Automotive Camshaft Market Synopsis

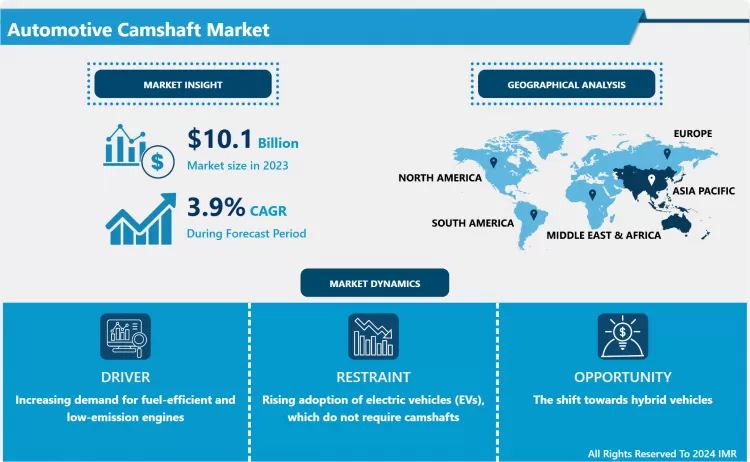

Automotive Camshaft Market Size Was Valued at USD 10.1 Billion in 2023, and is Projected to Reach USD 14.3 Billion by 2032, Growing at a CAGR of 3.9% From 2024-2032.

Automotive camshaft market derives its meaning from the global market of camshafts which are the essential parts of internal combustion engines that control the operation of engine valves. The camshaft is complex and plays a vital role in most vehicles to maintain good timing of most valves so that good performance, efficiency and fuel combustion can take place inside the engine. This component has a central function of increasing maximum engine power, decreasing emissions, and increasing fuel economy. Automotive camshaft is a type of product applicable for passenger cars, commercial vehicles as well as heavy vehicles. These camshafts come in different materials including cast iron, forged steel and billet steel each with its strengths in terms of hard wearing properties and costs. With the change in the automotive Industry, for instance, in the development of the fuel-efficient, low emissions new generation of engines, the Camshaft Industry is witnessing innovation and development alike. The factors such as, hike in engine downsizing trends, turbo charging, hybrid vehicles are pushing the demand for complicated as well as high performing camshaft.

- Looking at the year 2023, there has been growth in the automotive camshaft market this was brought by the growing vehicle production and the never-ending market for fuel-efficient engines. The engine technology prospective, emission laws reinforcement, and light weight material utilization are some of the key drivers, which enhance the market demand for high quality camshaft. Another change that has affected the nature of this market is the movement from ordinary camshafts to overhead camshafts (OHC) and dual overhead camshafts (DOHC) as auto makers work to satisfy consumers needs for vehicles with high levels of fuel efficiency and low or no tailpipe emissions. Further, the emergence of the hybrid and electric vehicle (EVs) segment places another challenge before the camshaft making companies since they need to address the changing demand in the market. Camshafts are traditionally associated with internal combustion engines, although advanced vehicles today including EV’s do not necessarily have camshafts although hybrids with ICEs keep up the demand.

- Furthermore, owing to increase in the production of vehicles in the growth countries like China, India and Brazil will affect it favourably.. This is evident in these regions there is a steady rise in disposable income, increased urbanization besides the enhancement of infrastructure that has seen a rampant increase of car usage. In addition, aftermarket for automotive camshafts is another source for the market growth due to frequency of maintenance, repair and replacement of camshafts in the old car fleet. Many players are participating in this market- OEMs (Original Equipment Manufacturers) and a number of suppliers in the aftermarket, thereby making it a very competitive segment. Therefore, the automotive camshaft market is expected to sustain its growth rates in the years to come across the world.

Automotive Camshaft Market Trend Analysis

Increasing Demand for High-Performance Camshafts

- Current tendencies found in the automotive camshaft market include far-famed high-performance camshafts.. These include, improvement in the internal structure of the engines, an increase in the demand for economical automotive vehicles which are environmentally friendly and powerful. Today automotive manufacturers are sharply oriented on engine downsizing, using turbochargers and direct fuel injections to meet low emission standards, and camshaft producers are developing new kind of camshafts to be in line with these standards.

- For example, VVT technology used in camshafts enhances flexibility in the manner valves operate based on the driving conditions, improving fuel economy, and engine performance.. In addition, the use of materials including light metals and alloys, together with composites, has enhanced the efficiency of camshaft by seeking to establish light weight in addition to strength.

Hybrid Vehicle Growth Propelling Market Expansion

- Owing to the current vehicle transformation to electric cars, the camshaft market still has immense potential in the hybrid vehicle niche.. Camshafts are still needed in today’s hybrid automobiles as they use a mix of internal combustion engines and electrical motors to make use of cams for controlling valve procedures, thereby providing a market for the sustained demand of such items within this new automobile market. Increased deployment of hybrid automobiles throughout the globe targeting the fuel-efficient vehicle market makes for a highly promising market specializing in camshafts. Organisations that would be in a position to innovate, and develop camshafts to this hybrid powerplants with VVT and low friction coefficient will be in a good position to take advantage of this development. Also, the rise in research and development dollars to design camshafts that are suitable to work with the advanced hybrid powertrains that are next generation also offer market growth opportunities to the players in the global camshafts market.

Automotive Camshaft Market Segment Analysis:

Automotive Camshaft Market Segmented on the basis of type, Vehicle Type and Sales Channel.

By Type, Cast Camshaft segment is expected to dominate the market during the forecast period

- Out of all the types of camshafts, the cast camshaft segment is expected to be the largest in the automotive camshaft market during the forecast period because it is cheaper and more widely used in several car models.. Most cast camshafts are made from cast iron or steel, so they are easier and less costly to make than forged or billet camshafts. The casting process also making it easier to come up with design that may be difficult to achieve through other methods due to the continuous advancement in the use of engines in both individual and commercial vehicles.

- Finally, the cast camshafts provide adequate hardness and robustness for most ordinary internal combustion engines and, therefore, are favoured by automotive manufacturers to achieve optimum performance at reasonable costs.. As automotive manufacturing gets shifting to the emerging economies especially in the Asia-Pacific where concerns of manufacturing costs are keenly observed, the cast camshaft segment will continue to hold the supremacy. Further, the progress in the materials cast camshafts is enhancing the quality and performance of cast camshafts, strengthening its market position.

By Vehicle Type, Passenger Car segment expected to held the largest share

- The automotive camshaft market by passenger car is estimated to hold the largest share, in terms of growth, throughout the forecast period due to the increasing global demand for personal cars.. The major category of vehicles that encompass the largest market share in the worldwide automotive production system include sedans, hatchbacks, SUVS, and compact passenger cars, curtailing in the Asia-Pacific region, North America and Europe. This high production volume is sensitive with the huge market demand for camshafts applied in internal combustion engines (ICEs) of passenger cars. As consumers look at fuel economy, engine power and emission control, auto makers shifts towards high quality camshaft types including overhead camshaft (OHC) and dual overhead camshaft (DOHC) engines.

- Thirdly, the trend towards hybrid cars, while these automobiles still require fully-functional, camshaft-integrated engines for high-level performance adds to the demand in question.. New middle-class consumers in developing countries and the drive for greener cars will ensure that the passenger car market remains the largest consumer of camshafts, maintaining camshaft’s position as the most used automotive part.

Automotive Camshaft Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific zone held the largest share in the automotive camshaft market in 2023, primarily backed by booming automotive industries in China, Japan, India, and South Korea.. The region holds a significant market position in the global market where China occupies more than 40% market position in the automotive camshaft market. It is on the grounds that; the region presently possesses a high car manufacturing gradient, a fast-growing population, expanding and densely city land, and gradually increasing per capita incomes in the Asia-Pacific region. China is the largest automobile producer in the world and this means that they dictate the demand for camshafts due to the fact that automobile producers both local and international are increasing their market base in the region.

- Moreover, due to the availability of key OEMs and wherein the aftermarket in automotive components has strengthened the leadership of the Asia-Pacific region even more.. The increase in trends for passenger cars and the increase in the commercial vehicles sector have led to the increase in automotive camshafts in this region.

Active Key Players in the Automotive Camshaft Market

- Bharat Forge (India)

- Engine Power Components (USA)

- Honda Foundry Co., Ltd. (Japan)

- JD Norman Industries (USA)

- Kautex Textron (Germany)

- LACO (Italy)

- Linamar Corporation (Canada)

- MAHLE GmbH (Germany)

- Melling Tool Company (USA)

- Ningbo Tianrun Mechanical Parts Co., Ltd. (China)

- Precision Camshafts Ltd. (India)

- Schrick Camshafts (Germany)

- Shijiazhuang Jingshi New Material Science and Technology Co., Ltd. (China)

- Thyssenkrupp (Germany)

- Zhejiang CHIRAL Auto Parts Co., Ltd. (China) and Other Active Players

Key Industry Developments in the Automotive Camshaft Market:

- In July 2023, Precision Camshaft, an influential camshaft manufacturer, announced that it is strategically concentrating on the EV segment as it provides high-margin opportunities. The firm announced its plans to set up an EV plant in Solapur and has been developing an electric powertrain, which is designed for sub-4 tons Light Commercial Vehicles.

Automotive Camshaft Market Scope:

|

Global Automotive Camshaft Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.1 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.9% |

Market Size in 2032: |

USD 14.3 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Vehicle Type |

|

||

|

By Sales channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Camshaft Market by Type (2018-2032)

4.1 Automotive Camshaft Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Cast Camshaft

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Forged Camshaft

4.5 Assembled Camshaft

Chapter 5: Automotive Camshaft Market by Vehicle Type (2018-2032)

5.1 Automotive Camshaft Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Passenger Car

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Light Commercial Vehicle

5.5 Heavy Commercial Vehicle

Chapter 6: Automotive Camshaft Market by Sales channel (2018-2032)

6.1 Automotive Camshaft Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Original Equipment Manufacturer (OEM)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Aftermarket

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Automotive Camshaft Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BHARAT FORGE (INDIA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ENGINE POWER COMPONENTS (USA)

7.4 HONDA FOUNDRY COLTD. (JAPAN)

7.5 JD NORMAN INDUSTRIES (USA)

7.6 KAUTEX TEXTRON (GERMANY)

7.7 LACO (ITALY)

7.8 LINAMAR CORPORATION (CANADA)

7.9 MAHLE GMBH (GERMANY)

7.10 MELLING TOOL COMPANY (USA)

7.11 NINGBO TIANRUN MECHANICAL PARTS COLTD. (CHINA)

7.12 PRECISION CAMSHAFTS LTD. (INDIA)

7.13 SCHRICK CAMSHAFTS (GERMANY)

7.14 SHIJIAZHUANG JINGSHI NEW MATERIAL SCIENCE AND TECHNOLOGY COLTD. (CHINA)

7.15 THYSSENKRUPP (GERMANY)

7.16 ZHEJIANG CHIRAL AUTO PARTS COLTD. (CHINA)

Chapter 8: Global Automotive Camshaft Market By Region

8.1 Overview

8.2. North America Automotive Camshaft Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Cast Camshaft

8.2.4.2 Forged Camshaft

8.2.4.3 Assembled Camshaft

8.2.5 Historic and Forecasted Market Size by Vehicle Type

8.2.5.1 Passenger Car

8.2.5.2 Light Commercial Vehicle

8.2.5.3 Heavy Commercial Vehicle

8.2.6 Historic and Forecasted Market Size by Sales channel

8.2.6.1 Original Equipment Manufacturer (OEM)

8.2.6.2 Aftermarket

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Automotive Camshaft Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Cast Camshaft

8.3.4.2 Forged Camshaft

8.3.4.3 Assembled Camshaft

8.3.5 Historic and Forecasted Market Size by Vehicle Type

8.3.5.1 Passenger Car

8.3.5.2 Light Commercial Vehicle

8.3.5.3 Heavy Commercial Vehicle

8.3.6 Historic and Forecasted Market Size by Sales channel

8.3.6.1 Original Equipment Manufacturer (OEM)

8.3.6.2 Aftermarket

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Automotive Camshaft Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Cast Camshaft

8.4.4.2 Forged Camshaft

8.4.4.3 Assembled Camshaft

8.4.5 Historic and Forecasted Market Size by Vehicle Type

8.4.5.1 Passenger Car

8.4.5.2 Light Commercial Vehicle

8.4.5.3 Heavy Commercial Vehicle

8.4.6 Historic and Forecasted Market Size by Sales channel

8.4.6.1 Original Equipment Manufacturer (OEM)

8.4.6.2 Aftermarket

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Automotive Camshaft Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Cast Camshaft

8.5.4.2 Forged Camshaft

8.5.4.3 Assembled Camshaft

8.5.5 Historic and Forecasted Market Size by Vehicle Type

8.5.5.1 Passenger Car

8.5.5.2 Light Commercial Vehicle

8.5.5.3 Heavy Commercial Vehicle

8.5.6 Historic and Forecasted Market Size by Sales channel

8.5.6.1 Original Equipment Manufacturer (OEM)

8.5.6.2 Aftermarket

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Automotive Camshaft Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Cast Camshaft

8.6.4.2 Forged Camshaft

8.6.4.3 Assembled Camshaft

8.6.5 Historic and Forecasted Market Size by Vehicle Type

8.6.5.1 Passenger Car

8.6.5.2 Light Commercial Vehicle

8.6.5.3 Heavy Commercial Vehicle

8.6.6 Historic and Forecasted Market Size by Sales channel

8.6.6.1 Original Equipment Manufacturer (OEM)

8.6.6.2 Aftermarket

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Automotive Camshaft Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Cast Camshaft

8.7.4.2 Forged Camshaft

8.7.4.3 Assembled Camshaft

8.7.5 Historic and Forecasted Market Size by Vehicle Type

8.7.5.1 Passenger Car

8.7.5.2 Light Commercial Vehicle

8.7.5.3 Heavy Commercial Vehicle

8.7.6 Historic and Forecasted Market Size by Sales channel

8.7.6.1 Original Equipment Manufacturer (OEM)

8.7.6.2 Aftermarket

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Automotive Camshaft Market Scope:

|

Global Automotive Camshaft Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.1 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.9% |

Market Size in 2032: |

USD 14.3 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Vehicle Type |

|

||

|

By Sales channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Automotive Camshaft Market research report is 2024-2032.

Bharat Forge (India), Engine Power Components (USA), Honda Foundry Co., Ltd. (Japan), JD Norman Industries (USA), Kautex Textron (Germany) and Other Major Players.

The Automotive Camshaft Market is segmented into Type, Vehicle Type, Sales Channel and region. By Type, the market is categorized into Cast Camshaft, Forged Camshaft, Assembled Camshaft. By Vehicle Type, the market is categorized into Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle. By Sales Channel, the market is categorized into xx. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Automotive camshaft market derives its meaning from the global market of camshafts which are the essential parts of internal combustion engines that control the operation of engine valves. The camshaft is complex and plays a vital role in most vehicles to maintain good timing of most valves so that good performance, efficiency and fuel combustion can take place inside the engine. This component has a central function of increasing maximum engine power, decreasing emissions, and increasing fuel economy. Automotive camshaft is a type of product applicable for passenger cars, commercial vehicles as well as heavy vehicles. These camshafts come in different materials including cast iron, forged steel and billet steel each with its strengths in terms of hard wearing properties and costs. With the change in the automotive Industry, for instance, in the development of the fuel-efficient, low emissions new generation of engines, the Camshaft Industry is witnessing innovation and development alike. The factors such as, hike in engine downsizing trends, turbo charging, hybrid vehicles are pushing the demand for complicated as well as high performing camshaft.

Automotive Camshaft Market Size Was Valued at USD 10.1 Billion in 2023, and is Projected to Reach USD 14.3 Billion by 2032, Growing at a CAGR of 3.9% From 2024-2032.