B2B Mobile Commerce Market Synopsis

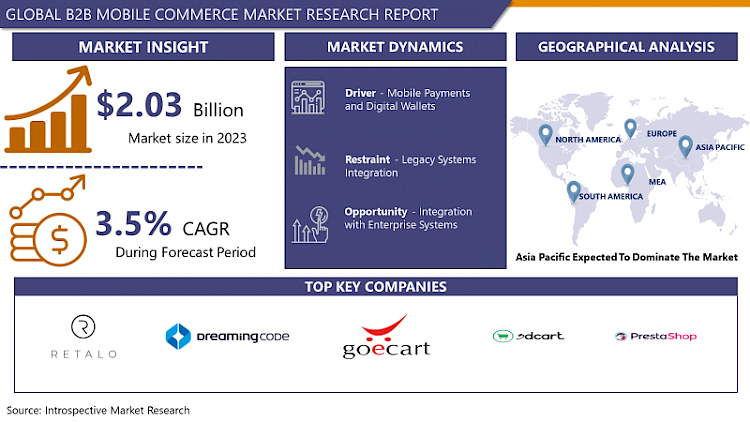

B2B Mobile Commerce Market Size Was Valued at USD 19.6 Billion in 2023 and is Projected to Reach USD 84.32 Billion by 2032, Growing at a CAGR of 17.6% From 2024-2032.

Business-to-business mobile commerce has also recently emerged to become one of the most popular market areas because most companies have opted to incorporate the technology with the aim of enhancing their relations with their own customers as well as being able to elevate their overall performance. This market relates to negotiated business sales where firms and enterprises use mobile devices to facilitate supply chain, purchasing, and selling. Specifically, the increase in the popularity of the use of mobile device such as smartphones and tablets, advancement in technologies in the mobile devices and the increasing demand for speed and real time information access in business to business communication are the main driving forces for this expansion. Businesses are investing in mobile commerce platforms as a way of improving the order taking, facilitating partners and adding more and more customer care. In addition, the integration with the trends of mobile commerce innovation including artificial intelligence (AI), blockchain, and the Internet of Things (IoT) is disrupting B2B. Machine learning commonly known as AI helps in predictive analysis and personalization; block chain on the other hand, provides secure and trustworthy transaction. It helps in outlining an effective logistics company as it allows real time tracking of products and sharing of information.

- The B2B mobile commerce sector is characterized by a fast-growing trend attribute to smart phone usage and integration of mobile technology in business. B2B organizations’ survey showed that mobile either becomes or is contributing to more than 40% of overall revenues, making mobile crucial for sales.

- Mobile apps, artificial intelligence, and big data are among the marvels improving the future B2B mobile commerce. Mobile apps for native platforms are also distinctive and can enrich customer experience, provide effective means of payment and improve customers’ engagement. These apps enable multi-step transactions, for instance, customization of products, and bargaining with suppliers, making them important components in business.

- Players in global B2B mobile commerce industry include Shopify, BigCommerce, Magento, and Alibaba. There are small business, mid- sized business, and large business categories, and the mobile solution meet these business sizes individual needs. Furthermore, the overall use of mobile commerce is rising in business industries, facilitating an optimum performance in sales.

B2B Mobile Commerce Market Trend Analysis

Mobile Payments and Digital Wallets

- Among various fields of opportunity in B2B mobile commerce, the concept of MP/DW holds the unique position of being a burgeoning disruptor of transactional domains. The frequency of business transactions through mobile devices has ultimately led to the need for enabling users to make seamless, secure payments. Convenience payment methods like the Apple and Google Pay and other online wallets have quickly adapted themselves in the purchasing process and improved B2B buying experience and personal financial management.

- These solutions not only enhance the facet of purchasing by reducing the time duration spent on the process but also make payments safer with the help of tokenization and biometric facilities as compared to the conventional payment concepts. Furthermore, the use of mobile payments & digital wallets in B2B transactions makes it easier to track payments & C2B COD orders since they are recorded in an electronic format thus improving the overall reconciliations & auditing of any B2B transactions that take place.

- In addition, adaptable ability of the mobile payments due to versatility can support different types of B2B sectors and flexibility by covering the bulk, regular, and subscription requirement basis needs. It allows businesses and companies to seize opportunities and constantly make necessary changes in accordance with changing market conditions on the backdrop of emerging digital economy.

- Altogether, the utilization of mobile payments and digital wallets in the B2B mobile commerce market streamlines the interactions of the transactions and equally fuels innovation and trust between buyer and seller that will create the sustainability of the mobile commerce market and increase competitiveness in the digital channel.

Integration with Enterprise Systems

- Among emerging strategies in the context of B2B mobile commerce, switching to enterprise systems cooperation becomes recognized as a key driver that can affect the effectiveness of business transactions. Also, mobility is gradually becoming an important facet of B2B business transactions, wherein integrating with backend such as ERP, CRM solutions, and others becomes mandatory for reshaping business processes and improving productivity.

- It means that with integration of B2B mobile commerce with enterprise systems the data can be updated in real time, which helps firms update their stock and order management, and deliver customised customer experience. It allows organisations to dismantle traditional silo-based approaches to workflows and make sure that every stakeholder receives a detailed and well-constructed picture of sales outcomes, customer behaviours, and, ultimately, market conditions.

- Additionally, linking it to enterprise systems improves the security concerns and issue of compliance since the information is encrypted and is stored in secure backend frameworks. It gives confidence among B2B buyers thus promoting better purchasing behaviors that enhance the chances of repeat purchasing.

- In addition, the communication enhanced by connected systems permits organizations to participate in essential processes like automation technologies, running with artificial intelligence (AI) functions, automating recurrent activities, and facilitating decision-making processes with intelligent, analytical, and learning capacities.

- In other words, through integration with enterprise systems in the B2B mobile commerce market, there is understanding of connectivity and collaboration as a key factor towards attaining optimal organizational performance and offering high value to the consumer in a rapidly accelerating connected environment.

B2B Mobile Commerce Market Segment Analysis:

B2B Mobile Commerce Market Segmented based on by Application, and by Product.

By Application, Small Businesses segment is expected to dominate the market during the forecast period.

- In the vast solution area of B2B mobile commerce, all sizes of applications are available which address the needs of each kind of business separately.

- To the small businesses, it is very useful to undertake the B2B mobile commerce applications as they assist in procurement and inventory control as well as the contacts to the suppliers and distributors. They usually come with convenient graphic user interfaces, easy payment methods, and a capacity to expand, which allows retail firms and small business players to level up their competition within digital markets without having to invest too much on overhead.

- For B2B m-commerce applications, value creation can be derived from the improved customization to the existing systems and business functionalities, as well as the enabling of advanced analytics for midsized businesses. These applications assist midsized businesses to manage supply chain, to analyze the tendencies of purchasing and to build successful sources of supply, thereby promoting growth and profitability in the framework of competitive prerequisites.

- B2B Mobile commerce strategic applications constitute a strategic part of enterprise systems architecture, interrelating with ERP, CRM, and other support systems in large businesses. These applications support all enabler processes in procurement all the way from initiating to a procurement event, allow real-time collaboration with the vendors and clients and leverage data analytics for decision-making for large businesses, ensuring they continue to be agile and innovative as they grow big.

- To sum, B2B mobile commerce applications help all sizes of companies, deliver customizations to the available features and functionalities of m-commerce solutions that suit their needs and help them grow and succeed in the contemporary and globalized economic landscape.

By Product, Native Mobile Commerce Apps segment held the largest share in 2023

- Among all the trends in the ever-growing market of B2B mobile commerce, native mobile commerce applications have been identified as an essential product accelerating business performance, establishing relationships, and expanding markets.The native application for mobile commerce enables the business to have an exclusive domain through which it will be easy to sell products to the buyers or even the B2B clients by offering a platform where customers can be provided with what they desire in terms of experience and product usage. They are developed deliberately for mobile platforms with the primary focus on benefiting from particular features of the operating systems such as Apple’s IOS and the Android systems, offering easy to use interfaces designs for the mobile applications.

- For B2B sellers, native mobile commerce apps allow clients to access their product catalogs and detailed information on prices and customer profiles directly from their mobile devices, and such features help salespeople to respond promptly to their clients and complete orders quickly while developing a strong rapport with them. Besides, these apps may also interact with the backend functions such as ERP and CRM to update the inventory control, order, and others or provide customers support in real time.

- From the buyer’s side, NMCommerce apps provide greater convenience, options, and usability as with NMCommerce apps, they are able to search for products, make purchases and follow delivery status at their own convenience. Other related features like push notifications, that implements individual recommendations and in-app messaging enhances the overall purchasing experience to ensure continuity as well as consumer loyalty.

- In sum, native mobile commerce apps are crucial in the market in sustaining innovation and competitiveness of the B2B mobile commerce market through enhancing the business competition and prepared them for change that view customer’s expectations, opportunities that are shaping a new business environment through centralization and digitization.

B2B Mobile Commerce Market Regional Insights:

Asia Pacific region accounted for the largest market share and also witnessed the fastest growth Rate.

- Among all the regions in the world, the Asia Pacific region takes the biggest market share in the B2B mobile commerce market and grows rapidly due to the growing use of the e-commerce platforms among B2B enterprises.

- This growth is attributed to factors such as the increased business environment in the region by Anticipated SMEs: B2B companies are likely to benefit immensely from the digital economy to expand and enhance competitiveness. Due to skyrocketing sales of smartphone devices and access to internet services, there has been increased adoption of mobile commerce among the business entities in the Asia Pacific region in order to enhance procurement flows, reach to new customers and establish partnerships beyond borders.

- Furthermore, there are several developing countries in the Asia Pacific region, which are active in the manufacturing and trading business, to satisfy the needs of B2B mobile commerce for efficient and effective transaction and to improve the business relationship between suppliers, distributors, and buyers.

- Besides this, the improved legal conditions granted for the adoption of digitalization and investment opportunities in infrastructural development have helped to foster a conducive environment to B2B mobile commerce in the region as it has influenced business organisations to adopt technology advanced strategies in the noble course of innovation and progression for sustainable development.

- Consequently, the region of Asia pacific retains to be a global of various opportunities for B2B mobile commerce providers hence immense potential market expansion and revenues generation as the behavior and dynamics of the market changes.

Active Key Players in the B2B Mobile Commerce Market

- Retalo (Germany)

- Handshake Corp. (United States)

- DreamingCode (United States)

- Contalog (India)

- GoECart (United States)

- Insite Software (United States)

- 3dcart (United States)

- PrestaShop (France)

- BigCommerce (United States)

- WOOCOMMERCE (United States)

- Shopify (Canada)

- Magento (United States), and Other Key Players

|

Global Smart Surfaces Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 19.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

17.6% |

Market Size in 2032: |

USD 84.32 Bn. |

|

Segments Covered: |

By Application |

|

|

|

By Product |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Retalo (Germany), Handshake Corp. (United States), Dreaming Code (United States), Contalog (India), GoECart (United States), Insite Software (United States),3dcart (United States), PrestaShop (France), BigCommerce (United States), WOOCOMMERCE (United States), Shopify (Canada), Magento (United States) and Other Key Players |

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- B2B MOBILE COMMERCE MARKET BY APPLICATION (2017-2032)

- B2B MOBILE COMMERCE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SMALL BUSINESSES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MIDSIZED BUSINESSES

- LARGE BUSINESSES

- B2B MOBILE COMMERCE MARKET BY PRODUCT (2017-2032)

- B2B MOBILE COMMERCE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- NATIVE MOBILE COMMERCE APPS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- OTHER

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- B2B Mobile Commerce Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- RETALO (GERMANY)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- HANDSHAKE CORP. (UNITED STATES)

- DREAMINGCODE (UNITED STATES)

- CONTALOG (INDIA)

- GOECART (UNITED STATES)

- INSITE SOFTWARE (UNITED STATES)

- 3DCART (UNITED STATES)

- PRESTASHOP (FRANCE)

- BIGCOMMERCE (UNITED STATES)

- WOOCOMMERCE (UNITED STATES)

- SHOPIFY (CANADA)

- MAGENTO (UNITED STATES)

- COMPETITIVE LANDSCAPE

- GLOBAL B2B MOBILE COMMERCE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Product

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Smart Surfaces Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 19.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

17.6% |

Market Size in 2032: |

USD 84.32 Bn. |

|

Segments Covered: |

By Application |

|

|

|

By Product |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Retalo (Germany), Handshake Corp. (United States), Dreaming Code (United States), Contalog (India), GoECart (United States), Insite Software (United States),3dcart (United States), PrestaShop (France), BigCommerce (United States), WOOCOMMERCE (United States), Shopify (Canada), Magento (United States) and Other Key Players |

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. B2B MOBILE COMMERCE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. B2B MOBILE COMMERCE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. B2B MOBILE COMMERCE MARKET COMPETITIVE RIVALRY

TABLE 005. B2B MOBILE COMMERCE MARKET THREAT OF NEW ENTRANTS

TABLE 006. B2B MOBILE COMMERCE MARKET THREAT OF SUBSTITUTES

TABLE 007. B2B MOBILE COMMERCE MARKET BY TYPE

TABLE 008. NATIVE MOBILE COMMERCE APPS MARKET OVERVIEW (2016-2028)

TABLE 009. OTHER MARKET OVERVIEW (2016-2028)

TABLE 010. B2B MOBILE COMMERCE MARKET BY APPLICATION

TABLE 011. APPLICATION A MARKET OVERVIEW (2016-2028)

TABLE 012. APPLICATION B MARKET OVERVIEW (2016-2028)

TABLE 013. APPLICATION C MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA B2B MOBILE COMMERCE MARKET, BY TYPE (2016-2028)

TABLE 015. NORTH AMERICA B2B MOBILE COMMERCE MARKET, BY APPLICATION (2016-2028)

TABLE 016. N B2B MOBILE COMMERCE MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE B2B MOBILE COMMERCE MARKET, BY TYPE (2016-2028)

TABLE 018. EUROPE B2B MOBILE COMMERCE MARKET, BY APPLICATION (2016-2028)

TABLE 019. B2B MOBILE COMMERCE MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC B2B MOBILE COMMERCE MARKET, BY TYPE (2016-2028)

TABLE 021. ASIA PACIFIC B2B MOBILE COMMERCE MARKET, BY APPLICATION (2016-2028)

TABLE 022. B2B MOBILE COMMERCE MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA B2B MOBILE COMMERCE MARKET, BY TYPE (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA B2B MOBILE COMMERCE MARKET, BY APPLICATION (2016-2028)

TABLE 025. B2B MOBILE COMMERCE MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA B2B MOBILE COMMERCE MARKET, BY TYPE (2016-2028)

TABLE 027. SOUTH AMERICA B2B MOBILE COMMERCE MARKET, BY APPLICATION (2016-2028)

TABLE 028. B2B MOBILE COMMERCE MARKET, BY COUNTRY (2016-2028)

TABLE 029. RETALO: SNAPSHOT

TABLE 030. RETALO: BUSINESS PERFORMANCE

TABLE 031. RETALO: PRODUCT PORTFOLIO

TABLE 032. RETALO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. HANDSHAKE CORP.: SNAPSHOT

TABLE 033. HANDSHAKE CORP.: BUSINESS PERFORMANCE

TABLE 034. HANDSHAKE CORP.: PRODUCT PORTFOLIO

TABLE 035. HANDSHAKE CORP.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. DREAMINGCODE: SNAPSHOT

TABLE 036. DREAMINGCODE: BUSINESS PERFORMANCE

TABLE 037. DREAMINGCODE: PRODUCT PORTFOLIO

TABLE 038. DREAMINGCODE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. CONTALOG: SNAPSHOT

TABLE 039. CONTALOG: BUSINESS PERFORMANCE

TABLE 040. CONTALOG: PRODUCT PORTFOLIO

TABLE 041. CONTALOG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. GOECART: SNAPSHOT

TABLE 042. GOECART: BUSINESS PERFORMANCE

TABLE 043. GOECART: PRODUCT PORTFOLIO

TABLE 044. GOECART: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. INSITE SOFTWARE: SNAPSHOT

TABLE 045. INSITE SOFTWARE: BUSINESS PERFORMANCE

TABLE 046. INSITE SOFTWARE: PRODUCT PORTFOLIO

TABLE 047. INSITE SOFTWARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. 3DCART: SNAPSHOT

TABLE 048. 3DCART: BUSINESS PERFORMANCE

TABLE 049. 3DCART: PRODUCT PORTFOLIO

TABLE 050. 3DCART: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. PRESTASHOP: SNAPSHOT

TABLE 051. PRESTASHOP: BUSINESS PERFORMANCE

TABLE 052. PRESTASHOP: PRODUCT PORTFOLIO

TABLE 053. PRESTASHOP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. BIGCOMMERCE: SNAPSHOT

TABLE 054. BIGCOMMERCE: BUSINESS PERFORMANCE

TABLE 055. BIGCOMMERCE: PRODUCT PORTFOLIO

TABLE 056. BIGCOMMERCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. WOOCOMMERCE: SNAPSHOT

TABLE 057. WOOCOMMERCE: BUSINESS PERFORMANCE

TABLE 058. WOOCOMMERCE: PRODUCT PORTFOLIO

TABLE 059. WOOCOMMERCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. SHOPIFY: SNAPSHOT

TABLE 060. SHOPIFY: BUSINESS PERFORMANCE

TABLE 061. SHOPIFY: PRODUCT PORTFOLIO

TABLE 062. SHOPIFY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. MAGENTO: SNAPSHOT

TABLE 063. MAGENTO: BUSINESS PERFORMANCE

TABLE 064. MAGENTO: PRODUCT PORTFOLIO

TABLE 065. MAGENTO: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. B2B MOBILE COMMERCE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. B2B MOBILE COMMERCE MARKET OVERVIEW BY TYPE

FIGURE 012. NATIVE MOBILE COMMERCE APPS MARKET OVERVIEW (2016-2028)

FIGURE 013. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 014. B2B MOBILE COMMERCE MARKET OVERVIEW BY APPLICATION

FIGURE 015. APPLICATION A MARKET OVERVIEW (2016-2028)

FIGURE 016. APPLICATION B MARKET OVERVIEW (2016-2028)

FIGURE 017. APPLICATION C MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA B2B MOBILE COMMERCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE B2B MOBILE COMMERCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC B2B MOBILE COMMERCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA B2B MOBILE COMMERCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA B2B MOBILE COMMERCE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the B2B Mobile Commerce Market research report is 2024-2032.

Retalo (Germany), Handshake Corp. (United States), Dreaming Code (United States), Contalog (India), GoECart (United States), Insite Software (United States),3dcart (United States), PrestaShop (France), BigCommerce (United States), WOOCOMMERCE (United States), Shopify (Canada), Magento (United States) and Other Key Players

The B2B Mobile Commerce Market is segmented into Application (Small Businesses, Midsized Businesses, Large Businesses), Product (Native Mobile Commerce Apps, Other) and By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

B2B mobile commerce refers to the buying and selling of goods and services between businesses through mobile devices such as smartphones and tablets. It encompasses a range of activities including procurement, order management, inventory tracking, and payment processing conducted via mobile applications, websites, or other digital platforms. B2B mobile commerce enables businesses to streamline transactions, enhance efficiency, and extend their reach to customers and suppliers in a fast-paced, interconnected digital marketplace.

B2B Mobile Commerce Market Size Was Valued at USD 19.6 Billion in 2023 and is Projected to Reach USD 84.32 Billion by 2032, Growing at a CAGR of 17.6% From 2024-2032.