Audio IC Market Synopsis

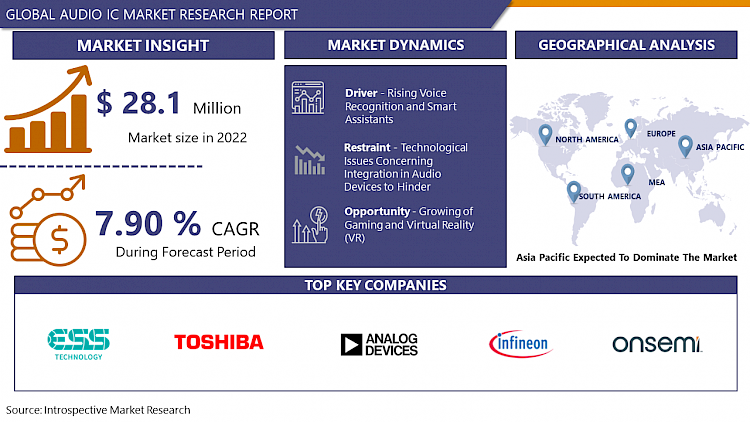

Global Audio IC Market Size Was Valued at USD 28.1 Million in 2022, and is Projected to Reach USD 51.63 Billion by 2030, Growing at a CAGR of 7.90% From 2023-2030.

Audio ICs are semiconductor devices used for processing and managing audio signals, including amplifiers, codecs, and converters. They enhance audio quality and functionality in various applications like smartphones, home audio systems, and automotive entertainment. These specialized circuits facilitate signal processing, conversion between analog and digital formats, and power amplification.

- Audio ICs (Integrated Circuits) are widely adopted due to their numerous advantages, offering compact and efficient solutions for processing audio signals. They integrate functions like amplification, conversion, and signal management into a single chip, leading to space and power savings, particularly beneficial for portable devices such as smartphones and wearables. Additionally, these ICs contribute to improved sound quality by supporting features like noise reduction, high-resolution audio, and immersive experiences.

- Market trends in the Audio IC industry reveal a growing demand for wireless solutions, with Bluetooth-enabled ICs facilitating seamless connectivity. The rise of smart speakers, voice-activated devices, and IoT applications has spurred the development of Audio ICs that support voice recognition and processing. Moreover, there's a notable shift towards energy-efficient designs to meet sustainability goals and prolong battery life in portable devices.

- The demand for Audio ICs is driven by the expanding consumer electronics market, encompassing smartphones, smart home devices, and automotive entertainment systems. With consumers seeking enhanced audio experiences, manufacturers are continuously innovating, resulting in a heightened demand for advanced Audio ICs. This trend aligns with the broader market shift towards connected, high-performance devices, positioning Audio ICs as integral components in the ongoing technological evolution.

Audio IC Market Trend Analysis

Rising Voice Recognition and Smart Assistants

- The increasing prominence of voice recognition technology and the widespread adoption of smart assistants stand as influential factors propelling the demand for Audio ICs (Integrated Circuits). As consumers embrace voice-activated devices like Amazon's Alexa, Google Assistant, and Apple's Siri, there is a notable surge in the need for Audio ICs equipped with sophisticated voice processing capabilities.

- Voice recognition systems rely on the effective processing of audio signals for accurate interpretation and response to spoken commands. In this context, Audio ICs play a crucial role, facilitating functions such as noise cancellation, voice modulation, and signal clarity. This ensures the optimal functioning of smart assistants, even in environments with background noise.

- Smart speakers, integral components of voice-controlled ecosystems, leverage Audio ICs to deliver high-quality sound and precise voice capture. With the expanding smart home trend, featuring voice-activated controls for various connected devices, there is a corresponding increase in the demand for high-performance Audio ICs.

- The automotive sector is also witnessing the integration of voice recognition systems for hands-free control of in-car functions, further emphasizing the importance of advanced Audio ICs. These ICs contribute to creating a seamless and responsive user experience, enhancing safety and convenience while driving.

Growing of Gaming and Virtual Reality (VR)

- The booming expansion of the gaming and virtual reality (VR) industries creates a compelling prospect for Audio ICs (Integrated Circuits). In an era where gaming experiences strive for heightened immersion, the need for top-tier audio solutions is escalating. In this landscape, Audio ICs play a pivotal role, delivering spatial audio, lifelike sound effects, and an overall improved audio performance in gaming consoles, PCs, and virtual reality headsets.

- In the gaming domain, Audio ICs contribute significantly to crafting a more captivating and dynamic auditory atmosphere, enriching the gaming encounter. They enable precise rendering of various sounds like footsteps, gunfire, and ambient noises, thereby amplifying players' spatial awareness and deepening their engagement in virtual worlds.

- For the VR sector, where audio is integral to establishing a convincing sense of presence, Audio ICs are indispensable. These circuits facilitate 3D audio rendering, allowing users to perceive sounds in a three-dimensional space, enriching the VR experience with a heightened level of realism.

- As the landscape of gaming and VR technologies continues to advance, the demand for specialized Audio ICs capable of delivering real-time, high-fidelity audio is poised to grow, presenting an enduring and substantial opportunity for innovation in the Audio IC market.

Audio IC Market Segment Analysis:

Audio IC Market Segmented on the basis of IC Type, Application, Technology Type, and End-User.

By IC Type, Audio Amplifier segment is expected to dominate the market during the forecast period

- Audio IC market anticipates the dominance of the Audio Amplifier segment within the IC types. Audio Amplifiers, essential components in audio systems, enhance the strength and quality of electrical audio signals for speakers or headphones. The dominance of this segment is attributed to several factors. Firstly, the perpetual growth in consumer electronics, including smartphones, smart speakers, and home audio systems, fuels the demand for high-performance Audio Amplifiers.

- Moreover, the continual growth of audio-focused applications in automotive entertainment systems and the gaming industry contributes to the sustained popularity of these amplifiers. The Audio Amplifier segment plays a central role in delivering crisp and potent sound experiences, aligning with the rising consumer expectations for superior audio quality.

- As technology evolves, introducing innovations like high-resolution audio and immersive sound, Audio Amplifiers become indispensable in meeting these changing consumer preferences. The dominance of this segment underscores the pivotal role Audio Amplifiers play in shaping the overall audio experience across diverse electronic devices, solidifying their position as a key driving force in the Audio IC market.

By Application, Phones segment is expected to dominate the market during the forecast period

- The phone segment is expected to maintain its dominance in the Audio ICs (Integrated Circuits) market. This forecast underscores the sustained leadership of Audio ICs in mobile phones, emphasizing their crucial role in elevating the audio capabilities of smartphones. As mobile devices evolve into multifunctional essentials for daily life, the demand for advanced audio processing remains a primary consideration. Audio ICs within phones serve as vital components, responsible for enhancing sound quality, facilitating clear voice communication, and supporting various multimedia applications.

- The continued dominance of the phones segment is driven by ongoing innovations in smartphones. Manufacturers consistently strive to enhance audio quality, introduce advanced features, and meet the rising consumer expectations for immersive audio experiences. Whether for voice calls, music playback, or multimedia applications, the phone segment remains a driving force in the Audio IC market, reflecting the persistent integration of sophisticated audio technologies into mobile devices.

Audio IC Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific region is poised to assert dominance over the Audio ICs (Integrated Circuits) market throughout the forecast period. This expectation is rooted in various factors that contribute to the region's market leadership. Asia-Pacific, housing major economies such as China, Japan, South Korea, and Taiwan, stands as a global hub for the manufacturing of consumer electronics. The continuous demand for smartphones, smart devices, and various electronic products in these nations propels the requirement for advanced Audio ICs, solidifying the region's position at the forefront of the market.

- Furthermore, Asia-Pacific showcases swift adoption of advanced audio technologies, with a well-established semiconductor manufacturing infrastructure in countries like Taiwan and South Korea. This manufacturing prowess underscores the region's capability to produce Audio ICs efficiently. The burgeoning automotive industry, along with the expanding middle-class population in countries like China and India, significantly contributes to the region's continued dominance. Collectively, these elements affirm Asia-Pacific's pivotal role in shaping the trajectory of the Audio ICs market throughout the projected period.

Audio IC Market Top Key Players:

- Analog Devices Inc. (US)

- Synaptics (US)

- THAT Corporation (US)

- Texas Instruments (US)

- Cirrus Logic (US)

- ESS Technology (US)

- Maxim Integrated (US)

- Microchip (US)

- ON Semiconductor (US)

- Qualcomm (US)

- Microsemi Corporation (US)

- STMicroelectronics (Switzerland)

- Dialog Semiconductor (UK)

- Infineon (Germany)

- NXP Semiconductors (Netherlands)

- Asahi Kasei Microdevices (AKM) (Japan)

- Renesas Electronics (Japan)

- ROHM CO. LTD. (Japan)

- New Japan Radio (NJR) (Japan)

- Toshiba Corporation (Japan)

- Yamaha (Japan)

- Bestechnic (China)

- ams AG (Austria)

- Realtek (Taiwan), and Other Major Players.

Key Industry Developments in the Audio IC Market:

- In October 2023, NXP Semiconductors and Dolby Laboratories forged a partnership to collaborate on the development and integration of Dolby Atmos technology into NXP's audio processors. This strategic alliance aims to enhance immersive audio solutions for automotive and home entertainment applications, showcasing the commitment of both companies to elevate the audio experience in these domains.

- In October 2023, Cirrus Logic unveiled the CS43131 High-Fidelity DAC, a cutting-edge single-chip solution. This DAC features an integrated headphone amplifier and microphone pre-amp, strategically designed for premium audiophile equipment.

|

Global Audio IC Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 28.1 Mn. |

|

Forecast Period 2023-30 CAGR: |

7.90 % |

Market Size in 2030: |

USD 51.63 Mn. |

|

Segments Covered: |

By IC Type |

|

|

|

By Application |

|

||

|

By Technology Type |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- AUDIO IC MARKET BY IC TYPE (2016-2030)

- AUDIO IC MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AUDIO AMPLIFIER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- AUDIO DSP

- AUDIO CODEC

- MEMS MICROPHONE

- AUDIO IC MARKET BY APPLICATION (2016-2030)

- AUDIO IC MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- COMPUTER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PHONES

- HEADPHONES

- HOME ENTERTAINMENT SYSTEMS

- TABLETS

- OTHERS

- AUDIO IC MARKET BY TECHNOLOGY TYPE (2016-2030)

- AUDIO IC MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ANALOG AUDIO ICS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DIGITAL AUDIO ICS

- MIXED-SIGNAL AUDIO ICS

- AUDIO IC MARKET BY END-USER (2016-2030)

- AUDIO IC MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CONSUMER ELECTRONICS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- TELECOMMUNICATIONS

- INDUSTRIAL

- GAMING

- MEDICAL DEVICES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Audio IC Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ANALOG DEVICES INC. (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- SYNAPTICS (US)

- THAT CORPORATION (US)

- TEXAS INSTRUMENTS (US)

- CIRRUS LOGIC (US)

- ESS TECHNOLOGY (US)

- MAXIM INTEGRATED (US)

- MICROCHIP (US)

- ON SEMICONDUCTOR (US)

- QUALCOMM (US)

- MICROSEMI CORPORATION (US)

- STMICROELECTRONICS (SWITZERLAND)

- DIALOG SEMICONDUCTOR (UK)

- INFINEON (GERMANY)

- NXP SEMICONDUCTORS (NETHERLANDS)

- ASAHI KASEI MICRODEVICES (AKM) (JAPAN)

- RENESAS ELECTRONICS (JAPAN)

- ROHM CO. LTD. (JAPAN)

- NEW JAPAN RADIO (NJR) (JAPAN)

- TOSHIBA CORPORATION (JAPAN)

- YAMAHA (JAPAN)

- BESTECHNIC (CHINA)

- AMS AG (AUSTRIA)

- REALTEK (TAIWAN)

- COMPETITIVE LANDSCAPE

- GLOBAL AUDIO IC MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By IC Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Technology Type

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Audio IC Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 28.1 Mn. |

|

Forecast Period 2023-30 CAGR: |

7.90 % |

Market Size in 2030: |

USD 51.63 Mn. |

|

Segments Covered: |

By IC Type |

|

|

|

By Application |

|

||

|

By Technology Type |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. AUDIO IC MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. AUDIO IC MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. AUDIO IC MARKET COMPETITIVE RIVALRY

TABLE 005. AUDIO IC MARKET THREAT OF NEW ENTRANTS

TABLE 006. AUDIO IC MARKET THREAT OF SUBSTITUTES

TABLE 007. AUDIO IC MARKET BY TYPE

TABLE 008. AUDIO PROCEOR MARKET OVERVIEW (2016-2028)

TABLE 009. AUDIO AMPLIFIERS MARKET OVERVIEW (2016-2028)

TABLE 010. MEMS MICROPHONE MARKET OVERVIEW (2016-2028)

TABLE 011. AUDIO IC MARKET BY APPLICATION

TABLE 012. PORTABLE AUDIO MARKET OVERVIEW (2016-2028)

TABLE 013. COMPUTER AUDIO MARKET OVERVIEW (2016-2028)

TABLE 014. HOME AUDIO MARKET OVERVIEW (2016-2028)

TABLE 015. AUTOMOTIVE AUDIO MARKET OVERVIEW (2016-2028)

TABLE 016. NORTH AMERICA AUDIO IC MARKET, BY TYPE (2016-2028)

TABLE 017. NORTH AMERICA AUDIO IC MARKET, BY APPLICATION (2016-2028)

TABLE 018. N AUDIO IC MARKET, BY COUNTRY (2016-2028)

TABLE 019. EUROPE AUDIO IC MARKET, BY TYPE (2016-2028)

TABLE 020. EUROPE AUDIO IC MARKET, BY APPLICATION (2016-2028)

TABLE 021. AUDIO IC MARKET, BY COUNTRY (2016-2028)

TABLE 022. ASIA PACIFIC AUDIO IC MARKET, BY TYPE (2016-2028)

TABLE 023. ASIA PACIFIC AUDIO IC MARKET, BY APPLICATION (2016-2028)

TABLE 024. AUDIO IC MARKET, BY COUNTRY (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA AUDIO IC MARKET, BY TYPE (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA AUDIO IC MARKET, BY APPLICATION (2016-2028)

TABLE 027. AUDIO IC MARKET, BY COUNTRY (2016-2028)

TABLE 028. SOUTH AMERICA AUDIO IC MARKET, BY TYPE (2016-2028)

TABLE 029. SOUTH AMERICA AUDIO IC MARKET, BY APPLICATION (2016-2028)

TABLE 030. AUDIO IC MARKET, BY COUNTRY (2016-2028)

TABLE 031. CIRRUS LOGIC: SNAPSHOT

TABLE 032. CIRRUS LOGIC: BUSINESS PERFORMANCE

TABLE 033. CIRRUS LOGIC: PRODUCT PORTFOLIO

TABLE 034. CIRRUS LOGIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. QUALCOMM: SNAPSHOT

TABLE 035. QUALCOMM: BUSINESS PERFORMANCE

TABLE 036. QUALCOMM: PRODUCT PORTFOLIO

TABLE 037. QUALCOMM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. REALTEK: SNAPSHOT

TABLE 038. REALTEK: BUSINESS PERFORMANCE

TABLE 039. REALTEK: PRODUCT PORTFOLIO

TABLE 040. REALTEK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. TI: SNAPSHOT

TABLE 041. TI: BUSINESS PERFORMANCE

TABLE 042. TI: PRODUCT PORTFOLIO

TABLE 043. TI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. ADI: SNAPSHOT

TABLE 044. ADI: BUSINESS PERFORMANCE

TABLE 045. ADI: PRODUCT PORTFOLIO

TABLE 046. ADI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. ON SEMI: SNAPSHOT

TABLE 047. ON SEMI: BUSINESS PERFORMANCE

TABLE 048. ON SEMI: PRODUCT PORTFOLIO

TABLE 049. ON SEMI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. MAXIM: SNAPSHOT

TABLE 050. MAXIM: BUSINESS PERFORMANCE

TABLE 051. MAXIM: PRODUCT PORTFOLIO

TABLE 052. MAXIM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. NXP: SNAPSHOT

TABLE 053. NXP: BUSINESS PERFORMANCE

TABLE 054. NXP: PRODUCT PORTFOLIO

TABLE 055. NXP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. DIALOG: SNAPSHOT

TABLE 056. DIALOG: BUSINESS PERFORMANCE

TABLE 057. DIALOG: PRODUCT PORTFOLIO

TABLE 058. DIALOG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. YAMAHA: SNAPSHOT

TABLE 059. YAMAHA: BUSINESS PERFORMANCE

TABLE 060. YAMAHA: PRODUCT PORTFOLIO

TABLE 061. YAMAHA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. AKM: SNAPSHOT

TABLE 062. AKM: BUSINESS PERFORMANCE

TABLE 063. AKM: PRODUCT PORTFOLIO

TABLE 064. AKM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. E TECHNOLOGY: SNAPSHOT

TABLE 065. E TECHNOLOGY: BUSINESS PERFORMANCE

TABLE 066. E TECHNOLOGY: PRODUCT PORTFOLIO

TABLE 067. E TECHNOLOGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. CONEXANT: SNAPSHOT

TABLE 068. CONEXANT: BUSINESS PERFORMANCE

TABLE 069. CONEXANT: PRODUCT PORTFOLIO

TABLE 070. CONEXANT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. FORTEMEDIA: SNAPSHOT

TABLE 071. FORTEMEDIA: BUSINESS PERFORMANCE

TABLE 072. FORTEMEDIA: PRODUCT PORTFOLIO

TABLE 073. FORTEMEDIA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. ROHM: SNAPSHOT

TABLE 074. ROHM: BUSINESS PERFORMANCE

TABLE 075. ROHM: PRODUCT PORTFOLIO

TABLE 076. ROHM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. KNOWLES: SNAPSHOT

TABLE 077. KNOWLES: BUSINESS PERFORMANCE

TABLE 078. KNOWLES: PRODUCT PORTFOLIO

TABLE 079. KNOWLES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. AAC: SNAPSHOT

TABLE 080. AAC: BUSINESS PERFORMANCE

TABLE 081. AAC: PRODUCT PORTFOLIO

TABLE 082. AAC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. INVENSENSE: SNAPSHOT

TABLE 083. INVENSENSE: BUSINESS PERFORMANCE

TABLE 084. INVENSENSE: PRODUCT PORTFOLIO

TABLE 085. INVENSENSE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. GOERTEK: SNAPSHOT

TABLE 086. GOERTEK: BUSINESS PERFORMANCE

TABLE 087. GOERTEK: PRODUCT PORTFOLIO

TABLE 088. GOERTEK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. STM: SNAPSHOT

TABLE 089. STM: BUSINESS PERFORMANCE

TABLE 090. STM: PRODUCT PORTFOLIO

TABLE 091. STM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. BSE: SNAPSHOT

TABLE 092. BSE: BUSINESS PERFORMANCE

TABLE 093. BSE: PRODUCT PORTFOLIO

TABLE 094. BSE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. HOSIDEN: SNAPSHOT

TABLE 095. HOSIDEN: BUSINESS PERFORMANCE

TABLE 096. HOSIDEN: PRODUCT PORTFOLIO

TABLE 097. HOSIDEN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. BOSCH: SNAPSHOT

TABLE 098. BOSCH: BUSINESS PERFORMANCE

TABLE 099. BOSCH: PRODUCT PORTFOLIO

TABLE 100. BOSCH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 100. NEOMEMS: SNAPSHOT

TABLE 101. NEOMEMS: BUSINESS PERFORMANCE

TABLE 102. NEOMEMS: PRODUCT PORTFOLIO

TABLE 103. NEOMEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 103. MEMSENSING: SNAPSHOT

TABLE 104. MEMSENSING: BUSINESS PERFORMANCE

TABLE 105. MEMSENSING: PRODUCT PORTFOLIO

TABLE 106. MEMSENSING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 106. TDK-EPC: SNAPSHOT

TABLE 107. TDK-EPC: BUSINESS PERFORMANCE

TABLE 108. TDK-EPC: PRODUCT PORTFOLIO

TABLE 109. TDK-EPC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 109. GETTOP: SNAPSHOT

TABLE 110. GETTOP: BUSINESS PERFORMANCE

TABLE 111. GETTOP: PRODUCT PORTFOLIO

TABLE 112. GETTOP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 112. SEMCO: SNAPSHOT

TABLE 113. SEMCO: BUSINESS PERFORMANCE

TABLE 114. SEMCO: PRODUCT PORTFOLIO

TABLE 115. SEMCO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 115. 3S: SNAPSHOT

TABLE 116. 3S: BUSINESS PERFORMANCE

TABLE 117. 3S: PRODUCT PORTFOLIO

TABLE 118. 3S: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 118. INFINEON: SNAPSHOT

TABLE 119. INFINEON: BUSINESS PERFORMANCE

TABLE 120. INFINEON: PRODUCT PORTFOLIO

TABLE 121. INFINEON: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. AUDIO IC MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. AUDIO IC MARKET OVERVIEW BY TYPE

FIGURE 012. AUDIO PROCEOR MARKET OVERVIEW (2016-2028)

FIGURE 013. AUDIO AMPLIFIERS MARKET OVERVIEW (2016-2028)

FIGURE 014. MEMS MICROPHONE MARKET OVERVIEW (2016-2028)

FIGURE 015. AUDIO IC MARKET OVERVIEW BY APPLICATION

FIGURE 016. PORTABLE AUDIO MARKET OVERVIEW (2016-2028)

FIGURE 017. COMPUTER AUDIO MARKET OVERVIEW (2016-2028)

FIGURE 018. HOME AUDIO MARKET OVERVIEW (2016-2028)

FIGURE 019. AUTOMOTIVE AUDIO MARKET OVERVIEW (2016-2028)

FIGURE 020. NORTH AMERICA AUDIO IC MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. EUROPE AUDIO IC MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. ASIA PACIFIC AUDIO IC MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. MIDDLE EAST & AFRICA AUDIO IC MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. SOUTH AMERICA AUDIO IC MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Audio IC Market research report is 2023-2030.

Analog Devices Inc. (US), Synaptics (US), THAT Corporation (US), Texas Instruments (US), Cirrus Logic (US), ESS Technology (US), Maxim Integrated (US), Microchip (US), ON Semiconductor (US), Qualcomm (US), Microsemi Corporation (US), STMicroelectronics (Switzerland), Dialog Semiconductor (UK), Infineon (Germany), NXP Semiconductors (Netherlands), Asahi Kasei Microdevices (AKM) (Japan), Renesas Electronics (Japan), ROHM CO. LTD. (Japan), New Japan Radio (NJR) (Japan), Toshiba Corporation (Japan), Yamaha (Japan), Bestechnic (China), ams AG (Austria), Realtek (Taiwan) and Other Major Players.

The Audio IC Market is segmented into IC Type, Application, Technology Type, End-User, and Region. By IC Type, the market is categorized into Audio Amplifier, Audio DSP, Audio CODEC, and MEMS microphones. By Application, the market is categorized into Computer, Phones, Headphones, Home Entertainment Systems, Tablets, and Others. By Technology Type, the market is categorized into Analog Audio ICs, Digital Audio ICs, and Mixed-Signal Audio ICs. By End-User, the market is categorized into Consumer Electronics, Telecommunications, Industrial, Gaming, and Medical devices. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Audio ICs are semiconductor devices used for processing and managing audio signals, including amplifiers, codecs, and converters. They enhance audio quality and functionality in various applications like smartphones, home audio systems, and automotive entertainment. These specialized circuits facilitate signal processing, conversion between analog and digital formats, and power amplification.

Global Audio IC Market Size Was Valued at USD 28.1 Million in 2022, and is Projected to Reach USD 51.63 Billion by 2030, Growing at a CAGR of 7.90% From 2023-2030.