Hydrogen Generation Market Synopsis

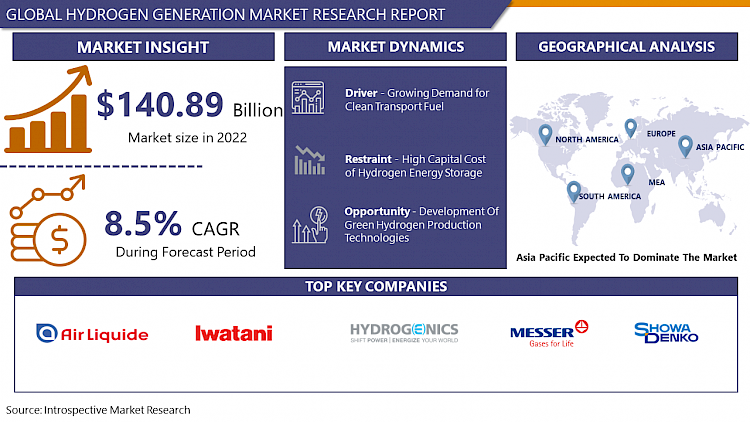

Hydrogen Generation Market Size Was Valued at USD 140.89 Billion in 2022, and is Projected to Reach USD 270.59 Billion by 2030, Growing at a CAGR of 8.5% From 2023-2030.

Hydrogen is made from a variety of resources, including biomass, natural gas, coal, and a variety of other renewable and non-renewable energy sources. Natural gas is currently the most common source of hydrogen, and natural gas steam methane reformers are commonly utilized in hydrogen generation.

- The market for hydrogen generation encompasses various technologies, including steam methane reforming (SMR), electrolysis, and gasification. SMR has traditionally been a dominant method, utilizing natural gas to produce hydrogen, while electrolysis, powered by renewable energy sources, has gained traction as a green and carbon-neutral alternative.

- Government initiatives and corporate commitments to reduce carbon emissions have been driving investments in hydrogen infrastructure and production technologies. Hydrogen is seen as a versatile energy carrier, offering potential solutions for energy storage and decarbonization in sectors that are challenging to electrify directly.

- Collaborations between governments, industries, and research institutions are fostering innovation and the development of cost-effective, efficient hydrogen production methods.

Hydrogen Generation Market Trend Analysis

Growing Demand for Clean Transport Fuel

- The growing demand for clean transport fuel is a significant driving factor for the hydrogen generation market. As the world intensifies its efforts to reduce greenhouse gas emissions and combat climate change, hydrogen has emerged as a promising clean energy carrier, particularly in the transportation sector. Hydrogen can be utilized as a fuel for fuel cell electric vehicles (FCEVs), offering zero-emission mobility solutions.

- Governments and industries globally are investing in the development of hydrogen infrastructure and technologies to support the transition to cleaner transportation. The hydrogen generation market is witnessing increased attention due to its role in producing hydrogen for various applications, including fuel cells for vehicles. Electrolysis, a process that uses renewable energy sources to split water into hydrogen and oxygen, is gaining prominence as a sustainable method for hydrogen production.

- Additionally, advancements in hydrogen production technologies, such as green hydrogen produced through renewable energy sources, further contribute to the market's growth. The demand for clean transport fuel, coupled with supportive policies and investments, positions hydrogen as a key player in the global energy transition towards a more sustainable and low-carbon future.

Development Of Green Hydrogen Production Technologies creates an Opportunity

- The development of green hydrogen production technologies has created a significant opportunity in the hydrogen generation market. Green hydrogen, produced through electrolysis using renewable energy sources like wind or solar power, has emerged as a clean and sustainable alternative to conventional hydrogen production methods, which often rely on fossil fuels. This shift towards green hydrogen aligns with global efforts to reduce carbon emissions and combat climate change.

- Investments in research and development have led to advancements in electrolysis technology, making green hydrogen production more efficient and cost-effective. As governments worldwide commit to ambitious decarbonization goals, the demand for green hydrogen is expected to soar. Industries such as transportation, manufacturing, and energy are increasingly looking to incorporate green hydrogen into their operations as a clean energy source.

- The hydrogen generation market is poised for substantial growth, driven by the expanding applications of green hydrogen across various sectors. This trend not only addresses environmental concerns but also presents economic opportunities for companies involved in hydrogen production technologies. Governments, recognizing the potential of green hydrogen, are likely to implement supportive policies and incentives, further propelling the development and adoption of this sustainable energy solution.

Hydrogen Generation Market Segment Analysis:

Hydrogen Generation Market Segmented on the basis of Type, Technology, Application.

By Type, Merchant segment is expected to dominate the market during the forecast period

- In the rapidly evolving landscape of the hydrogen generation market, the Merchant segment is poised to assert dominance. The Merchant segment refers to companies or entities specialized in hydrogen production and distribution, catering to a diverse range of industries and end-users. This dominance can be attributed to several key factors.

- Merchant hydrogen producers possess the expertise and infrastructure required for efficient large-scale production. Their established facilities and technological capabilities enable them to meet the growing demand for hydrogen across various sectors, including industrial, transportation, and energy.

- The Merchant segment often adopts advanced technologies for hydrogen generation, such as steam methane reforming (SMR), electrolysis, and other innovative methods. This technological prowess not only enhances production efficiency but also aligns with the global push towards green and sustainable hydrogen solutions.

- Additionally, Merchant players are strategically positioned to navigate the complexities of hydrogen distribution and supply chain management. Their ability to offer a reliable and steady supply of hydrogen contributes to their prominence in the market.

By Technology, Steam methane reformation segment held the largest share of 67.3% in 2022

- The Steam Methane Reforming (SMR) segment has emerged as a dominant force in the Hydrogen Generation Market due to its widespread adoption and technological advantages. SMR is a widely employed method for producing hydrogen, accounting for a significant portion of global hydrogen production.

- SMR involves the reaction of methane (natural gas) with steam to produce hydrogen and carbon monoxide. This method is preferred for its efficiency, cost-effectiveness, and scalability. The mature and well-established nature of SMR technology has contributed to its dominance in the hydrogen generation landscape. Industries such as petrochemicals, refineries, and ammonia production heavily rely on SMR for their hydrogen needs.

- Furthermore, the integration of carbon capture and storage (CCS) technologies with SMR has addressed environmental concerns associated with carbon emissions, making it a more sustainable option.

Hydrogen Generation Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific region in the hydrogen generation market is driven by several key factors. Asia Pacific has witnessed a surge in demand for hydrogen as a clean energy carrier, especially in countries like China, Japan, and South Korea, where there is a strong commitment to reducing carbon emissions and transitioning to sustainable energy sources.

- Several initiatives and policies promoting the development and adoption of hydrogen technologies have been implemented in the region, fostering a conducive environment for the growth of the hydrogen generation market. Governments and industries in Asia Pacific are investing heavily in research, development, and deployment of hydrogen production technologies, including electrolysis and steam methane reforming.

- Additionally, the region's abundant renewable energy resources, such as solar and wind power, contribute to the feasibility and sustainability of green hydrogen production methods. Collaborations between governments, industry players, and research institutions further accelerate advancements in hydrogen generation technologies.

- The Asia Pacific's strategic positioning as a major player in the global hydrogen market is expected to persist and strengthen in the coming years, as the region continues to lead in adopting innovative solutions for sustainable energy and achieving carbon-neutral goals.

Hydrogen Generation Market Top Key Players:

- Air Liquide (France)

- Iwatani Corporation (Japan)

- Hydrogenics (Canada)

- Messer Group (Germany)

- Showa Denko K.K. (Japan)

- Linde (UK)

- Epoch Energy Technology Corporation (Taiwan)

- Idroenergy Spa (Italy)

- Praxair Inc (U.S.)

- Air Products(U.S.)

- McPhy (France)

- LNI Swiss gas (Switzerland)

- Airgas (U.S.)

- Parker Hannifin (U.S.)

- Fuel Cell Energy (U.S.)

Key Industry Developments in the Hydrogen Generation Market:

- In October 2023, Air Liquide Partnership with Siemens Energy, inaugurated a gigawatt electrolyzer factory in Berlin to manufacture PEM electrolyzers at scale and drive renewable hydrogen development.

- In November 2023, Air Liquide Investment in Normand'Hy electrolyzer, announced a €400 million investment to build a 200 MW electrolyzer in France, contributing to decarbonizing the Normandy region.

- In December 2023, Air Liquide Collaborated with ENEOS (Japan), Signed a MoU to accelerate the development of low-carbon hydrogen in Japan, leveraging ENEOS' infrastructure and Air Liquide's expertise.

|

Global Hydrogen Generation Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 140.89 Bn. |

|

Forecast Period 2023-30 CAGR: |

8.5% |

Market Size in 2030: |

USD 270.59 Bn. |

|

Segments Covered: |

By System Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- HYDROGEN GENERATION MARKET BY TYPE (2016-2030)

- HYDROGEN GENERATION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MERCHANT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CAPTIVE

- HYDROGEN GENERATION MARKET BY TECHNOLOGY (2016-2030)

- HYDROGEN GENERATION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- STEAM METHANE REFORMING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COAL GASTIFICATION

- HYDROGEN GENERATION MARKET BY APPLICATION (2016-2030)

- HYDROGEN GENERATION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CHEMICAL PROCESSING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FUEL CELLS

- PETROLEUM RECOVERY

- REFINING

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- HYDROGEN GENERATION Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- AIR LIQUIDE (FRANCE)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- IWATANI CORPORATION (JAPAN)

- HYDROGENICS (CANADA)

- MESSER GROUP (GERMANY)

- SHOWA DENKO K.K. (JAPAN)

- LINDE (UK)

- EPOCH ENERGY TECHNOLOGY CORPORATION (TAIWAN)

- IDROENERGY SPA (ITALY)

- PRAXAIR INC (U.S.)

- AIR PRODUCTS (U.S.)

- MCPHY (FRANCE)

- LNI SWISS GAS (SWITZERLAND)

- AIRGAS (U.S.)

- PARKER HANNIFIN (U.S.)

- FUEL CELL ENERGY (U.S.)

- COMPETITIVE LANDSCAPE

- GLOBAL HYDROGEN GENERATION MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By TYPE

- Historic And Forecasted Market Size By TECHNOLOGY

- Historic And Forecasted Market Size By APPLICATION

- Historic And Forecasted Market Size By Segment4

- Historic And Forecasted Market Size By Segment5

- Historic And Forecasted Market Size By Segment6

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Hydrogen Generation Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 140.89 Bn. |

|

Forecast Period 2023-30 CAGR: |

8.5% |

Market Size in 2030: |

USD 270.59 Bn. |

|

Segments Covered: |

By System Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. HYDROGEN GENERATION MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. HYDROGEN GENERATION MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. HYDROGEN GENERATION MARKET COMPETITIVE RIVALRY

TABLE 005. HYDROGEN GENERATION MARKET THREAT OF NEW ENTRANTS

TABLE 006. HYDROGEN GENERATION MARKET THREAT OF SUBSTITUTES

TABLE 007. HYDROGEN GENERATION MARKET BY SYSTEMS TYPE

TABLE 008. MERCHANT MARKET OVERVIEW (2016-2028)

TABLE 009. CAPTIVE MARKET OVERVIEW (2016-2028)

TABLE 010. HYDROGEN GENERATION MARKET BY TECHNOLOGY

TABLE 011. STEAM METHANE REFORMING MARKET OVERVIEW (2016-2028)

TABLE 012. COAL GASIFICATION MARKET OVERVIEW (2016-2028)

TABLE 013. HYDROGEN GENERATION MARKET BY APPLICATION

TABLE 014. CHEMICAL PROCESSING MARKET OVERVIEW (2016-2028)

TABLE 015. FUEL CELLS MARKET OVERVIEW (2016-2028)

TABLE 016. PETROLEUM RECOVERY MARKET OVERVIEW (2016-2028)

TABLE 017. REFINING MARKET OVERVIEW (2016-2028)

TABLE 018. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA HYDROGEN GENERATION MARKET, BY SYSTEMS TYPE (2016-2028)

TABLE 020. NORTH AMERICA HYDROGEN GENERATION MARKET, BY TECHNOLOGY (2016-2028)

TABLE 021. NORTH AMERICA HYDROGEN GENERATION MARKET, BY APPLICATION (2016-2028)

TABLE 022. N HYDROGEN GENERATION MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE HYDROGEN GENERATION MARKET, BY SYSTEMS TYPE (2016-2028)

TABLE 024. EUROPE HYDROGEN GENERATION MARKET, BY TECHNOLOGY (2016-2028)

TABLE 025. EUROPE HYDROGEN GENERATION MARKET, BY APPLICATION (2016-2028)

TABLE 026. HYDROGEN GENERATION MARKET, BY COUNTRY (2016-2028)

TABLE 027. ASIA PACIFIC HYDROGEN GENERATION MARKET, BY SYSTEMS TYPE (2016-2028)

TABLE 028. ASIA PACIFIC HYDROGEN GENERATION MARKET, BY TECHNOLOGY (2016-2028)

TABLE 029. ASIA PACIFIC HYDROGEN GENERATION MARKET, BY APPLICATION (2016-2028)

TABLE 030. HYDROGEN GENERATION MARKET, BY COUNTRY (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA HYDROGEN GENERATION MARKET, BY SYSTEMS TYPE (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA HYDROGEN GENERATION MARKET, BY TECHNOLOGY (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA HYDROGEN GENERATION MARKET, BY APPLICATION (2016-2028)

TABLE 034. HYDROGEN GENERATION MARKET, BY COUNTRY (2016-2028)

TABLE 035. SOUTH AMERICA HYDROGEN GENERATION MARKET, BY SYSTEMS TYPE (2016-2028)

TABLE 036. SOUTH AMERICA HYDROGEN GENERATION MARKET, BY TECHNOLOGY (2016-2028)

TABLE 037. SOUTH AMERICA HYDROGEN GENERATION MARKET, BY APPLICATION (2016-2028)

TABLE 038. HYDROGEN GENERATION MARKET, BY COUNTRY (2016-2028)

TABLE 039. AIR LIQUIDE: SNAPSHOT

TABLE 040. AIR LIQUIDE: BUSINESS PERFORMANCE

TABLE 041. AIR LIQUIDE: PRODUCT PORTFOLIO

TABLE 042. AIR LIQUIDE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. IWATANI CORPORATION: SNAPSHOT

TABLE 043. IWATANI CORPORATION: BUSINESS PERFORMANCE

TABLE 044. IWATANI CORPORATION: PRODUCT PORTFOLIO

TABLE 045. IWATANI CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. HYDROGENICS: SNAPSHOT

TABLE 046. HYDROGENICS: BUSINESS PERFORMANCE

TABLE 047. HYDROGENICS: PRODUCT PORTFOLIO

TABLE 048. HYDROGENICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. MESSER GROUP: SNAPSHOT

TABLE 049. MESSER GROUP: BUSINESS PERFORMANCE

TABLE 050. MESSER GROUP: PRODUCT PORTFOLIO

TABLE 051. MESSER GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. SHOWA DENKO K.K.: SNAPSHOT

TABLE 052. SHOWA DENKO K.K.: BUSINESS PERFORMANCE

TABLE 053. SHOWA DENKO K.K.: PRODUCT PORTFOLIO

TABLE 054. SHOWA DENKO K.K.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. LINDE: SNAPSHOT

TABLE 055. LINDE: BUSINESS PERFORMANCE

TABLE 056. LINDE: PRODUCT PORTFOLIO

TABLE 057. LINDE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. EPOCH ENERGY TECHNOLOGY CORPORATION: SNAPSHOT

TABLE 058. EPOCH ENERGY TECHNOLOGY CORPORATION: BUSINESS PERFORMANCE

TABLE 059. EPOCH ENERGY TECHNOLOGY CORPORATION: PRODUCT PORTFOLIO

TABLE 060. EPOCH ENERGY TECHNOLOGY CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. IDROENERGY SPA: SNAPSHOT

TABLE 061. IDROENERGY SPA: BUSINESS PERFORMANCE

TABLE 062. IDROENERGY SPA: PRODUCT PORTFOLIO

TABLE 063. IDROENERGY SPA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. PRAXAIR INC.: SNAPSHOT

TABLE 064. PRAXAIR INC.: BUSINESS PERFORMANCE

TABLE 065. PRAXAIR INC.: PRODUCT PORTFOLIO

TABLE 066. PRAXAIR INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. AIR PRODUCTS: SNAPSHOT

TABLE 067. AIR PRODUCTS: BUSINESS PERFORMANCE

TABLE 068. AIR PRODUCTS: PRODUCT PORTFOLIO

TABLE 069. AIR PRODUCTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. MCPHY: SNAPSHOT

TABLE 070. MCPHY: BUSINESS PERFORMANCE

TABLE 071. MCPHY: PRODUCT PORTFOLIO

TABLE 072. MCPHY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. LNI SWISSGAS: SNAPSHOT

TABLE 073. LNI SWISSGAS: BUSINESS PERFORMANCE

TABLE 074. LNI SWISSGAS: PRODUCT PORTFOLIO

TABLE 075. LNI SWISSGAS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. AIRGAS: SNAPSHOT

TABLE 076. AIRGAS: BUSINESS PERFORMANCE

TABLE 077. AIRGAS: PRODUCT PORTFOLIO

TABLE 078. AIRGAS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. PARKER HANNIFIN: SNAPSHOT

TABLE 079. PARKER HANNIFIN: BUSINESS PERFORMANCE

TABLE 080. PARKER HANNIFIN: PRODUCT PORTFOLIO

TABLE 081. PARKER HANNIFIN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. FUELCELL ENERGY: SNAPSHOT

TABLE 082. FUELCELL ENERGY: BUSINESS PERFORMANCE

TABLE 083. FUELCELL ENERGY: PRODUCT PORTFOLIO

TABLE 084. FUELCELL ENERGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 085. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 086. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 087. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. HYDROGEN GENERATION MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. HYDROGEN GENERATION MARKET OVERVIEW BY SYSTEMS TYPE

FIGURE 012. MERCHANT MARKET OVERVIEW (2016-2028)

FIGURE 013. CAPTIVE MARKET OVERVIEW (2016-2028)

FIGURE 014. HYDROGEN GENERATION MARKET OVERVIEW BY TECHNOLOGY

FIGURE 015. STEAM METHANE REFORMING MARKET OVERVIEW (2016-2028)

FIGURE 016. COAL GASIFICATION MARKET OVERVIEW (2016-2028)

FIGURE 017. HYDROGEN GENERATION MARKET OVERVIEW BY APPLICATION

FIGURE 018. CHEMICAL PROCESSING MARKET OVERVIEW (2016-2028)

FIGURE 019. FUEL CELLS MARKET OVERVIEW (2016-2028)

FIGURE 020. PETROLEUM RECOVERY MARKET OVERVIEW (2016-2028)

FIGURE 021. REFINING MARKET OVERVIEW (2016-2028)

FIGURE 022. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA HYDROGEN GENERATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE HYDROGEN GENERATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC HYDROGEN GENERATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA HYDROGEN GENERATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA HYDROGEN GENERATION MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Hydrogen Generation Market research report is 2023-2030.

Air Liquide (France), Iwatani Corporation (Japan), Hydrogenics (Canada), Messer Group (Germany), Showa Denko K.K. (Japan), Linde (UK), Epoch Energy Technology Corporation (Taiwan), Idroenergy Spa (Italy), Praxair Inc (U.S.), Air Products (U.S.), McPhy (France), LNI Swissgas (Switzerland), Airgas (U.S.), Parker Hannifin (U.S.), FuelCell Energy (U.S.), and other major players.

The Hydrogen Generation Market is segmented into System Type, Technology, Application, and region. By System Type, the market is categorized into Merchant, and Captive. By Technology, the market is categorized into Steam Methane Reforming, Coal Gasification. By Application, the market is categorized into Chemical Processing, Fuel Cells, Petroleum Recovery, Refining, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Hydrogen is made from a variety of resources, including biomass, natural gas, coal, and a variety of other renewable and non-renewable energy sources. Natural gas is currently the most common source of hydrogen, and natural gas steam methane reformers are commonly utilized in hydrogen generation. However, modern processes such as electrolysis and pyrolysis can also be used to create hydrogen.

Hydrogen Generation Market Size Was Valued at USD 140.89 Billion in 2022, and is Projected to Reach USD 270.59 Billion by 2030, Growing at a CAGR of 8.5 % From 2023-2030.