Bottled Water Market Synopsis

According to a new report published by Introspective Market Research, titled, ?Bottled Water Market by Type, Packaging, and Distribution Channel: Global Opportunity Analysis and Industry Forecast, 2024?2032,?

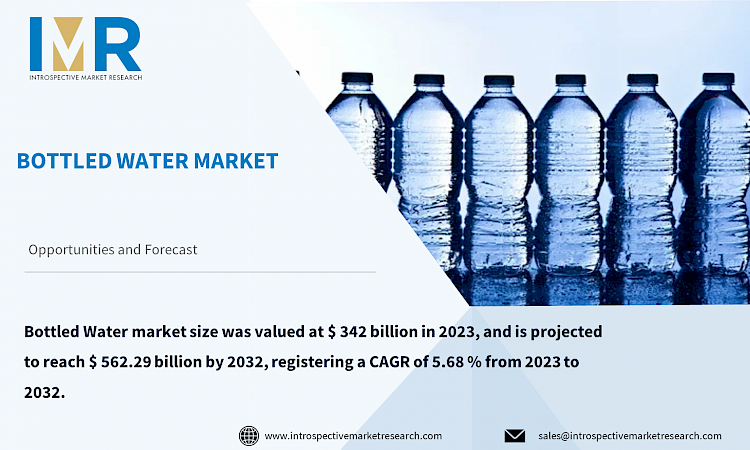

global Bottled Water market size was valued at $ 342 billion in 2023, and is projected to reach $ 562.29 billion by 2032, registering a CAGR of 5.68 % from 2023 to 2032.

The bottled water market involves producing, packaging, and distributing drinking water in sealed containers made of plastic, glass, or other materials. It includes various types such as spring, mineral, purified, alkaline, sparkling, and electrolyte-enhanced waters. These products are sold through supermarkets, convenience stores, vending machines, and online platforms.

Key drivers of the global bottled water market include rising health consciousness, changing lifestyles, the convenience of on-the-go hydration, concerns about tap water quality, and aggressive marketing strategies. Bottled water is perceived as a reliable source of hydration, free from the chlorine taste of tap water, making it a preferred choice for many, especially when traveling or outdoors. The market's significant impact is evident in its revenue generation, job creation, and influence on consumer preferences in health and wellness, urbanization, and lifestyle changes.

The market is expanding beyond traditional still and sparkling water to include functional and enhanced waters with added vitamins, minerals, and electrolytes. The growing awareness of health and well-being is leading consumers to choose healthier alternatives like purified and nutrient-enriched bottled water. Rapid urbanization and population growth are driving investments in water infrastructure, including purification and treatment facilities. Sustainable packaging is also becoming more popular, with consumers preferring eco-friendly options like glass and aluminum bottles. Companies are diversifying their offerings to include flavored and functionally enhanced waters, catering to evolving consumer preferences.

Health consciousness is boosting demand for bottled water as a healthier alternative to sugary drinks. Urbanization and declining tap water quality in many areas are further driving this demand. Brands emphasizing health benefits and rigorous purification processes are particularly appealing to consumers. Segmentation analysis shows that mineral and sparkling water are expected to dominate the market. The Asia Pacific region leads the market, driven by a growing middle class, urbanization, and concerns about tap water quality. North America follows as the second-largest market, fueled by rising demand for beverages and personal care products.

Global Bottled Water Market, Segmentation

The Bottled Water market is segmented based on Type, Packaging, and Distribution Channel, and region.

Type:

The mineral water segment focuses on water from natural springs or wells, rich in essential minerals like calcium, magnesium, and potassium. Consumers are attracted to mineral water for its perceived health benefits, including improved digestion and bone health. The segment thrives on increasing health consciousness and the desire for pure, natural hydration. Companies often highlight the specific mineral compositions and purity of their products, differentiating them from other water types. Innovation within this segment includes eco-friendly packaging and the introduction of flavored variants to broaden consumer appeal.

Packaging:

The polyethylene terephthalate (PET) segment is dominant due to its favorable properties. PET bottles are lightweight, durable, and shatter-resistant, making them convenient for transportation and everyday use. PET is cost-effective and offers excellent clarity, enhancing the visual appeal of bottled water. Its recyclability addresses environmental concerns, contributing to sustainability efforts. The material's versatility allows for various bottle shapes and sizes, catering to diverse consumer preferences. The widespread availability of PET, coupled with technological advancements in manufacturing, supports large-scale production, further solidifying its leading position in the market. Consequently, PET remains the preferred choice for both manufacturers and consumers globally.

Region:

The Asia Pacific region is experiencing significant growth in its middle-class population, leading to a shift in preferences towards products emphasizing safety, hygiene, and convenience. Bottled water, being packaged and regulated, meets these needs by assuring clean and safe drinking water. Countries like China, India, Indonesia, Japan, and Vietnam are seeing a surge in bottled water demand due to rapid economic growth, urbanization, and industrialization, which raises concerns about tap water quality. Middle-income consumers prioritize health and are willing to spend more on perceived safe products. Bottled water offers convenience and portability, making it a preferred choice. North America, the second-largest market, is driven by increasing demand for bottled water, beverages, and personal care products.

Some of The Leading/Active Market Players Are-

- Bisleri International (India)

- Nestl? (Switzerland)

- PepsiCo (United States)

- The Coca-Cola Company (United States)

- DANONE (France)

- Primo Water Corporation (United States)

- Gerolsteiner Brunnen (Germany)

- Mountain Valley Spring (US)

- CG Roxane (US), Fiji water (US)

- Keurig Dr Pepper Inc. (US), and Other Active Players

Key Industry Developments

In April 2023, PepsiCo announced a new partnership with Constellation Brands to expand its presence in the alcoholic beverage market. PepsiCo will be acquiring Constellation Brands' wine and spirits brands, including Svedka vodka, Corona Extra beer, and Robert Mondavi wine, for a total of $41 billion.

In May 2023, Coca-Cola announced an investment of $50 million in plant-based packaging company Aseptic Packaging. Aseptic Packaging's technology allows for the production of shelf-stable bottled water without the use of preservatives or artificial flavors.

Key Findings of the Study

- Rising health consciousness and urbanization are major drivers, with consumers favoring bottled water over sugary drinks and tap water due to perceived health benefits and concerns over tap water quality.

- The Asia Pacific region leads the market, driven by a growing middle class and urbanization, while North America follows as the second-largest market due to increasing demand for beverages and personal care products.

- The PET packaging segment dominates the market due to its lightweight, durability, and recyclability, aligning with consumer preferences for eco-friendly options.