Artificial Lift Systems Market Synopsis

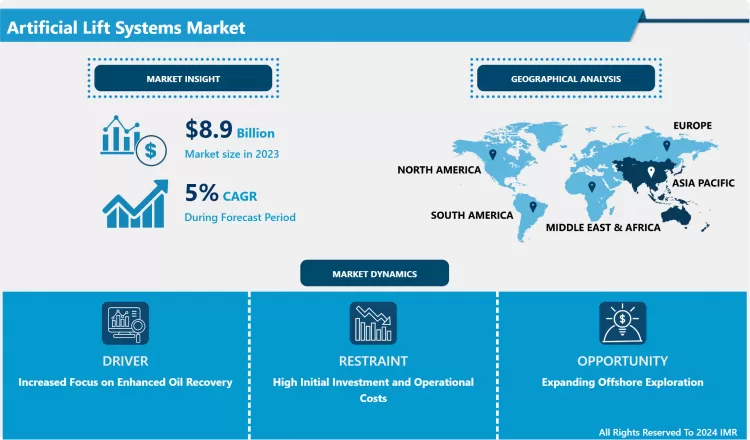

Artificial Lift Systems Market Size Was Valued at USD 8.9 Billion in 2023, and is Projected to Reach USD 14.40 Billion by 2032, Growing at a CAGR of 5.00% From 2024-2032.

Artificial lift means a technology which helps to enhance the capability of the production wells to deliver natural hydrocarbon liquids like oil and gas to the surface since the natural pressures of the reservoir are incapable of removing them.

- Worldwide demand for Artificial Lift Systems is spurred heavily by the need to increase the productivity of many oil and gas assets which are primarily, located in the mature field where natural reservoir pressure has waned significantly. These systems are particularly important in keeping and increasing production rates in wells that do not flow naturally. All those upstream operations involve the use of artificial lift systems such as ESPs, rod lifts, gas lift, and PCPs to reduce cost and improve operations. The kind of artificial lift system to install depends on factors such as the depth of the well, fluid and its characteristics and properties, and the characteristics of the reservoir which makes the artificial lift market specialized and fragmented. They are most commonly used in high volume wells because they perform optimally well when dealing with relatively large amounts of fluids.

- However, rod lifts are used in the onshore facilities since they are more dependable and involve low maintenance as compared to the tubular lift. In contrast, gas lifts are widely used in offshore environments where issues such as limited area as well as environment are critical. PCPs are now being adopted because they can deal with high viscosity and sand laden fluids that are characteristic of the production of shallow, unconventional oils.

- Automated technologies are evolving and altering the Artificial Lift Systems Market network while encouraging developments that increase output, minimize equipment breakdowns, and prolong the life span of the systems. There is a greater reliance on the application of digital solutions in the form of real time or predictive monitoring and maintenance to allow the operator to maintain control and knowledge of the systems and to identify potential areas of failure. 2019 also focuses on the improvement of other main features of lifts, the introduction of automation or the use of other robust materials that can extend the life of the lifts is also evident. Further, there is a demand for the systems to work in different environments such as high temperature and high pressure reservoirs markets.

- The pressure for more sustainability outcomes is demanding that more energy efficient and ecofriendly lift solutions be created that decrease the impact and carbon emissions from oil operations. It is this focus on the sustainability of resources that is further pushing manufacturers of equipment and energy companies to work together and set a cooperation on the innovation path.

- The Artificial Lift Systems Market trends vary from region to region, depending on the factors such as the maturity of the oilfield, level of technology, and regulatory standard. North of America especially USA is still a key market given the number of mature oil fields and on going high interest in shale oil production. Experiences oil field service providers, together with the availability of improved technologies also support the implementation of artificial lift systems within the region.

- On the other hand, Middle East, focusing more on the fledging field and how to optimize the production at mature ones, is now dedicating more to enhanced oil recovery. To handle the high temperature and the corrosive fluids in the region reservoir it has caused the need for specialized equipment systems. South America and Africa are growing markets; offshore as well as onshore facilities require artificial lift systems in these regions. These regions are now relying on the most competent oil players to enhance production capabilities of oil.

- Oligopolistic structure of the artificial lift systems market is defined by the presence of numerous major international oilfield service companies as well as the specialized of lift system manufacturers. Various players are concentrating on new product development, affiliate market acquisitions, and joint ventures to access the variety of market demands. They are also emphasising the post sale services and contract based services which are very important to retain the clients and to make the lift systems to perform optimum in a long run. There are now entrants within the local regions that are gaining entrant by providing practical and more affordable solutions mainly in the regions where aspects such as budget controls and localization are paramount. It is for this reasons that competition remained a complex affair where technological global leadership paired with regional specialization. Traditional and new lift technologies are still developing and have become a part of oil field basic requirements for essential manipulations for artificial lift systems.

Artificial Lift Systems Market Trend Analysis

Digitalization and Smart Lift Technologies

- Artificial Lift Systems Market is growing at a swift pace due to the integration of digital technologies and smart lift solutions. This trend entails the, employment of sensors, real time data analysis, automated control systems all of which further the effectiveness and efficiency of the lifts. Organizations are going for intelligent maintenance that allows for the identification of possible equipment breakdowns which prevents business disruption and increase in maintenance costs. Automated controls allow production rates and equipment lifespan to be mastered by promptly changing the key characteristics of smart lift systems.

- Moreover, the IIoT is improving the ability to monitor and optimise artificial lift systems as a result of developments in the technology. With cloud-connected platforms, an operator will be able to receive information from otherwise isolated well which makes decision-making more centralised. This shift in electric means not only increases the work rate but also subdues energy and pollution issues that are ordinarily involved in lifting mechanisms.

Expanding Offshore Exploration

- Offshore exploration and production appears to be one of the hottest prospects for the artificial lift systems market. With conventional resources onshore being accessed frequently and production rates declining steadily companies have shifted towards the appraisal of offshore fields especially in deep and ultradeep waters. Artificial lift systems are of essence in these environments because keeping up with the production rates is not easy given the high pressures and deep well drilling.

- Sophisticated innovations regarding the lift systems that can be accommodated to the offshore conditions, for instance the ESPs that can work well under the deepwater conditions having high gas content, are creating new opportunities for the industry. The increase in the ability to provide stronger and corrosion resistant materials also improves the efficiency of artificial lift systems in offshore environment. As bigger offshore projects are projected in areas including the Gulf of Mexico, North Sea, and offshore Brazil, the need for improved artificial lift solutions is estimated to increase, holding significant growth opportunities for market participants.

Artificial Lift Systems Market Segment Analysis:

Artificial Lift Systems Market Segmented based on Type, and Application.

By Type, Sucker Rod Pumps (SRP) segment is expected to dominate the market during the forecast period

- The Artificial Lift Systems Market is categorized based on types Electric Submersible Pumps (ESP), Sucker Rod Pumps (SRP), Progressive Cavity Pumps (PCP), Gas Lift, and other. ESP is the most popular type because of the capabilities of conducting large amounts of flow rate and well suited to deep well drilling for both onshore and offshore use. ESPs are preferred in high volume production wells and this equipment has given preference due to advancement in technology especially on speed drive.

- Sucker Rod Pumps (SRP) is second in importance and familiarity; Simple, Robust design and most efficient in shallow wells. They are extensively applied in onshore facilities because they require minimum maintenance and are suited for varying production rates. Progressive Cavity Pump (PCP) is gradually gaining acceptance also attributed to its suitability in moving high density and high viscosity fluids which are typical of the unconventional oil bearing formations. Gas Lift systems are especially preferred in wells containing high levels of gas because reservoir gas is used to lift the fluid, making the system highly efficient in both conventional and unconventional wells.

By Application , Onshore segment held the largest share in 2023

- Artificial lift systems are used in the onshore and offshore production of the oil and gas industry. Onshore application has the largest market share owing to a greater number of well and lower well cost than the offshore. This paper establishes that SRPs and PCPs enable the production rate to be enhanced, especially in the mature onshore fields where the technology is well-suited. Onshore lift systems are easy to maintain because they do not face many operational risks, and therefore they are commonly installed.

- Although the market for offshore applications is a significantly smaller one than that for domestic applications, it is also one that is growing very quickly. As offshore formations become increasing deeper, operating in higher pressure, and extreme conditions, there is a growing need for enhanced production facilities like ESPs that are suited to these environments. With the recent shift of offshore exploration to the ultra deep waters, this application segment will be boosted and consequently will require more lift solutions and, therefore, innovations.

Artificial Lift Systems Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- North America especially the United States is the most significant consumer of the Artificial Lift Systems Market, on account of the increasing onshore as well as offshore oil and gas exploration and production. The need for artificial lift systems is underpinned by the region’s mature oilfield development and huge capital expenditures on unconventional oil and gas, including shale and other tight resources. The market has been driven by the US shale boom where there has been high intensity of use of unconventional wells that have encouraged application of lift technologies for production enhancement.

- Also, this industry in North America receives support from the emphasis on high technology as most of the key players of manufacturing and service industries are based here. Existing large production centres like the Permian Basin, investment in increasing the recovery factor from ageing fields have supported the market. Offshore is also an important factor considering the Gulf of Mexico due to deepwater exploration that triggers a strong demand for reliable and efficient artificial lift systems.

Active Key Players in the Artificial Lift Systems Market

- Schlumberger Limited (USA)

- Baker Hughes Company (USA)

- Halliburton Company (USA)

- Weatherford International (USA)

- NOV Inc. (USA)

- Borets International Limited (UAE)

- ChampionX Corporation (USA)

- Apergy Corporation (USA)

- National Oilwell Varco (USA)

- CIRCOR International, Inc. (USA) and Others Active Player

Key Industry Developments in the Artificial Lift Systems Market

- January 2022:Unbridled ESP Systems, a subsidiary of ChampionX, brought High Rise series pumps for lessening carbon emissions during ESP operations. This product is used in unconventional well-completion operations.

- November 2021:Halliburton signed a Memorandum of Understanding with Cairn Gas & Oil. Under this agreement, both companies will jointly develop new technologies to help Cairn Oil & Gas to achieve its target of increasing recoverable reserve to 300 mmboe from 30 mmboe.

- October 2021:Baker Hughes launched a regional hub of oilfield services (OFS) located in King Salman Energy Park (SPARK). The new facility will support ongoing customer activities for three Oilfield Services product lines, ensuring high-quality service delivery and positioning BHGE for future growth in the Region.

- In November 2022: Halliburton Company announced a successful installation of the industry's first single trip, electro-hydraulic wet connect in deepwater for Petrobras in Brazil. The Halliburton Fuzion® EH electro-hydraulic downhole wet-mate connector helps increase well recovery factors by maintaining integrity of Halliburton's SmartWell® completion systems throughout the well's lifecycle.

|

Global Artificial Lift Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.9 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.00% |

Market Size in 2032: |

USD 14.40 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Artificial Lift Systems Market by Type (2018-2032)

4.1 Artificial Lift Systems Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Electric Submersible Pump (ESP)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Sucker Rod Pump (SRP)

4.5 Progressive Cavity Pump (PCP)

4.6 Gas Lift

4.7 Others

Chapter 5: Artificial Lift Systems Market by Application (2018-2032)

5.1 Artificial Lift Systems Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Onshore

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Offshore

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Artificial Lift Systems Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 SCHLUMBERGER LIMITED (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 BAKER HUGHES COMPANY (USA)

6.4 HALLIBURTON COMPANY (USA)

6.5 WEATHERFORD INTERNATIONAL (USA)

6.6 NOV INC. (USA)

6.7 BORETS INTERNATIONAL LIMITED (UAE)

6.8 CHAMPIONX CORPORATION (USA)

6.9 APERGY CORPORATION (USA)

6.10 NATIONAL OILWELL VARCO (USA)

6.11 CIRCOR INTERNATIONAL INC. (USA) OTHERS ACTIVE PLAYER

Chapter 7: Global Artificial Lift Systems Market By Region

7.1 Overview

7.2. North America Artificial Lift Systems Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Electric Submersible Pump (ESP)

7.2.4.2 Sucker Rod Pump (SRP)

7.2.4.3 Progressive Cavity Pump (PCP)

7.2.4.4 Gas Lift

7.2.4.5 Others

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Onshore

7.2.5.2 Offshore

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Artificial Lift Systems Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Electric Submersible Pump (ESP)

7.3.4.2 Sucker Rod Pump (SRP)

7.3.4.3 Progressive Cavity Pump (PCP)

7.3.4.4 Gas Lift

7.3.4.5 Others

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Onshore

7.3.5.2 Offshore

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Artificial Lift Systems Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Electric Submersible Pump (ESP)

7.4.4.2 Sucker Rod Pump (SRP)

7.4.4.3 Progressive Cavity Pump (PCP)

7.4.4.4 Gas Lift

7.4.4.5 Others

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Onshore

7.4.5.2 Offshore

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Artificial Lift Systems Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Electric Submersible Pump (ESP)

7.5.4.2 Sucker Rod Pump (SRP)

7.5.4.3 Progressive Cavity Pump (PCP)

7.5.4.4 Gas Lift

7.5.4.5 Others

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Onshore

7.5.5.2 Offshore

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Artificial Lift Systems Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Electric Submersible Pump (ESP)

7.6.4.2 Sucker Rod Pump (SRP)

7.6.4.3 Progressive Cavity Pump (PCP)

7.6.4.4 Gas Lift

7.6.4.5 Others

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Onshore

7.6.5.2 Offshore

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Artificial Lift Systems Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Electric Submersible Pump (ESP)

7.7.4.2 Sucker Rod Pump (SRP)

7.7.4.3 Progressive Cavity Pump (PCP)

7.7.4.4 Gas Lift

7.7.4.5 Others

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Onshore

7.7.5.2 Offshore

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Artificial Lift Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.9 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.00% |

Market Size in 2032: |

USD 14.40 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Artificial Lift Systems Market research report is 2024-2032.

Schlumberger Limited (USA),Baker Hughes Company (USA),Halliburton Company (USA),Weatherford International (USA),NOV Inc. (USA),Borets International Limited (UAE),ChampionX Corporation (USA),Apergy Corporation (USA),and Other Major Players.

The Artificial Lift Systems Market is segmented into Type , Application and Region. By Type, the market is categorized into Electric Submersible Pump (ESP),Sucker Rod Pump (SRP),Progressive Cavity Pump (PCP),Gas Lift,Others.By Application, the market is categorized into Onshore,Offshore. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Artificial lift means a technology which helps to enhance the capability of the production wells to deliver natural hydrocarbon liquids like oil and gas to the surface since the natural pressures of the reservoir are incapable of removing them.

Artificial Lift Systems Market Size Was Valued at USD 8.9 Billion in 2023, and is Projected to Reach USD 14.40 Billion by 2032, Growing at a CAGR of 5.00% From 2024-2032.