Wood Coating Market Synopsis:

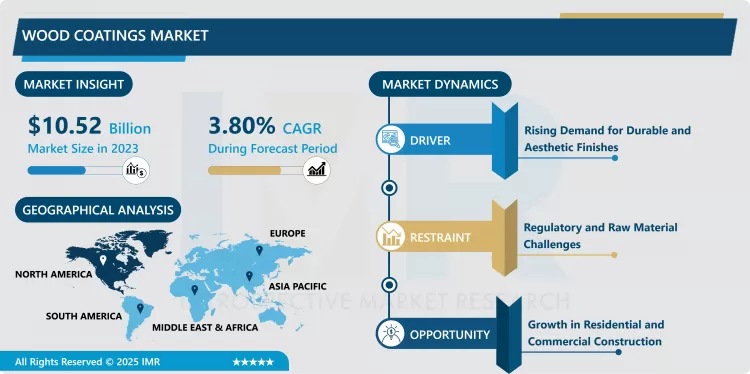

Wood Coating Market Size Was Valued at USD 10.52 Billion in 2023, and is Projected to Reach USD 14.72 Billion by 2032, Growing at a CAGR of 3.80% From 2024-2032.

Wood Coating can be described as subsegment of the Coating industry that deals with the products that are intended for use on wood and for enhancing its appearance. These Coating have different uses such as protection and beautification of furniture, floor, and cabinets among others with an appropriate finishing that keeps them as new by offering durability, repellent properties against water, nice looks, and protection from UV3313rays.

The overall market for wood Coating has expanded rapidly as the result of its demand in the construction industry for residential as well as for commercial purposes. From the buyer perspective, the general increase, particularly the recent interest in home improvement coupled with the ever emerging push towards environmental conscious goods and services has led to a diversification of the green products in the market. Principal applications of wood are in furniture, flooring, and construction since the material has an excellent appearance and renewable sources, hence the increasing need for better Coating for wood. Also, the improvement in coating technology has improved characteristics including scratch resistance, anti-fading, and the durability of the Coating.

The market is also determined by trends in interior and exterior developments as well. Housing construction and refurbishment and the commercial segment have been the primary consumption causes. However, there is emerging a trend for the higher class of wood Coating, particularly because customers want better quality for a superior look and feel. This also includes using high-performance coating that has low-VOC and water based and increasing environmental issues.

The development of improved Coating technology enables better ease and quick-drying property and a variety of appearances. This is resulting into high demand for wood Coating especially for use in the industrial sector. Markets actively continue purchasing product innovations within the specified roles of use, and market regulations demand usage of environmentally friendly solutions by manufacturers. For the foreseeable future, wood coating is likely to grow apace as the construction and furniture manufacturing industries undergo transformation.

Wood Coating Market Trend Analysis:

Advancements in Eco-friendly Coating

- The rising green concerns constitute the one of the main driving forces in the development of wood coating market. With such factors in mind, manufactures are concentrating on creating environmentally friendly coating solutions. This is because water-based and low-VOC Coating are becoming widely used since they offer the required layers of protection for the wooden surface and conform to modern ecological efficiency. These Coating generate less dangerous substances into the environment, and are safer to use in identifying errors.

- Incidentally, biodegradable wooden Coating are also compendious to discuss in terms of durability since they are formed to provide the same degree of protection as ordinary Coating each at the same time being less invasive. This trend is booster through the increase of consumers awareness towards green products resulting to the development of Coating that is composed of natural ingredients and biodegradable substances. Thus, the change is not only rooted in the regulatory issues, but also in the increased tendency for the construction and sectors of home improvements towards sustainability.

Growth in Residential and Commercial Construction

- The main potential in the wood coating market remains with the rising trend of demand from the construction and housing industry. Due to new constructions and development frameworks, proper management of wooden structures by proper coating is having a rapid rise in the developed world with regard to further developments of constructional structures within urban world. It is imperative to apply a coat on wooden interior as well as exterior surfaces of residential dwellings and business establishments because of beauty and weather endurance.

- In addition, the growth in the home improvement and renovations and the do it yourself segment, is also contributing in the growth of the wood Coating market. Consumers are looking for Klant Products that will give their homes a smarter look with better quality wood finishes and thus the increased sales for the wood Coating products. The same applies to the commercial aspect of life such as offices, restaurants, and hotels due to its beautiful looks and sustainability, which in turn put pressure on the Coating manufacturers to deliver both performance and beauty.

Wood Coating Market Segment Analysis:

Wood Coating Market Segmented on the basis of Type, Technology, Wood Type, Formulation, End User, and Region

By Type, Stains segment is expected to dominate the market during the forecast period

- that type of wood coating is utilized depending on the intended finishing and performance of the wood coating. The primary use of stains is in applying decorative Coating where the coating’s protective capability is rated low. Varnishes and lacquers are used mostly in places where there is lots of traffic, because they give the surface a high degree of protection. Polyurethanes and shellacs are excellent for products made from woods that require protection from wear and tear, humidity, and other influences which make it applicable for home and commercial use.

- This will depend with the type of wooden surface to be covered, the final required finish, and lastly the conditions that the wooden surface is bound to face. For instance, while using fence and outdoor dispositions, uses such as wooden decks and many others will call for special UV and water resistant Coating; for indoor applications such as wooden floors will call for added Coating such as strengthened durability and scratch resistant Coating.

By End User, Residential segment expected to held the largest share

- The dominance of the positive trend in the segment of home renovation and the constantly growing popularity of DIY among homeowners should be noted, especially as it applies to wood Coating. People look for not just durability but also the looks on their Coating that why there is much demand for eco-friendly and ease to apply coating solutions. The others segments such as the commercial construction especially in offices, hotel and restaurants are also increasing the market size for the wood Coating. These applications often necessitate Coating that are strong and aesthetically pleasing because commercial businesses want to create pretty environments and they want to advertise there logo.

- With regards to the industrial segment, need of the wood Coating is directly proportional to the products made of wood. In this segment, paints and Coating must be able to deliver on performance criteria of chemical, wear and UV resistance. Given increased developments in scale and sophistication of industrial applications, expectations are that demand for competitive Coating to counteract harsh operational conditions will follow a similar trajectory.

Wood Coating Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- At the moment, the largest market for wood Coating is in North America because of a significant demand for wood finishes in residences and offices. High economic development of the region and well developed construction industry leads to a constant demand for wood Coating. Also, the increasing awareness of using green building and environment friendly products is adding another avenue to the market for green wood Coating.

- In addition, the region has experienced a shift towards higher quality, including water-based and low VOC Coating innovation due to customers’ appreciation and regulatory policies. The concentration of key manufacturers and distributors in North America help to maintain an open competitive market for the consumers and companies as well.

Active Key Players in the Wood Coating Market:

- AkzoNobel (Netherlands)

- Sherwin-Williams (USA)

- BASF SE (Germany)

- PPG Industries (USA)

- RPM International Inc. (USA)

- Behr Paint Company (USA)

- Axalta Coating Systems (USA)

- Jotun (Norway)

- Hempel (Denmark)

- Benjamin Moore (USA)

- Tikkurila (Finland)

- Kansai Paint (Japan)

- Other Active Players

|

Wood Coating Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.52 Billion |

|

Forecast Period 2024-32 CAGR: |

3.80% |

Market Size in 2032: |

USD 14.72 Billion |

|

Segments Covered: |

By Type |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Wood Coating Market by Type (2018-2032)

4.1 Wood Coating Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Stains

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Varnishes

4.5 Lacquers

4.6 Polyurethanes

4.7 Shellacs

4.8 Oils

4.9 Others

Chapter 5: Wood Coating Market by End User (2018-2032)

5.1 Wood Coating Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Residential

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Commercial

5.5 Industrial

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Wood Coating Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 AKZONOBEL (NETHERLANDS)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 BASF SE (GERMANY)

6.4 PPG INDUSTRIES INC. (UNITED STATES)

6.5 SHERWIN-WILLIAMS COMPANY (UNITED STATES)

6.6 RPM INTERNATIONAL INC. (UNITED STATES)

6.7 KANSAI PAINT COLTD. (JAPAN)

6.8 ASIAN PAINTS LIMITED (INDIA)

6.9 NIPPON PAINT HOLDINGS COLTD. (JAPAN)

6.10 BERGER PAINTS INDIA LIMITED (INDIA)

6.11 BENJAMIN MOORE & CO. (UNITED STATES)

6.12 OTHERS

6.13

Chapter 7: Global Wood Coating Market By Region

7.1 Overview

7.2. North America Wood Coating Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Stains

7.2.4.2 Varnishes

7.2.4.3 Lacquers

7.2.4.4 Polyurethanes

7.2.4.5 Shellacs

7.2.4.6 Oils

7.2.4.7 Others

7.2.5 Historic and Forecasted Market Size by End User

7.2.5.1 Residential

7.2.5.2 Commercial

7.2.5.3 Industrial

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Wood Coating Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Stains

7.3.4.2 Varnishes

7.3.4.3 Lacquers

7.3.4.4 Polyurethanes

7.3.4.5 Shellacs

7.3.4.6 Oils

7.3.4.7 Others

7.3.5 Historic and Forecasted Market Size by End User

7.3.5.1 Residential

7.3.5.2 Commercial

7.3.5.3 Industrial

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Wood Coating Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Stains

7.4.4.2 Varnishes

7.4.4.3 Lacquers

7.4.4.4 Polyurethanes

7.4.4.5 Shellacs

7.4.4.6 Oils

7.4.4.7 Others

7.4.5 Historic and Forecasted Market Size by End User

7.4.5.1 Residential

7.4.5.2 Commercial

7.4.5.3 Industrial

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Wood Coating Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Stains

7.5.4.2 Varnishes

7.5.4.3 Lacquers

7.5.4.4 Polyurethanes

7.5.4.5 Shellacs

7.5.4.6 Oils

7.5.4.7 Others

7.5.5 Historic and Forecasted Market Size by End User

7.5.5.1 Residential

7.5.5.2 Commercial

7.5.5.3 Industrial

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Wood Coating Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Stains

7.6.4.2 Varnishes

7.6.4.3 Lacquers

7.6.4.4 Polyurethanes

7.6.4.5 Shellacs

7.6.4.6 Oils

7.6.4.7 Others

7.6.5 Historic and Forecasted Market Size by End User

7.6.5.1 Residential

7.6.5.2 Commercial

7.6.5.3 Industrial

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Wood Coating Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Stains

7.7.4.2 Varnishes

7.7.4.3 Lacquers

7.7.4.4 Polyurethanes

7.7.4.5 Shellacs

7.7.4.6 Oils

7.7.4.7 Others

7.7.5 Historic and Forecasted Market Size by End User

7.7.5.1 Residential

7.7.5.2 Commercial

7.7.5.3 Industrial

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Wood Coating Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.52 Billion |

|

Forecast Period 2024-32 CAGR: |

3.80% |

Market Size in 2032: |

USD 14.72 Billion |

|

Segments Covered: |

By Type |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Wood Coating Market research report is 2024-2032.

AkzoNobel (Netherlands), Sherwin-Williams (USA), BASF SE (Germany), PPG Industries (USA), RPM International Inc. (USA), Behr Paint Company (USA), Axalta Coating Systems (USA), Jotun (Norway), Hempel (Denmark), Benjamin Moore (USA), Tikkurila (Finland), Kansai Paint (Japan), and Other Active Players.

The Wood Coating Market is segmented into Type, Formulation, Technology , Wood Type ,End User and region. By Type, the market is categorized into Stains, Varnishes, Lacquers, Polyurethanes, Shellacs, Oils, Others. By Formulation, the market is categorized into Solvent-based, Water-based, Powder Coating. By End-use, the market is categorized into Residential, Commercial, Industrial. By Technology, the market is categorized into Conventional Coating, UV-cured Coating, Eco-friendly Coating. By Wood Type, the market is categorized into Hardwood, Softwood. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Wood Coating can be described as subsegment of the Coating industry that deals with the products that are intended for use on wood and for enhancing its appearance. These Coating have different uses such as protection and beautification of furniture, floor, and cabinets among others with an appropriate finishing that keeps them as new by offering durability, repellent properties against water, nice looks, and protection from UV3313rays.

Wood Coating Market Size Was Valued at USD 10.52 Billion in 2023, and is Projected to Reach USD 14.72 Billion by 2032, Growing at a CAGR of 3.80% From 2024-2032.