Biostimulants Market Synopsis

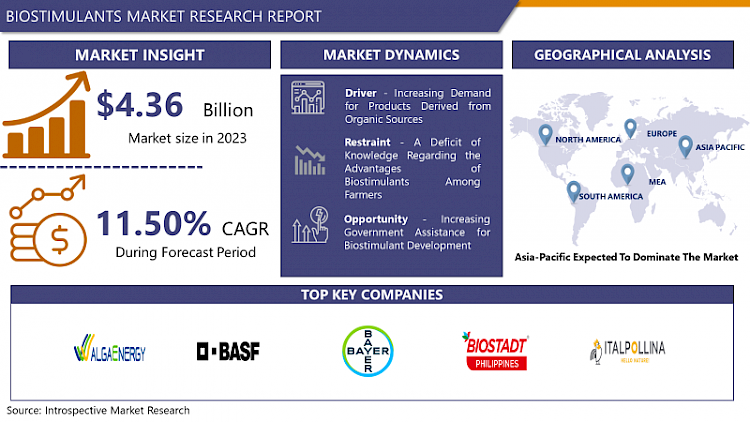

Biostimulants Market Size is Valued at USD 4.36 Billion in 2023, and is Projected to Reach USD 10.43 Billion by 2032, Growing at a CAGR of 11.50% From 2024-2032.

Products and microorganisms that are applied to plants or substrate with the objective to improve and boost all forms of plant growth and vigor fall under the description of Biostimulants. These are altogether different from fertilizers as these benefit the plants in areas that are physiological involving nutrient use and stress protection among others. This is due to the promoting need to incorporate sustainable agriculture practices in the market and enhance crop production. The level of regulatory standards regarding the establishment of business and innovation of products is another determinative aspect with regard to development and uptake.

- Biostimulants have found their major uses in making the crop yield and quality better the growth in sustainable agriculture is the major driver for the biostimulants market. In a bid to find more environmentally sustainable ways of using agri-inputs to promote crop fertility, farmers are increasingly exploring biostimulants. Moreover, consumer consciousness about food hygiene and biodegradable soil management techniques that exist in traditional agriculture also includes higher demand for biostimulants.

- Therefore, the emphasis on sustainable agriculture practices also helped in developing more trustworthy policies from the government side and increased the market growth. These regulations tend to incentivise the use of biostimulants such as through subsidies which would incorporate farmers purchase into the policy. More so, new technology like the biotechnology as well as microbiology has bring in new biostimulant products that in one way or the other have greater efficacy and sustainability hence enhancing the growth of the market.

Biostimulants Market Trend Analysis

Growing Demand for Biostimulants, Enhancing Sustainable Agriculture Practices for Better Crop Yield and Quality

- In the present period the use of biostimulants is on the rise due to rising demand in sustainable agriculture has boosted the global market of biostimulants due to need for better yield and quality of crops. Kroggel examines how biostimulants are growing in popularity as they contribute to improving nutrient efficiency, stress management, and plant growth. This has been fueled by increasing practice of organic farming in production and increasing legal measures in banning the use of chemical fertilizer. In addition, factors such as innovations in production techniques concerning biostimulants and booming awareness among farmers about the efficacy of biostimulants also contribute to the overall market growth.

- The global biostimulants market will also likely to move up in the future and definite business prospects are in the crossways of growth by introducing new forms of biostimulant products and increase the market share in the emerging countries. Nonetheless, there are factors that could somewhat negatively impact the growth of the market and they include inadequate regulatory understanding coupled with high product cost of biostimulant. All in all, the biostimulants are expected to keep on thriving by healthier agricultural practices and the more pressing the need for improved foods and crops.

Cultivating Success, The Rise of Biostimulants in Modern Agriculture

- The use of biostimulants in agriculture has created more opportunities that can be capitalized for growth and development, especially in the current world where environmental conservation while producing food is being encouraged through sustainable farming practices. Biostimulants are defined as preparations aimed at activating and stimulating the natural processes of plants or the soil, specifically, mainly, or exclusively to promote better nutrient uptake, crop quality, or tolerance to abiotic stress. Increasing population and demand for the improvement in the agricultural productivity without harming the environment, biostimulants can be a viable option.

- Some of the drivers that have led to the positive growth outlook of the biostimulants market include the innovation in the field of biotechnology, the growing perception of forth-management amongst farmers, and the strengthened nature of policies that support the development of environmentally friendly agribusiness inputs. Bio-based is an emerging market in agriculture to reduce chemical inputs in the market, where the market is also growing. Therefore, there are opportunities for farmers and agribusinesses to include biostimulants in their activities indicating that this market will continue to attract corporations willing to invest in the production of these inputs.

Biostimulants Market Segment Analysis:

Bio stimulants Market is segmented on the basis of Active ingredients, Source, Crop Type, Application, and Form.

By Active Ingredients, Vitamins segment is expected to dominate the market during the forecast period

- The biostimulants are made of different components and they are subdivided in accordance with their contents. One popular type is the humic substance-a group of organic compounds produced by plant matter decaying. Because of their nature and function, these substances aid in structuring the soil, enhancing nutrient holding capacity, and stimulating microbial growth to enable improved stress tolerance and plant growth.

- Other key nutrient groups comprise vitamins, molecules that fulfill important functions in regulating growth as well as other metabolic activities within plant organisms. They can improve the quality and vigor of the plants; they can improve productivity plus the plants’ performance even under unfavourable conditions. They also incorporate amino acids as other parts of biostimulants, amino acids are the basic structures of proteins and are involved in a number of physiological processes including nutrient transport and enzyme regulation.

- Seaweed extract is another common ingredient in such stmulants, containing nutrients, hormones, and other biologically active substances that contribute to growth and development of plants. Composts & microbial agents: application of efficacious beneficial bacteria and fungi’s help in improving the health of soil & nutrient uptake thereby; facilitating plant growth.

- Other introduced within biostimulants can be hormones, enzymes, and complex organic matters. These nutrients all contribute in their own way to helping plants grow better, healthier, and more disease-resistant, which points to the vast number of biostimulant products in the market for farmers.

By Application, Foliar spray segment held the largest share in 2023

- The essentially of using Biostimulants is done through various methods with different application hat has distinct value. In shock application technique, important combination of biostimulant is sprayed on the leaves of the plants A familiar use of biostimulants comes in the foliar application where the biostimulants solution is applied directly to the foliage of the plants. This ensures that plants undergo fast nutrient and bioactive compound absorption enhancing immediate growth and stress alleviation.

- Another practical approach for biostimulants application is soil treatment, during which the substances under consideration are mixed with the soil. This method is also useful in the improvement of soil health, and the promotion of nutrient cycling and microbial action, which will in turn improve plant growth and yield.

- Seed coating involves the use of biostimulant on seeds before planting. To explain the above two phrases, we take a look at the following definitions: They encourage early germination and seedling growth to originate a healthy root system and produce improved plant vigor; therefore, better land establishment and yield capacity.

- Application method for fertilizer is specific to plant crop type, crop growth stage, outcome expected based on the previous point. To get the best results of biostimulants farmers sometimes apply more than one method in the course of their farming practices.

Biostimulants Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Continued advancement of sustainable ecosystems in agricultural practices and growing concerns over health issues and the consumption of food produced that has been chemically enhanced has led to the Asia Pacific biostimulants market to grow at a very fast pace. Region wise, Asia Pacific is dominating the organic farming market due to high farm land area in China and India and active government support for utilization of organic products. Also the growing consciousness among farmers for the uses of biostimulants, the increase in yield as well as the quality of the co-products is driving the market. The variation of climate and various types of soil used in the region also play a major role in biostimulants market growth as this input are known to reduce the impacts of biotic and abiotic stresses in plants.

- In addition, the growing concerns from the governments and agencies of Asia Pacific to minimize the consumption of chemical fertilizers and the change in the trend towards the use of bio and environmentally friendly agro-products are expected to promote the market of biostimulants in Asia Pacific region. Players involved are putting emphasis on sorting out new products through research to suit the conditions of crops in the region and farming techniques. Positive changes in legislation urging farmers to support sustainable agriculture and increasing demand from farmers to switch to biostimulants as part of long-term strategy are expected to drive market growth in the nearest future.

Active Key Players in the Biostimulants Market

- AlgaEnergy (Spain)

- BASF SE (Germany)

- Bayer Crop Science’s (Germany)

- Biostadt India Ltd. (India)

- Italpollina SAP

- Koppert B.V. (Netherlands)

- Lallemand (Canada)

- Novozymes A/S. (Denmark)

- Platform Product Specialty Corporation (US)

- Sapec Group (Belgium)

- Syngenta (Switzerland)

- UPL (India)

- Valagro (Italy)

- Others

Key Industry Developments in the Biostimulants Market:

- In March 2024, UPM Biochemicals introduces UPM SolargoTM, a novel line of bio-based plant stimulants, marking its debut in the agrochemicals sector. These bio stimulants enhance nutrient absorption and stress tolerance in crops without directly supplying nutrients, promoting sustainable agriculture with reduced environmental impact compared to conventional products.

- In August 2023, FMC India introduced ENTAZIA™ bio fungicide, featuring Bacillus subtilis for effective crop protection. This innovative solution combats bacterial leaf blight in rice by enhancing natural plant defenses while maintaining ecosystem balance. ENTAZIA™ integrates seamlessly into integrated pest management strategies alongside FMC's bio stimulants and synthetic fungicides, promoting crop health and resilience.

|

Global Biostimulants Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 4.36 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.50 % |

Market Size in 2032: |

USD 10.43 Bn. |

|

Segments Covered: |

By Active Ingredients |

|

|

|

By Source |

|

||

|

By Crop Type |

|

||

|

By Application |

|

||

|

By Form |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- BIOSTIMULANTS MARKET BY ACTIVE INGREDIENTS (2017-2032)

- BIOSTIMULANTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ACTIVE INGREDIENTSA

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- VITAMINS

- AMINO ACIDS

- SEAWEED EXTRACT

- MICROBIAL SOIL AMENDMENTS

- OTHERS

- BIOSTIMULANTS MARKET BY SOURCE (2017-2032)

- BIOSTIMULANTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MICROBIAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- NON-MICROBIAL

- BIOSTIMULANTS MARKET BY CROP TYPE (2017-2032)

- BIOSTIMULANTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FRUITS AND VEGETABLES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CEREALS AND GRAINS

- TURF AND ORNAMENTALS

- OILSEEDS AND PULSES

- OTHERS

- BIOSTIMULANTS MARKET BY APPLICATION (2017-2032)

- BIOSTIMULANTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FOLIAR SPRAY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SOIL TREATMENT

- SEED TREATMENT

- BIOSTIMULANTS MARKET BY FORM (2017-2032)

- BIOSTIMULANTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DRY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LIQUID

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Biostimulants Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ALGAENERGY (SPAIN)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ALGAENERGY (SPAIN)

- BASF SE (GERMANY)

- BAYER CROP SCIENCE’S (GERMANY)

- BIOSTADT INDIA LTD. (INDIA)

- ITALPOLLINA SAP

- KOPPERT B.V. (NETHERLANDS)

- LALLEMAND (CANADA)

- NOVOZYMES A/S. (DENMARK)

- PLATFORM PRODUCT SPECIALTY CORPORATION (US)

- SAPEC GROUP (BELGIUM)

- SYNGENTA (SWITZERLAND)

- UPL (INDIA)

- VALAGRO (ITALY)

- COMPETITIVE LANDSCAPE

- GLOBAL BIOSTIMULANTS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Active Ingredients

- Historic And Forecasted Market Size By Source

- Historic And Forecasted Market Size By Crop Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Form

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Biostimulants Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 4.36 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.50 % |

Market Size in 2032: |

USD 10.43 Bn. |

|

Segments Covered: |

By Active Ingredients |

|

|

|

By Source |

|

||

|

By Crop Type |

|

||

|

By Application |

|

||

|

By Form |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BIOSTIMULANTS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BIOSTIMULANTS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BIOSTIMULANTS MARKET COMPETITIVE RIVALRY

TABLE 005. BIOSTIMULANTS MARKET THREAT OF NEW ENTRANTS

TABLE 006. BIOSTIMULANTS MARKET THREAT OF SUBSTITUTES

TABLE 007. BIOSTIMULANTS MARKET BY ACTIVE INGREDIENTS

TABLE 008. HUMIC SUBSTANCES MARKET OVERVIEW (2016-2028)

TABLE 009. VITAMINS MARKET OVERVIEW (2016-2028)

TABLE 010. AMINO ACIDS MARKET OVERVIEW (2016-2028)

TABLE 011. SEAWEED EXTRACT MARKET OVERVIEW (2016-2028)

TABLE 012. MICROBIAL SOIL AMENDMENTS MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. BIOSTIMULANTS MARKET BY SOURCE

TABLE 015. MICROBIAL MARKET OVERVIEW (2016-2028)

TABLE 016. NON-MICROBIAL MARKET OVERVIEW (2016-2028)

TABLE 017. BIOSTIMULANTS MARKET BY CROP TYPE

TABLE 018. FRUITS & VEGETABLES MARKET OVERVIEW (2016-2028)

TABLE 019. CEREALS & GRAINS MARKET OVERVIEW (2016-2028)

TABLE 020. TURF & ORNAMENTALS MARKET OVERVIEW (2016-2028)

TABLE 021. OILSEEDS & PULSES MARKET OVERVIEW (2016-2028)

TABLE 022. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 023. BIOSTIMULANTS MARKET BY APPLICATION

TABLE 024. FOLIAR SPRAY MARKET OVERVIEW (2016-2028)

TABLE 025. SOIL TREATMENT MARKET OVERVIEW (2016-2028)

TABLE 026. SEED TREATMENT MARKET OVERVIEW (2016-2028)

TABLE 027. BIOSTIMULANTS MARKET BY FORM

TABLE 028. DRY MARKET OVERVIEW (2016-2028)

TABLE 029. LIQUID MARKET OVERVIEW (2016-2028)

TABLE 030. NORTH AMERICA BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENTS (2016-2028)

TABLE 031. NORTH AMERICA BIOSTIMULANTS MARKET, BY SOURCE (2016-2028)

TABLE 032. NORTH AMERICA BIOSTIMULANTS MARKET, BY CROP TYPE (2016-2028)

TABLE 033. NORTH AMERICA BIOSTIMULANTS MARKET, BY APPLICATION (2016-2028)

TABLE 034. NORTH AMERICA BIOSTIMULANTS MARKET, BY FORM (2016-2028)

TABLE 035. N BIOSTIMULANTS MARKET, BY COUNTRY (2016-2028)

TABLE 036. EUROPE BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENTS (2016-2028)

TABLE 037. EUROPE BIOSTIMULANTS MARKET, BY SOURCE (2016-2028)

TABLE 038. EUROPE BIOSTIMULANTS MARKET, BY CROP TYPE (2016-2028)

TABLE 039. EUROPE BIOSTIMULANTS MARKET, BY APPLICATION (2016-2028)

TABLE 040. EUROPE BIOSTIMULANTS MARKET, BY FORM (2016-2028)

TABLE 041. BIOSTIMULANTS MARKET, BY COUNTRY (2016-2028)

TABLE 042. ASIA PACIFIC BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENTS (2016-2028)

TABLE 043. ASIA PACIFIC BIOSTIMULANTS MARKET, BY SOURCE (2016-2028)

TABLE 044. ASIA PACIFIC BIOSTIMULANTS MARKET, BY CROP TYPE (2016-2028)

TABLE 045. ASIA PACIFIC BIOSTIMULANTS MARKET, BY APPLICATION (2016-2028)

TABLE 046. ASIA PACIFIC BIOSTIMULANTS MARKET, BY FORM (2016-2028)

TABLE 047. BIOSTIMULANTS MARKET, BY COUNTRY (2016-2028)

TABLE 048. MIDDLE EAST & AFRICA BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENTS (2016-2028)

TABLE 049. MIDDLE EAST & AFRICA BIOSTIMULANTS MARKET, BY SOURCE (2016-2028)

TABLE 050. MIDDLE EAST & AFRICA BIOSTIMULANTS MARKET, BY CROP TYPE (2016-2028)

TABLE 051. MIDDLE EAST & AFRICA BIOSTIMULANTS MARKET, BY APPLICATION (2016-2028)

TABLE 052. MIDDLE EAST & AFRICA BIOSTIMULANTS MARKET, BY FORM (2016-2028)

TABLE 053. BIOSTIMULANTS MARKET, BY COUNTRY (2016-2028)

TABLE 054. SOUTH AMERICA BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENTS (2016-2028)

TABLE 055. SOUTH AMERICA BIOSTIMULANTS MARKET, BY SOURCE (2016-2028)

TABLE 056. SOUTH AMERICA BIOSTIMULANTS MARKET, BY CROP TYPE (2016-2028)

TABLE 057. SOUTH AMERICA BIOSTIMULANTS MARKET, BY APPLICATION (2016-2028)

TABLE 058. SOUTH AMERICA BIOSTIMULANTS MARKET, BY FORM (2016-2028)

TABLE 059. BIOSTIMULANTS MARKET, BY COUNTRY (2016-2028)

TABLE 060. BASF SE: SNAPSHOT

TABLE 061. BASF SE: BUSINESS PERFORMANCE

TABLE 062. BASF SE: PRODUCT PORTFOLIO

TABLE 063. BASF SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. SYNGENTA: SNAPSHOT

TABLE 064. SYNGENTA: BUSINESS PERFORMANCE

TABLE 065. SYNGENTA: PRODUCT PORTFOLIO

TABLE 066. SYNGENTA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. UPL: SNAPSHOT

TABLE 067. UPL: BUSINESS PERFORMANCE

TABLE 068. UPL: PRODUCT PORTFOLIO

TABLE 069. UPL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. BAYER CROPSCIENCE'S: SNAPSHOT

TABLE 070. BAYER CROPSCIENCE'S: BUSINESS PERFORMANCE

TABLE 071. BAYER CROPSCIENCE'S: PRODUCT PORTFOLIO

TABLE 072. BAYER CROPSCIENCE'S: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. VALAGRO: SNAPSHOT

TABLE 073. VALAGRO: BUSINESS PERFORMANCE

TABLE 074. VALAGRO: PRODUCT PORTFOLIO

TABLE 075. VALAGRO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. ITALPOLLINA SAP: SNAPSHOT

TABLE 076. ITALPOLLINA SAP: BUSINESS PERFORMANCE

TABLE 077. ITALPOLLINA SAP: PRODUCT PORTFOLIO

TABLE 078. ITALPOLLINA SAP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. PLATFORM PRODUCT SPECIALTY CORPORATION: SNAPSHOT

TABLE 079. PLATFORM PRODUCT SPECIALTY CORPORATION: BUSINESS PERFORMANCE

TABLE 080. PLATFORM PRODUCT SPECIALTY CORPORATION: PRODUCT PORTFOLIO

TABLE 081. PLATFORM PRODUCT SPECIALTY CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. SAPEC GROUP: SNAPSHOT

TABLE 082. SAPEC GROUP: BUSINESS PERFORMANCE

TABLE 083. SAPEC GROUP: PRODUCT PORTFOLIO

TABLE 084. SAPEC GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. BIOSTADT INDIA LTD.: SNAPSHOT

TABLE 085. BIOSTADT INDIA LTD.: BUSINESS PERFORMANCE

TABLE 086. BIOSTADT INDIA LTD.: PRODUCT PORTFOLIO

TABLE 087. BIOSTADT INDIA LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. KOPPERT B.V.: SNAPSHOT

TABLE 088. KOPPERT B.V.: BUSINESS PERFORMANCE

TABLE 089. KOPPERT B.V.: PRODUCT PORTFOLIO

TABLE 090. KOPPERT B.V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. NOVOZYMES A/S.: SNAPSHOT

TABLE 091. NOVOZYMES A/S.: BUSINESS PERFORMANCE

TABLE 092. NOVOZYMES A/S.: PRODUCT PORTFOLIO

TABLE 093. NOVOZYMES A/S.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. LALLEMAND: SNAPSHOT

TABLE 094. LALLEMAND: BUSINESS PERFORMANCE

TABLE 095. LALLEMAND: PRODUCT PORTFOLIO

TABLE 096. LALLEMAND: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. ALGAENERGY: SNAPSHOT

TABLE 097. ALGAENERGY: BUSINESS PERFORMANCE

TABLE 098. ALGAENERGY: PRODUCT PORTFOLIO

TABLE 099. ALGAENERGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 100. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 101. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 102. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BIOSTIMULANTS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BIOSTIMULANTS MARKET OVERVIEW BY ACTIVE INGREDIENTS

FIGURE 012. HUMIC SUBSTANCES MARKET OVERVIEW (2016-2028)

FIGURE 013. VITAMINS MARKET OVERVIEW (2016-2028)

FIGURE 014. AMINO ACIDS MARKET OVERVIEW (2016-2028)

FIGURE 015. SEAWEED EXTRACT MARKET OVERVIEW (2016-2028)

FIGURE 016. MICROBIAL SOIL AMENDMENTS MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. BIOSTIMULANTS MARKET OVERVIEW BY SOURCE

FIGURE 019. MICROBIAL MARKET OVERVIEW (2016-2028)

FIGURE 020. NON-MICROBIAL MARKET OVERVIEW (2016-2028)

FIGURE 021. BIOSTIMULANTS MARKET OVERVIEW BY CROP TYPE

FIGURE 022. FRUITS & VEGETABLES MARKET OVERVIEW (2016-2028)

FIGURE 023. CEREALS & GRAINS MARKET OVERVIEW (2016-2028)

FIGURE 024. TURF & ORNAMENTALS MARKET OVERVIEW (2016-2028)

FIGURE 025. OILSEEDS & PULSES MARKET OVERVIEW (2016-2028)

FIGURE 026. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 027. BIOSTIMULANTS MARKET OVERVIEW BY APPLICATION

FIGURE 028. FOLIAR SPRAY MARKET OVERVIEW (2016-2028)

FIGURE 029. SOIL TREATMENT MARKET OVERVIEW (2016-2028)

FIGURE 030. SEED TREATMENT MARKET OVERVIEW (2016-2028)

FIGURE 031. BIOSTIMULANTS MARKET OVERVIEW BY FORM

FIGURE 032. DRY MARKET OVERVIEW (2016-2028)

FIGURE 033. LIQUID MARKET OVERVIEW (2016-2028)

FIGURE 034. NORTH AMERICA BIOSTIMULANTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 035. EUROPE BIOSTIMULANTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 036. ASIA PACIFIC BIOSTIMULANTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 037. MIDDLE EAST & AFRICA BIOSTIMULANTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 038. SOUTH AMERICA BIOSTIMULANTS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Biostimulants Market research report is 2024-2032.

AlgaEnergy (Spain), BASF SE (Germany), Bayer Crop Science’s (Germany), Biostadt India Ltd. (India), Italpollina SAP, Koppert B.V. (Netherlands), Lallemand (Canada), Novozymes A/S. (Denmark), Platform Product Specialty Corporation (US), Sapec Group (Belgium), Syngenta (Switzerland), UPL (India), Valagro (Italy), Others and Other Major Players.

The Biostimulants Market is segmented by Active Ingredients (Humic Substances, Vitamins, Amino Acids, Seaweed Extract, Microbial Soil Amendments, Others), Source (Microbial, Non-Microbial), Crop Type (Fruits & Vegetables, Cereals & Grains, Turf & Ornamentals, Oilseeds & Pulses, Others), Application (Foliar Spray, Soil Treatment, Seed Treatment), Form (Dry, Liquid),. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Products and microorganisms that are applied to plants or substrate with the objective to improve and boost all forms of plant growth and vigor fall under the description of Biostimulants. These are altogether different from fertilizers as these benefit the plants in areas that are physiological involving nutrient use and stress protection among others. This is due to the promoting need to incorporate sustainable agriculture practices in the market and enhance crop production. The level of regulatory standards regarding the establishment of business and innovation of products is another determinative aspect with regard to development and uptake.

Biostimulants Market Size is Valued at USD 4.36 Billion in 2024, and is Projected to Reach USD 10.43 Billion by 2032, Growing at a CAGR of 11.50% From 2024-2032.