Global Biopesticides Market Overview

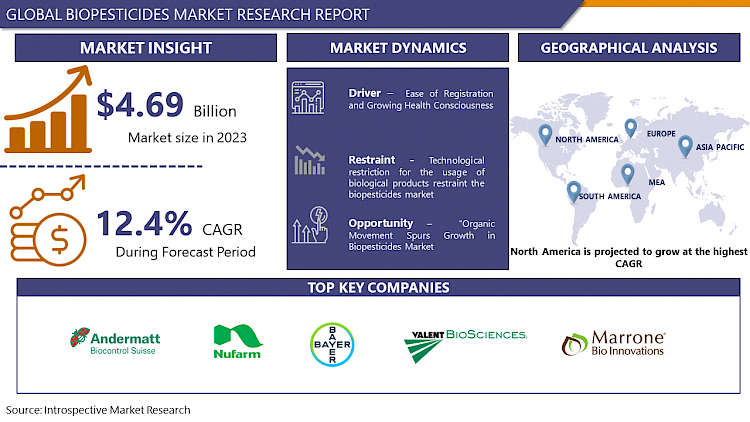

Global Biopesticides Market Size Was Valued at USD 4.69 Billion in 2023, and is Projected to Reach USD 13.43 Billion by 2032, Growing at a CAGR of 12.4% From 2024-2032.

Biopesticides, derived from natural sources like animals, plants, bacteria, and minerals, represent a safer, eco-friendly alternative to synthetic pesticides. They find widespread application in agriculture, forestry, aquaculture, and public health, offering targeted pest control while minimizing harm to non-target organisms and ecosystems. With various application methods and end-users ranging from farmers to consumers, biopesticides play a pivotal role in sustainable pest management, aligning with organic farming practices and regulatory standards.

While biopesticides boast advantages such as low toxicity, target specificity, and reduced residue levels, they also pose challenges like slower action and variability in efficacy. Despite these limitations, their role in promoting sustainable agriculture and mitigating environmental impacts underscores their significance in modern pest control strategies.

Market Dynamics and Factors of Biopesticides Market

Drivers:

The simplicity of registration for manufacturing biopesticide which leads to creating new windows for producers as health consciousness and awareness is growing among people, the attentiveness towards the use of harmful pesticides and chemicals in agricultural commodities is also rising. Therefore, producers are targeting biopesticides and natural ingredients for farmers. Governments and regulatory bodies are also taking lead for the accessibility of natural and organic food commodities, and allowing the usage of biopesticides in agricultural practices. Due to these, producers of biopesticides are getting easy registration for their products in almost every country. The process of biopesticides registration is easier and more elastic than that of synthetic pesticides.

Demand for organic products and growing population accelerating the growth of the biopesticides market. According to the US environmental protection agency, by 2050 the world population will reach 9.7 billion, and 60% of the population will live in the urban region. To feed this rising population, the production of agricultural goods required to be increased sustainably without injuring the environment or land. Areas such as the Asia Pacific and Latin America have the largest population with basic demand for agricultural goods such as grains, vegetables, cereals, fruits, and others in their daily routine. The agricultural industry acts an important role in the food sector. Food demand affects the demand for agricultural products, which is improving the growth of the biopesticides market.

Increasing organic farming systems and targeting environmental sustainability which leads to organic movement is trending all across the globe. Organic farming is one of the operations or practices of this movement. Rising crops and vegetables with organic techniques supply a more nutritional and healthier lifestyle to consumers. Organic farming is done without the application of any chemical pesticides and fertilizers on crops and helps them grow organically. In organic farming, instead of chemical pesticides, biopesticides are used to control pests against crops and vegetables.

Restraints:

Technological restriction for the usage of biological products restraint the biopesticides market. Biological products have a very few shelf life and a high probability of contamination. The other harmful parameters include exposure to culture mediums, sunlight, the physiological state of microorganisms when harvested, temperature maintenance while storage, and water activity of inoculants that influence their shelf life. Another issue with the application of microbial inoculants in the soil is their similarity with other agricultural products, such as chemical fungicides and herbicides.

Opportunities:

Soil treatment operations producing massive opportunities for the biopesticides market to rise production and earn more profits, growers are using more synthetic pesticides and chemicals on soil, which results in soil damage and loss. Owing to these operations, the soil is losing its productivity, and farmers are experiencing several issues. It takes nature a long period to restore 25mm of lost soil. Biopesticides treat and control plants and crops without harming the soil. In the emerged nations, soil treatment biopesticides are easily accepted by regulatory bodies due to their positive characteristics and better functionality as compared to chemical pesticides. Emerging economies have massive potential, and they can create lucrative opportunities shortly in the biopesticides market. Because of this, the soil treatment and management category can enhance the growth of the biopesticides market.

Market Segmentation

Segmentation Analysis of Biopesticides Market:

Based on the Product Type, the bioinsecticides segment is expected to hold the maximum share in the market during the forecast period. Growth in the rising pest resistance and renewal of crops is leading to the affectation of sustainable solutions such as bioinsecticides. Many insect pests are observed to damage the growth of the plant and also damage the crops post-harvest or in storage, resulting in crop loss. The marketability of the crops is also declined to owe to the infestation caused by insect pests. Hence, bioinsecticides that do not influence natural enemies of pests, do not contaminate the environment, or leave residues in the products are dominating the market.

Based on the Source, microbial pesticides dominate the global biopesticides market due to the effective substitutes for places where the use of traditional pesticides is prohibited. These places majorly include streams and lake borders of watersheds, urban & recreational areas, and schools in agricultural settings. The key microbial sources such as bacteria, viruses, yeast, and fungi, protozoa.

Based on Formulation, liquid formulation dominates the market owing to its advantages over the dry formulation in supplying boosted field performance with decreased changes of nozzle blockage. Furthermore, the ease in applicability and uniform application may help the segment share over the forecast period.

Based on the Crop Type, the fruits & vegetable segment is expected to be the highest growing segment in the biopesticides market over the projected frame line. With the shift in eating habits, farmers are influenced to switch to adopt a sustainable method of farming. Fruit & vegetable cultivation needs more investment, and with the massive infestation of fruits & vegetables both in open fields and greenhouses, the demand for biopesticides is growing. Also, to accomplish the export demand for residue-free crops, farmers are executing the applications of biopesticide in combination with conventional chemicals. The trend in the utilization of organic crops is also hastening the farmers to use biopesticides.

Based on Mode of Application, foliar spray accounted for the maximum share in the market because the foliar sprays include the application of microbial pesticides directly on the leaves to control the insects and mites. It is a beneficial tool to manage pests in a short term. The foliar application supplies a quick means of correcting pest attacks, when visible on the plant. When soil conditions are critical, foliar applications are desirable to supply control pests. The ease of application of foliar spray is also one of the major drivers for the development in the biopesticides market.

Regional Analysis of Biopesticides Market:

The North American region accounted for the maximum share of the global market over the forecast period. The US is one of the leading economies for the export of different fruits and vegetables. The demand to accomplish international export standards is demanding the farmers to acquire biological crop protection inputs. The growth in consumer demand for organic-based food awareness about residue levels in foods is also turning farmers to acquire biopesticides in this region. The region is being the presence of leading biopesticide produces have leads the research on biological crop protection products.

The Asia-Pacific biopesticides market is expected to register a maximum share over the forecast period. The regional market growth depends on the requirement for land productivity of agricultural farms while keeping soil health intact. The need for high crop productivity and production with high quality, evolving agricultural operations, and precision farming have been turning the market growth for biopesticides in the region. The region is encouraging the application of microbial pesticides, as opposed to chemical fertilizer and pesticides, to balance the agricultural sector development required to sustain its large-scale production.

The market in Europe is expected to register the highest CAGR during the forecast timeline mainly owing to rising demand for food safety and quality, growing consumer demand for organic products, thus motivating organic farming operations, and increasing government initiatives in stimulating biocontrol products.

Players Covered in Biopesticides Market are:

- Andermatt Biocontrol AG (Switzerland)

- Nufarm (Australia)

- Bayer AG (Germany)

- Som Phytopharma India Ltd (India)

- Valent Biosciences LLC (US)

- Marrone Bio Innovation (US)

- Novozymes A/S (Denmark)

- UPL Ltd (India)

- Koppert Biological Systems (Netherlands)

- Vegalab S.A (US)

- Biobest Group NV (Belgium)

- Syngenta AG (Switzerland)

- STK Bio-ag (Israel)

- Bionema (US)

- Certis US L.L.C (US)

- International Panacea Ltd (India)

- BASF SE (Germany)

- BioWorks Inc. (the US)

- Isagro S.p.An (Italy)

- FMC Corporation (US) and other major players.

Key Industry Developments In Biopesticides Market

- In September 2023, Croda unveils Atlox™ BS-50, marking its foray into the biopesticide market. This innovative delivery system caters to the needs of sustainable agriculture by providing an optimal environment for spore forming microbes. With Atlox BS-50, Croda aims to streamline formulation development while ensuring performance and viability, contributing to a more eco-friendly future in agriculture.

- In January 2023, Sumitomo Chemical is set to acquire FBSciences Holdings, Inc., a U.S. biostimulant company, to bolster its biorationals business. This move aligns with the growing demand for environmentally friendly crop protection solutions, with biorationals valued at $10 billion globally. Biostimulants, a key component, enhance crop resilience, nutrient uptake, and overall yield, contributing to sustainable agriculture practices.

|

Global Biopesticides Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.69 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.4% |

Market Size in 2032: |

USD 13.43 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Crop Type |

|

||

|

By Mode of Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Source

3.3 By Crop Type

3.4 By Mode of Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: BioPesticides Market by Type

5.1 BioPesticides Market Overview Snapshot and Growth Engine

5.2 BioPesticides Market Overview

5.3 Bioinsecticide

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Bioinsecticide: Grographic Segmentation

5.4 Biofungicide

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Biofungicide: Grographic Segmentation

5.5 Bioherbicides

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Bioherbicides: Grographic Segmentation

5.6 Other

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Other: Grographic Segmentation

Chapter 6: BioPesticides Market by Source

6.1 BioPesticides Market Overview Snapshot and Growth Engine

6.2 BioPesticides Market Overview

6.3 Microbials

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Microbials: Grographic Segmentation

6.4 Biochemicals

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Biochemicals: Grographic Segmentation

Chapter 7: BioPesticides Market by Crop Type

7.1 BioPesticides Market Overview Snapshot and Growth Engine

7.2 BioPesticides Market Overview

7.3 Fruits & Vegetables

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Fruits & Vegetables: Grographic Segmentation

7.4 Cereals

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Cereals: Grographic Segmentation

7.5 Oilseeds

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Oilseeds: Grographic Segmentation

7.6 Other

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Other: Grographic Segmentation

Chapter 8: BioPesticides Market by Mode of Application

8.1 BioPesticides Market Overview Snapshot and Growth Engine

8.2 BioPesticides Market Overview

8.3 Foliar Spray

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size(2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Foliar Spray: Grographic Segmentation

8.4 Soil Treatment

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size(2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Soil Treatment: Grographic Segmentation

8.5 Post-Harvest

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size (2017-2032F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Post-Harvest: Grographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 BioPesticides Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Ansoff Matrix

9.1.5 BioPesticides Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 BioPesticides Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 ANDERMATT BIOCONTROL AG

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 NUFARM

9.4 BAYER AG

9.5 SOM PHYTOPHARMA INDIA LTD

9.6 VALENT BIOSCIENCES LLC

9.7 MARRONE BIO INNOVATION

9.8 NOVOZYMES A/S

9.9 UPL LTD

9.10 KOPPERT BIOLOGICAL SYSTEMS

9.11 VEGALAB S.A

9.12 BIOBEST GROUP NV

9.13 SYNGENTA AG

9.14 STK BIO-AG

9.15 BIONEMA

9.16 CERTIS US LLC

9.17 INTERNATIONAL PANACEA LTD

9.18 BASF SE

9.19 BIOWORKS INC.

9.20 ISAGRO S.P.A

9.21 FMC CORPORATION

9.22 OTHER MAJOR PLAYERS

Chapter 10: Global BioPesticides Market Analysis, Insights and Forecast, 2017-2032

10.1 Market Overview

10.2 Historic and Forecasted Market Size By Type

10.2.1 Bioinsecticide

10.2.2 Biofungicide

10.2.3 Bioherbicides

10.2.4 Other

10.3 Historic and Forecasted Market Size By Source

10.3.1 Microbials

10.3.2 Biochemicals

10.4 Historic and Forecasted Market Size By Crop Type

10.4.1 Fruits & Vegetables

10.4.2 Cereals

10.4.3 Oilseeds

10.4.4 Other

10.5 Historic and Forecasted Market Size By Mode of Application

10.5.1 Foliar Spray

10.5.2 Soil Treatment

10.5.3 Post-Harvest

Chapter 11: North America BioPesticides Market Analysis, Insights and Forecast, 2017-2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Bioinsecticide

11.4.2 Biofungicide

11.4.3 Bioherbicides

11.4.4 Other

11.5 Historic and Forecasted Market Size By Source

11.5.1 Microbials

11.5.2 Biochemicals

11.6 Historic and Forecasted Market Size By Crop Type

11.6.1 Fruits & Vegetables

11.6.2 Cereals

11.6.3 Oilseeds

11.6.4 Other

11.7 Historic and Forecasted Market Size By Mode of Application

11.7.1 Foliar Spray

11.7.2 Soil Treatment

11.7.3 Post-Harvest

11.8 Historic and Forecast Market Size by Country

11.8.1 U.S.

11.8.2 Canada

11.8.3 Mexico

Chapter 12: Europe BioPesticides Market Analysis, Insights and Forecast,2017-2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Bioinsecticide

12.4.2 Biofungicide

12.4.3 Bioherbicides

12.4.4 Other

12.5 Historic and Forecasted Market Size By Source

12.5.1 Microbials

12.5.2 Biochemicals

12.6 Historic and Forecasted Market Size By Crop Type

12.6.1 Fruits & Vegetables

12.6.2 Cereals

12.6.3 Oilseeds

12.6.4 Other

12.7 Historic and Forecasted Market Size By Mode of Application

12.7.1 Foliar Spray

12.7.2 Soil Treatment

12.7.3 Post-Harvest

12.8 Historic and Forecast Market Size by Country

12.8.1 Germany

12.8.2 U.K.

12.8.3 France

12.8.4 Italy

12.8.5 Russia

12.8.6 Spain

12.8.7 Rest of Europe

Chapter 13: Asia-Pacific BioPesticides Market Analysis, Insights and Forecast, 2017-2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Bioinsecticide

13.4.2 Biofungicide

13.4.3 Bioherbicides

13.4.4 Other

13.5 Historic and Forecasted Market Size By Source

13.5.1 Microbials

13.5.2 Biochemicals

13.6 Historic and Forecasted Market Size By Crop Type

13.6.1 Fruits & Vegetables

13.6.2 Cereals

13.6.3 Oilseeds

13.6.4 Other

13.7 Historic and Forecasted Market Size By Mode of Application

13.7.1 Foliar Spray

13.7.2 Soil Treatment

13.7.3 Post-Harvest

13.8 Historic and Forecast Market Size by Country

13.8.1 China

13.8.2 India

13.8.3 Japan

13.8.4 Singapore

13.8.5 Australia

13.8.6 New Zealand

13.8.7 Rest of APAC

Chapter 14: Middle East & Africa BioPesticides Market Analysis, Insights and Forecast, 2017-2032

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Bioinsecticide

14.4.2 Biofungicide

14.4.3 Bioherbicides

14.4.4 Other

14.5 Historic and Forecasted Market Size By Source

14.5.1 Microbials

14.5.2 Biochemicals

14.6 Historic and Forecasted Market Size By Crop Type

14.6.1 Fruits & Vegetables

14.6.2 Cereals

14.6.3 Oilseeds

14.6.4 Other

14.7 Historic and Forecasted Market Size By Mode of Application

14.7.1 Foliar Spray

14.7.2 Soil Treatment

14.7.3 Post-Harvest

14.8 Historic and Forecast Market Size by Country

14.8.1 Turkey

14.8.2 Saudi Arabia

14.8.3 Iran

14.8.4 UAE

14.8.5 Africa

14.8.6 Rest of MEA

Chapter 15: South America BioPesticides Market Analysis, Insights and Forecast, 2017-2032

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Type

15.4.1 Bioinsecticide

15.4.2 Biofungicide

15.4.3 Bioherbicides

15.4.4 Other

15.5 Historic and Forecasted Market Size By Source

15.5.1 Microbials

15.5.2 Biochemicals

15.6 Historic and Forecasted Market Size By Crop Type

15.6.1 Fruits & Vegetables

15.6.2 Cereals

15.6.3 Oilseeds

15.6.4 Other

15.7 Historic and Forecasted Market Size By Mode of Application

15.7.1 Foliar Spray

15.7.2 Soil Treatment

15.7.3 Post-Harvest

15.8 Historic and Forecast Market Size by Country

15.8.1 Brazil

15.8.2 Argentina

15.8.3 Rest of SA

Chapter 16 Investment Analysis

Chapter 17 Analyst Viewpoint and Conclusion

|

Global Biopesticides Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.69 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.4% |

Market Size in 2032: |

USD 13.43 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Crop Type |

|

||

|

By Mode of Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BIOPESTICIDES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BIOPESTICIDES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BIOPESTICIDES MARKET COMPETITIVE RIVALRY

TABLE 005. BIOPESTICIDES MARKET THREAT OF NEW ENTRANTS

TABLE 006. BIOPESTICIDES MARKET THREAT OF SUBSTITUTES

TABLE 007. BIOPESTICIDES MARKET BY TYPE

TABLE 008. BIOINSECTICIDE MARKET OVERVIEW (2016-2028)

TABLE 009. BIOFUNGICIDE MARKET OVERVIEW (2016-2028)

TABLE 010. BIOHERBICIDES MARKET OVERVIEW (2016-2028)

TABLE 011. OTHER MARKET OVERVIEW (2016-2028)

TABLE 012. BIOPESTICIDES MARKET BY SOURCE

TABLE 013. MICROBIALS MARKET OVERVIEW (2016-2028)

TABLE 014. BIOCHEMICALS MARKET OVERVIEW (2016-2028)

TABLE 015. BIOPESTICIDES MARKET BY CROP TYPE

TABLE 016. FRUITS & VEGETABLES MARKET OVERVIEW (2016-2028)

TABLE 017. CEREALS MARKET OVERVIEW (2016-2028)

TABLE 018. OILSEEDS MARKET OVERVIEW (2016-2028)

TABLE 019. OTHER MARKET OVERVIEW (2016-2028)

TABLE 020. BIOPESTICIDES MARKET BY MODE OF APPLICATION

TABLE 021. FOLIAR SPRAY MARKET OVERVIEW (2016-2028)

TABLE 022. SOIL TREATMENT MARKET OVERVIEW (2016-2028)

TABLE 023. POST-HARVEST MARKET OVERVIEW (2016-2028)

TABLE 024. NORTH AMERICA BIOPESTICIDES MARKET, BY TYPE (2016-2028)

TABLE 025. NORTH AMERICA BIOPESTICIDES MARKET, BY SOURCE (2016-2028)

TABLE 026. NORTH AMERICA BIOPESTICIDES MARKET, BY CROP TYPE (2016-2028)

TABLE 027. NORTH AMERICA BIOPESTICIDES MARKET, BY MODE OF APPLICATION (2016-2028)

TABLE 028. N BIOPESTICIDES MARKET, BY COUNTRY (2016-2028)

TABLE 029. EUROPE BIOPESTICIDES MARKET, BY TYPE (2016-2028)

TABLE 030. EUROPE BIOPESTICIDES MARKET, BY SOURCE (2016-2028)

TABLE 031. EUROPE BIOPESTICIDES MARKET, BY CROP TYPE (2016-2028)

TABLE 032. EUROPE BIOPESTICIDES MARKET, BY MODE OF APPLICATION (2016-2028)

TABLE 033. BIOPESTICIDES MARKET, BY COUNTRY (2016-2028)

TABLE 034. ASIA PACIFIC BIOPESTICIDES MARKET, BY TYPE (2016-2028)

TABLE 035. ASIA PACIFIC BIOPESTICIDES MARKET, BY SOURCE (2016-2028)

TABLE 036. ASIA PACIFIC BIOPESTICIDES MARKET, BY CROP TYPE (2016-2028)

TABLE 037. ASIA PACIFIC BIOPESTICIDES MARKET, BY MODE OF APPLICATION (2016-2028)

TABLE 038. BIOPESTICIDES MARKET, BY COUNTRY (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA BIOPESTICIDES MARKET, BY TYPE (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA BIOPESTICIDES MARKET, BY SOURCE (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA BIOPESTICIDES MARKET, BY CROP TYPE (2016-2028)

TABLE 042. MIDDLE EAST & AFRICA BIOPESTICIDES MARKET, BY MODE OF APPLICATION (2016-2028)

TABLE 043. BIOPESTICIDES MARKET, BY COUNTRY (2016-2028)

TABLE 044. SOUTH AMERICA BIOPESTICIDES MARKET, BY TYPE (2016-2028)

TABLE 045. SOUTH AMERICA BIOPESTICIDES MARKET, BY SOURCE (2016-2028)

TABLE 046. SOUTH AMERICA BIOPESTICIDES MARKET, BY CROP TYPE (2016-2028)

TABLE 047. SOUTH AMERICA BIOPESTICIDES MARKET, BY MODE OF APPLICATION (2016-2028)

TABLE 048. BIOPESTICIDES MARKET, BY COUNTRY (2016-2028)

TABLE 049. ANDERMATT BIOCONTROL AG: SNAPSHOT

TABLE 050. ANDERMATT BIOCONTROL AG: BUSINESS PERFORMANCE

TABLE 051. ANDERMATT BIOCONTROL AG: PRODUCT PORTFOLIO

TABLE 052. ANDERMATT BIOCONTROL AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. NUFARM: SNAPSHOT

TABLE 053. NUFARM: BUSINESS PERFORMANCE

TABLE 054. NUFARM: PRODUCT PORTFOLIO

TABLE 055. NUFARM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. BAYER AG: SNAPSHOT

TABLE 056. BAYER AG: BUSINESS PERFORMANCE

TABLE 057. BAYER AG: PRODUCT PORTFOLIO

TABLE 058. BAYER AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. SOM PHYTOPHARMA INDIA LTD: SNAPSHOT

TABLE 059. SOM PHYTOPHARMA INDIA LTD: BUSINESS PERFORMANCE

TABLE 060. SOM PHYTOPHARMA INDIA LTD: PRODUCT PORTFOLIO

TABLE 061. SOM PHYTOPHARMA INDIA LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. VALENT BIOSCIENCES LLC: SNAPSHOT

TABLE 062. VALENT BIOSCIENCES LLC: BUSINESS PERFORMANCE

TABLE 063. VALENT BIOSCIENCES LLC: PRODUCT PORTFOLIO

TABLE 064. VALENT BIOSCIENCES LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. MARRONE BIO INNOVATION: SNAPSHOT

TABLE 065. MARRONE BIO INNOVATION: BUSINESS PERFORMANCE

TABLE 066. MARRONE BIO INNOVATION: PRODUCT PORTFOLIO

TABLE 067. MARRONE BIO INNOVATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. NOVOZYMES A/S: SNAPSHOT

TABLE 068. NOVOZYMES A/S: BUSINESS PERFORMANCE

TABLE 069. NOVOZYMES A/S: PRODUCT PORTFOLIO

TABLE 070. NOVOZYMES A/S: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. UPL LTD: SNAPSHOT

TABLE 071. UPL LTD: BUSINESS PERFORMANCE

TABLE 072. UPL LTD: PRODUCT PORTFOLIO

TABLE 073. UPL LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. KOPPERT BIOLOGICAL SYSTEMS: SNAPSHOT

TABLE 074. KOPPERT BIOLOGICAL SYSTEMS: BUSINESS PERFORMANCE

TABLE 075. KOPPERT BIOLOGICAL SYSTEMS: PRODUCT PORTFOLIO

TABLE 076. KOPPERT BIOLOGICAL SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. VEGALAB S.A: SNAPSHOT

TABLE 077. VEGALAB S.A: BUSINESS PERFORMANCE

TABLE 078. VEGALAB S.A: PRODUCT PORTFOLIO

TABLE 079. VEGALAB S.A: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. BIOBEST GROUP NV: SNAPSHOT

TABLE 080. BIOBEST GROUP NV: BUSINESS PERFORMANCE

TABLE 081. BIOBEST GROUP NV: PRODUCT PORTFOLIO

TABLE 082. BIOBEST GROUP NV: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. SYNGENTA AG: SNAPSHOT

TABLE 083. SYNGENTA AG: BUSINESS PERFORMANCE

TABLE 084. SYNGENTA AG: PRODUCT PORTFOLIO

TABLE 085. SYNGENTA AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. STK BIO-AG: SNAPSHOT

TABLE 086. STK BIO-AG: BUSINESS PERFORMANCE

TABLE 087. STK BIO-AG: PRODUCT PORTFOLIO

TABLE 088. STK BIO-AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. BIONEMA: SNAPSHOT

TABLE 089. BIONEMA: BUSINESS PERFORMANCE

TABLE 090. BIONEMA: PRODUCT PORTFOLIO

TABLE 091. BIONEMA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. CERTIS US LLC: SNAPSHOT

TABLE 092. CERTIS US LLC: BUSINESS PERFORMANCE

TABLE 093. CERTIS US LLC: PRODUCT PORTFOLIO

TABLE 094. CERTIS US LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. INTERNATIONAL PANACEA LTD: SNAPSHOT

TABLE 095. INTERNATIONAL PANACEA LTD: BUSINESS PERFORMANCE

TABLE 096. INTERNATIONAL PANACEA LTD: PRODUCT PORTFOLIO

TABLE 097. INTERNATIONAL PANACEA LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. BASF SE: SNAPSHOT

TABLE 098. BASF SE: BUSINESS PERFORMANCE

TABLE 099. BASF SE: PRODUCT PORTFOLIO

TABLE 100. BASF SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 100. BIOWORKS INC.: SNAPSHOT

TABLE 101. BIOWORKS INC.: BUSINESS PERFORMANCE

TABLE 102. BIOWORKS INC.: PRODUCT PORTFOLIO

TABLE 103. BIOWORKS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 103. ISAGRO S.P.A: SNAPSHOT

TABLE 104. ISAGRO S.P.A: BUSINESS PERFORMANCE

TABLE 105. ISAGRO S.P.A: PRODUCT PORTFOLIO

TABLE 106. ISAGRO S.P.A: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 106. FMC CORPORATION: SNAPSHOT

TABLE 107. FMC CORPORATION: BUSINESS PERFORMANCE

TABLE 108. FMC CORPORATION: PRODUCT PORTFOLIO

TABLE 109. FMC CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 109. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 110. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 111. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 112. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BIOPESTICIDES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BIOPESTICIDES MARKET OVERVIEW BY TYPE

FIGURE 012. BIOINSECTICIDE MARKET OVERVIEW (2016-2028)

FIGURE 013. BIOFUNGICIDE MARKET OVERVIEW (2016-2028)

FIGURE 014. BIOHERBICIDES MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 016. BIOPESTICIDES MARKET OVERVIEW BY SOURCE

FIGURE 017. MICROBIALS MARKET OVERVIEW (2016-2028)

FIGURE 018. BIOCHEMICALS MARKET OVERVIEW (2016-2028)

FIGURE 019. BIOPESTICIDES MARKET OVERVIEW BY CROP TYPE

FIGURE 020. FRUITS & VEGETABLES MARKET OVERVIEW (2016-2028)

FIGURE 021. CEREALS MARKET OVERVIEW (2016-2028)

FIGURE 022. OILSEEDS MARKET OVERVIEW (2016-2028)

FIGURE 023. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 024. BIOPESTICIDES MARKET OVERVIEW BY MODE OF APPLICATION

FIGURE 025. FOLIAR SPRAY MARKET OVERVIEW (2016-2028)

FIGURE 026. SOIL TREATMENT MARKET OVERVIEW (2016-2028)

FIGURE 027. POST-HARVEST MARKET OVERVIEW (2016-2028)

FIGURE 028. NORTH AMERICA BIOPESTICIDES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. EUROPE BIOPESTICIDES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. ASIA PACIFIC BIOPESTICIDES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. MIDDLE EAST & AFRICA BIOPESTICIDES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. SOUTH AMERICA BIOPESTICIDES MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Biopesticides Market research report is 2024-2032.

AgBiTech Pty Ltd.; Agrauxine SA; AgrichemBio; Andermatt Biocontrol AG; BASF SE; Bayer CropScience AG; BioWorks, Inc.; Certis USA LLC; Dow AgroSciences LLC; Environmental Crop Management Limited; FUTURECO BIOSCIENCE S.A.; Invivo; Isagro SpA; Koppert B.V.; Lallemand Inc.; LAM International Corp.; Marrone Bio Innovations, Inc.; stk bio-ag technologies; Stoller; Syngenta AG; Valent BioSciences Corporation and other major players.

The Biopesticides Market is segmented into Type, Source, Crop Type, Mode of Application, and region. By Type, the market is categorized into Bioinsecticide, Biofungicide, Bioherbicides, Other. By Source, the market is categorized into Microbials, Biochemicals. By Crop Type, the market is categorized into Fruits & Vegetables, Cereals, Oilseeds, Other. By Mode of Application, the market is categorized into Foliar Spray, Soil Treatment, Post-Harvest. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Biopesticides are pesticides obtained from natural resources such as animals, plants, certain minerals, and bacteria. Biopesticides consist of microorganisms that control pests (microbial pesticides), natural substances that control pests (biochemical pesticides), and biochemical plant growth, regulators.

Global Biopesticides Market Size Was Valued at USD 4.69 Billion in 2023, and is Projected to Reach USD 13.43 Billion by 2032, Growing at a CAGR of 12.4% From 2024-2032.