Biochip Product and Services Market Synopsis:

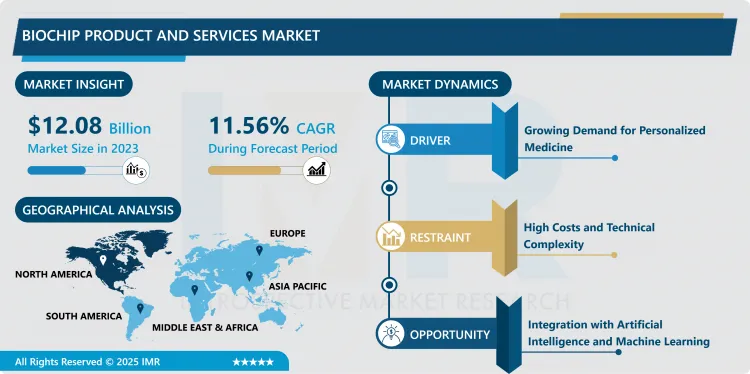

Biochip Product and Services Market Was Valued at USD 12.08 Billion in 2023 and is Projected to Reach USD 32.33 Billion by 2032, Growing at a CAGR of 11.56 % from 2024 to 2032.

The biochip product and services market are the economic sector that in some cases will produce, and mainly will sell biochips –small devices that could analyze biological materials at the molecular level. These biochips normally come in form of arrays of micro structures like DNA, protein or antibodies to be used in diagnostic, individualized therapies, drug discovery and exploration among others. Market is defined as the global biochip bioelectronics and related services including biochip production, data services and maintenance for markets including but not limited to biomedical, pharmacological and biotechnological. Biochips have the advantages of high throughput, miniaturization, easy transformation into rapid and inexpensive diagnostic methods, so without biochips, there can be no progress in healthcare and science.

It also determined that the Biochip Products and Services market is expanding due to the introduction of personalized medicine, enhanced biotechnology, and the surge of point-of-care diagnostics. Biochips which can perform multiple biological assays in a single chip possess characteristics such as high throughput, miniaturization, and comparatively lower cost for different applications in diagnostics, drug discovery, genomics and proteomics. Products offered in the market include DNA microarrays, protein microarrays, lab-on-a-chip devices and biosensors: the products help researchers, clinicians and industries achieve different goals and objectives.

Recent improvement in the fields of micro-fluid dynamics and miniaturization has caused bio-chips to become more efficient in the results obtained. However, biochips have important application in disease diagnosis, most importantly in cancer, infectious disease, and genetic disorders where timely diagnosis is of essence. Other services such as data analysis particularly related to the usage of the biochips, product customization and integration of the chips into existing diagnostic platforms are also gradually picking up due to the efforts of healthcare systems worldwide to enhance efficiency and patient value. The market’s growth is the development of partnerships between pharmaceutical companies, healthcare providers, biochips’ producers, which causes growing investments in the new biochip technologies. However, few problems, including start-up costs, legal requirements, and data analysis, remain barriers to dissemination. Nonetheless, the Biochip Products and Services market has significant prospects for growth because of continuous development and higher demand for multiplexed diagnostics.

Biochip Product and Services Market Trend Analysis

Trend

Driving the Growth of the Biochip Products and Services Market

- Biochips, small composite structures containing biological macromolecules such as DNA, RNA or proteins arrayed on a solid substrate for analysis, are currently on the receiving end for several areas of usage which include; diagnostics, drug discovery, pharmacogenomics and genetic analysis. These devices enable the high-speed and reliable analysis of biological information and are therefore critical resources in genomics and molecular biology. The trends that are expected to fuel growth of the biochip market are; Humanized/inialized medicine/ precision medicine. Since biochips ensable the rapid detection of biomarkers and genes, they help in the creation of novel treatments, enhancing the quality of life and the evolution of a personalized medicine.

- Rise in the incidence of chronic diseases like cancer, diabetes and cardiovascular diseases exert additional pressure to use the biochip-based diagnostic tools. Timely identification of the diseases is always important if they are to be effectively dealt with and biochips present this opportunity to be able to make that identification in the shortest time possible. It is conveniently poised to meet some of the emerging trends in modern medicine such as precision medicine and shift from acute care to preventive care as well as a platform for developing new drugs and diagnostics that are customized to patients’ needs. This trend is fuelling the need for biochip based testing solutions and standard kit for reasons such as are faster and provide more accurate data in comparison with conventional diagnostic tools proving that they are essential in today’s health care system.

Advancements in the Biochip Products and Services Market

- Biochips are instrumental in molecular diagnostics, drug discovery, and other applications and since the chips can potentially perform more than one test at a time with great accuracy, they are revolutionary. Perhaps the greatest chance biochip technology has is within the area of healthcare, particularly through the use of companion diagnostics. Hailed as the diagnostics that go a long way in matching patients with the most effective treatments based on their biochips that tend to analyse their genetic makeup. With the development of the concept as precision medicine, biochips act as reliable devices for providing personalized treatments and better results for patients. An increasing interest in new methods such as genetic-based treatment has even advanced the applications of biochips because of the fast and effective response in clinical applications.

- Moreover, the current introduction of the biosensor into the health care delivery systems will definitely trigger the need for an increased number of biochips to be used in giving out new generation services such as high level diagnostic tests and monitoring of chronic diseases. Patients and healthcare organizations – and manufacturers of drugs and medical equipment – are increasingly incorporating biochips inside commonly practiced clinical practices, and for detection and subsequent tracking of ailments like cancer and cardiovascular disorders. Perhaps it is even more crucial for chronic diseases as people often need to reconsider their treatment and care routines frequently. As biochips make possible constant surveillance and accurate measurements, biochip services and products offer to help to increase standards in the healthcare business, thus presenting many prospects for corporations in this sector.

Biochip Product and Services Market Segment Analysis:

Biochip Product and Services Market Segmented on the basis of Technology, Application, End-User, and Region

By Technology, DNA Microarrays segment is expected to dominate the market during the forecast period

- DNA microarrays have become THE vital tool in genomics because they allow the analysis large number of genes at once, which is very useful in gene expression, sequencing, and polymorphism analysis. This technology is essentially like studying various gene expressions in a single sample slide as to identify which genes are turned on, turned off, or are distorted in some way. Since microarrays can be applied to determine the relation of gene expression to certain conditions, it is central to disease mechanisms. This capability is the core of genomics techniques as it enables them to look at millions of pieces of genetic data at one time, a process that saves time and money compared to carrying out thousands of experiments individually.

- Within the context of pharmacogenomics, especially within the field of individualized medicine, DNA microarrays are crucial in defining genetic changes and sequenced associated with specific disease. They allow doctors identify special DNA that might be connected with diseases such as cancer, heart disorders or diabetes and improve treatment applications. By means of both these arrays clinicians can determine how patients will react to one or another medication and open the way to deep personalized treatment programs that yield the utmost therapeutic affectivity with the least possible side effects. Therefore, application of DNA microarray increases the diagnostic accuracy and treatment specificity; the role of which is critical in perfecting the Precision Medicine.

By End-User, Diagnostics segment expected to held the largest share

- Diagnostic centres today remain key early adopters of biochip technology which relies on DNA and protein microarrays for such uses as disease diagnosis, genetic profiling and pharmacogenomics. Through the employment of biochips, these centers are in a position to determine diseases at an early stage and these include cancer, cardiovascular diseases and most importantly genetic disorders. High throughput of this biochip technology makes it possible to test numerously the multiple genetic markers and accrue significant data about patient’s health profile within a short span of time. While this capability is useful in integrating diagnostic information for clinical use, its value comes from assisting in more accurate decision making for complex and perhaps critical problems that require immediate action.

- The use of biochips for diagnosing healthcare disorders in diagnostic centers has slowly gained traction due to an escalating number of diseases attributing to chronic and weaker lifestyles, and an emphasis on medical check-ups, the market. This is the reason why more people are looking for early diagnosis to have a chance to control the progression of diseases, biochip technology makes it possible in large scale. Also, they allow physicians to design personal therapy measures thanks to the identification of the patient’s genetic or molecular biomarkers associated with the risk of getting ill or responding to a particular treatment. Such accurate diagnostic tests allow for more appropriate strategies to be designed to increase the chances of the patient’s recovery and minimize downsides, and it is where biochip technology is critical to contemporary diagnostics.

Biochip Product and Services Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In North America region, the biochip products and service market has experience high growth due to the well-developed health care sector and high investment on research and development. The region’s established network of hospitals, universities and research institutes together with the biotechnology firms makes the environment suitable for development of biochip applications. The US in particular stands to gain most of it with vigorous governmental push and grants meant for genomics, proteomics and more molecular processes research. These governmental supports along with the participation of the famous biochip producers played the role of significant boosts in technology improvements and boosts the accuracy, the effectiveness, and the replicability of biochip technologies. Therefore, the U.S. has emerged as a leader in growth within the biochip industry, while North America, in general, dominates the international market.

- In addition, North America demographic experienced a growing necessity for the biochip solutions in clinical diagnostics, drug discovery, and even in forensic investigation fields. Biochips have now emerged as powerful instruments in differentiating the markers of the gene, helping advance the processes of personalized therapeutic procedures, and contributing to the implementation of Precision Medicine programs. Biochips are useful in clinical diagnostics as they are helping to diagnose diseases at an early stage and therefore provide favourable treatment solutions. Consequently, they are providing improved, and far more specific and accurate analytical results in forensic science which assists police and legal systems. Such diverse applications document North America as a strategic region in the future prospects of the biochip industry worldwide as it remains a densely populated with innovative mindsets, high acceptance, and significant market influence region.

Active Key Players in the Biochip Product and Services Market:

- Thermo Fisher Scientific Inc.

- Agilent Technologies Inc.

- Illumina Inc.

- Qiagen N.V.

- PerkinElmer Inc.

- Bio-Rad Laboratories, Inc.

- NantHealth

- HTG Molecular Diagnostics

- Oxford Nanopore Technologies

- Other Active Players

|

Biochip Product and Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.08 Billion |

|

Forecast Period 2024-32 CAGR: |

11.56% |

Market Size in 2032: |

USD 32.33 Billion |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Biochip Product and Services Market by Technology

4.1 Biochip Product and Services Market Snapshot and Growth Engine

4.2 Biochip Product and Services Market Overview

4.3 DNA Microarrays

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 DNA Microarrays: Geographic Segmentation Analysis

4.4 Protein Microarrays

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Protein Microarrays: Geographic Segmentation Analysis

4.5 Lab-on-a-chip (LOC)

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Lab-on-a-chip (LOC): Geographic Segmentation Analysis

4.6 Other Biochip Technologies

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Other Biochip Technologies: Geographic Segmentation Analysis

Chapter 5: Biochip Product and Services Market by Application

5.1 Biochip Product and Services Market Snapshot and Growth Engine

5.2 Biochip Product and Services Market Overview

5.3 Diagnostics

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Diagnostics: Geographic Segmentation Analysis

5.4 Drug Discovery and Development

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Drug Discovery and Development: Geographic Segmentation Analysis

5.5 Environmental Testing

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Environmental Testing: Geographic Segmentation Analysis

5.6 Forensic Applications

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Forensic Applications: Geographic Segmentation Analysis

5.7 Other Applications

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Other Applications: Geographic Segmentation Analysis

Chapter 6: Biochip Product and Services Market by End-User

6.1 Biochip Product and Services Market Snapshot and Growth Engine

6.2 Biochip Product and Services Market Overview

6.3 Diagnostics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Diagnostics: Geographic Segmentation Analysis

6.4 Drug Discovery and Development

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Drug Discovery and Development: Geographic Segmentation Analysis

6.5 Environmental Testing

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Environmental Testing: Geographic Segmentation Analysis

6.6 Forensic Applications

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Forensic Applications: Geographic Segmentation Analysis

6.7 Other Applications

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Other Applications: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Biochip Product and Services Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 THERMO FISHER SCIENTIFIC INC.

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AGILENT TECHNOLOGIES INC.

7.4 ILLUMINA INC.

7.5 QIAGEN N.V.

7.6 PERKINELMER INC.

7.7 BIO-RAD LABORATORIES INC.

7.8 NANTHEALTH

7.9 HTG MOLECULAR DIAGNOSTICS

7.10 OXFORD NANOPORE TECHNOLOGIES

7.11 OTHER ACTIVE PLAYERS

Chapter 8: Global Biochip Product and Services Market By Region

8.1 Overview

8.2. North America Biochip Product and Services Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Technology

8.2.4.1 DNA Microarrays

8.2.4.2 Protein Microarrays

8.2.4.3 Lab-on-a-chip (LOC)

8.2.4.4 Other Biochip Technologies

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Diagnostics

8.2.5.2 Drug Discovery and Development

8.2.5.3 Environmental Testing

8.2.5.4 Forensic Applications

8.2.5.5 Other Applications

8.2.6 Historic and Forecasted Market Size By End-User

8.2.6.1 Diagnostics

8.2.6.2 Drug Discovery and Development

8.2.6.3 Environmental Testing

8.2.6.4 Forensic Applications

8.2.6.5 Other Applications

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Biochip Product and Services Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Technology

8.3.4.1 DNA Microarrays

8.3.4.2 Protein Microarrays

8.3.4.3 Lab-on-a-chip (LOC)

8.3.4.4 Other Biochip Technologies

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Diagnostics

8.3.5.2 Drug Discovery and Development

8.3.5.3 Environmental Testing

8.3.5.4 Forensic Applications

8.3.5.5 Other Applications

8.3.6 Historic and Forecasted Market Size By End-User

8.3.6.1 Diagnostics

8.3.6.2 Drug Discovery and Development

8.3.6.3 Environmental Testing

8.3.6.4 Forensic Applications

8.3.6.5 Other Applications

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Biochip Product and Services Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Technology

8.4.4.1 DNA Microarrays

8.4.4.2 Protein Microarrays

8.4.4.3 Lab-on-a-chip (LOC)

8.4.4.4 Other Biochip Technologies

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Diagnostics

8.4.5.2 Drug Discovery and Development

8.4.5.3 Environmental Testing

8.4.5.4 Forensic Applications

8.4.5.5 Other Applications

8.4.6 Historic and Forecasted Market Size By End-User

8.4.6.1 Diagnostics

8.4.6.2 Drug Discovery and Development

8.4.6.3 Environmental Testing

8.4.6.4 Forensic Applications

8.4.6.5 Other Applications

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Biochip Product and Services Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Technology

8.5.4.1 DNA Microarrays

8.5.4.2 Protein Microarrays

8.5.4.3 Lab-on-a-chip (LOC)

8.5.4.4 Other Biochip Technologies

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Diagnostics

8.5.5.2 Drug Discovery and Development

8.5.5.3 Environmental Testing

8.5.5.4 Forensic Applications

8.5.5.5 Other Applications

8.5.6 Historic and Forecasted Market Size By End-User

8.5.6.1 Diagnostics

8.5.6.2 Drug Discovery and Development

8.5.6.3 Environmental Testing

8.5.6.4 Forensic Applications

8.5.6.5 Other Applications

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Biochip Product and Services Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Technology

8.6.4.1 DNA Microarrays

8.6.4.2 Protein Microarrays

8.6.4.3 Lab-on-a-chip (LOC)

8.6.4.4 Other Biochip Technologies

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Diagnostics

8.6.5.2 Drug Discovery and Development

8.6.5.3 Environmental Testing

8.6.5.4 Forensic Applications

8.6.5.5 Other Applications

8.6.6 Historic and Forecasted Market Size By End-User

8.6.6.1 Diagnostics

8.6.6.2 Drug Discovery and Development

8.6.6.3 Environmental Testing

8.6.6.4 Forensic Applications

8.6.6.5 Other Applications

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Biochip Product and Services Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Technology

8.7.4.1 DNA Microarrays

8.7.4.2 Protein Microarrays

8.7.4.3 Lab-on-a-chip (LOC)

8.7.4.4 Other Biochip Technologies

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Diagnostics

8.7.5.2 Drug Discovery and Development

8.7.5.3 Environmental Testing

8.7.5.4 Forensic Applications

8.7.5.5 Other Applications

8.7.6 Historic and Forecasted Market Size By End-User

8.7.6.1 Diagnostics

8.7.6.2 Drug Discovery and Development

8.7.6.3 Environmental Testing

8.7.6.4 Forensic Applications

8.7.6.5 Other Applications

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Biochip Product and Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.08 Billion |

|

Forecast Period 2024-32 CAGR: |

11.56% |

Market Size in 2032: |

USD 32.33 Billion |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Biochip Product and Services Market research report is 2024-2032.

Thermo Fisher Scientific Inc., Agilent Technologies Inc., Illumina Inc., Qiagen N.V., PerkinElmer Inc., Bio-Rad Laboratories, Inc., NantHealth, HTG Molecular Diagnostics, Oxford Nanopore Technologies, and Other Active Players.

The Biochip Product and Services Market is segmented into By Technology, By Application, By End-User and region. By Technology, the market is categorized into DNA Microarrays, Protein Microarrays, Lab-on-a-chip (LOC) and Other Biochip Technologies. By Application, the market is categorized into Diagnostics, Drug Discovery and Development, Environmental Testing, Forensic Applications and Other Applications. By End-User, the market is categorized into Diagnostics, Drug Discovery and Development, Environmental Testing, Forensic Applications and Other Applications. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Biochip products and services refer to miniature devices that integrate biological materials with microfabricated platforms to perform various biochemical analyses. These chips are used for applications such as diagnostics, drug discovery, genetic testing, and environmental monitoring. Typically composed of arrays of sensors, electrodes, or probes, biochips enable the simultaneous analysis of multiple biological samples at high throughput and precision. They offer significant advancements in personalized medicine, genomics, and molecular biology by providing rapid, cost-effective, and miniaturized solutions for detecting and monitoring biological markers, diseases, and genetic conditions.

Biochip Product and Services Market Was Valued at USD 12.08 Billion in 2023 and is Projected to Reach USD 32.33 Billion by 2032, Growing at a CAGR of 11.56 % from 2024 to 2032.