Wood Plastic Composites Market Synopsis

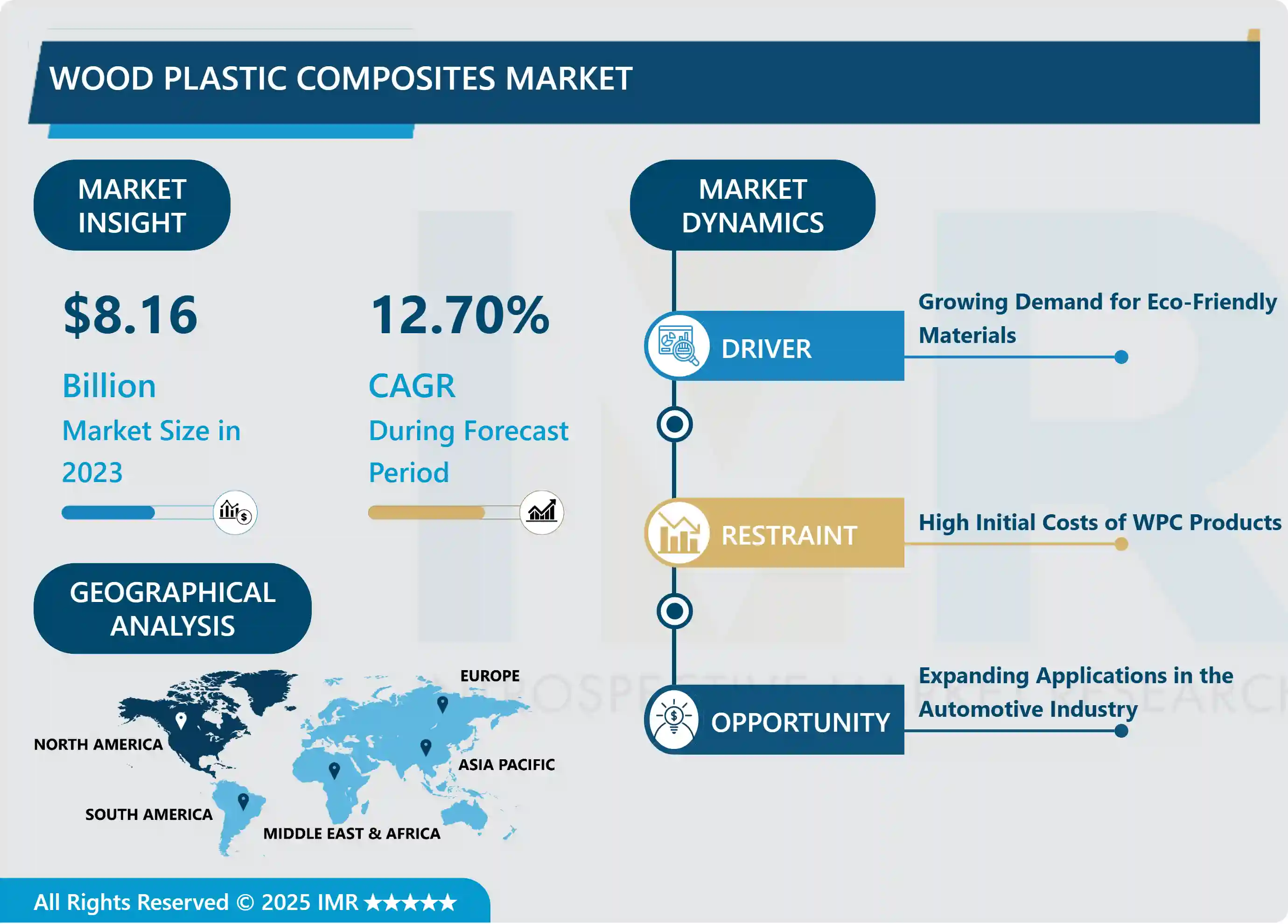

Wood Plastic Composites Market Size Was Valued at USD 8.16 Billion in 2023, and is Projected to Reach USD 23.93 Billion by 2032, Growing at a CAGR of 12.70% From 2024-2032.

WPCs are high performance composites made mainly by blending wood fibers or wood flour with thermoplastics such as polyethylene, polypropylene and/or PVC. Based on these composites, numerous applications have been used with activities which include combining the features of a plastic like the durability and wooden like, natural look and environmental friendly injustice friendlessness.• WPC market has also been growing rapidly in recent years due to flexibility in application and environmental gain.cluding polyethylene, polypropylene, and/or polyvinyl chloride. All of these composites are applied for different purposes combining the advantages of plastic-like durability, and wooden like, natural look and environmental friendlessness.

The WPC market has been rising rapidly in recent years because of its application flexibility and benefits to the environment. WPC is a type of material that has properties of both wood and plastic; wood – plastic composites being an example. The uses of this composite include treating as deck, fence, railing, car parts, outdoor furniture among others. WPCs have been called for because industries are on the search of a material that is environmentally friendly and sustainable as a substitute to wood and plastic. This market has probably the most outspoken push factor in a modern world: the amplified concern with the condition of the environment and the efforts to save it. It is a reusable product mainly made by recycled material and hence they are minimizing on virgin wood and plastics which help in minimizing on deforestation and plastics waste. Additionally, WPCs have the top hand over natural wood in as much as they do not degrade when exposed to rot, decay or pests, and as such can be used for construction projects that are to be undertaken out door or for production of items that will need with long service life.

In this regard, the third factor which contributes to the market growth of WPC is the enhancement of demand for low maintenance and aesthetically superior products in construction. WPCs are easier to design on and can be manipulated unlike the pure wooden which might get damage by harsh weathers within a short span of time. That has resulted in increased utilization of WPCs in residential and commercial buildings particularly for decking and sidings. Secondly, new technologies developed in the production of WPCs have enhanced their capabilities, and aesthetics, making them popular with architects and designers. These composites can be produced in many sizes and shapes, and can be provided using an extensive range of surface treatments and colours, which may not be achievable with ‘traditional’ materials. WPCs could remain a popular material in several sectors where sustainability, low environmental impact, and durability in addition to unique design flexibility are important to the consumer and the industry.

Another important factor is the massive development of the WPC market in the automotive industry. Since auto makers’ attempts to diminish their vehicle weights to enhance fuel economy, WPCs can provide suitable substitute for heavier conventional material. In automobile structure WPCs are employed for the formation of panel structures and trims along with the use in interior decorative trims imparting a natural looking appearance as well as enhanced strength. In the automotive industry, this adoption is because of the requirements of materials that are durable, anti-moisture, and enable automotive companies to reduce their emissions. According to the usage of the green car such as electric car, WPCs are expected to experience a steady growth because the material is light as well as environmentally friendly.

The Wood Plastic Composites market is expected to exhibit further growth in the following years due to the development the production processes and the shift to environmentally friendly solutions across various sectors. However, there are some issues that should be considered like cost of a raw material and rivalry with other types of composite material, for example, fiber reinforced plastics. WPC’s suppliers are dedicating efforts to improve the mechanical characteristics of WPCs to appeal to various clients’ demands and at the same time cut manufacturing expenses. The continuously increasing market awareness in consumers regarding the ecological problems makes WPCs set to be a core solution of sustainable, durable and attractive products in several markets to ensure the sustainability of the market.

Wood Plastic Composites Market Trend Analysis

Sustainable Innovation in WPC Manufacturing

- Another important factor, which is becoming distinctive in the field of Wood Plastic Composites at the present stage, is the shift towards environmentally friendly production. With increasing environmental consciousness streamlining to the demands of creating WPCs from recycled materials; both the wood fibre and the plastic wastes. This has an added advantage of not only decreasing waste material from virgin plastic but also disposing of wood waste in the landfills. Another advantage of WPCs is the replacement of conventional petrochemical based plastics with bioplastics or bio-based plastics in effect making WPCs environmentally friendly.

- However, the integration of sustainability practices in the making of WPC products is in track with a global quest to minimize carbon emission and the development of circular economies. there has been a trend in the incorporation of technologies that deal with the recycling or using of waste materials hence lowering cost while meeting the legal requirements on friendly environmental products. Due to the progressive realization of environmentally friendly construction and automotive materials, WPC appears poised to benefit from this increasing trend, catalyzing its advances and improvements.

Expanding Applications in the Automotive Industry

- Automotive is the largest segment for Wood Plastic Composites market and finds a good prospect in the fabrication of automotive interior parts. Since auto makers are looking for strong lightweight materials that are long lasting and friendly to the environment, WPCs offer a good solution. Due to their water and rot resistant characteristics, they are suitable for application in dooring panels, instrument panels and seat backs where appearance as well as functional utility is required.

- However, the recent trend in the automobile industry towards the use of EVs has made the use of lightweight materials which can enhance the fuel efficiency of automobile, especially crucial. This would also serve as a reference that WPCs could be instrumental in shedding car weight and in the process boost the energy efficiency and emissions levels. In the future years, there is information that WPCs will be getting more popularity because of its appropriateness to the current changing pace of the automotive industry with inclination towards developing more environment friendly technology.

Wood Plastic Composites Market Segment Analysis:

Wood Plastic Composites Market Segmented based on Product and Application.

By Product, Polypropylene (PP) segment is expected to dominate the market during the forecast period

- Polyethylene (PE) enjoys the highest market of WPCs as it is the most compatible polymer with wood fibers and widely used in decking, fencing, and other outside use. WPCs made with polyethylene resin are highly durable, capable of withstanding moisture, and flexible enough for use in creating a variety of forms and thicknesses. The following reasons explain why PE-based WPCs are favored; they are readily available and cheaper than other thermoplastics, perfect for use in construction where volume production is expected.

- On the other hand Polypropylene (PP) and Polyvinyl Chloride (PVC) are emerging in the high mechanical strength application segment and better thermal properties’ applications. As mentioned above the PP based WPC’s are normally utilized for car components because of well increased rigidity and high temperature tolerance. On the other hand, PVC based component includes high fire resistance this is why WPCs made from PVC are used for building material like door frame, door panel and roofing. Hence there is the likelihood that as the market advances manufacturers will develop more use for the products in these markets and other related ones.

By Application ,Automotive Components segment held the largest share in 2023

- The largest application area categorised for WPCs is the Building & Construction segment due to increased focus on the use of environment-friendly products in construction. WPCs are rapidly used for decking railing fencing cladding and have some advantages over traditional wood such as better durability, weather resistance, and low maintenance. These have ensured an upward trend in green practices in construction and the use of environmentally friendly building materials hence the increased consumption of WPCs in the building and construction sector green. Further, the WPCs’ high resistance to environmental conditions makes the products ideal for residential as well as commercial applications.

- Another important application area of WPCs is the Automotive Components sector; especially in the internal uses such as door panels and dashboards etc. The use of WPCs in car interiors is favored by such benefits as lightweight, moisture, and rot resistance. Since car makers are focusing on weight reduction for increased fuel economy the use of WPCs is expected to increase especially in electric vehicles where every gram of weight equates to reduced range.

Wood Plastic Composites Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America has currently high share in the WPC market and the main driving force behind WPC products includes construction and automotive industries. Environmental conservation practices in buildings have inspired more construction companies in the region to use WPCs in the construction of homes and commercial buildings. Moreover, increased environmental standards as regards the use of environmentally friendly raw materials have also fanned the uptake of WPCs across North America.

- WPC has gained much popularity in the United States in decking, fencing, and in other applications because of its durability and low maintenance. North America has also a major automotive market, and as larger automotive companies moved into the NA region, the need for WPCs in vehicle interiors has continued to rise as vehicle manufacturers seek lightweight and durable and cost effective material in their products. The trend towards sustainability should help to keep North America, and specifically the USA and Canada, the dominant consumer of WPCs in the future.

Active Key Players in the Wood Plastic Composites Market

- Trex Company, Inc. (United States)

- Fiberon LLC (United States)

- Advanced Environmental Recycling Technologies, Inc. (United States)

- UPM-Kymmene Corporation (Finland)

- Axion International, Inc. (United States)

- Beologic N.V. (Belgium)

- JELU-WERK J. Ehrler GmbH & Co. KG (Germany)

- Polyplank AB (Sweden)

- Others Key Player

Key Industry Developments in the Wood Plastic Composites Market

- In June 2024, Oakio Plastic Wood Building Materials Co. Ltd., Inc. introduced Proshield WPC Cladding. This advanced cladding solution offers durability, sustainability, and aesthetic versatility for exterior building materials. Proshield WPC Cladding is engineered with a unique blend of wood fibers and high-density polyethylene, encased in a robust polymer shield.

- In January 2023, UFP Industries, Inc. announced to feature new and innovative products from two leading brands, Deckorators and UFP-Edge. These distinctive products allow both DIYers and builders to bring the personal creativity of interior design to outdoor living, thereby helping the company to gain a competitive edge.

|

Global Wood Plastic Composites Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.16 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.70% |

Market Size in 2032: |

USD 23.93 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Wood Plastic Composites Market by Product (2018-2032)

4.1 Wood Plastic Composites Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Polyethylene

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Polypropylene

4.5 Polyvinylchloride

4.6 Others

Chapter 5: Wood Plastic Composites Market by Application (2018-2032)

5.1 Wood Plastic Composites Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Building & Construction

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Automotive Components

5.5 Industrial & Consumer Goods

5.6 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Wood Plastic Composites Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 TREX COMPANY INC. (UNITED STATES)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 FIBERON LLC (UNITED STATES)

6.4 ADVANCED ENVIRONMENTAL RECYCLING TECHNOLOGIES INC. (UNITED STATES)

6.5 UPM-KYMMENE CORPORATION (FINLAND)

6.6 AXION INTERNATIONAL INC. (UNITED STATES)

6.7 BEOLOGIC N.V. (BELGIUM)

6.8 JELU-WERK J. EHRLER GMBH & CO. KG (GERMANY)

6.9 POLYPLANK AB (SWEDEN)

6.10 OTHERS KEY PLAYER

Chapter 7: Global Wood Plastic Composites Market By Region

7.1 Overview

7.2. North America Wood Plastic Composites Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Product

7.2.4.1 Polyethylene

7.2.4.2 Polypropylene

7.2.4.3 Polyvinylchloride

7.2.4.4 Others

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Building & Construction

7.2.5.2 Automotive Components

7.2.5.3 Industrial & Consumer Goods

7.2.5.4 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Wood Plastic Composites Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Product

7.3.4.1 Polyethylene

7.3.4.2 Polypropylene

7.3.4.3 Polyvinylchloride

7.3.4.4 Others

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Building & Construction

7.3.5.2 Automotive Components

7.3.5.3 Industrial & Consumer Goods

7.3.5.4 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Wood Plastic Composites Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Product

7.4.4.1 Polyethylene

7.4.4.2 Polypropylene

7.4.4.3 Polyvinylchloride

7.4.4.4 Others

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Building & Construction

7.4.5.2 Automotive Components

7.4.5.3 Industrial & Consumer Goods

7.4.5.4 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Wood Plastic Composites Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Product

7.5.4.1 Polyethylene

7.5.4.2 Polypropylene

7.5.4.3 Polyvinylchloride

7.5.4.4 Others

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Building & Construction

7.5.5.2 Automotive Components

7.5.5.3 Industrial & Consumer Goods

7.5.5.4 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Wood Plastic Composites Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Product

7.6.4.1 Polyethylene

7.6.4.2 Polypropylene

7.6.4.3 Polyvinylchloride

7.6.4.4 Others

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Building & Construction

7.6.5.2 Automotive Components

7.6.5.3 Industrial & Consumer Goods

7.6.5.4 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Wood Plastic Composites Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Product

7.7.4.1 Polyethylene

7.7.4.2 Polypropylene

7.7.4.3 Polyvinylchloride

7.7.4.4 Others

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Building & Construction

7.7.5.2 Automotive Components

7.7.5.3 Industrial & Consumer Goods

7.7.5.4 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Wood Plastic Composites Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.16 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.70% |

Market Size in 2032: |

USD 23.93 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||