Black Seed Oil Market Synopsis

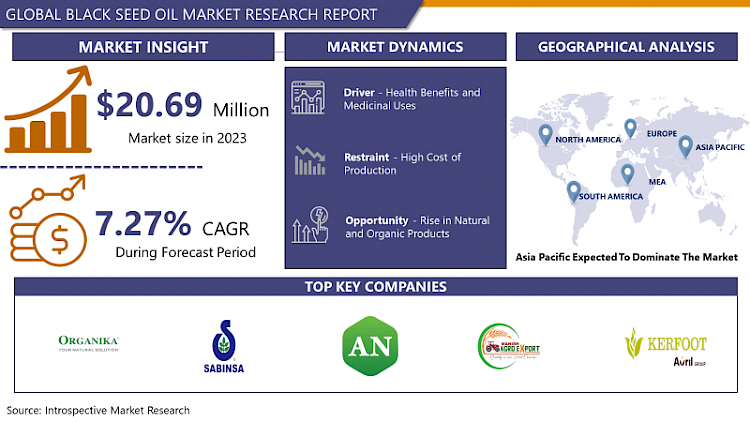

Black Seed Oil Market Size Was Valued at USD 20.69 Million in 2023 and is Projected to Reach USD 38.91 Million by 2032, Growing at a CAGR of 7.27% From 2024-2032.

Black seed oil is extracted from Nigella sativa as an oil-rich seed from the family of Ranunculucae writing a history on the map of traditional medicine with more emphasis to Middle Eastern and Southeast Asia.

- Because of its high concentrations of biologically active chemicals, black seed oil is valued for its pharmacological attributes, such as thymoquinone, nigellone, and beta-sitosterol. It has been used for decades to remedy assorted diseases, which affected the respiratory system, digestion, and other organs and systems of the human body, and its healing properties are described in hundreds of years ago in various documents.

- However, the usage and importance of black seed oil has recently increased in the scientific world due to indications on its anti-inflammatory, antioxidant, and antimicrobial properties. It is frequently utilized for its beneficial role in enhancing immune health, skin health, asthma, diabetes, and hypertension.

- However, as for the positive effects of black seed oil, to date, it is still regarding it as a natural supplement for a holistic approach to health and treatment.

Black Seed Oil Market Trend Analysis

Growing demand for natural remedies

- Owing to the increased awareness of clients about the benefits of natural products, black seed oil is witnessing a consistent boost. The buying public today goes for products derived from natural sources as they look for natural remedies for their health complications instead of synthetic chemical products.

- This has been driven by increasing consciousness of the variety of side effects linked with the usual chemical drugs, and thereby, to venture into plant products that have long background use and treatment values. Black seed oil perfectly aptly falls into this category again due to the historical knowledge about it, and the wide array of potentially healthful effects on the body – it can be considered as a dietary product which can be consumed by everyone who aims at improving their health naturally.

- Furthermore, the well-being and supplement sector has rightly embraced this and widely marketed black seeds oil as an all-inclusive herbal cure. Health experts, social media personalities, blogger sites have been at the frontier of advocating for it in the market and among the users.

- The market has seen its stocks rise, offering a diverse range of BO in various forms, such as natural oils, capsules, and gels that some clients may prefer over others. This growth not only aids the market in expanding but also in promoting the scientific analysis of aloe Vera oil for enhanced health benefits that may unlock other uses of the product for health improvement thereby cementing its presence in the market for organic cures.

Increased research on the effectiveness of black seed oil

- The possibility of enhanced research on the efficacy of the black seed oil and the shortcomings of the black seed oil market is a major opportunity. Ongoing research on this minute constituent aims at establishing the health benefits of the oil, therefore increasing consumer confidence on the same.

- But the rigorous clinical trials and research made available by peer-reviewed journals eradicating myths about its bogus applications and explaining its inflammatory, antioxidant, and antimicrobial effects. This stream of research interest not only benefits health and nutritionally conscious customers, but it also reaches out to the medical professionals and the overall well-being market, which may contribute to a higher rise in regard to black seed oil as a viable, all-natural cure.

- Furthermore it can also bring about new advancements within the market and its continual growth research. The application of the new scientific outputs in the production process of black seed oil products creates the opportunity for companies to deliver enhanced and focused products to address various health issues including metabolic issues, dermatological ailments or immune support.

- Health-related improvements to the composition of the products and the creation of innovative delivery systems, supported by research, have the potential of creating product differentiation and, in turn, attract more clients. Therefore, in view of the fact that various scientific research has shown that there are many benefits to Black Seed Oil, regulatory authorities may in future allow its use for many more applications, which will help stoke further market growth and make Black Seed Oil an industry standard under health foods/natural supplements.

Black Seed Oil Market Segment Analysis:

Black Seed Oil Market is Segmented based on Product, and Application.

By Product, oil is expected to dominate the market during the forecast period

- The oil segment holds the highest market share in the black seed oil market, which can be attributed to the fact that the product has found widespread application and is traditionally consumed in meals. It is preferred to be in pure oil form as they are a versatile form that can be taken internally, applied externally, or mixed with food and drinks.

- One thing that is appealing about this form of oil is its flexibility making it suitable for anybody who wants oils from coconut for overall body health improvement or for those who want to use it to address specific challenges like skin problems or breathing difficulties. Further, one gets the impression of the oil being stronger and the option of choosing the size of the doses to administer also adds to creating a market for oil extracts over the packaged forms.

- Also, the oil segment utilizes a very important factor such as presence in cultural practices ,and as such has more credibility as compared to the rest. Most consumers remain convinced of the genuine and efficiency of the pure black seed oil as supported by traditional medicine and the uses of the product in natural and other medicine. This trust is further supported by the testimonies from health influential and advocates of natural remedies who recommend the oil form because it lacks additives and can be used in many instances.

- Consequently, while such forms as powders, tablets, capsules and soft gels are relatively more common as they gain market acceptance, the oil segment remains most popular with the consumers thanks to the more established base and versatility of the product.

By Applications, Nutraceutical segment held the largest share

- The two major segments of the global black seed oil are nutraceutical, due to the shift of the consumers opting for more natural and preventive health care products. The Black seed oil has numerous health benefits thus covering many aspects of the health needs of an individual, some of the benefits include supports the immune system, helps to reduce inflammation, has shown to have potential in the control of chronic illnesses for example diabetes and hypertension among others. T

- his accounts for the popularity of the supplement in the nutraceutical market, whereby it is sold as a compound that is beneficial to the body and can be used; to reinforce general health and well-being. Consumers are resorting to preventive measures regarding their health and are using nutraceutical products using natural and scientifically proven benefits for the body leading to high growth in the demand for black seed oil it this segment.

- In addition, the nutraceutical segment has a particularly strong footing due to increased research and development expenditure, which in turn has highlighted the versatility of benefits of black seed oil. This scientific support not only enhances the buyer emotions of effectiveness but also persuades the health military to use it as another natural health product.

- It has been socialized that anticipated products of black seed oil in capsule and soft gel forms are tailor fitted to the demands of the nutraceutical market with respect to palatability. Thus, current awareness of ‘healthy living’ makes people dedicated to using nutraceuticals, thus keeping this segment as the major application for black seed oil, which stimulates the growth of the market.

Black Seed Oil Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region holds the greatest market share for black seed oil due to the longstanding use and culture towards natural herbs and medications in the various countries of the region. It was used in numerous countries where ancient medical systems like Ayurveda of India, Traditional Chinese Medicine of China and Unani are practiced extensively, including South East Asian countries.

- Such a prolonged usage throughout the history has established a healthy bond and belief of people living in these areas with the black seed oil. The acknowledgement and build-up of conventional natural products in today’s culture indicates the massive potential market for black seed oil products.

- In addition, Various markets like the Asia-Pacific region show an increased rate of economic growth, and since people have more disposable income they prefer to spend on health and wellness products. The audience today is more conscious about its health, educated on preventive health and is ready to spend on that aspect and natural supplements. This is because, today’s advancing middle class and following the trend in global health and fitness, has also boosted the consumption of black seed oil.

- Also, because the region has enormous and rich resources of agricultural prospects, it effectively allows for the large scale production and accessibility to black seed oil—a significant factor consolidating the market. Due to the values of culture, the progress in the economic growth, and health consciousness in the Asia Pacific region, black seed oil is predominantly preferred region.

Active Key Players in the Black Seed Oil Market

- Al-Ameen Sales and Marketing Pvt Ltd (Pakistan)

- Amazing Herbs (USA)

- BioNatal LLC (USA)

- Botanic Choice (USA)

- Hab Shifa (Australia)

- Hearthy Foods (USA)

- Hemani Herbal LLC (UAE)

- Kalonji Oil (Pvt) Ltd (Pakistan)

- Manus Aktteva Biopharma LLP (India)

- Nature’s Blends (UK)

- Nature's Way Products, LLC (USA)

- Organika Health Products Inc. (Canada)

- Perfect Press (Canada)

- Sabinsa Corporation (USA)

- Safa Honey Co. (India)

- Sanabio GmbH (Germany)

- Sweet Sunnah (USA)

- The Blessed Seed (UK)

- TriNutra Ltd. (Israel)

- Z-Company (Netherlands)

- Other Key Players

Key Industry Developments in the Black Seed Oil Market:

-

In February 2023, Blackmores, Australia's leading natural health company, launched its Ultra Refined Black Seed Oil in India. This marks Blackmores' entry into the Indian market, aiming to provide individuals with a natural option for improving their health and well-being through this product.

In November 2023, the Thailand FDA approved TriNutra's ThymoQuin, a cold-pressed black seed oil standardized to 3% thymoquinone and under 1.25% free fatty acids, as a novel dietary supplement ingredient. Available via Aumento Chemical Ltd, it supports immune and cardiovascular health and is recognized in Thai herbal medicine for digestive and circulatory benefits.

|

Global Black Seed Oil Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 20.99 Mn. |

|

Forecast Period 2023-32 CAGR: |

7.27% |

Market Size in 2032: |

USD 39.91 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- BLACK SEED OIL MARKET BY TYPE (2017-2032)

- BLACK SEED OIL MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- OIL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- POWDER,

- TABLETS, & CAPSULES

- SOFT GEL

- BLACK SEED OIL MARKET BY APPLICATIONS (2017-2032)

- BLACK SEED OIL MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PERSONAL CARE & COSMETICS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PHARMACEUTICALS

- NUTRACEUTICAL

- FLAVORING & DRESSING

- CULINARY

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- BLACK SEED OIL Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- AL-AMEEN SALES AND MARKETING PVT LTD (PAKISTAN)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- AMAZING HERBS (USA)

- BIONATAL LLC (USA)

- BOTANIC CHOICE (USA)

- HAB SHIFA (AUSTRALIA)

- HEARTHY FOODS (USA)

- HEMANI HERBAL LLC (UAE)

- KALONJI OIL (PVT) LTD (PAKISTAN)

- MANUS AKTTEVA BIOPHARMA LLP (INDIA)

- NATURE’S BLENDS (UK)

- NATURE'S WAY PRODUCTS, LLC (USA)

- ORGANIKA HEALTH PRODUCTS INC. (CANADA)

- PERFECT PRESS (CANADA)

- SABINSA CORPORATION (USA)

- SAFA HONEY CO. (INDIA)

- SANABIO GMBH (GERMANY)

- SWEET SUNNAH (USA)

- THE BLESSED SEED (UK)

- TRINUTRA LTD. (ISRAEL)

- Z-COMPANY (NETHERLANDS)

- COMPETITIVE LANDSCAPE

- GLOBAL BLACK SEED OIL MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Black Seed Oil Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 20.99 Mn. |

|

Forecast Period 2023-32 CAGR: |

7.27% |

Market Size in 2032: |

USD 39.91 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BLACK SEED OIL MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BLACK SEED OIL MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BLACK SEED OIL MARKET COMPETITIVE RIVALRY

TABLE 005. BLACK SEED OIL MARKET THREAT OF NEW ENTRANTS

TABLE 006. BLACK SEED OIL MARKET THREAT OF SUBSTITUTES

TABLE 007. BLACK SEED OIL MARKET BY FORM

TABLE 008. LIQUID MARKET OVERVIEW (2016-2028)

TABLE 009. CAPSULE MARKET OVERVIEW (2016-2028)

TABLE 010. AND SOFT GEL MARKET OVERVIEW (2016-2028)

TABLE 011. BLACK SEED OIL MARKET BY APPLICATION

TABLE 012. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

TABLE 013. PERSONAL CARE AND COSMETICS MARKET OVERVIEW (2016-2028)

TABLE 014. FOOD SUPPLEMENT MARKET OVERVIEW (2016-2028)

TABLE 015. FUNCTIONAL FOOD MARKET OVERVIEW (2016-2028)

TABLE 016. FLAVORING AND DRESSING MARKET OVERVIEW (2016-2028)

TABLE 017. CULINARY AND OTHERS MARKET OVERVIEW (2016-2028)

TABLE 018. BLACK SEED OIL MARKET BY DISTRIBUTION CHANNELS

TABLE 019. HYPERMARKET/SUPERMARKET MARKET OVERVIEW (2016-2028)

TABLE 020. DRUG STORE MARKET OVERVIEW (2016-2028)

TABLE 021. CONVENIENCE STORE MARKET OVERVIEW (2016-2028)

TABLE 022. ONLINE MARKET OVERVIEW (2016-2028)

TABLE 023. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 024. NORTH AMERICA BLACK SEED OIL MARKET, BY FORM (2016-2028)

TABLE 025. NORTH AMERICA BLACK SEED OIL MARKET, BY APPLICATION (2016-2028)

TABLE 026. NORTH AMERICA BLACK SEED OIL MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 027. N BLACK SEED OIL MARKET, BY COUNTRY (2016-2028)

TABLE 028. EUROPE BLACK SEED OIL MARKET, BY FORM (2016-2028)

TABLE 029. EUROPE BLACK SEED OIL MARKET, BY APPLICATION (2016-2028)

TABLE 030. EUROPE BLACK SEED OIL MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 031. BLACK SEED OIL MARKET, BY COUNTRY (2016-2028)

TABLE 032. ASIA PACIFIC BLACK SEED OIL MARKET, BY FORM (2016-2028)

TABLE 033. ASIA PACIFIC BLACK SEED OIL MARKET, BY APPLICATION (2016-2028)

TABLE 034. ASIA PACIFIC BLACK SEED OIL MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 035. BLACK SEED OIL MARKET, BY COUNTRY (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA BLACK SEED OIL MARKET, BY FORM (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA BLACK SEED OIL MARKET, BY APPLICATION (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA BLACK SEED OIL MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 039. BLACK SEED OIL MARKET, BY COUNTRY (2016-2028)

TABLE 040. SOUTH AMERICA BLACK SEED OIL MARKET, BY FORM (2016-2028)

TABLE 041. SOUTH AMERICA BLACK SEED OIL MARKET, BY APPLICATION (2016-2028)

TABLE 042. SOUTH AMERICA BLACK SEED OIL MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 043. BLACK SEED OIL MARKET, BY COUNTRY (2016-2028)

TABLE 044. SAFA HONEY COMPANY: SNAPSHOT

TABLE 045. SAFA HONEY COMPANY: BUSINESS PERFORMANCE

TABLE 046. SAFA HONEY COMPANY: PRODUCT PORTFOLIO

TABLE 047. SAFA HONEY COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. Z-COMPANY: SNAPSHOT

TABLE 048. Z-COMPANY: BUSINESS PERFORMANCE

TABLE 049. Z-COMPANY: PRODUCT PORTFOLIO

TABLE 050. Z-COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. AMAZING AN NUTRITION: SNAPSHOT

TABLE 051. AMAZING AN NUTRITION: BUSINESS PERFORMANCE

TABLE 052. AMAZING AN NUTRITION: PRODUCT PORTFOLIO

TABLE 053. AMAZING AN NUTRITION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. INC.: SNAPSHOT

TABLE 054. INC.: BUSINESS PERFORMANCE

TABLE 055. INC.: PRODUCT PORTFOLIO

TABLE 056. INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. FLAVEX INC.: SNAPSHOT

TABLE 057. FLAVEX INC.: BUSINESS PERFORMANCE

TABLE 058. FLAVEX INC.: PRODUCT PORTFOLIO

TABLE 059. FLAVEX INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. KERFOOT GROUP.: SNAPSHOT

TABLE 060. KERFOOT GROUP.: BUSINESS PERFORMANCE

TABLE 061. KERFOOT GROUP.: PRODUCT PORTFOLIO

TABLE 062. KERFOOT GROUP.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. OAS PRODUCTS: SNAPSHOT

TABLE 063. OAS PRODUCTS: BUSINESS PERFORMANCE

TABLE 064. OAS PRODUCTS: PRODUCT PORTFOLIO

TABLE 065. OAS PRODUCTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. MANISH AGRO: SNAPSHOT

TABLE 066. MANISH AGRO: BUSINESS PERFORMANCE

TABLE 067. MANISH AGRO: PRODUCT PORTFOLIO

TABLE 068. MANISH AGRO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. SABINSA CORPORATION: SNAPSHOT

TABLE 069. SABINSA CORPORATION: BUSINESS PERFORMANCE

TABLE 070. SABINSA CORPORATION: PRODUCT PORTFOLIO

TABLE 071. SABINSA CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. ORGANIKA HEALTH PRODUCTS INC.: SNAPSHOT

TABLE 072. ORGANIKA HEALTH PRODUCTS INC.: BUSINESS PERFORMANCE

TABLE 073. ORGANIKA HEALTH PRODUCTS INC.: PRODUCT PORTFOLIO

TABLE 074. ORGANIKA HEALTH PRODUCTS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. SANABIO: SNAPSHOT

TABLE 075. SANABIO: BUSINESS PERFORMANCE

TABLE 076. SANABIO: PRODUCT PORTFOLIO

TABLE 077. SANABIO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. HENRY LAMOTTE OILS GMBH: SNAPSHOT

TABLE 078. HENRY LAMOTTE OILS GMBH: BUSINESS PERFORMANCE

TABLE 079. HENRY LAMOTTE OILS GMBH: PRODUCT PORTFOLIO

TABLE 080. HENRY LAMOTTE OILS GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. OILS GMBH.: SNAPSHOT

TABLE 081. OILS GMBH.: BUSINESS PERFORMANCE

TABLE 082. OILS GMBH.: PRODUCT PORTFOLIO

TABLE 083. OILS GMBH.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. LIFE EXTENSION: SNAPSHOT

TABLE 084. LIFE EXTENSION: BUSINESS PERFORMANCE

TABLE 085. LIFE EXTENSION: PRODUCT PORTFOLIO

TABLE 086. LIFE EXTENSION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. EARTHOIL PLANTATION LTD.: SNAPSHOT

TABLE 087. EARTHOIL PLANTATION LTD.: BUSINESS PERFORMANCE

TABLE 088. EARTHOIL PLANTATION LTD.: PRODUCT PORTFOLIO

TABLE 089. EARTHOIL PLANTATION LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. OMEGA PHARMA: SNAPSHOT

TABLE 090. OMEGA PHARMA: BUSINESS PERFORMANCE

TABLE 091. OMEGA PHARMA: PRODUCT PORTFOLIO

TABLE 092. OMEGA PHARMA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. BIOPRAEP: SNAPSHOT

TABLE 093. BIOPRAEP: BUSINESS PERFORMANCE

TABLE 094. BIOPRAEP: PRODUCT PORTFOLIO

TABLE 095. BIOPRAEP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. NUVERUS: SNAPSHOT

TABLE 096. NUVERUS: BUSINESS PERFORMANCE

TABLE 097. NUVERUS: PRODUCT PORTFOLIO

TABLE 098. NUVERUS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BLACK SEED OIL MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BLACK SEED OIL MARKET OVERVIEW BY FORM

FIGURE 012. LIQUID MARKET OVERVIEW (2016-2028)

FIGURE 013. CAPSULE MARKET OVERVIEW (2016-2028)

FIGURE 014. AND SOFT GEL MARKET OVERVIEW (2016-2028)

FIGURE 015. BLACK SEED OIL MARKET OVERVIEW BY APPLICATION

FIGURE 016. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

FIGURE 017. PERSONAL CARE AND COSMETICS MARKET OVERVIEW (2016-2028)

FIGURE 018. FOOD SUPPLEMENT MARKET OVERVIEW (2016-2028)

FIGURE 019. FUNCTIONAL FOOD MARKET OVERVIEW (2016-2028)

FIGURE 020. FLAVORING AND DRESSING MARKET OVERVIEW (2016-2028)

FIGURE 021. CULINARY AND OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 022. BLACK SEED OIL MARKET OVERVIEW BY DISTRIBUTION CHANNELS

FIGURE 023. HYPERMARKET/SUPERMARKET MARKET OVERVIEW (2016-2028)

FIGURE 024. DRUG STORE MARKET OVERVIEW (2016-2028)

FIGURE 025. CONVENIENCE STORE MARKET OVERVIEW (2016-2028)

FIGURE 026. ONLINE MARKET OVERVIEW (2016-2028)

FIGURE 027. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 028. NORTH AMERICA BLACK SEED OIL MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. EUROPE BLACK SEED OIL MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. ASIA PACIFIC BLACK SEED OIL MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. MIDDLE EAST & AFRICA BLACK SEED OIL MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. SOUTH AMERICA BLACK SEED OIL MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Black Seed Oil Market research report is 2024-2032.

Al-Ameen Sales and Marketing Pvt Ltd (Pakistan), Amazing Herbs (USA), BioNatal LLC (USA), Botanic Choice (USA), Hab Shifa (Australia), Hearthy Foods (USA), Hemani Herbal LLC (UAE), Kalonji Oil (Pvt) Ltd (Pakistan), Manus Aktteva Biopharma LLP (India), Nature’s Blends (UK), Nature's Way Products, LLC (USA), Organika Health Products Inc. (Canada), Perfect Press (Canada), Sabinsa Corporation (USA), Safa Honey Co. (India), Sanabio GmbH (Germany), Sweet Sunnah (USA), The Blessed Seed (UK), TriNutra Ltd. (Israel), Z-Company (Netherlands)and Other Major Players.

The Black Seed Oil Market is segmented into Product, Application, and region. By Product, the market is categorized into Oil, Powder, Tablets, & Capsules, Soft Gel. By Applications, the market is categorized into Personal Care & Cosmetics, Pharmaceuticals, Nutraceutical, Flavoring & Dressing, Culinary. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Black seed oil which comes from the seeds of the N. sativa plant is an important natural oil containing potent recovery elements like thymoquinone, nigellone, and beta-sitosterol. Originally originating from cultures in Middle Eastern and Southeast Asia, people used this for its medical benefits which include the element of reducing inflammation, acting as an antioxidant and being a natural antibiotic. Packed with powerful nutrients and a wide array of antioxidants, it has been employed as an immune booster, skin improver, and a treatment for multiple ailments within both folk and contemporary medicine.

Black Seed Oil Market Size Was Valued at USD 20.99 Million in 2023, and is Projected to Reach USD 39.91 Million by 2032, Growing at a CAGR of 7.4% From 2024-2032.