Cottonseed Oil Market Synopsis

The Global Cottonseed Oil Market size is expected to grow from USD 4.52 billion in 2023 to USD 6.27 billion by 2032, at a CAGR of 3.7% during the forecast period (2024-2032).

- Cottonseed oil is an edible oil obtained from the seeds of various cotton plants, mainly from the seeds of cotton plants grown for cotton fiber, animal feed, and oil. Cotton seeds have a similar structure to other oil seeds, such as sunflower seeds, with an oil-rich core surrounded by a hard-outer shell during processing, the oil is separated from the kernel.

- Cottonseed oil is used in salad oil, mayonnaise, salad dressings, and similar products because of its flavor stability. Cottonseed oil is a commonly used vegetable oil obtained from the seeds of cotton plants. Whole cottonseed contains about 15-20 percent oil. Unrefined cottonseed oil contains a poison called gossypol. This naturally occurring toxin gives the crude oil its yellow color and protects the plant from insects. Sometimes unrefined cottonseed oil is used as a pesticide. Cottonseed oil is often used in processed foods because it increases shelf life.

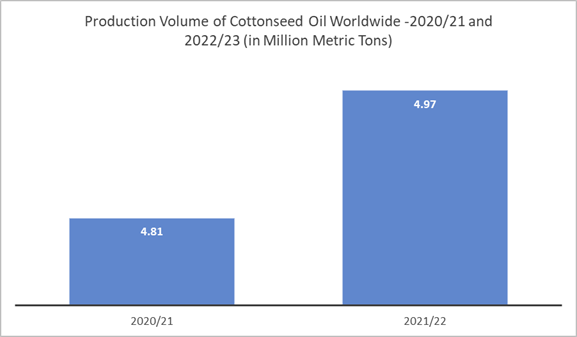

- The above graph shows the production volume of cottonseed oil. The global production of cottonseed oil has been increasing in recent years. The increasing production value drives the growth of the market.

- Cottonseed is also a popular ingredient in baking. It provides a solid fat index for shortening, making baked goods moist and chewy. It also helps achieve a creamy texture in the frosting and filling. The oil is obtained by crushing and further processing the cotton kernel. Cottonseed oil is used in various verticals; therefore, it is in demand in the oil market among various industries. Because its quality absorbs the taste of food, it does not add its own, so it is widely used in the food industry. In addition to this, it is poised to offer various health and skin benefits to the user, making it a popular cosmetic ingredient in the cosmetic industry.

The Cottonseed Oil Market Trend Analysis

Increasing Health Awareness of the Consumption of Cottonseed Oils

- Cottonseed oil helps reduce the risk of abnormal heartbeats or arrhythmias, which can lead to sudden death in a patient. It also helps lower triglyceride levels, slow the growth of atherosclerotic plaques, and lower blood pressure. Consumers are increasingly choosing a healthier option while viewing preventative care as a necessary tool for a healthier lifestyle. As a result, cottonseed oils are becoming increasingly popular because they are a good source of vitamins, proteins, and minerals and can help with conditions such as cancer, asthma, and depression driving the growth of the market. The rising awareness of the benefits of cottonseed oil through various forms of media boosts the growth of the cottonseed oil market.

- Cottonseed, due to its abundance of vitamin E, fatty acids, and antioxidants, works as an excellent cosmetic ingredient in the preparation of moisturizers, anti-aging and anti-inflammatory products. The presence of linoleic acid reduces inflammation in the hair and other areas, which helps reduce dandruff and other hair diseases in the consumer. Such factors drive the demand for cottonseed oil.

- Additionally, most of the world's current population has uncontrolled and undiagnosed blood pressure. Although there are many comparison tables comparing cottonseed oil with sunflower oil - scientific studies have shown that cottonseed oil is higher in unsaturated fats, which leads to an increase in good cholesterol while lowering bad cholesterol. Hence the increasing awareness of cotton seeds among the population drives the growth of the market.

Various Mergers and Acquisitions, Partnerships, and New Product Launches

- The benefits of cottonseed oil are likely to influence purchasing behavior through various forms of media, including electronic and print information. Cottonseed oil is an excellent cosmetic ingredient for moisturizing, anti-aging, and anti-inflammatory products because it is rich in vitamin E, fatty acids, and antioxidants. Linoleic acid reduces inflammation in the hair and other areas, which helps the consumer reduce dandruff and other hair diseases.

- Additionally, the presence of many key players in the market such as Archer Daniels Midland Co., La Tourangelle, Best Natures Cosmetic, and other major players are driving the growth of the market. Various mergers and acquisitions, partnerships, and cooperative relationships in the cottonseed oil market, as well as relatively large investments in the food industry, create growth opportunities for the market. For instance, Patanjali Ayurved acquired Ruchi Soya Industries and as part of the acquisition, Patanjali got exclusive rights to Mahakosh Oil, which enabled Patanjali Ayurved to expand its product range in the edible oil segment. Mahakosh Oil is the brand name under which the edible oil is sold and cottonseed oil is one of the edible oils under this brand name.

Segmentation Analysis of The Cottonseed Oil Market

The Cottonseed Oil market segments cover the Nature, Raw Material, Packaging, Distribution Channel, and End User. By End User, the Industrial segment is anticipated to dominate the Market Over the Forecast period.

- The industrial segment drives the growth of the market. The industrial segment is dominated by food processing industries, as cottonseed oil is used in various applications and products, such as margarine, icings, bakery and confectionary, salad dressing, and is more importantly used as a flying and cooking oil.

- Moreover, the reason for such domination lies in the several qualities of cottonseed oil. For instance, it acts as a substitute for edible oil, with low cholesterol than others, thus, the food processing industry demands a higher proportion. It also doesn’t mask the food’s natural taste, helps in the manufacturing of chips and snacks, bakery as well as confectionery, and has a high proportion of fatty acids, which drives the industrial segment growth and boost the cottonseeds oil market growth.

Regional Analysis of The Cottonseed Oil Market

North America is Expected to Dominate the Cottonseed Oil Market Over the Forecast Period.

- North America dominated the cottonseed market. Low-fat, low-cholesterol foods are driving demand in this region. The fast food and the food industry made a significant contribution to the total share of the market. The United States is a major producer of cottonseed oil. The market is driven by new developments in production techniques. The increasing use of cottonseed oil in the manufacture of cosmetic products and the presence of major manufacturers of cottonseed oil increase the market value.

- The United States is a significant producer and user of cottonseed oil. The market in the United States is primarily driven by new developments in product ways. The growing operation of cottonseed oil for the product of cosmetics and the presence of top cottonseed oil manufacturers are boosting market value. Market expansion is anticipated to be told by rising consumer interest in nutritive food products.

COVID-19 Impact Analysis on the Cottonseed Oil Market

- COVID-19 pandemic affects almost every industry. It also hampers the growth of the cottonseed oil market. Moreover, the COVID-19 pandemic increased the consumption of nutritious foods and oils such as cottonseed oil in the same region as consumer health concerns increased in 2020. Also, vaccines were introduced in 2021, leading to the lifting of lockdown restrictions across the region. As shutdown restrictions eased, oil refining units were restarted to meet growing demand. In addition, shipping and business activity recovered, which increased the demand for cottonseed oil.

- However, the outbreak of coronavirus influenced consumers to consume dietary supplements in their daily lives in order to protect themselves from severe respiratory syndrome coronavirus, which increases the demand for cottonseed oils, which are boosting the cottonseed oil product market in the upcoming years. The market is excepted to grow vigorously during the forecast period.

Top Key Players Covered in The Cottonseed Oil Market

- Archer Daniels Midland Co. (US)

- La Tourangelle (US)

- Best Natures Cosmetic (Canada)

- Higher Nature Limited (UK)

- Bio Planete (Germany)

- Louis Dreyfus Company B.V. (Netherlands)

- Biopurus. CO. UK (UK)

- Aromex Industry (India)

- Byodo Naturkost GmbH (Germany)

- Cargill Inc.(US)

- Oilseeds Australia Pty Ltd. (Australia)

- Ruchi Soya Industries Ltd. (India)

- Associated British Foods PLC (UK)

- Matangi Cotton Industries (India), and Other Major Players.

Key Industry Developments in the Cottonseed Oil Market

- In January 2024, Cargill achieved a significant milestone by becoming the first global supplier to meet the World Health Organization's (WHO) best practice standard on eliminating industrially produced trans-fatty acids (iTFA) from its entire worldwide edible oils portfolio. In adhering to the WHO's recommended maximum tolerance level for iTFA content in fats and oils, which stands at no more than two grams per 100 grams, Cargill ensures that every food customer, regardless of their location, can have confidence in the quality of the company's fats and oils. Notably, Cargill has removed iTFA from its fats and oils even in countries where there are no legislative mandates in place.

- In November 2023, ADM, a global leader in human and animal nutrition, announced its agreement to acquire FDL, a prominent UK-based developer and producer of premium flavor and functional ingredient systems. This strategic move broadens ADM's global flavors capabilities. FDL, with projected sales of around $120 million in 2023, boasts significant innovation capabilities and holds a strong position in the European foodservice channel, valued at $900 billion. Operating three production facilities and two customer innovation centers in the United Kingdom, FDL employs approximately 235 staff members, including 40 dedicated innovation specialists. The company has developed over 10,000 proprietary flavor formulations, facilitating accelerated speed to market for its clients across various channels.

|

Global Cottonseed Oil Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.52 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.7 % |

Market Size in 2032: |

USD 6.27 Bn. |

|

Segments Covered: |

By Nature |

|

|

|

By Raw Material |

|

||

|

By Packaging |

|

||

|

By Distribution Channel |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

TABLE OF CONTENT

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power of Supplier

- Threat of New Entrants

- Threat of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On the Overall Market

- Impact On the Supply Chain

- Impact On the Key Manufacturers

- Impact On the Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- COTTONSEED OIL MARKET BY NATURE(2016-2030)

- COTTONSEED OIL MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ORGANIC

- Introduction and Market Overview

- Historic and Forecasted Market Size in Value (2016 – 2030F)

- Historic and Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- CONVENTIONAL

- COTTONSEED OIL MARKET BY RAW MATERIAL (2016-2030)

- COTTONSEED OIL MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- GENETICALLY MODIFIED COTTON

- Introduction and Market Overview

- Historic and Forecasted Market Size in Value (2016 – 2030F)

- Historic and Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- NON-GENETICALLY MODIFIED COTTON

- COTTONSEED OIL MARKET BY PACKAGING (2016-2030)

- COTTONSEED OIL MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BULK

- Introduction and Market Overview

- Historic and Forecasted Market Size in Value (2016 – 2030F)

- Historic and Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- RETAIL

- COTTONSEED OIL MARKET BY DISTRIBUTION CHANEL (2016-2030)

- COTTONSEED OIL MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- OFFLINE

- Introduction and Market Overview

- Historic and Forecasted Market Size in Value (2016 – 2030F)

- Historic and Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- ONLINE

- COTTONSEED OIL MARKET BY END USERS (2016-2030)

- COTTONSEED OIL MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- INDUSTRIAL

- Introduction and Market Overview

- Historic and Forecasted Market Size in Value (2016 – 2030F)

- Historic and Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- COSMETICS AND PERSONAL CARE

- RETAIL

- FOOD SERVICE PROVIDER

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Cottonseed Oil Market Share by Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ARCHER DANIELS MIDLAND CO. (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves and Recent Developments

- SWOT Analysis

- LA TOURANGELLE (US)

- BEST NATURES COSMETIC (CANADA)

- HIGHER NATURE LIMITED (UK)

- BIO PLANETE (GERMANY)

- LOUIS DREYFUS COMPANY B.V. (NETHERLANDS)

- BIOPURUS. CO. UK (UK)

- AROMEX INDUSTRY (INDIA)

- BYODO NATURKOST GMBH (GERMANY)

- CARGILL INC. (US)

- OILSEEDS AUSTRALIA PTY LTD. (AUSTRALIA)

- RUCHI SOYA INDUSTRIES LTD. (INDIA)

- ASSOCIATED BRITISH FOODS PLC (UK)

- MATANGI COTTON INDUSTRIES (INDIA), AND OTHER MAJOR PLAYERS

- COMPETITIVE LANDSCAPE

- GLOBAL COTTONSEED OIL MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors, And Opportunities

- Impact of Covid-19

- Key Manufacturers

- Historic and Forecasted Market Size by Product

- Historic and Forecasted Market Size by BUSINESS

- Historic and Forecasted Market Size by APPLICATION

- Historic and Forecasted Market Size by Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors and Opportunities

- Impact of Covid-19

- Key Manufacturers

- Historic and Forecasted Market Size by Segments

- Historic and Forecasted Market Size by Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors, And Opportunities

- Impact of Covid-19

- Key Manufacturers

- Historic and Forecasted Market Size by Segments

- Historic and Forecasted Market Size by Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors, And Opportunities

- Impact of Covid-19

- Key Manufacturers

- Historic and Forecasted Market Size by Segments

- Historic and Forecasted Market Size by Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors, And Opportunities

- Impact of Covid-19

- Key Manufacturers

- Historic and Forecasted Market Size by Segments

- Historic and Forecasted Market Size by Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors, And Opportunities

- Impact of Covid-19

- Key Manufacturers

- Historic and Forecasted Market Size by Segments

- Historic and Forecasted Market Size by Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Cottonseed Oil Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.52 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.7 % |

Market Size in 2032: |

USD 6.27 Bn. |

|

Segments Covered: |

By Nature |

|

|

|

By Raw Material |

|

||

|

By Packaging |

|

||

|

By Distribution Channel |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. COTTONSEED OIL MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. COTTONSEED OIL MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. COTTONSEED OIL MARKET COMPETITIVE RIVALRY

TABLE 005. COTTONSEED OIL MARKET THREAT OF NEW ENTRANTS

TABLE 006. COTTONSEED OIL MARKET THREAT OF SUBSTITUTES

TABLE 007. COTTONSEED OIL MARKET BY NATURE

TABLE 008. ORGANIC MARKET OVERVIEW (2016-2030)

TABLE 009. CONVENTIONAL MARKET OVERVIEW (2016-2030)

TABLE 010. COTTONSEED OIL MARKET BY RAW MATERIAL

TABLE 011. GENETICALLY MODIFIED COTTON MARKET OVERVIEW (2016-2030)

TABLE 012. NON-GENETICALLY MODIFIED COTTON MARKET OVERVIEW (2016-2030)

TABLE 013. COTTONSEED OIL MARKET BY PACKAGING

TABLE 014. BULK MARKET OVERVIEW (2016-2030)

TABLE 015. RETAIL MARKET OVERVIEW (2016-2030)

TABLE 016. COTTONSEED OIL MARKET BY DISTRIBUTION CHANNEL

TABLE 017. OFFLINE MARKET OVERVIEW (2016-2030)

TABLE 018. ONLINE MARKET OVERVIEW (2016-2030)

TABLE 019. COTTONSEED OIL MARKET BY END USER

TABLE 020. INDUSTRIAL MARKET OVERVIEW (2016-2030)

TABLE 021. COSMETICS AND PERSONAL CARE MARKET OVERVIEW (2016-2030)

TABLE 022. RETAIL MARKET OVERVIEW (2016-2030)

TABLE 023. FOOD SERVICE PROVIDER MARKET OVERVIEW (2016-2030)

TABLE 024. NORTH AMERICA COTTONSEED OIL MARKET, BY NATURE (2016-2030)

TABLE 025. NORTH AMERICA COTTONSEED OIL MARKET, BY RAW MATERIAL (2016-2030)

TABLE 026. NORTH AMERICA COTTONSEED OIL MARKET, BY PACKAGING (2016-2030)

TABLE 027. NORTH AMERICA COTTONSEED OIL MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 028. NORTH AMERICA COTTONSEED OIL MARKET, BY END USER (2016-2030)

TABLE 029. N COTTONSEED OIL MARKET, BY COUNTRY (2016-2030)

TABLE 030. EASTERN EUROPE COTTONSEED OIL MARKET, BY NATURE (2016-2030)

TABLE 031. EASTERN EUROPE COTTONSEED OIL MARKET, BY RAW MATERIAL (2016-2030)

TABLE 032. EASTERN EUROPE COTTONSEED OIL MARKET, BY PACKAGING (2016-2030)

TABLE 033. EASTERN EUROPE COTTONSEED OIL MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 034. EASTERN EUROPE COTTONSEED OIL MARKET, BY END USER (2016-2030)

TABLE 035. COTTONSEED OIL MARKET, BY COUNTRY (2016-2030)

TABLE 036. WESTERN EUROPE COTTONSEED OIL MARKET, BY NATURE (2016-2030)

TABLE 037. WESTERN EUROPE COTTONSEED OIL MARKET, BY RAW MATERIAL (2016-2030)

TABLE 038. WESTERN EUROPE COTTONSEED OIL MARKET, BY PACKAGING (2016-2030)

TABLE 039. WESTERN EUROPE COTTONSEED OIL MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 040. WESTERN EUROPE COTTONSEED OIL MARKET, BY END USER (2016-2030)

TABLE 041. COTTONSEED OIL MARKET, BY COUNTRY (2016-2030)

TABLE 042. ASIA PACIFIC COTTONSEED OIL MARKET, BY NATURE (2016-2030)

TABLE 043. ASIA PACIFIC COTTONSEED OIL MARKET, BY RAW MATERIAL (2016-2030)

TABLE 044. ASIA PACIFIC COTTONSEED OIL MARKET, BY PACKAGING (2016-2030)

TABLE 045. ASIA PACIFIC COTTONSEED OIL MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 046. ASIA PACIFIC COTTONSEED OIL MARKET, BY END USER (2016-2030)

TABLE 047. COTTONSEED OIL MARKET, BY COUNTRY (2016-2030)

TABLE 048. MIDDLE EAST & AFRICA COTTONSEED OIL MARKET, BY NATURE (2016-2030)

TABLE 049. MIDDLE EAST & AFRICA COTTONSEED OIL MARKET, BY RAW MATERIAL (2016-2030)

TABLE 050. MIDDLE EAST & AFRICA COTTONSEED OIL MARKET, BY PACKAGING (2016-2030)

TABLE 051. MIDDLE EAST & AFRICA COTTONSEED OIL MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 052. MIDDLE EAST & AFRICA COTTONSEED OIL MARKET, BY END USER (2016-2030)

TABLE 053. COTTONSEED OIL MARKET, BY COUNTRY (2016-2030)

TABLE 054. SOUTH AMERICA COTTONSEED OIL MARKET, BY NATURE (2016-2030)

TABLE 055. SOUTH AMERICA COTTONSEED OIL MARKET, BY RAW MATERIAL (2016-2030)

TABLE 056. SOUTH AMERICA COTTONSEED OIL MARKET, BY PACKAGING (2016-2030)

TABLE 057. SOUTH AMERICA COTTONSEED OIL MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 058. SOUTH AMERICA COTTONSEED OIL MARKET, BY END USER (2016-2030)

TABLE 059. COTTONSEED OIL MARKET, BY COUNTRY (2016-2030)

TABLE 060. ARCHER DANIELS MIDL CO.: SNAPSHOT

TABLE 061. ARCHER DANIELS MIDL CO.: BUSINESS PERFORMANCE

TABLE 062. ARCHER DANIELS MIDL CO.: PRODUCT PORTFOLIO

TABLE 063. ARCHER DANIELS MIDL CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. LA TOURANGELLE: SNAPSHOT

TABLE 064. LA TOURANGELLE: BUSINESS PERFORMANCE

TABLE 065. LA TOURANGELLE: PRODUCT PORTFOLIO

TABLE 066. LA TOURANGELLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. BEST NATURES COSMETIC: SNAPSHOT

TABLE 067. BEST NATURES COSMETIC: BUSINESS PERFORMANCE

TABLE 068. BEST NATURES COSMETIC: PRODUCT PORTFOLIO

TABLE 069. BEST NATURES COSMETIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. HIGHER NATURE LIMITED: SNAPSHOT

TABLE 070. HIGHER NATURE LIMITED: BUSINESS PERFORMANCE

TABLE 071. HIGHER NATURE LIMITED: PRODUCT PORTFOLIO

TABLE 072. HIGHER NATURE LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. BIO PLANETE: SNAPSHOT

TABLE 073. BIO PLANETE: BUSINESS PERFORMANCE

TABLE 074. BIO PLANETE: PRODUCT PORTFOLIO

TABLE 075. BIO PLANETE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. LOUIS DREYFUS COMPANY B.V.: SNAPSHOT

TABLE 076. LOUIS DREYFUS COMPANY B.V.: BUSINESS PERFORMANCE

TABLE 077. LOUIS DREYFUS COMPANY B.V.: PRODUCT PORTFOLIO

TABLE 078. LOUIS DREYFUS COMPANY B.V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. BIOPURUS. CO. UK: SNAPSHOT

TABLE 079. BIOPURUS. CO. UK: BUSINESS PERFORMANCE

TABLE 080. BIOPURUS. CO. UK: PRODUCT PORTFOLIO

TABLE 081. BIOPURUS. CO. UK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. AROMEX INDUSTRY: SNAPSHOT

TABLE 082. AROMEX INDUSTRY: BUSINESS PERFORMANCE

TABLE 083. AROMEX INDUSTRY: PRODUCT PORTFOLIO

TABLE 084. AROMEX INDUSTRY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. BYODO NATURKOST GMBH: SNAPSHOT

TABLE 085. BYODO NATURKOST GMBH: BUSINESS PERFORMANCE

TABLE 086. BYODO NATURKOST GMBH: PRODUCT PORTFOLIO

TABLE 087. BYODO NATURKOST GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. CARGILL INC.: SNAPSHOT

TABLE 088. CARGILL INC.: BUSINESS PERFORMANCE

TABLE 089. CARGILL INC.: PRODUCT PORTFOLIO

TABLE 090. CARGILL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. OILSEEDS AUSTRALIA PTY LTD.: SNAPSHOT

TABLE 091. OILSEEDS AUSTRALIA PTY LTD.: BUSINESS PERFORMANCE

TABLE 092. OILSEEDS AUSTRALIA PTY LTD.: PRODUCT PORTFOLIO

TABLE 093. OILSEEDS AUSTRALIA PTY LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. RUCHI SOYA INDUSTRIES LTD.: SNAPSHOT

TABLE 094. RUCHI SOYA INDUSTRIES LTD.: BUSINESS PERFORMANCE

TABLE 095. RUCHI SOYA INDUSTRIES LTD.: PRODUCT PORTFOLIO

TABLE 096. RUCHI SOYA INDUSTRIES LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. ASSOCIATED BRITISH FOODS PLC: SNAPSHOT

TABLE 097. ASSOCIATED BRITISH FOODS PLC: BUSINESS PERFORMANCE

TABLE 098. ASSOCIATED BRITISH FOODS PLC: PRODUCT PORTFOLIO

TABLE 099. ASSOCIATED BRITISH FOODS PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. MATANGI COTTON INDUSTRIES: SNAPSHOT

TABLE 100. MATANGI COTTON INDUSTRIES: BUSINESS PERFORMANCE

TABLE 101. MATANGI COTTON INDUSTRIES: PRODUCT PORTFOLIO

TABLE 102. MATANGI COTTON INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 102. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 103. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 104. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 105. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. COTTONSEED OIL MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. COTTONSEED OIL MARKET OVERVIEW BY NATURE

FIGURE 012. ORGANIC MARKET OVERVIEW (2016-2030)

FIGURE 013. CONVENTIONAL MARKET OVERVIEW (2016-2030)

FIGURE 014. COTTONSEED OIL MARKET OVERVIEW BY RAW MATERIAL

FIGURE 015. GENETICALLY MODIFIED COTTON MARKET OVERVIEW (2016-2030)

FIGURE 016. NON-GENETICALLY MODIFIED COTTON MARKET OVERVIEW (2016-2030)

FIGURE 017. COTTONSEED OIL MARKET OVERVIEW BY PACKAGING

FIGURE 018. BULK MARKET OVERVIEW (2016-2030)

FIGURE 019. RETAIL MARKET OVERVIEW (2016-2030)

FIGURE 020. COTTONSEED OIL MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 021. OFFLINE MARKET OVERVIEW (2016-2030)

FIGURE 022. ONLINE MARKET OVERVIEW (2016-2030)

FIGURE 023. COTTONSEED OIL MARKET OVERVIEW BY END USER

FIGURE 024. INDUSTRIAL MARKET OVERVIEW (2016-2030)

FIGURE 025. COSMETICS AND PERSONAL CARE MARKET OVERVIEW (2016-2030)

FIGURE 026. RETAIL MARKET OVERVIEW (2016-2030)

FIGURE 027. FOOD SERVICE PROVIDER MARKET OVERVIEW (2016-2030)

FIGURE 028. NORTH AMERICA COTTONSEED OIL MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 029. EASTERN EUROPE COTTONSEED OIL MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 030. WESTERN EUROPE COTTONSEED OIL MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 031. ASIA PACIFIC COTTONSEED OIL MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 032. MIDDLE EAST & AFRICA COTTONSEED OIL MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 033. SOUTH AMERICA COTTONSEED OIL MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Cottonseed Oil Market research report is 2024-2032.

Archer Daniels Midland Co. (US), La Tourangelle (US), Best Natures Cosmetic (Canada), Higher Nature Limited (UK), Bio Planete (Germany), Louis Dreyfus Company B.V. (Netherlands), Biopurus. CO. UK (UK), Aromex Industry (India), Byodo Naturkost GmbH (Germany), Cargill Inc. (US), Oilseeds Australia Pty Ltd. (Australia), Ruchi Soya Industries Ltd. (India), Associated British Foods PLC (UK), Matangi Cotton Industries (India), and Other Major Players.

The Cottonseed Oil Market is segmented Nature, Raw Material, Packaging, Distribution Channel, End User, and region. By Nature, the market is categorized into Organic, Conventional. By Raw Material, the market is categorized into Genetically Modified Cotton and Non-Genetically Modified Cotton. By Packaging, the market is categorized into Bulk, Retail. By Distribution Channel, the market is categorized into Offline, Online. By End User, the market is categorized into Industrial, Cosmetics and Personal Care, Retail, and Food Service Providers. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Cottonseed oil is an edible oil obtained from the seeds of various cotton plants, mainly from the seeds of cotton plants grown for cotton fiber, animal feed, and oil. Cotton seeds have a similar structure to other oil seeds, such as sunflower seeds, with an oil-rich core surrounded by a hard-outer shell during processing, the oil is separated from the kernel. Cottonseed oil is used in salad oil, mayonnaise, salad dressings, and similar products because of its flavor stability. Cottonseed oil is a commonly used vegetable oil obtained from the seeds of cotton plants.

The Global Cottonseed Oil Market size is expected to grow from USD 4.52 billion in 2023 to USD 6.27 billion by 2032, at a CAGR of 3.7% during the forecast period (2024-2032).