Automotive Emission Test Equipment Market Synopsis

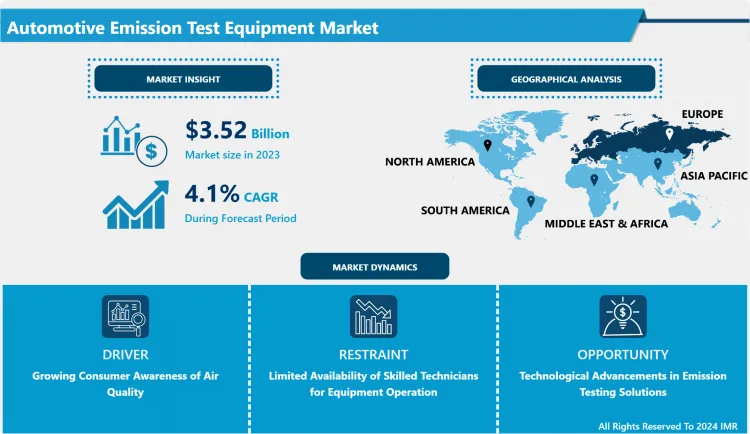

Automotive Emission Test Equipment Market Size is Valued at USD 3.52 Billion in 2023, and is Projected to Reach USD 4.85 Billion by 2032, Growing at a CAGR of 4.10% From 2024-2032.

Automotive Emission Test Equipment Market encompasses, manufacturing, selling and distributing equipment and testing systems utilized in identifying pollutants from vehicles. This equipment assists in making sure that vehicles meet the emission standards of the environment through determination of carbon monoxide (CO), nitrogen oxides (NOx), hydrocarbons (HC), particulate matter (PM) and also from gasoline, diesel and other alt. Fuel vehicles. This market is important for automotive industries, governments and agencies responsible for standards, and services centers for emission standards all around the world.

- The major factor that thus increases the growth of the AE TE market is the higher legal requirements for emissions and environmental standards. As the levels of environmental pollution increase and its impacts on the health of citizens and the state are becoming more and more alarming, many countries have imposed mandatory emissions control, and vehicle inspection. Legal requirements regarding reduced emissions persuade automotive manufacturers and repair centers to invest in the high-end emission testing equipment driving its market. Moreover, support from a government to encourage the implementation of cleaner transportation systems push the need for these testing solutions even further.

- The other is increasing consciousness on negative effects of emissions from cars among consumers and industries. The dynamism of the financier world and increasing global gross, urbanization and industrialization especially among the emerging economies resulted to increased numbers of vehicles causing pollution. For this reason, the importance of developed testing methods for fuel efficiency improvement and decreasing hazardous emissions is increased. Automotive manufacturers are also pressured to release environment friendly automobiles that undergo far more rigorous emissions testing before they are allowed on the market.

Automotive Emission Test Equipment Market Trend Analysis

Shift toward digitalization and automation.

- It is important to clarify those proportional changes in the Automotive Emission Test Equipment Market concern digitalization and automation. As the technologies in sensors and data analysis are improving, the equipment used for emission tests are enhancing in terms of efficiency, accuracy and interface for the end users. With automated emission testing systems, there are fewer opportunities for the error that comes with manual inputs, and the systems offer constant updates which can be applied to evaluations or documented. This trend is especially valuable for massive automotive service stations and OEMs where numerous tests are likely to be performed.

- Another giant trend is the growing need for transportable and miniature emission testing equipment. Since the various diagnostic models in vehicles are becoming more developed, portable emission testers are becoming popular with service centers as well as persons owning vehicles. These devices are portable, and this means that tests for emissions can be carried out on site and concurrently and therefore increases efficiency and effectiveness. However, market development of electric and hybrid vehicles is also affects the market and to test these new emission standard vehicles, new emission standards newly introduced.

Adoption of electric and hybrid vehicles.

- Perhaps, one of the biggest prospects in the automotive emission test equipment market is electrification and hybrid vehicles. With the shift towards cleaner energy and transport emissions standards for hybrids are getting more elaborate and the testing technologies more sophisticated. Firms that design, produce, or install the equipment for testing emission from the sources of the new generation of fuels will experience major opportunities especially given the growing markets in electric cars in Europe, North America and China.

- Therefore, emission testing is increasingly on demand in the regions where vehicle density increases significantly, such as developing countries. Today Asia-Pacific, Latin America, Middle East & Africa automotive markets are rapidly evolving and it is found that a number of governments have started implementing more stringent emission regulations. Therefore, there is a growing demand for proper emission testing equipment in these areas and allow firms the chance to market their solutions to a new market.

Automotive Emission Test Equipment Market Segment Analysis:

Automotive Emission Test Equipment Market Segmented on the basis of Product type, Emission Type, application, and end-users.

By Product Type, Opacity Meters segment is expected to dominate the market during the forecast period

- The segmentation of the automotive emission test equipment is carried out based on the product as it comprises of a several tools used to measure different types of emissions. An opacity meter and a smoke meter are utilized to determine the amount of smoke and the degree of opacity in the gaseous fumes, particularly those evolved by diesel engines. The primary analyzers are CO and CO2 analyzers that concern carbon monoxide and carbon dioxide exhausts which are important in air pollution regulation standards. HC analyzers measure unburned HC concentrations in the exhaust that shows poor level of combustion of fuel. NOx analyzers measure NOx, which is a major source of air borne pollutants. Other emission test equipment include gadget that is used to monitor other pollutants or equipment required to enhance the testing procedure. These devices taken as one make certain that vehicles conform to the emissions standards set by law.

By Application, Passenger Vehicles segment held the largest share in 2024

- In certain cases, the marginal usage of auto emission test equipment is a necessity as automotive emission test equipment applications are made based on automobile types such as passenger vehicles, Commercial vehicles, and motorcycles. Passenger cars followed by light commercial vehicles are the largest type, which has to undergo emission testing on a regular basis in order to comply with emissions standards. Trucks buses and other heavy facilities fall under the heavy-duty category and therefore require higher standards of emission safety testing and this requires more robust testing equipment. Powered by engines, however smaller, motorcycles also contribute to emissions and are tested, especially in areas, where emission-choked regulation is strict. Every category of vehicles is unique as per their construction and emission profile which need solution definitely for testing their emissions.

Automotive Emission Test Equipment Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

- Europe is the largest and fastest-growing region in the Automotive Emission Test Equipment Market due to growing concern over emission control and its largest automotive industries. Germany, France and UK among others have adopted some of the highest emission standards known to mankind and this has lead humanity to experience the necessity to test the emissions from their vehicles frequently. The European Union’s legal requirements surrounding environmental requirements are definitive in the push towards more efficient emission testing solutions across the Europe. Also, Europe automobile industry which has specialized in luxury and performance cars also concentrate on needs of emission requirements.

- Thus apart from a relatively high level of regulatory requirements Europe has been experiencing a high growth rate of sales of electric and hybrid vehicles. This is specifically because automakers have not relented in their quest to develop new and better designs of energy saving vehicles, and thus emission testing technology has had to move to the next level in order to ensure that it is on par with the kind of vehicles being produced on the market. This has also led to increased sales of test equipments for emission manufactures which has specialized in testing equipments for hybrid & electric vehicles.

Active Key Players in the Automotive Emission Test Equipment Market

- Horiba Ltd. (Japan)

- AVL LIST GmbH (Austria)

- Bosch Automotive Service Solutions Inc. (USA)

- Applus+ Technologies Inc. (Spain)

- SGS SA (Switzerland)

- TSI Incorporated (USA)

- Opus Group (Sweden)

- ABB Ltd. (Switzerland)

- Emission Systems Inc. (USA)

- Sierra Instruments Inc. (USA) and Others Active Players

|

Global Automotive Emission Test Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.52 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.10 % |

Market Size in 2032: |

USD 4.85 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Emission Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Horiba Ltd. (Japan), AVL LIST GmbH (Austria), Bosch Automotive, Service Solutions Inc. (USA), Applus+ Technologies Inc. (Spain), SGS SA (Switzerland), TSI Incorporated (USA), Opus Group (Sweden), ABB Ltd. (Switzerland), Emission Systems Inc. (USA), Sierra Instruments Inc. (USA), and Other Major Players. |

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Emission Test Equipment Market by Product Type (2018-2032)

4.1 Automotive Emission Test Equipment Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Opacity Meters

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Smoke Meters

4.5 CO and CO2 Analyzers

4.6 Hydrocarbon (HC) Analyzers

4.7 NOx Analyzers

4.8 Other Emission Test Equipment

Chapter 5: Automotive Emission Test Equipment Market by Emission Type (2018-2032)

5.1 Automotive Emission Test Equipment Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Gasoline Emission Testing

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Diesel Emission Testing

5.5 Alternative Fuel Emission Testing

Chapter 6: Automotive Emission Test Equipment Market by Application (2018-2032)

6.1 Automotive Emission Test Equipment Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Passenger Vehicles

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Commercial Vehicles

6.5 Motorcycles

Chapter 7: Automotive Emission Test Equipment Market by End User (2018-2032)

7.1 Automotive Emission Test Equipment Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Automotive OEMs

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Automotive Service and Repair Centers

7.5 Government Regulatory Agencies

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Automotive Emission Test Equipment Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 HORIBA LTD. (JAPAN)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 AVL LIST GMBH (AUSTRIA)

8.4 BOSCH AUTOMOTIVE SERVICE SOLUTIONS INC. (USA)

8.5 APPLUS+ TECHNOLOGIES INC. (SPAIN)

8.6 SGS SA (SWITZERLAND)

8.7 TSI INCORPORATED (USA)

8.8 OPUS GROUP (SWEDEN)

8.9 ABB LTD. (SWITZERLAND)

8.10 EMISSION SYSTEMS INC. (USA)

8.11 SIERRA INSTRUMENTS INC. (USA) OTHERS ACTIVE PLAYERS

8.12

Chapter 9: Global Automotive Emission Test Equipment Market By Region

9.1 Overview

9.2. North America Automotive Emission Test Equipment Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Product Type

9.2.4.1 Opacity Meters

9.2.4.2 Smoke Meters

9.2.4.3 CO and CO2 Analyzers

9.2.4.4 Hydrocarbon (HC) Analyzers

9.2.4.5 NOx Analyzers

9.2.4.6 Other Emission Test Equipment

9.2.5 Historic and Forecasted Market Size by Emission Type

9.2.5.1 Gasoline Emission Testing

9.2.5.2 Diesel Emission Testing

9.2.5.3 Alternative Fuel Emission Testing

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Passenger Vehicles

9.2.6.2 Commercial Vehicles

9.2.6.3 Motorcycles

9.2.7 Historic and Forecasted Market Size by End User

9.2.7.1 Automotive OEMs

9.2.7.2 Automotive Service and Repair Centers

9.2.7.3 Government Regulatory Agencies

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Automotive Emission Test Equipment Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Product Type

9.3.4.1 Opacity Meters

9.3.4.2 Smoke Meters

9.3.4.3 CO and CO2 Analyzers

9.3.4.4 Hydrocarbon (HC) Analyzers

9.3.4.5 NOx Analyzers

9.3.4.6 Other Emission Test Equipment

9.3.5 Historic and Forecasted Market Size by Emission Type

9.3.5.1 Gasoline Emission Testing

9.3.5.2 Diesel Emission Testing

9.3.5.3 Alternative Fuel Emission Testing

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Passenger Vehicles

9.3.6.2 Commercial Vehicles

9.3.6.3 Motorcycles

9.3.7 Historic and Forecasted Market Size by End User

9.3.7.1 Automotive OEMs

9.3.7.2 Automotive Service and Repair Centers

9.3.7.3 Government Regulatory Agencies

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Automotive Emission Test Equipment Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Product Type

9.4.4.1 Opacity Meters

9.4.4.2 Smoke Meters

9.4.4.3 CO and CO2 Analyzers

9.4.4.4 Hydrocarbon (HC) Analyzers

9.4.4.5 NOx Analyzers

9.4.4.6 Other Emission Test Equipment

9.4.5 Historic and Forecasted Market Size by Emission Type

9.4.5.1 Gasoline Emission Testing

9.4.5.2 Diesel Emission Testing

9.4.5.3 Alternative Fuel Emission Testing

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Passenger Vehicles

9.4.6.2 Commercial Vehicles

9.4.6.3 Motorcycles

9.4.7 Historic and Forecasted Market Size by End User

9.4.7.1 Automotive OEMs

9.4.7.2 Automotive Service and Repair Centers

9.4.7.3 Government Regulatory Agencies

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Automotive Emission Test Equipment Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Product Type

9.5.4.1 Opacity Meters

9.5.4.2 Smoke Meters

9.5.4.3 CO and CO2 Analyzers

9.5.4.4 Hydrocarbon (HC) Analyzers

9.5.4.5 NOx Analyzers

9.5.4.6 Other Emission Test Equipment

9.5.5 Historic and Forecasted Market Size by Emission Type

9.5.5.1 Gasoline Emission Testing

9.5.5.2 Diesel Emission Testing

9.5.5.3 Alternative Fuel Emission Testing

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Passenger Vehicles

9.5.6.2 Commercial Vehicles

9.5.6.3 Motorcycles

9.5.7 Historic and Forecasted Market Size by End User

9.5.7.1 Automotive OEMs

9.5.7.2 Automotive Service and Repair Centers

9.5.7.3 Government Regulatory Agencies

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Automotive Emission Test Equipment Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Product Type

9.6.4.1 Opacity Meters

9.6.4.2 Smoke Meters

9.6.4.3 CO and CO2 Analyzers

9.6.4.4 Hydrocarbon (HC) Analyzers

9.6.4.5 NOx Analyzers

9.6.4.6 Other Emission Test Equipment

9.6.5 Historic and Forecasted Market Size by Emission Type

9.6.5.1 Gasoline Emission Testing

9.6.5.2 Diesel Emission Testing

9.6.5.3 Alternative Fuel Emission Testing

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Passenger Vehicles

9.6.6.2 Commercial Vehicles

9.6.6.3 Motorcycles

9.6.7 Historic and Forecasted Market Size by End User

9.6.7.1 Automotive OEMs

9.6.7.2 Automotive Service and Repair Centers

9.6.7.3 Government Regulatory Agencies

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Automotive Emission Test Equipment Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Product Type

9.7.4.1 Opacity Meters

9.7.4.2 Smoke Meters

9.7.4.3 CO and CO2 Analyzers

9.7.4.4 Hydrocarbon (HC) Analyzers

9.7.4.5 NOx Analyzers

9.7.4.6 Other Emission Test Equipment

9.7.5 Historic and Forecasted Market Size by Emission Type

9.7.5.1 Gasoline Emission Testing

9.7.5.2 Diesel Emission Testing

9.7.5.3 Alternative Fuel Emission Testing

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Passenger Vehicles

9.7.6.2 Commercial Vehicles

9.7.6.3 Motorcycles

9.7.7 Historic and Forecasted Market Size by End User

9.7.7.1 Automotive OEMs

9.7.7.2 Automotive Service and Repair Centers

9.7.7.3 Government Regulatory Agencies

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Automotive Emission Test Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.52 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.10 % |

Market Size in 2032: |

USD 4.85 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Emission Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Horiba Ltd. (Japan), AVL LIST GmbH (Austria), Bosch Automotive, Service Solutions Inc. (USA), Applus+ Technologies Inc. (Spain), SGS SA (Switzerland), TSI Incorporated (USA), Opus Group (Sweden), ABB Ltd. (Switzerland), Emission Systems Inc. (USA), Sierra Instruments Inc. (USA), and Other Major Players. |

||

Frequently Asked Questions :

The forecast period in the Automotive Emission Test Equipment Market research report is 2024-2032.

Horiba Ltd. (Japan), AVL LIST GmbH (Austria), Bosch Automotive, Service Solutions Inc. (USA), Applus+ Technologies Inc. (Spain), SGS SA (Switzerland), TSI Incorporated (USA), Opus Group (Sweden), ABB Ltd. (Switzerland), Emission Systems Inc. (USA), Sierra Instruments Inc. (USA), and Other Major Players. and Other Major Players.

The Automotive Emission Test Equipment Market is segmented into by Product Type (Opacity Meters, Smoke Meters, CO and CO2 Analyzers, Hydrocarbon (HC) Analyzers, NOx Analyzers, Other Emission Test Equipment), By Emission Type (Gasoline Emission Testing, Diesel Emission Testing, Alternative Fuel Emission Testing), By Application (Passenger Vehicles, Commercial Vehicles, Motorcycles), End-User (Automotive OEMs, Automotive Service and Repair Centers, Government Regulatory Agencies). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Automotive Emission Test Equipment Market involves the production, sales, and distribution of devices and systems used to measure and analyze the pollutants emitted from vehicles. This equipment helps ensure vehicles comply with environmental regulations by testing emissions such as carbon monoxide (CO), nitrogen oxides (NOx), hydrocarbons (HC), and particulate matter (PM) from gasoline, diesel, and alternative fuel vehicles. This market serves a critical role in automotive industries, government regulatory agencies, and service centers to maintain and enforce emission standards globally.

Automotive Emission Test Equipment Market Size is Valued at USD 3.52 Billion in 2024, and is Projected to Reach USD 4.85 Billion by 2032, Growing at a CAGR of 4.10% From 2024-2032.