Global A2 Milk Market Overview

The Global A2 Milk Market size is expected to grow from USD 2.05 billion in 2022 to USD 4.79 billion by 2030, at a CAGR of 11.2% during the forecast period (2023-2030).

A2 milk is a healthy alternative to regular cow’s milk. A2 milk is a type of cows' milk that primarily lacks a type of β-casein polypeptide known as A1, and has majorly the A2 form. Milk from Jersey, Asian herds, Guernsey, etc. comprises majorly A2 beta-casein. A2 Milk has comparatively more protein i.e. 12% more than regular cow’s milk, 25% more vitamin A, 33% more vitamin D, 15% more calcium as well as 30% more thick cream. Additionally, research on A2 milk consumption studies that the regular consumption of A2 milk is beneficial in slowing down muscle catabolism, further improving muscle recovery. Milk is a vital dietary staple as well as an integral part of baby food. A2 milk is effective in releasing lower levels of BCM-7, thereby leading to increased consumption among infants. A2 milk is preferred widely in infant formulas by baby food manufacturers, and also by the working women population, which boosts the market growth. Additionally, widespread knowledge related to health and well-being, a rise in consumer spending in major developing regions, and increasing disposable incomes are expected to fuel the growth of the A2 milk market.

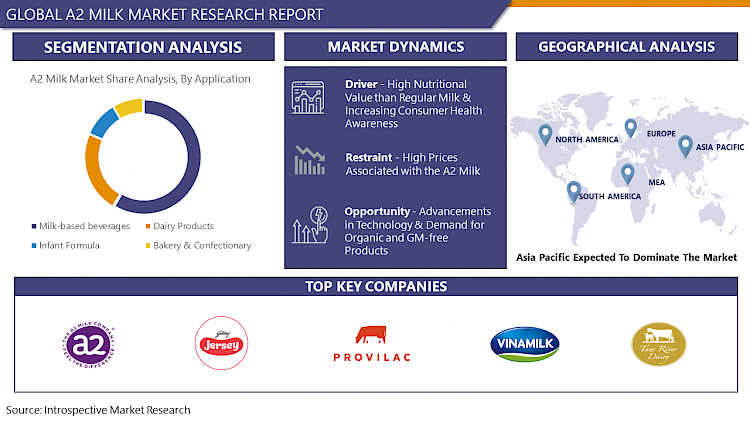

Market Dynamics And Factors For A2 Milk Market

Drivers:

High Nutritional Value than Regular Milk & Increasing Consumer Health Awareness

Milk is consumed as healthy food as it contains various nutrients necessary for human as well as animal health. One of the major nutrients in milk is fat which is known to be good fat. The fat content in A2 milk is comparatively higher than that of regular milk. In regular milk, the fat content is around 3.6%, whereas, in A2 milk, it is found to be around 4.8% fat. In the past few decades, manufacturers have offered A2 as a healthier alternative to regular milk. A2 milk is obtained by a unique breed of cow that produces beta-casein proteins containing phenylalanine at position 67 in its milk. A few species that deliver A2 milk are Gir, Shahiwal, Guernsey, and Red Sindhi. Owing to the greater presence of vitamin D, calcium, potassium, and protein in A2 milk, it has better potential and nutritional value than regular milk, which further fosters market growth.

Moreover, there has been a rising trend of eating healthy food among consumers. Also, the number of people unable to consume milk and milk products due to indigestion problems is rising. Thus, as A2 milk is easier to digest, the demand for A2 milk as a healthy food that can be digested easily is increasing. Also, many people across the globe are suffering from heart-related diseases, and dairy-related inflammation by consuming regular milk. However, A2 milk is effective in reducing the risk of dairy-related inflammation and heart disease among consumers, thus propelling rapid growth worldwide. The FDA has also issued strict policies and guidelines regarding food quality, food safety, and nutritional product level. Hence, A2 Milk is certified to be free from hormones as well as antibiotics, further leading to rapid market growth. There has also been an upsurge in demand for functional beverages that are significant in delivering digestive benefits. Henceforth, owing to the rise in health consciousness among consumers, growing consumer spending on healthy and clean label products, offering additional benefits than regular milk, and an increase in product knowledge through advertisements, the A2 Milk market is expected to grow rapidly in the upcoming years.

Restraints:

High Prices Associated with the A2 Milk

A2 milk has higher prices than the conventional type of milk owing to the added benefits it provides, which results in hampering the market growth. The demand and supply gap for A2 milk is the second factor that is most likely to restrict growth. For instance, cows of Indian origin produce A2 milk, but the production of A2 milk per cow is very less. This thereby leads to creating the gap between supply and demand, and further rising the prices of the final product, making the A2 type of milk costlier than A1 milk. The nutritious nature of A2 grade milk is also responsible for its increased application in dietary products, and as it offers added benefits, the costs become higher. Cows that produce A1 milk possess more quantity than A2 beta-casein milk. As a result, most companies started selling A1 milk to the public at an affordable price. Thus, the price of A2 is higher than regular A1 milk. Moreover, the availability of cheaper and vegan alternatives is also expected to restrain the growth of the A2 milk market.

Opportunity:

Advancements in Technology & Demand for Organic and GM-free Products

Various emerging technologies and ‘datafication’ of agriculture are offering farmers quantifiable information to continuously measure, react, and monitor farm operations. Adapting these technologies can ensure farmers that all decisions contribute positively to farm efficiency and profitability. Many technologies for assisting herd and grass management are becoming popular and can provide lucrative opportunities for the growth of the dairy sector. Improved smartphone data applications, drones, micro-sensor technology, robotics (such as automated milking parlors), and satellite systems are all likely to offer huge growth in the A2 Milk market. Further, the rising demand for organic and GM-free products is significant in boosting the A2 milk industry. Organic agriculture has a reputation for catering to a high-income niche. However, the market is growing beyond affluent buyers to those who are highly interested in food quality and safety and hold a desire for GM-free ingredients. Currently, under EU regulation, genetically modified foods are not allowed to be put on the market unless they are approved by the EU, as well as the foods containing GM ingredients must make a declaration on their labels. Owing to such advancements in technology, and rising demand from consumers for GM-free and organic products is anticipated to offer profitable growth opportunities for the A2 Milk market.

Segmentation Analysis Of A2 Milk Market

By Form, the liquid segment dominates the market growth of A2 Milk as it is more convenient than any other form. The liquid form helps in deriving maximum nutrients such as proteins, vitamins, minerals, and calcium to the consumers. These vitamins are useful in maintaining the health of the nervous system. Fresh A2 milk also provides more phosphorus and selenium than powdered milk. Additionally, the natural flavor & gentle taste of liquid A2 beta-casein milk increases the consumption level, thereby boosting the market growth. Liquid A2 milk is witnessing rapid growth as consumers prefer fresh milk for direct consumption. The rising application of powder form of A2 milk in infant formula is further estimated to witness fast growth. With the increasing demand for A2 Milk for applications such as confectionery, salty products, & baked desserts, the powder form segment will grow at pace.

By Packaging, the carton segment holds the maximum share of the A2 milk market. Cartons are effective in providing a longer shelf life to the product, incurring relatively low transportation costs, and are convenient to use for consumers. Thus, due to the increasing consumer preference and growing consumption, the carton segment is estimated to continue its dominance in the upcoming years. Carton packaging is much safer and more convenient for storing food as the carton protects and provides longer durability of product content into it. Also, as the carton has a lower weight, the transportation cost is lower, which helps in maximum usage for storing A2 milk. The carton segment is also expected to be the fastest-growing segment owing to the significant demand for hard packaging in the dairy products industry worldwide.

By Distribution Channel, the supermarkets and hypermarkets segment accounted for the highest share in the A2 Milk market. The primary factor driving this huge growth is the availability of a wide range of products in stores as well as the increasing number of supermarkets and hypermarkets. Supermarkets & hypermarkets have controlled temperature shelves for dairy-based products for preventing any type of spoilage. Consumers find it very convenient to buy their daily needs at comparatively lower prices in such stores, which is anticipated to drive the segment growth over the forecast period. Further, the online segment is expected to attain huge growth due to the convenience offered by these distribution channels. Moreover, the increasing internet usage for shopping, higher convenience, reduction in lead time, and added discounts are the key factors expected to drive the sales of online segments.

By Application, Milk based beverages are expected to dominate the market growth of A2 Milk, and its dominance can be attributed to the growing demand for high-protein milkshakes, fortified milk products, and many others. High-protein milkshakes, powders, milk drinks, smoothies, and fortified milk products are the major commercialized milk-based beverages with additional health benefits such as the products with high protein content in the world. Protein-based products are in high demand worldwide, especially among health-conscious people. Dairy plays a key role in sports nutrition, with ingredients like whey and casein as staple components of many product varieties, and as the sports nutrition market is currently experiencing rapid growth, the A2 milk market for milk-based beverages is expected to grow at pace.

Regional Analysis Of A2 Milk Market

Asia Pacific dominates the market growth of A2 milk and is expected to continue its dominance over the forecasted period. Asia Pacific is considered a prominent market owing to the rising awareness regarding the benefits of A2 beta-casein milk in developing countries such as China and India. Moreover, the product is widely produced in the Asia Pacific region due to the huge presence of A2 breed cows and the growing demand for dairy products in this region. Countries such as China, New Zealand, Australia, and India are also responsible for positively contributing to the market revenue. Milk is considered the best health product among citizens of any age group, thus boosting market growth. Moreover, the ease and convenience in the availability of breeds of cows & buffalo have resulted in ample production of milk. The increasing milk consumption especially in the countries like China and India, owing to the rising population, growing disposable income, and rapid urbanization, among others, is propelling the growth of the market. Furthermore, the rise in awareness about the health benefits offered by A2 milk, especially among the geriatric population, is anticipated to drive the market growth of the Asia Pacific region over the forecasted years.

North America is anticipated to witness rapid growth in the upcoming years. Countries such as US and Canada are significantly contributing to this rapid growth due to the owing to the increased demand for healthy milk across the countries. The increasing demand with acceptance of A2 milk as beverages as well as rising spending from consumers is also estimated to drive the growth of the North American region. Further, the expansion of supermarkets and hypermarkets, the surging inclination towards health and fitness, and the growing prevalence of chronic diseases are most likely to foster the demand for A2 milk in North America. Additionally, the increased usage of A2 grade milk in bakery and confectionery products in the U.K., Germany, and France is also anticipated to boost the product demand. North America is also expected to witness robust growth due to the continuous research and development activities in the dairy sector.

Covid-19 Impact Analysis On A2 Milk Market

The occurrence of the Covid-19 pandemic has negatively affected major supply chains of the market. The sudden lockdown in various countries had a great impact on the raw material supply for manufacturing, packaging, and delivery. In addition, the demand for dairy products is also observed to be decreased owing to the severe impact of the novel coronavirus on various channels. However, the current situation of the global market is studied to be stable as there are continuous efforts from key players and manufacturers to introduce new products in the market. Owing to the outspread of Covid 19, there has been a substantial rise in demand for functional beverages as a result of rising consumer spending and health consciousness. Covid-19 is further projected to boost the demand for A2 milk at a much higher rate globally. An increase in awareness amongst people to strengthen their immunity & immune system to prevent themselves from being infected easily is compelling them to maintain a healthy lifestyle and proper diet.

Top Key Players Covered In A2 Milk Market

- The A2 Milk Company (New Zealand)

- Gujarat Co-operative Milk Marketing Federation Ltd. (GCMMF) (India)

- Godrej Jersey (India)

- PROVILAC Dairy Farms Pvt. Ltd. (India)

- Freedom Foods Group (Australia)

- Vinamilk (Vietnam)

- Erden Creamery Private Limited (India)

- Nestle S.A. (Switzerland)

- Vedaaz Organics Pvt. Ltd. (India)

- Ripley Farms (U.S.)

- Taw River Dairy (UK)

- Urban Farms Milk (India)

- Amul (India)

- Lion Dairy & Drinks (Australia), and other major players.

Key Industry Development In The A2 Milk Market

In October 2021, The a2 Milk Company™ and The Hershey Company announced the release of co-branded Hershey's. The a2 Milk Company partnered with Hershey's and became the first premium milk company. The new Hershey's a2 Milk® will further provide natural chocolate milk that uniquely combines the taste, nutrition, and all-family appeal,

In July 2021, The A2 Milk Company introduced a premium half and half product made with all-natural a2 Milk and cream that delivers better taste, better protein, and better digestibility than its counterparts. The new a2 Milk Half and Half is made from cows that naturally produce only the A2 protein rather than the combination of A1 and A2 proteins contained in most dairy products.

|

Global A2 Milk Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2021 |

Market Size in 2022: |

USD 2.05 Bn. |

|

Forecast Period 2023-30 CAGR: |

11.2% |

Market Size in 2030: |

USD 4.79 Bn. |

|

Segments Covered: |

By Form |

|

|

|

By Packaging |

|

||

|

By Distribution Channel |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Form

3.2 By Packaging

3.3 By Distribution Channels

3.4 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: A2 Milk Market by Form

5.1 A2 Milk Market Overview Snapshot and Growth Engine

5.2 A2 Milk Market Overview

5.3 Powder

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Powder: Grographic Segmentation

5.4 Liquid

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Liquid: Grographic Segmentation

Chapter 6: A2 Milk Market by Packaging

6.1 A2 Milk Market Overview Snapshot and Growth Engine

6.2 A2 Milk Market Overview

6.3 Cartons

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Cartons: Grographic Segmentation

6.4 Bottles

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Bottles: Grographic Segmentation

Chapter 7: A2 Milk Market by Distribution Channels

7.1 A2 Milk Market Overview Snapshot and Growth Engine

7.2 A2 Milk Market Overview

7.3 Supermarkets/Hypermarkets

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Supermarkets/Hypermarkets: Grographic Segmentation

7.4 Convenience Stores

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Convenience Stores: Grographic Segmentation

7.5 Online Retail

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Online Retail: Grographic Segmentation

7.6 Others

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2028F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Others: Grographic Segmentation

Chapter 8: A2 Milk Market by Application

8.1 A2 Milk Market Overview Snapshot and Growth Engine

8.2 A2 Milk Market Overview

8.3 Dairy Products

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2016-2028F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Dairy Products: Grographic Segmentation

8.4 Milk-based Beverages

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2016-2028F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Milk-based Beverages: Grographic Segmentation

8.5 Infant Formula

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size (2016-2028F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Infant Formula: Grographic Segmentation

8.6 Bakery & Confectionery

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size (2016-2028F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Bakery & Confectionery: Grographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 A2 Milk Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Ansoff Matrix

9.1.5 A2 Milk Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 A2 Milk Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 THE A2 MILK COMPANY

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 GUJARAT CO-OPERATIVE MILK MARKETING FEDERATION LTD.

9.4 GODREJ JERSEY

9.5 PROVILAC DAIRY FARMS PVT. LTD.

9.6 FREEDOM FOODS GROUP

9.7 VINAMILK

9.8 ERDEN CREAMERY PRIVATE LIMITED

9.9 NESTLE S.A.

9.10 VEDAAZ ORGANICS PVT. LTD.

9.11 RIPLEY FARMS

9.12 TAW RIVER DAIRY

9.13 URBAN FARMS MILK

9.14 AMUL

9.15 LION DAIRY & DRINKS

9.16 OTHER MAJOR PLAYERS

Chapter 10: Global A2 Milk Market Analysis, Insights and Forecast, 2016-2028

10.1 Market Overview

10.2 Historic and Forecasted Market Size By Form

10.2.1 Powder

10.2.2 Liquid

10.3 Historic and Forecasted Market Size By Packaging

10.3.1 Cartons

10.3.2 Bottles

10.4 Historic and Forecasted Market Size By Distribution Channels

10.4.1 Supermarkets/Hypermarkets

10.4.2 Convenience Stores

10.4.3 Online Retail

10.4.4 Others

10.5 Historic and Forecasted Market Size By Application

10.5.1 Dairy Products

10.5.2 Milk-based Beverages

10.5.3 Infant Formula

10.5.4 Bakery & Confectionery

Chapter 11: North America A2 Milk Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Form

11.4.1 Powder

11.4.2 Liquid

11.5 Historic and Forecasted Market Size By Packaging

11.5.1 Cartons

11.5.2 Bottles

11.6 Historic and Forecasted Market Size By Distribution Channels

11.6.1 Supermarkets/Hypermarkets

11.6.2 Convenience Stores

11.6.3 Online Retail

11.6.4 Others

11.7 Historic and Forecasted Market Size By Application

11.7.1 Dairy Products

11.7.2 Milk-based Beverages

11.7.3 Infant Formula

11.7.4 Bakery & Confectionery

11.8 Historic and Forecast Market Size by Country

11.8.1 U.S.

11.8.2 Canada

11.8.3 Mexico

Chapter 12: Europe A2 Milk Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Form

12.4.1 Powder

12.4.2 Liquid

12.5 Historic and Forecasted Market Size By Packaging

12.5.1 Cartons

12.5.2 Bottles

12.6 Historic and Forecasted Market Size By Distribution Channels

12.6.1 Supermarkets/Hypermarkets

12.6.2 Convenience Stores

12.6.3 Online Retail

12.6.4 Others

12.7 Historic and Forecasted Market Size By Application

12.7.1 Dairy Products

12.7.2 Milk-based Beverages

12.7.3 Infant Formula

12.7.4 Bakery & Confectionery

12.8 Historic and Forecast Market Size by Country

12.8.1 Germany

12.8.2 U.K.

12.8.3 France

12.8.4 Italy

12.8.5 Russia

12.8.6 Spain

12.8.7 Rest of Europe

Chapter 13: Asia-Pacific A2 Milk Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Form

13.4.1 Powder

13.4.2 Liquid

13.5 Historic and Forecasted Market Size By Packaging

13.5.1 Cartons

13.5.2 Bottles

13.6 Historic and Forecasted Market Size By Distribution Channels

13.6.1 Supermarkets/Hypermarkets

13.6.2 Convenience Stores

13.6.3 Online Retail

13.6.4 Others

13.7 Historic and Forecasted Market Size By Application

13.7.1 Dairy Products

13.7.2 Milk-based Beverages

13.7.3 Infant Formula

13.7.4 Bakery & Confectionery

13.8 Historic and Forecast Market Size by Country

13.8.1 China

13.8.2 India

13.8.3 Japan

13.8.4 Singapore

13.8.5 Australia

13.8.6 New Zealand

13.8.7 Rest of APAC

Chapter 14: Middle East & Africa A2 Milk Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Form

14.4.1 Powder

14.4.2 Liquid

14.5 Historic and Forecasted Market Size By Packaging

14.5.1 Cartons

14.5.2 Bottles

14.6 Historic and Forecasted Market Size By Distribution Channels

14.6.1 Supermarkets/Hypermarkets

14.6.2 Convenience Stores

14.6.3 Online Retail

14.6.4 Others

14.7 Historic and Forecasted Market Size By Application

14.7.1 Dairy Products

14.7.2 Milk-based Beverages

14.7.3 Infant Formula

14.7.4 Bakery & Confectionery

14.8 Historic and Forecast Market Size by Country

14.8.1 Turkey

14.8.2 Saudi Arabia

14.8.3 Iran

14.8.4 UAE

14.8.5 Africa

14.8.6 Rest of MEA

Chapter 15: South America A2 Milk Market Analysis, Insights and Forecast, 2016-2028

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Form

15.4.1 Powder

15.4.2 Liquid

15.5 Historic and Forecasted Market Size By Packaging

15.5.1 Cartons

15.5.2 Bottles

15.6 Historic and Forecasted Market Size By Distribution Channels

15.6.1 Supermarkets/Hypermarkets

15.6.2 Convenience Stores

15.6.3 Online Retail

15.6.4 Others

15.7 Historic and Forecasted Market Size By Application

15.7.1 Dairy Products

15.7.2 Milk-based Beverages

15.7.3 Infant Formula

15.7.4 Bakery & Confectionery

15.8 Historic and Forecast Market Size by Country

15.8.1 Brazil

15.8.2 Argentina

15.8.3 Rest of SA

Chapter 16 Investment Analysis

Chapter 17 Analyst Viewpoint and Conclusion

|

Global A2 Milk Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2021 |

Market Size in 2022: |

USD 2.05 Bn. |

|

Forecast Period 2023-30 CAGR: |

11.2% |

Market Size in 2030: |

USD 4.79 Bn. |

|

Segments Covered: |

By Form |

|

|

|

By Packaging |

|

||

|

By Distribution Channel |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. A2 MILK MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. A2 MILK MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. A2 MILK MARKET COMPETITIVE RIVALRY

TABLE 005. A2 MILK MARKET THREAT OF NEW ENTRANTS

TABLE 006. A2 MILK MARKET THREAT OF SUBSTITUTES

TABLE 007. A2 MILK MARKET BY FORM

TABLE 008. POWDER MARKET OVERVIEW (2016-2028)

TABLE 009. LIQUID MARKET OVERVIEW (2016-2028)

TABLE 010. A2 MILK MARKET BY PACKAGING

TABLE 011. CARTONS MARKET OVERVIEW (2016-2028)

TABLE 012. BOTTLES MARKET OVERVIEW (2016-2028)

TABLE 013. A2 MILK MARKET BY DISTRIBUTION CHANNELS

TABLE 014. SUPERMARKETS/HYPERMARKETS MARKET OVERVIEW (2016-2028)

TABLE 015. CONVENIENCE STORES MARKET OVERVIEW (2016-2028)

TABLE 016. ONLINE RETAIL MARKET OVERVIEW (2016-2028)

TABLE 017. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 018. A2 MILK MARKET BY APPLICATION

TABLE 019. DAIRY PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 020. MILK-BASED BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 021. INFANT FORMULA MARKET OVERVIEW (2016-2028)

TABLE 022. BAKERY & CONFECTIONERY MARKET OVERVIEW (2016-2028)

TABLE 023. NORTH AMERICA A2 MILK MARKET, BY FORM (2016-2028)

TABLE 024. NORTH AMERICA A2 MILK MARKET, BY PACKAGING (2016-2028)

TABLE 025. NORTH AMERICA A2 MILK MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 026. NORTH AMERICA A2 MILK MARKET, BY APPLICATION (2016-2028)

TABLE 027. N A2 MILK MARKET, BY COUNTRY (2016-2028)

TABLE 028. EUROPE A2 MILK MARKET, BY FORM (2016-2028)

TABLE 029. EUROPE A2 MILK MARKET, BY PACKAGING (2016-2028)

TABLE 030. EUROPE A2 MILK MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 031. EUROPE A2 MILK MARKET, BY APPLICATION (2016-2028)

TABLE 032. A2 MILK MARKET, BY COUNTRY (2016-2028)

TABLE 033. ASIA PACIFIC A2 MILK MARKET, BY FORM (2016-2028)

TABLE 034. ASIA PACIFIC A2 MILK MARKET, BY PACKAGING (2016-2028)

TABLE 035. ASIA PACIFIC A2 MILK MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 036. ASIA PACIFIC A2 MILK MARKET, BY APPLICATION (2016-2028)

TABLE 037. A2 MILK MARKET, BY COUNTRY (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA A2 MILK MARKET, BY FORM (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA A2 MILK MARKET, BY PACKAGING (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA A2 MILK MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA A2 MILK MARKET, BY APPLICATION (2016-2028)

TABLE 042. A2 MILK MARKET, BY COUNTRY (2016-2028)

TABLE 043. SOUTH AMERICA A2 MILK MARKET, BY FORM (2016-2028)

TABLE 044. SOUTH AMERICA A2 MILK MARKET, BY PACKAGING (2016-2028)

TABLE 045. SOUTH AMERICA A2 MILK MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 046. SOUTH AMERICA A2 MILK MARKET, BY APPLICATION (2016-2028)

TABLE 047. A2 MILK MARKET, BY COUNTRY (2016-2028)

TABLE 048. THE A2 MILK COMPANY: SNAPSHOT

TABLE 049. THE A2 MILK COMPANY: BUSINESS PERFORMANCE

TABLE 050. THE A2 MILK COMPANY: PRODUCT PORTFOLIO

TABLE 051. THE A2 MILK COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. GUJARAT CO-OPERATIVE MILK MARKETING FEDERATION LTD.: SNAPSHOT

TABLE 052. GUJARAT CO-OPERATIVE MILK MARKETING FEDERATION LTD.: BUSINESS PERFORMANCE

TABLE 053. GUJARAT CO-OPERATIVE MILK MARKETING FEDERATION LTD.: PRODUCT PORTFOLIO

TABLE 054. GUJARAT CO-OPERATIVE MILK MARKETING FEDERATION LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. GODREJ JERSEY: SNAPSHOT

TABLE 055. GODREJ JERSEY: BUSINESS PERFORMANCE

TABLE 056. GODREJ JERSEY: PRODUCT PORTFOLIO

TABLE 057. GODREJ JERSEY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. PROVILAC DAIRY FARMS PVT. LTD.: SNAPSHOT

TABLE 058. PROVILAC DAIRY FARMS PVT. LTD.: BUSINESS PERFORMANCE

TABLE 059. PROVILAC DAIRY FARMS PVT. LTD.: PRODUCT PORTFOLIO

TABLE 060. PROVILAC DAIRY FARMS PVT. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. FREEDOM FOODS GROUP: SNAPSHOT

TABLE 061. FREEDOM FOODS GROUP: BUSINESS PERFORMANCE

TABLE 062. FREEDOM FOODS GROUP: PRODUCT PORTFOLIO

TABLE 063. FREEDOM FOODS GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. VINAMILK: SNAPSHOT

TABLE 064. VINAMILK: BUSINESS PERFORMANCE

TABLE 065. VINAMILK: PRODUCT PORTFOLIO

TABLE 066. VINAMILK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. ERDEN CREAMERY PRIVATE LIMITED: SNAPSHOT

TABLE 067. ERDEN CREAMERY PRIVATE LIMITED: BUSINESS PERFORMANCE

TABLE 068. ERDEN CREAMERY PRIVATE LIMITED: PRODUCT PORTFOLIO

TABLE 069. ERDEN CREAMERY PRIVATE LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. NESTLE S.A.: SNAPSHOT

TABLE 070. NESTLE S.A.: BUSINESS PERFORMANCE

TABLE 071. NESTLE S.A.: PRODUCT PORTFOLIO

TABLE 072. NESTLE S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. VEDAAZ ORGANICS PVT. LTD.: SNAPSHOT

TABLE 073. VEDAAZ ORGANICS PVT. LTD.: BUSINESS PERFORMANCE

TABLE 074. VEDAAZ ORGANICS PVT. LTD.: PRODUCT PORTFOLIO

TABLE 075. VEDAAZ ORGANICS PVT. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. RIPLEY FARMS: SNAPSHOT

TABLE 076. RIPLEY FARMS: BUSINESS PERFORMANCE

TABLE 077. RIPLEY FARMS: PRODUCT PORTFOLIO

TABLE 078. RIPLEY FARMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. TAW RIVER DAIRY: SNAPSHOT

TABLE 079. TAW RIVER DAIRY: BUSINESS PERFORMANCE

TABLE 080. TAW RIVER DAIRY: PRODUCT PORTFOLIO

TABLE 081. TAW RIVER DAIRY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. URBAN FARMS MILK: SNAPSHOT

TABLE 082. URBAN FARMS MILK: BUSINESS PERFORMANCE

TABLE 083. URBAN FARMS MILK: PRODUCT PORTFOLIO

TABLE 084. URBAN FARMS MILK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. AMUL: SNAPSHOT

TABLE 085. AMUL: BUSINESS PERFORMANCE

TABLE 086. AMUL: PRODUCT PORTFOLIO

TABLE 087. AMUL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. LION DAIRY & DRINKS: SNAPSHOT

TABLE 088. LION DAIRY & DRINKS: BUSINESS PERFORMANCE

TABLE 089. LION DAIRY & DRINKS: PRODUCT PORTFOLIO

TABLE 090. LION DAIRY & DRINKS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 091. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 092. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 093. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. A2 MILK MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. A2 MILK MARKET OVERVIEW BY FORM

FIGURE 012. POWDER MARKET OVERVIEW (2016-2028)

FIGURE 013. LIQUID MARKET OVERVIEW (2016-2028)

FIGURE 014. A2 MILK MARKET OVERVIEW BY PACKAGING

FIGURE 015. CARTONS MARKET OVERVIEW (2016-2028)

FIGURE 016. BOTTLES MARKET OVERVIEW (2016-2028)

FIGURE 017. A2 MILK MARKET OVERVIEW BY DISTRIBUTION CHANNELS

FIGURE 018. SUPERMARKETS/HYPERMARKETS MARKET OVERVIEW (2016-2028)

FIGURE 019. CONVENIENCE STORES MARKET OVERVIEW (2016-2028)

FIGURE 020. ONLINE RETAIL MARKET OVERVIEW (2016-2028)

FIGURE 021. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 022. A2 MILK MARKET OVERVIEW BY APPLICATION

FIGURE 023. DAIRY PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 024. MILK-BASED BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 025. INFANT FORMULA MARKET OVERVIEW (2016-2028)

FIGURE 026. BAKERY & CONFECTIONERY MARKET OVERVIEW (2016-2028)

FIGURE 027. NORTH AMERICA A2 MILK MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. EUROPE A2 MILK MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. ASIA PACIFIC A2 MILK MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. MIDDLE EAST & AFRICA A2 MILK MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. SOUTH AMERICA A2 MILK MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the A2 Milk Market research report is 2023-2030.

The A2 Milk Company, Gujarat Co-operative Milk Marketing Federation Ltd., Godrej Jersey, PROVILAC Dairy Farms Pvt. Ltd., Freedom Foods Group, Vinamilk, Erden Creamery Private Limited, Nestle S.A., Vedaaz Organics Pvt. Ltd., Ripley Farms, Taw River Dairy, Urban Farms Milk, Amul, Lion Dairy & Drinks, Other Major Players.

The A2 Milk Market is segmented into form, packaging, distribution channels, application, and region. By Form, the market is categorized into powder and liquid. By Packaging, the market is categorized into cartons and bottles. By Distribution channels, the market is categorized into Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Others. By Application, the market is categorized into Dairy Products, Milk-based Beverages, Infant Formula, Bakery & Confectionery. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A2 milk is a healthy alternative to regular cow’s milk. A2 milk is a type of cows' milk that primarily lacks a type of β-casein polypeptide known as A1, and has majorly the A2 form.

The Global A2 Milk Market size is expected to grow from USD 2.05 billion in 2022 to USD 4.79 billion by 2030, at a CAGR of 11.2% during the forecast period (2023-2030).