AC Drives Market Synopsis

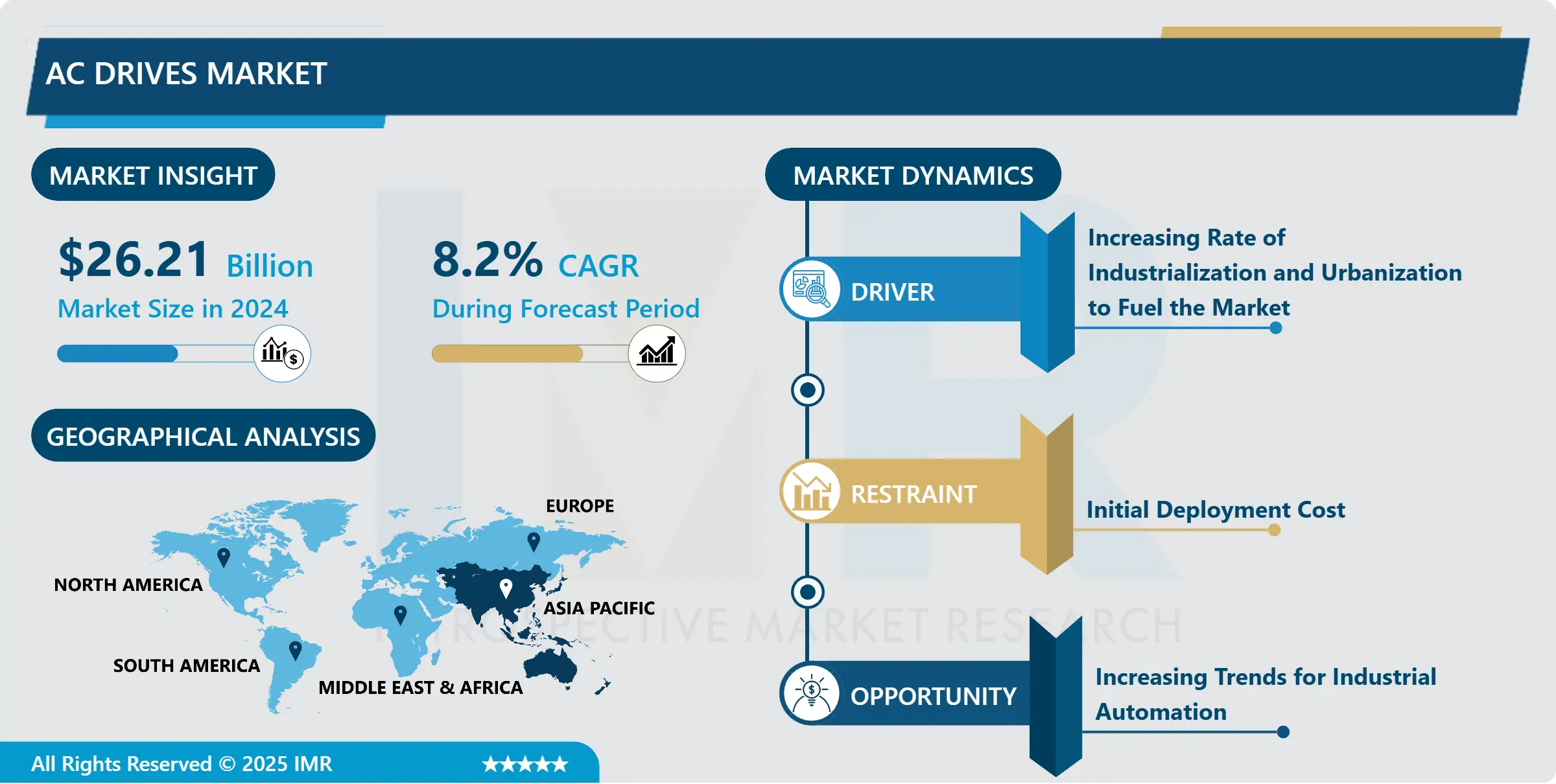

The global AC Drives Market size was valued at USD 26.21 Billion in 2024 and is projected to reach USD 49.23 Billion by 2032, growing at a CAGR of 8.2% from 2025 to 2032.

An AC drive is a device used to control the speed of an electrical motor to enhance process control. Reduce energy usage and generate energy efficiently. Decrease mechanical stress on motor control applications. Optimize the operation of various applications relying on electric motors.

AC drives, also known as variable frequency drives (VFDs) or inverters, are electronic devices used to control the speed and torque of an alternating current (AC) electric motor. They accomplish this by varying the frequency and voltage supplied to the motor. AC drives are essential in a wide range of industries and applications where precise control of motor speed is required.

AC drives convert the incoming AC voltage (typically at a fixed frequency of 50 or 60 Hz) into a variable frequency and voltage output. By adjusting the frequency and voltage, the drive can control the motor's speed, allowing for precise regulation of processes.

AC drives enable soft-start and soft-stop capabilities, reducing mechanical stress during motor start-up and shutdown. This feature prolongs the lifespan of motors and other connected equipment and contributes to energy savings by preventing abrupt, energy-intensive starts.

The AC Drives Market Trend Analysis

AC Drives Market Drivers- Increasing Rate of Industrialization and Urbanization to Fuel the Market

- Substantial increases in urbanization along with the growing rate of industrialization are the major factors driving the AC market growth. Urbanization would increase consumer demand, which results in to increase in the manufacturing sector, propelling the demand for AC drives during the forecast period.

- For instance, as per the Central Intelligence Agency, China, India, Malaysia, and Vietnam have an urban population of 60.3%, 34.5%, 76.6%, and 36.6% as of 2020 which is increasing at a rate of 2.4%, 2.4%, 2.1%, and 3% respectively. According to the World Investment Report, Governments are parallelly focusing on improvising the industrial policies and regulations to bring a conducive environment for exploring new industries and improve the sustainability amongst competitors such as strategic investment policy priorities, entry and establishment of foreign investors, and promotion and facilitation of investment policies. Hence, significant industrialization growth helps the market to grow at a faster pace. Rising urbanization and increasing rate of industrialization act as potential drivers for the AC drive market during the forecast period.

- Favourable government regulations and supportive policies enhance the growth of the manufacturing industry, which helps to boost the AC drives market. For instance, the implementation of standards such as ISO 50001 (energy- management-system standard) in the building & automation sector has the potential to accelerate the integration of building automation systems.

AC Drives Market Opportunities- Increasing Trends for Industrial Automation

- Industrial automation systems aim to improve efficiency, reduce downtime, and enhance productivity. AC drives play a crucial role by providing precise control over motor speeds. This level of control allows machines and processes to operate at optimal speeds, leading to energy savings and increased efficiency.

- Energy efficiency is a top priority in industrial settings. AC drives allow motors to operate at variable speeds, which means they can run at lower speeds when full power is not required. This not only reduces energy consumption but also extends the lifespan of motors and reduces maintenance costs. As energy costs continue to rise, industries seek ways to reduce their power usage, making AC drives a valuable solution.

- Many industrial processes require precise control of motor speeds and torque to maintain quality and consistency. AC drives enable fine-tuned control, which is essential in industries such as chemical manufacturing, food processing, and pharmaceuticals. The demand for such control is a driving force behind the adoption of AC drives.

- The concept of Industry 4.0, which focuses on smart, connected manufacturing, relies on automation and data exchange. AC drives are an integral part of this transformation as they can be integrated with sensors and data analytics to enable predictive maintenance and real-time adjustments. This leads to reduced downtime and improved overall equipment effectiveness (OEE).

Segmentation Analysis of The AC Drives Market

The AC Drives market segments cover Voltage, Power Voltage, Application, and End User. By Power Voltage, the Low Power segment is Anticipated to Dominate the Market Over the Forecast period.

- Low-power drives are predominantly used for various applications such as fans, pumps, cranes, fluid machines, machine tools, printing machines, metal processing machines, food processing machines, and health & medical care instruments, among others. Due to the wide scope of application in vertical industries, the low-power drive segment is expected to dominate the market during the forecast period.

- Major players in the industry are projecting the demand for AC drive based on application and technological scenarios which helps to meet consumer demand. The key players offering the low-power drive are Siemens, TMEIC, Fuji Electric, Nidec Industrial Solutions, and other players.

- Low-power AC drives are generally more affordable than their medium-voltage counterparts. This affordability makes them an attractive option for businesses and industries looking to implement motor control solutions within budget constraints.

- There is a growing emphasis on energy efficiency across industries. Low-power AC drives are effective in improving energy efficiency for small and medium-sized motors. Many commercial and industrial facilities seek to reduce their energy consumption, which drives the demand for low-power AC Drivers.

Regional Analysis of The AC Drives Market

Asia Pacific is Expected to Dominate the Market Over the Forecast Period.

- APAC is home to the world's largest and fastest-growing industrial economies, including China and India. These countries have experienced significant industrialization and manufacturing expansion in recent decades. The demand for AC drives in various industries, such as automotive, electronics, chemicals, and textiles, has surged as a result.

- The countries in Asia Pacific have been investing heavily in infrastructure development, including transportation, energy, and construction projects. AC drives are widely used in infrastructure applications, such as elevators, escalators, pumps, and ventilation systems. The rapid urbanization in the region has driven the need for motor control solutions, contributing to the dominance of the AC drives market.

- The adoption of industrial automation and Industry 4.0 principles is on the rise in APAC. As industries seek to improve efficiency, productivity, and quality, they turn to AC drives for precise motor control. The automotive, electronics, and food processing industries, among others, heavily rely on automation systems that incorporate AC drives.

- APAC has become a global product manufacturing hub, including consumer electronics, automobiles, and machinery. These manufacturing facilities require AC drives to control motors in production lines and ensure consistent product quality.

Top Key Players Covered AC Drives Market

- Rockwell Automation, Inc. (USA)

- Emerson Electric Co. (USA)

- Parker Hannifin Corporation (USA)

- TMEIC Corporation (USA)

- ABB (Switzerland)

- Siemens AG (Germany)

- Invertek Drives Ltd. (United Kingdom)

- Control Techniques (Nidec Corporation) (United Kingdom)

- Lenze SE (Germany)

- Schneider Electric SE (France)

- Bonfiglioli Riduttori S.p.A. (Italy)

- Danfoss Group (Denmark)

- Mitsubishi Electric Corporation (Japan)

- Eaton Corporation plc (Ireland)

- Yaskawa Electric Corporation (Japan)

- Fuji Electric Co., Ltd. (Japan)

- Hitachi, Ltd. (Japan)

- Nidec Corporation (Japan)

- Toshiba Corporation (Japan)

- Delta Electronics, Inc. (Taiwan)

- Vacon (Nidec Corporation) (Finland)

- Hiconics Drive Technology Co., Ltd. (China)

- Hyosung Heavy Industries Corporation (South Korea)

- LS Electric (South Korea)

- WEG S.A. (Brazil)

- Other Active Players

Key Industry Developments in the AC Drives Market

- In May 2023, ABB announced the opening of its manufacturing plant in Peenya, located in Bengaluru, India which will produce a new line of variable frequency drives. This factory will produce and offer drives ranging from 75 kW to 250 kW along with will catering to the major industrial segments. The expansion will strengthen the company's domestic supplier eco-system for low voltage AC drives product portfolio and enhance its market position across the AC drives industry.

- In May 2023, Emotron Drives Power Control LLC, part of CG Drives & Automation inaugurated a new manufacturing facility in UAE. This state-of-the-art production plant will manufacture AC drives and will further enable shorter delivery times of high-powered variable frequency drives. This expansion will expand the company's market presence across the region and is set to enhance its position across the AC dives industry.

|

Global AC Drives Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 26.21 Bn. |

|

CAGR: |

8.2 % |

Market Size in 2032: |

USD 49.23 Bn. |

|

Segments Covered: |

By Voltage |

|

|

|

By Power Voltage |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: AC Drives Market by Voltage (2018-2032)

4.1 AC Drives Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Low Voltage

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Medium Voltage

4.5 High Voltage

Chapter 5: AC Drives Market by Power Voltage (2018-2032)

5.1 AC Drives Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Low Power

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Medium Power

5.5 High Power

Chapter 6: AC Drives Market by Application (2018-2032)

6.1 AC Drives Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Pump

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Fan

6.5 Conveyor

6.6 Compressor

6.7 Extruders

Chapter 7: AC Drives Market by End User (2018-2032)

7.1 AC Drives Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Oil & Gas

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Power Generation

7.5 Food and Beverages

7.6 Building Automation

7.7 Mining & Metals

7.8 Other Industries

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 AC Drives Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 CERNER CORPORATION (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 EPIC SYSTEMS CORPORATION (USA)

8.4 ALLSCRIPTS HEALTHCARE SOLUTIONS INC. (USA)

8.5 ATHENAHEALTH INC. (USA)

8.6 MCKESSON CORPORATION (USA)

8.7 ECLINICALWORKS (USA)

8.8 NEXTGEN HEALTHCARE INC. (USA)

8.9 MEDITECH (USA)

8.10 GE HEALTHCARE (USA)

8.11 GREENWAY HEALTH (USA)

8.12 SIEMENS HEALTHINEERS (GERMANY)

8.13 PHILIPS HEALTHCARE (NETHERLANDS)

8.14 CPSI (COMPUTER PROGRAMS AND SYSTEMS INC.) (USA)

8.15 HENRY SCHEIN MICROMD (USA)

8.16 QUEST DIAGNOSTICS (USA)

8.17 TELUS HEALTH (CANADA)

8.18 GE HEALTHCARE (USA)

8.19 IBM WATSON HEALTH (USA)

8.20 GE HEALTHCARE (USA)

8.21 TATA ELXSI (INDIA)

8.22 PRACTICE FUSION (USA)

8.23 AGFA-GEVAERT GROUP (BELGIUM)

8.24 DASSAULT SYSTÈMES (FRANCE)

8.25 NEXTGEN HEALTHCARE (USA)

8.26 VALANT (GERMANY)

8.27

Chapter 9: Global AC Drives Market By Region

9.1 Overview

9.2. North America AC Drives Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Voltage

9.2.4.1 Low Voltage

9.2.4.2 Medium Voltage

9.2.4.3 High Voltage

9.2.5 Historic and Forecasted Market Size by Power Voltage

9.2.5.1 Low Power

9.2.5.2 Medium Power

9.2.5.3 High Power

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Pump

9.2.6.2 Fan

9.2.6.3 Conveyor

9.2.6.4 Compressor

9.2.6.5 Extruders

9.2.7 Historic and Forecasted Market Size by End User

9.2.7.1 Oil & Gas

9.2.7.2 Power Generation

9.2.7.3 Food and Beverages

9.2.7.4 Building Automation

9.2.7.5 Mining & Metals

9.2.7.6 Other Industries

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe AC Drives Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Voltage

9.3.4.1 Low Voltage

9.3.4.2 Medium Voltage

9.3.4.3 High Voltage

9.3.5 Historic and Forecasted Market Size by Power Voltage

9.3.5.1 Low Power

9.3.5.2 Medium Power

9.3.5.3 High Power

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Pump

9.3.6.2 Fan

9.3.6.3 Conveyor

9.3.6.4 Compressor

9.3.6.5 Extruders

9.3.7 Historic and Forecasted Market Size by End User

9.3.7.1 Oil & Gas

9.3.7.2 Power Generation

9.3.7.3 Food and Beverages

9.3.7.4 Building Automation

9.3.7.5 Mining & Metals

9.3.7.6 Other Industries

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe AC Drives Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Voltage

9.4.4.1 Low Voltage

9.4.4.2 Medium Voltage

9.4.4.3 High Voltage

9.4.5 Historic and Forecasted Market Size by Power Voltage

9.4.5.1 Low Power

9.4.5.2 Medium Power

9.4.5.3 High Power

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Pump

9.4.6.2 Fan

9.4.6.3 Conveyor

9.4.6.4 Compressor

9.4.6.5 Extruders

9.4.7 Historic and Forecasted Market Size by End User

9.4.7.1 Oil & Gas

9.4.7.2 Power Generation

9.4.7.3 Food and Beverages

9.4.7.4 Building Automation

9.4.7.5 Mining & Metals

9.4.7.6 Other Industries

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific AC Drives Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Voltage

9.5.4.1 Low Voltage

9.5.4.2 Medium Voltage

9.5.4.3 High Voltage

9.5.5 Historic and Forecasted Market Size by Power Voltage

9.5.5.1 Low Power

9.5.5.2 Medium Power

9.5.5.3 High Power

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Pump

9.5.6.2 Fan

9.5.6.3 Conveyor

9.5.6.4 Compressor

9.5.6.5 Extruders

9.5.7 Historic and Forecasted Market Size by End User

9.5.7.1 Oil & Gas

9.5.7.2 Power Generation

9.5.7.3 Food and Beverages

9.5.7.4 Building Automation

9.5.7.5 Mining & Metals

9.5.7.6 Other Industries

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa AC Drives Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Voltage

9.6.4.1 Low Voltage

9.6.4.2 Medium Voltage

9.6.4.3 High Voltage

9.6.5 Historic and Forecasted Market Size by Power Voltage

9.6.5.1 Low Power

9.6.5.2 Medium Power

9.6.5.3 High Power

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Pump

9.6.6.2 Fan

9.6.6.3 Conveyor

9.6.6.4 Compressor

9.6.6.5 Extruders

9.6.7 Historic and Forecasted Market Size by End User

9.6.7.1 Oil & Gas

9.6.7.2 Power Generation

9.6.7.3 Food and Beverages

9.6.7.4 Building Automation

9.6.7.5 Mining & Metals

9.6.7.6 Other Industries

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America AC Drives Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Voltage

9.7.4.1 Low Voltage

9.7.4.2 Medium Voltage

9.7.4.3 High Voltage

9.7.5 Historic and Forecasted Market Size by Power Voltage

9.7.5.1 Low Power

9.7.5.2 Medium Power

9.7.5.3 High Power

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Pump

9.7.6.2 Fan

9.7.6.3 Conveyor

9.7.6.4 Compressor

9.7.6.5 Extruders

9.7.7 Historic and Forecasted Market Size by End User

9.7.7.1 Oil & Gas

9.7.7.2 Power Generation

9.7.7.3 Food and Beverages

9.7.7.4 Building Automation

9.7.7.5 Mining & Metals

9.7.7.6 Other Industries

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global AC Drives Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 26.21 Bn. |

|

CAGR: |

8.2 % |

Market Size in 2032: |

USD 49.23 Bn. |

|

Segments Covered: |

By Voltage |

|

|

|

By Power Voltage |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||