Xylitol Market Synopsis

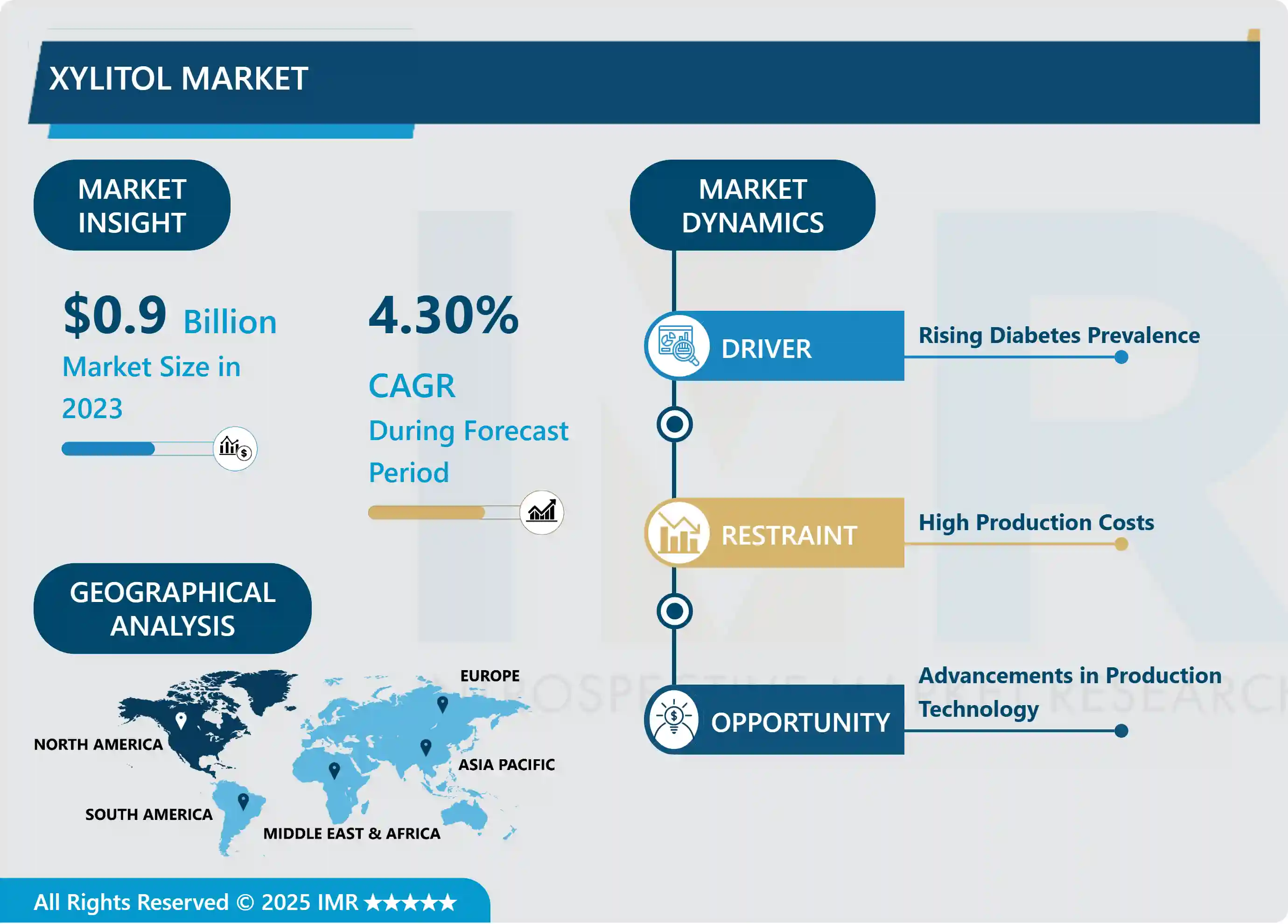

Xylitol Market Size Was Valued at USD 0.90 Billion in 2023 and is Projected to Reach USD 1.31 Billion by 2032, Growing at a CAGR of 4.30% From 2024-2032.

Xylitol is the fifth in the list of sugar alcohols and is also used as a sweetener. It is usually found in a number of fruits and vegetables including berries, corn and mushrooms. The physical and chemical composition of xylitol very closely resembles that of sucrose, or table sugar, without the majority of calories; in fact, it contains only 40% of the caloric content of regular table sugar. It is commonly employed as an artificial sweetener in sugarless gum, candies, and mouth wash products and the like because of its dental advantages.

The market for xylitol has also been growing steadily responsive to consumers’ needs for the reduction of sugar consumption and for the known health benefits of xylitol. Xylitol is an impoveriser of the glycaemic index it is obtained from the birch trees and from corn and is approved for use by the diabetic and the health conscious societies the world over. The increase in the consumption of low calorie sweeteners can be attributed to the increase in obesity and diabetes in consumers and sweeteners are applied in in food, beverages, oral care products and pharmaceutical products. Also, power-packed growth in clean label products and a global move towards natural ingredients have added to extensive market growth.

North America and Europe are seen as the global leaders in product penetration, and availability in Asia-Pacific has also risen due to changes in diets and life styles. At the same time, new product developments in the formulation of functional foods and commercialization of xylitol will offer robust profitability to market stakeholders in the next couple of years. However, issues arising from the procurement of raw materials and price change on the market are key issues that might affect the market. Altogether, the xylitol market will remain rather promising in view of the tendencies in the field of health improvement and people’s tendency towards the usage of sweeteners and sugar replacements in their daily lives.

Xylitol Market Trend Analysis

A Natural Sweetener for Health-Conscious Consumers

- Xylitol which is converted from birch trees and other plant sources is also being preferred by modern and healthier population who is being very selective in the use of sugar. A low glycemic index makes it popular among those with diabetes and everyone eager to avoid drastic spikes in blood sugar. Since the public becomes more informed on how high sugar has negative effects towards their health for instance obesity and metabolic syndrome, many consumers will therefore, intentionally choose products that are in compliance with their desired healthy lifestyle. This change of consumers’ preferences can also be explained by the increasing number of studies showing the positive effects of xylitol for the oral health since this sugar substitute can prevent the formation of cavities by decreasing the proliferation of pathogenic bacteria in the oral cavity. As such, manufacturers are levelling up to this call by adding xylitol in the production of their products or developing new ones which are sweetened majorly by this substance taking into consideration the health-conscious persons.

- Xylitol is again favoured through the growing demand of sugarless products in the market. They continue to shift their preferences towards NO/LOW sugar products especially in chewing gums, candies, bakery goods and beverages, and xylitol has been proven to be an ingredient of choice due to the sweetener’s taste profile and functionality. This trend is being exploited by companies that include xylitol into their products as they advertise these products as healthier options while offering the same taste and texture. Furthermore, the wave of clean label, which focuses on clear and transparent declaration of ingredients and the way of their production, makes many consumers lean to natural products especially if compared to artificial sweeteners, such as xylitol. This has not only fuelled innovation with consumers, but also has parallels competition which can promote the escalation of the xylitol based products hence boosting this natural sweetener across diversified sectors of food and beverages industry.

Beyond Food and Beverages

- Although the use of xylitol in sweetening food and beverages is remarkable, this ingredient finds substantial utility in personal care and drug items. The benefits of its use in oral hygiene has propelled it as an active market component for many oral care products such as tooth paste, mouth wash and chewing gum. This use of xylitol makes it reduce the growth of other detrimental bacteria as it prevents cavities and enhances dental health. Since people are beginning to pay attention to their dental health, xylitol containing products are on the rise so that manufacturers can develop new formulations that make use of this natural sweetener. This entry into cleaning and personal care represents a further embrace of xylitol as a versatile ingredient that is not solely a sweetener, but has functional benefits for the overall well being of consumers.

- Also, the increasing demand for clean label products which supports the market rapidly affects the xylitol market as consumers switch to natural ingredients that are GMO-free and have clear sourcing. This change in consumers is putting pressure on manufacturers of these products not only to include xylitol in their products but also source the ingredients eco-friendly. Today many companies pay much attention to the fact that xylitol should be produced from renewable raw materials, extracted for example from birch or from corn starch, because people caring about the environment are very important to manufacturers. Moreover, by calling attention to these sustainable practices and pointing out that xylitol is derived from a natural source, manufacturers can make the appeal for the ingredient that is becoming a key focus in a market that lean heavily towards health and wellness and sustainability. In light of the growing appreciation of the versatility of xylitol, the prospect of catalyzing change, across numerous sectors remains great and will, therefore, spur on future development of the market.

Xylitol Market Segment Analysis:

Xylitol Market Segmented based on By Form, By Raw Materials and By Application

By Form, Solid segment is expected to dominate the market during the forecast period

- While large and pure xylitol has found its application in the international food industry and especially in Chewing gum and confectionery products. Thanks to this characteristic, solid xylitol can be easily incorporated into many formulations due to its granular structure. It also thickens food and contributes a pleasantly sweet taste – as sweet as sucrose – without the caloric content. It crystalline structure also makes it retain the right texture in products, which is why it is often preferred by manufacturers who are interested in creating new products with little or no sugar content. Moreover, solid xylitol is a chemically stable material: it maintains its physical properties when treated under different thermal conditions. This stability helps the final product to maintain quality and the dish’s taste, which will win over health-conscious consumers seeking suitable substitutes.

- Also, the present solid xylitol has low hygroscopicity which indicates the extent of moisture that it is capable of absorbing in the system. Of this characteristic is all the more beneficial in food applications because it results in maintained textural and microbiological integrity in the products. Non hygroscopic chewing gum ingredients on the other hand are easier to handle for manufacture since it does not stick together making the chewing gum enjoyable throughout the intended shelf-life. More to the point, solid xylitol is beneficial to oral health by acting as an anti-stick for the growth of cavity producing bacteria thus making it useful in dental and oral products. With increasing consumer trend towards healthier food and snacking habits, solid xylitol can afford to more important position in confectionery involved in the upcoming time, where it will act as a highly versatile, health oriented addition to any confectionery that provides not only more favourable taste profile, but also overall quality improvement.

By Application, Chewing Gum segment held the largest share in 2023

- In chewing gum business xylitol is appreciated not only as sweetening agent but for its health promoting features. Since xylitol is a sugar substitute, it brings about the sweetness that customers require without any energy value of normal sugar hence considered ideal for people who are conscious on their energy intake or those who are on a diets program. In addition to this, it has also emerged that there are dentain health benefits associated with the use of xylitol. It has been found to decrease the amount of cavity producing bacteria in the mouth resulting in a decrease of the possibility of tooth decay. This gives xylitol a two in one role in the production of sugarless gums and makes the substance strategic for brands who are considering marketing their gums as healthy alternatives. Also the emergence of health conscious customers who want to indulge in the goodness of a good chewing gum and still have an added value ;xylitol chewing gums carry thistaget along the retail and specialty outlets.

- In the same way, xylitol is gradually entering the confectionery segment because of its sweet taste and positive effect on the body, with a low glycemic index included here. Compared to sucrose which causes a sudden surge in blood glucose levels, xylitol has a slow digestibility that makes it perfect for users with diabetes or even those who areANS: over burdened with the load of sugar intake. This has created a good opportunity for more manufacturers to come up with varieties of sugar-free candies and other food products that would suit a rising population that is conscious about quality life and health issues. Xylitol has multiple uses and can be worked into almost any confectionery type, from hard-boys to chocolates; different tactics are therefore available to entice consumers and assist companies in their aims. In light of the growing concern among the consumers regarding the risks of consumption of excessive sugar, the candy making industry will likely gain increasing demand for xylitol sweetened goods, being a healthy and more closely matching the needs of the modern client.

Xylitol Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In North America especially in USA, the market for xylitol is exhibiting healthy growth due to the growth in food and beverages segment.. Owing to high consumers’ awareness of health risks associated with regular sugar intake, xylitol is gradually used in everything from sugarless chewing gums, candies, cakes, and cookies to other baked items. Increasing clue on the impact of excessive sugar intake in the society especially as concerns to ones health has made it imperative for manufactures to replace the traditional sugar with xylitol. Furthermore, xylitol is often used in dental products including tooth pastes and mouth washes and consumers are slowly appreciating the benefits of the sweetener in a fight against cavity causing bacteria.• The problem of diabetes and obesity detected in North America has changed consumption habits as the demand for healthy foods has increased dramatically.rising health consciousness among consumers, xylitol is increasingly being incorporated into a variety of sugar-free products, including chewing gums, candies, and baked goods. The growing trend towards healthier eating habits, fueled by a greater awareness of the health risks associated with excessive sugar consumption, is prompting manufacturers to reformulate their products with xylitol as a natural sweetener. Additionally, the popularity of xylitol in dental care items, such as toothpaste and mouthwashes, is further enhancing its market presence, as consumers recognize the sweetener's potential benefits in reducing cavity-causing bacteria and promoting oral health.

- The prevalence of diabetes and obesity in North America has significantly influenced consumer behavior, with a marked shift towards healthier lifestyle choices. Therefore, low calorie and low glycemic index sweeteners such as xylitol are slowly gaining high local demand. The relatively highly developed structures of the markets of the region mean that a wide variety of xylitol-based products are available and can be consumed by a large number of users. Supermarkets, specialized health food stores as well as e-marketing outlets have steadily begun to stock all manner of products containing xylitol, thereby improving market access. The growth in the demand for xylitol in North America is expected to be stable since consumers are looking for naturist sugar substitutes to reduce the effects of chronic diseases such as diabetes in North America due to increased innovation in the formulation of Xylitol products as well as increased marketing of the benefits of this product.

Active Key Players in the Xylitol Market

- Cargill, Incorporated (U.S.)

- DuPont (U.S.)

- NovaGreen Inc. (Canada)

- Shandong Futaste Co. (China)

- ZuChem, Inc. (U.S.)

- Zhejiang Huakang Pharmaceutical Co., Ltd. (China)

- Roquette Frères (France)

- Merck KGaA (Germany)

- AVANSCHEM (India)

- Foodchem International Corporation (China)

- Ingredion (U.S.)

- DFI Corporation (U.S.)

- Yusweet Xylitol Technology Co., Ltd. (China)

- Fengchen Group Co., Ltd. (China)

- Other Key Players

Key Industry Developments in the Xylitol Market:

- In August 2022, researchers at I.I.T. Guwahati in India introduced a novel fermentation method to produce xylitol from sugarcane bagasse, a byproduct of sugar cane processing. This innovative approach overcomes the operational constraints of traditional chemical synthesis and the delays typical of conventional fermentation processes

- In August 2022, IFF unveiled its new Nourish Innovation Lab at its research and development center in Union Beach, New Jersey, U.S. This state-of-the-art facility will support customers with IFF’s full range of products, including proteins, flavor modulators, sweeteners, seasonings, functional ingredients, cultures, and enzymes

Xylitol Market Scope:

|

Global Xylitol Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.90 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.30% |

Market Size in 2032: |

USD 1.31 Bn. |

|

Segments Covered: |

By Form |

|

|

|

By Raw Materials |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Xylitol Market by Form (2018-2032)

4.1 Xylitol Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Solid

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Liquid

Chapter 5: Xylitol Market by Raw Materials (2018-2032)

5.1 Xylitol Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Corn Husk

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Berries

5.5 Sugarcane Bagasse

5.6 Mushrooms

5.7 Oats

Chapter 6: Xylitol Market by Application (2018-2032)

6.1 Xylitol Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Chewing Gum

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Confectionery

6.5 Pharmaceutical and Personal Care

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Xylitol Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CARGILL INCORPORATED (U.S.)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 DUPONT (U.S.)

7.4 NOVAGREEN INC. (CANADA)

7.5 SHANDONG FUTASTE CO. (CHINA)

7.6 ZUCHEM INC. (U.S.)

7.7 ZHEJIANG HUAKANG PHARMACEUTICAL COLTD. (CHINA)

7.8 ROQUETTE FRÈRES (FRANCE)

7.9 MERCK KGAA (GERMANY)

7.10 AVANSCHEM (INDIA)

7.11 FOODCHEM INTERNATIONAL CORPORATION (CHINA)

7.12 INGREDION (U.S.)

7.13 DFI CORPORATION (U.S.)

7.14 YUSWEET XYLITOL TECHNOLOGY COLTD. (CHINA)

7.15 FENGCHEN GROUP COLTD. (CHINA)

7.16 OTHER KEY PLAYERS

Chapter 8: Global Xylitol Market By Region

8.1 Overview

8.2. North America Xylitol Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Form

8.2.4.1 Solid

8.2.4.2 Liquid

8.2.5 Historic and Forecasted Market Size by Raw Materials

8.2.5.1 Corn Husk

8.2.5.2 Berries

8.2.5.3 Sugarcane Bagasse

8.2.5.4 Mushrooms

8.2.5.5 Oats

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Chewing Gum

8.2.6.2 Confectionery

8.2.6.3 Pharmaceutical and Personal Care

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Xylitol Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Form

8.3.4.1 Solid

8.3.4.2 Liquid

8.3.5 Historic and Forecasted Market Size by Raw Materials

8.3.5.1 Corn Husk

8.3.5.2 Berries

8.3.5.3 Sugarcane Bagasse

8.3.5.4 Mushrooms

8.3.5.5 Oats

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Chewing Gum

8.3.6.2 Confectionery

8.3.6.3 Pharmaceutical and Personal Care

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Xylitol Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Form

8.4.4.1 Solid

8.4.4.2 Liquid

8.4.5 Historic and Forecasted Market Size by Raw Materials

8.4.5.1 Corn Husk

8.4.5.2 Berries

8.4.5.3 Sugarcane Bagasse

8.4.5.4 Mushrooms

8.4.5.5 Oats

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Chewing Gum

8.4.6.2 Confectionery

8.4.6.3 Pharmaceutical and Personal Care

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Xylitol Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Form

8.5.4.1 Solid

8.5.4.2 Liquid

8.5.5 Historic and Forecasted Market Size by Raw Materials

8.5.5.1 Corn Husk

8.5.5.2 Berries

8.5.5.3 Sugarcane Bagasse

8.5.5.4 Mushrooms

8.5.5.5 Oats

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Chewing Gum

8.5.6.2 Confectionery

8.5.6.3 Pharmaceutical and Personal Care

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Xylitol Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Form

8.6.4.1 Solid

8.6.4.2 Liquid

8.6.5 Historic and Forecasted Market Size by Raw Materials

8.6.5.1 Corn Husk

8.6.5.2 Berries

8.6.5.3 Sugarcane Bagasse

8.6.5.4 Mushrooms

8.6.5.5 Oats

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Chewing Gum

8.6.6.2 Confectionery

8.6.6.3 Pharmaceutical and Personal Care

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Xylitol Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Form

8.7.4.1 Solid

8.7.4.2 Liquid

8.7.5 Historic and Forecasted Market Size by Raw Materials

8.7.5.1 Corn Husk

8.7.5.2 Berries

8.7.5.3 Sugarcane Bagasse

8.7.5.4 Mushrooms

8.7.5.5 Oats

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Chewing Gum

8.7.6.2 Confectionery

8.7.6.3 Pharmaceutical and Personal Care

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Xylitol Market Scope:

|

Global Xylitol Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.90 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.30% |

Market Size in 2032: |

USD 1.31 Bn. |

|

Segments Covered: |

By Form |

|

|

|

By Raw Materials |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||