Yeast Extract Market Synopsis

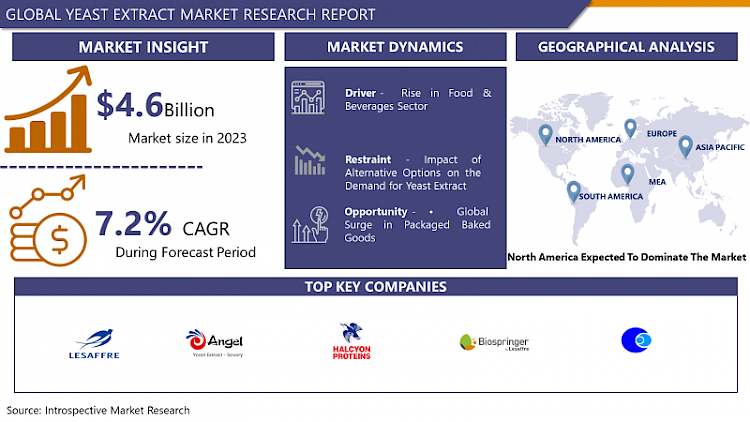

Yeast Extract Market Size Was Valued at USD 4.6 Billion in 2023, and is Projected to Reach USD 8.6 Billion by 2032, Growing at a CAGR of 7.2% From 2024-2032.

Yeast extract is a clean-label constituent that is used in different products such as sauces, soups, ready meals, and savory snacks. The product in question is obtained from fresh yeast, which is used in making bread and beers as well as in the preparation of wines. The substance is characterized by its distinctive tasty flavor and acts as a taste enhancer in the preparation of a variety of foods as a seasoning agent.

The foremost use of yeast extract is in the production of food and beverage products as a flavor enhancer and also in restaurants. Its use is to enhance the flavor of a range of foods and beverages as well as add flavor to sauces, soups, snacks, seasonings, meat products, prepared meals, and other food products. The food services sector is going through a strong growth phase and the top food processing firms are increasingly expressing their intentions to expand in the developing countries such as China & India. This is indicative of a rather robust growth chance for the market.

- Consumer diets are shifting to products that can be consumed quickly due to the busy nature of their routines or increased earning capabilities due to economic growth. The market is experiencing increased consumption of packaged foods since it simplifies their usage as a consumers’ commodity. Yeast extract is widely used in the manufacture of frozen foods, snack goods, sauces, and soups to enhance the palatability of these products due to its rich, savory taste. The increasing demand for yeast extract in the global markets can be attributed to the growing consumption of processed foods during the forecast period.

- The application of yeast extracts as products of baker’s yeast is further expected to grow at a compound annual growth rate of more than XX% for the timeframe till 2030. It is an important food that contains various nutrients such as amino acids, trace elements, peptides, nucleotides, and vitamins. These nutrients are essential in maintaining the metabolic activities of the bacteria and encouraging their growth. With improving economy and rising disposable income bread consumption has gone up especially in China and India enhancing the probable demand for bakery products. The industry growth will be boosted by the increased trend in the FDA regulation relating to the use of baker’s yeast extract in food products.

- The major inputs used for the production of yeast extract include baker’s yeast especially saccharomyces cerevisiae, sugar molasse and nitrogen. The growth of the yeast extract market can also be under threat because of the fluctuations in the prices of such materials. Due to high costs for instance in holding buffers of molasses for biofuel production, there has been a consecutively declining supply of yeast extract to manufactures. This has in turn led to increased competition in the industry as players seek to achieve competitive advantages. In addition, competition from easily available and comparatively cheaper substitutes, use of ingredients such as MSG, HVPs, HAPs and nucleotides in foods also paradoxically put a limit on the consumption of yeast extracts on a global level.

Yeast Extract Market Trend Analysis

Rising Trend in Veganism Adoption Drive the Market

- This dietary preference for veganism is expected to extend further and strengthen the use of Nutritional Yeast Extract as a well-entrenched pattern. Nutritional yeast has become widely known for its unique, nutty cheesy-like taste, and is perfect for those on a gluten free and vegan diet.

- There are global tendencies towards an increase in the consumption of food products without added or high amounts of salt, organic foods, vegan, and plant-based protein products. Recent observations reveal that inactive dried nutritional yeast is widely used in the domain of animal feed. By virtue of the aforementioned factors, the demand for nutritional yeast rises at a very high rate. Yeast refers to fungi that are made up of single cells; these microscopic organisms are found within plants and soil. For instance, yeast does not contain a cardiovascular or a nervous system, as one would expect in animals.

- In addition, BY avoiding cruel products and opting for yeast products, we eliminate animal suffering and exploitation. This is in parity with the ethical principles and values as embraced among vegans. The products contain a high proportion of mineral trace elements, vitamins, and antioxidant accumulators. It is widely used as an active ingredient in a broad category of food items serving to accelerate the improvement of the texture and taste of these foods in addition to boosting their nutritional value.

Global Widespread Use in Food and Beverage Sector boost the sales

- Yeast extract is considered to be one of the essential ingredients which contribute to leavening of bread in the baking industry. This particular substance is vividly used within the food and beverage industry to enhance the fermentation process of draft beers via adding glucose. These vital nutrients consist of selenium, chromium, protein, potassium, zinc, magnesium, and iron among others. These nutrients are known for their health benefits when taken as a dietary supplement. The product in question has a high application flexibility and should be familiar to many individuals due to its common uses in culinary preparations including bouillons, seasoning sauces, soups, and savory snacking. Moreover, this particular product is very useful when it comes to preparing vegetarian and vegan dishes. The key trend that promotes the yeast extract market development is the increase in the consumption of alcoholic beverages and the efforts of producers to provide consumers with quality products containing natural components for healthy diets.

Yeast Extract Market Segment Analysis:

Yeast Extract Market Segmented based on type, and application.

By type, autolyzed segment is expected to dominate the market during the forecast period

- The autolyzed technology segment exhibited a high market penetration in 2020, accounting for a large share of 63%. 99%. Moving further, the segment in question is expected to witness high dominance within the study period of 2022-2029. This can be considered as due to the fact that the product proved to be very popular in terms of taste and this makes it suitable for a great number of foods such as soups, dressings and bakery products. The tested product has a satisfactory level of vitamin B as well as micronutrients. The primary driving force for the clean label products growth is the consumer preference for products which contain natural food ingredients to enhance their quality.

- There are two commonly employed methodologies for the production of yeast extract: There are two hydrolysis types: autolysis and hydrolysis.

- Self-degradation is a naturally occurring phenomenon that occurs post cell death. The action described here is related to the process of controlled self-destruction in a yeast cell that takes place due to the action of endo-exonucleases – the enzymes created by the cell to digest it. The autolysis process has limitations as follows; difficulties in separating the clarified liquid from the insoluble solids, and also low extraction efficiency. These disadvantages are attributed mainly due to the fact that time taken in incubations may lead to contamination by microbes.

By application, food and beverage segment held the largest share in 2023

- Yeast extracts have seen widespread acceptance in the F&B processing industry and are used across every food sector including dairy alternatives, bakery, energy drinks, and confectionery industries. Yeast extracts are also used more in recent days due to the many health benefits that are associated with the use of yeast extracts. They work as an efficient method of producing specific and unique tastes by intensifying one or more ingredients, and eradicating the need for other components for good, when these relate to healthier eating or clean label. Yeast extracts have found to be very effective in a variety of processed meat and poultry products, convenience foods such as canned and frozen products, and other food and beverage products both in savory and sweet categories. Also, yeasts are additive, which is considered most appropriate for applying to vegan and vegetarian foods due to the exclusion of artificial, animal, and synthetic components.

Yeast Extract Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Burgeoning demand for clean label ingredients and additives is fuelling growth in North American region, which is considered as one of the most important region in the global market. Moreover, it is believed that the regional market will expand due to the rising interest in convenience products like ready to eat food items. This need can therefore be associated with changes which have occurred in consumer diets. It is used as a natural additive, mainly as a salt replacer and a food conditioner that is used in baked goods, canned and frozen soups and sauces, meat products, fish, and seasoned mixes.

- This growth can be attributed to the use of flavor enhancers with good and clean tastes and smells. The consumer demographics of the region are showing a rising trend of health and environment consciousness amongst consumers. This is well illustrated through the increase in the awareness of factors such as traceability, naturality, sustainability, and the effects of food choices on nutrition.

Active Key Players in the Yeast Extract Market

- Lesaffre (France)

- AngelYeast Co., Ltd (China)

- Halcyon Proteins, (Australia)

- Biospringer. (France)

- Thai Foods International (Thailand)

- Alltech (U.S.)

- Synergy Flavors (U.S.)

- Lallemand, Inc. (Canada)

- Ohly (Germany)

- Leiber GmBH (Germany)

- Other Key Players

Key Industry Developments in the Yeast Extract Market:

- In June 2024, Lesaffre, a global fermentation and microorganisms’ expert, announced the acquisition of DSM-firmenich’s yeast extract business. This strategic move enhances Lesaffre’s capabilities in savory ingredients, expanding its product range and R&D expertise. The collaboration includes acquiring DSM-firmenich’s know-how and technology and strengthening Biospringer through Lesaffre’s market presence and customer offerings.

- In December 2023, Lallemand’s Bio-Ingredients and Specialty Cultures have launched Natural Rosé, a yeast extract-based product designed to reduce color formulation in processed meat products. This innovative solution offers a natural alternative for meat processors, enhancing the appeal of their products while maintaining quality and color consistency.

|

Global Yeast Extract Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.2 % |

Market Size in 2032: |

USD 8.6 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- YEAST EXTRACT MARKET BY TYPE (2017-2032)

- YEAST EXTRACT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AUTOLYZED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HYDROLYZED

- YEAST EXTRACT MARKET BY APPLICATION (2017-2032)

- YEAST EXTRACT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FOOD AND BEVERAGES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ANIMAL FEED

- PHARMACEUTICALS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Luxury Goods Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- LESAFFRE (FRANCE)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ANGELYEAST CO., LTD (CHINA)

- HALCYON PROTEINS, (AUSTRALIA)

- BIOSPRINGER. (FRANCE)

- THAI FOODS INTERNATIONAL (THAILAND)

- ALLTECH (U.S.)

- SYNERGY FLAVORS (U.S.)

- LALLEMAND, INC. (CANADA)

- OHLY (GERMANY)

- LEIBER GMBH (GERMANY)

- COMPETITIVE LANDSCAPE

- GLOBAL YEAST EXTRACT MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Segment3

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Yeast Extract Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.2 % |

Market Size in 2032: |

USD 8.6 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. YEAST EXTRACT MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. YEAST EXTRACT MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. YEAST EXTRACT MARKET COMPETITIVE RIVALRY

TABLE 005. YEAST EXTRACT MARKET THREAT OF NEW ENTRANTS

TABLE 006. YEAST EXTRACT MARKET THREAT OF SUBSTITUTES

TABLE 007. YEAST EXTRACT MARKET BY TECHNOLOGY

TABLE 008. HYDROLYZED YEAST MARKET OVERVIEW (2016-2028)

TABLE 009. AUTOLYZED YEAST MARKET OVERVIEW (2016-2028)

TABLE 010. YEAST EXTRACT MARKET BY SOURCE

TABLE 011. BAKER'S YEAST MARKET OVERVIEW (2016-2028)

TABLE 012. BREWER'S YEAST MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. YEAST EXTRACT MARKET BY APPLICATION

TABLE 015. FOOD AND BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 016. ANIMAL FEED MARKET OVERVIEW (2016-2028)

TABLE 017. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

TABLE 018. AND OTHERS MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA YEAST EXTRACT MARKET, BY TECHNOLOGY (2016-2028)

TABLE 020. NORTH AMERICA YEAST EXTRACT MARKET, BY SOURCE (2016-2028)

TABLE 021. NORTH AMERICA YEAST EXTRACT MARKET, BY APPLICATION (2016-2028)

TABLE 022. N YEAST EXTRACT MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE YEAST EXTRACT MARKET, BY TECHNOLOGY (2016-2028)

TABLE 024. EUROPE YEAST EXTRACT MARKET, BY SOURCE (2016-2028)

TABLE 025. EUROPE YEAST EXTRACT MARKET, BY APPLICATION (2016-2028)

TABLE 026. YEAST EXTRACT MARKET, BY COUNTRY (2016-2028)

TABLE 027. ASIA PACIFIC YEAST EXTRACT MARKET, BY TECHNOLOGY (2016-2028)

TABLE 028. ASIA PACIFIC YEAST EXTRACT MARKET, BY SOURCE (2016-2028)

TABLE 029. ASIA PACIFIC YEAST EXTRACT MARKET, BY APPLICATION (2016-2028)

TABLE 030. YEAST EXTRACT MARKET, BY COUNTRY (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA YEAST EXTRACT MARKET, BY TECHNOLOGY (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA YEAST EXTRACT MARKET, BY SOURCE (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA YEAST EXTRACT MARKET, BY APPLICATION (2016-2028)

TABLE 034. YEAST EXTRACT MARKET, BY COUNTRY (2016-2028)

TABLE 035. SOUTH AMERICA YEAST EXTRACT MARKET, BY TECHNOLOGY (2016-2028)

TABLE 036. SOUTH AMERICA YEAST EXTRACT MARKET, BY SOURCE (2016-2028)

TABLE 037. SOUTH AMERICA YEAST EXTRACT MARKET, BY APPLICATION (2016-2028)

TABLE 038. YEAST EXTRACT MARKET, BY COUNTRY (2016-2028)

TABLE 039. ANGEL EAST: SNAPSHOT

TABLE 040. ANGEL EAST: BUSINESS PERFORMANCE

TABLE 041. ANGEL EAST: PRODUCT PORTFOLIO

TABLE 042. ANGEL EAST: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. DSM: SNAPSHOT

TABLE 043. DSM: BUSINESS PERFORMANCE

TABLE 044. DSM: PRODUCT PORTFOLIO

TABLE 045. DSM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. AB MAURI: SNAPSHOT

TABLE 046. AB MAURI: BUSINESS PERFORMANCE

TABLE 047. AB MAURI: PRODUCT PORTFOLIO

TABLE 048. AB MAURI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. LESAFFRE GROUP: SNAPSHOT

TABLE 049. LESAFFRE GROUP: BUSINESS PERFORMANCE

TABLE 050. LESAFFRE GROUP: PRODUCT PORTFOLIO

TABLE 051. LESAFFRE GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. SYNERGY FLAVORS: SNAPSHOT

TABLE 052. SYNERGY FLAVORS: BUSINESS PERFORMANCE

TABLE 053. SYNERGY FLAVORS: PRODUCT PORTFOLIO

TABLE 054. SYNERGY FLAVORS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. OHLY: SNAPSHOT

TABLE 055. OHLY: BUSINESS PERFORMANCE

TABLE 056. OHLY: PRODUCT PORTFOLIO

TABLE 057. OHLY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. ALLTECH: SNAPSHOT

TABLE 058. ALLTECH: BUSINESS PERFORMANCE

TABLE 059. ALLTECH: PRODUCT PORTFOLIO

TABLE 060. ALLTECH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. BIORIGIN: SNAPSHOT

TABLE 061. BIORIGIN: BUSINESS PERFORMANCE

TABLE 062. BIORIGIN: PRODUCT PORTFOLIO

TABLE 063. BIORIGIN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. ORIENTAL YEAST: SNAPSHOT

TABLE 064. ORIENTAL YEAST: BUSINESS PERFORMANCE

TABLE 065. ORIENTAL YEAST: PRODUCT PORTFOLIO

TABLE 066. ORIENTAL YEAST: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. KERRY GROUP: SNAPSHOT

TABLE 067. KERRY GROUP: BUSINESS PERFORMANCE

TABLE 068. KERRY GROUP: PRODUCT PORTFOLIO

TABLE 069. KERRY GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. HALCYON PROTEINS: SNAPSHOT

TABLE 070. HALCYON PROTEINS: BUSINESS PERFORMANCE

TABLE 071. HALCYON PROTEINS: PRODUCT PORTFOLIO

TABLE 072. HALCYON PROTEINS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. LALLEMAND INC.: SNAPSHOT

TABLE 073. LALLEMAND INC.: BUSINESS PERFORMANCE

TABLE 074. LALLEMAND INC.: PRODUCT PORTFOLIO

TABLE 075. LALLEMAND INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. LEIBER GMBH.: SNAPSHOT

TABLE 076. LEIBER GMBH.: BUSINESS PERFORMANCE

TABLE 077. LEIBER GMBH.: PRODUCT PORTFOLIO

TABLE 078. LEIBER GMBH.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. THAI FOODS INTERNATIONAL CO. LTD.: SNAPSHOT

TABLE 079. THAI FOODS INTERNATIONAL CO. LTD.: BUSINESS PERFORMANCE

TABLE 080. THAI FOODS INTERNATIONAL CO. LTD.: PRODUCT PORTFOLIO

TABLE 081. THAI FOODS INTERNATIONAL CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. SPECIALTY BIOTECH: SNAPSHOT

TABLE 082. SPECIALTY BIOTECH: BUSINESS PERFORMANCE

TABLE 083. SPECIALTY BIOTECH: PRODUCT PORTFOLIO

TABLE 084. SPECIALTY BIOTECH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. SENSIENT TECHNOLOGY PVT LTD.: SNAPSHOT

TABLE 085. SENSIENT TECHNOLOGY PVT LTD.: BUSINESS PERFORMANCE

TABLE 086. SENSIENT TECHNOLOGY PVT LTD.: PRODUCT PORTFOLIO

TABLE 087. SENSIENT TECHNOLOGY PVT LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. TITAN BIOTECH LTD CO.: SNAPSHOT

TABLE 088. TITAN BIOTECH LTD CO.: BUSINESS PERFORMANCE

TABLE 089. TITAN BIOTECH LTD CO.: PRODUCT PORTFOLIO

TABLE 090. TITAN BIOTECH LTD CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. KOHJIN LIFE SCIENCE: SNAPSHOT

TABLE 091. KOHJIN LIFE SCIENCE: BUSINESS PERFORMANCE

TABLE 092. KOHJIN LIFE SCIENCE: PRODUCT PORTFOLIO

TABLE 093. KOHJIN LIFE SCIENCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. KOTHARI FERMENTATION AND BIOCHEM LTD.: SNAPSHOT

TABLE 094. KOTHARI FERMENTATION AND BIOCHEM LTD.: BUSINESS PERFORMANCE

TABLE 095. KOTHARI FERMENTATION AND BIOCHEM LTD.: PRODUCT PORTFOLIO

TABLE 096. KOTHARI FERMENTATION AND BIOCHEM LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. YEAST EXTRACT MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. YEAST EXTRACT MARKET OVERVIEW BY TECHNOLOGY

FIGURE 012. HYDROLYZED YEAST MARKET OVERVIEW (2016-2028)

FIGURE 013. AUTOLYZED YEAST MARKET OVERVIEW (2016-2028)

FIGURE 014. YEAST EXTRACT MARKET OVERVIEW BY SOURCE

FIGURE 015. BAKER'S YEAST MARKET OVERVIEW (2016-2028)

FIGURE 016. BREWER'S YEAST MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. YEAST EXTRACT MARKET OVERVIEW BY APPLICATION

FIGURE 019. FOOD AND BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 020. ANIMAL FEED MARKET OVERVIEW (2016-2028)

FIGURE 021. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

FIGURE 022. AND OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA YEAST EXTRACT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE YEAST EXTRACT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC YEAST EXTRACT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA YEAST EXTRACT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA YEAST EXTRACT MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Yeast Extract Market research report is 2024-2032.

Lesaffre (France), AngelYeast Co., Ltd (China), Halcyon Proteins, (Australia), Biospringer. (France), Thai Foods International (Thailand), Alltech (U.S.), Synergy Flavors (U.S.), Lallemand, Inc. (Canada), Ohly (Germany), Leiber GmBH (Germany), and Other Major Players..

The Yeast Extract Market is segmented into type, application, and region. By type, the market is categorized into XX. By application, the market is categorized into XX. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Yeast extract is a food constituent procured from yeast, especially from the saccharomyces cerevisiae through a process called autolyse which implies self-digestive process. This substance is one of the richest sources of amino acids, vitamins, minerals, nucleotids, which makes it an addendum valuable in the food industry. Yeast extract helps intensify inherent flavors, and a popular characteristic attributed to it is taste associated with broth or meat. It is generally incorporated into soups, sauces, snack products as well as processed foods to enhance taste to the required level without necessarily having to incorporate more sodium or artificial chemically produced flavors.

Yeast Extract Market Size Was Valued at USD 4.6 Billion in 2023, and is Projected to Reach USD 8.6 Billion by 2032, Growing at a CAGR of 7.2% From 2024-2032.