Animal Feed Antioxidants Market Synopsis

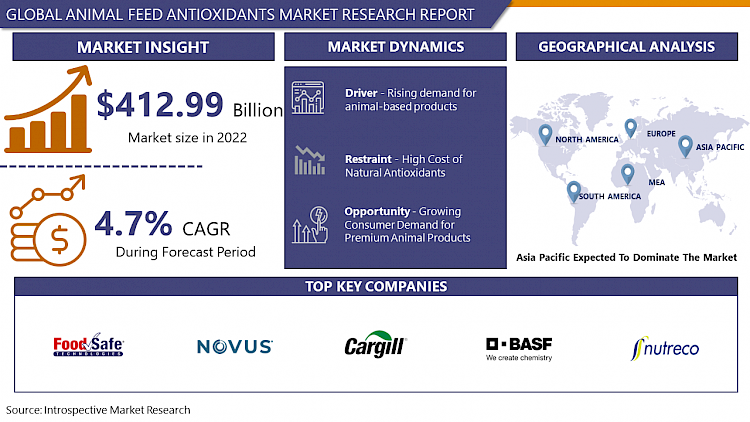

Animal Feed Antioxidants Market Size Was Valued at USD 412.99 Billion in 2022, and is Projected to Reach USD 596.37 Billion by 2030, Growing at a CAGR of 4.7% From 2023-2030.

Animal feed antioxidants are substances added to animal diets to prevent or delay the oxidative deterioration of feed components. They function by inhibiting or scavenging free radicals, which contribute to oxidative stress. Common antioxidants in animal feed include vitamins E and C, selenium, and synthetic antioxidants like BHA and BHT. These antioxidants support animal health, growth, and performance while extending the feed's shelf life.

- Antioxidants in animal feed are essential to the nutrition of contemporary cattle and poultry and offer several benefits to the animal husbandry industry. Antioxidants that assist reduce oxidative stress in feed components include selenium, vitamins E and C, and synthetic additives like BHA and BHT. Antioxidants boost animal health, development, and performance by stopping the deterioration of vital nutrients and lowering the production of toxic chemicals. They are also essential in extending the feed's shelf life and maintaining its nutritional value until cattle eat it.

- Growing awareness of the value of animal nutrition and the necessity of sustainable agricultural techniques is driving a favorable trend in the animal feed antioxidant industry. Demand for feed additives that improve the nutritional content of animal diets is rising as customers grow more aware of the quality of animal products.

- The market dynamics are also being influenced by regulatory demands and a move toward natural and sustainable solutions, which is resulting in the creation of innovative antioxidant formulations with increased efficacy and less environmental impact. As the livestock sector develops and emphasizes the value of antioxidants and balanced nutrition in achieving optimal animal well-being, there will likely be an increase in the global demand for antioxidants in animal feed.

Animal Feed Antioxidants Market Trend Analysis:

Rising demand for animal-based products

- The use of antioxidants in animal feed is significantly influenced by the growing market for goods derived from animals. Meat, dairy, and other goods generated from animals are consumed at an increasing rate in tandem with increases in the world's population and affluence. This increased demand puts a lot of pressure on livestock farming methods to improve animal welfare and production efficiency.

- Antioxidants in animal feed are essential for preserving cattle health and productivity. These antioxidants assist in reducing the harmful effects of oxidative stress, which may be caused by a number of things, including dietary imbalances, stressful environments, and high-intensity manufacturing systems. Animal producers can maximize reproductive success, growth rates, and overall health of their animals by adding antioxidants to their diet.

- Moreover, as customers become more aware of the quality of the animal products they buy, the welfare of livestock is becoming more and more important. Because of this, farmers and feed producers are spending money on nutritional tactics, such as using antioxidants, to satisfy changing customer demands and maintain effective and sustainable animal husbandry methods. Their vital importance in contemporary livestock production is highlighted by the mutually beneficial interaction between the growing demand for animal-based goods and the requirement for antioxidants in animal feed.

Growing Consumer Demand for Premium Animal Products

- The market for antioxidants in animal feed offers a substantial opportunity due to the rising consumer demand for high-quality animal products. Consumers are prepared to spend more on premium animal goods, such organic meats and eggs, as long as they can demonstrate that sustainability and health are important to them. A change in purchasing habits is being caused by the perception that these high-end items are healthier and more ethically manufactured.

- Livestock producers are implementing improved animal nutrition techniques, such as adding antioxidants to animal feed, to satisfy these customer desires. In order to preserve animal health and raise the caliber of animal products, antioxidants are essential. They improve immunological response, lessen oxidative stress, and improve the general health of cattle.

- As the demand for premium animal products rises, the need for superior feed formulations grows. Animal feed antioxidants not only aid in maintaining the health and performance of livestock but also contribute to the production of high-quality meat, dairy, and eggs. This presents a lucrative market opportunity for companies in the animal feed antioxidant sector, aligning with the evolving consumer landscape and fostering sustainable agricultural practices.

Animal Feed Antioxidants Market Segment Analysis:

Animal Feed Antioxidants Market Segmented on the basis of Product Type, Source, Animal Type, End-User and Distribution Channel.

By Animal Type, Poultry segment is expected to dominate the market during the forecast period

- Antioxidants included in animal feed are mostly consumed by poultry for a number of reasons. As the need for inexpensive, lean protein sources rises globally, the chicken sector has grown significantly. Large-scale chicken farming has thus grown to be a significant participant in the cattle industry. Oxidative stress is quite common in poultry, and it can affect the production and health of birds. In chicken, antioxidants are essential for reducing oxidative stress and improving growth rates, feed efficiency, and overall performance.

- Furthermore, the shorter production cycle of poultry allows for a faster and more direct response to dietary changes, making it easier to incorporate antioxidants into their feed formulations. This combination of market dominance and specific nutritional needs makes the poultry industry a key driver for the utilization of animal feed antioxidants in modern agricultural practices.

By Product Type, Synthetic Antioxidants segment is expected to dominate the market during the forecast period

- A number of reasons will contribute to the Synthetic Antioxidants segment's dominance in the animal feed antioxidants market throughout the projected timeframe. As of their stability, affordability, and excellent oxidative stress mitigation, synthetic antioxidants like ethoxyquin and butylated hydroxytoluene (BHT) are preferred. These artificial substances offer an affordable and dependable means of halting feed component degradation and preserving the nutritious content of animal meals over an extended period of time. Their ability to consistently maintain feed component quality throughout storage and guarantee the general well-being and productivity of livestock is the driving force behind their extensive usage in the animal nutrition sector.

- Moreover, synthetic antioxidants often exhibit a longer shelf life compared to their natural counterparts, making them a preferred choice for feed manufacturers seeking extended product stability. The cost efficiency and efficacy of synthetic antioxidants position this segment as a dominant force in the market, appealing to livestock producers and feed industry players aiming to achieve optimal animal performance and product quality while maintaining economic viability.

Animal Feed Antioxidants Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific dominates the animal feed antioxidants market for several key reasons. Firstly, the region is home to a significant share of the global livestock population, including poultry, swine, and cattle, driven by the increasing demand for animal products in densely populated countries like China and India. As the livestock industry expands to meet the growing protein needs of the population, there is a parallel surge in the demand for effective and sustainable animal nutrition solutions.

- Furthermore, Asia Pacific economies are experiencing rapid urbanization and rising incomes, leading to a shift in dietary preferences towards higher-quality animal products. This shift fuels the demand for premium animal feed formulations that enhance the health and productivity of livestock. In response to these market dynamics, the animal feed antioxidants sector in the region has witnessed substantial investments in research and development, innovation, and production.

- Governments in the Asia Pacific region are increasingly focusing on improving the efficiency and sustainability of agriculture, including animal husbandry. This emphasis on sustainable practices further propels the adoption of advanced feed additives, including antioxidants, to optimize animal health and productivity. Given these factors, Asia Pacific stands out as a dominant force in the global animal feed antioxidants market, driven by its significant livestock population, changing consumer preferences, and the commitment to sustainable agricultural practices.

Animal Feed Antioxidants Market Top Key Players:

- Cargill (US)

- Archer Daniels Midland Company (US)

- Kemin (US)

- Alltech (US)

- Novus International (US)

- FoodSafe Technologies (US)

- Videka (US)

- Lallemand Animal Nutrition (Canada)

- Caldic (Canada)

- BASF SE (Germany)

- Koninklijke DSM N.V. (Netherlands)

- Nutreco (Netherlands)

- Adisseo (France)

- BTSA (Spain)

- Oxiris Chemical (Spain)

- Industrial Tecnica Pecuária (Spain)

- Perstorp (Sweden)

- Chemical Fine Sciences (India)

- VDH Chemicals (India)

- Zhejiang Medicine Co. Ltd. (China) and Other Major Players

Key Industry Developments in the Animal Feed Antioxidants Market:

- May 2022, Kemin Industries, in its commitment to serving Kemin Animal Nutrition, has established new offices and a distribution center in Mexico. The goal is to deliver services of the utmost quality and provide tailor-made solutions.

- March 2022, Biovet SA has entered into a distribution partnership with Agfield, a Philippine-based company. As part of this collaboration, Agfield will integrate various products from Biovet SA's range of pro nutrients into its distribution channels in the Philippines.

|

Global Animal Feed Antioxidants Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 412.99 Bn. |

|

Forecast Period 2023-30 CAGR: |

4.7 % |

Market Size in 2030: |

USD 596.37 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Source |

|

||

|

By Animal Type |

|

||

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ANIMAL FEED ANTIOXIDANTS MARKET BY PRODUCT TYPE (2016-2030)

- ANIMAL FEED ANTIOXIDANTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SYNTHETIC ANTIOXIDANTS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- NATURAL ANTIOXIDANTS

- ANIMAL FEED ANTIOXIDANTS MARKET BY SOURCE (2016-2030)

- ANIMAL FEED ANTIOXIDANTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- NATURAL SOURCES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PLANT-BASED

- ANIMAL-BASED

- SYNTHETIC SOURCES

- ANIMAL FEED ANTIOXIDANTS MARKET BY ANIMAL TYPE (2016-2030)

- ANIMAL FEED ANTIOXIDANTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- POULTRY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SWINE

- RUMINANTS

- AQUACULTURE

- PETS

- ANIMAL FEED ANTIOXIDANTS MARKET BY END-USER (2016-2030)

- ANIMAL FEED ANTIOXIDANTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FEED MANUFACTURERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FARMERS

- INTEGRATORS

- ANIMAL FEED ANTIOXIDANTS MARKET BY DISTRIBUTION CHANNEL (2016-2030)

- ANIMAL FEED ANTIOXIDANTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DIRECT SALES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DISTRIBUTORS

- ONLINE RETAIL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Animal Feed Antioxidants Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- CARGILL (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ARCHER DANIELS MIDLAND COMPANY (US)

- KEMIN (US)

- ALLTECH (US)

- NOVUS INTERNATIONAL (US)

- FOODSAFE TECHNOLOGIES (US)

- VIDEKA (US)

- LALLEMAND ANIMAL NUTRITION (CANADA)

- CALDIC (CANADA)

- BASF SE (GERMANY)

- KONINKLIJKE DSM N.V. (NETHERLANDS)

- NUTRECO (NETHERLANDS)

- ADISSEO (FRANCE)

- BTSA (SPAIN)

- OXIRIS CHEMICAL (SPAIN)

- INDUSTRIAL TECNICA PECUÁRIA (SPAIN)

- PERSTORP (SWEDEN)

- CHEMICAL FINE SCIENCES (INDIA)

- VDH CHEMICALS (INDIA)

- ZHEJIANG MEDICINE CO. LTD. (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL ANIMAL FEED ANTIOXIDANTS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product Type

- Historic And Forecasted Market Size By Source

- Historic And Forecasted Market Size By Animal Type

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Animal Feed Antioxidants Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 412.99 Bn. |

|

Forecast Period 2023-30 CAGR: |

4.7 % |

Market Size in 2030: |

USD 596.37 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Source |

|

||

|

By Animal Type |

|

||

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ANIMAL FEED ANTIOXIDANT MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ANIMAL FEED ANTIOXIDANT MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ANIMAL FEED ANTIOXIDANT MARKET COMPETITIVE RIVALRY

TABLE 005. ANIMAL FEED ANTIOXIDANT MARKET THREAT OF NEW ENTRANTS

TABLE 006. ANIMAL FEED ANTIOXIDANT MARKET THREAT OF SUBSTITUTES

TABLE 007. ANIMAL FEED ANTIOXIDANT MARKET BY TYPE

TABLE 008. NATURAL ANTIOXIDANT MARKET OVERVIEW (2016-2028)

TABLE 009. SYNTHETIC ANTIOXIDANT MARKET OVERVIEW (2016-2028)

TABLE 010. ANIMAL FEED ANTIOXIDANT MARKET BY APPLICATION

TABLE 011. LIVESTOCK MARKET OVERVIEW (2016-2028)

TABLE 012. POULTRY MARKET OVERVIEW (2016-2028)

TABLE 013. AQUACULTURE MARKET OVERVIEW (2016-2028)

TABLE 014. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA ANIMAL FEED ANTIOXIDANT MARKET, BY TYPE (2016-2028)

TABLE 016. NORTH AMERICA ANIMAL FEED ANTIOXIDANT MARKET, BY APPLICATION (2016-2028)

TABLE 017. N ANIMAL FEED ANTIOXIDANT MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE ANIMAL FEED ANTIOXIDANT MARKET, BY TYPE (2016-2028)

TABLE 019. EUROPE ANIMAL FEED ANTIOXIDANT MARKET, BY APPLICATION (2016-2028)

TABLE 020. ANIMAL FEED ANTIOXIDANT MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC ANIMAL FEED ANTIOXIDANT MARKET, BY TYPE (2016-2028)

TABLE 022. ASIA PACIFIC ANIMAL FEED ANTIOXIDANT MARKET, BY APPLICATION (2016-2028)

TABLE 023. ANIMAL FEED ANTIOXIDANT MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA ANIMAL FEED ANTIOXIDANT MARKET, BY TYPE (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA ANIMAL FEED ANTIOXIDANT MARKET, BY APPLICATION (2016-2028)

TABLE 026. ANIMAL FEED ANTIOXIDANT MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA ANIMAL FEED ANTIOXIDANT MARKET, BY TYPE (2016-2028)

TABLE 028. SOUTH AMERICA ANIMAL FEED ANTIOXIDANT MARKET, BY APPLICATION (2016-2028)

TABLE 029. ANIMAL FEED ANTIOXIDANT MARKET, BY COUNTRY (2016-2028)

TABLE 030. BASF: SNAPSHOT

TABLE 031. BASF: BUSINESS PERFORMANCE

TABLE 032. BASF: PRODUCT PORTFOLIO

TABLE 033. BASF: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. ADM: SNAPSHOT

TABLE 034. ADM: BUSINESS PERFORMANCE

TABLE 035. ADM: PRODUCT PORTFOLIO

TABLE 036. ADM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. DUPONT: SNAPSHOT

TABLE 037. DUPONT: BUSINESS PERFORMANCE

TABLE 038. DUPONT: PRODUCT PORTFOLIO

TABLE 039. DUPONT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. DSM: SNAPSHOT

TABLE 040. DSM: BUSINESS PERFORMANCE

TABLE 041. DSM: PRODUCT PORTFOLIO

TABLE 042. DSM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. CARGILL: SNAPSHOT

TABLE 043. CARGILL: BUSINESS PERFORMANCE

TABLE 044. CARGILL: PRODUCT PORTFOLIO

TABLE 045. CARGILL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. ZHEJIANG MEDICINE: SNAPSHOT

TABLE 046. ZHEJIANG MEDICINE: BUSINESS PERFORMANCE

TABLE 047. ZHEJIANG MEDICINE: PRODUCT PORTFOLIO

TABLE 048. ZHEJIANG MEDICINE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. ADISSEO: SNAPSHOT

TABLE 049. ADISSEO: BUSINESS PERFORMANCE

TABLE 050. ADISSEO: PRODUCT PORTFOLIO

TABLE 051. ADISSEO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. NOVOZYMES: SNAPSHOT

TABLE 052. NOVOZYMES: BUSINESS PERFORMANCE

TABLE 053. NOVOZYMES: PRODUCT PORTFOLIO

TABLE 054. NOVOZYMES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. ALLTECH: SNAPSHOT

TABLE 055. ALLTECH: BUSINESS PERFORMANCE

TABLE 056. ALLTECH: PRODUCT PORTFOLIO

TABLE 057. ALLTECH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. BELDEM: SNAPSHOT

TABLE 058. BELDEM: BUSINESS PERFORMANCE

TABLE 059. BELDEM: PRODUCT PORTFOLIO

TABLE 060. BELDEM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. KEMIN INDUSTRIES: SNAPSHOT

TABLE 061. KEMIN INDUSTRIES: BUSINESS PERFORMANCE

TABLE 062. KEMIN INDUSTRIES: PRODUCT PORTFOLIO

TABLE 063. KEMIN INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. AB VISTA: SNAPSHOT

TABLE 064. AB VISTA: BUSINESS PERFORMANCE

TABLE 065. AB VISTA: PRODUCT PORTFOLIO

TABLE 066. AB VISTA: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ANIMAL FEED ANTIOXIDANT MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ANIMAL FEED ANTIOXIDANT MARKET OVERVIEW BY TYPE

FIGURE 012. NATURAL ANTIOXIDANT MARKET OVERVIEW (2016-2028)

FIGURE 013. SYNTHETIC ANTIOXIDANT MARKET OVERVIEW (2016-2028)

FIGURE 014. ANIMAL FEED ANTIOXIDANT MARKET OVERVIEW BY APPLICATION

FIGURE 015. LIVESTOCK MARKET OVERVIEW (2016-2028)

FIGURE 016. POULTRY MARKET OVERVIEW (2016-2028)

FIGURE 017. AQUACULTURE MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA ANIMAL FEED ANTIOXIDANT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE ANIMAL FEED ANTIOXIDANT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC ANIMAL FEED ANTIOXIDANT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA ANIMAL FEED ANTIOXIDANT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA ANIMAL FEED ANTIOXIDANT MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Animal Feed Antioxidants Market research report is 2023-2030.

Cargill (US), Archer Daniels Midland Company (US), Kemin (US), Alltech (US), Novus International (US), FoodSafe Technologies (US), Videka (US), Lallemand Animal Nutrition (Canada), Caldic (Canada), BASF SE (Germany), Koninklijke DSM N.V. (Netherlands), Nutreco (Netherlands), Adisseo (France), BTSA (Spain), Oxiris Chemical (Spain), Industrial Tecnica Pecuária (Spain), Perstorp (Sweden), Chemical Fine Sciences (India), VDH Chemicals (India), Zhejiang Medicine Co. Ltd. (China) and Other Major Players and Other Major Players.

The Animal Feed Antioxidants Market is segmented into Product Type, Source, Animal Type, End-User, Distribution Channel, and region. By Product Type, the market is categorized into Synthetic Antioxidants, Natural Antioxidants. By Source, the market is categorized into Natural Sources, Plant-based, Animal-based, and Synthetic Sources. By Animal Type, the market is categorized into Poultry, Swine, Ruminants, Aquaculture, and Pets. By End-User, the market is categorized into Feed Manufacturers, Farmers, and Integrators. By Distribution Channel, the market is categorized into Direct Sales, Distributors, and Online Retail. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Animal feed antioxidants are substances added to animal diets to prevent or delay oxidative deterioration of feed components. They function by inhibiting or scavenging free radicals, which contribute to oxidative stress. Common antioxidants in animal feed include vitamins E and C, selenium, and synthetic antioxidants like BHA and BHT. These antioxidants support animal health, growth, and performance while extending the feed's shelf life.

Global Animal Feed Antioxidants Market Size Was Valued at USD 412.99 Billion in 2022, and is Projected to Reach USD 596.37 Billion by 2030, Growing at a CAGR of 4.7% From 2023-2030.