Account Receivable Automation Market Synopsis

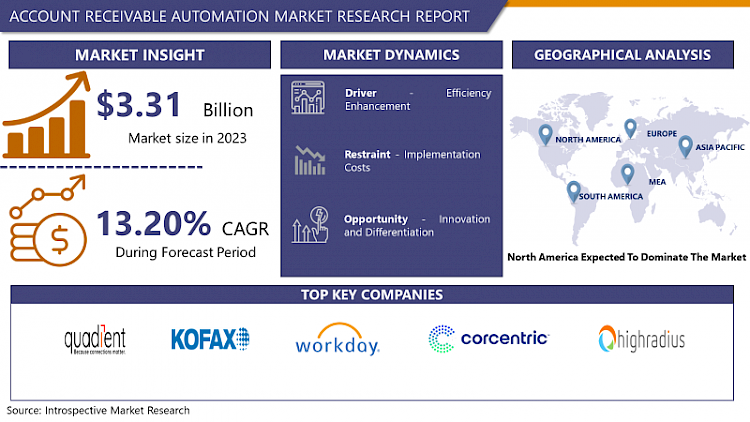

Account Receivable Automation Market Size Was Valued at USD 3313.82 Million in 2023, and is Projected to Reach USD 10114.54 Billion by 2032, Growing at a CAGR of 13.20% From 2024-2032.

The Account Receivable Automation Market refers to the segment of the financial technology industry dedicated to streamlining and optimizing the processes involved in managing and processing accounts receivable for businesses. It encompasses a range of software solutions and technologies designed to automate tasks such as invoice generation, payment processing, collections management, and reconciliation. By leveraging artificial intelligence, machine learning, and robotic process automation, companies aim to reduce manual effort, minimize errors, accelerate cash flows, and enhance overall efficiency in managing their receivables, thereby improving their financial health and operational performance.

- Account Receivable Automation market is in the course of extreme transition due to increased technological innovations and higher need for efficiency of financial solutions. Due to the growing concern for proper Account Receivables management, it has become important to incorporate automation solutions within businesses. This report analyses this market’s executive summary for the purpose of comprehending trends that influence the market’s growth.

- First, it is essential to highlight that there is an ever-increasing demand for cloud-based automations with open access to markets due to positive factors included in the plan with references to the overall flexibility and affordability for business. This is because cloud solutions allow users to gain instant access to their financial information and data which in return increases the rate of decision-making and other activities. Further, through deep incorporation of AI and ML, the receivables management is also under transition in organizations that such algorithms eliminates the need for repetitive tasks, enhances the accuracy of results and helps to identify the best possible strategies for collection of outstanding amounts.

- Also, increasing the level of regulation compliance and concerns related to data protection are causing companies to look out for reliable automation solutions that would guarantee compliance to these regulation measures as well as protection of financial data. Since companies are developing strategies to reduce exposure to risks imposed by frauds and cyber attacks, these companies are buying subsystems with a high level of encryption and authentication.

- In addition, there is a higher level of market emphasis on the comprehensive outbound and inbound receivables management systems that are aimed at providing the full spectrum of services, including invoicing, payments, collections, and information reporting. These systems make a smooth flow of actions for a user and avoid working and coordinating through different software applications and thus removing the costs of extra manual work.

- As a whole, the Account Receivable Automation market continues to be highly favorable for the aspect of solution because companies in all industries look for ways in improving their accounts receivables and subsequently, make improvements on their accounts receivables to cash conversion. However, the implementation hurdles that include, resistance to change as well as the need for expertise to drive and manage automation solutions serves as the major factors of consideration among the market stakeholders. When tackling these issues and leveraging on the opportunities identified, firms may enhance their prospects of continued success and resilience in the receiveables management business environment that is increasing in complexity and dynamics.

Account Receivable Automation Market Trend Analysis

Cloud-Based Solutions Transforming Account Receivable Automation

- Account Receivable Automation is a new concept that signifies a shift of businesses to the cloud for managing their crucial accounts receivable services and operations. The promise of scalability in many cloud-based platforms is one of the main reasons for this kind of pattern. Another compelling advantage of cloud solutions is their ability to scale up or scale down bearing in mind that cloud capacity can quickly be adjusted to meet demands of workload or higher number of transactions without necessarily meaning expensive infrastructure investments to be made. This aspect of scalability is of particular importance to organizations engaged in growth or features with fluctuations since they can easily scale up or down on AR automation resource depending on the business needs for maximum functionality and efficiency.

- The last advantage, which is also worth emphasizing is flexibility of cloud-based AR automation solutions. Some of the disadvantages that are inherent in the on-premise software model include; The program cannot be easily altered to meet other needs of the business or integrated easily with other programs in the business environment. On the other hand, cloud-based platforms tend to be more flexible for businesses to implement methodologies and solutions more flexibly without having them integrated into other business applications or enterprise systems, which can be a rigid concept. It makes organizations leverage opportunities to be more responsive to the changing consumers’ needs, tastes, and preferences and the emerging rules and regulations in the accounts receivable collection and management. In summary, the flexibility, cost control, and scalability of cloud-based AR automation solutions are its main advantages, which may be of interest to numerous organizations looking to enhance their operations’ efficiency in the highly competitive environment of the modern world.

The Impact of AI and ML Integration in Account Receivable Automation

- Artificial Intelligence (AI) and, to a greater extent, Machine Learning (ML) are transforming the Account Receivable Automation by providing abstract levels of reach, effectiveness, and visibility. AI and ML integrated selected automation platforms can provide inputs for rapid analysis of humongous amounts of data leaving no room for manual follow-through and can identify patterns and trends inherent and not easily discernible. Through PMML method, firms can detect payment problems before they transform into disorders, thereby allowing for intervention. Furthermore, these technologies facilitate improved accuracy with respect to forecasting of cash flows thereby providing businesses good insight on them and help the financial health in the business improve.

- In addition, AI and ML are instrumental in an organization’s ability to deliver individualized message delivery to its customers in a way that would help create loyal customers and properly manage its cash inflows. Automation platforms which are integrated with AI can cluster the customers, relying on their payment records, preferences, and behavior, which create a unique approach for interacting with such clients. Not only does this approach make it easier for companies to form more personal relationships with customers but it also has them make payments sooner. Further, AI-based chatbots and smart personal assistants help in engaging customers and respond in real-time to questions, complaints, and to some extent, even handle payments, making collections easier and contributing more effectively to developing a healthy collection on the accounts receivable side as well. In a nutshell, advanced integration of AI and ML technologies is the key that can change the Account Receivable Automation efficiently and bring more benefits for business sectors in terms of risk mitigation and growth.

Account Receivable Automation Market Segment Analysis:

Account Receivable Automation Market is Segmented based on Component, Deployment, By Organization Size and Vertical

By Component, Solutions (Credit Evaluation & Management) segment is expected to dominate the market during the forecast period

- Credit evaluation and management solutions dominate in the Banking and Financial Services sector due to the critical role these solutions play in assessing creditworthiness and managing credit risk. Banks and financial institutions deal with a high volume of credit transactions daily, including loans, credit cards, and other credit products. The need to thoroughly evaluate the creditworthiness of applicants is paramount to mitigate the risk of default and ensure the stability of financial portfolios. These institutions rely heavily on sophisticated credit evaluation tools that utilize advanced algorithms, comprehensive financial data, and predictive analytics to assess the risk profiles of potential borrowers accurately. This proactive approach to credit management not only helps in reducing bad debt but also enhances the institution's ability to offer competitive interest rates and terms, thereby attracting more customers.

- Furthermore, the regulatory landscape in the Banking and Financial Services sector imposes stringent requirements for risk management and reporting. Compliance with these regulations necessitates the use of robust credit evaluation and management systems that can generate detailed risk assessments and maintain accurate records of credit decisions. These systems are essential for meeting the compliance standards set by regulatory bodies such as the Basel Committee on Banking Supervision, which emphasizes the need for effective risk management practices. As a result, the demand for advanced credit evaluation and management solutions is particularly high in this sector, cementing its dominant share. Financial institutions continuously invest in these technologies to enhance their credit risk frameworks, improve decision-making processes, and ensure long-term financial health and regulatory compliance.

By Vertical, IT & Telecom segment held the largest share in 2023

- The IT & Telecom sector commands the largest share in advanced analytics and automation solutions due to the intricate and multifaceted nature of its billing cycles and the sheer volume of its customer base. Companies in this sector often offer a wide range of services, including voice, data, and various digital services, each with its own billing requirements and cycles. Managing such complexity manually is not feasible; hence, the adoption of advanced analytics becomes crucial. These analytics tools help telecom companies make sense of vast amounts of billing data, identifying trends, discrepancies, and opportunities for optimization. By leveraging predictive analytics, companies can forecast customer behaviors, anticipate billing issues, and streamline operations to ensure timely and accurate billing, thus enhancing overall customer satisfaction and reducing churn.

- Automation further solidifies its dominance in the IT & Telecom sector by enabling the efficient handling of repetitive and time-consuming tasks associated with billing and customer management. Automation tools facilitate processes such as invoice generation, payment processing, and account reconciliation, significantly reducing the margin for human error and speeding up the entire billing cycle. This is particularly important in a sector with a large and diverse customer base, where maintaining accuracy and efficiency is crucial for customer retention and regulatory compliance. Moreover, automation allows IT & Telecom companies to scale their operations seamlessly as they grow, ensuring that the billing infrastructure can handle increased demand without compromising on performance. The integration of advanced analytics and automation not only optimizes operational efficiency but also provides valuable insights that drive strategic decision-making, giving companies in this sector a competitive edge.

Account Receivable Automation Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America dominates the accounts receivable (AR) automation market, primarily due to the widespread adoption of advanced financial technologies and the presence of key market players such as Oracle, SAP, and Workday. The U.S. and Canada are at the forefront of this trend, with a significant number of enterprises across various sectors, including manufacturing, retail, healthcare, and finance, actively seeking to optimize their financial processes. These companies are increasingly turning to AR automation to streamline workflows, enhance accuracy, and reduce operational costs. The region's robust technological infrastructure and high internet penetration further facilitate the rapid implementation and integration of these advanced solutions, making North America a leader in AR automation.

- Moreover, the strong emphasis on compliance and regulatory requirements in the U.S. and Canada significantly propels the demand for AR automation solutions. Financial regulations such as the Sarbanes-Oxley Act in the U.S. and the Canadian Anti-Spam Legislation mandate stringent reporting and data accuracy standards, compelling businesses to adopt automation to ensure compliance. Automated AR solutions help organizations maintain transparency and accuracy in financial transactions, thereby reducing the risk of regulatory breaches and associated penalties. Additionally, the ongoing advancements in artificial intelligence and machine learning within the region are continuously enhancing the capabilities of AR automation tools, making them more efficient and reliable. This regulatory landscape, combined with technological innovation, underscores North America's leading position in the AR automation market.

Active Key Players in the Account Receivable Automation Market

- SK Global Software

- Quadient (YayPay Inc.)

- Kofax Inc.

- Workday, Inc.

- Corcentric LLC

- HighRadius Corporation

- Qvalia AB

- MHC Automation

- Bill.com Holdings Inc.

- Comarch SA

- Esker Inc.

- Sage

- SAP

- Oracle

- Bottomline Technologies

- Other Key Players

Key Industry Developments in the Account Receivable Automation Market:

- In December 2023, Paymerang launched its Receivables Automation product, enhancing its finance automation solutions. This new offering streamlines accounts receivable processes, providing real-time cash flow insights, increasing efficiency, and reducing errors. Integrated with Fiserv, it enables card payment acceptance and processing across the U.S. Paymerang CEO Nasser Chanda highlighted the product's role in driving financial efficiency for CFOs and finance teams.

- In June 2023, Oracle NetSuite launched NetSuite Account Reconciliation to automate and streamline balance sheet account reconciliation. Integrated into NetSuite’s cloud ERP suite, this solution leverages Oracle technology to enhance financial statement accuracy, bolster internal controls, and accelerate the financial close process.

|

Global Account Receivable Automation Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 3751.24 Mn. |

|

Forecast Period 2024-32 CAGR: |

13.20% |

Market Size in 2032: |

USD 10114.54 Mn. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment |

|

||

|

By Organization Size |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

SK Global Software, Quadient (YayPay Inc.), Kofax Inc., Workday, Inc., Corcentric LLC, HighRadius Corporation, Qvalia AB, MHC Automation, Bill.com Holdings Inc., Comarch SA, Esker Inc., Sage, SAP , Oracle , Bottomline Technologies and Other Major Players. |

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ACCOUNT RECEIVABLE AUTOMATION MARKET BY COMPONENT (2017-2032)

- ACCOUNT RECEIVABLE AUTOMATION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SOLUTIONS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SERVICES

- ACCOUNT RECEIVABLE AUTOMATION MARKET BY DEPLOYMENT (2017-2032)

- ACCOUNT RECEIVABLE AUTOMATION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CLOUD

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ON-PREMISES

- ACCOUNT RECEIVABLE AUTOMATION MARKET BY ORGANIZATION SIZE (2017-2032)

- ACCOUNT RECEIVABLE AUTOMATION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LARGE ENTERPRISES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SMALL & MEDIUM SIZED ENTERPRISES

- ACCOUNT RECEIVABLE AUTOMATION MARKET BY VERTICAL (2017-2032)

- ACCOUNT RECEIVABLE AUTOMATION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BANKING, FINANCIAL SERVICES & INSURANCE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- IT & TELECOM

- MANUFACTURING

- CONSUMER GOODS & RETAIL

- HEALTHCARE

- ENERGY & UTILITIES

- OTHER VERTICALS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Account Receivable Automation Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- SK GLOBAL SOFTWARE

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- QUADIENT (YAYPAY INC.)

- KOFAX INC.

- WORKDAY, INC.

- CORCENTRIC LLC

- HIGHRADIUS CORPORATION

- QVALIA AB

- MHC AUTOMATION

- BILL.COM HOLDINGS INC.

- COMARCH SA

- ESKER INC.

- SAGE

- SAP

- ORACLE

- BOTTOMLINE TECHNOLOGIES

- COMPETITIVE LANDSCAPE

- GLOBAL ACCOUNT RECEIVABLE AUTOMATION MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Deployment

- Historic And Forecasted Market Size By Organization Size

- Historic And Forecasted Market Size By Vertical

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Account Receivable Automation Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 3751.24 Mn. |

|

Forecast Period 2024-32 CAGR: |

13.20% |

Market Size in 2032: |

USD 10114.54 Mn. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment |

|

||

|

By Organization Size |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

SK Global Software, Quadient (YayPay Inc.), Kofax Inc., Workday, Inc., Corcentric LLC, HighRadius Corporation, Qvalia AB, MHC Automation, Bill.com Holdings Inc., Comarch SA, Esker Inc., Sage, SAP , Oracle , Bottomline Technologies and Other Major Players. |

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ACCOUNT RECEIVABLE AUTOMATION MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ACCOUNT RECEIVABLE AUTOMATION MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ACCOUNT RECEIVABLE AUTOMATION MARKET COMPETITIVE RIVALRY

TABLE 005. ACCOUNT RECEIVABLE AUTOMATION MARKET THREAT OF NEW ENTRANTS

TABLE 006. ACCOUNT RECEIVABLE AUTOMATION MARKET THREAT OF SUBSTITUTES

TABLE 007. ACCOUNT RECEIVABLE AUTOMATION MARKET BY TYPE

TABLE 008. SOLUTIONS AND SERVICES MARKET OVERVIEW (2016-2028)

TABLE 009. ACCOUNT RECEIVABLE AUTOMATION MARKET BY DEPLOYMENT MODEL

TABLE 010. ON-PREMISE MARKET OVERVIEW (2016-2028)

TABLE 011. CLOUD MARKET OVERVIEW (2016-2028)

TABLE 012. ACCOUNT RECEIVABLE AUTOMATION MARKET BY ORGANIZATION

TABLE 013. SMALL AND MEDIUM ENTERPRISES MARKET OVERVIEW (2016-2028)

TABLE 014. LARGE ENTERPRISES MARKET OVERVIEW (2016-2028)

TABLE 015. ACCOUNT RECEIVABLE AUTOMATION MARKET BY END-USER

TABLE 016. BFSI MARKET OVERVIEW (2016-2028)

TABLE 017. IT AND TELECOM MARKET OVERVIEW (2016-2028)

TABLE 018. MANUFACTURING MARKET OVERVIEW (2016-2028)

TABLE 019. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 020. TRANSPORTATION AND LOGISTICS MARKET OVERVIEW (2016-2028)

TABLE 021. OTHER END-USER INDUSTRIES MARKET OVERVIEW (2016-2028)

TABLE 022. NORTH AMERICA ACCOUNT RECEIVABLE AUTOMATION MARKET, BY TYPE (2016-2028)

TABLE 023. NORTH AMERICA ACCOUNT RECEIVABLE AUTOMATION MARKET, BY DEPLOYMENT MODEL (2016-2028)

TABLE 024. NORTH AMERICA ACCOUNT RECEIVABLE AUTOMATION MARKET, BY ORGANIZATION (2016-2028)

TABLE 025. NORTH AMERICA ACCOUNT RECEIVABLE AUTOMATION MARKET, BY END-USER (2016-2028)

TABLE 026. N ACCOUNT RECEIVABLE AUTOMATION MARKET, BY COUNTRY (2016-2028)

TABLE 027. EUROPE ACCOUNT RECEIVABLE AUTOMATION MARKET, BY TYPE (2016-2028)

TABLE 028. EUROPE ACCOUNT RECEIVABLE AUTOMATION MARKET, BY DEPLOYMENT MODEL (2016-2028)

TABLE 029. EUROPE ACCOUNT RECEIVABLE AUTOMATION MARKET, BY ORGANIZATION (2016-2028)

TABLE 030. EUROPE ACCOUNT RECEIVABLE AUTOMATION MARKET, BY END-USER (2016-2028)

TABLE 031. ACCOUNT RECEIVABLE AUTOMATION MARKET, BY COUNTRY (2016-2028)

TABLE 032. ASIA PACIFIC ACCOUNT RECEIVABLE AUTOMATION MARKET, BY TYPE (2016-2028)

TABLE 033. ASIA PACIFIC ACCOUNT RECEIVABLE AUTOMATION MARKET, BY DEPLOYMENT MODEL (2016-2028)

TABLE 034. ASIA PACIFIC ACCOUNT RECEIVABLE AUTOMATION MARKET, BY ORGANIZATION (2016-2028)

TABLE 035. ASIA PACIFIC ACCOUNT RECEIVABLE AUTOMATION MARKET, BY END-USER (2016-2028)

TABLE 036. ACCOUNT RECEIVABLE AUTOMATION MARKET, BY COUNTRY (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA ACCOUNT RECEIVABLE AUTOMATION MARKET, BY TYPE (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA ACCOUNT RECEIVABLE AUTOMATION MARKET, BY DEPLOYMENT MODEL (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA ACCOUNT RECEIVABLE AUTOMATION MARKET, BY ORGANIZATION (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA ACCOUNT RECEIVABLE AUTOMATION MARKET, BY END-USER (2016-2028)

TABLE 041. ACCOUNT RECEIVABLE AUTOMATION MARKET, BY COUNTRY (2016-2028)

TABLE 042. SOUTH AMERICA ACCOUNT RECEIVABLE AUTOMATION MARKET, BY TYPE (2016-2028)

TABLE 043. SOUTH AMERICA ACCOUNT RECEIVABLE AUTOMATION MARKET, BY DEPLOYMENT MODEL (2016-2028)

TABLE 044. SOUTH AMERICA ACCOUNT RECEIVABLE AUTOMATION MARKET, BY ORGANIZATION (2016-2028)

TABLE 045. SOUTH AMERICA ACCOUNT RECEIVABLE AUTOMATION MARKET, BY END-USER (2016-2028)

TABLE 046. ACCOUNT RECEIVABLE AUTOMATION MARKET, BY COUNTRY (2016-2028)

TABLE 047. SAGE: SNAPSHOT

TABLE 048. SAGE: BUSINESS PERFORMANCE

TABLE 049. SAGE: PRODUCT PORTFOLIO

TABLE 050. SAGE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. ORACLE CORPORATION: SNAPSHOT

TABLE 051. ORACLE CORPORATION: BUSINESS PERFORMANCE

TABLE 052. ORACLE CORPORATION: PRODUCT PORTFOLIO

TABLE 053. ORACLE CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. SAP SE: SNAPSHOT

TABLE 054. SAP SE: BUSINESS PERFORMANCE

TABLE 055. SAP SE: PRODUCT PORTFOLIO

TABLE 056. SAP SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. WORKDAY INC.: SNAPSHOT

TABLE 057. WORKDAY INC.: BUSINESS PERFORMANCE

TABLE 058. WORKDAY INC.: PRODUCT PORTFOLIO

TABLE 059. WORKDAY INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. COMARCH SA: SNAPSHOT

TABLE 060. COMARCH SA: BUSINESS PERFORMANCE

TABLE 061. COMARCH SA: PRODUCT PORTFOLIO

TABLE 062. COMARCH SA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. BOTTOMLINE TECHNOLOGIES: SNAPSHOT

TABLE 063. BOTTOMLINE TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 064. BOTTOMLINE TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 065. BOTTOMLINE TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. KOFAX INC.: SNAPSHOT

TABLE 066. KOFAX INC.: BUSINESS PERFORMANCE

TABLE 067. KOFAX INC.: PRODUCT PORTFOLIO

TABLE 068. KOFAX INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. VANGUARD SYSTEMS INC.: SNAPSHOT

TABLE 069. VANGUARD SYSTEMS INC.: BUSINESS PERFORMANCE

TABLE 070. VANGUARD SYSTEMS INC.: PRODUCT PORTFOLIO

TABLE 071. VANGUARD SYSTEMS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. YAYPAY INC.: SNAPSHOT

TABLE 072. YAYPAY INC.: BUSINESS PERFORMANCE

TABLE 073. YAYPAY INC.: PRODUCT PORTFOLIO

TABLE 074. YAYPAY INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. QVALIA AB: SNAPSHOT

TABLE 075. QVALIA AB: BUSINESS PERFORMANCE

TABLE 076. QVALIA AB: PRODUCT PORTFOLIO

TABLE 077. QVALIA AB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. AND OTHERS.: SNAPSHOT

TABLE 078. AND OTHERS.: BUSINESS PERFORMANCE

TABLE 079. AND OTHERS.: PRODUCT PORTFOLIO

TABLE 080. AND OTHERS.: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ACCOUNT RECEIVABLE AUTOMATION MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ACCOUNT RECEIVABLE AUTOMATION MARKET OVERVIEW BY TYPE

FIGURE 012. SOLUTIONS AND SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 013. ACCOUNT RECEIVABLE AUTOMATION MARKET OVERVIEW BY DEPLOYMENT MODEL

FIGURE 014. ON-PREMISE MARKET OVERVIEW (2016-2028)

FIGURE 015. CLOUD MARKET OVERVIEW (2016-2028)

FIGURE 016. ACCOUNT RECEIVABLE AUTOMATION MARKET OVERVIEW BY ORGANIZATION

FIGURE 017. SMALL AND MEDIUM ENTERPRISES MARKET OVERVIEW (2016-2028)

FIGURE 018. LARGE ENTERPRISES MARKET OVERVIEW (2016-2028)

FIGURE 019. ACCOUNT RECEIVABLE AUTOMATION MARKET OVERVIEW BY END-USER

FIGURE 020. BFSI MARKET OVERVIEW (2016-2028)

FIGURE 021. IT AND TELECOM MARKET OVERVIEW (2016-2028)

FIGURE 022. MANUFACTURING MARKET OVERVIEW (2016-2028)

FIGURE 023. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 024. TRANSPORTATION AND LOGISTICS MARKET OVERVIEW (2016-2028)

FIGURE 025. OTHER END-USER INDUSTRIES MARKET OVERVIEW (2016-2028)

FIGURE 026. NORTH AMERICA ACCOUNT RECEIVABLE AUTOMATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. EUROPE ACCOUNT RECEIVABLE AUTOMATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. ASIA PACIFIC ACCOUNT RECEIVABLE AUTOMATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. MIDDLE EAST & AFRICA ACCOUNT RECEIVABLE AUTOMATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. SOUTH AMERICA ACCOUNT RECEIVABLE AUTOMATION MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Account Receivable Automation Market research report is 2024-2032.

SK Global Software, Quadient (YayPay Inc.), Kofax Inc., Workday, Inc., Corcentric LLC, HighRadius Corporation, Qvalia AB, MHC Automation, Bill.com Holdings Inc., Comarch SA, Esker Inc., Sage, SAP , Oracle , Bottomline Technologies and Other Major Players.

The Account Receivable Automation Market is segmented into By Component, By Deployment, By Organization Size, By Vertical and region.By Component, the market is categorized into Solutions(Credit Evaluation & Management, Bill Presentment & Payment, Dispute Management, Collections Management, Deductions Management, Cash Application Automation, Receivables Analytics) and Services(Managed Services, Professional Services, Implementation & Integration, Consulting Support and Maintenance ). By Deployment, the market is categorized into Cloud and On-premises. By Organization Size the market is categorized into Large Enterprises and Small & Medium Sized Enterprises. By Vertical Size the market is categorized into (Banking, Financial Services & Insurance, IT & Telecom, Manufacturing, Consumer Goods & Retail, Healthcare, Energy & Utilities and Other Verticals. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Account Receivable Automation Market refers to the segment of the financial technology industry dedicated to streamlining and optimizing the processes involved in managing and processing accounts receivable for businesses. It encompasses a range of software solutions and technologies designed to automate tasks such as invoice generation, payment processing, collections management, and reconciliation. By leveraging artificial intelligence, machine learning, and robotic process automation, companies aim to reduce manual effort, minimize errors, accelerate cash flows, and enhance overall efficiency in managing their receivables, thereby improving their financial health and operational performance

Account Receivable Automation Market Size Was Valued at USD 3313.82 Billion in 2023, and is Projected to Reach USD 10114.54 Billion by 2032, Growing at a CAGR of 13.20% From 2024-2032.