enzyme producer Chr. Hansen in a €8.3 billion deal. This creates a global leader in natural ingredients, aiming to leverage combined expertise and market reach.

|

Global Botanical Extracts Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.43 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.06% |

Market Size in 2032: |

USD 10.91 Bn. |

|

Segments Covered: |

By Form |

|

|

|

By Source |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- BOTANICAL EXTRACTS MARKET BY FORM (2016-2030)

- BOTANICAL EXTRACTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- POWDER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LIQUID

- BOTANICAL EXTRACTS MARKET BY SOURCE (2016-2030)

- BOTANICAL EXTRACTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HERBS AND SPICES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FRUITS

- BOTANICAL EXTRACTS MARKET BY APPLICATION (2016-2030)

- BOTANICAL EXTRACTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BEVERAGES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PERSONAL CARE

- PHARMACEUTICAL

- NUTRACEUTICALS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- BOTANICAL EXTRACTS Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- BI NUTRACEUTICALS

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- SYNERGY FLAVORS (U.S.)

- BELL FLAVORS & FRAGRANCES (U.S.)

- INTERNATIONAL FLAVORS AND FRAGRANCES INC (US)

- KALSEC INC (U.S.)

- MARTIN BAUER GROUP (GERMANY)

- DÖHLER GMBH (GERMANY)

- FYTOSAN (FRANCE)

- NEXIRA (FRANCE)

- BLUE SKY BOTANICS (U.K.)

- RANSOM NATURALS LIMITED (UK)

- FRUTAROM LTD. (ISRAEL)

- HALDIN NATURAL (INDONESIA)

- NUTRA GREEN BIOTECHNOLOGY CO.LTD. (CHINA)

- SYNTHITE INDUSTRIES LIMITED (INDIA)

- COMPETITIVE LANDSCAPE

- GLOBAL BOTANICAL EXTRACTS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Form

- Historic And Forecasted Market Size By Source

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

-

|

Global Botanical Extracts Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.43 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.06% |

Market Size in 2032: |

USD 10.91 Bn. |

|

Segments Covered: |

By Form |

|

|

|

By Source |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BOTANICAL EXTRACTS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BOTANICAL EXTRACTS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BOTANICAL EXTRACTS MARKET COMPETITIVE RIVALRY

TABLE 005. BOTANICAL EXTRACTS MARKET THREAT OF NEW ENTRANTS

TABLE 006. BOTANICAL EXTRACTS MARKET THREAT OF SUBSTITUTES

TABLE 007. BOTANICAL EXTRACTS MARKET BY FORM

TABLE 008. POWDER MARKET OVERVIEW (2016-2028)

TABLE 009. LIQUID MARKET OVERVIEW (2016-2028)

TABLE 010. BOTANICAL EXTRACTS MARKET BY SOURCE

TABLE 011. HERBS & SPICES MARKET OVERVIEW (2016-2028)

TABLE 012. FRUITS MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. BOTANICAL EXTRACTS MARKET BY APPLICATION

TABLE 015. FOOD MARKET OVERVIEW (2016-2028)

TABLE 016. BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 017. PERSONAL CARE MARKET OVERVIEW (2016-2028)

TABLE 018. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

TABLE 019. NUTRACEUTICALS MARKET OVERVIEW (2016-2028)

TABLE 020. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 021. NORTH AMERICA BOTANICAL EXTRACTS MARKET, BY FORM (2016-2028)

TABLE 022. NORTH AMERICA BOTANICAL EXTRACTS MARKET, BY SOURCE (2016-2028)

TABLE 023. NORTH AMERICA BOTANICAL EXTRACTS MARKET, BY APPLICATION (2016-2028)

TABLE 024. N BOTANICAL EXTRACTS MARKET, BY COUNTRY (2016-2028)

TABLE 025. EUROPE BOTANICAL EXTRACTS MARKET, BY FORM (2016-2028)

TABLE 026. EUROPE BOTANICAL EXTRACTS MARKET, BY SOURCE (2016-2028)

TABLE 027. EUROPE BOTANICAL EXTRACTS MARKET, BY APPLICATION (2016-2028)

TABLE 028. BOTANICAL EXTRACTS MARKET, BY COUNTRY (2016-2028)

TABLE 029. ASIA PACIFIC BOTANICAL EXTRACTS MARKET, BY FORM (2016-2028)

TABLE 030. ASIA PACIFIC BOTANICAL EXTRACTS MARKET, BY SOURCE (2016-2028)

TABLE 031. ASIA PACIFIC BOTANICAL EXTRACTS MARKET, BY APPLICATION (2016-2028)

TABLE 032. BOTANICAL EXTRACTS MARKET, BY COUNTRY (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA BOTANICAL EXTRACTS MARKET, BY FORM (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA BOTANICAL EXTRACTS MARKET, BY SOURCE (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA BOTANICAL EXTRACTS MARKET, BY APPLICATION (2016-2028)

TABLE 036. BOTANICAL EXTRACTS MARKET, BY COUNTRY (2016-2028)

TABLE 037. SOUTH AMERICA BOTANICAL EXTRACTS MARKET, BY FORM (2016-2028)

TABLE 038. SOUTH AMERICA BOTANICAL EXTRACTS MARKET, BY SOURCE (2016-2028)

TABLE 039. SOUTH AMERICA BOTANICAL EXTRACTS MARKET, BY APPLICATION (2016-2028)

TABLE 040. BOTANICAL EXTRACTS MARKET, BY COUNTRY (2016-2028)

TABLE 041. FRUTAROM LTD. (ISRAEL): SNAPSHOT

TABLE 042. FRUTAROM LTD. (ISRAEL): BUSINESS PERFORMANCE

TABLE 043. FRUTAROM LTD. (ISRAEL): PRODUCT PORTFOLIO

TABLE 044. FRUTAROM LTD. (ISRAEL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. KALSEC INC (U.S.): SNAPSHOT

TABLE 045. KALSEC INC (U.S.): BUSINESS PERFORMANCE

TABLE 046. KALSEC INC (U.S.): PRODUCT PORTFOLIO

TABLE 047. KALSEC INC (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. DÖHLER GMBH (GERMANY): SNAPSHOT

TABLE 048. DÖHLER GMBH (GERMANY): BUSINESS PERFORMANCE

TABLE 049. DÖHLER GMBH (GERMANY): PRODUCT PORTFOLIO

TABLE 050. DÖHLER GMBH (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. NEXIRA (FRANCE): SNAPSHOT

TABLE 051. NEXIRA (FRANCE): BUSINESS PERFORMANCE

TABLE 052. NEXIRA (FRANCE): PRODUCT PORTFOLIO

TABLE 053. NEXIRA (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. HALDIN NATURAL (INDONESIA): SNAPSHOT

TABLE 054. HALDIN NATURAL (INDONESIA): BUSINESS PERFORMANCE

TABLE 055. HALDIN NATURAL (INDONESIA): PRODUCT PORTFOLIO

TABLE 056. HALDIN NATURAL (INDONESIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. SYNERGY FLAVORS (U.S.): SNAPSHOT

TABLE 057. SYNERGY FLAVORS (U.S.): BUSINESS PERFORMANCE

TABLE 058. SYNERGY FLAVORS (U.S.): PRODUCT PORTFOLIO

TABLE 059. SYNERGY FLAVORS (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. BELL FLAVORS & FRAGRANCES (U.S.): SNAPSHOT

TABLE 060. BELL FLAVORS & FRAGRANCES (U.S.): BUSINESS PERFORMANCE

TABLE 061. BELL FLAVORS & FRAGRANCES (U.S.): PRODUCT PORTFOLIO

TABLE 062. BELL FLAVORS & FRAGRANCES (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. NUTRA GREEN BIOTECHNOLOGY CO.LTD. (CHINA): SNAPSHOT

TABLE 063. NUTRA GREEN BIOTECHNOLOGY CO.LTD. (CHINA): BUSINESS PERFORMANCE

TABLE 064. NUTRA GREEN BIOTECHNOLOGY CO.LTD. (CHINA): PRODUCT PORTFOLIO

TABLE 065. NUTRA GREEN BIOTECHNOLOGY CO.LTD. (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. BLUE SKY BOTANICS (U.K.): SNAPSHOT

TABLE 066. BLUE SKY BOTANICS (U.K.): BUSINESS PERFORMANCE

TABLE 067. BLUE SKY BOTANICS (U.K.): PRODUCT PORTFOLIO

TABLE 068. BLUE SKY BOTANICS (U.K.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. FYTOSAN (FRANCE): SNAPSHOT

TABLE 069. FYTOSAN (FRANCE): BUSINESS PERFORMANCE

TABLE 070. FYTOSAN (FRANCE): PRODUCT PORTFOLIO

TABLE 071. FYTOSAN (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. BI NUTRACEUTICALS (U.S.): SNAPSHOT

TABLE 072. BI NUTRACEUTICALS (U.S.): BUSINESS PERFORMANCE

TABLE 073. BI NUTRACEUTICALS (U.S.): PRODUCT PORTFOLIO

TABLE 074. BI NUTRACEUTICALS (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. RANSOM NATURALS LIMITED (UK): SNAPSHOT

TABLE 075. RANSOM NATURALS LIMITED (UK): BUSINESS PERFORMANCE

TABLE 076. RANSOM NATURALS LIMITED (UK): PRODUCT PORTFOLIO

TABLE 077. RANSOM NATURALS LIMITED (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. INTERNATIONAL FLAVORS AND FRAGRANCES INC (USA): SNAPSHOT

TABLE 078. INTERNATIONAL FLAVORS AND FRAGRANCES INC (USA): BUSINESS PERFORMANCE

TABLE 079. INTERNATIONAL FLAVORS AND FRAGRANCES INC (USA): PRODUCT PORTFOLIO

TABLE 080. INTERNATIONAL FLAVORS AND FRAGRANCES INC (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. SYNTHITE INDUSTRIES LIMITED (INDIA): SNAPSHOT

TABLE 081. SYNTHITE INDUSTRIES LIMITED (INDIA): BUSINESS PERFORMANCE

TABLE 082. SYNTHITE INDUSTRIES LIMITED (INDIA): PRODUCT PORTFOLIO

TABLE 083. SYNTHITE INDUSTRIES LIMITED (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. MARTIN BAUER GROUP (GERMANY): SNAPSHOT

TABLE 084. MARTIN BAUER GROUP (GERMANY): BUSINESS PERFORMANCE

TABLE 085. MARTIN BAUER GROUP (GERMANY): PRODUCT PORTFOLIO

TABLE 086. MARTIN BAUER GROUP (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 087. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 088. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 089. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BOTANICAL EXTRACTS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BOTANICAL EXTRACTS MARKET OVERVIEW BY FORM

FIGURE 012. POWDER MARKET OVERVIEW (2016-2028)

FIGURE 013. LIQUID MARKET OVERVIEW (2016-2028)

FIGURE 014. BOTANICAL EXTRACTS MARKET OVERVIEW BY SOURCE

FIGURE 015. HERBS & SPICES MARKET OVERVIEW (2016-2028)

FIGURE 016. FRUITS MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. BOTANICAL EXTRACTS MARKET OVERVIEW BY APPLICATION

FIGURE 019. FOOD MARKET OVERVIEW (2016-2028)

FIGURE 020. BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 021. PERSONAL CARE MARKET OVERVIEW (2016-2028)

FIGURE 022. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

FIGURE 023. NUTRACEUTICALS MARKET OVERVIEW (2016-2028)

FIGURE 024. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 025. NORTH AMERICA BOTANICAL EXTRACTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. EUROPE BOTANICAL EXTRACTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. ASIA PACIFIC BOTANICAL EXTRACTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. MIDDLE EAST & AFRICA BOTANICAL EXTRACTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. SOUTH AMERICA BOTANICAL EXTRACTS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Botanical Extracts Market research report is 2024-2032.

Frutarom Ltd. (Israel), Kalsec Inc (U.S.), Döhler GmbH (Germany), Nexira (France), Haldin Natural (Indonesia), Synergy Flavors (U.S.), Bell Flavors & Fragrances (U.S.), Nutra Green Biotechnology Co.Ltd. (China), Blue Sky Botanics (U.K.), Fytosan (France), BI Nutraceuticals (U.S.), Ransom Naturals Limited (UK), International Flavors and Fragrances Inc (USA), Synthite Industries Limited (India), Martin Bauer Group (Germany) and Other Major Players.

The Botanical Extracts Market is segmented into form, source, application, and region. Form, the market is categorized into Powder and Liquid. By Source, the market is categorized into Herbs & Spices and Fruits. By Application, the market is categorized into Beverages, Personal care, Pharmaceuticals, Nutraceuticals. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Botanical extracts are used as an ingredient in the food & beverages industry to amend flavor, aroma, or nutritive quality. This market is greatly altered by the changes in preferences and consumption patterns of consumers who are looking for natural flavors in their food.

The Global Botanical Extracts Market size is expected to grow from USD 6.43 billion in 2023 to USD 10.91 billion by 2032, at a CAGR of 6.06% during the forecast period (2024-2032)