AC Drives Market Synopsis

The global AC Drives Market size was valued at USD 24.22 Billion in 2023 and is projected to reach USD 49.23 Billion by 2032, growing at a CAGR of 8.2% from 2024 to 2032.

An AC drive is a device used to control the speed of an electrical motor to enhance process control. Reduce energy usage and generate energy efficiently. Decrease mechanical stress on motor control applications. Optimize the operation of various applications relying on electric motors.

- AC drives, also known as variable frequency drives (VFDs) or inverters, are electronic devices used to control the speed and torque of an alternating current (AC) electric motor. They accomplish this by varying the frequency and voltage supplied to the motor. AC drives are essential in a wide range of industries and applications where precise control of motor speed is required.

- AC drives convert the incoming AC voltage (typically at a fixed frequency of 50 or 60 Hz) into a variable frequency and voltage output. By adjusting the frequency and voltage, the drive can control the motor's speed, allowing for precise regulation of processes.

- AC drives enable soft-start and soft-stop capabilities, reducing mechanical stress during motor start-up and shutdown. This feature prolongs the lifespan of motors and other connected equipment and contributes to energy savings by preventing abrupt, energy-intensive starts.

The AC Drives Market Trend Analysis

Increasing Rate of Industrialization and Urbanization to Fuel the Market

- Substantial increases in urbanization along with the growing rate of industrialization are the major factors driving the AC market growth. Urbanization would increase consumer demand, which results in to increase in the manufacturing sector, propelling the demand for AC drives during the forecast period.

- For instance, as per the Central Intelligence Agency, China, India, Malaysia, and Vietnam have an urban population of 60.3%, 34.5%, 76.6%, and 36.6% as of 2020 which is increasing at a rate of 2.4%, 2.4%, 2.1%, and 3% respectively. According to the World Investment Report, Governments are parallelly focusing on improvising the industrial policies and regulations to bring a conducive environment for exploring new industries and improve the sustainability amongst competitors such as strategic investment policy priorities, entry and establishment of foreign investors, and promotion and facilitation of investment policies. Hence, significant industrialization growth helps the market to grow at a faster pace. Rising urbanization and increasing rate of industrialization act as potential drivers for the AC drive market during the forecast period.

- Favourable government regulations and supportive policies enhance the growth of the manufacturing industry, which helps to boost the AC drives market. For instance, the implementation of standards such as ISO 50001 (energy- management-system standard) in the building & automation sector has the potential to accelerate the integration of building automation systems.

Increasing Trends for Industrial Automation

- Industrial automation systems aim to improve efficiency, reduce downtime, and enhance productivity. AC drives play a crucial role by providing precise control over motor speeds. This level of control allows machines and processes to operate at optimal speeds, leading to energy savings and increased efficiency.

- Energy efficiency is a top priority in industrial settings. AC drives allow motors to operate at variable speeds, which means they can run at lower speeds when full power is not required. This not only reduces energy consumption but also extends the lifespan of motors and reduces maintenance costs. As energy costs continue to rise, industries seek ways to reduce their power usage, making AC drives a valuable solution.

- Many industrial processes require precise control of motor speeds and torque to maintain quality and consistency. AC drives enable fine-tuned control, which is essential in industries such as chemical manufacturing, food processing, and pharmaceuticals. The demand for such control is a driving force behind the adoption of AC drives.

- The concept of Industry 4.0, which focuses on smart, connected manufacturing, relies on automation and data exchange. AC drives are an integral part of this transformation as they can be integrated with sensors and data analytics to enable predictive maintenance and real-time adjustments. This leads to reduced downtime and improved overall equipment effectiveness (OEE).

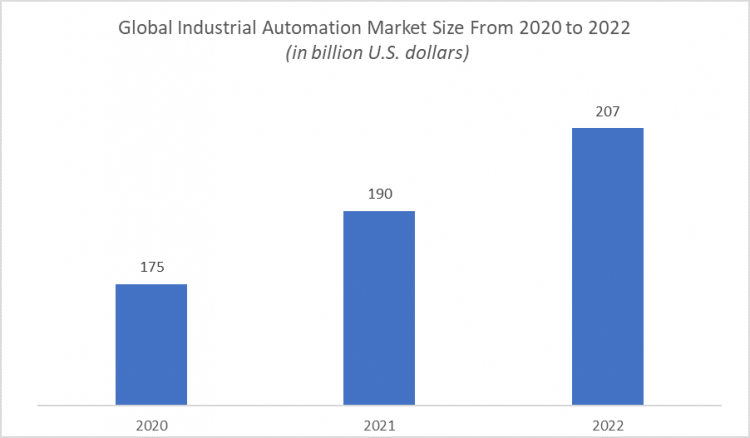

- As per Statista, the above graph shows the growth of the size of the global industrial automation market during 2020-2022. The global industrial automation market size was valued at USD 175 billion in 2020. The market is expected to grow at a compound annual growth rate (CAGR) of around 9% during the forecast period.

Segmentation Analysis of The AC Drives Market

The AC Drives market segments cover Voltage, Power Voltage, Application, and End User. By Power Voltage, the Low Power segment is Anticipated to Dominate the Market Over the Forecast period.

- Low-power drives are predominantly used for various applications such as fans, pumps, cranes, fluid machines, machine tools, printing machines, metal processing machines, food processing machines, and health & medical care instruments, among others. Due to the wide scope of application in vertical industries, the low-power drive segment is expected to dominate the market during the forecast period.

- Major players in the industry are projecting the demand for AC drive based on application and technological scenarios which helps to meet consumer demand. The key players offering the low-power drive are Siemens, TMEIC, Fuji Electric, Nidec Industrial Solutions, and other players.

- Low-power AC drives are generally more affordable than their medium-voltage counterparts. This affordability makes them an attractive option for businesses and industries looking to implement motor control solutions within budget constraints.

- There is a growing emphasis on energy efficiency across industries. Low-power AC drives are effective in improving energy efficiency for small and medium-sized motors. Many commercial and industrial facilities seek to reduce their energy consumption, which drives the demand for low-power AC Drivers.

Regional Analysis of The AC Drives Market

Asia Pacific is Expected to Dominate the Market Over the Forecast Period.

- APAC is home to the world's largest and fastest-growing industrial economies, including China and India. These countries have experienced significant industrialization and manufacturing expansion in recent decades. The demand for AC drives in various industries, such as automotive, electronics, chemicals, and textiles, has surged as a result.

- The countries in Asia Pacific have been investing heavily in infrastructure development, including transportation, energy, and construction projects. AC drives are widely used in infrastructure applications, such as elevators, escalators, pumps, and ventilation systems. The rapid urbanization in the region has driven the need for motor control solutions, contributing to the dominance of the AC drives market.

- The adoption of industrial automation and Industry 4.0 principles is on the rise in APAC. As industries seek to improve efficiency, productivity, and quality, they turn to AC drives for precise motor control. The automotive, electronics, and food processing industries, among others, heavily rely on automation systems that incorporate AC drives.

- APAC has become a global product manufacturing hub, including consumer electronics, automobiles, and machinery. These manufacturing facilities require AC drives to control motors in production lines and ensure consistent product quality.

COVID-19 Impact Analysis on AC Drives Market

The COVID-19 pandemic had a significant impact on the AC drives market. The pandemic disrupted global supply chains, leading to delays in producing and delivering AC drive components and equipment. Manufacturers faced challenges in sourcing raw materials and components, which affected their ability to meet demand. Many industries and businesses postponed or canceled capital expenditure projects during the pandemic due to economic uncertainty. This affected the demand for AC drives, particularly in the construction, manufacturing, and infrastructure development sectors. Various industries, including automotive manufacturing and some construction projects, temporarily shut down operations in response to lockdowns and social distancing measures. This led to reduced demand for AC drives during the shutdown periods.

Top Key Players Covered AC Drives Market

- Rockwell Automation, Inc. (USA)

- Emerson Electric Co. (USA)

- Parker Hannifin Corporation (USA)

- TMEIC Corporation (USA)

- ABB (Switzerland)

- Siemens AG (Germany)

- Invertek Drives Ltd. (United Kingdom)

- Control Techniques (Nidec Corporation) (United Kingdom)

- Lenze SE (Germany)

- Schneider Electric SE (France)

- Bonfiglioli Riduttori S.p.A. (Italy)

- Danfoss Group (Denmark)

- Mitsubishi Electric Corporation (Japan)

- Eaton Corporation plc (Ireland)

- Yaskawa Electric Corporation (Japan)

- Fuji Electric Co., Ltd. (Japan)

- Hitachi, Ltd. (Japan)

- Nidec Corporation (Japan)

- Toshiba Corporation (Japan)

- Delta Electronics, Inc. (Taiwan)

- Vacon (Nidec Corporation) (Finland)

- Hiconics Drive Technology Co., Ltd. (China)

- Hyosung Heavy Industries Corporation (South Korea)

- LS Electric (South Korea)

- WEG S.A. (Brazil)

Key Industry Developments in the AC Drives Market

In May 2023, ABB announced the opening of its manufacturing plant in Peenya, located in Bengaluru, India which will produce a new line of variable frequency drives. This factory will produce and offer drives ranging from 75 kW to 250 kW along with will catering to the major industrial segments. The expansion will strengthen the company's domestic supplier eco-system for low voltage AC drives product portfolio and enhance its market position across the AC drives industry.

In May 2023, Emotron Drives Power Control LLC, part of CG Drives & Automation inaugurated a new manufacturing facility in UAE. This state-of-the-art production plant will manufacture AC drives and will further enable shorter delivery times of high-powered variable frequency drives. This expansion will expand the company's market presence across the region and is set to enhance its position across the AC dives industry.

|

Global AC Drives Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 24.22 Bn. |

|

CAGR: |

8.2 % |

Market Size in 2032: |

USD 49.23 Bn. |

|

Segments Covered: |

By Voltage |

|

|

|

By Power Voltage |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Power Rating

3.2 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: AC Drives Market by Power Rating

5.1 AC Drives Market Overview Snapshot and Growth Engine

5.2 AC Drives Market Overview

5.3 Low Power Drives

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Low Power Drives: Geographic Segmentation

5.4 Medium Power Drives

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Medium Power Drives: Geographic Segmentation

5.5 High Power Drives

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 High Power Drives: Geographic Segmentation

Chapter 6: AC Drives Market by Application

6.1 AC Drives Market Overview Snapshot and Growth Engine

6.2 AC Drives Market Overview

6.3 Pumps

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Pumps: Geographic Segmentation

6.4 Fans

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Fans: Geographic Segmentation

6.5 Compressors

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Compressors: Geographic Segmentation

6.6 Other

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Other: Geographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 AC Drives Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 AC Drives Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 AC Drives Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 ABB LTD. (SWITZERLAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 DANFOSS GROUP (DENMARK)

7.4 MITSUBISHI ELECTRICAL CO. (JAPAN)

7.5 SCHNEIDER ELECTRIC CO. (FRANCE)

7.6 SIEMENS AG FUJI ELECTRIC CO. LTD. (JAPAN)

7.7 EMERSON ELECTRIC CO. (UNITED STATES)

7.8 HICONICS DRIVE TECHNOLOGY CO. LTD. (CHINA)

7.9 HITACHI LTD. (JAPAN)

7.10 PARKER HANNIFIN CO. (INDIA)

7.11 ROCKWELL AUTOMATION INC. (UNITED STATES)

7.12 OTHER MAJOR PLAYERS

Chapter 8: Global AC Drives Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Power Rating

8.2.1 Low Power Drives

8.2.2 Medium Power Drives

8.2.3 High Power Drives

8.3 Historic and Forecasted Market Size By Application

8.3.1 Pumps

8.3.2 Fans

8.3.3 Compressors

8.3.4 Other

Chapter 9: North America AC Drives Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Power Rating

9.4.1 Low Power Drives

9.4.2 Medium Power Drives

9.4.3 High Power Drives

9.5 Historic and Forecasted Market Size By Application

9.5.1 Pumps

9.5.2 Fans

9.5.3 Compressors

9.5.4 Other

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe AC Drives Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Power Rating

10.4.1 Low Power Drives

10.4.2 Medium Power Drives

10.4.3 High Power Drives

10.5 Historic and Forecasted Market Size By Application

10.5.1 Pumps

10.5.2 Fans

10.5.3 Compressors

10.5.4 Other

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific AC Drives Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Power Rating

11.4.1 Low Power Drives

11.4.2 Medium Power Drives

11.4.3 High Power Drives

11.5 Historic and Forecasted Market Size By Application

11.5.1 Pumps

11.5.2 Fans

11.5.3 Compressors

11.5.4 Other

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa AC Drives Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Power Rating

12.4.1 Low Power Drives

12.4.2 Medium Power Drives

12.4.3 High Power Drives

12.5 Historic and Forecasted Market Size By Application

12.5.1 Pumps

12.5.2 Fans

12.5.3 Compressors

12.5.4 Other

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America AC Drives Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Power Rating

13.4.1 Low Power Drives

13.4.2 Medium Power Drives

13.4.3 High Power Drives

13.5 Historic and Forecasted Market Size By Application

13.5.1 Pumps

13.5.2 Fans

13.5.3 Compressors

13.5.4 Other

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global AC Drives Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 24.22 Bn. |

|

CAGR: |

8.2 % |

Market Size in 2032: |

USD 49.23 Bn. |

|

Segments Covered: |

By Voltage |

|

|

|

By Power Voltage |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. AC DRIVES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. AC DRIVES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. AC DRIVES MARKET COMPETITIVE RIVALRY

TABLE 005. AC DRIVES MARKET THREAT OF NEW ENTRANTS

TABLE 006. AC DRIVES MARKET THREAT OF SUBSTITUTES

TABLE 007. AC DRIVES MARKET BY VOLTAGE

TABLE 008. LOW VOLTAGE MARKET OVERVIEW (2016-2030)

TABLE 009. MEDIUM VOLTAGE MARKET OVERVIEW (2016-2030)

TABLE 010. HIGH VOLTAGE MARKET OVERVIEW (2016-2030)

TABLE 011. AC DRIVES MARKET BY POWER VOLTAGE

TABLE 012. LOW POWER MARKET OVERVIEW (2016-2030)

TABLE 013. MEDIUM POWER MARKET OVERVIEW (2016-2030)

TABLE 014. HIGH POWER MARKET OVERVIEW (2016-2030)

TABLE 015. AC DRIVES MARKET BY APPLICATION

TABLE 016. PUMP MARKET OVERVIEW (2016-2030)

TABLE 017. FAN MARKET OVERVIEW (2016-2030)

TABLE 018. CONVEYOR MARKET OVERVIEW (2016-2030)

TABLE 019. COMPRESSOR MARKET OVERVIEW (2016-2030)

TABLE 020. EXTRUDERS MARKET OVERVIEW (2016-2030)

TABLE 021. AC DRIVES MARKET BY END-USE

TABLE 022. OIL & GAS MARKET OVERVIEW (2016-2030)

TABLE 023. POWER GENERATION MARKET OVERVIEW (2016-2030)

TABLE 024. FOOD AND BEVERAGES MARKET OVERVIEW (2016-2030)

TABLE 025. BUILDING AUTOMATION MARKET OVERVIEW (2016-2030)

TABLE 026. MINING & METALS MARKET OVERVIEW (2016-2030)

TABLE 027. OTHER INDUSTRIES MARKET OVERVIEW (2016-2030)

TABLE 028. NORTH AMERICA AC DRIVES MARKET, BY VOLTAGE (2016-2030)

TABLE 029. NORTH AMERICA AC DRIVES MARKET, BY POWER VOLTAGE (2016-2030)

TABLE 030. NORTH AMERICA AC DRIVES MARKET, BY APPLICATION (2016-2030)

TABLE 031. NORTH AMERICA AC DRIVES MARKET, BY END-USE (2016-2030)

TABLE 032. N AC DRIVES MARKET, BY COUNTRY (2016-2030)

TABLE 033. EASTERN EUROPE AC DRIVES MARKET, BY VOLTAGE (2016-2030)

TABLE 034. EASTERN EUROPE AC DRIVES MARKET, BY POWER VOLTAGE (2016-2030)

TABLE 035. EASTERN EUROPE AC DRIVES MARKET, BY APPLICATION (2016-2030)

TABLE 036. EASTERN EUROPE AC DRIVES MARKET, BY END-USE (2016-2030)

TABLE 037. AC DRIVES MARKET, BY COUNTRY (2016-2030)

TABLE 038. WESTERN EUROPE AC DRIVES MARKET, BY VOLTAGE (2016-2030)

TABLE 039. WESTERN EUROPE AC DRIVES MARKET, BY POWER VOLTAGE (2016-2030)

TABLE 040. WESTERN EUROPE AC DRIVES MARKET, BY APPLICATION (2016-2030)

TABLE 041. WESTERN EUROPE AC DRIVES MARKET, BY END-USE (2016-2030)

TABLE 042. AC DRIVES MARKET, BY COUNTRY (2016-2030)

TABLE 043. ASIA PACIFIC AC DRIVES MARKET, BY VOLTAGE (2016-2030)

TABLE 044. ASIA PACIFIC AC DRIVES MARKET, BY POWER VOLTAGE (2016-2030)

TABLE 045. ASIA PACIFIC AC DRIVES MARKET, BY APPLICATION (2016-2030)

TABLE 046. ASIA PACIFIC AC DRIVES MARKET, BY END-USE (2016-2030)

TABLE 047. AC DRIVES MARKET, BY COUNTRY (2016-2030)

TABLE 048. MIDDLE EAST & AFRICA AC DRIVES MARKET, BY VOLTAGE (2016-2030)

TABLE 049. MIDDLE EAST & AFRICA AC DRIVES MARKET, BY POWER VOLTAGE (2016-2030)

TABLE 050. MIDDLE EAST & AFRICA AC DRIVES MARKET, BY APPLICATION (2016-2030)

TABLE 051. MIDDLE EAST & AFRICA AC DRIVES MARKET, BY END-USE (2016-2030)

TABLE 052. AC DRIVES MARKET, BY COUNTRY (2016-2030)

TABLE 053. SOUTH AMERICA AC DRIVES MARKET, BY VOLTAGE (2016-2030)

TABLE 054. SOUTH AMERICA AC DRIVES MARKET, BY POWER VOLTAGE (2016-2030)

TABLE 055. SOUTH AMERICA AC DRIVES MARKET, BY APPLICATION (2016-2030)

TABLE 056. SOUTH AMERICA AC DRIVES MARKET, BY END-USE (2016-2030)

TABLE 057. AC DRIVES MARKET, BY COUNTRY (2016-2030)

TABLE 058. ROCKWELL AUTOMATION INC. (USA): SNAPSHOT

TABLE 059. ROCKWELL AUTOMATION INC. (USA): BUSINESS PERFORMANCE

TABLE 060. ROCKWELL AUTOMATION INC. (USA): PRODUCT PORTFOLIO

TABLE 061. ROCKWELL AUTOMATION INC. (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. EMERSON ELECTRIC CO. (USA): SNAPSHOT

TABLE 062. EMERSON ELECTRIC CO. (USA): BUSINESS PERFORMANCE

TABLE 063. EMERSON ELECTRIC CO. (USA): PRODUCT PORTFOLIO

TABLE 064. EMERSON ELECTRIC CO. (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. PARKER HANNIFIN CORPORATION (USA): SNAPSHOT

TABLE 065. PARKER HANNIFIN CORPORATION (USA): BUSINESS PERFORMANCE

TABLE 066. PARKER HANNIFIN CORPORATION (USA): PRODUCT PORTFOLIO

TABLE 067. PARKER HANNIFIN CORPORATION (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. TMEIC CORPORATION (USA) ABB (SWITZERLAND): SNAPSHOT

TABLE 068. TMEIC CORPORATION (USA) ABB (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 069. TMEIC CORPORATION (USA) ABB (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 070. TMEIC CORPORATION (USA) ABB (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. SIEMENS AG (GERMANY): SNAPSHOT

TABLE 071. SIEMENS AG (GERMANY): BUSINESS PERFORMANCE

TABLE 072. SIEMENS AG (GERMANY): PRODUCT PORTFOLIO

TABLE 073. SIEMENS AG (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. INVERTEK DRIVES LTD. (UNITED KINGDOM): SNAPSHOT

TABLE 074. INVERTEK DRIVES LTD. (UNITED KINGDOM): BUSINESS PERFORMANCE

TABLE 075. INVERTEK DRIVES LTD. (UNITED KINGDOM): PRODUCT PORTFOLIO

TABLE 076. INVERTEK DRIVES LTD. (UNITED KINGDOM): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. CONTROL TECHNIQUES (UNITED KINGDOM): SNAPSHOT

TABLE 077. CONTROL TECHNIQUES (UNITED KINGDOM): BUSINESS PERFORMANCE

TABLE 078. CONTROL TECHNIQUES (UNITED KINGDOM): PRODUCT PORTFOLIO

TABLE 079. CONTROL TECHNIQUES (UNITED KINGDOM): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. LENZE SE (GERMANY): SNAPSHOT

TABLE 080. LENZE SE (GERMANY): BUSINESS PERFORMANCE

TABLE 081. LENZE SE (GERMANY): PRODUCT PORTFOLIO

TABLE 082. LENZE SE (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. SCHNEIDER ELECTRIC SE (FRANCE): SNAPSHOT

TABLE 083. SCHNEIDER ELECTRIC SE (FRANCE): BUSINESS PERFORMANCE

TABLE 084. SCHNEIDER ELECTRIC SE (FRANCE): PRODUCT PORTFOLIO

TABLE 085. SCHNEIDER ELECTRIC SE (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. BONFIGLIOLI RIDUTTORI S.P.A. (ITALY): SNAPSHOT

TABLE 086. BONFIGLIOLI RIDUTTORI S.P.A. (ITALY): BUSINESS PERFORMANCE

TABLE 087. BONFIGLIOLI RIDUTTORI S.P.A. (ITALY): PRODUCT PORTFOLIO

TABLE 088. BONFIGLIOLI RIDUTTORI S.P.A. (ITALY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. DANFOSS GROUP (DENMARK): SNAPSHOT

TABLE 089. DANFOSS GROUP (DENMARK): BUSINESS PERFORMANCE

TABLE 090. DANFOSS GROUP (DENMARK): PRODUCT PORTFOLIO

TABLE 091. DANFOSS GROUP (DENMARK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. MITSUBISHI ELECTRIC CORPORATION (JAPAN): SNAPSHOT

TABLE 092. MITSUBISHI ELECTRIC CORPORATION (JAPAN): BUSINESS PERFORMANCE

TABLE 093. MITSUBISHI ELECTRIC CORPORATION (JAPAN): PRODUCT PORTFOLIO

TABLE 094. MITSUBISHI ELECTRIC CORPORATION (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. EATON CORPORATION PLC (IRELAND): SNAPSHOT

TABLE 095. EATON CORPORATION PLC (IRELAND): BUSINESS PERFORMANCE

TABLE 096. EATON CORPORATION PLC (IRELAND): PRODUCT PORTFOLIO

TABLE 097. EATON CORPORATION PLC (IRELAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. YASKAWA ELECTRIC CORPORATION (JAPAN): SNAPSHOT

TABLE 098. YASKAWA ELECTRIC CORPORATION (JAPAN): BUSINESS PERFORMANCE

TABLE 099. YASKAWA ELECTRIC CORPORATION (JAPAN): PRODUCT PORTFOLIO

TABLE 100. YASKAWA ELECTRIC CORPORATION (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 100. FUJI ELECTRIC CO.: SNAPSHOT

TABLE 101. FUJI ELECTRIC CO.: BUSINESS PERFORMANCE

TABLE 102. FUJI ELECTRIC CO.: PRODUCT PORTFOLIO

TABLE 103. FUJI ELECTRIC CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 103. LTD. (JAPAN): SNAPSHOT

TABLE 104. LTD. (JAPAN): BUSINESS PERFORMANCE

TABLE 105. LTD. (JAPAN): PRODUCT PORTFOLIO

TABLE 106. LTD. (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 106. HITACHI: SNAPSHOT

TABLE 107. HITACHI: BUSINESS PERFORMANCE

TABLE 108. HITACHI: PRODUCT PORTFOLIO

TABLE 109. HITACHI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 109. LTD. (JAPAN): SNAPSHOT

TABLE 110. LTD. (JAPAN): BUSINESS PERFORMANCE

TABLE 111. LTD. (JAPAN): PRODUCT PORTFOLIO

TABLE 112. LTD. (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 112. NIDEC CORPORATION (JAPAN): SNAPSHOT

TABLE 113. NIDEC CORPORATION (JAPAN): BUSINESS PERFORMANCE

TABLE 114. NIDEC CORPORATION (JAPAN): PRODUCT PORTFOLIO

TABLE 115. NIDEC CORPORATION (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 115. TOSHIBA CORPORATION (JAPAN): SNAPSHOT

TABLE 116. TOSHIBA CORPORATION (JAPAN): BUSINESS PERFORMANCE

TABLE 117. TOSHIBA CORPORATION (JAPAN): PRODUCT PORTFOLIO

TABLE 118. TOSHIBA CORPORATION (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 118. DELTA ELECTRONICS: SNAPSHOT

TABLE 119. DELTA ELECTRONICS: BUSINESS PERFORMANCE

TABLE 120. DELTA ELECTRONICS: PRODUCT PORTFOLIO

TABLE 121. DELTA ELECTRONICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 121. INC. (TAIWAN): SNAPSHOT

TABLE 122. INC. (TAIWAN): BUSINESS PERFORMANCE

TABLE 123. INC. (TAIWAN): PRODUCT PORTFOLIO

TABLE 124. INC. (TAIWAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 124. VACON (NIDEC CORPORATION) (FINLAND): SNAPSHOT

TABLE 125. VACON (NIDEC CORPORATION) (FINLAND): BUSINESS PERFORMANCE

TABLE 126. VACON (NIDEC CORPORATION) (FINLAND): PRODUCT PORTFOLIO

TABLE 127. VACON (NIDEC CORPORATION) (FINLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 127. HICONICS DRIVE TECHNOLOGY CO.: SNAPSHOT

TABLE 128. HICONICS DRIVE TECHNOLOGY CO.: BUSINESS PERFORMANCE

TABLE 129. HICONICS DRIVE TECHNOLOGY CO.: PRODUCT PORTFOLIO

TABLE 130. HICONICS DRIVE TECHNOLOGY CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 130. LTD. (CHINA): SNAPSHOT

TABLE 131. LTD. (CHINA): BUSINESS PERFORMANCE

TABLE 132. LTD. (CHINA): PRODUCT PORTFOLIO

TABLE 133. LTD. (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 133. HYOSUNG HEAVY INDUSTRIES CORPORATION (SOUTH KOREA): SNAPSHOT

TABLE 134. HYOSUNG HEAVY INDUSTRIES CORPORATION (SOUTH KOREA): BUSINESS PERFORMANCE

TABLE 135. HYOSUNG HEAVY INDUSTRIES CORPORATION (SOUTH KOREA): PRODUCT PORTFOLIO

TABLE 136. HYOSUNG HEAVY INDUSTRIES CORPORATION (SOUTH KOREA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 136. LS ELECTRIC (SOUTH KOREA): SNAPSHOT

TABLE 137. LS ELECTRIC (SOUTH KOREA): BUSINESS PERFORMANCE

TABLE 138. LS ELECTRIC (SOUTH KOREA): PRODUCT PORTFOLIO

TABLE 139. LS ELECTRIC (SOUTH KOREA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 139. WEG S.A. (BRAZIL): SNAPSHOT

TABLE 140. WEG S.A. (BRAZIL): BUSINESS PERFORMANCE

TABLE 141. WEG S.A. (BRAZIL): PRODUCT PORTFOLIO

TABLE 142. WEG S.A. (BRAZIL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 142. AND OTHER MAJOR PLAYER.: SNAPSHOT

TABLE 143. AND OTHER MAJOR PLAYER.: BUSINESS PERFORMANCE

TABLE 144. AND OTHER MAJOR PLAYER.: PRODUCT PORTFOLIO

TABLE 145. AND OTHER MAJOR PLAYER.: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. AC DRIVES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. AC DRIVES MARKET OVERVIEW BY VOLTAGE

FIGURE 012. LOW VOLTAGE MARKET OVERVIEW (2016-2030)

FIGURE 013. MEDIUM VOLTAGE MARKET OVERVIEW (2016-2030)

FIGURE 014. HIGH VOLTAGE MARKET OVERVIEW (2016-2030)

FIGURE 015. AC DRIVES MARKET OVERVIEW BY POWER VOLTAGE

FIGURE 016. LOW POWER MARKET OVERVIEW (2016-2030)

FIGURE 017. MEDIUM POWER MARKET OVERVIEW (2016-2030)

FIGURE 018. HIGH POWER MARKET OVERVIEW (2016-2030)

FIGURE 019. AC DRIVES MARKET OVERVIEW BY APPLICATION

FIGURE 020. PUMP MARKET OVERVIEW (2016-2030)

FIGURE 021. FAN MARKET OVERVIEW (2016-2030)

FIGURE 022. CONVEYOR MARKET OVERVIEW (2016-2030)

FIGURE 023. COMPRESSOR MARKET OVERVIEW (2016-2030)

FIGURE 024. EXTRUDERS MARKET OVERVIEW (2016-2030)

FIGURE 025. AC DRIVES MARKET OVERVIEW BY END-USE

FIGURE 026. OIL & GAS MARKET OVERVIEW (2016-2030)

FIGURE 027. POWER GENERATION MARKET OVERVIEW (2016-2030)

FIGURE 028. FOOD AND BEVERAGES MARKET OVERVIEW (2016-2030)

FIGURE 029. BUILDING AUTOMATION MARKET OVERVIEW (2016-2030)

FIGURE 030. MINING & METALS MARKET OVERVIEW (2016-2030)

FIGURE 031. OTHER INDUSTRIES MARKET OVERVIEW (2016-2030)

FIGURE 032. NORTH AMERICA AC DRIVES MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 033. EASTERN EUROPE AC DRIVES MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 034. WESTERN EUROPE AC DRIVES MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 035. ASIA PACIFIC AC DRIVES MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 036. MIDDLE EAST & AFRICA AC DRIVES MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 037. SOUTH AMERICA AC DRIVES MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the AC Drives Market research report is 2024-2032.

Rockwell Automation Inc. (USA), Emerson Electric Co. (USA), Parker Hannifin Corporation (USA), TMEIC Corporation (USA) ABB (Switzerland), Siemens AG (Germany), Invertek Drives Ltd. (United Kingdom), Control Techniques (United Kingdom), Lenze SE (Germany), Schneider Electric SE (France), Bonfiglioli Riduttori S.p.A. (Italy), Danfoss Group (Denmark), Mitsubishi Electric Corporation (Japan), Eaton Corporation plc (Ireland), Yaskawa Electric Corporation (Japan), Fuji Electric Co., Ltd. (Japan), Hitachi, Ltd. (Japan), Nidec Corporation (Japan), Toshiba Corporation (Japan), Delta Electronics, Inc. (Taiwan), Vacon (Nidec Corporation) (Finland), Hiconics Drive Technology Co., Ltd. (China), Hyosung Heavy Industries Corporation (South Korea), LS Electric (South Korea), WEG S.A. (Brazil), and Other Major Player.

The AC Drives Market is segmented into Voltage, Power Voltage, Application, End User, and region. By Voltage, the market is categorized into Low Voltage, Medium Voltage, and High Voltage. By Power Voltage, the market is categorized into Low Power, Medium Power, and High Power. By Application, the market is categorized into Pumps, Fan, Conveyor, Compressor, and Extruders. By End User, the market is categorized into Oil and gas, Power Generation, Food and Beverages, Building Automation, Mining and metals, and Other Industries. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

An AC drive is a device used to control the speed of an electrical motor to enhance process control. Reduce energy usage and generate energy efficiently. Decrease mechanical stress on motor control applications. Optimize the operation of various applications relying on electric motors.

The global AC Drives Market size was valued at USD 24.22 Billion in 2023 and is projected to reach USD 49.23 Billion by 2032, growing at a CAGR of 8.2% from 2024 to 2032.