Global Bone Cutting Surgical Tool Market Overview

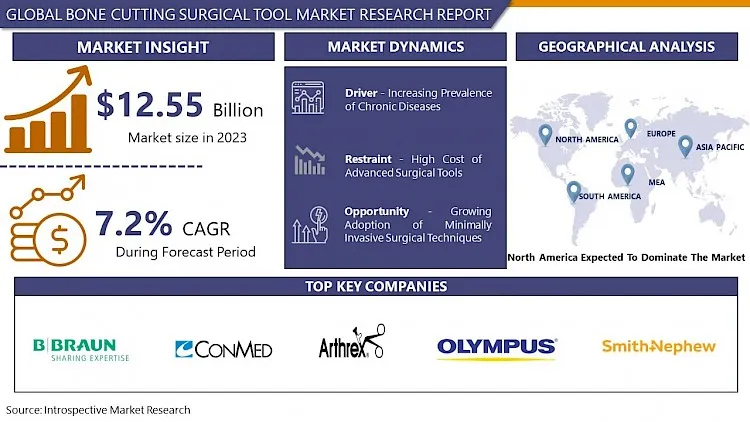

Bone Cutting Surgical Tool Market Size Was Valued at USD 12.55 Billion in 2023, and is Projected to Reach USD 23.47 Billion by 2032, Growing at a CAGR of 7.2% From 2024-2032.

As the name implies, a bone cutter is a surgical tool used to cut or remove bones. The bone cutter is a vital part of modern medicine. An effective medical tool, the Bone-Cutting Tool is used for cutting bone during surgical procedures. Bones can be carefully trimmed or removed with the help of a specialized tool called a bone shaper. Create a bone fitting from the tibia tubercle measuring 9 millimeters in width and a bone fitting from the patella measuring 11 millimeters in width by using a bone shaper or mischief to remove excess bone from both bone attachments.

Only turning devices such as penetrates and brambles or moderately swaying saws were used for the specialist's daily work of performing bone cuts and bone trepanations. This chore was an essential part of the specialist's job. Just in the past ten years, new technologies have been commercially available and ensured the availability of tools for bone cutting such as lasers and piezo tomes. When it comes to the actual function of cutting bone, drills, brambles, lasers, and piezo tomes all act in a generally distinct manner. In addition to their use in medical procedures, these instruments are also utilized in the investigation of crime scenes, the torturing, and the evisceration of victims. The increasing number of people who are interested in surgery or bone problems.

Market Dynamics And Factors For Bone Cutting Surgical Tool Market

Drivers:

Increase in Cases of Bone Issues and Muscular Problems

- The Bone Cutting Surgical Tool Market has seen a surge in demand due to an increase in cases of bone issues and muscular problems. Several factors are driving this trend. The aging population worldwide is experiencing a rise in musculoskeletal disorders such as osteoarthritis, osteoporosis, and fractures, leading to a greater need for surgical interventions. Additionally, the prevalence of sports injuries and accidents contributes to the demand for advanced bone-cutting tools to aid in precise and efficient surgeries.

- Technological advancements in orthopedic surgical tools have enhanced surgical outcomes, reducing recovery time and improving patient satisfaction. These innovations include minimally invasive techniques, computer-assisted navigation systems, and robotic-assisted surgeries, which require specialized bone-cutting instruments for optimal performance.

- Increasing healthcare expenditure and growing awareness about the benefits of surgical interventions among patients and healthcare providers are also fueling the growth of the bone-cutting surgical tool market.

Restraints:

Lack of Knowledge of Proper Handling of the Device

- The Bone Cutting Surgical Tool Market faces significant restraints due to the lack of knowledge in proper device handling. Surgical tools designed for cutting bone require precise handling to ensure patient safety and optimal surgical outcomes. However, inadequate training and education among healthcare professionals contribute to mishandling, leading to potential risks such as tissue damage, infections, and surgical errors.

- The complexity of these devices demands thorough understanding and proficiency in their operation. Without proper training programs and guidelines, healthcare providers may struggle to utilize these tools effectively, limiting their adoption and utilization in clinical settings. Additionally, the lack of standardized protocols for training exacerbates the issue, leaving healthcare professionals with inconsistent knowledge and skills across different institutions.

Opportunity:

Rise in Research & Development Activities to Improve Quality

- The surge in research and development (R&D) activities presents significant opportunities for the Bone Cutting Surgical Tool Market. Advancements in technology and materials, coupled with increasing demand for minimally invasive procedures, are driving innovation in surgical tools.

- R&D efforts are focusing on enhancing the precision, efficiency, and safety of bone cutting tools, ultimately improving patient outcomes. Innovations such as laser-guided systems, robotics-assisted surgery, and advanced imaging techniques are revolutionizing bone surgery by offering greater accuracy and reducing recovery times.

- The growing prevalence of orthopedic conditions, including osteoporosis and fractures, necessitates better tools for surgical interventions. R&D initiatives aim to address these clinical needs by developing tools that are tailored to specific procedures, anatomies, and patient demographics.

- Collaborations between medical device companies, research institutions, and healthcare providers are fostering a conducive environment for innovation. This collaborative approach facilitates the translation of research findings into practical solutions, accelerating the pace of technological advancement in the bone cutting surgical tool market.

Regional Analysis of Bone Cutting Surgical Tool Market

Because of the large number of elderly people in the rapidly expanding American population, North America is the leading market for bone-cutting technologies. North America continues to have a robust R&D history, and the area is also spending more on healthcare.

Since there are more influential people in the medical device industry in the United States, medical products sold there have a larger market share. Manufacturers have long had their sights set on the United States as a market for their cutting-edge wares. The backing of these influential people, together with the United States established medical infrastructure and high healthcare spending, propels the country in a profitable direction. Significant growth in the market for cutting-edge technology has been spurred by factors such as the growing number of patients, increasingly sophisticated healthcare facilities, and the strategic developments of the leading competitors.

Top Key Players Covered In Bone Cutting Surgical Tool Market

- B. Braun Melsungen AG (Germany)

- CONMED Corporation (United States)

- MicroAire Surgical Instruments, LLC (United States)

- DePuy Synthes Companies (United States)

- Arthrex, Inc. (United States)

- Karl Storz SE & Co. KG (Germany)

- Olympus Corporation (Japan)

- Richard Wolf GmbH (Germany)

- CONMED Corporation (United States)

- Aesculap, Inc. (Germany)

- Tekno-Medical Optik-Chirurgie GmbH (Germany)

- Hu-Friedy Mfg. Co., LLC (United States)

- KLS Martin Group (Germany)

- Innomed, Inc. (United States)

- Millennium Surgical Corp. (United States

Key Industry Developments:

- In March 2024: Stryker announced the release of its Gamma4 Hip Fracture Nailing System in most of the European markets. The newest Gamma system will provide surgeons with the next generation of Stryker’s intramedullary nailing system. The Gamma4 system is designed to treat hip and femur fractures and streamline procedural workflows for surgeons.

- In March 2024: Stryker announced that it had completed the previously announced acquisition of SERF SAS, a France-based joint replacement company, from Menix. The acquisition of SERF SAS further strengthens global portfolio and reinforces dedication to orthopaedic excellence.

- In March 2024: Medtronic plc, announced that the United States Food and Drug Administration (FDA) has approved the Evolut™ FX+ transcatheter aortic valve replacement (TAVR) system for the treatment of symptomatic severe aortic stenosis. The latest Evolut FX+ TAVR system maintains the valve performance benefits of the legacy Evolut TAVR platform and is designed to facilitate coronary access.

|

Global Bone Cutting Surgical Tool Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.55 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.2% |

Market Size in 2032: |

USD 23.47 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By End-Users

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Bone Cutting Surgical Tool Market by Type

5.1 Bone Cutting Surgical Tool Market Overview Snapshot and Growth Engine

5.2 Bone Cutting Surgical Tool Market Overview

5.3 Direct Apposition Sphincteroplasty

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Direct Apposition Sphincteroplasty: Geographic Segmentation

5.4 Overlapping Sphincteroplasty

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Overlapping Sphincteroplasty: Geographic Segmentation

Chapter 6: Bone Cutting Surgical Tool Market by End-Users

6.1 Bone Cutting Surgical Tool Market Overview Snapshot and Growth Engine

6.2 Bone Cutting Surgical Tool Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals: Geographic Segmentation

6.4 Ambulatory Surgical Centers

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Ambulatory Surgical Centers: Geographic Segmentation

6.5 Others

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Others: Geographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Bone Cutting Surgical Tool Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Bone Cutting Surgical Tool Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Bone Cutting Surgical Tool Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 INTUITIVE SURGICAL INC. (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 STRYKER CORPORATION (UNITED STATES)

7.4 MEDTRONIC PLC. (IRELAND)

7.5 ZIMMER BIOMET (UNITED STATES)

7.6 GLOBUS MEDICAL INC. (UNITED STATES)

7.7 SMITH AND NEPHEW PLC. (UNITED KINGDOM)

7.8 MAZOR ROBOTICS (ISRAEL)

7.9 ACCURAY INCORPORATED (UNITED STATES)

7.10 WRIGHT MEDICAL GROUP N.V. (UNITED STATES)

7.11 JOHNSON & JOHNSON SERVICES INC. (NEW JERSEY)

7.12 OTHER MAJOR PLAYERS

Chapter 8: Global Bone Cutting Surgical Tool Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Direct Apposition Sphincteroplasty

8.2.2 Overlapping Sphincteroplasty

8.3 Historic and Forecasted Market Size By End-Users

8.3.1 Hospitals

8.3.2 Ambulatory Surgical Centers

8.3.3 Others

Chapter 9: North America Bone Cutting Surgical Tool Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Direct Apposition Sphincteroplasty

9.4.2 Overlapping Sphincteroplasty

9.5 Historic and Forecasted Market Size By End-Users

9.5.1 Hospitals

9.5.2 Ambulatory Surgical Centers

9.5.3 Others

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Bone Cutting Surgical Tool Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Direct Apposition Sphincteroplasty

10.4.2 Overlapping Sphincteroplasty

10.5 Historic and Forecasted Market Size By End-Users

10.5.1 Hospitals

10.5.2 Ambulatory Surgical Centers

10.5.3 Others

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Bone Cutting Surgical Tool Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Direct Apposition Sphincteroplasty

11.4.2 Overlapping Sphincteroplasty

11.5 Historic and Forecasted Market Size By End-Users

11.5.1 Hospitals

11.5.2 Ambulatory Surgical Centers

11.5.3 Others

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Bone Cutting Surgical Tool Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Direct Apposition Sphincteroplasty

12.4.2 Overlapping Sphincteroplasty

12.5 Historic and Forecasted Market Size By End-Users

12.5.1 Hospitals

12.5.2 Ambulatory Surgical Centers

12.5.3 Others

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Bone Cutting Surgical Tool Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Direct Apposition Sphincteroplasty

13.4.2 Overlapping Sphincteroplasty

13.5 Historic and Forecasted Market Size By End-Users

13.5.1 Hospitals

13.5.2 Ambulatory Surgical Centers

13.5.3 Others

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Bone Cutting Surgical Tool Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.55 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.2% |

Market Size in 2032: |

USD 23.47 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Bone Cutting Surgical Tool Market research report is 2024-2032.

Intuitive Surgical Inc. (United States), Stryker Corporation (United States), Medtronic Plc. (Ireland), Zimmer Biomet (United States), Globus Medical Inc. (United States), Smith and Nephew plc. (United Kingdom), Mazor Robotics (Israel), Accuray Incorporated (United States), Wright Medical Group N.V. (United States), Johnson and Johnson Services Inc. (New Jersey), and Other Major Players.

The Bone Cutting Surgical Tool Market has been segmented into Product Type, Technology Type, Application, and region. By Product Type, the market is categorized into Systems, Disposables. By Technology Type, the market is categorized into Drills, Burs, Lasers, Piezo tomes, and Others. By Application Type, Partial Knee Replacement, Total Knee Replacement, MIS Fusion, Endochondral ossification, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A bone cutter is a surgical instrument used to cut or remove bones. Bone-Cutting Tool is a fundamental piece of present-day advancements. Bone-Cutting Tool is a useful gadget utilized for bone medical procedures. A bone shaper is a careful instrument used to cut or eliminate bones. Utilize a bone shaper or mischief to eliminate overabundance of bone from both bone attachments to design a 9-mm-width bone fitting from the tibia tubercle and an 11-mm-measurement bone fitting from the patella. Utilize a bone sizer to pack any abundance of cancellous bone.

Bone Cutting Surgical Tool Market Size Was Valued at USD 12.55 Billion in 2023, and is Projected to Reach USD 23.47 Billion by 2032, Growing at a CAGR of 7.2% From 2024-2032.