Australia Electric Car Market Synopsis

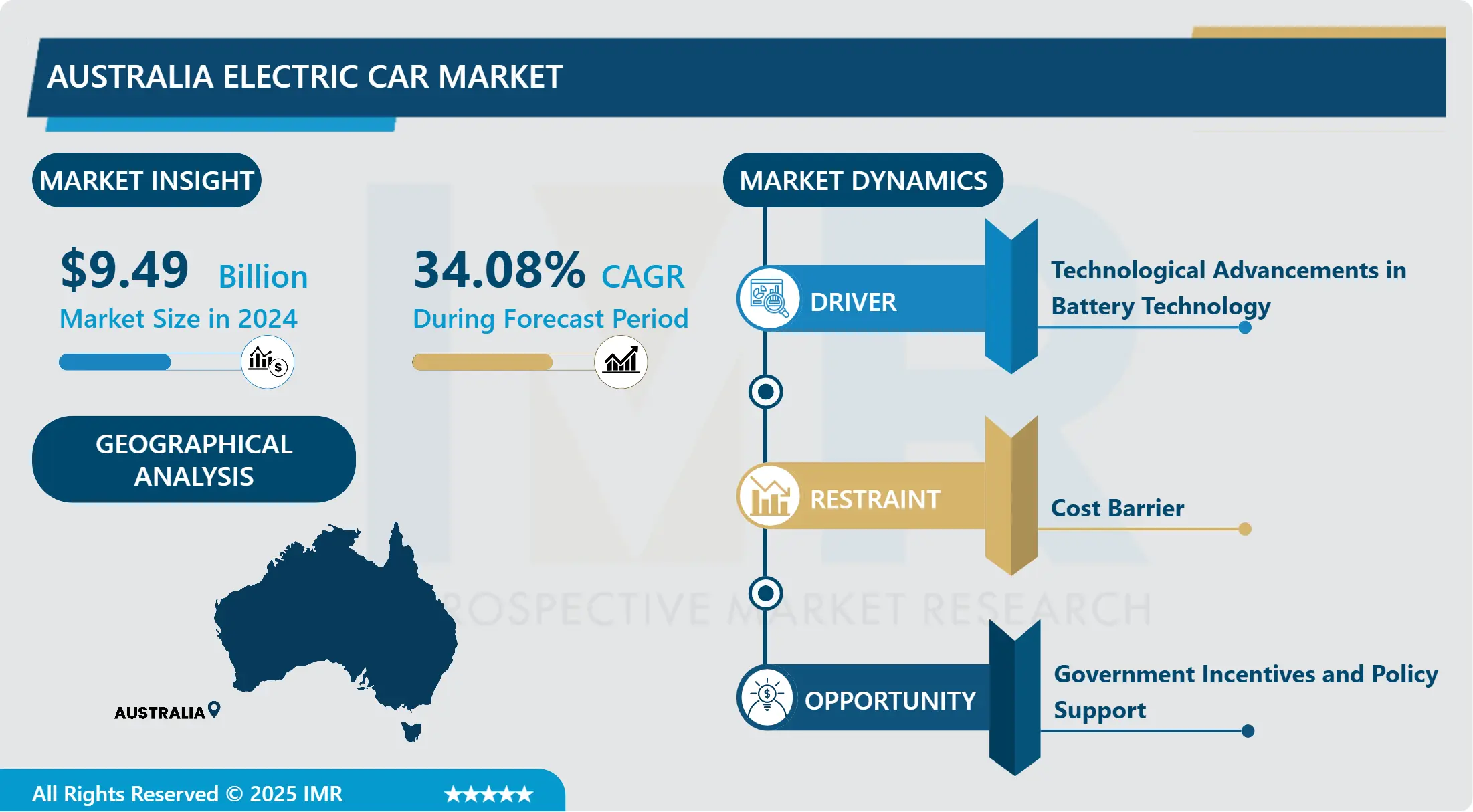

Australia Electric Car Market Size Was Valued at USD 9.49 Billion in 2024, and is Projected to Reach USD 99.12 Billion by 2032, Growing at a CAGR of 34.08% From 2025-2032.

An electric vehicle or EV as it is commonly referred to in Australia is a car that is run by one or more electric motors via rechargeable battery or some other energy storage system. Thus, electric cars do not emit any tailpipe emissions and have a low emission of Green House Gases unlike Internal Combustion Engine vehicles. The are acquiring popularity in Australia as environmentally friendly and economically viable substitutes to conventional automobiles as they come with factors for example lower running costs as well as less dependency on oil. The expansion of EV infrastructure such as charging stations are helping in the uptake of EVs across the nation.

At the moment, the electric car market is Australia is growing slowly but it is still growing due to factors like the policies of the government, awareness and technology. This is through observing the various factors that are associated with the market including the challenges like infrastructure limits and high cost of vehicles Osano & Nguthe ,p. 483 Thus the market has the potential of expanding .

Australia has been implementing different policies and strategies for the consumption of EVs coupled with cutting back emissions. Measures consist of grants for the acquisition of electric vehicles, tax credits, and infrastructure in the form of charging stations. These initiatives are to increase interest in EVs and thus their market uptake among individuals and companies.

It has been noted that Australians’ knowledge about environmental problems associated with car usage and the advantages of the EVs is becoming more pronounced. This new view towards sustainable products is impacting on consumers’ behaviors and this is most apparent in the Britain’s urban population owing to perceived poor air quality. The level of understanding of the Australian public and businesses regarding EV technology and its benefits, would thus likely continue to rise over time and therefore drive the adoption rate in the market.

The future of electric cars in Australia depends on the battery technology progress, the range, and charging. Deeper battery capacity and the increased distance that cars can travel without recharging is reducing the objections connected with the performance of electric cars and concerns regarding range, allowing Australians to use EVs for travelling within the country’s various climates and terrains.

However, several decades remain ahead How ever, several challenges are still evident. Still, one of the main challenges relates to higher initial cost that EVs have compared to ICEVs. Furthermore, due to the giant PTO of Australia and less population density the penetration of charging infrastructure outside the cities and towns remains difficult.

However, what it means is that there are several points of challenges that at the same time are opportunities for development. More investment in the charging infrastructure, new breakthroughs in the storage technology of batteries, and favorable government policies can frame the market’s evolution even more. This implies that both the government and the industry players and the infrastructure providers must come together to break the barriers and ensure that the market for electric cars is boosted in Australia.

Therefore, although, electric car market in Australia could still be considered rather emerging in comparison with, for instance, leaders of China or Norway, it has prospects. The contribution of government programs, the growth of consumer awareness, and the improvements in technology holding the key to a greener automobile industry in Australia with EVs at its core, taking the nation closer to the goal of minimizing carbon emissions and improving transport ease across the country.

Australia Electric Car Market Trend Analysis

Australia Electric Car Market Growth Driver- Expansion of Electric Vehicle Charging Infrastructure

- It is worth mentioning that in recent years the interest and use of electric cars is ever increasing in Australia and thus is the movement towards building infrastructure for Electric vehicle charging stations. The Australian government as well as private organizations are trying continuously to strengthen the charging network in the country. This expansion is important to, in an effort to cope up with the ever growing population of EVs and range anxiety. Proposals include provision of fast charging points on the motorways, in cities, and near shopping malls, hotels, and offices.

- Chargefox and Evie Networks are among the leading players that are engaged in the installation of a vast network of AC as well as DC charging stations compatible with different models of EVs. Electric mobility is also backed by incentives as well as the policies from the governments towards the cleaner transport solutions. Challenges towards building a comprehensive EV charging structure like the preliminary infrastructure costs and grid capacities issues, canoes with the general global shift towards sustainable mobility coupled with a diminution of carbon emissions from the automobile industry.

Australia Electric Car Market Expansion Opportunity- Government Incentives and Policy Support

- The adoption of the electric car has received attention in Australia through different forms of incentives and polices from the government to encourage the use of electric cars and reduce emission of pollution. Speaking of recent changes, incentives are the LCT exemption in respect of the EVs below a certain value to ensure affordability. Also, some other related incentives that some states in America provide are rebates and subsidies for purchasing of electric cars although these are not standardized and they depend on the budget available for their provision. Actions always entailing funding aspects may include subsidies for charging stations or the expansion of charging points to the regions and cities.

- However, for now, Australia has been singled out as lagging behind other developed countries, thanks to the lack of a coherent national strategy, a set of coherent incentives, and sustainable investment in the necessary infrastructure throughout the country’s states and territories. The future depends on the constant lobbying for prime and more elaborate federal policies that support the EV drive through incentives, improved charging stations and policies across the nation, as there is a global shift toward better and cleaner transportation solutions.

Australia Electric Car Market Segment Analysis:

Australia Electric Car Market Segmented based on Propulsion, Vehicals Type, and Region.

By Propulsion Type, Hybrid Electric Vehicles segment is expected to dominate the market during the forecast period

- Looking at the distribution of propulsion types in the Australia electric car market, it is possible to conclude that the composition of electric and hybrid cars in the country is quite diverse and depends on the specific types of automobiles. BEVs, Battery Electric Vehicles, are becoming popular as the buyers and governments prefer electric vehicles with zero emissions. BEVs have a large market share because it fully employs electric batteries as their only source of power to results to a cleaner environment and lower operating costs in the long run. Hybrid Electric Vehicles (HEVs) are also captured in this category for they meet the needs of customers who would wish to transitch from traditional gasoline vehicles to fully electric ones.

- FCEVs are still in the budding state in Australia due to limitations of refueling infrastructure such as hydrogen stations. Hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs) combine the electric power train with conventional systems because the former might lack adequate power to meet the client’s demand and the latter are for consumers who are concerned with range issues but want to cut emissions. In general, the Australia electric car market shows the continuous change for the better as the people start seeking more eco-friendly ways to transport themselves and goods.

By Vehicle Type , Commercial Vehicles segment held the largest share in 2024

- Electric car distribution in Australia divides into different types of passenger cars, LCVs, MDCVs, and HDVCs. The market for electric vehicles (EV) is led by passenger cars majorly due to rising consumer awareness about environmentally friendly means of transport and policies that encourage switching to EVs. Light commercials are also emerging to be popular especially with establishments seeking to cut down on both the costs of running their operations and carbon emission.

- Gradually, the medium-duty and the heavy-duty commercial vehicles are being electrified with innovative battery technology and environmental legislations forcing automobile manufacturers to come up with environmentally friendly vehicles, especially those in city centers. The market growth is backed up by the charging infrastructure and governmental policies that are targeting EVs market development of all types of vehicles making a radical change to a cleaner transport system in Australi.

Active Key Players in the Australia Electric Car Market

- Toyota Motor Corporation

- Tesla Inc.

- Lexus Motor Corporation

- MG Motor (SAIC MOTOR AUSTRALIA PTY LTD )

- Mazda Motor Corporation

- Other Active Players

|

Australia Electric Car Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 9.49 Bn. |

|

Forecast Period 2025-32 CAGR: |

34.08% |

Market Size in 2032: |

USD 99.12 Bn. |

|

Segments Covered: |

By Propulsion Type |

|

|

|

By Vehicle Type |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Australia Electric Car Market by Propulsion Type (2018-2032)

4.1 Australia Electric Car Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Battery Electric Vehicles

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Hybrid Electric Vehicles

4.5 Fuel Cell Electric Vehicles

4.6 Plug-In Hybrid Electric Vehicles

Chapter 5: Australia Electric Car Market by Vehicle Type (2018-2032)

5.1 Australia Electric Car Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Passenger Cars

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Light Commercial Vehicles

5.5 Medium-Duty

5.6 Commercial Vehicles

5.7 Heavy-Duty

5.8 Commercial Vehicles

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Australia Electric Car Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 TOYOTA MOTOR CORPORATION

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 TESLA INC.

6.4 LEXUS MOTOR CORPORATION

6.5 MG MOTOR (SAIC MOTOR AUSTRALIA PTY LTD )

6.6 MAZDA MOTOR CORPORATION

6.7 OTHER KEY PLAYERS

Chapter 7 Analyst Viewpoint and Conclusion

7.1 Recommendations and Concluding Analysis

7.2 Potential Market Strategies

Chapter 8 Research Methodology

8.1 Research Process

8.2 Primary Research

8.3 Secondary Research

|

Australia Electric Car Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 9.49 Bn. |

|

Forecast Period 2025-32 CAGR: |

34.08% |

Market Size in 2032: |

USD 99.12 Bn. |

|

Segments Covered: |

By Propulsion Type |

|

|

|

By Vehicle Type |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||