Algae Market Synopsis

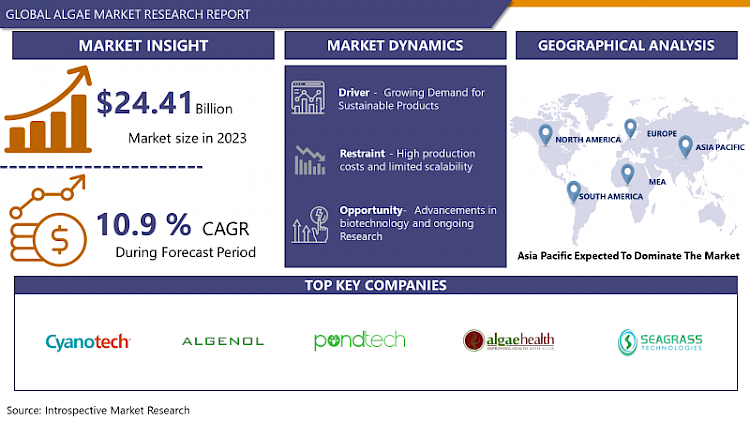

Algae Market Size Was Valued at USD 24.41 Billion in 2023 and is Projected to Reach USD 61.93 Billion by 2032, Growing at a CAGR of 10.9% From 2024-2032.

Algae play a vital role in several industries such as food and beverages, pharmaceuticals and nutraceuticals, Cosmetic industries, and bio energy. Those materials contain proteins, vitamins, and antioxidants—hence, they are demanded for use in the production of health supplements and functional foods. Also, the increased use of algae as an energy source for the production of renewable energy for the generation of biofuels is driving their use.

- There is a lot of emphasis placed on health and wellness in the world today, and this has made the algae market popular. Another benefit of believing in algae is the public awareness of natural and organic food, which drives the supplementation and superfood markets. Spirulina and chlorella are the most known species with numerous health propaganda objectives, including immunity boasts and various other essential nutrient substances.

- Aquaculture is favorable in terms of reducing pressure on other crops and water resources since algae do not necessarily need the same facilities as regular crops. In addition, algae may help in removing carbon dioxide from the air in any way they can, therefore aiding in carbon capture processes. These are attractive in the same way to the customers as well as to the industries and companies that are concerned with minimizing the impact that they have on the natural environment.

- New and improved equipment in algae cultivation and conversion systems are characteristically improving the potential of algae production. These techniques have seen the algae production per unit time increase and costs decrease as it poses a competitive threat to products in the market.

- In conclusion, market opportunities for algae products are increasing continuously because it has multiple uses, possess very nutritional values, and are eco-friendly, along with modern technology. There is every reason to believe that such proportions will only grow in the coming years as industries and consumers embrace the multiple possibilities of algae.

Algae Market Trend Analysis

Nutraceuticals and Functional Foods

- Most algae are nutrient-dense and from the family of spirulina and chlorella which are nutritious and packed with protein, vitamins, and minerals as well as antioxidant nutrients. It was known, for example, that these nutrients promote better health through boosting immunity and detoxing as well as the anti-inflammatory properties of the foods. Consequently, usage aspects of algae are persistently rising in nutraceuticals, which are manufactured to benefit consumers’ overall well-being.

- There is an identified trend of consumer preference towards natural and plant-based products due to the current perception of health and well-being, and the general need for environmental conservation. supplements, which have few reported side effects and provide various health benefits, fit well with the current mentality. Algae protein powders, capsules, and snacks have been found to penetrate the nutraceutical market as regular foods today.

- Algae are used not only in traditional food products but also as a functional ingredient in snack foods like energy bars bottled drinks, and products that mimic dairy foods. These foods are meant or developed for specific health goals above and beyond nutrients and calorie counts. This is with regards to the improvement of the nutrient content of these foods when algae are included in the production of these foods hence making them lucrative for the health conscious clientèle.

- Due to the continuity of research in advanced technology in the production of algae, the production of superior quality, cheap algae products is being realized. Microencapsulation is a development that helps in enhancing the bioavailability and stability of the nutrients provided by algae. This is easing the development of new high-value, specialized nutraceuticals and functional foods that can optimize the use of algae.

Biofuels for a Sustainable Future

- Algae are one of the most efficient denizens of the biosphere in the way that they harness solar energy for photosynthesis. It is used to produce a higher yield of biofuel per acre than soya, corn, or any other traditional crops. Due to this efficiency, algae becomes an effective and renewable resource in the generation of biofuel, which can be generated in large quantities without using vast amounts of fertile soil.

- It makes sense to mention that algae cultivation can be effective during climate change as the algae can fix considerable amounts of carbon dioxide during their life cycle. This carbon sequestration capability goes a long way toward reducing the levels of greenhouse gases and thereby providing a boost to the sustainability of algae-based biofuels. Algae biofuels are a form of renewable energy in that they can be used to create fuels but it is also environmentally friendly because algae consume pollutants.

- Algae can be cultured in water and even in wastewater as well as in saline water in which agricultural practices cannot be practiced. It also means that more accessible areas of unused land and water can be used in production with little or no interference with the arable ones, thus ensuring that there is little pressure from the production process on the crops needed for food. Furthermore, the backflow of wastewater can be beneficial in recycling nutrients and minimizing pollution.

- It is important to note that new developments in the field of biotechnology and engineering are creating positive impacts on algae biofuel production. Technological advancements such as genetic engineering, the design of an efficient photobioreactor, and development of an efficient bi-photographer are improving the feasibility and large-scale production of algae bio-fuels. These have eventually led to decreasing cost of production and therefore algae biofuel has been affirmed to be equally competitive with fossil fuels.

Algae Market Segment Analysis:

Algae Market is segmented based on Cultivation Technology, Product Type, and Application

By Cultivation Technology, Open Pond segment is expected to dominate the market during the forecast period

- Ponds for open cultivation of algae are one of the most inexpensive technologies known today. Such systems employ several shallow and large ponds which encourage the growth of algae naturally under sunlight. Although it is relatively cheap to implement, open ponds undergo problems like contamination, water evaporation, and light fluctuations all of which impact the productivity and quality of algae. However they act as a more effective device for large cultivation of algae such as spirulina.

- Aquiculture is the practice of cultivating algae in natural conditions including lakes, rivers, and seas whereby water bodies acting as growth mediums are used. Organic farming is less reliant on inorganic inputs as organic fertile and water is available naturally, and the plants get the required sunlight. However, the process is hindered by certain environmental conditions it thrusts on the environment, the effects of the process on the environment, and the challenge of controlling environmental characteristics that affect growth. This method is less preferred but can be extended on large scales for low-cost algae production.

- Photobioreactors, customary enclosures, present a closed setting for the development of the bacteria culture. These systems mimic the natural environment thereby allowing controlled light, temperature, and nutrient feed to the algae and hence a high yield and purity. Such a system reduces contact between the valuable strain and external influences and at the same time supports the growth of the selected species of algae. While they require a higher initial investment and operating costs, they are well suited for the culture of algae for lucrative purposes such as in medical, nutritional supplements, and energy sectors.

- Some algae producers use mixed open ponds that incorporate some of the closure systems. For instance, microalgae may be anchored in photobioreactors for cleanliness before moving them into massive open culturing rooms. It can be seen that this approach focuses on keeping costs optimal and quality on par, to manage the general production process more effectively.

- In conclusion, the algae market relies on open ponds, natural environments, closed structures for various algae production purposes and is sensitive to the cost factor. Technology is also used differently when it comes to cultivation as every has its benefits and shortcoming and it depends on the purpose and the level of production being carried out.

By Product Type, Microalgae segment held the largest share in 2023

- Microalgae have become a large part of the algae market, with uses including food and nutraceuticals, to bioenergy. Because of their small size, the yield and collection from farm is relatively easy hence are produced in large quantities to be used in several industries.

- Macroalgae, else known as seaweeds, also form a part of the algae market where they function in a significant manner. It includes products such as reagents and biochemicals for the food and beverage industry, fertilizer and agrochemicals and drugs and pharmaceuticals. Therefore, they are attractive for growing their populations on a commercial level because they are relatively big and have greater biomass.

- Microalga and macroalga are also being consumed more in the present time due to nutritional values for human consumption, bioactive compounds, and biodegradable characteristics. People are using algae derived products more with an aim of acquiring health benefits while at the same time acting as substitutes to foods and energy sources.

- It is important to point out that the algae market remains promising, though there are ongoing attempts to extend the application fields and improve the farming techniques. Today’s advanced technologies through the use of biotechnologies such as the genetic engineering and algae bioreactors are some advancements that is promoting growth and new opportunities for commercialism. Owing to the need for sustainability in the market, algae has more chances by controlling many environmental problems affecting the market growth and development.

Algae Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- The role of the countries in Asia-Pacific region such as China, India, Japan, and South Korea is increasing dramatically and the economy size of all these countries is increasing rapidly. This growth is associated with rise in urbanisation, industrialisation and spending by Consumers hence creating a market for number of products from the algae.

- The ocean coastline is significantly large in the Asia-Pacific region and it has climatic conditions that are ideal for algae cultivation, especially for macroalgae. Organized seaweed farming has been practiced in Asian countries such as Japan and South Korea, which thrust them to a position of advantage as they possess experience and actual facilities for engaging in large scale algae farming.

- Several countries around the Asia Pacific region have duly encouraged the algae industry through the announcement of policies aimed at funding and promoting research and providing incentives towards the improvement of the industry. These programmes are geared towards improvement of the peoples food security position and reducing on the number of things imported into the country; not to mention the issues of the environment.

- Seaweed products are versatile in their uses ; they are and used as food and beverage additives, cosmetics and drugs, and feeds as well as being used in the production of biofuels. It is still recognized that large population and increasing demand in the regional market can become the primary incentive for investments and the development of technology for algae-derived products. Concerning the future of the algae business in the Asia-Pacific region, it is for this reason that the growth in concern for health and environment among customers will pressure producers to develop more solutions from algae that are sustainably produced and nutritious foods.

Active Key Players in the Algae Market

- Cynotech Corporation

- Algenol

- Femico

- Algae Health Science

- Pond Technologies Holdings Inc.

- Seagrass Tech Pvt Ltd

- Parry Nutraceutical

- Firglas

- Manta Biofuel

- Earthrise Nutritionals

- others

Recent Industry Developments In Algae Market

- In December 2023, in a significant step towards sustainable textile manufacturing, Algaeing™, a leader in clean textile innovation, collaborated with Birla Cellulose, a global leader in man-made cellulosic fibers. The parties signed an agreement to develop and introduce a unique, algae-powered cellulosic fiber. This innovative fiber, designed to be environmentally friendly, offered multiple benefits to end-users. The collaboration aimed to leverage the strengths of both companies, combining Algaeing’s expertise in algae-based solutions with Birla Cellulose’s extensive experience in cellulosic fiber production, marking a milestone in the pursuit of eco-friendly textile solutions.

- In June 2023, Green Aqua and Algikey, both Portuguese companies, formed a strategic partnership to produce and commercialize high-quality algae products for the aquaculture market. This collaboration aimed to enhance the supply of superior algae-based products to hatcheries, improving the nutrition and overall health of aquatic species. By leveraging their combined expertise and resources, Green Aqua and Algikey successfully addressed the growing demand for sustainable and nutritious feed solutions in the aquaculture industry. Their joint efforts resulted in the development of innovative algae products, contributing significantly to the advancement of aquaculture practices and the promotion of environmentally friendly solutions.

- In May 2022, Netherlands-based organization Duplaco developed a novel cultivar of golden chlorella, enabling the incorporation of nutrients into plant-based foods.

|

Global Algae Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 24.41 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.9% |

Market Size in 2032: |

USD 61.93 Bn. |

|

Segments Covered: |

By Cultivation Technology |

|

|

|

By Product Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ALGAE MARKET BY CULTIVATION TECHNOLOGY (2017-2032)

- ALGAE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- OPEN POND

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- NATURAL SETTINGS

- CLOSED SYSTEM

- ALGAE MARKET BY PRODUCT TYPE (2017-2032)

- ALGAE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MICROALGAE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MACROALGAE

- ALGAE MARKET BY APPLICATION (2017-2032)

- ALGAE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FOOD & BEVERAGES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- NUTRACEUTICAL

- PHARMACEUTICAL

- COSMETICS

- ANIMAL

- FISH FEED

- OTHERS

- ALGAE MARKET BY SEGMENT4 (2017-2032)

- ALGAE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SEGMENT4A

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SEGMENT4B

- SEGMENT4C

- SEGMENT4D

- SEGMENT4E

- SEGMENT4F

- ALGAE MARKET BY SEGMENT5 (2017-2032)

- ALGAE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SEGMENT5A

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SEGMENT5B

- SEGMENT5C

- SEGMENT5D

- SEGMENT5E

- SEGMENT5F

- ALGAE MARKET BY SEGMENT6 (2017-2032)

- ALGAE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SEGMENT6A

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SEGMENT6B

- SEGMENT6C

- SEGMENT6D

- SEGMENT6E

- SEGMENT6F

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- ALGAE Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- COMPANYA

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- CYNOTECH CORPORATION

- ALGENOL

- FEMICO

- ALGAE HEALTH SCIENCE

- POND TECHNOLOGIES HOLDINGS INC.

- SEAGRASS TECH PVT LTD

- PARRY NUTRACEUTICAL

- FIRGLAS

- MANTA BIOFUEL

- EARTHRISE NUTRITIONALS

- COMPETITIVE LANDSCAPE

- GLOBAL ALGAE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Cultivation Technology

- Historic And Forecasted Market Size By Product Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Algae Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 24.41 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.9% |

Market Size in 2032: |

USD 61.93 Bn. |

|

Segments Covered: |

By Cultivation Technology |

|

|

|

By Product Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ALGAE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ALGAE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ALGAE MARKET COMPETITIVE RIVALRY

TABLE 005. ALGAE MARKET THREAT OF NEW ENTRANTS

TABLE 006. ALGAE MARKET THREAT OF SUBSTITUTES

TABLE 007. ALGAE MARKET BY TYPE

TABLE 008. OPEN PONDS CULTIVATION MARKET OVERVIEW (2016-2028)

TABLE 009. RACEWAY PONDS CULTIVATION MARKET OVERVIEW (2016-2028)

TABLE 010. CLOSED PHOTO BIOREACTOR CULTIVATION MARKET OVERVIEW (2016-2028)

TABLE 011. CLOSED FERMENTER SYSTEMS CULTIVATION MARKET OVERVIEW (2016-2028)

TABLE 012. ALGAE MARKET BY APPLICATION

TABLE 013. DHA PRODUCTION (PROTEIN SALES) MARKET OVERVIEW (2016-2028)

TABLE 014. DHA PRODUCTION (PHARMACEUTICAL APPLICATIONS) MARKET OVERVIEW (2016-2028)

TABLE 015. BIOPLASTICS MARKET OVERVIEW (2016-2028)

TABLE 016. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA ALGAE MARKET, BY TYPE (2016-2028)

TABLE 018. NORTH AMERICA ALGAE MARKET, BY APPLICATION (2016-2028)

TABLE 019. N ALGAE MARKET, BY COUNTRY (2016-2028)

TABLE 020. EUROPE ALGAE MARKET, BY TYPE (2016-2028)

TABLE 021. EUROPE ALGAE MARKET, BY APPLICATION (2016-2028)

TABLE 022. ALGAE MARKET, BY COUNTRY (2016-2028)

TABLE 023. ASIA PACIFIC ALGAE MARKET, BY TYPE (2016-2028)

TABLE 024. ASIA PACIFIC ALGAE MARKET, BY APPLICATION (2016-2028)

TABLE 025. ALGAE MARKET, BY COUNTRY (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA ALGAE MARKET, BY TYPE (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA ALGAE MARKET, BY APPLICATION (2016-2028)

TABLE 028. ALGAE MARKET, BY COUNTRY (2016-2028)

TABLE 029. SOUTH AMERICA ALGAE MARKET, BY TYPE (2016-2028)

TABLE 030. SOUTH AMERICA ALGAE MARKET, BY APPLICATION (2016-2028)

TABLE 031. ALGAE MARKET, BY COUNTRY (2016-2028)

TABLE 032. ALGAE TEC: SNAPSHOT

TABLE 033. ALGAE TEC: BUSINESS PERFORMANCE

TABLE 034. ALGAE TEC: PRODUCT PORTFOLIO

TABLE 035. ALGAE TEC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. POND BIOFUELS INCORPORATED: SNAPSHOT

TABLE 036. POND BIOFUELS INCORPORATED: BUSINESS PERFORMANCE

TABLE 037. POND BIOFUELS INCORPORATED: PRODUCT PORTFOLIO

TABLE 038. POND BIOFUELS INCORPORATED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. LIVEFUELS: SNAPSHOT

TABLE 039. LIVEFUELS: BUSINESS PERFORMANCE

TABLE 040. LIVEFUELS: PRODUCT PORTFOLIO

TABLE 041. LIVEFUELS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. ALGAE SYSTEMS: SNAPSHOT

TABLE 042. ALGAE SYSTEMS: BUSINESS PERFORMANCE

TABLE 043. ALGAE SYSTEMS: PRODUCT PORTFOLIO

TABLE 044. ALGAE SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. SAPPHIRE ENERGY: SNAPSHOT

TABLE 045. SAPPHIRE ENERGY: BUSINESS PERFORMANCE

TABLE 046. SAPPHIRE ENERGY: PRODUCT PORTFOLIO

TABLE 047. SAPPHIRE ENERGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. SOLAZYME: SNAPSHOT

TABLE 048. SOLAZYME: BUSINESS PERFORMANCE

TABLE 049. SOLAZYME: PRODUCT PORTFOLIO

TABLE 050. SOLAZYME: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. DIVERSIFIED ENERGY CORPORATION: SNAPSHOT

TABLE 051. DIVERSIFIED ENERGY CORPORATION: BUSINESS PERFORMANCE

TABLE 052. DIVERSIFIED ENERGY CORPORATION: PRODUCT PORTFOLIO

TABLE 053. DIVERSIFIED ENERGY CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. ALGENOL: SNAPSHOT

TABLE 054. ALGENOL: BUSINESS PERFORMANCE

TABLE 055. ALGENOL: PRODUCT PORTFOLIO

TABLE 056. ALGENOL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. KAI BIOENERGY: SNAPSHOT

TABLE 057. KAI BIOENERGY: BUSINESS PERFORMANCE

TABLE 058. KAI BIOENERGY: PRODUCT PORTFOLIO

TABLE 059. KAI BIOENERGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. ALGIX: SNAPSHOT

TABLE 060. ALGIX: BUSINESS PERFORMANCE

TABLE 061. ALGIX: PRODUCT PORTFOLIO

TABLE 062. ALGIX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. DSM NUTRITIONAL PRODUCTS: SNAPSHOT

TABLE 063. DSM NUTRITIONAL PRODUCTS: BUSINESS PERFORMANCE

TABLE 064. DSM NUTRITIONAL PRODUCTS: PRODUCT PORTFOLIO

TABLE 065. DSM NUTRITIONAL PRODUCTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. DAO ENERGY: SNAPSHOT

TABLE 066. DAO ENERGY: BUSINESS PERFORMANCE

TABLE 067. DAO ENERGY: PRODUCT PORTFOLIO

TABLE 068. DAO ENERGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. PHYCAL: SNAPSHOT

TABLE 069. PHYCAL: BUSINESS PERFORMANCE

TABLE 070. PHYCAL: PRODUCT PORTFOLIO

TABLE 071. PHYCAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. KENT BIOENERGY CORPORATION: SNAPSHOT

TABLE 072. KENT BIOENERGY CORPORATION: BUSINESS PERFORMANCE

TABLE 073. KENT BIOENERGY CORPORATION: PRODUCT PORTFOLIO

TABLE 074. KENT BIOENERGY CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 075. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 076. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 077. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ALGAE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ALGAE MARKET OVERVIEW BY TYPE

FIGURE 012. OPEN PONDS CULTIVATION MARKET OVERVIEW (2016-2028)

FIGURE 013. RACEWAY PONDS CULTIVATION MARKET OVERVIEW (2016-2028)

FIGURE 014. CLOSED PHOTO BIOREACTOR CULTIVATION MARKET OVERVIEW (2016-2028)

FIGURE 015. CLOSED FERMENTER SYSTEMS CULTIVATION MARKET OVERVIEW (2016-2028)

FIGURE 016. ALGAE MARKET OVERVIEW BY APPLICATION

FIGURE 017. DHA PRODUCTION (PROTEIN SALES) MARKET OVERVIEW (2016-2028)

FIGURE 018. DHA PRODUCTION (PHARMACEUTICAL APPLICATIONS) MARKET OVERVIEW (2016-2028)

FIGURE 019. BIOPLASTICS MARKET OVERVIEW (2016-2028)

FIGURE 020. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA ALGAE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE ALGAE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC ALGAE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA ALGAE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA ALGAE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Algae Market research report is 2024-2032.

Cynotech Corporation, Algenol, Femico, Algae Health Science,Pond Technologies Holdings Inc., Seagrass Tech Pvt Ltd, Parry Nutraceutical, Firglas, Manta Biofuel, Earthrise Nutritionals and others

The Algae Market is segmented into By Cultivation Technology, By Product Type , By Application and region. By Cultivation Technology (Open Pond, Natural Settings, and Closed System), By Product Type (Microalgae and Macroalgae), By Application (Food & Beverages, Nutraceutical, Pharmaceutical, Cosmetics, Animal and Fish Feed, Biofuel, Waste Water Treatment, Fertilizer, and Specialty Chemicals and Polymers) By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Algae are a diverse group of photosynthetic organisms that range from microscopic single-celled organisms to large multicellular seaweeds. They can be found in various aquatic environments, including freshwater lakes, rivers, oceans, and even damp terrestrial habitats. Algae harness sunlight to convert carbon dioxide and water into organic compounds through photosynthesis, playing a vital role in global carbon cycling and oxygen production. While often associated with green coloration due to chlorophyll, algae exhibit a wide array of colors and forms, including green, red, brown, and blue-green. They serve as fundamental components of aquatic ecosystems, providing food and habitat for various organisms, and hold immense economic importance due to their applications in food, pharmaceuticals, biofuels, wastewater treatment, and more.

Algae Market Size Was Valued at USD 24.41 Billion in 2023, and is Projected to Reach USD 61.93 Billion by 2032, Growing at a CAGR of 10.9% From 2024-2032.