Global 3D Secure Pay Authentication Market Overview

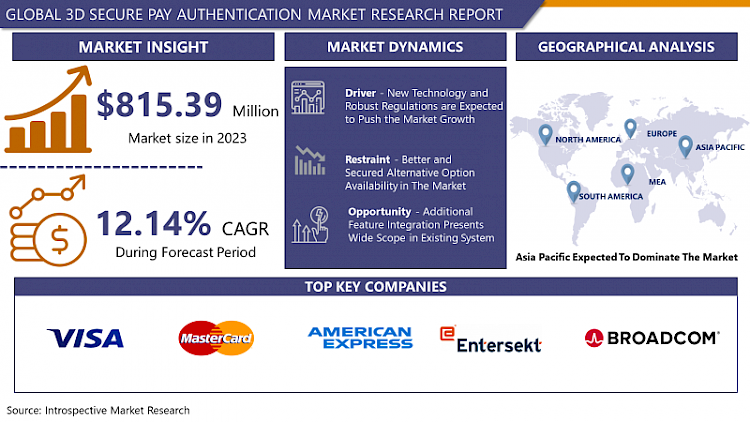

3D Secure Pay Authentication Market Size Was Valued at USD 815.39 Million in 2023 and is Projected to Reach USD 2286.71 Million by 2032, Growing at a CAGR of 12.14% From 2024-2032

3D Secure (3DS) is a verification method that boosts the security of online credit card purchases by asking customers to confirm their identity with the card issuer while making a payment. The added authentication layer greatly decreases the chances of fraudulent behavior.

- For retailers, 3D Secure provides various advantages. First and foremost, it offers a liability shift. If a chargeback occurs, usually the responsibility lies with the merchant. Nonetheless, if the 3D Secure protocol is adhered to properly, the issuing bank will take on this responsibility. Merchants must thoroughly examine all documents provided by their issuer to grasp the implementation guidelines and regulations fully.

- Additionally, 3DS protects against chargebacks. Transactions authenticated through Verified by Visa provide merchants with protection from chargebacks, safeguarding them against friendly fraud or chargeback fraud. It is essential to mention that MasterCard does not provide a comparable assurance, hence merchants need to recognize the distinctions among card networks.

- Another benefit is the possibility of exchanging advantages. Merchants could benefit from reduced interchange fees and extended payment terms from their acquirer by utilizing 3D Secure, leading to savings on costs and better management of cash flow.

- Finally, 3D Secure boosts customer trust. Building trust with customers is crucial for Card-Not-Present (CNP) merchants. The extra protection from 3DS gives customers peace of mind that their information is safe, which could make them more likely to finish purchases and drive up total sales. 3D Secure is a useful tool for merchants aiming to prevent fraud, lower liability, and establish customer confidence.

Market Dynamics And Factors For 3D Secure Pay Authentication Market

Drivers:

- New Technology And Robust Regulations Are Expected To Push The Market Growth

New technology, such as automated table service and app-based ordering, have been quickly adopted by hotels and restaurants. Customers now have access to a myriad of mobile platforms that make purchasing and paying easier, with several payment options. For things like room reservations and other services, most hotels, resorts, and tourism centers now allow online transactions and payments. Online fraud can happen throughout a reservation transaction. Online payments are commonly performed through online travel agencies (OTAs), online booking engines, and/or directly on the hotel's website. Hotels are more exposed to online payment frauds and malevolent activities when they allow card-present transactions through their property management system, as well as when they make and receive payments online. With the implementation of the PSD2 standard, hoteliers and restaurants will be required to use forced authentication, also known as Strong Customer Authentication (SCA), which requires two-factor authentication (2FA) to be exact and secure while conducting online transactions. The cashless payment system is expanding at an exponential rate, thanks to evolving payment methods, rising e-commerce use, enhanced internet connectivity, and the introduction of new technology. According to Razorpay, digital payment transactions will grow by 76% in 2020. India's digital payments business is estimated to reach USD 700 billion by 2022, according to the Reserve Bank of India.

Restraints:

Over the last few decades, several governments and nationalized banks have established high- and low-value payment systems based on security requirements and proprietary communication. As payment systems become more autonomous, there is a higher requirement for standardization and automation across intra-bank and inter-bank networks between countries. This is predicted to limit the use of 3D secure services, and it usually involves the gathering and correction of human data. Intra-bank transactions enable multinational corporations and banks with subsidiaries and branches to transfer funds to countries where they are needed. Beneficiaries are credited to their foreign operation accounts instantly, or payments are sent to their banks via national clearing and settlement processes or bilateral transfers. As a result, the availability of alternatives is likely to stymie the uptake of 3D secure pay authentication systems.

Opportunities:

The improved 3D Secure protocol, 3DS 2.0, will have a big impact on the payments industry, including the ability to cast a wider net in fraud prevention. There are now more channels where the protocol can be implemented for secure transactions, including non-browser-based platforms and mobile integration. Non-payment authentication is one of the aspects that will be introduced with 3DS 2.0 that allows the protocol to be used in more than just traditional browser-based payments. According to a survey conducted by Mastercard, digital wallets were mentioned in some form or another in 75% of all monitored social media conversations. According to a poll done by Points, nearly 100% of users would use a mobile wallet more frequently if it included a loyalty program. This is where the 3DS 2.0's extra features come into play. It enables the authentication procedure to take place on the merchant's mobile app, adding an extra degree of security when the customer submits their card information on the platform for later usage.

Challenges:

The most difficult aspect of 3DS2 has been knowledge transfer. The merchants and consumers, in particular, were not sufficiently informed about the necessary modifications. Merchants and banks have until the end of 2020 to comply with 3DS2 or face fines. It's worth noting that, aside from information exchange, the banks were also unprepared for the introduction of 3DS2. Many big banks initially failed transactions because they did not support the 3DS version 2 flow, which Visa and Mastercard required. The larger banks were eventually able to deliver a satisfactory implementation of 3DS2 via their app or website, but the lesser banks were unable to keep up. This scenario even stretched to whole countries, as some mandated 3DS2 while others did not. As a result, it became increasingly difficult for merchants, particularly worldwide merchants, to keep up with local compliance and implementation of 3DS2.

Segmentation Analysis of 3D Secure Pay Authentication Market

By Type, the Merchant plug-in is dominating in the 3D Secure Pay Authentication Market. The merchant plug-in (MPI) is one of the most significant aspects of the online card payment system, as it conducts 3D secure pay authentication and verification of debit and credit cards. It's a server-side software module that allows the merchant to identify the issuer card's account number and see if it's registered in the 3D-secure procedure. For example, GPayments Pty Ltd offers ActiveMerchant, Worldline offers Plugins, and Worldpay offers MOLPay, Redsys, and Iyzico. MPI assists in cardholder verification with the issuing bank, resulting in a higher success rate for online transactions. The market for 3D secure pay authentication is dominated by access control servers (ACS). Each card issuer is obligated to maintain ACS, which is an inherent element of the issuer domain/banks.

By Application, Merchants and Payment processors are the dominating in the 3D Secure Pay Authentication Market. In the event of a fraudulent transaction, 3D secure pay authentication protects merchants from chargebacks. Accepting credit cards in Europe requires 3D security, which is presently optional in other locations. It assists merchants and payment processors in reducing fraud and chargebacks, as well as increasing online commerce and cardholder trust. Similarly, 3D secure pay authentication allows banks to take into account elements such as a customer's transaction history, behavioral history, transaction cost, and device information.

Regional Analysis of 3D Secure Pay Authentication Market

North America is dominating the 3D Secure Pay Authentication Market. North America is the potent region for fintech companies due to favored government policies, tax relaxations, and market competitiveness making it an ideal location for fintech companies to invest and introduced new products before the global launch. Also, In North America is the hub for fintech and payment companies such as Visa, Mastercard, America Express, Fiserv. These companies have the upper hand in the regional market. Two-factor authentication also improves security and complies with the new Payment Service Directives (PSD2) standard, which takes effect on September 14, 2019. As international organizations in the United States conduct business with European clients, 3DS2 adoption is projected to expand as they see success in Europe.

Europe region is the fastest-growing region in the 3D Secure Pay Authentication Market. The growth in the region is attributed to the legislation and robust regulatory framework applied in all European Union countries which gives protection for merchants as well as a customer from any misconduct from both ends. Strong Customer Authentication (SCA) imposed in Europe is a part of the revised Payment service directive (PSD2) regulation with the additional mandate of extra authentication measures. The United Kingdom is now the only European country that offers Address Verification Service (AVS) and 3D secure pay authentication. It is one of the only places in the world where providing three-dimensional secure payment authentication has improved total transactions. The United Kingdom has a developed internet shopping business, with most users opting for bank-linked card payments when purchasing goods. The acceptance rate of 3D security is high in nations like Finland, Sweden, Denmark, and Norway (between 83-86 percent acceptance). In terms of payment options, Germany is regarded as one of the most fragmented markets. The bulk of online transactions is made using non-credit card payment options including SOFORT, SEPA direct debit, and Giropay.

Although the Asia Pacific is recognized as a leader in several trends, such as mobile payment and ecommerce adoption, it is also one of the most fragmented areas in terms of digital payments. China is Asia Pacific's largest retail ecommerce market and a major factor behind mobile commerce. UnionPay, Alipay, and WeChat Pay are the most popular payment methods in the nation. Credit and debit cards are the most popular payment methods in nations like Australia, Singapore, and South Korea.

Players Covered in 3D Secure Pay Authentication Market are:

- Visa Inc. (USA)

- Mastercard Incorporated (USA)

- The American Express Company (USA)

- ENTERSEKT (South Africa)

- Broadcom Inc. (USA)

- Medium (Estonia)

- SIA SpA (Italy)

- Fiserv Inc. (USA)

- Cardknox Development Inc. (the USA)

- Marqeta Inc. (the USA)

- Gemalto (Netherlands)

- Adyen (Netherlands)

- Nets Group (Denmark)

- Worldline (France)

- Cybersource (USA)

- Discover Financial Services (USA) and other major players.

Key Industry Developments In 3D Secure Pay Authentication Market:

- In April 2023, Visa announced it is partnering with PayPal and Venmo to pilot Visa+, an innovative service that aims to help individuals move money quickly and securely between different person-to-person (P2P) digital payment apps. Later this year, Venmo and PayPal users in the US will be able to start moving money seamlessly between the two platforms.

- In February 2023, PayU, India's leading online payments solution provider, announced the launch of 3D Secure 2.0 SDK, offering a full native checkout and superior customer experience for all card transactions. PayU merchants can provide optimized customer experience while complying with major card network upgrades - including Visa and Mastercard while gaining better security and fraud protection. PayU's lightweight 3DS 2.0 SDK provides lowered latency and a 40% reduction in checkout time.

|

Global 3D Secure Pay Authentication Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2016 to 2022 |

Market Size in 2023: |

USD 815.39 Mn. |

|

Forecast Period 2024-32 CAGR: |

12.14% |

Market Size in 2032: |

USD 2286.71 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: 3D Secure Pay Authentication Market by Type

5.1 3D Secure Pay Authentication Market Overview Snapshot and Growth Engine

5.2 3D Secure Pay Authentication Market Overview

5.3 Access Control Server

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Access Control Server: Grographic Segmentation

5.4 Merchant Plug-in

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Merchant Plug-in: Grographic Segmentation

5.5 Others

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Others: Grographic Segmentation

Chapter 6: 3D Secure Pay Authentication Market by Application

6.1 3D Secure Pay Authentication Market Overview Snapshot and Growth Engine

6.2 3D Secure Pay Authentication Market Overview

6.3 Merchant & Payment Processors

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Merchant & Payment Processors: Grographic Segmentation

6.4 Banks

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Banks: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 3D Secure Pay Authentication Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 3D Secure Pay Authentication Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 3D Secure Pay Authentication Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 VISA INC.

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 MASTERCARD INCORPORATED

7.4 THE AMERICAN EXPRESS COMPANY

7.5 ENTERSEKT (SOUTH AFRICA)

7.6 BROADCOM INC.

7.7 MEDIUM

7.8 SIA SPA

7.9 FISERV INC.

7.10 CARDKNOX DEVELOPMENT INC.

7.11 MARQETA INC.

7.12 DISCOVER FINANCIAL SERVICES

7.13 OTHER MAJOR PLAYERS

Chapter 8: Global 3D Secure Pay Authentication Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Access Control Server

8.2.2 Merchant Plug-in

8.2.3 Others

8.3 Historic and Forecasted Market Size By Application

8.3.1 Merchant & Payment Processors

8.3.2 Banks

Chapter 9: North America 3D Secure Pay Authentication Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Access Control Server

9.4.2 Merchant Plug-in

9.4.3 Others

9.5 Historic and Forecasted Market Size By Application

9.5.1 Merchant & Payment Processors

9.5.2 Banks

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe 3D Secure Pay Authentication Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Access Control Server

10.4.2 Merchant Plug-in

10.4.3 Others

10.5 Historic and Forecasted Market Size By Application

10.5.1 Merchant & Payment Processors

10.5.2 Banks

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific 3D Secure Pay Authentication Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Access Control Server

11.4.2 Merchant Plug-in

11.4.3 Others

11.5 Historic and Forecasted Market Size By Application

11.5.1 Merchant & Payment Processors

11.5.2 Banks

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa 3D Secure Pay Authentication Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Access Control Server

12.4.2 Merchant Plug-in

12.4.3 Others

12.5 Historic and Forecasted Market Size By Application

12.5.1 Merchant & Payment Processors

12.5.2 Banks

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America 3D Secure Pay Authentication Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Access Control Server

13.4.2 Merchant Plug-in

13.4.3 Others

13.5 Historic and Forecasted Market Size By Application

13.5.1 Merchant & Payment Processors

13.5.2 Banks

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global 3D Secure Pay Authentication Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2016 to 2022 |

Market Size in 2023: |

USD 815.39 Mn. |

|

Forecast Period 2024-32 CAGR: |

12.14% |

Market Size in 2032: |

USD 2286.71 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. 3D SECURE PAY AUTHENTICATION MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. 3D SECURE PAY AUTHENTICATION MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. 3D SECURE PAY AUTHENTICATION MARKET COMPETITIVE RIVALRY

TABLE 005. 3D SECURE PAY AUTHENTICATION MARKET THREAT OF NEW ENTRANTS

TABLE 006. 3D SECURE PAY AUTHENTICATION MARKET THREAT OF SUBSTITUTES

TABLE 007. 3D SECURE PAY AUTHENTICATION MARKET BY TYPE

TABLE 008. ACCESS CONTROL SERVER MARKET OVERVIEW (2016-2028)

TABLE 009. MERCHANT PLUG-IN MARKET OVERVIEW (2016-2028)

TABLE 010. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 011. 3D SECURE PAY AUTHENTICATION MARKET BY APPLICATION

TABLE 012. MERCHANT & PAYMENT PROCESSORS MARKET OVERVIEW (2016-2028)

TABLE 013. BANKS MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA 3D SECURE PAY AUTHENTICATION MARKET, BY TYPE (2016-2028)

TABLE 015. NORTH AMERICA 3D SECURE PAY AUTHENTICATION MARKET, BY APPLICATION (2016-2028)

TABLE 016. N 3D SECURE PAY AUTHENTICATION MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE 3D SECURE PAY AUTHENTICATION MARKET, BY TYPE (2016-2028)

TABLE 018. EUROPE 3D SECURE PAY AUTHENTICATION MARKET, BY APPLICATION (2016-2028)

TABLE 019. 3D SECURE PAY AUTHENTICATION MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC 3D SECURE PAY AUTHENTICATION MARKET, BY TYPE (2016-2028)

TABLE 021. ASIA PACIFIC 3D SECURE PAY AUTHENTICATION MARKET, BY APPLICATION (2016-2028)

TABLE 022. 3D SECURE PAY AUTHENTICATION MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA 3D SECURE PAY AUTHENTICATION MARKET, BY TYPE (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA 3D SECURE PAY AUTHENTICATION MARKET, BY APPLICATION (2016-2028)

TABLE 025. 3D SECURE PAY AUTHENTICATION MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA 3D SECURE PAY AUTHENTICATION MARKET, BY TYPE (2016-2028)

TABLE 027. SOUTH AMERICA 3D SECURE PAY AUTHENTICATION MARKET, BY APPLICATION (2016-2028)

TABLE 028. 3D SECURE PAY AUTHENTICATION MARKET, BY COUNTRY (2016-2028)

TABLE 029. VISA INC.: SNAPSHOT

TABLE 030. VISA INC.: BUSINESS PERFORMANCE

TABLE 031. VISA INC.: PRODUCT PORTFOLIO

TABLE 032. VISA INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. MASTERCARD INCORPORATED: SNAPSHOT

TABLE 033. MASTERCARD INCORPORATED: BUSINESS PERFORMANCE

TABLE 034. MASTERCARD INCORPORATED: PRODUCT PORTFOLIO

TABLE 035. MASTERCARD INCORPORATED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. THE AMERICAN EXPRESS COMPANY: SNAPSHOT

TABLE 036. THE AMERICAN EXPRESS COMPANY: BUSINESS PERFORMANCE

TABLE 037. THE AMERICAN EXPRESS COMPANY: PRODUCT PORTFOLIO

TABLE 038. THE AMERICAN EXPRESS COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. ENTERSEKT (SOUTH AFRICA): SNAPSHOT

TABLE 039. ENTERSEKT (SOUTH AFRICA): BUSINESS PERFORMANCE

TABLE 040. ENTERSEKT (SOUTH AFRICA): PRODUCT PORTFOLIO

TABLE 041. ENTERSEKT (SOUTH AFRICA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. BROADCOM INC.: SNAPSHOT

TABLE 042. BROADCOM INC.: BUSINESS PERFORMANCE

TABLE 043. BROADCOM INC.: PRODUCT PORTFOLIO

TABLE 044. BROADCOM INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. MEDIUM: SNAPSHOT

TABLE 045. MEDIUM: BUSINESS PERFORMANCE

TABLE 046. MEDIUM: PRODUCT PORTFOLIO

TABLE 047. MEDIUM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. SIA SPA: SNAPSHOT

TABLE 048. SIA SPA: BUSINESS PERFORMANCE

TABLE 049. SIA SPA: PRODUCT PORTFOLIO

TABLE 050. SIA SPA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. FISERV INC.: SNAPSHOT

TABLE 051. FISERV INC.: BUSINESS PERFORMANCE

TABLE 052. FISERV INC.: PRODUCT PORTFOLIO

TABLE 053. FISERV INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. CARDKNOX DEVELOPMENT INC.: SNAPSHOT

TABLE 054. CARDKNOX DEVELOPMENT INC.: BUSINESS PERFORMANCE

TABLE 055. CARDKNOX DEVELOPMENT INC.: PRODUCT PORTFOLIO

TABLE 056. CARDKNOX DEVELOPMENT INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. MARQETA INC.: SNAPSHOT

TABLE 057. MARQETA INC.: BUSINESS PERFORMANCE

TABLE 058. MARQETA INC.: PRODUCT PORTFOLIO

TABLE 059. MARQETA INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. DISCOVER FINANCIAL SERVICES: SNAPSHOT

TABLE 060. DISCOVER FINANCIAL SERVICES: BUSINESS PERFORMANCE

TABLE 061. DISCOVER FINANCIAL SERVICES: PRODUCT PORTFOLIO

TABLE 062. DISCOVER FINANCIAL SERVICES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 063. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 064. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 065. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. 3D SECURE PAY AUTHENTICATION MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. 3D SECURE PAY AUTHENTICATION MARKET OVERVIEW BY TYPE

FIGURE 012. ACCESS CONTROL SERVER MARKET OVERVIEW (2016-2028)

FIGURE 013. MERCHANT PLUG-IN MARKET OVERVIEW (2016-2028)

FIGURE 014. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 015. 3D SECURE PAY AUTHENTICATION MARKET OVERVIEW BY APPLICATION

FIGURE 016. MERCHANT & PAYMENT PROCESSORS MARKET OVERVIEW (2016-2028)

FIGURE 017. BANKS MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA 3D SECURE PAY AUTHENTICATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE 3D SECURE PAY AUTHENTICATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC 3D SECURE PAY AUTHENTICATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA 3D SECURE PAY AUTHENTICATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA 3D SECURE PAY AUTHENTICATION MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the 3D Secure Pay Authentication Market research report is 2024-2032.

Visa Inc. (USA), Mastercard Incorporated (USA), The American Express Company (USA), ENTERSEKT (South Africa), Broadcom Inc. (USA), Medium (Estonia), SIA SpA (Italy), Fiserv Inc. (USA), Cardknox Development Inc. (the USA), Marqeta Inc. (the USA), Discover Financial Services (USA), and other major players.

The 3D Secure Pay Authentication Market is segmented into Type, Application, and region. By Type, the market is categorized into Access Control Server, Merchant Plug-in, Others. By Application, the market is categorized into Merchant & Payment Processors, Banks. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

3D Secure is an extra layer of security that you may enable for each online card transaction. Customers and vendors benefit from increased security.

3D Secure Pay Authentication Market Size Was Valued at USD 815.39 Million in 2023 and is Projected to Reach USD 2286.71 Million by 2032, Growing at a CAGR of 12.14% From 2024-2032