Bio Coal Market Synopsis

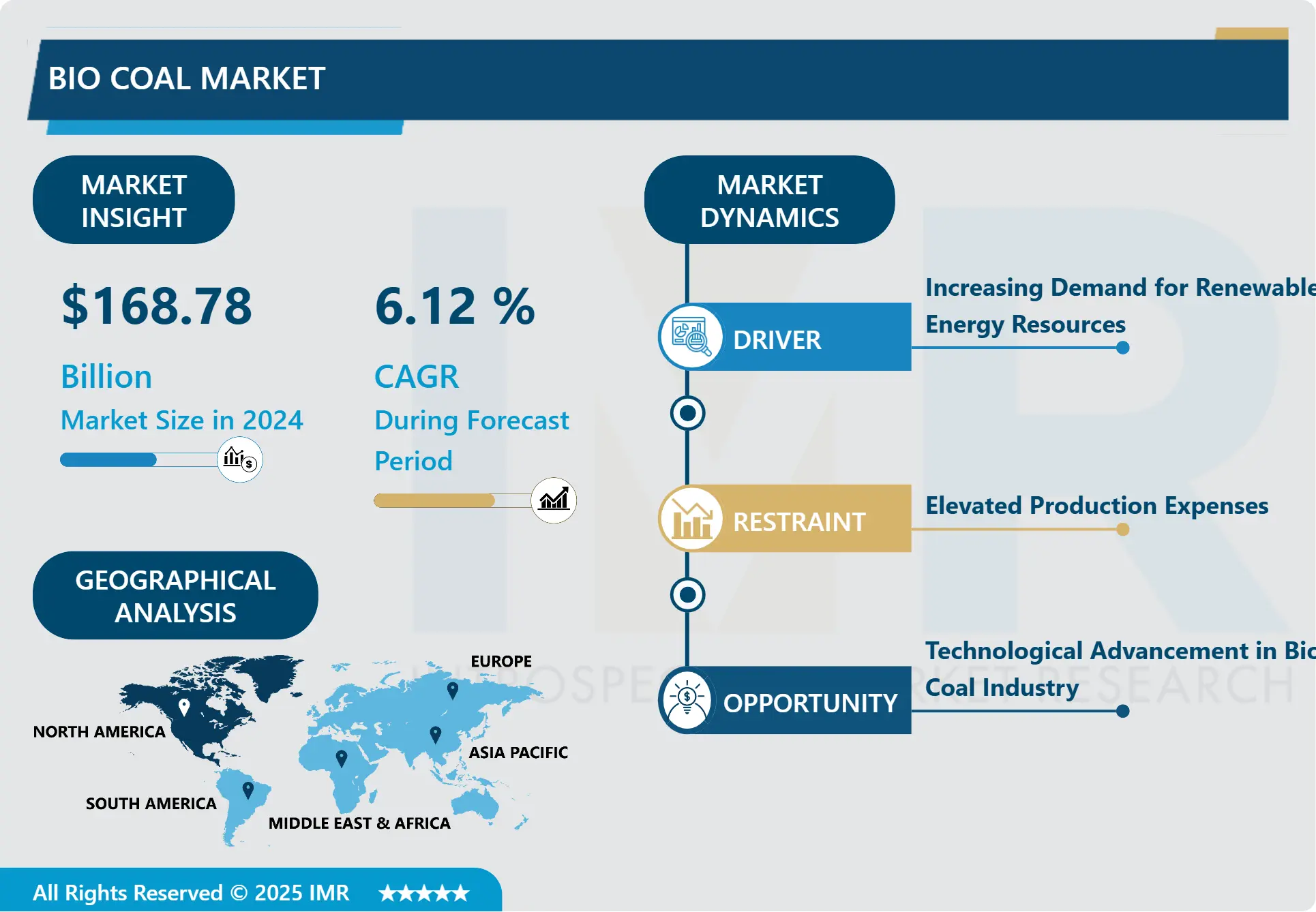

Bio Coal Market Size Was Valued at USD 168.78 Billion in 2024, and is Projected to Reach USD 271.46 Billion by 2030, Growing at a CAGR of 6.12 % From 2025-2032.

Bio coal is a carbon-neutral fuel that can replace fossil coal in industrial processes. It is produced within the process of Bio-green pyrolysis and carbonization of raw biomass performed within controlled temperature and residence time conditions.

Thermal conversion of biomass, which is done under the oxygen-free conditions process, allows to remove volatile organic compounds and cellulose components from the feedstock and create a uniform, solid biofuel with characteristics similar to the ones in fossil coal. Such fuels are gaining increasing attention in the carbon-intensive industries and the launch of new Bio-green production facilities dedicated to bio coal production is heralding a new approach towards the using of fossil-free solid fuels.

In contrary to the raw biomass, the character of the bio coal is significantly different from the typical standard wood pellets or briquets. It features higher energy density, high carbon content, hydrophobic properties and significant resistance to biological degradation. Bio-coal can offer a sustainable and fossil-free alternative for industries such as metallurgy, where using raw biomass as a reducing agent in blast furnace would normally not be possible because of the biomass high moisture content, low fixed carbon and high contents of volatile matter and oxygen.

Bio Coal Market Trend Analysis

Bio Coal Market Growth Driver- Increasing Demand for Renewable Energy Resources

- Global bio coal market escalating a high demand for renewable energy sources. There is rising concerns about climate change and environmental sustainability increased and also government, businesses and consumers are actively seeking for alternatives to traditional fossil fuels. Bio coal is formed from organic waste and biomass, as helps to reduce greenhouse gas emission and dependence on non-renewable resources.

- Diversification of energy sources enhances energy security by reducing dependence on fossil fuels, which are subject to price volatility and geopolitical uncertainties. Bio-coal provides a domestic, renewable energy option that can complement other renewable energy sources like wind and solar. Government around the world also promoting to stimulate investment in the sector, promote research and development and create a conductive environment for the growth of bio coal market.

Bio Coal Market Opportunity- Technological Advancements in Bio Coal Industry

- Advancements in technology have been instrumental in enhancing the efficiency and viability of bio coal production Innovations in biomass conversion technologies, pyrolysis, and torrefaction processes have enabled the creation of high-quality bio coal with improved energy content and combustion characteristics. These technological strides contribute to making bio coal a competitive alternative to traditional coal and other fossil fuels.

- Improved process efficiency not only enhances the quality of bio coal but also reduces production costs, making it more economically attractive. Research and development efforts in the field of bio coal technology continue to refine existing methods and explore new techniques, further boosting the marker's growth. As technological barriers are overcome, the scalability and commercial viability bio coal production increase, driving its adoption on a global scale?

Bio Coal Market Segment Analysis:

Bio Coal Market is Segmented on the basis of type, application, and end-users.

By Type, Woody Biomass Segment Is Expected to Dominate the Market During The Forecast Period

- Woody biomass is expected to dominating a market in forecasted period because it is used commonly for bio coal production. Woody biomass is widely available globally, sourced from forests, sawmills, and wood processing industries. This abundance ensures a consistent and reliable supply, making it a preferred feedstock for bio-coal production. Woody biomass is relatively easy to process into bio-coal through various techniques such as torrefaction, pyrolysis, or hydrothermal carbonization.

- Its composition and properties make it suitable for efficient conversion into high-quality bio-coal products. Due to its reliability, consistent quality, and favourable properties, woody biomass often enjoys greater market preference among consumers and industries involved in bio-coal production and utilization.

By Application, Power Generation Segment Held the Largest Share of In 2024

- Power generation is a significant application for bio-coal, mainly in regions aiming to reduce reliance on fossil fuels and meet renewable energy targets. Bio coal is increasingly used as a renewable and sustainable alternative source to fossil fuels in power plants.

- Factors such as government incentives, renewable energy policies, and the need for clean energy sources to mitigate climate change can drive the dominance of bio-coal in power generation. Additionally, advancements in bio-coal production technologies and improvements in combustion efficiency contribute to its suitability for power plants

Bio Coal Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is expected to dominating bio coal market in that United States is main consumer of bio-coal. They focus on energy security and climate change mitigation aligns with the goals of bio-coal utilization. By reducing reliance on fossil fuels and lowering greenhouse gas emissions, bio-coal contributes to achieving regional energy and environmental targets.

- The region has been at the forefront of research and development in bioenergy technologies, including those related to bio-coal production. Advanced processing techniques and efficient conversion methods contribute to the competitiveness of North American bio-coal in the global market.

Bio Coal Key Industry Players

- Enviva Partners (USA)

- FutureMetrics (USA)

- Pinnacle Renewable Energy Inc. (Canada)

- Pacific BioEnergy Corporation (Canada)

- Blackwood Technology (UK)

- Valmet Corporation (Finland)

- Drax Group plc (UK)

- Viridis Energy Inc. (Canada)

- Biochar Now LLC (USA)

- Diacarbon Energy Inc. (Canada)

- Agri-Tech Producers, LLC (USA)

- Thunderbolt Biomass, Inc. (USA)

- White Energy (USA)

- Neste Corporation (Finland)

- Green Circle Bio Energy Inc. (USA)

- Nova Pangaea Technologies Ltd (UK)

- Anellotech (USA)

- Clean Energy Holdings, LLC (USA)

- Renewable Energy Group, Inc. (USA)

- Licella Holdings Ltd (Australia)

- Velocys plc (UK)

- Black & Veatch Holding Company (USA)

- Enerkem Inc. (Canada)

- Wood PLC (UK)

- Advanced BioRefinery Inc (USA)

- Other Active Player

|

Global Bio Coal Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 168.78 Bn. |

|

Forecast Period 2025-32 CAGR: |

6.12 % |

Market Size in 2032: |

USD 271.46 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Agri-Tech Producers, LLC (USA), Thunderbolt Biomass, Inc. (USA), White Energy (USA), Neste Corporation (Finland), Green Circle Bio Energy Inc. (USA) and other Active Players. |

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Bio Coal Market by Type (2018-2032)

4.1 Bio Coal Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Woody Biomass

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Agricultural Waste

Chapter 5: Bio Coal Market by Application (2018-2032)

5.1 Bio Coal Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Power Generation

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Residential

5.5 Commercial heating

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Bio Coal Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ENVIVA PARTNERS (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 FUTUREMETRICS (USA)

6.4 PINNACLE RENEWABLE ENERGY INC. (CANADA)

6.5 PACIFIC BIOENERGY CORPORATION (CANADA)

6.6 BLACKWOOD TECHNOLOGY (UK)

6.7 VALMET CORPORATION (FINLAND)

6.8 DRAX GROUP PLC (UK)

6.9 VIRIDIS ENERGY INC. (CANADA)

6.10 BIOCHAR NOW LLC (USA)

6.11 DIACARBON ENERGY INC. (CANADA)

6.12 AGRI-TECH PRODUCERS

6.13 LLC (USA)

6.14 THUNDERBOLT BIOMASS INC. (USA)

6.15 WHITE ENERGY (USA)

6.16 NESTE CORPORATION (FINLAND)

6.17 GREEN CIRCLE BIO ENERGY INC. (USA)

6.18 NOVA PANGAEA TECHNOLOGIES LTD (UK)

6.19 ANELLOTECH (USA)

6.20 CLEAN ENERGY HOLDINGS

6.21 LLC (USA)

6.22 RENEWABLE ENERGY GROUP INC. (USA)

6.23 LICELLA HOLDINGS LTD (AUSTRALIA)

6.24 VELOCYS PLC (UK)

6.25 BLACK & VEATCH HOLDING COMPANY (USA)

6.26 ENERKEM INC. (CANADA)

6.27 WOOD PLC (UK)

6.28 ADVANCED BIOREFINERY INC (USA)

Chapter 7: Global Bio Coal Market By Region

7.1 Overview

7.2. North America Bio Coal Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Woody Biomass

7.2.4.2 Agricultural Waste

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Power Generation

7.2.5.2 Residential

7.2.5.3 Commercial heating

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Bio Coal Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Woody Biomass

7.3.4.2 Agricultural Waste

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Power Generation

7.3.5.2 Residential

7.3.5.3 Commercial heating

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Bio Coal Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Woody Biomass

7.4.4.2 Agricultural Waste

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Power Generation

7.4.5.2 Residential

7.4.5.3 Commercial heating

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Bio Coal Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Woody Biomass

7.5.4.2 Agricultural Waste

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Power Generation

7.5.5.2 Residential

7.5.5.3 Commercial heating

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Bio Coal Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Woody Biomass

7.6.4.2 Agricultural Waste

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Power Generation

7.6.5.2 Residential

7.6.5.3 Commercial heating

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Bio Coal Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Woody Biomass

7.7.4.2 Agricultural Waste

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Power Generation

7.7.5.2 Residential

7.7.5.3 Commercial heating

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Bio Coal Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 168.78 Bn. |

|

Forecast Period 2025-32 CAGR: |

6.12 % |

Market Size in 2032: |

USD 271.46 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Agri-Tech Producers, LLC (USA), Thunderbolt Biomass, Inc. (USA), White Energy (USA), Neste Corporation (Finland), Green Circle Bio Energy Inc. (USA) and other Active Players. |

||