Biomethane Market Synopsis

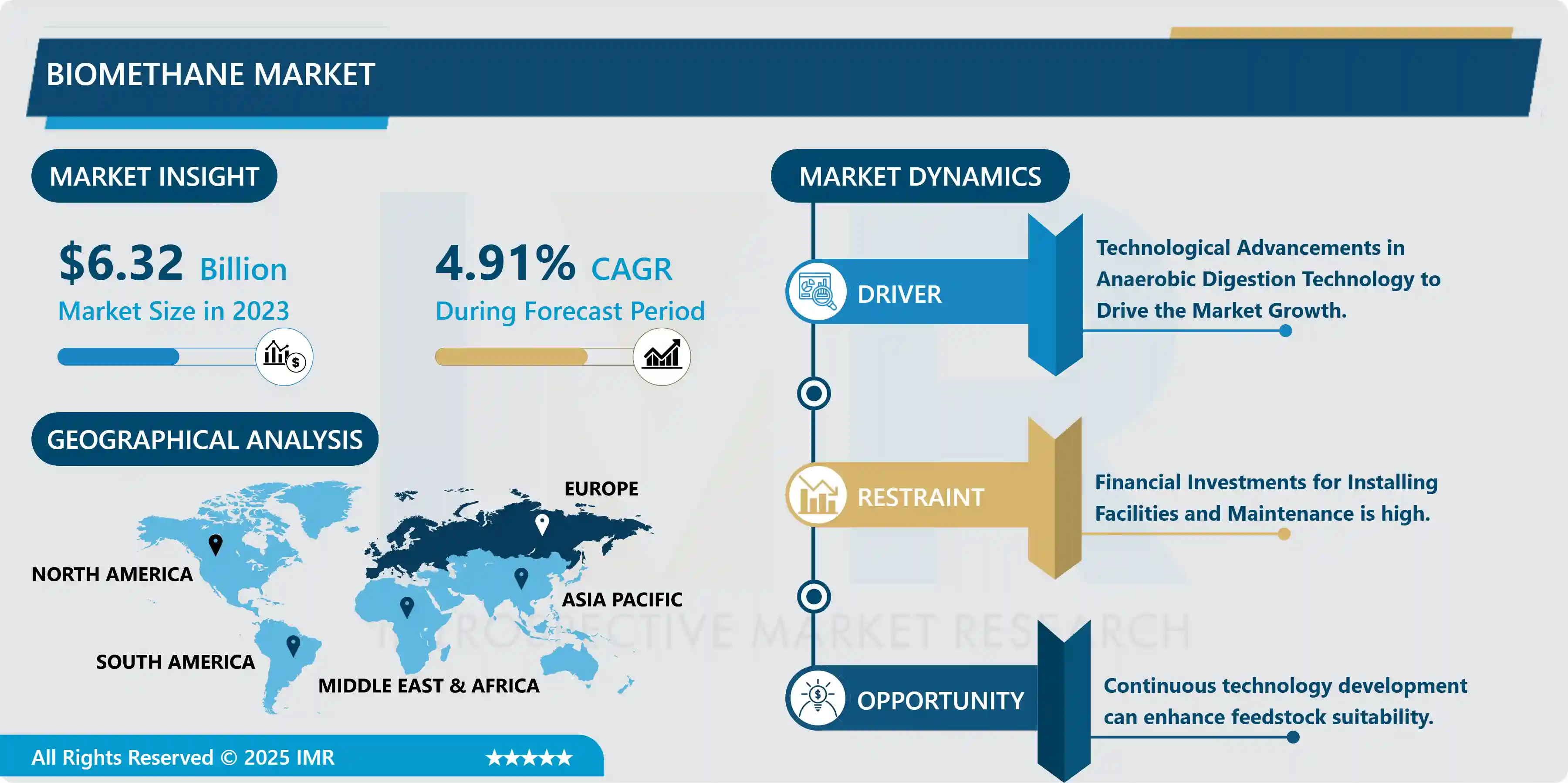

Biomethane Market Size Was Valued at USD 6.32 Billion in 2023 and is Projected to Reach USD 9.73 Billion by 2032, Growing at a CAGR of 4.91% From 2024-2032.

Promising biomethane markets are emerging in various European countries, with over 1000 plants operational in Europe. Globally, several other bright spots for market development are evident, such as consumption in heavy-duty transport in the United States and an emerging market in Brazil underpinned by vast feedstock potential and new policy incentives. Nevertheless, biomethane output was around 5 billion cubic meters (bcm).

Globally in 2020 (Cedigaz, 2022) utilizing only a small fraction of the feedstock available for production. Given current global natural gas consumption of over 4000 bcm, where favorable policies and market conditions are established there will be numerous ready-made opportunities to substitute biomethane into existing natural gas uses and grow demand

In Europe, given the wide-ranging impacts arising from Russia´s invasion of Ukraine, the importance of scaling up biomethane is further underlined by the energy security benefits it can offer as a domestically produced alternative to partially substitute natural gas imports from Russia. The EU´s target of producing 35 billion cubic meters (bcm) of biomethane by 2030, represents 9% of its natural gas demand in 2021, a share which will be higher in 2030 given EU efforts to diversify energy supplies in line with the REPowerEU plan.

Biomethane Market Trend Analysis

Facilitating access to sustainable waste management.

- The use of organic waste and residue feedstocks is the key starting point. Biomethane production represents a waste management solution for such materials, offers low and sometimes negative lifecycle GHG emissions, and mitigates the methane emissions that could occur for some feedstocks if left unmanaged. Waste management frameworks that channel these resources towards biomethane production rather than disposal.

- Options include prohibiting or putting a cost on landfilling/incineration of organic wastes and ensuring segregation and collection of the organic fraction of municipal wastes. Establish best-practice waste management frameworks that ensure the segregation and valorization of sustainable waste and residue feedstocks for biomethane.

- Maximizing biomethane production from woody biomass needs further commercial-scale demonstration of the thermal gasification of biomass. Advances in pre-treatment to permit higher shares of lignocellulosic feedstocks in anaerobic digestion plants are another avenue for technology development.

Continuous technology development can enhance feedstock suitability, methane production efficiency, and cost reduction in the biomethane industry.

- Continuous technology development will have an important role in improving the performance of and scaling up the biomethane industry. This can yield benefits in terms of opening up a wider base of suitable feedstocks, delivering higher methane production efficiencies, and lowering costs. Anaerobic digestion (AD) processes and the upgrading technology to convert raw biogas to biomethane are already in commercial use.

- However, there is still scope for incremental technology improvements in areas such as feedstock pre-treatment, co-digestion, and integrating biomethane liquefaction into certain plants among others. Aside from these opportunities for incremental improvements, four important areas of further technology development for the industry are: minimizing methane leakage from biomethane plants is critical to ensure optimal GHG emissions performance, Integrating monitoring programs, technological solutions to detect fugitive emissions and rigorous maintenance regimes will ensure methane slip is minimized, therefore reducing the carbon intensity of biomethane and enhancing plant revenues.

- Optimizing plant performance at all scales: lower production costs can be achieved through economies of scale. Increasing biomethane yields with renewable hydrogen: as the energy transition advances opportunities may arise to harness synergies between the growth of biomethane and renewable (” green”) hydrogen as the production of both increases.

- Commercializing new production processes: as outlined in the previous section, commercialization of biomass gasification has an important role to play in harnessing solid biomass feedstocks. In addition, efforts to advance innovative biomethane production pathways warrant consideration where they offer an avenue to sustainably increase production volumes or lower costs.

Biomethane Market Segment Analysis:

The Biomethane Market is Segmented on the basis of Feedstock, Production Method, Application, and End-User.

By Application, Power Generation Segment Is Expected to Dominate the Market During the Forecast Period

- The biggest market share in the biomethane market is held by the power generation segment, fueled by the growing demand for electric grid networks in homes for activities such as water heating and cooking. The quick increase in urbanization has resulted in a rise in residential building construction projects, further driving the segment's growth. Moreover, a lot of anaerobic digesters are shifting from producing biogas power to installing upgraded biogas units to attain better efficiency. The increasing population leads to a higher demand for electricity, which adds to the power generation sector's dominance.

- The importance of biomethane as a renewable and eco-friendly energy source for generating electricity is a major reason for the prominence of the power generation industry. Governments and energy stakeholders are keen on lowering carbon emissions in the power sector, and biomethane provides an attractive option due to its renewable qualities and reduced environmental footprint. Sophisticated advancements in anaerobic digestion and gas upgrading facilitate easy incorporation into current natural gas systems, improving biomethane's flexibility and availability for electricity production.

- Furthermore, there is an expectation for growth in the automotive industry because of the increasing need for renewable natural gas (RNG) as a fuel for vehicles. RNG is environmentally friendly, decreases carbon dioxide emissions, and works well with vehicle engines, helping to boost the growth of this sector.

- In general, the worldwide dedication to cleaner energy sources supports biomethane's characteristics, reinforcing its crucial role in the expansion of the power generation sector in the biomethane market.

By Production Method, Anaerobic Digestion Segment Held the Largest Share In 2023

- Anaerobic digestion is the leading player in the biomethane market, holding 78.15% of the market share due to its cost-efficiency, ease of use, and versatility in utilizing various feedstocks. This approach is becoming more and more popular globally, especially in the United States, Europe, and China. In the United States, where the most biogas is produced overall, 75% comes from landfills, while 1,497 anaerobic plants handle sewage sludge, bio waste, and agricultural and industrial wastes. Biogas production in Germany predominantly depends on agricultural and industrial waste.

Anaerobic digestion is a process where microorganisms break down organic materials without oxygen to create biogas, which is mostly made up of methane (50-75%) and carbon dioxide (25-50%). The biogas needs to be cleansed and improved to biomethane by eliminating contaminants and raising methane levels to above 95%, in order to be appropriate for natural gas grid injection or as vehicle fuel.

The gasification sector, while less developed and accounting for 21.85% of the market, demands significant investment and includes the upkeep of various factors like temperature and pressure throughout the production process.

The simplicity, cost-effectiveness, and generation of a renewable and sustainable energy source that minimizes greenhouse gas emissions and addresses climate change are all benefits of anaerobic digestion. The sector is projected to experience a higher compound annual growth rate in the coming years, thanks to these advantages and the rising worldwide use of anaerobic digestion systems.

Biomethane Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast Period

- Europe's leading position in the biomethane market is attributed to its proactive approach towards renewable energy and stringent environmental regulations, resulting in the largest market share. The region's strong emphasis on reducing carbon emissions and shifting towards cleaner energy aligns with the creation of biomethane from organic waste through processes like anaerobic digestion. The European Union's strong infrastructure, ambitious renewable energy goals, and government policies contribute to its dominance.

- The rising implementation of circular economy principles and the significant emphasis on decarbonization are also fueling the increasing adoption of biomethane in sectors like transportation and power generation. Europe's market expansion is fueled by increasing environmental awareness, technological advancements, and the increasing demand for Renewable Natural Gas (RNG). Important RNG facilities and initiatives are currently being implemented in Germany, the UK, the Netherlands, Denmark, Sweden, and France. Growing interest in biogas upgrading technologies, coupled with government support, is boosting the region's prospects for development.

- Between 2023 and 2031, Europe is projected to maintain its position as the frontrunner in the biomethane industry because of its dedication to reducing greenhouse gas emissions, transitioning to renewable energy sources, and decarbonization efforts. Government support for biomethane, stringent environmental laws, and financial rewards are fueling market expansion.

- Europe leads the biomethane market due to its comprehensive approach to renewable energy, supportive policies, and significant investments, making it a global leader in green energy solutions.

Biomethane Market Active Players

- TotalEnergies (France)

- ENGIE (France)

- Veolia Group (France)

- Air Liquide (France)

- E.ON SE (Germany)

- Nature Energy (Denmark)

- Landwärme GmbH (Germany)

- Gasrec Ltd. (UK)

- SGN (UK)

- Future Biogas Limited (UK)

- Biokraft International AB (Sweden)

- VERBIO Vereinigte BioEnergie AG (Germany)

- Gasum Oy (Finland)

- ENVO Biogas Tønder A/S (Denmark)

- EnviTec Biogas AG (Germany)

- WELTEC BIOPOWER GmbH (Germany)

- AB Holding SpA (Italy)

- RENERGON International AG (Switzerland)

- PlanET Biogas Global GmbH (Germany)

- StormFisher (Canada)

- Quantum Green (India)

- Scandinavian Biogas (Sweden)

- Ameresco (US)

- CNG Services Ltd. (UK)

- Gazasia Limited (UK)

- Ecofinity (UK)

- Orbital Gas Systems (UK)

- ETW Energietechnik GmbH (Germany)

- Biogas Products (UK)

- Gastric Inc. (US)

- JV Energen (India)

- MagneGas Corp. (US)

- SoCalGas Corp. (US)

- Schmack Carbotech (Germany) and Other Active Players,

|

Biomethane Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.32 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.91% |

Market Size in 2032: |

USD 9.73 Bn. |

|

Segments Covered: |

By Feedstock |

|

|

|

By Production Method |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Biomethane Market by Feedstock (2018-2032)

4.1 Biomethane Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Organic household Waste

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Animal Manure

4.5 Energy Crops

4.6 Agriculture Waste

4.7 Sewage sludge

4.8 Industrial food processing waste

Chapter 5: Biomethane Market by Production Method (2018-2032)

5.1 Biomethane Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Anaerobic Digestion

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Gasification

5.5 Fermentation

Chapter 6: Biomethane Market by Application (2018-2032)

6.1 Biomethane Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Automotive Transportation Fuel

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Power Generation

6.5 Industrial Uses

Chapter 7: Biomethane Market by End-User (2018-2032)

7.1 Biomethane Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Residential

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Commercial

7.5 Industrial

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Biomethane Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 TOTALENERGIES (FRANCE)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 ENGIE (FRANCE)

8.4 VEOLIA GROUP (FRANCE)

8.5 AIR LIQUIDE (FRANCE)

8.6 E.ON SE (GERMANY)

8.7 NATURE ENERGY (DENMARK)

8.8 LANDWÄRME GMBH (GERMANY)

8.9 GASREC LTD. (UK)

8.10 SGN (UK)

8.11 FUTURE BIOGAS LIMITED (UK)

8.12 BIOKRAFT INTERNATIONAL AB (SWEDEN)

8.13 VERBIO VEREINIGTE BIOENERGIE AG (GERMANY)

8.14 GASUM OY (FINLAND)

8.15 ENVO BIOGAS TØNDER A/S (DENMARK)

8.16 ENVITEC BIOGAS AG (GERMANY)

8.17 WELTEC BIOPOWER GMBH (GERMANY)

8.18 AB HOLDING SPA (ITALY)

8.19 RENERGON INTERNATIONAL AG (SWITZERLAND)

8.20 PLANET BIOGAS GLOBAL GMBH (GERMANY)

8.21 STORMFISHER (CANADA)

8.22 QUANTUM GREEN (INDIA)

8.23 SCANDINAVIAN BIOGAS (SWEDEN)

8.24 AMERESCO (US)

8.25 CNG SERVICES LTD. (UK)

8.26 GAZASIA LIMITED (UK)

8.27 ECOFINITY (UK)

8.28 ORBITAL GAS SYSTEMS (UK)

8.29 ETW ENERGIETECHNIK GMBH (GERMANY)

8.30 BIOGAS PRODUCTS (UK)

8.31 GASTRIC INC. (US)

8.32 JV ENERGEN (INDIA)

8.33 MAGNEGAS CORP. (US)

8.34 SOCALGAS CORP. (US)

8.35 SCHMACK CARBOTECH (GERMANY)

Chapter 9: Global Biomethane Market By Region

9.1 Overview

9.2. North America Biomethane Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Feedstock

9.2.4.1 Organic household Waste

9.2.4.2 Animal Manure

9.2.4.3 Energy Crops

9.2.4.4 Agriculture Waste

9.2.4.5 Sewage sludge

9.2.4.6 Industrial food processing waste

9.2.5 Historic and Forecasted Market Size by Production Method

9.2.5.1 Anaerobic Digestion

9.2.5.2 Gasification

9.2.5.3 Fermentation

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Automotive Transportation Fuel

9.2.6.2 Power Generation

9.2.6.3 Industrial Uses

9.2.7 Historic and Forecasted Market Size by End-User

9.2.7.1 Residential

9.2.7.2 Commercial

9.2.7.3 Industrial

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Biomethane Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Feedstock

9.3.4.1 Organic household Waste

9.3.4.2 Animal Manure

9.3.4.3 Energy Crops

9.3.4.4 Agriculture Waste

9.3.4.5 Sewage sludge

9.3.4.6 Industrial food processing waste

9.3.5 Historic and Forecasted Market Size by Production Method

9.3.5.1 Anaerobic Digestion

9.3.5.2 Gasification

9.3.5.3 Fermentation

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Automotive Transportation Fuel

9.3.6.2 Power Generation

9.3.6.3 Industrial Uses

9.3.7 Historic and Forecasted Market Size by End-User

9.3.7.1 Residential

9.3.7.2 Commercial

9.3.7.3 Industrial

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Biomethane Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Feedstock

9.4.4.1 Organic household Waste

9.4.4.2 Animal Manure

9.4.4.3 Energy Crops

9.4.4.4 Agriculture Waste

9.4.4.5 Sewage sludge

9.4.4.6 Industrial food processing waste

9.4.5 Historic and Forecasted Market Size by Production Method

9.4.5.1 Anaerobic Digestion

9.4.5.2 Gasification

9.4.5.3 Fermentation

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Automotive Transportation Fuel

9.4.6.2 Power Generation

9.4.6.3 Industrial Uses

9.4.7 Historic and Forecasted Market Size by End-User

9.4.7.1 Residential

9.4.7.2 Commercial

9.4.7.3 Industrial

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Biomethane Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Feedstock

9.5.4.1 Organic household Waste

9.5.4.2 Animal Manure

9.5.4.3 Energy Crops

9.5.4.4 Agriculture Waste

9.5.4.5 Sewage sludge

9.5.4.6 Industrial food processing waste

9.5.5 Historic and Forecasted Market Size by Production Method

9.5.5.1 Anaerobic Digestion

9.5.5.2 Gasification

9.5.5.3 Fermentation

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Automotive Transportation Fuel

9.5.6.2 Power Generation

9.5.6.3 Industrial Uses

9.5.7 Historic and Forecasted Market Size by End-User

9.5.7.1 Residential

9.5.7.2 Commercial

9.5.7.3 Industrial

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Biomethane Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Feedstock

9.6.4.1 Organic household Waste

9.6.4.2 Animal Manure

9.6.4.3 Energy Crops

9.6.4.4 Agriculture Waste

9.6.4.5 Sewage sludge

9.6.4.6 Industrial food processing waste

9.6.5 Historic and Forecasted Market Size by Production Method

9.6.5.1 Anaerobic Digestion

9.6.5.2 Gasification

9.6.5.3 Fermentation

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Automotive Transportation Fuel

9.6.6.2 Power Generation

9.6.6.3 Industrial Uses

9.6.7 Historic and Forecasted Market Size by End-User

9.6.7.1 Residential

9.6.7.2 Commercial

9.6.7.3 Industrial

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Biomethane Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Feedstock

9.7.4.1 Organic household Waste

9.7.4.2 Animal Manure

9.7.4.3 Energy Crops

9.7.4.4 Agriculture Waste

9.7.4.5 Sewage sludge

9.7.4.6 Industrial food processing waste

9.7.5 Historic and Forecasted Market Size by Production Method

9.7.5.1 Anaerobic Digestion

9.7.5.2 Gasification

9.7.5.3 Fermentation

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Automotive Transportation Fuel

9.7.6.2 Power Generation

9.7.6.3 Industrial Uses

9.7.7 Historic and Forecasted Market Size by End-User

9.7.7.1 Residential

9.7.7.2 Commercial

9.7.7.3 Industrial

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Biomethane Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.32 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.91% |

Market Size in 2032: |

USD 9.73 Bn. |

|

Segments Covered: |

By Feedstock |

|

|

|

By Production Method |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||