Women’s Luxury Footwear Market Synopsis

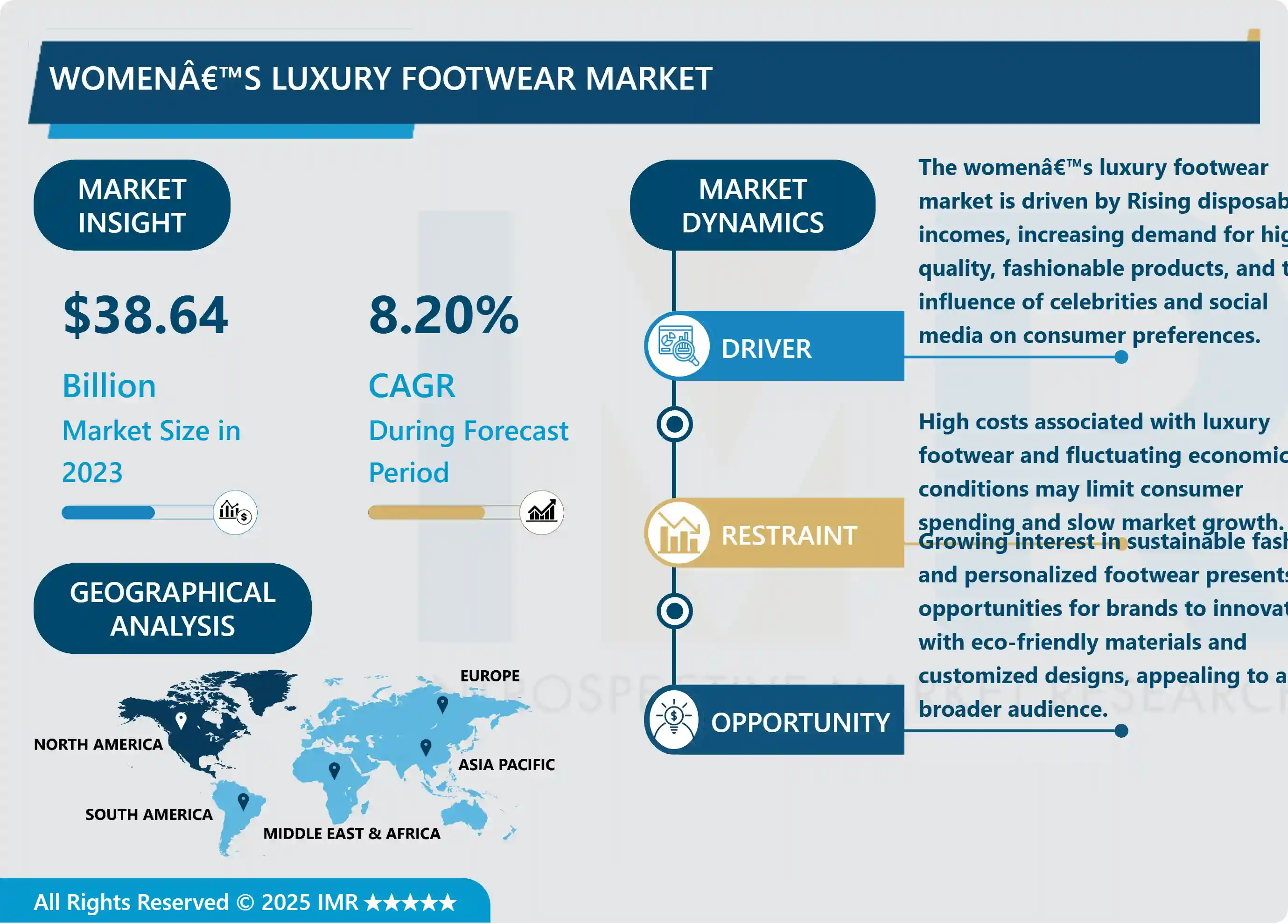

Women’s Luxury Footwear Market Size is Valued at USD 38.64 Billion in 2023, and is Projected to Reach USD 72.60 Billion by 2032, Growing at a CAGR of 8.20% From 2024-2032.

The women’s luxury footwear segment is one of the rapidly growing segments in the international fashion industry because of growing demand for luxury goods and improving buying power among women. Top fashion brands within this category include Christian Louboutin, Jimmy Choo, and Manolo Blahnik; fashion designers whose status is synonymous with quality and good design. Investment fashion is also noticeable so that women buys good quality and long lasting shoe that fulfills their fashion demands along with fulfilling the need for a long-term fashionable shoe for her.

Design as well as dedication for the sustainability and customization in manufacture has been the major factors that have triggered growth in the luxury footwear market. People are demanding unique and sustainable products, meaning that companies have to adopt moral policies for production, and provide individual services. This change is supported by the growth of online retailing which has enhanced sales of luxury footwear in world market. The platforms of e-commerce have provided many brands with the leverage of having large and diversifying consumers in markets including Asia-Pacific that is widely expanding.

Apart from that trend, consumer preferences in the case of women’s luxury footwear are also determined by celebrities, social networks and fashion leaders. Casual luxury and luxury sneakers have taken the market further than conventional formal shoes, and therefore attract the younger generation. The revolutionary change in footwear preferences signifies more cellularizing of luxury fashion in terms of comfort and practicality while not being synonymous with fashion fore go.

Women’s Luxury Footwear Market Trend Analysis

Rise of Sustainable and Ethical Footwear

- However, the most important trend that has emerged within the past few years is the increasing importance of sustainability in the women’s luxury footwear industry. Sophisticated shoes, particularly, became the object of conscious choice in favor of environmental friendliness and ethical production more and more often. Renowned fashion brands such as Stella McCartney and Gucci have started developing footwear products that will be made from recycled products, organic fabric and even animal friendly leather. It is altering customer expectations and putting pressure on companies/advertisers to build sustainable products in a luxury and trendy way.

- Apart from materials, the transparency in supply chain is also coming into view. Through research on luxury shoes, consumers are demanding details of the process that is undertaken to produce the shoes as well as the health of the environment in which they are produced. Manufacturers that engage in sustainability or corporate responsibility practices are getting consumers’ loyalty especially the ones of the young generation and who are environmental-friendly. They argued this trend toward consuming more sustainable luxury footwear continues to shape design and marketing in future.

Growth of the Luxury Sneaker Segment

- The AS sector has rapidly developed a niche of luxury sneakers embracing anti-classical notions of formal wear. Famous brands such as Balenciaga, Louis Vuitton, and Chanel have joined this trend producing luxurious sneakers which enjoy both fashionable and comfortable look. Shoes especially sneakers which used to be referred to as informal wear are now ranked among the luxury products especially to the young and across the spectrum of color. This shift is changing the wider concept of luxury footwear and expanding the bracket to everyone who, whether male or female, needs quality, fashionable and purposeful footwear.

- It is also linked to the trend of ‘athleisure’ – worn clothing that has features in common with sportswear and which is designed for leisure activities. Fashion houses are now taking notice of this trend which has seen more and more luxury brands incorporate both casual and formal sneakers. Being in fashion, luxury sneakers are now a new cash cow for premium footwear brands, especially in the segments of North America and the Asia-Pacific.

Women’s Luxury Footwear Market Segment Analysis:

Women’s Luxury Footwear Market Segmented on the basis of By Product, By Material ,By Distribution Channel and End-User

By Product, Formal Shoes segment is expected to dominate the market during the forecast period

- The women's luxury footwear market is segmented into three main product categories: It has formal shoes, casual and athletic shoe all targeting the different consumer needs and occasions. Sophisticated and glamour casuals in the form of high heels, pumps, evening sandals and more constitutes a major market when it comes to special occasions or workplace. These shoes are normally great designs, exotic leather and superb workmanship, provided by established companies such as Christian Louboutin and Manolo Blahnik. Nonetheless, even though formally-appointment shoes have been characteristically part of luxury segment, it has been experiencing a decline in market share with the emergence of increasingly used and comfortable ones.

- Sneakers and sports footwear are the categories most rapidly developing within the sphere of luxury goods as people pay more attention to the comfort of shoes in everyday wear. High-top sneakers, espadrilles, and loafers are being bought more than ever before thanks to the athleisure and casual luxury evolution. There was an example in which fashion brands of luxury brands such as Gucci, Prada, Balenciaga have widened their ambitions to targeting luxury sports and leisure shoes. The expansion of these categories is typical of changes in the preferences of consumers who do not wear fashionable accessories only on formal events but to any occasion, focusing on youth-oriented and those people who want to wear luxury footwear every day.

By End-User, Women segment held the largest share in 2024

- The end-user segment in women’s luxury footwear market constituted of men, women, and children where women stand as the largest and most dominant segment. Market interest is dominated by women’s luxury footwear due to fashion’s associated quality of Desire, with brands like Gucci, Chanel, Valentino being designed particularly for women who aim to gain superiority and sophistication. The segment with women is dominated by heels, flats and boots, lace ups to luxury sneakers that are suitable for both business and leisure. These differences in design and performance are germane to the changing market tastes of women, who desire comfort and elegance in their designer shoes.

- Although these segments are developing, they are still less sizes compared to the women’s segment which might be a result of the long-time tendency in the development of luxury footwear as a women’s accessory. However, the luxury men’s and children’s shoes have realized a more significant demand surpassing the previous trends or better still, the demand for luxury shoes is on the rise as more young people embrace the brands and fashion of luxury products. However the segment of women continues to hold maximum share in luxury footwear industry, for they always prefer to have style, comfort, quality and uniqueness, and all these aspects are highlighted by using finest quality of material and workmanship and thus this segment is the most profitable and growing faster.

Women’s Luxury Footwear Market Regional Insights:

North America is expected to dominate the women’s luxury footwear market

- North America is set to be a market leader in women’s luxury footwear market due to high purchase rate on luxury fashion accessories and reputable brands. The wearer base has remained highly fashion conscious in the realized regions particularly the metropolitan cities as New York and Los Angeles contributing significantly to the demand in luxurious footwear. Besides this, the solid e-commerce environment and effective retailing approaches, including tailored services and virtual fittings, have also promoted the market growth. To assert this, more focus has been developed on the U.S. market where luxury footwear has now become an icon of class and value addition on appearance.

- The women’s luxury shoes market remains steady, with industry leaders maintaining their interest on the value proposition of extending their ranges beyond stilettos and luxury sneakers. Traditionally fashion demand is the primary driver for brands, but as the consumer becomes more aware of the adverse effects which fashion has on the environment, there is a shift towards sustainable clothing, making it one of the most important factors. Further, as luxury shoes become available to younger customers through digital sales, North America is expected to continue its reign as the leading region owing to designing, sustainable materials, and innovative retail experience.

Active Key Players in the Women’s Luxury Footwear Market

- Adidas AG (Germany)

- LVMH Moët Hennessy (France)

- Chanel (France)

- Burberry (U.K.)

- ZINTALA SRL (Italy)

- Prada S.P.A. (Italy)

- a.testoni spa (Italy)

- Dr. Martens (U.K.)

- Base London (U.K.)

- Salvatore Ferragamo S.P.A. (Italy)

- Lottusse – Mallorca (Spain)

- Caleres (U.S.)

- KERING (France)

- CAPRI HOLDINGS LIMITED (U.K.)

- Under Armour Inc. (U.S.)

- Christian Dior SE (France)

- Hermès (France)

- Christian Louboutin (France)

- others

|

Global Women’s Luxury Footwear Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 38.64 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.20% |

Market Size in 2032: |

USD 72.60 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Material |

|

||

|

By Distribution Channel |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Women’s Luxury Footwear Market by Product (2018-2032)

4.1 Women’s Luxury Footwear Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Formal Shoes

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Casual Shoes

4.5 Athletic

Chapter 5: Women’s Luxury Footwear Market by Material (2018-2032)

5.1 Women’s Luxury Footwear Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Leather

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Non-leather

Chapter 6: Women’s Luxury Footwear Market by Distribution Channel (2018-2032)

6.1 Women’s Luxury Footwear Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Brand Store

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Specialty Store

6.5 Online Sales Channel

Chapter 7: Women’s Luxury Footwear Market by End-User (2018-2032)

7.1 Women’s Luxury Footwear Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Men

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Women

7.5 Children

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Women’s Luxury Footwear Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ADIDAS AG (GERMANY)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 LVMH MOËT HENNESSY (FRANCE)

8.4 CHANEL (FRANCE)

8.5 BURBERRY (U.K.)

8.6 ZINTALA SRL (ITALY)

8.7 PRADA S.P.A. (ITALY)

8.8 A.TESTONI SPA (ITALY)

8.9 DR. MARTENS (U.K.)

8.10 BASE LONDON (U.K.)

8.11 SALVATORE FERRAGAMO S.P.A. (ITALY)

8.12 LOTTUSSE – MALLORCA (SPAIN)

8.13 CALERES (U.S.)

8.14 KERING (FRANCE)

8.15 CAPRI HOLDINGS LIMITED (U.K.)

8.16 UNDER ARMOUR INC. (U.S.)

8.17 CHRISTIAN DIOR SE (FRANCE)

8.18 HERMÈS (FRANCE)

8.19 CHRISTIAN LOUBOUTIN (FRANCE)

8.20 OTHERS

8.21

Chapter 9: Global Women’s Luxury Footwear Market By Region

9.1 Overview

9.2. North America Women’s Luxury Footwear Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Product

9.2.4.1 Formal Shoes

9.2.4.2 Casual Shoes

9.2.4.3 Athletic

9.2.5 Historic and Forecasted Market Size by Material

9.2.5.1 Leather

9.2.5.2 Non-leather

9.2.6 Historic and Forecasted Market Size by Distribution Channel

9.2.6.1 Brand Store

9.2.6.2 Specialty Store

9.2.6.3 Online Sales Channel

9.2.7 Historic and Forecasted Market Size by End-User

9.2.7.1 Men

9.2.7.2 Women

9.2.7.3 Children

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Women’s Luxury Footwear Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Product

9.3.4.1 Formal Shoes

9.3.4.2 Casual Shoes

9.3.4.3 Athletic

9.3.5 Historic and Forecasted Market Size by Material

9.3.5.1 Leather

9.3.5.2 Non-leather

9.3.6 Historic and Forecasted Market Size by Distribution Channel

9.3.6.1 Brand Store

9.3.6.2 Specialty Store

9.3.6.3 Online Sales Channel

9.3.7 Historic and Forecasted Market Size by End-User

9.3.7.1 Men

9.3.7.2 Women

9.3.7.3 Children

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Women’s Luxury Footwear Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Product

9.4.4.1 Formal Shoes

9.4.4.2 Casual Shoes

9.4.4.3 Athletic

9.4.5 Historic and Forecasted Market Size by Material

9.4.5.1 Leather

9.4.5.2 Non-leather

9.4.6 Historic and Forecasted Market Size by Distribution Channel

9.4.6.1 Brand Store

9.4.6.2 Specialty Store

9.4.6.3 Online Sales Channel

9.4.7 Historic and Forecasted Market Size by End-User

9.4.7.1 Men

9.4.7.2 Women

9.4.7.3 Children

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Women’s Luxury Footwear Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Product

9.5.4.1 Formal Shoes

9.5.4.2 Casual Shoes

9.5.4.3 Athletic

9.5.5 Historic and Forecasted Market Size by Material

9.5.5.1 Leather

9.5.5.2 Non-leather

9.5.6 Historic and Forecasted Market Size by Distribution Channel

9.5.6.1 Brand Store

9.5.6.2 Specialty Store

9.5.6.3 Online Sales Channel

9.5.7 Historic and Forecasted Market Size by End-User

9.5.7.1 Men

9.5.7.2 Women

9.5.7.3 Children

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Women’s Luxury Footwear Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Product

9.6.4.1 Formal Shoes

9.6.4.2 Casual Shoes

9.6.4.3 Athletic

9.6.5 Historic and Forecasted Market Size by Material

9.6.5.1 Leather

9.6.5.2 Non-leather

9.6.6 Historic and Forecasted Market Size by Distribution Channel

9.6.6.1 Brand Store

9.6.6.2 Specialty Store

9.6.6.3 Online Sales Channel

9.6.7 Historic and Forecasted Market Size by End-User

9.6.7.1 Men

9.6.7.2 Women

9.6.7.3 Children

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Women’s Luxury Footwear Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Product

9.7.4.1 Formal Shoes

9.7.4.2 Casual Shoes

9.7.4.3 Athletic

9.7.5 Historic and Forecasted Market Size by Material

9.7.5.1 Leather

9.7.5.2 Non-leather

9.7.6 Historic and Forecasted Market Size by Distribution Channel

9.7.6.1 Brand Store

9.7.6.2 Specialty Store

9.7.6.3 Online Sales Channel

9.7.7 Historic and Forecasted Market Size by End-User

9.7.7.1 Men

9.7.7.2 Women

9.7.7.3 Children

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Women’s Luxury Footwear Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 38.64 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.20% |

Market Size in 2032: |

USD 72.60 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Material |

|

||

|

By Distribution Channel |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||