Acrylic Rubber Market Synopsis

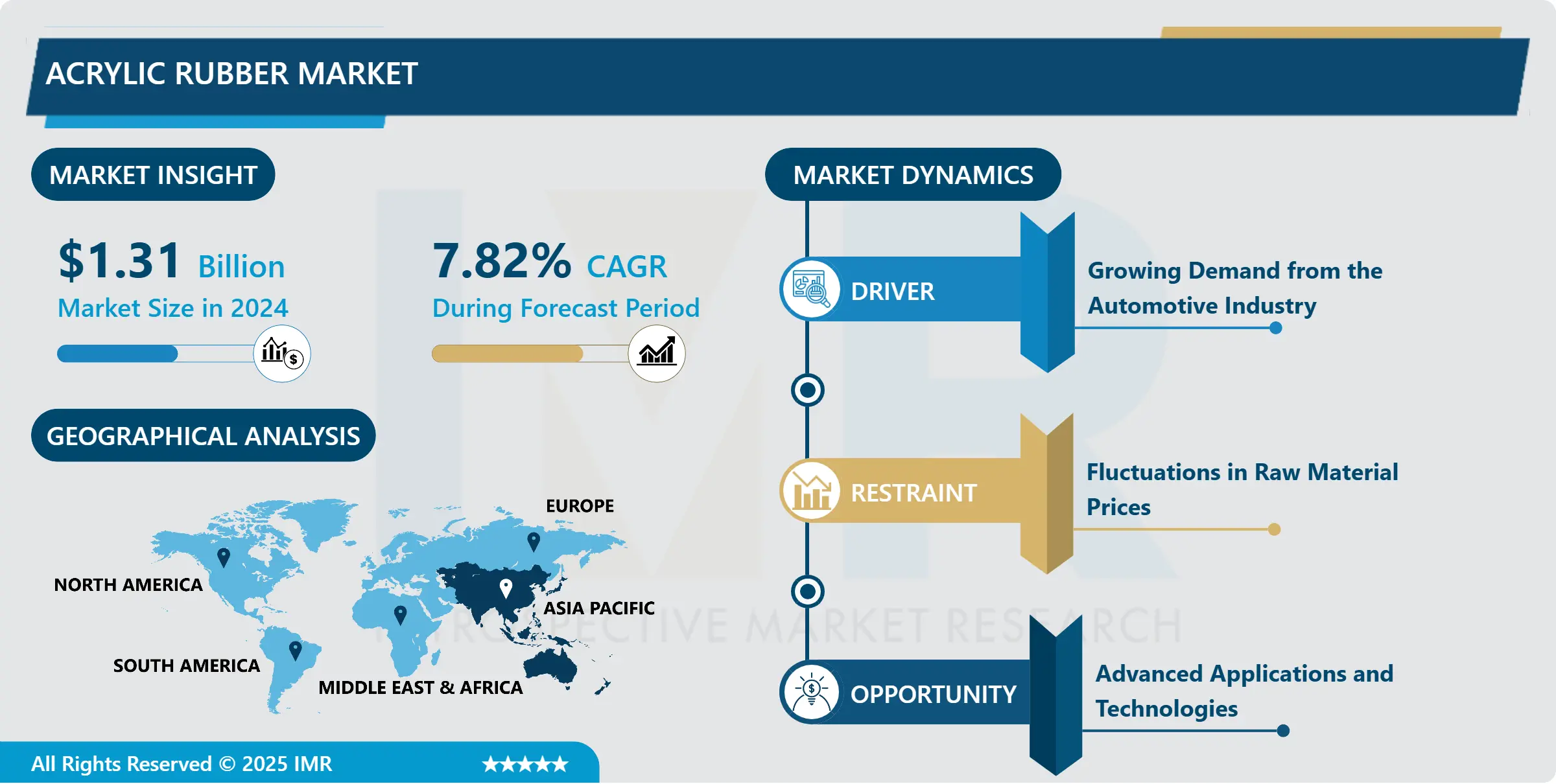

Global Acrylic Rubber Market Size Was Valued at USD 1.31 Billion in 2024 and is Projected to Reach USD 3.1 Billion by 2035, Growing at a CAGR of 7.82 % From 2025-2035

Acrylic rubber, an essential element in the industrial realm, represents a specialized synthetic elastomer well-known for its outstanding resistance to heat and oil. This durable polymer, fundamental to diverse manufacturing sectors, exhibits exceptional strength and resilience in demanding conditions. Its varied uses extend across the automotive, aerospace, and oil industries, emphasizing its importance in improving the performance and lifespan of products.

Acrylic rubber, recognized for its remarkable versatility, is widely utilized across various industries. Its distinctive characteristics make it a preferred option for sealing and gasket applications within the automotive sector. The material's ability to resist heat, oil, and chemicals is essential for ensuring optimal performance in challenging environments. Moreover, its capacity to adapt to extreme temperatures and harsh conditions establishes acrylic rubber as a dependable solution for a variety of industrial applications, enhancing the durability and longevity of components.

The material's outstanding weather resistance and UV stability contribute to its popularity in outdoor applications, such as in the construction and aerospace industries. Its inherent capability to maintain flexibility and elasticity over time enhances its attractiveness, ensuring a lasting seal and protection against environmental factors. As industries increasingly prioritize durability and longevity, the advantageous characteristics of acrylic rubber position it as a key player in diverse applications.

The future demand for acrylic rubber is poised for substantial growth, propelled by its expanding utility across industries. Amid ongoing technological advancements and a growing focus on sustainable materials, acrylic rubber is anticipated to experience heightened adoption in environmentally sensitive applications. The demand for high-performance sealing solutions in critical sectors, including energy and healthcare, further emphasizes the material's significance. As industries progress, the unique properties of acrylic rubber establish it as a resilient and indispensable component, guaranteeing its continued prominence in the market.

Acrylic Rubber Market Trend Analysis:

Growing Demand from the Automotive Industry

- The expanding need in the automotive sector serves as a crucial catalyst for the growth of the Acrylic Rubber Market. The insatiable demand for advanced materials within this industry, driven by evolving design and performance standards, propels the increasing adoption of acrylic rubber. Its capacity to endure extreme temperatures, resist oil and chemicals, and provide durable sealing solutions seamlessly aligns with the challenging conditions prevalent in automotive applications. As automakers persistently search for materials that enhance component longevity and reliability, the growing preference for acrylic rubber underscores its pivotal role in meeting the industry's evolving needs.

- Acrylic rubber has gained significant traction in various industrial applications. Its versatility extends beyond vehicular uses, encompassing sectors such as construction and aerospace. The material's exceptional weather resistance and stability against UV radiation contribute to its attractiveness in outdoor applications. This adaptability, coupled with the ability to maintain elasticity over time, positions acrylic rubber as a sought-after solution for sealing and protective purposes across various industries, thereby propelling its market growth beyond the automotive domain.

- The trajectory of the Acrylic Rubber Market is poised for sustained growth, driven by the unwavering demand from the automotive industry. As advancements in automotive technology continue to fuel innovation, the reliance on specialized materials like acrylic rubber is expected to intensify. Furthermore, the material's relevance extends into emerging industries, aligning with the broader trend of sustainable and resilient material choices. The automotive industry's unwavering preference for acrylic rubber is indicative of both its present necessity and its potential to continue influencing material preferences in other industries in the future.

Advanced Applications and Technologies

- A key factor propelling the expansion of the acrylic rubber market is the ever-changing environment of advanced applications and technologies. Within this realm, the material's versatility positions it as a key enabler for a spectrum of innovative applications. Acrylic rubber's ability to withstand extreme conditions, along with its resilience to heat, oil, and chemicals, aligns seamlessly with the evolving requirements of cutting-edge technologies. Industries spanning from electronics to aerospace leverage these unique properties, fuelling the demand for acrylic rubber as a foundational component in diverse advanced applications.

- Acrylic Rubber discovers lucrative opportunities within evolving technological domains. The material's significance extends to its application in emerging technologies that demand precision and reliability. In sectors such as renewable energy and medical devices, where stringent performance standards prevail, acrylic rubber's attributes become instrumental. As technological advancements continue to push boundaries, the adaptable nature of acrylic rubber positions it as a material of choice, presenting substantial growth opportunities beyond traditional applications.

- The path of the Acrylic Rubber Market is intricately tied to the ongoing evolution of Advanced Applications and Technologies. As industries embrace more sophisticated and specialized applications, the demand for acrylic rubber is poised to surge. The material's role in enhancing the durability and functionality of cutting-edge technologies solidifies its standing as a growth catalyst. This represents a positive turning point in the market's development and emphasizes the material's current significance as well as its essential function in influencing the landscape of cutting-edge applications and technologies.

Acrylic Rubber Market Segment Analysis:

Acrylic Rubber Market Segmented on the basis of Type, Fabrication Process, and Application

By Type, Epoxy Acrylate segment is expected to dominate the market during the forecast period

- The dominance of Epoxy Acrylate emerges as a decisive factor propelling the growth of the Acrylic Rubber Market. Epoxy Acrylate's unparalleled properties, including exceptional adhesion, chemical resistance, and durability, position it as a dominant force in various industries. Its widespread application in sectors requiring robust bonding and sealing solutions, particularly in construction and automotive, underscores its influential role in shaping the market's expansion. As industries increasingly recognize the distinctive advantages offered by Epoxy Acrylate, its prevalence is poised to soar, further solidifying its dominance and guiding the Acrylic Rubber Market toward sustained growth.

- The profound impact of Epoxy Acrylate extends beyond its immediate applications, permeating diverse industrial landscapes. Its superiority in meeting stringent performance requirements, coupled with its adaptability to various environmental conditions, establishes it as the preferred choice for manufacturers across sectors. The increasing integration of Epoxy Acrylate into emerging technologies and advanced materials heralds a new era for the Acrylic Rubber Market.

By Product Type, Automotive Industry segment held the largest share of 60.10% in 2022

- The pre-eminence of the Automotive Industry segment in the Acrylic Rubber market is derived from its commanding influence, directing the market's growth trajectory. This sector serves as a primary driver, significantly shaping the market landscape. The robust demand within the Automotive Industry underscores the indispensable role that acrylic rubber plays in meeting the stringent requirements of this dynamic sector. Its ability to endure extreme temperatures, resist oil and chemicals, and provide durable sealing solutions aligns seamlessly with the rigorous demands of automotive applications, solidifying its dominance in this segment.

- The dominance of the Automotive Industry signifies the strategic importance of acrylic rubber in the sector's operational efficiency and longevity. The widespread utilization of acrylic rubber in critical automotive components underscores its strategic position as a material of choice. As the automotive sector continues to evolve, driven by technological advancements and the pursuit of enhanced performance, the demand for acrylic rubber is poised to persist and expand, reinforcing the Automotive Industry's significant share in directing the growth dynamics of the Acrylic Rubber market.

Acrylic Rubber Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The dominance of the Asia Pacific region in driving the growth of the Acrylic Rubber market is underpinned by its commanding influence, positioning it as the foremost contributor to market expansion. This region emerges as a primary driver, significantly shaping the market dynamics. The robust demand for acrylic rubber within the Asia Pacific region is a testament to the pivotal role it assumes in meeting the distinctive needs of diverse industries across this vast geographical expanse. Its widespread adoption in critical applications, such as automotive, construction, and electronics, attests to its instrumental contribution to the region's economic activities, reinforcing the Asia Pacific's position as the focal point for the burgeoning growth of the Acrylic Rubber market.

- The prominence of the Asia Pacific region in leading the Acrylic Rubber market reflects not only its current prevalence but also underscores its strategic significance in regional economic development. As industries in the Asia Pacific continue to evolve and expand, fueled by factors such as rapid industrialization and technological advancements, the demand for acrylic rubber is poised to witness sustained growth. This region's dominance signifies its crucial role as a major consumer and producer of acrylic rubber, solidifying its leading position in directing the growth dynamics of the Acrylic Rubber market within the global economic landscape.

Acrylic Rubber Market Top Key Players:

- Ames Rubber Manufacturing (U.S.)

- DuPont (U.S.)

- Elder Rubber Company (U.S.)

- Fostek Corporation Hi-Tech Polymers (U.S.)

- GBSA (U.S.)

- Hanna Rubber Company (U.S.)

- Jet Rubber Company (U.S.)

- Plexipave (U.S.)

- Rubber Mill (U.S.)

- CANADA SILICONE INC (Canada)

- Harboro Rubber (U.K.)

- ZORGE (Russia)

- Anabond Limited (India)

- APCOTEX Industries Ltd. (India)

- Hi-Tech Polymers (India)

- Kivi Markings (India)

- Sreeji Trading Company (India)

- Tiger Rubber Company (India)

- Changzhou Haiba (China)

- Chongqing Jianfeng (China)

- Suining Qinglong (China)

- Denka (Japan)

- NOK (Japan)

- Zeon (Japan), and Other Major Players.

|

Global Acrylic Rubber Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.31 Bn. |

|

Forecast Period 2025-35 CAGR: |

7.82 % |

Market Size in 2035: |

USD 3.1 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Fabrication Process |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Acrylic Rubber Market by Type (2018-2035)

4.1 Acrylic Rubber Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Butyl Acrylate (BA)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Ethoxy Ethyl Acrylate (EEA)

4.5 Methoxyethyl Acrylate (MEA)

4.6 Ethyl Acrylate (EA)

4.7 Epoxy Acrylate

Chapter 5: Acrylic Rubber Market by Fabrication Process (2018-2035)

5.1 Acrylic Rubber Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Compression Moulding

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Transfer Moulding

5.5 Injection Moulding

Chapter 6: Acrylic Rubber Market by Application (2018-2032)

6.1 Acrylic Rubber Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Textiles

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Seals & Gaskets

6.5 Adhesives

6.6 Engine Oils and Lubricants

6.7 Coating

6.8 Piping

Chapter 7: Acrylic Rubber Market by End-User (2018-2032)

7.1 Acrylic Rubber Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Automotive Industry

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Chemical Industry

7.5 Electrical & Electronics

7.6 Oil & Gas

7.7 Aerospace

7.8 Manufacturing

7.9 Marine Industry

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Acrylic Rubber Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 BASF SE (GERMANY)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 EVONIK INDUSTRIES (GERMANY)

8.4 LANXESS AKTIENGESELLSCHAFT (GERMANY)

8.5 PERSTORP AB (SWEDEN)

8.6 SOLVAY (BELGIUM)

8.7 FUSHUN TIANFU CHEMICALS CO. LTD. (CHINA)

8.8 HEFEI TNJ CHEMICAL INDUSTRY CO. LTD. (CHINA)

8.9 HENAN TIANFU CHEMICAL CO. LTD. CHINA)

8.10 LINSHUI NANMING CHEMICAL CO. LTD. (CHINA)

8.11 YUANLI SCIENCE AND TECHNOLOGY (CHINA)

8.12 ZHEJIANG LISHUI NANMING CHEMICAL CO. LTD. (CHINA)

8.13 ZHENGZHOU MEIYA CHEMICAL PRODUCTS CO. LTD. (CHINA)

8.14 SHANDONG YUANLI SCIENCE AND TECHNOLOGY CO. LTD. (CHINA)

8.15 MUBY CHEMICALS (INDIA)

8.16 NOVEL CHEM (INDIA)

8.17 PRASOL CHEMICALS PVT. LTD. (INDIA)

8.18 UBE CORPORATION (JAPAN)

8.19 LG CHEM (SOUTH KOREA)

8.20 AND OTHERS MAJOR PLAYERS.

Chapter 9: Global Acrylic Rubber Market By Region

9.1 Overview

9.2. North America Acrylic Rubber Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Butyl Acrylate (BA)

9.2.4.2 Ethoxy Ethyl Acrylate (EEA)

9.2.4.3 Methoxyethyl Acrylate (MEA)

9.2.4.4 Ethyl Acrylate (EA)

9.2.4.5 Epoxy Acrylate

9.2.5 Historic and Forecasted Market Size by Fabrication Process

9.2.5.1 Compression Moulding

9.2.5.2 Transfer Moulding

9.2.5.3 Injection Moulding

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Textiles

9.2.6.2 Seals & Gaskets

9.2.6.3 Adhesives

9.2.6.4 Engine Oils and Lubricants

9.2.6.5 Coating

9.2.6.6 Piping

9.2.7 Historic and Forecasted Market Size by End-User

9.2.7.1 Automotive Industry

9.2.7.2 Chemical Industry

9.2.7.3 Electrical & Electronics

9.2.7.4 Oil & Gas

9.2.7.5 Aerospace

9.2.7.6 Manufacturing

9.2.7.7 Marine Industry

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Acrylic Rubber Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Butyl Acrylate (BA)

9.3.4.2 Ethoxy Ethyl Acrylate (EEA)

9.3.4.3 Methoxyethyl Acrylate (MEA)

9.3.4.4 Ethyl Acrylate (EA)

9.3.4.5 Epoxy Acrylate

9.3.5 Historic and Forecasted Market Size by Fabrication Process

9.3.5.1 Compression Moulding

9.3.5.2 Transfer Moulding

9.3.5.3 Injection Moulding

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Textiles

9.3.6.2 Seals & Gaskets

9.3.6.3 Adhesives

9.3.6.4 Engine Oils and Lubricants

9.3.6.5 Coating

9.3.6.6 Piping

9.3.7 Historic and Forecasted Market Size by End-User

9.3.7.1 Automotive Industry

9.3.7.2 Chemical Industry

9.3.7.3 Electrical & Electronics

9.3.7.4 Oil & Gas

9.3.7.5 Aerospace

9.3.7.6 Manufacturing

9.3.7.7 Marine Industry

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Acrylic Rubber Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Butyl Acrylate (BA)

9.4.4.2 Ethoxy Ethyl Acrylate (EEA)

9.4.4.3 Methoxyethyl Acrylate (MEA)

9.4.4.4 Ethyl Acrylate (EA)

9.4.4.5 Epoxy Acrylate

9.4.5 Historic and Forecasted Market Size by Fabrication Process

9.4.5.1 Compression Moulding

9.4.5.2 Transfer Moulding

9.4.5.3 Injection Moulding

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Textiles

9.4.6.2 Seals & Gaskets

9.4.6.3 Adhesives

9.4.6.4 Engine Oils and Lubricants

9.4.6.5 Coating

9.4.6.6 Piping

9.4.7 Historic and Forecasted Market Size by End-User

9.4.7.1 Automotive Industry

9.4.7.2 Chemical Industry

9.4.7.3 Electrical & Electronics

9.4.7.4 Oil & Gas

9.4.7.5 Aerospace

9.4.7.6 Manufacturing

9.4.7.7 Marine Industry

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Acrylic Rubber Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Butyl Acrylate (BA)

9.5.4.2 Ethoxy Ethyl Acrylate (EEA)

9.5.4.3 Methoxyethyl Acrylate (MEA)

9.5.4.4 Ethyl Acrylate (EA)

9.5.4.5 Epoxy Acrylate

9.5.5 Historic and Forecasted Market Size by Fabrication Process

9.5.5.1 Compression Moulding

9.5.5.2 Transfer Moulding

9.5.5.3 Injection Moulding

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Textiles

9.5.6.2 Seals & Gaskets

9.5.6.3 Adhesives

9.5.6.4 Engine Oils and Lubricants

9.5.6.5 Coating

9.5.6.6 Piping

9.5.7 Historic and Forecasted Market Size by End-User

9.5.7.1 Automotive Industry

9.5.7.2 Chemical Industry

9.5.7.3 Electrical & Electronics

9.5.7.4 Oil & Gas

9.5.7.5 Aerospace

9.5.7.6 Manufacturing

9.5.7.7 Marine Industry

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Acrylic Rubber Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Butyl Acrylate (BA)

9.6.4.2 Ethoxy Ethyl Acrylate (EEA)

9.6.4.3 Methoxyethyl Acrylate (MEA)

9.6.4.4 Ethyl Acrylate (EA)

9.6.4.5 Epoxy Acrylate

9.6.5 Historic and Forecasted Market Size by Fabrication Process

9.6.5.1 Compression Moulding

9.6.5.2 Transfer Moulding

9.6.5.3 Injection Moulding

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Textiles

9.6.6.2 Seals & Gaskets

9.6.6.3 Adhesives

9.6.6.4 Engine Oils and Lubricants

9.6.6.5 Coating

9.6.6.6 Piping

9.6.7 Historic and Forecasted Market Size by End-User

9.6.7.1 Automotive Industry

9.6.7.2 Chemical Industry

9.6.7.3 Electrical & Electronics

9.6.7.4 Oil & Gas

9.6.7.5 Aerospace

9.6.7.6 Manufacturing

9.6.7.7 Marine Industry

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Acrylic Rubber Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Butyl Acrylate (BA)

9.7.4.2 Ethoxy Ethyl Acrylate (EEA)

9.7.4.3 Methoxyethyl Acrylate (MEA)

9.7.4.4 Ethyl Acrylate (EA)

9.7.4.5 Epoxy Acrylate

9.7.5 Historic and Forecasted Market Size by Fabrication Process

9.7.5.1 Compression Moulding

9.7.5.2 Transfer Moulding

9.7.5.3 Injection Moulding

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Textiles

9.7.6.2 Seals & Gaskets

9.7.6.3 Adhesives

9.7.6.4 Engine Oils and Lubricants

9.7.6.5 Coating

9.7.6.6 Piping

9.7.7 Historic and Forecasted Market Size by End-User

9.7.7.1 Automotive Industry

9.7.7.2 Chemical Industry

9.7.7.3 Electrical & Electronics

9.7.7.4 Oil & Gas

9.7.7.5 Aerospace

9.7.7.6 Manufacturing

9.7.7.7 Marine Industry

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Acrylic Rubber Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.31 Bn. |

|

Forecast Period 2025-35 CAGR: |

7.82 % |

Market Size in 2035: |

USD 3.1 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Fabrication Process |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||